Annual Information Form Year Ended

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Canadian Media Directors' Council

Display until February 28, 2011 PUBLICATIONS MAIL aGREEMENT 40070230 pOstaGe paiD in tOrOntO MarketinG MaGazine, One MOunt pleasant RoaD, tOrOntO, CanaDa M4y 2y5 September 2010 27, $19.95 Pre P ared by: MEDIA Canadian Media Directors’ Council Directors’ Media Canadian DIGEST 10 Published by: 11 4 Y CELEBRATING E A 0 RS www.marketingmag.ca Letter from the President CMDC MEMBER AGENCIES Agency 59 Canadian Media Directors’ Council AndersonDDB Cossette Welcome readers, Doner DraftFCB The Canadian Media Directors’ Council is celebrating the 40th anniversary of the Genesis Vizeum Media Digest with the publication of this 2010/11 issue you are accessing. Forty years is Geomedia quite an achievement of consistently providing the comprehensive source of key trends GJP and details on the full media landscape in the Canadian marketplace. Fascinating to Initiative consider how the media industry has evolved over those forty years and how the content M2 Universal of the Digest has evolved along with the industry. MPG As our industry has transformed and instant digital access has become such an import- MediaCom ant component of any reference source, we are pleased to make the Digest and its valu- Mediaedge.cia able and unique reference information freely available to the industry online at www. Media Experts cmdc.ca and www.marketingmag.ca, in addition to the hard copies distributed through Mindshare Marketing Magazine and our member agencies. OMD The CMDC member agencies play a crucial role in updating and reinventing the PHD Digest content on a yearly basis, and we thank each agency for their contribution. The Pegi Gross and Associates 2010/11 edition was chaired by Fred Forster, president & CEO of PHD Canada and RoundTable Advertising produced by Margaret Rye, the CMDC Digest administrator. -

2011-2012 CJFE's Review of Free Expression in Canada

2011-2012 CJFE’s Review of Free Expression in Canada LETTER FROM THE EDITORS OH, HOW THE MIGHTY FALL. ONCE A LEADER IN ACCESS TO INFORMATION, PEACEKEEPING, HUMAN RIGHTS AND MORE, CANADA’S GLOBAL STOCK HAS PLUMMETED IN RECENT YEARS. This Review begins, as always, with a Report Card that grades key issues, institutions and governmental departments in terms of how their actions have affected freedom of expres- sion and access to information between May 2011 and May 2012. This year we’ve assessed Canadian scientists’ freedom of expression, federal protection of digital rights and Internet JOIN CJFE access, federal access to information, the Supreme Court, media ownership and ourselves—the Canadian public. Being involved with CJFE is When we began talking about this Review, we knew we wanted to highlight a major issue with a series of articles. There were plenty of options to choose from, but we ultimately settled not restricted to journalists; on the one topic that is both urgent and has an impact on your daily life: the Internet. Think about it: When was the last time you went a whole day without accessing the membership is open to all Internet? No email, no Skype, no gaming, no online shopping, no Facebook, Twitter or Instagram, no news websites or blogs, no checking the weather with that app. Can you even who believe in the right to recall the last time you went totally Net-free? Our series on free expression and the Internet (beginning on p. 18) examines the complex free expression. relationship between the Internet, its users and free expression, access to information, legislation and court decisions. -

Annual Information Form Year Ended

ANNUAL INFORMATION FORM YEAR ENDED DECEMBER 31, 2016 March 6, 2017 TABLE OF CONTENTS Page ITEM 1 THE CORPORATION ................................................................................................................. 1 1.1. Subsidiaries .................................................................................................................... 1 ITEM 2 BUSINESS .................................................................................................................................. 2 2.1. Broadcasting & production ............................................................................................. 3 2.1.1. Television Broadcasting .................................................................................. 3 2.1.2. Specialty Services ........................................................................................... 4 2.1.3. TVA Productions Inc. and TVA Productions II Inc. .......................................... 5 2.1.4. TVA Films ........................................................................................................ 5 2.1.5. Sources of revenue ......................................................................................... 6 2.1.6. Licenses and regulation................................................................................... 6 2.1.7. Competition, Viewing Audiences and Television Market Share .................... 10 2.2. Magazines .................................................................................................................... 11 -

