Report Publisher

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

An Open Letter from LGIM and Other Global Investors to the Oil and Gas Industry Oil and Gas Groups Must Do More to Support Climate Accord

2018 An open letter from LGIM and other global investors to the oil and gas industry Oil and gas groups must do more to support climate accord. For the Paris climate agreement to succeed, the oil and gas industry must be more transparent and take responsibility for all its emissions. Over the next few weeks some of the world’s largest oil and gas companies will hold their annual shareholder meetings. How these companies are positioning themselves for a low-carbon future will be an important topic for discussion. As long-term investors, representing more than $10.4tn in Regardless of the result at the Shell AGM, we strongly assets, the case for action on climate change is clear. We encourage all companies in this sector to clarify how they are keenly aware of the importance of moving to a low- see their future in a low-carbon world. This should involve carbon future for the sustainability of the global economy making concrete commitments to substantially reduce and prosperity of our clients. Additionally, regulation to carbon emissions, assessing the impact of emissions keep global warming below 2C and in line with the Paris from the use of their products and explaining how the agreement will create additional costs for carbon-intensive investments they make are compatible with a pathway industries and risk stranding assets. towards the Paris goal. The Carbon Disclosure Project estimates that the oil and gas Investors also urge policymakers to take clearer and industry and its products account for 50 per cent of global more collective action on implementing regulation that carbon emissions. -

NP Key Contacts.Pdf

IGP Network Partners: Key Contacts Region: Americas Country / Territory IGP Network Partner IGP Contact Email Type IGP Regional Coordinator Mr. Michael Spincemaille [email protected] Argentina SMG LIFE Mr. Nicolas Passet [email protected] Partner Brazil MAPFRE Vida S.A. Ms. Débora Nunes Santos [email protected] Partner Canada Manulife Financial Corporation Mr. Kajan Ramanathan [email protected] Partner Chile MAPFRE Chile Ms. Nathalie Gonzalez [email protected] Partner Colombia MAPFRE Colombia Ms. Ingrid Olarte Pérez [email protected] Partner Costa Rica MAPFRE Costa Rica Mr. Armando Sevilla [email protected] Partner Dominican Republic (Life) MAPFRE BHD Mrs. Alejandra Quirico [email protected] Partner Dominican Republic (Health) MAPFRE Salud ARS, S. A. Mr. Christian Wazar [email protected] Partner Ecuador MAPFRE Atlas * Mr. Carlos Zambrano [email protected] Correspondent El Salvador MAPFRE Seguros El Salvador S.A. Mr. Daniel Acosta González [email protected] Partner French Guiana Refer to France - - Partner Guadeloupe Refer to France - - Partner Guatemala MAPFRE Guatemala Mr. Luis Pedro Chavarría [email protected] Partner Honduras MAPFRE Honduras Mr. Carlos Ordoñez [email protected] Partner Martinique Refer to France - - Partner Mexico Seguros Monterrey New York Life Ms. Paola De Uriarte [email protected] Partner Nicaragua MAPFRE Nicaragua Mr. Dany Lanuza Flores [email protected] Partner Panama MAPFRE Panama Mr. Manuel Rodriguez [email protected] Partner Paraguay MAPFRE Paraguay Mr. Sergio Alvarenga [email protected] Partner Peru MAPFRE Peru Mr. Ramón Acuña Huerta [email protected] Partner Saint Martin Refer to France - - Partner Saint Barthélemy Refer to France - - Partner Saint Pierre & Miquelon Refer to France - - Partner United States Prudential Insurance Company of America Mr. -

