Annual 2017 Food Service

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Comparative Analysis of Chinese Immigrant Parenting in the United States and Singapore

genealogy Article Challenges and Strategies for Promoting Children’s Education: A Comparative Analysis of Chinese Immigrant Parenting in the United States and Singapore Min Zhou 1,* and Jun Wang 2 1 Department of Sociology, University of California, Los Angeles, CA 90095-1551, USA 2 School of Social Sciences, Nanyang Technological University, Singapore 639818, Singapore; [email protected] * Correspondence: [email protected] Received: 18 February 2019; Accepted: 11 April 2019; Published: 15 April 2019 Abstract: Confucian heritage culture holds that a good education is the path to upward social mobility as well as the road to realizing an individual’s fullest potential in life. In both China and Chinese diasporic communities around the world, education is of utmost importance and is central to childrearing in the family. In this paper, we address one of the most serious resettlement issues that new Chinese immigrants face—children’s education. We examine how receiving contexts matter for parenting, what immigrant parents do to promote their children’s education, and what enables parenting strategies to yield expected outcomes. Our analysis is based mainly on data collected from face-to-face interviews and participant observations in Chinese immigrant communities in Los Angeles and New York in the United States and in Singapore. We find that, despite different contexts of reception, new Chinese immigrant parents hold similar views and expectations on children’s education, are equally concerned about achievement outcomes, and tend to adopt overbearing parenting strategies. We also find that, while the Chinese way of parenting is severely contested in the processes of migration and adaptation, the success in promoting children’s educational excellence involves not only the right set of culturally specific strategies but also tangible support from host-society institutions and familial and ethnic social networks. -

Restaurant Information

RESTAURANT INFORMATION Type of Services Location Contact Details RestaurantsISnackBarsI Western Restaurant +86-21-2890 6776 Catering inside of #1 Entrance Hall (South +86-135 0188 4836 nd Entrance Hall, 2 floor Landing Coffee & Restaurant inside of #3 Entrance Hall (East Entrance Hall) 98 Restaurant +86-21-2890 6776 mezzanine of Halls E3 and E4 +86-135 0188 4836 McDonalds east side of Hall W5, west side of Hall E1 & E4 south side of Hall N4 KFC & East Dawning East Dawning inside of #2 Entrance Hall (North booking-tel Entrance Hall) +86-21-2890 6785/6 Papa Johns +86-21-2892 8777 west side of Hall E4 +86-159 0096 6003 La Cite Cafe +86-21-2890 6783 west side of Hall E6, +86-159 0096 6003 south side of Hall N5 Milano Restaurant west side of Hall E5 & E7 Lv Quan Restaurant mezzanine of Halls W2 and W3 Shi Ke Fast Food +86-186 2100 6367 west side of Hall E5, #3 Entrance Hall (East Entrance Hall, 2nd floor) Hui Zhan Lunch Box the loading bay between Hall W3 & W4 Li Hua Lunch Box the loading bay between Hall W2 & W3, HB Restaurant west side of Hall E2 Snack Bars east side of Halls W1 - W5 inside, west side of Halls E1- E6 inside THE DELI by Paulaner south side of Hall N2 Lv Quan Lunch Box south side of Hall N2 Forever Valley (Chinese fast food) south side of Hall N3 7 VENUE INFORMATION (CONT'D) Type of Services Location Contact Details Shen Nong Shi Fast Food the loading bay between Hall N3 & N4 Uncle Fast Food (Chinese fast food) mezzanine of Halls N3 and N4 Restaurants outside the Expo Centre (SNIEC) Kerry Parkside I B1 Kush -vegetarian Subway -

