Guidelines on Tour Operators and Travel Agents Licences

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

21 Functions of Travel Agencies and Tour

Functions of Travel Agencies and Tour Operations MODULE – 6A Travel and Tour Operation Bussiness 21 FUNCTIONS OF TRAVEL Notes AGENCIES AND TOUR OPERA- TIONS Travel agents and tour operators play a major role in boosting tourism growth across the globe. They are today accepted as crucial component of travel and tourism industry. They contribute to revenue generation through travel trade operations by bringing together clients and suppliers. According to an estimate, they account for 70% of domestic and 90% of international tourists traffic globally. In this chapter we will discuss the major functions of travel agencies and tour operators such as marketing and publicity, booking of tickets, itinerary preparation, designing of tour packages, processing of travel documents, travel insurance, travel research, conducting tours etc. OBJECTIVES After studying this lesson, you will be able to: z explain the importance of Marketing and Publicity; z explain the functioning of the following, Reservation of Tickets, Reservation of Hotel Rooms, Reservation of Ground Services, Selling Cruise Package; z conduct research, training and development of marketing of tourism; z analyse the relevance of Corporate Social Responsibility; z design Package Tours; z conduct FIT, GIT and FAM Tours; TOURISM 13 MODULE – 6A Functions of Travel Agencies and Tour Operations Travel and Tour Operation Bussiness z to provide Travel Information; z coordinate with Public and Private Tour Organisations and z appreciate the role of Disaster Preparedness 21.1 MARKETING AND PUBLICITY Marketing and publicity of tourism products in general and tour packages and Notes other services in specific is one of the major functions of travel agencies and tour operators. -

Republic of the Philippines Department of Tourism Manila

REPUBLIC OF THE PHILIPPINES DEPARTMENT OF TOURISM MANILA RULES AND REGULATIONS TO GOVERN THE ACCREDITATION OF TRAVEL AND TOUR SERVICES PURSUANT TO THE PROVISIONS OF EXECUTIVE ORDER NO.120 IN RELATION TO REPUBLIC ACT NO.7160, OTHERWISE KNOWN AS THE LOCAL GOVERNMENT CODE OF 1991 ON THE DEVOLUTION OF THE LICENSING AND REGULATORY AUTHORITY OVER CERTAIN ESTABLISHMENTS, THE FOLLOWING RULES AND REGULATIONS TO GOVERN THE ACCREDITATION OF TOUR OPERATORS, TOURIST TRANSPORTOPERA TORS, TOUR GUIDES AND PROFESSIONAL CONGRESS ORGANIZERS ARE HEREBY PROMULGATED . CHAPTER I DEFINITION Section 1. Definition of Terms. For purposes of these Rules, the following shall mean: a. "Tour Operator" shall mean an entity which may either be a single proprietorship, partnership or corporation regularly engaged in the business of extending to individuals or groups, such services pertaining to arrangements and bookings for transportation and/or accommodation, handling and/or conduct of inbound tours whether or not for a fee, commission, or any form of compensation; b. "Inbound Tour" means a tour to or of the Philippines or any place within the Philippines; c. "Department" shall mean the Department of Tourism; d. "Accreditation" a certification issued by the Department that the holder is recognized by the Department as having complied with its minimum standards in the operation of the establishment concerned; e. "Tour Guide" shall mean an individual who guides tourists, both foreign and domestic, for a fee, commission, or any other form of lawful remuneration. f. "Tourist Land Transport Operator" - a person or entity which may either be a single proprietorship, partnership or corporation, regularly engaged in providing, for a fee or lawful consideration, tourist transport services as hereinafter defined, either on charter or regular run. -