Annual Information Form

ANNUAL INFORMATION FORM FINANCIAL YEAR ENDED DECEMBER 31, 2015 MARCH 30, 2016 TABLE OF CONTENTS Page ITEM 1 — THE CORPORATION ................................................................................................................. 1 1.1 THE SUBSIDIARIES ............................................................................................................. 2 ITEM 2 — THE BUSINESS ......................................................................................................................... 3 2.1 TELECOMMUNICATIONS .................................................................................................... 3 2.1.1 Business Overview .................................................................................................... 3 2.1.2 Products and Services ............................................................................................... 4 2.1.3 Customer Statistics Summary ................................................................................... 8 2.1.4 Pricing of Products and Services ............................................................................... 8 2.1.5 Network Technology .................................................................................................. 9 2.1.6 Marketing and Customer Care ................................................................................. 10 2.1.7 Programming ........................................................................................................... 12 2.1.8 Competition ............................................................................................................. -

Top 5 Players

Canada’s Top Media, Internet & Telecom Wireline % MARKET SHARE Wireless Companies by Market Share (2017) Internet Access Cable cmcrp.org | [email protected] Broadcast TV & Pay TV 47% 31% Radio Newspaper & Magazine 25% Internet Advertising & Subscriptions Over-the-top (OTT) Subscriptions 16.5% 29% 27.5% 28% 29% 16.5% 0.1% Twitter 30% 1.4% 21% Wireline 3% 12% 0.1% GROUPE Wireless CAPITALE 33% 11% 9% Internet Access MEDIA 15% Cable 5% 18% Wireline Broadcast TV & Pay TV 13% Wireless Radio 72.5% Internet Access Over the top (OTT) Subscriptions 0.2% POWER CORP 7.3% Cable 12% 6% 8% top 5 players5% 2% Wireline 12% Wireless 23% Internet Access 0.8% EastLink control 72.5 % of the entire15% media economy* Cable 3% GLOBE & MAIL 8% Broadcast TV & Pay TV 2% 0.2% Wireline Radio 0.9% POSTMEDIA 1% 7% Magazines Wireless 1.4% SaskTel 30% 4.7% Internet Access 2.0% Facebook 1% Cable 2% Broadcast TV & Pay TV 23.3% 3% Radio 2% 0.9% TORSTAR 9% 2% 27% 12% 2% 1.0% NETFLIX 6% Wireline 4.3% Google Wireless 2.0% CBC 1.6% COGECO 7% Internet Access 6% 6% Cable 85% Broadcast TV & Pay TV Newspaper & Magazine 50% *market share is based 16% 16% on revenue 1% 5% 0.1% CONTENT OWNERSHIP: BELL Discovery World HD) TSN Radio, Énergie and Sportsnet (formerly Rogers SHAW Fyi (Twist TV) TreeHouse TV addikTV (formerly Mys- Canadian Living Calgary Herald The Hamilton Spectator POWERCORP Broadcast TV & Pay TV E! (formerly Star! TV) Rouge FM brands Sportsnet) & Hockey Night in Canada Broadcast TV & Pay TV H2 (The Cave, Men TV) Univision Canada tère) Clin d’oeil Cornwall Standard Freeholder Niagara Falls Review La Press CTV (22 stations, 2 affiliates) ESPN Classic OTT Subscription Sportsnet One Global (15 stations, 3 affiliates) HGTV Canada W Network Canal Indigo Coup de pouce Edmonton Journal Peterborough Examiner CTV Two (7 stations, 2 regional MTS Video on Demand CraveTV Sportsnet PPV ABC Spark History Television YTV Casa - (formerly Les idées de Échos vedettes London Free Press St. -