The Educator's Guide

Resources A Guide for Secondary School Educators The Educator’s Guide Created in conjunction with the exhibition, SINGAPO人: Discovering Chinese Singaporean Culture Discovering Chinese Singaporean Culture This exhibition examines how the Chinese community in Singapore developed its own distinctive culture. Here, visitors discover and rediscover what it means to be a Chinese Singaporean. The aim is to develop a stronger sense of the Chinese Singaporean identity amongst youths. This will help foster a greater sense of belonging while giving them an understanding of how we are similar to or different from other Chinese communities. This exhibition presents Chinese Singaporean culture through daily life in Singapore – through the things we see, hear, do and eat every day. Therefore, the experience is highly interactive where visitors can touch various stations, play games, listen to stories and have a dialogue with the gallery. Through this exhibition, we will explore ideas of: Chinese heritage Cultural interactions Public policies The exhibition content extends classroom learning and teaching, by complementing History, Social Studies and Character & Citizenship Education subjects taught in secondary schools. It is also self-guided, where students can learn and explore independently. One of the main interactive features of the exhibition is the use of wristband tags. Students can tap their wristband tags to answer questions scattered throughout the space, trigger videos and play games. At the end of the visit, students can print out their own personalised report card which summarises their exhibition journey along with prompts for further cultural exploration beyond the exhibition. This report card serves as a starting point for them to reflect about their identity in relation to everyday life. -

Construction

February 2020 Ministry of Trade and Industry Republic of Singapore website: www.mti.gov.sg email: [email protected] All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanised, photocopying, recording or otherwise, without the prior permission of the copyright holder. CONTENTS 02 50 90 MAIN INDICATORS CHAPTER 5 CHAPTER 7 OF THE SINGAPORE ECONOMY Balance of Payments Economic Outlook 06 56 94 CHAPTER 1 CHAPTER 6 FEATURE ARTICLE Economic Performance Sectoral Performance Innovation Space and the Cumulative Nature of 60 6.1 Technological Progress: A 14 Manufacturing Case Study of Singapore CHAPTER 2 Labour Market and 62 6.2 Productivity Construction 66 6.3 22 Wholesale & Retail Trade CHAPTER 3 Costs, Investments and Prices 68 6.4 Accommodation & Food Services 27 BOX 3.1 Business Cost 70 6.5 Conditions in Singapore’s Transportation & Storage Manufacturing and Services Sectors 72 6.6 Information & Communications 73 6.7 Finance & Insurance 78 6.8 42 Business Services CHAPTER 4 International Trade 80 BOX 6.1 Trends in E-commerce in the Services Sector 02 MAIN INDICATORS OF THE SINGAPORE ECONOMY OVERALL ECONOMY 2018 2018 2018 $503.4 billion 3.4% $80,705 GDP 2019 2019 at Current Real GDP 2019 GNI Market Prices $507.6 billion (Year-on-Year-Growth) 0.7% Per Capita $80,778 STRUCTURE OF THE ECONOMY IN 2019 Breakdown of Services Producing Industries Wholesale & Business Finance & Retail Trade Services Insurance 17.3% 14.8% 13.9% of Nominal VA of -

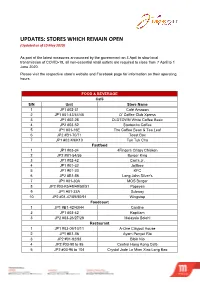

UPDATES: STORES WHICH REMAIN OPEN (Updated As of 10 May 2020)