Part VII Transfers Pursuant to the UK Financial Services and Markets Act 2000

PART VII TRANSFERS EFFECTED PURSUANT TO THE UK FINANCIAL SERVICES AND MARKETS ACT 2000 www.sidley.com/partvii Sidley Austin LLP, London is able to provide legal advice in relation to insurance business transfer schemes under Part VII of the UK Financial Services and Markets Act 2000 (“FSMA”). This service extends to advising upon the applicability of FSMA to particular transfers (including transfers involving insurance business domiciled outside the UK), advising parties to transfers as well as those affected by them including reinsurers, liaising with the FSA and policyholders, and obtaining sanction of the transfer in the English High Court. For more information on Part VII transfers, please contact: Martin Membery at [email protected] or telephone + 44 (0) 20 7360 3614. If you would like details of a Part VII transfer added to this website, please email Martin Membery at the address above. Disclaimer for Part VII Transfers Web Page The information contained in the following tables contained in this webpage (the “Information”) has been collated by Sidley Austin LLP, London (together with Sidley Austin LLP, the “Firm”) using publicly-available sources. The Information is not intended to be, and does not constitute, legal advice. The posting of the Information onto the Firm's website is not intended by the Firm as an offer to provide legal advice or any other services to any person accessing the Firm's website; nor does it constitute an offer by the Firm to enter into any contractual relationship. The accessing of the Information by any person will not give rise to any lawyer-client relationship, or any contractual relationship, between that person and the Firm. -

Demystifying Negative Screens: the Full Implications of ESG Exclusions

Marketing material for professional investors or advisers only Demystifying negative screens: The full implications of ESG exclusions December 2017 Contents Demystifying negative screens: Appendix: A close look at the full implications of ESG different screening options exclusions 14 Alcohol 3 Executive summary 15 Fossil fuels 3 Screening remains very popular 16 Fur in general 17 Gambling 4 But some individual screens are more 18 Nuclear popular than others 19 Pornography 4 Our Global Investor Survey highlights 20 Sin changing attitudes towards 21 Tobacco negative screens 22 Weapons 5 Interest in fossil fuel and tobacco divestment is rising 7 Focusing narrowly on returns can be deeply misleading 9 Screens can have a heavy impact on specific investment strategies 11 Details matter when implementing screens 11 Screen definition decisions can significantly alter exclusion lists and investment results 12 Different data providers can produce very different exclusion lists 12 Active management can add more value than passive when applying screens Demystifying negative screens: the full implications of ESG exclusions Screening out investments that Alexander Monk Sustainable do not meet environmental, social Investment Analyst or governance (ESG) criteria is and the Sustainable superficially simple but fraught with Investment Team practical challenges. Understanding the complexities and biases screens create before they are implemented and appropriately assessing performance afterward is crucial for investors. In this paper, we investigate the pitfalls when implementing different screens. Executive summary The chart in Figure 1 shows the extent to which typical Negative screens that sieve investments on environmental, negative exclusions constrain managers. Implementing social and governance grounds remain critical to many screens may be mechanical, but assessing their impact on investors. -

Finance for Tomorrow Brings Together Asset Managers and Asset Owners

Finance for Tomorrow brings together asset managers and asset owners representing 3.6 trillion euros in the first global engagement coalition to promote a just transition to low-carbon economies. Paris, 30 June 2021 – Finance for Tomorrow announces the launch of “Investors for a Just Transition”: the first global investor engagement coalition on the just transition. Bringing together asset managers and asset owners of the French financial ecosystem, along with corporates, the coalition aims to promote a socially acceptable transition to low-carbon economies. The founding members of the coalition will commit to engaging with companies, encouraging them to integrate the social aspects of the transition into their strategies and to highlight best practices within key industries. Through this collaborative platform, investors will work with different stakeholders – companies, labor unions, universities and research institutes – to define a common strategy and specific engagement objectives. Initiated by Finance for Tomorrow, the coalition currently represents 3.6 trillion euros and includes Amundi, Aviva France, AXA & AXA Investment Managers, Caisse des Dépôts, CNP Assurances, CPR Asset Management, Eiffel, ERAFP, La Banque Postale Asset Management, ODDO BHF Asset Management, Rothschild & Co Asset Management Europe, and SCOR Investment Partners among its founding members. Major players such as the Principles for Responsible Investment (PRI) have also joined the coalition as observers. With the COP26 to be held in a context marked by the social and economic fallout from the Covid-19 crisis, the concept of the just transition has emerged as a major factor of the global fight against climate change. Indeed, the environmental transition will only be possible through the consideration of social issues, whether they affect workers, local communities, consumers, or civil society as a whole. -