Press Release TVA Publications Maintains Status As Key Player In

Press release TVA Publications maintains status as key player in Canada’s magazine market and #1 in French magazines Nearly 9 million readers on all platforms MONTREAL, November 13, 2019 – TVA Publications has held its position as an influencer from coast to coast with a substantial 7% increase in cross-platform readership. It remains a Canadian magazine leader with a total of nearly 9 million loyal readers and it is the top publisher in Quebec. Its English titles reach 5.3 million readers and its French titles 3.9 million. “The survey results show that Canada’s magazines market is growing both in print and across all platforms,” says Lyne Robitaille, Senior Vice President, Newspapers, Magazines, Distribution & Printing, Quebecor. “We are pleased to see that 14 of our publications registered strong growth. This success demonstrates our ability to offer all readers from all generations compelling content.” Clin d’œil, Quebec’s most popular fashion and beauty magazine, posts 22% growth Clin d’œil magazine’s readership surged 22%, cementing its position as Quebec’s fashion and beauty leader. It had 626,000 avid readers per month on all platforms, 135,000 more than its closest rival. Lifestyle magazines draw 6.3 million readers* In the lifestyle magazine category, the Canadian Living, Good Times, Bel Âge and Coup de pouce brands continued to inspire Canadians from the Atlantic to the Pacific, reaching 6.3 million cross-platform readers in all demographics, a 12% increase. Canadian Living alone reached more than 4 million readers, a 13% increase. Coup de pouce was the most-read French-language print paid-circulation lifestyle magazine with nearly 1.5 million readers on all platforms. -

Canadian Broadcasting Regulation and the Digital Television Transition

Canadian Broadcasting Regulation and the Digital Television Transition Gregory Taylor PhD Dissertation Department of Art History and Communication Studies Faculty of Arts McGill University Montreal, Canada A thesis submitted to McGill University in partial fulfilment of the requirements of the degree of Doctor of Philosophy August 10, 2009 ©Gregory Taylor, 2009. 1 Library and Archives Bibliothèque et Canada Archives Canada Published Heritage Direction du Branch Patrimoine de l’édition 395 Wellington Street 395, rue Wellington Ottawa ON K1A 0N4 Ottawa ON K1A 0N4 Canada Canada Your file Votre référence ISBN: 978-0-494-66541-1 Our file Notre référence ISBN: 978-0-494-66541-1 NOTICE: AVIS: The author has granted a non- L’auteur a accordé une licence non exclusive exclusive license allowing Library and permettant à la Bibliothèque et Archives Archives Canada to reproduce, Canada de reproduire, publier, archiver, publish, archive, preserve, conserve, sauvegarder, conserver, transmettre au public communicate to the public by par télécommunication ou par l’Internet, prêter, telecommunication or on the Internet, distribuer et vendre des thèses partout dans le loan, distribute and sell theses monde, à des fins commerciales ou autres, sur worldwide, for commercial or non- support microforme, papier, électronique et/ou commercial purposes, in microform, autres formats. paper, electronic and/or any other formats. The author retains copyright L’auteur conserve la propriété du droit d’auteur ownership and moral rights in this et des droits moraux qui protège cette thèse. Ni thesis. Neither the thesis nor la thèse ni des extraits substantiels de celle-ci substantial extracts from it may be ne doivent être imprimés ou autrement printed or otherwise reproduced reproduits sans son autorisation. -

Media Tree Letter

CANADIAN MEDIA LANDSCAPE 2006 TELEVISION SPECIALTY TV CHANNELS Showcase History Television Life Network HGTV Canada (80.2%) Food Network Canada (57.58%) Fine Living Showcase Action Showcase Diva +10 others full or part ownership TOTAL BROADCAST REVENUES: $283.4 MILLION CANADIAN MEDIA LANDSCAPE 2006 TELEVISION RADIO INTERNET OUT OF HOME SPECIALTY TV CHANNELS CFXY the Fox, Fredericton, N.B. Radiolibre.ca 3,700 faces Canal Vie CKTY 99.5 Truro, N.S. Teatv.ca (online classified) in Ontario and Quebec MusiMax Energie 94.3, Montreal, QC Historia +26 others Cinepop +7 others full or part ownership PAY TV CHANNELS TOTAL REVENUES: $549.6 MILLION The Movie Network Viewer's Choice TV: $391.1 MILLION Super Ecran Radio: $110.4 MILLION Outdoor: +3 others $42.2 MILLION Web not broken out separately CANADIAN MEDIA LANDSCAPE 2006 TELEVISION NEWSPAPERS MAGAZINES INTERNET NETWORK TV The Globe and Mail Report on Business globeandmail.com CTV Globe Television robtv.com ASN ctv.ca TQS (40% ownership) tsn.ca REVENUE FIGURES: N/A mtv.ca SPECIALTY TV CHANNELS workopolis.com (40%) ROB TV +15 others MTV (launched CTV Broadband Dec. 2, 2005: The Comedy Network BGM parent company BCE Inc. reduces its network this summer) TSN (70 %) ownership stake in BCE to 20% from 48.5%. Torstar Discovery Channel (56%) and the Ontario Teachers’ Pension Plan each pay $283 million for a 20% stake in the company, while the Thomson NHL Network (15%) family’s Woodbridge Inc. pays $120 million to increase its ownership +11 others full or partial stake to 40% from 31.5%. On Sept. -