UPDATES: STORES WHICH REMAIN OPEN (Updated as of 10 May 2020) As part of the latest measures announced by the government on 3 April to slow local transmission of COVID-19, all non-essential retail outlets are required to close from 7 April to 1 June 2020. Please visit the respective store's website and Facebook page for information on their operating hours. FOOD & BEVERAGE Café S/N Unit Store Name 1 JP1 #02-31 Café Amazon 2 JP1 #01-43/44/45 O’ Coffee Club Xpress 3 JP1 #02-28 OLDTOWN White Coffee Basic 4 JP2 #03-52 Starbucks Coffee 5 JP1 #01-16E The Coffee Bean & Tea Leaf 6 JP2 #B1-70/71 Toast Box 7 JP1 #02-K9/K10 Tuk Tuk Cha Fastfood 1 JP1 #03-34 4Fingers Crispy Chicken 2 JP2 #B1-54/55 Burger King 3 JP1 #02-42 Carl’s Jr. 4 JP1 #01-32 Jollibee 5 JP1 #01-30 KFC 6 JP2 #B1-56 Long John Silver’s 7 JP1 #01-30A MOS Burger 8 JP2 #03-K5/48/49/50/51 Popeyes 9 JP1 #01-33A Subway 10 JP2 #01-47/89/90/91 Wingstop Foodcourt 1 JP1 #B1-42/43/44 Cantine 2 JP1 #03-42 Kopitiam 3 JP2 #03-26/27/28 Malaysia Boleh! Restaurant 1 JP1 #03-09/10/11 A-One Claypot House 2 JP1 #B1-06 Ayam Penyet Ria 3 JP2 #01-92/93 Bibik Nio 4 JP2 #03-90 to 95 Central Hong Kong Café 5 JP2 #03-96 to 104 Crystal Jade La Mian Xiao Long Bao 6 JP2 #B1-57/58/59 Dian Xiao Er 7 JP2 #B1-68/69 Din Tai Fung 8 JP2 #01-76 to 78 EAT. -

Visa Paywave Merchant List - July 2014

Visa payWave Merchant List - July 2014 Row Labels 180DEGREES ROTISSERIE 5 Cocktail Bar 63CELSIUS ACTION CITY ADIDAS Aeropostale Agyness Beauty Centre AJISEN GROUP AJISEN GROUP / BOTEJYU AJISEN GROUP / Tokyo Walker ALCOVE.ASIAN RESTN. BAR ALDO ALLURE / BY3 & CO AMARONE RESTAURANT AMBERLIGHTS ENTERTAINMENT PL / ARTERY AMERICAYA AMINO BAR ANDERSEN'S OF DENMARK ANIMAL ARTS ACADEMY AP HOUSE APD ARTISAN BOULANGERIE AUDIO HOUSE MARKETING P L AUNTIE ANNE'S B*DAZZLE BAJA FRESH BANYAN SHADE INDIAN COTTAGE CREATIONS BATA SHOES (SINGAPORE) PTE LTD BEBE BELLEZA SKIN CARE BERLUTI BERSHKA BHG DEPT STORE Bibigo BIG O CAFÉ RESTAURANT BLUME LINK BOARDGAMES REJUVENATE BOOKLINK BOTEJYU BREAD YARD BURGER KING CACHE CACHE CAFÉ MELBA CAMOUFLAGE CAMPERS' CORNER OUTDOOR CANDYLICIOUS CATHAY CINEPLEXES CEDELE CHAITIME CHALLENGER CHALLENGER Mini CHARCOAL CHICKEN EXPRESS CHARLES & KEITH CHARLY T'S CHEERS CHOP SHOPPE CHOPSTICK BY THE ASIAN KITCHEN @ ORQ CHOWON GARDEN KOREAN CHUCKWAGON BBQ & GRILL CI GUSTA! Citi Café CK ACCESSORIES COASTES COCO ICHIBANYA COLD STONE CREAMERY COLD STORAGE COLD STORAGE SPECIALTY COLD WEAR PTE LTD COLETTEE CRYSTAL JADE CAKERY CRYSTAL JADE MY BREAD CUPS N CANVAS CURRY GARDENN CURRY TIMES CYBERACTIVE TECHNOLOGY DEAN & DELUCA DENIZEN DESIGN & COMFORT DIAN XIAO ER DIVA DOROTHY PERKINS DOROTHY PERKINS DR. CAFÉ DRESSING LOLITA EDIT ENAGIC SINGAPORE Epilogue ESETTE GOURMETS & GIFTS ESPRIT ETUDE HOUSE EVERBEST SHOES & HANDBAGS EVERGREEN GROUP PTE LTD EXCLUSIVE HUB FACTORY DIRECT SALES FAIRPRICE FAIRPRICE FAIRPRICE FINEST FAIRPRICE XTRA FIESTA Fika -