Working with Otas

WORKING WITH OTAS How to Drive More Bookings, Make More Money and Not Lose Your Shirt HOLLIS THOMASES AUGUST 2018 +1 720.410.9395 www.arival.travel Boulder, CO [email protected] WHY YOU SHOULD READ THIS Over the past two decades, online travel agencies, or OTAs (companies such as Expedia, Priceline, TripAdvisor Experiences and Booking.com that sell travel online), have redefined how travelers book flights and hotels. Now they are going big into tours, activities and attractions. We have done the hard work of surveying and interviewing OTAs, tour and activity operators and industry experts to prepare this Arival Guide to Working with OTAs. Our goal: to help you succeed amid the growing and complex world of online activity sellers. ABOUT ARIVAL Arival advances the business of creating awesome in-destination experiences through events, insights and community for Tour, Activity & Attraction providers. Our mission: establish the Best Part of Travel as the major sector of the global travel, tourism and hospitality industry that it deserves to be. Page 2 Copyright 2018 Arival LLC All Rights Reserved www.arival.travel TABLE OF CONTENTS Online Travel Agencies: An Introduction 4 - What’s an OTA, and Why You Should Care - Where Should You Start? - What Tour, Activity & Attraction Operators Think about OTAs - What to Expect 5 M Your Guide to Working (and Winning) with OTAs - Commissions 9 - Terms & Conditions 12 - Product Setup 13 - Merchandising 17 - Pricing 19 - Guest Reviews 8 M 21 - Analytics 23 37 M Seven Strategic Takeaways (read this if nothing else) 25 Terms & Definitions 28 Page 3 Copyright 2018 Arival LLC All Rights Reserved www.arival.travel ONLINE TRAVEL AGENCIES: AN INTRODUCTION 1. -

Know Your Abcs When Choosing a Tour Operator

KNOW YOUR ABCS WHEN CHOOSING A TOUR OPERATOR Knowing the ABCs of choosing and working with a tour operator will ensure a successful pre-tour, on-tour and post-tour experience for your student group. Six Flags Great America So much to do. So Convenient. Let’s go! For an unforgettable student getaway, head to Lake County, Illinois, just 30 minutes north of Chicago. Experience the thrills on high-flying roller coasters and schedule a performance opportunity at Six Flags Great America. Splash down at the new Great Wolf Lodge Illinois indoor waterpark. Check out the largest outlet and shopping destination in Illinois at Gurnee Mills. Lake County has it all, so close together. Plan your group trip today! Find more group tour ideas and a sample student-themed itinerary at VisitLakeCounty.org/StudentSpaces, and request the free Lake County Visitors Guide by contacting Jayne Nordstrom at (800) 525-3669 or [email protected]. Great Wolf Lodge Illinois Gurnee Mills VisitLakeCounty.org Copyright © 2018 by Premier Travel Media. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, mechanical or electronic, including photocopying and recording, or by any information storage and retrieval system, without permission in writing from the publisher. Requests for permission or further information should be addressed to our offices at: 630-794-0696 Legal Notices While all attempts have been made to verify information provided in this publication, neither the author nor the publisher assumes any responsibility for errors, omissions or contrary interpretation of the subject matter herein. -

Product Packaging

HISTORY OF PRODUCT PACKAGE TOURS Since their establishment in the 1960's, package tours and the number of receptive tour operators have steadily grown in importance to all aspects of Canadian tourism. It is commonly perceived as a growth opportunity for both travel volume and type of tour package offered. A number of factors contributed to the popularity of packaged tours but the single largest factor was the airlines participation in creating packages to promote their inventory of seats. This not only widened travel options and destinations but also increased the number of travelers. Package tours have several key advantages for the northern traveler including discounted rates for transportation and accommodation, convenience of one-time payment for all or most travel services, ease of vacation planning, and more travel opportunities. THE PRINCIPLES OF PRODUCT PACKAGE DEVELOPMENT Tourists do not visit Toronto just to stay at the Royal York Hotel or travel to Vancouver to visit the Aquarium. Visitors are attracted for a number of widely diverse reasons: • History • Culture • Scenic Splendor (Spectacular) • Unique and different destination They are drawn to a destination because of what they have seen, read, or heard, about an area's attractions. Today most people learn about a destination through the media: • Newspaper • Magazines • Television • Internet/web Travel patterns evolve from this point and invariably centre on the individual's interest in a particular area but seldom on one specific service element. It is here that the convenience and organized structure of a complete travel program becomes the reason for making the choice of destinations. These arrangements can come in a varied assortment of components known as PACKAGE TOURS. -