Activity Report

A C T I V I T Y R E P O R T 2017 — 1 — TABLE OF CONTENT 2017 in Brief 3 Highlights 6 Message to Shareholders 8 Telecoms 12 Media 23 Sports and Entertainment 46 Corporate Social Responsability 52 Board of Directors and Officers of Quebecor Inc. 63 Board of Directors and Management Committee of Quebecor Media Inc. 64 — 2 — 2017 IN BRIEF PIERRE KARL PÉLADEAU On February 16, Pierre Karl Péladeau resumed his position as President and Chief Executive Officer $1.59 BILLION Adjusted operating income up 6.6%, the largest annual increase since 2009 $4.12 BILLION TVA SPORTS Quebecor’s revenues up 2.6% year over In June, TVA Sports registered the best Québec ratings year in 2017 since 2008 for the Stanley Cup final, which had been broadcast on a rival network from 2008 to 2014 CLUB ILLICO In March, the original series Victor Lessard logged a million viewings on Club illico in less than two weeks 82 $42 MILLION Number of cultural and sporting events Total value of philanthropy in 2017 – at the Videotron Centre in Québec City, distributed among more than in addition to 17 corporate events 400 organizations, more than half in the cultural sector GESTEV 1,000,000 On April 4, Gestev announced the acquisition of Number of subscriber connections to Wasabi atelier expérientiel to enhance its experiential Videotron’s mobile network, the latest marketing expertise and spearhead its expansion milestone for the service launched in into Montréal September 2010 — 3 — 1,000,000 Number of subscriber connections to Videotron’s mobile network, the latest milestone -

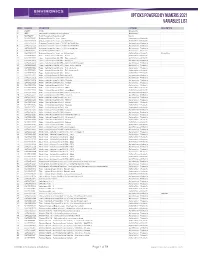

Opticks Powered by Numeris 2021 Variables List

Opticks Powered by Numeris 2021 Variables list Order Variable Description Category CONSUMPTION 0 CODE Code Geography 0 GEO Geographic Summarization Indicator Geography 1 NBAS12HP Total Household Population 12+ Basics 2 Q470010C01 Distance Driven Per Year - None Automotive - Products 3 Q470010C02 Distance Driven Per Year - 1 to 9,999 Km Automotive - Products 4 Q470010C03 Distance Driven Per Year - 10,000 to 19,999 Km Automotive - Products 5 Q470010C04 Distance Driven Per Year - 20,000 to 29,999 Km Automotive - Products 6 Q470010C05 Distance Driven Per Year - 30,000 or more Km Automotive - Products 7 Q4700100I0 Distance Driven Per Year - 1+ Automotive - Products 8 Q4700100A0 Distance Driven Per Year - 1+ (Kilometres) Automotive - Products Kilometres 9 Q470030C01 Type - Vehicle Driven [M Oft] - Sedan Automotive - Products 10 Q470030C02 Type - Vehicle Driven [M Oft] - Sub-compact Automotive - Products 11 Q470030C03 Type - Vehicle Driven [M Oft] - Sports car Automotive - Products 12 Q470030C04 Type - Vehicle Driven [M Oft] - Minivan/station wagon Automotive - Products 13 Q470030C05 Type - Vehicle Driven [M Oft] - Sport utility vehicle Automotive - Products 14 Q470030C06 Type - Vehicle Driven [M Oft] - Pick-up truck Automotive - Products 15 Q470030C07 Type - Vehicle Driven [M Oft] - Full-sized van (!) Automotive - Products 16 Q470030C08 Type - Vehicle Driven [M Oft] - Other Automotive - Products 17 Q470020C01 Make - Vehicle Driven [M Oft] - Buick (!) Automotive - Products 18 Q470020C03 Make - Vehicle Driven [M Oft] - Chevrolet Automotive - -