For Sublease - Downtown San Mateo 311 7Th Avenue, San Mateo

For Sublease - Downtown San Mateo 311 7th Avenue, San Mateo S B STREET S RAILROAD AVENUE RAILROAD S 7TH AVENUE ±3,554 Square Feet Available As exclusive agents, we are pleased to offer the following space: u ±3,554 Square Feet of Creative Space u 5 Conference Rooms u Open Space u Break Room u Server/Storage u Exterior Courtyard Area u Excellent Natural Light u 17’+ High Ceilings and Skylights u Located in Downtown San Mateo with Numerous Amenities Within Walking Distance u 0.4 Miles to Caltrain (9 Minute Walk) u LED: January 31, 2022 u Rental Rate: $4.95/sf NNN Wes Payne Associate 650.358.5275 [email protected] CA RE License #02054621 Craig Kalinowski Executive Managing Director 650.358.5287 [email protected] CA RE License #01260870 Jon Cannon Executive Managing Director 650.688.8525 [email protected] CA RE License #01836599 2950 South Delaware Street, Suite 125, San Mateo, CA 94403 www.ngkf.com The distributor of this communication is performing acts for which a real estate license is required. The information contained herein has been obtained from sources deemed reliable but has not been verified and no guarantee, warranty or representation, either express or implied, is made with respect to such information. Terms of sale or lease and availability are subject to change or withdrawal without notice. 18-0986•07/18 FOR LEASE - DOWNTOWN SAN MATEO 311FOR LEASE 7th Avenue - DOWNTOWN SAN MATEO 311San Mateo,7th Avenue California San Mateo, California For Sublease - Downtown San Mateo 311Floorplan 7th Avenue, San Mateo Floorplan Ground -

Online, Mobile, and Text Food Ordering in the U.S. Restaurant Industry

Online, Mobile, and Text Food Ordering in the U.S. Restaurant Industry Cornell Hospitality Report Vol. 11, No. 7, March 2011 by Sheryl E. Kimes, Ph.D., and Philipp F. Laqué www.chr.cornell.edu Advisory Board Niklas Andréen, Group Vice President Global Hospitality & Partner Marketing, Travelport GDS Ra’anan Ben-Zur, Chief Executive Officer, French Quarter Holdings, Inc. Scott Berman, Principal, Industry Leader, Hospitality & Leisure Practice, PricewaterhouseCoopers Raymond Bickson, Managing Director and Chief Executive Officer, Taj Group of Hotels, Resorts, and Palaces Stephen C. Brandman, Co-Owner, Thompson Hotels, Inc. Raj Chandnani, Vice President, Director of Strategy, WATG Benjamin J. “Patrick” Denihan, Chief Executive Officer, Denihan Hospitality Group Brian Ferguson, Vice President, Supply Strategy and Analysis, Expedia North America Chuck Floyd, Chief Operating Officer–North America, Hyatt The Robert A. and Jan M. Beck Center at Cornell University Gregg Gilman, Partner, Co-Chair, Employment Practices, Back cover photo by permission of The Cornellian and Jeff Wang. Davis & Gilbert LLP Susan Helstab, EVP Corporate Marketing, Four Seasons Hotels and Resorts Jeffrey A. Horwitz, Chair, Lodging + Gaming, and Co-Head, Mergers + Acquisitions, Proskauer Kevin J. Jacobs, Senior Vice President, Corporate Strategy & Treasurer, Hilton Worldwide Kenneth Kahn, President/Owner, LRP Publications Cornell Hospitality Reports, Kirk Kinsell, President of Europe, Middle East, and Africa, InterContinental Hotels Group Vol. 11, No. 7 (March 2011) Radhika Kulkarni, Ph.D., VP of Advanced Analytics R&D, SAS Institute © 2011 Cornell University Gerald Lawless, Executive Chairman, Jumeirah Group Mark V. Lomanno, President, Smith Travel Research Cornell Hospitality Report is produced for Betsy MacDonald, Managing Director, HVS Global Hospitality the benefit of the hospitality industry by Services The Center for Hospitality Research at David Meltzer, Vice President of Global Business Development, Cornell University Sabre Hospitality Solutions William F. -