Working with Inbound Tour Operators

INTERNATIONAL WORKING WITH INBOUND TOUR OPERATORS WHAT IS AN INBOUND TOUR OPERATOR? An inbound tour operator (ITO) is an Australian based business that provides itinerary planning, product selection and coordinates the reservation, confirmation and payment of travel arrangements on behalf of their overseas clients such as wholesaler or retail travel agents. They bring components such as accommodation, tours, transport and meals together to create a fully inclusive itinerary. ITOs are also known as ground operators or destination management companies (DMCs). WHAT DO ITOs DO? The ITO’s role as the local product expert in Australia is to select and agree to work with export ready products. These products are then promoted via overseas travel distributors that sell them, such as wholesalers, direct sellers, travel agents, meeting planners and incentive houses. ITOs choose to work with products that will appeal to the customers that their overseas clients are selling to. They do not work in isolation when selecting suitable product to work with, but are influenced by the needs of their partners overseas. WHAT IS IMPORTANT TO AN ITO? ITOs are looking for: • A tried and tested product that has preferably been operating in the domestic market for a minimum of one to two years with success and fills a need in the markets being targeted • A product that represents good value for money, particularly in markets where the Australian Dollar is strong • A good quality product that is delivered with consistency and excellent customer service • A product that offers the customer a unique experience (so it’s important to know your unique selling point) • Regular availability. -

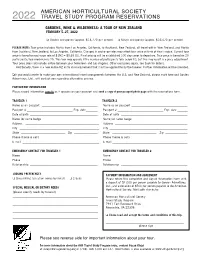

Reservation Form

AMERICAN HORTICULTURAL SOCIETY 2022 TRAVEL STUDY PROGRAM RESERVATIONS GARDENS, WINE & WILDERNESS: A TOUR OF NEW ZEALAND FEBRUARY 5–27, 2022 o Double occupancy (approx. $13,770 per person) o Single occupancy (approx. $16,470 per person) PLEASE NOTE: Tour price includes flights from Los Angeles, California, to Auckland, New Zealand, all travel within New Zealand, and flights from Auckland, New Zealand, to Los Angeles, California. Changes in exchange rates may affect tour price at time of final invoice. Current tour price is based on exchange rate of $1NZ = $0.65 US. Final pricing will be established 100 days prior to departure. Tour price is based on 20 participants; tour maximum is 25. This tour may operate if the number of participants falls below 20, but this may result in a price adjustment. Tour price does not include airfare between your hometown and Los Angeles. Other exclusions apply, see back for details. Additionally, there is a new online NZ entry visa requirement that must be applied for by the traveler. Further information will be provided. o If you would prefer to make your own international travel arrangements between the U.S. and New Zealand, please mark here and Garden Adventures, Ltd., will contact you regarding alternative pricing. PARTICIPANT INFORMATION Please record information exactly as it appears on your passport and send a copy of your passport photo page with the reservations form. TRAVELER 1 TRAVELER 2 Name as on passport ______________________________________ Name as on passport ______________________________________ -