Media Digest

2016⁄17 daD@ eS A definitive source for the media marketplace g THE BUSINESS OF MEDIA: The latest stats and insights on traditional, digital and emerging media MEDIA CHANNELS: Advertising spend in a slow economy CONSUMER DATA AND TRENDS: Adapting to changes in the consumer landscape 2 LETTER FROM THE CHAIR | CANADIAN MEDIA DIRECTORS’ COUNCIL The media challenge today is that we need Welcome to the to deliver across the continuum, from communications planning right through to Canadian Media programmatic offerings—tasks that truly sit at opposite ends of the spectrum, or so you Directors Council’s might think. The reality is that these and all a media planner LETTER FROM THE CHAIR the needs in-between are driven by two key makes and the only M way a marketer should i factors—consumer behaviour and data. c 2016–2017 edition of h e approve such a plan. le P Without a strong knowledge of their consumer a It requires fact-based u the Media Digest. c base, marketers are lost. How will they know hu decision-making. k where to place their communications, what is the | C Much thought and effort has been put into providing ha ir, Within this guide, you will you an invaluable guide to help you navigate the best angle for capturing attention and how will they CMD C find a wealth of information to continuously evolving world of media. develop strong relationships with their customers? help you start the journey to making We need to know what is influencing consumer those fact-based decisions. -

Subject Index

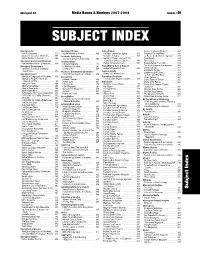

Aboriginal Art Media Names & Numbers 2007-2008 Alumni / 49 SUBJECT INDEX Aboriginal Art Aboriginal Women Aging/Elderly Québec Farmers’ Advocate . 343 Inuit Art Quarterly . 313 Native Women in the Arts . 383 Canadian Journal on Aging . 379 Regional Country News . 345 Journal of Canadian Art History. 381 Academic Publishing Geriatrics & Aging. 303 La Revue de Machinerie Agricole . 347 Native Women in the Arts . 383 Journal of Scholarly Publishing . 382 Geriatrics Today: Journal of the Rural Roots . 348 Aboriginal Government Relations Acadian Affairs Canadian Geriatrics Society . 381 Rural Voice . 348 Parliamentary Names & Numbers. 396 L’Acadie Nouvelle. 174 Journal of Geriatric Care . 381 Saskatchewan Farm Life . 349 Aboriginal Governments Le Moniteur Acadien. 242 Aging/Elderly Care & Support The Saskatchewan Stockgrower. 349 Chieftain: Journal of Traditional Le Ven’D’est . 365 Journal of Geriatric Care . 381 Sheep Canada . 351 Simmental Country. 352 Governance . 379 Access to Government Information Aging & Health Journal of Geriatric Care . 381 Southern Farm Guide. 353 Aboriginal Issues Parliamentary Names & Numbers. 396 La Terre de Chez-Nous . 357 Aboriginal Languages of Manitoba . 196 Accounting Agricultural Practices Union Farmer . 364 Aboriginal Peoples Television Beyond Numbers . 265 The Canadian Organic Grower . 277 Valley Farmers’ Forum. 365 Network (APTN) . 85 Bottom Line . 267 Agriculture Voice of the Farmer . 367 Aboriginal Times . 184 CAmagazine . 270 Aberdeen Angus World . 255 Voice of the Farmer (Central Alberta Native News. 184 CGA Magazine . 281 Agri Digest. 257 Editions) . 367 Alberta Sweetgrass. 184 Management Magazine . 320 The Agri Times . 257 Western Dairy Farmer . 369 Anishinabek News . 200 Outlook . 334 Agricom . 257 Western Hog Journal . 370 Batchewana First Nation Newsletter.