Singapore A. How to Commercialise

PART I General Overview of Items (A) – (F) COUNTRY: SINGAPORE A. HOW TO COMMERCIALISE INVENTIONS 1. Technology Transfer and Research Collaboration in R&D and Academic Institutions In Singapore, technology transfer and collaboration with industry play a central role in the two main universities as well as the five polytechnics. Besides these institutes of higher learning, the Agency for Science, Technology and Research (A*STAR) looks after twelve research institutes. The National University of Singapore (NUS) has an enrolment of 32,000, including 9000 postgraduate students. It has eight schools/faculties, an academic staff of 2080 and another 1130 research staff. In 2003, the NUS produced some 6150 graduates and 2660 postgraduates in the fields of engineering, science, medicine, business administration, architecture and building and estate management, law, arts and social sciences, and dentistry. The Nanyang Technological University (NTU) has a full-time student population exceeding 22,800, including 7100 postgraduates. It has 1400 academic and 580 research staff members. In 2003, some 5400 graduated in the fields of engineering, applied science, accountancy, mass communications, and education. Of these, about 1260 obtained higher degrees. The two universities are major producers of research output and they have been involved in a succession of initiatives aimed at capitalising opportunities latent in their research laboratories. This is to disseminate new and useful knowledge resulting from research and ensure that technology transfer obligations of the university towards a research sponsor are met. The NUS and the NTU have taken steps to enhance infrastructure and mechanisms to facilitate university-industry interaction with technology transfer being central to the research process. -

Spatial Competition and Marketing Strategy of Fast Food Chains in Tokyo

Geographical Review of Japan Vol. 68 (Ser. B), No. 1, 86-93, 1995 Spatial Competition and Marketing Strategy of Fast Food Chains in Tokyo Kenji ISHIZAKI* Key words: spatial competition,marketing strategy, nearest-neighbor spatial associationanalysis, fast food chain, Tokyo distributions of points, while Clark and Evans I. INTRODUCTION (1954) describe a statistic utilizing only a single set of points. This measure is suitable for de One of the important tasks of retail and res scribing the store distribution of competing taurant chain expansion is the development of firms such as retail chains. a suitable marketing strategy. In particular, a The nearest neighbor spatial association location strategy needs to be carefully deter value, R, is obtained as follows: mined for such chains, where store location is often the key to the successful corporate's R=ƒÁ0/ƒÁE (1) growth (Ghosh and McLafferty, 1987; Jones and The average nearest-neighbor distance, ƒÁ0, is Simmons, 1990). A number of chain entries into given by the same market can cause strong spatial com petition. As a result of this, retail and restaurant (2) chains are anxious to develop more accessible and well-defined location strategies. In restau where dAi is the distance between point i in type rant location, various patterns are respectively A distribution and its nearest-neighbor point in presented according to some types of restau type B distribution and dBj is the distance from rants (i.e. general full service, ethnic, fast food point j of type B to its nearest neighbor point of and so on) and stores of the same type are type A. -

