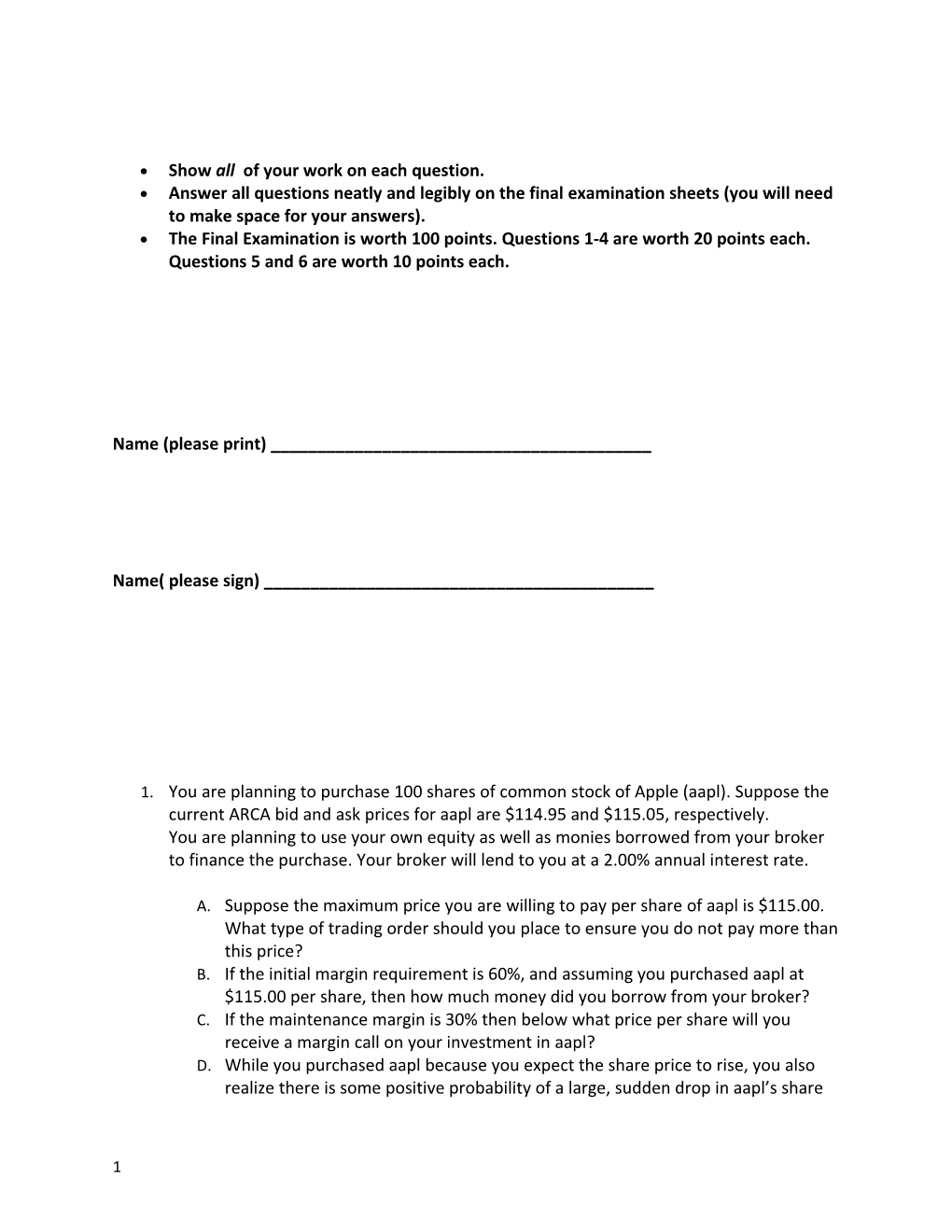

Show all of your work on each question. Answer all questions neatly and legibly on the final examination sheets (you will need to make space for your answers). The Final Examination is worth 100 points. Questions 1-4 are worth 20 points each. Questions 5 and 6 are worth 10 points each.

Name (please print) ______

Name( please sign) ______

1. You are planning to purchase 100 shares of common stock of Apple (aapl). Suppose the current ARCA bid and ask prices for aapl are $114.95 and $115.05, respectively. You are planning to use your own equity as well as monies borrowed from your broker to finance the purchase. Your broker will lend to you at a 2.00% annual interest rate.