Tour, Passport & Credit Card Information

Tour, Passport & Credit Card Information - Form is Per Couple or Person 0XVWEHFRPSOHWHGFRS\RISDVVSRUW VLJQDWXUHRIWHUPVDQGFRQGLWLRQV EDFNRIWKLVIRUP PXVWEHUHWXUQHGDVVRRQDVSRVVLEOH Tour Member Information NAME AS IT APPEARS ON PASSPORT (FIRST MIDDLE LAST). Many Tour Updates may be done via Email. Please make sure we have your correct email address. Tour Member 1 - ____________________________________Nick Name for Name Tag : __________________ Email Address:_________________________________ Tour Member 2 - ____________________________________Nick Name for Name Tag : ___________________Email Address:_________________________________ For Visa’s we require each passengers parents first names: Passenger 1 ________________ _______________ Passenger 2 ________________ _________________ Date of Departure: Make Domestic Reservations for me from: Tour Host: Dietary Restrictions: Roommate or Single-Room *We do our best to accommodate room requests however room requests Name of roommate are not guaranteed. Please read the enclosed know before you go I would like a single room at an additional cost (approximately $80/$180 per hotel night) booklet carefully; most of your questions will be answered before you ask I would like to have a roommate if possible - I understand that if there is no roommate DYDLODEOH,ZLOODFFHSWDVLQJOHURRPDQGSD\WKHVLQJOHURRPVXSSOHPHQW them. You can also refer to our website at www.Maranathatours.com for information on obtaining your passport. Passports 76$QRZUHTXLUHVVSHFL¿FLQIRUPDWLRQIURP\RXUSDVVSRUWWREHSURYLGHGDWWKHWLPH\RXUDLUOLQHWLFNHWLVLVVXHG7KH\DOVRUHTXLUHWKHQDPHRQ\RXUDLUOLQHWLFNHW -

International Reservation Form

http://www.pilgrimtours.com PO Box 268 • Morgantown, PA 19543 Phone: 800.322.0788 • Fax: 610.286.6262 International Reservation Form - Please Print Please complete the reservation form and return it with your payment (payable to “Pilgrim Tours”) to: PO Box 268, Morgantown, PA 19543 Tour Name:Israel In Depth Date of Tour: May 17-30 or June 2, 2014 Cost per person:$2,695.00 Optional Jordan Extension: $835.00 # of Persons: Departure City: No Air (land p ack age only) Deposit (per person): $300.00 X (# of travelers) = $ Cost of Insurance = (Plan Cost) : $ X (# of travelers) = $ Total Enclosed = $ Payment Method: Check Mastercard Visa Credit Card # (additional 3%, nonrefundable) Security Code (3 digits, back of card) Exp. Date Name on Credit Card Chg. Signature Address on Credit Card if different from below: Please Print Carefully! Inaccurate information will result in travel delays and/or airline change fees. FIRST PASSENGER SECOND PASSENGER (IF PAYMENT ON THIS FORM) First/Middle (as it appears on passport) First/Middle (as it appears on passport) Last (as it appears on passport) Last (as it appears on passport) Tour Badge Nickname Tour Badge Nickname Passport #* Passport #* Issuing country of passport Issuing country of passport Passport Issue Date (M/D/Y) / / Passport Issue Date (M/D/Y) / / Expiration Date (M/D/Y) / / Expiration Date (M/D/Y) / / Date of birth (M/D/Y) / / Male Female Date of birth (M/D/Y) / / Male Female P.O. Box P.O. Box Street Address Street Address City State City State Zip Phone #. Zip Phone #. Email Email Name of Roommate(s) (if on separate form) (Single supplement of $998.00 added to final invoice if no roommate listed. -

Tours and Vacation Packages

Tours and Vacation Packages INTRODUCTION Being able to suggest the perfect tour will help you become the professional whom clients rely on and return to with future travel needs. When you select the right Hawaiian tour package for a honeymoon couple or arrange a unique Asian adventure tour for a retired couple, you offer more than just airline tickets. You build an entire package that fills your clients’ needs as completely as possible. In this way, you establish a loyal clientele that will come back to you for their future travel needs. How Important Is Selling Tours and Vacation Packages? Tours are not only important—they’re crucial to any travel agency’s profitability. According to a recent survey conducted by American Society of Travel Agents (ASTA), 81 percent of all tours and packages are sold by travel agents. With a number that high, travel agents are sure to have a variety of Tours and Vacation Packages 1 needs and wants from their customers. As a travel agent, you need to be up on the latest trends in group tours and vacations packages, as well as have trips that are more unique from the rest of the tours out there. Group tours and vacation packages have varied in type over the years. The shift in touring preferences is largely driven by the baby boomer population. The demands of this generation are changing, as baby boomers want travel that matches their specific needs and interests. They like the idea of adventure and they want to travel in smaller, more concen- trated groups. -