Food Service - Hotel Restaurant Institutional

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 12/20/2016 GAIN Report Number: ID1640 Indonesia Food Service - Hotel Restaurant Institutional Food Service Hotel Restaurant Institutional Update Approved By: Ali Abdi Prepared By: Fahwani Y. Rangkuti and Thom Wright Report Highlights: The Indonesian hotel and restaurant industries grew 6.25 and 3.89 percent in 2015, respectively. Industry contacts attribute the increase to continued urbanization, tourism, and MICE (Meeting, Incentive, Conference, and Exhibitions) development. The Bank of Indonesia expects that economic growth will fall around 4.9 to 5.3 percent in 2016 and 5.2 to 5.6 percent in 2017. Post: Jakarta I. MARKET SUMMARY Market Overview Indonesia is the most populous country in the ASEAN region with an estimated 2017 population of 261 million people. It is home to approximately 13,500 islands and hundreds of local languages and ethnic groups, although the population is mostly concentrated on the main islands of Java, Sumatra, Kalimantan, Sulawesi and Papua. It is bestowed with vast natural resources, including petroleum and natural gas, lumber, fisheries and iron ore. Indonesia is a major producer of rubber, palm oil, coffee and cocoa. In 2015, Indonesian GDP declined to 4.79 percent. The Bank of Indonesia expects economic growth will reach between 4.9 and 5.3 percent in 2016 and 5.2 to 5.6 percent in 2017. This contrasts with growth rates above 6 percent during 2007 to 2012 period. Inflation has ranged between 2.79 (August) and 4.45 (March) during the January-October 2016 period, while the rupiah has remained weak vis-à- vis the U.S. -

Support Your Favourite Eateries

SUPPORT YOUR FAVOURITE EATERIES Eatery Unit No In Operation Contact No. Find them online https://www.absolutethai.com. Absolute Thai MBLM #B2-16 Open 6634 2371 my/absolute-thai Aloha Poke MBLM #B2-46 Open 66340730 www.alohapoke.com.sg https://m.facebook.com/arcad Arcade Fish Soup MBLM #B2-69 Open 8566 9077 efishsoup/ Awfully Chocolate MBLM #B2-33 Open 6509 9422 www.awfullychocolate.com Boost MBLM #B2-64 Open www.boostjuicebars.com.sg https://m.facebook.com/living. Botanica MBLM #B2-37 Open 6634 2330 botanica.sg/ Boulevard Bayfront MBFC T1 #01-02 Closed 6634 8761 www.Boulevard.sg Breadtalk MBLM #B2-18 Open 6509 4644 www.breadtalk.com.sg Closed but delivery available via Burger Burger King MBLM #B2-03 6634 1530 www.burgerking.com.sg King app, Deliveroo and FoodPanda https://www.facebook.com/bus Bushido MBLM GP #01-02 Closed 6634 8879 hidoasia/ Closed but delivery Cedele MBFC T3 #01-07 6443 8553 https://www.cedelemarket.com available via website .sg/ Cedele ORQ ST #B2-02 TBC 6423 4882 Chopsticks by ORQ ST#B2-04 Open 6534 9168 www.theasiankitchen.com.sg The Asian Kitchen Closed but delivery Copper Chimney MBFC T3 #02-06 9238 1272 www.copperchimney.com.sg available via website Crave MBLM #B2-63 Open - www.crave.com.sg MBFC T1 #01- Dimbulah Open - www.dimbulahcoffee.com 01A Dimbulah ORQ ST #01-10 Open - www.dimbulahcoffee.com Din Tai Fung MBLM #B2-05 Open 6634 7877 www.dintaifung.com.sg Erwin's Gastrobar MBLM GP#01-01 Open 6634 8715 www.erwins.com.sg Forbidden Duck MBLM GP #02-02 Open 6509 8767 www.forbiddenduck.sg Harry's Bar MBLM GP#01-03 Open 6634 6318 http://harrys.com.sg/ Hey Bo MBLM #B2-41 Open 6974 6209 www.heybo.sg https://m.facebook.com/Men- ya-KAIKO- 616389838505564/menu/?p_r Hokkaido Ramen ef=pa&refsrc=https%3A%2F% MBFC T3 #01-01 Open 6509 8150 Men-ya KAIKO 2Fm.facebook.com%2Fpg%2 FMen-ya-KAIKO- 616389838505564%2Fmenu %2F&_rdr Shops operating hours may vary due to exigencies.