Demutualization Details

Demutualization Details 1. American Mutual Life – AmerUs- Indianapolis Life Insurance Company - Central Life Assurance - Central Life Assurance merged with American Mutual in 1994. American Mutual Life was renamed AmerUs Life Insurance Company in 1995. On September 20, 2000, it demutualized to become AmerUs Group. In 2001, the company merged with Indianapolis Life, which had also undergone a demutualization. Approximately 300,000 policyholders and heirs became entitled to receive $452 million in AmerUs Group common stock and $340 million in cash and policy credits. Distribution began on July 31, 2001. Eligible policyholders received a fixed component of 20 AmerUS common shares, as well as a variable component based on policy value. Those who elected to receive cash were compensate $26 per share entitlement. In the first year after the initial public offering, the price of an AmerUS common share increased 99%. The current value of AmerUS Group stock is approximately $45 per share. 2. Anthem Insurance - On July 31, 2002 Anthem Insurance Companies, Inc. completed its conversion from a mutual insurance company to a stock company, and became a wholly owned subsidiary of Anthem, Inc. Eligible policyholders and heirs became entitled to approximately 48 million shares of Anthem, Inc. common stock and cash totaling $2.06 billion. Compensation consisted of a fixed component of 21 Anthem common shares, as well as a variable component based on policy value. The shares were offered to the public at $36. In the first year after the initial public offering, the price of an Anthem common share increased 54%. 3. Equitable Life – Axa - In 1992 the Equitable Life Assurance Society of the United States demutualized and a new parent holding company, the Equitable Companies, was listed on the New York Stock Exchange. -

EQUI-VEST® Series 100-500 (Excludes Series 201) Variable Annuities

EQUI-VEST® Series 100-500 (excludes Series 201) Variable Annuities Portfolio Expenses (as reported in each portfolio's prospectus dated May 1, 2017) as supplemented* Acquired Total Annual Net Annual Fee waivers Fund Fees Expense Expenses Management Other and/or Class CUSIP 12b-1 Fees and Expenses (Before (After Fees Expenses Expense (Underlying Expense Expense Reimbursements Portfolios) Limitations) Limitations) EQ Advisors Trust 1290 VT DoubleLine Dynamic Allocation B 26884M628 0.75% 0.25% 0.29% 0.03% 1.32% -0.04% 1.28% 1290 VT Equity Income B 29364E801 0.75% 0.25% 0.13% 0.00% 1.13% -0.13% 1.00% 1290 VT GAMCO Mergers and Acquisitions B 29364E744 0.90% 0.25% 0.18% 0.01% 1.34% 0.00% 1.34% 1290 VT GAMCO Small Company Value B 29364E207 0.71% 0.25% 0.12% 0.00% 1.08% 0.00% 1.08% 1290 VT High Yield Bond B 26884M487 0.60% 0.25% 0.24% 0.05% 1.14% -0.04% 1.10% 1290 VT Socially Responsible B 268940418 0.50% 0.25% 0.20% 0.00% 0.95% 0.00% 0.95% All Asset Growth-Alt 20 B 29364E306 0.10% 0.25% 0.24% 0.74% 1.33% 0.00% 1.33% AXA 2000 Managed Volatility B 26884M834 0.44% 0.25% 0.16% 0.00% 0.85% 0.00% 0.85% AXA 400 Managed Volatility B 26884M800 0.45% 0.25% 0.16% 0.00% 0.86% -0.01% 0.85% AXA 500 Managed Volatility B 26884M206 0.43% 0.25% 0.15% 0.00% 0.83% 0.00% 0.83% AXA Balanced Strategy B 268954328 0.10% 0.25% 0.17% 0.53% 1.05% 0.00% 1.05% AXA Conservative Growth Strategy B 268954344 0.10% 0.25% 0.17% 0.51% 1.03% -0.03% 1.00% AXA Conservative Strategy B 268954369 0.10% 0.25% 0.17% 0.49% 1.01% -0.06% 0.95% AXA Global Equity Managed Volatility B 268940756 -

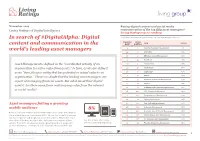

In Search of #Digitalalpha: Digital Content and Communication in the World's Leading Asset Managers