TOURISM BUSINESS OPPORTUNITIES February 2014 American Bus Association January 11-14, 2014

TOURISM BUSINESS OPPORTUNITIES February 2014 Please follow-up via email as most have International addresses and please feel free to contact Heather Colache 609-449-7151 should you have any questions. American Bus Association January 11-14, 2014 CONTACT/LEAD NOTES/OTHER Atlantic City is in their 2014 Brochure for the first time. Looking for a 3night/4day trip. They feel that one casino is more personable that the Hanover Holiday Tours Limited others. Travel agents sell their overnight 73 14th Ave. product. Believes that it’s AC’s time. Hanover, ON N4N 3W9 Canada Phone Number: 1 519 364-4911 Company Profile: Fax Number: 1 519 364-2299 Escorted motor coach and air/motor coach tours Email Address: [email protected] across Canada and the U.S. Set itineraries and Website: www.hanoverholidays.com multiple dates offered via a full-color brochure. All Ms. Diane Diebel, V.P. (Representative) packages are commissionable, and customized itineraries are available. Special commission levels for fellow Tour Operators. 90% Adults Client love casino’s and to gamble. Books Better Business Connection Inc./TABBC Express overnights that are 3day/2nights. Odessa Basil is 22664 Relocation Dr. the event manager, she books tours around Sterling, VA 20166 events. She goes direct and uses receptives, pick United States pout the tour and hotels and works with the DMO. Phone Number: 1 703 707-2020 ext:106 Fax Number: 1 703 834-1556 Company Profile: Email Address: [email protected] Ground transportation-offering sedans, limousines, Website: www.bbcexpress.com vans, minicoaches, and full-size coaches. Provide Mr. -

2014-Religious-Travel-Planning-Guide.Pdf

2014 EDITION A Premier Travel Media publication • www.ReligiousTravelPlanningGuide.com Let Collette Guide You to a Place Beyond Travel Collette tours, by their nature, strengthen faith and Why Collette? grow the bonds of fellowship. Every travel experience ÝÛ<YjfÛ^j]]ÛljYn]d carries a sense of possibility. Our knowledgeable ÝÛ=j]]Û`ge]lgofÛlgÛYajhgjlÛljYfkhgjlYlagfÛ team, drawing on nearly 100 years of expertise, for air-inclusive groups of 10 or more* understands your needs and takes on the details ÝÛJh][aYdar]\Û>jgmhkÛ;]hYjle]flÛYf\ that come with having the perfect trip. See why Û \]\a[Yl]\Û;aklja[lÛJYd]kÛDYfY_]jk more and more faith-based groups choose to go ÝÛ:gehdae]flYjqÛeYjc]laf_ÛkmhhgjlÛ guided and become devoted Collette travelers. ÝÛ=afYf[aYdÛklYZadalqÛ¦Ûr]jgÛ\]Zl family-owned and operated ÝÛLfhmZdak`]\Ûalaf]jYja]kÛ]p[dmkan]Û^gjÛ group travel programs guided by travel *Certain restrictions apply. Call for details. For more information call 800.762.5345 or your local Travel Agent. www.gocollette.com The two Towers of the Grossmuenster in the evening light in Zurich Switzerland’s Heritage. Switzerland’s diversity, its beautiful scenery, four nation- al languages, its people and different cultures are easy to explore on one of the best public transport networks. Lucerne and Lake Lucerne Region Road” in the world, the Bahnhofstrasse. Lucerne enjoys the distinction of being the The lively tradition of merchant guilds in only Swiss town that began as a monas- Zürich is dating back to the Middle Ages. tery.Switzerland’s only born saint Brother Equally impressive are their fine guild hou- Klaus‘ family house and chapel of the 15th ses and guildhalls – such as the Zunfthaus century can be visited near Lucerne.