A. Suppose the maximum price you are willing to pay per share of aapl is $115.00. What type of trading order should you place to ensure you do not pay more than this price? B. If the initial margin requirement is 60%, and assuming you purchased aapl at $115.00 per share, then how much money did you borrow from your broker? C. If the maintenance margin is 30% then below what price per share will you receive a margin call on your investment in aapl? D. While you purchased aapl because you expect the share price to rise, you also realize there is some positive probability of a large, sudden drop in aapl’s share

1 price based on the rumor that CEO Tim Cook is about to announce he is about to leave Apple to become an Economics and Finance professor at his alma mater - Auburn! What type of order should you place to protect your investment against such a devastating announcement?

2. Suppose six months have passed since you purchased 100 shares of aapl on margin for $115.00 per share. During these six months you have received $1.00 in dividends from aapl, and aapl is currently selling at $125.00 per share.

A. What is the Holding Period Return (HPR) on your aapl investment? B. What is the Return on Equity (ROE) on your aapl investment? C. What is the Effective Annual Return (EAR) on your aapl investment? D. Suppose that in the six months since you purchased aapl the inflation rate has been 1.50%. What was the “real”( inflation – adjusted) HPR on your aapl investment?

3. Suppose you calculate, using weekly return data, the equity beta and the standard deviation of returns for the NASDAQ 100 stock market index, Apple and Google (goog). Your calculations are as follows:

Stock Equity Beta Standard Deviation NASDAQ 100 (QQQ ETF) 1.00 1.25 aapl 1.20 1.40 goog 1.10 1.50

A. What is the difference between a stock’s equity beta and its standard deviation as measures of a stock’s riskiness? B. Which stock has greater “macro factor” risk, aapl or goog? Briefly explain. C. Which stock has greater total risk, aapl or goog? Briefly explain. D. If you intend to add either aapl or goog to an already well diversified portfolio of 50 stocks then which stock has the lower risk? Briefly explain.

2 E. If you intend to add either aapl or goog to an existing portfolio of only 3 other stocks then which stock has the lower risk? Briefly explain.

4. As discussed in the Value Investing book value investors argue that growth opportunities should have no effect on a company’s stock price. A. On what basis do they make this argument?

As also discussed in the Value Investing book value investors place considerable emphasis on the ease or difficulty of “replication” as an important determinant of a company’s attractiveness as an investment. B. What do value investors mean by replication, and why in their estimation is it an important aspect of valuation?

5. A range of economic indicators clearly point towards an acceleration of economic growth in the U.S. At the same time similar economic indicators clearly point towards slowdowns and scant economic growth in much of the rest of the global economy. Also, beginning in about June of this year crude oil prices started to plunge. They have fallen from about $108 per barrel in June to about $65 per barrel at present– a decline of roughly 40%! You are asked to assess the effects of the above events (economic activity and oil prices) on: A. The growth rates of operating profit in the Passenger Airline and Clothing industries. B. The growth rates of operating profit margins of two firms in each industry.

The industries, firms and a brief description of each firm’s strategy are listed below.

Industry Firm 1 & Firm Strategy Firm 2 & Firm Strategy

3 Airlines Southwest (luv) American Air+ US Air (aal) Low cost – US Regional only Full service – US + Int’l

Clothing Ralph Lauren (rl) Hugo Boss (boss) Mid -price & US market Hi price & EU market

6. For decades the ‘single factor’ Capital Asset Pricing Model (CAPM) has been the dominate model for estimating the relationship between expected return and risk on stocks. The CAPM is given by the familiar equation:

Re = RM - Rf]

Where: Re = the required return on a stock (equity). = the return on a stock when its beta is zero. = the sensitivity/risk of a stock’s return to variations in the equity risk premium.

RM = the return on the ‘macro factor.’

Rf = the risk-free rate of return

However, as discussed in class the research of Professors Fama and French has concluded "If you want to explain stock returns, we found you need three measures of risk.” In other words the “modern” version of the CAPM includes three factors.

What are the two additional measures of risk that Professors Fama and French’s research have demonstrated need to be included in the CAPM? Briefly explain each one.

4