November 2014 Rating digital content and social media Living Ratings of Digital Intelligence communication of the top fifty asset managers* Living Ratings top 20 ranking In search of #DigitalAlpha: Digital *According to Investment & Pensions Europe Top 400 Asset Managers, June 2014. INDUSTRY LIVING FIRM % SCORE content and communication in the RANK RATINGS world’s leading asset managers 4 1 Fidelity Worldwide Investments 76% 34 2 Schroders 74% 36 3 MFS Investment Management 69% 1 4= BlackRock 68% Asset Management is defined as the “coordinated activity of an 20 4= T.Rowe Price 68% organisation to realise value from assets.” In turn, assets are defined 35 4= Credit Suisse 68% as an “item, thing or entity that has potential or actual value to an 25 7 TIAA-CREF 67% organisation.” There’s no doubt that the leading asset managers are 7 8 PIMCO 66% 12 9 Northern Trust Asset Management 63% expert at managing financial assets. But what about their digital 17 10 Invesco 62% assets? Are these same firms realising any value from the internet 16 11 Goldman Sachs Asset Management Int 61% or social media? 18 12= AXA Investment Managers 60% 2 12= Vanguard Asset Management 60% 42 14 Federated Investors 59% Asset managers failing a growing 37 15= New York Life Investments 58% mobile audience 8% 48 15= Columbia Management 58% 8 15= Deutsche Asset & Wealth Management 58% Between 2010-2013 visits to websites from mobile devices more than doubled. 8% 8% This is a trend that is set to continue in 2015. Yet, just four of the fifty firms we 14 18= Natixis Global Asset Management 57% rated use responsive web design features in their websites. -

List of Authorised Fund Management Companies, Managers of Collective Assets and Representatives of Foreign Collective Investment Schemes

List of authorised fund management companies, managers of collective assets and representatives of foreign collective investment schemes Name City Fund management company Representatives Managers of collective assets 1741 Fund Solutions AG St. Gallen X X 1875 Finance SA Genève X 2Xideas AG Küsnacht ZH X 3V Asset Management AG Zürich X Abaris Investment Management AG Bäch SZ X ACE & COMPANY SA Genève X X ACOLIN Fund Services AG Zürich X Acoro Asset Management AG Zürich X Active Niche Funds SA Lausanne X Akara Funds AG Zug X ALATUS CAPITAL SA Genève X Albin Kistler AG Zürich X Allianz Global Investors (Schweiz) AG Zürich X Alpha Associates AG Zürich X Alpinum Investment Management AG Zürich X Alprime Capital AG Zürich X Alpstone Capital (Suisse) SA Genève X Altrafin Advisory AG Zürich X AMG Fondsverwaltung AG Zug X ANREPA Asset Management AG Baar X Apex Asset Management AG Freienbach X Aquamarine Zürich AG Zürich X Aquila Asset Management ZH AG Zürich X ARDIAN Investment Switzerland AG Zürich X Aretas Capital Management AG Zürich X Arete Ethik Invest AG Zürich X Arfina Capital SA Zürich X ARM Swiss Representatives SA Gland X Artico Partners AG Zürich X X Arvernus Capital AG Zürich X ARVEST Funds AG Zürich X AS Investment Management SARL Genève X Asia Green Real Estate AG Zürich X 24.09.2021 / 03:31 1/11 List of authorised fund management companies, managers of collective assets and representatives of foreign collective investment schemes Name City Fund management company Representatives Managers of collective assets Asteria Investment Managers SA Genève X Atlanticomnium SA Genève X AtonRâ Partners SA Genève X AUTONOMY CAPITAL RESEARCH TWO LIMITED, (St. -

Legal & General Re Financial Condition

DocuSign Envelope ID: 45FB1B7E-B64F-40D5-8835-04932528E605 LEGAL & GENERAL REINSURANCE COMPANY LIMITED FINANCIAL CONDITION REPORT 31 DECEMBER 2019 DocuSign Envelope ID: 45FB1B7E-B64F-40D5-8835-04932528E605 CONTENTS A. Business and Performance .......................................................................................................... 4 A.1 Name of insurer ....................................................................................................................... 4 A.2 Name and contact details of the insurance supervisor and group supervisor .......................... 4 A.3 Name and contact details of the Approved Auditor .................................................................. 4 A.4 Ownership details .................................................................................................................... 4 A.5 Where the insurer is part of a group, a group structure chart showing where the insurer fits within the group structure ....................................................................................... 4 A.6 Insurance business written by business segment and by geographical region during the reporting period ................................................................................................................. 6 A.7 Performance of investments during the reporting period ......................................................... 6 A.8 Any other material information ................................................................................................. 7 B. Governance -

Manulife Japan Company Profile English Version

About Manulife History Manulife Financial Corporation is a Canada-based leading international financial services group established in 1887. Starts life insurance business as Manulife Century Insurance Company with the transfer of 1999 ● goodwill from Daihyaku Mutual Life Insurance Company. Introduces a unique consulting system called "PlanRight". 2000 ● Completes the collective transfer of the policies and related assets of Daihyaku Mutual ● 2001 Life Insurance Company to Manulife. Changes name to Manulife Life Insurance Company. ● Press Conference in 1999 Manulife becomes the first Japanese insurance company to adopt the "Company Adopting ● 2003 Commitees System". (Now also known as “Company with Nomination Committee) Establishes Manulife Asset Management (Japan) Limited (formerly MFC Global Investment ● 2004 Management Japan Co., Ltd.) as a subsidiary. Establishes Manulife Investments Japan Limited as a subsidiary. Corporate Profile of Manulife Financial Corporation 2007 ● Manulife Financial Corporation provides a variety of products and services tailored to each Donates the rst and the second "Manulife Waku Waku Rooms," which are special playrooms ● fi market in order to respond to the changing needs of our customers. 2008 designed to improve the quality of life of children undergoing hospital treatment. Becomes the 2010 sponsor of the Pacific Baseball League. 2010 ● Manulife Waku Waku Rooms at Osaka Company Name Manulife Financial Corporation General Medical Center Introduces Japan's rst non-smoker rate for medical coverage as "ManuFlex" and "ManuMed". ● fi Head Office Toronto, Ontario, Canada (Excluding cancer-related special contracts. As of January 1, 2015; research conducted by Manulife Japan.) Year Established 1887 CORPORATE Becomes the main sponsor of the final tournament of the National High School Financial Quiz. -

Report Publisher

€ Factsheet: 31/08/2021 FIXED INCOME AXA WF Euro Sustainable Credit A EUR Key Figures (EUR)* Benchmark Since: 17/12/2012 Fund Cumulative Performance (%) Current NAV 100% ICE BofA Euro Corporate 1-10 Yrs YTD 1Y 3Y 10Y Launch Acc. Inc. +0.01 +2.01 +6.98 +36.11 +63.08 162.71 124.19 Fund Key Metrics Port. Bench. Fund Annualized Performance (%) Assets Under Management (M) Linear Average Rating BBB1 A3 3 Y. 5 Y. 10 Y. Launch EUR Mod. Duration 4.34 4.42 +2.27 +1.25 +3.13 +3.80 470.31 Mod. Duration To Worst 4.35 4.42 Yield To Worst (%) 0.27 0.12 Dividend Record Number of Holdings 206 3371 Number of Issuers 127 621 Record Date Ex-Date Dividend per Share 12 month Yield (%) Dec 2017 28/12/2017 29/12/2017 0.71 0.60 Fund Profile Dec 2018 27/12/2018 28/12/2018 0.53 0.46 Dec 2019 27/12/2019 30/12/2019 0.56 0.46 ESG Rating Dec 2020 29/12/2020 30/12/2020 0.38 0.31 12 Month Yield = (Sum of Dividends) / (Ending NAV). The 12 Month yield is calculated based on the sum of the ESG Relative Rating distributions over the previous 12 months and the latest NAV. The 12 month yield may be higher or lower than the actual annual dividend yield. A positive distribution yield does not imply positive return. Dividends are not guaranteed. Past dividends are not indicative of future dividends. CO2 Relative rating Please note that a positive distribution yield does not imply a positive return.