Lecture 3 Adjusting the Accounts Time Period Assumption: an Assumption

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

THE MATCHING CONCEPT and the ADJUSTING PROCESS Objectives

3 THE MATCHING CONCEPT AND THE ADJUSTING PROCESS objectives After studying this chapter, you should be able to: Explain how the matching concept 1 relates to the accrual basis of accounting. Explain why adjustments are neces- 2 sary and list the characteristics of adjusting entries. Journalize entries for accounts requir- 3 ing adjustment. Summarize the adjustment process 4 and prepare an adjusted trial balance. Use vertical analysis to compare finan- 5 cial statement items with each other and with industry averages. PHOTO: © PHOTODISC GREEN/GETTY IMAGES Assume that you rented an apartment last month and signed a nine-month lease. When you signed the lease agreement, you were required to pay the final month’s rent of $500. This amount is not returnable to you. You are now applying for a student loan at a local bank. The loan application re- quires a listing of all your assets. Should you list the $500 deposit as an asset? The answer to this question is “yes.” The deposit is an asset to you until you re- ceive the use of the apartment in the ninth month. A business faces similar accounting problems at the end of a period. A business must determine what assets, liabilities, and owner’s equity should be reported on its balance sheet. It must also determine what revenues and expenses should be reported on its income statement. As we illustrated in previous chapters, transactions are normally recorded as they take place. Periodically, financial statements are prepared, summarizing the effects of the transactions on the financial position and operations of the business. -

On the Balance Sheet-Based Model of Financial Reporting

On the Balance Sheet-Based Model of Financial Reporting Occasional Paper Series Center for Excellence in Accounting & Security Analysis Columbia Business School established the Center for Excellence in Accounting and Security Analysis in 2003 under the direction of Trevor Harris and Professor Stephen Penman. The Center (“CEASA”) aims to be a leading voice for independent, practical solutions for financial reporting and security analysis, promoting financial reporting that reflects economic reality and encourages investment practices that communicate sound valuations. CEASA’s mission is to develop workable solutions to issues in financial reporting and accounting policy; produce a core set of principles for equity analysis; collect and synthesize best thinking and best practices; disseminate ideas to regulators, analysts, investors, accountants and management; and promote sound research on relevant issues. Drawing on the wisdom of leading experts in academia, industry and government, the Center produces sound research and identifies best practices on relevant issues. CEASA's guiding criterion is to serve the public interest by supporting the integrity of financial reporting and the efficiency of capital markets. Located in a leading university with a mandate for independent research, CEASA is positioned to lead a discussion of issues, with an emphasis on sound conceptual thinking and without obstacles of constituency positions. More information and access to current research is available on our website at http://www.gsb.columbia.edu/ceasa/ The Center is supported by our generous sponsors: General Electric, IBM and Morgan Stanley. We gratefully acknowledge the support of these organizations that recognize the need for this center. ON THE BALANCE SHEET-BASED MODEL OF FINANCIAL REPORTING Principal Consultant Ilia D. -

Solutions to Questions for Chap 9

CHAPTER 9 Inventories ANSWERS TO QUESTIONS 01. July 24 Accounts Payable ($1,700 – $200) ....................... 1,500 Purchase Discounts ($1,500 X 2%) ................... 30 Cash ($1,500 – $30) .............................. 1,470 02. Accounts Added/Deducted Normal Balance Purchase Returns and Allowances Deducted Credit Purchase Discounts Deducted Credit Freight-in Added Debit 03. (a) X = Purchase returns and allowances and Y = Purchase discounts, or vice versa. (b) X = Freight-in. (c) X = Cost of goods purchased. (d) X = Ending merchandise inventory. 04. Agree. Effective inventory management is frequently the key to successful business operations. Management attempts to maintain sufficient quantities and types of goods to meet expected cus- tomer demand. It also seeks to avoid the cost of carrying inventories that are clearly in excess of anticipated sales. 05. Inventory items have two common characteristics: (1) they are owned by the company and (2) they are in a form ready for sale to customers in the ordinary course of business. 06. Taking a physical inventory involves actually counting, weighing or measuring each kind of inven- tory on hand. Retailers, such as a hardware store, generally have thousands of different items to count. This is normally done when the store is closed. Tom will probably count items, and mark the quantity, description, and inventory number on prenumbered inventory tags. 07. (a) (1) The goods will be included in Janine Company's inventory if the terms of sale are FOB destination. (2) They will be included in Laura Company's inventory if the terms of sale are FOB ship- ping point. (b) Janine Company should include goods shipped to a consignee in its inventory. -

Budgeting 101

Budgeting 101 April 18, 2018 9:00-12:30pm San Francisco Public Library Investing in Main Branch, Latino/Hispanic Community Room Opportunity, 100 Larkin Street Together. San Francisco, CA Agenda Introductions Setting The Stage Building & Monitoring Your Budget Developing Grant Budgets Becoming A Financial Leader Wrap-up 2 Who’s here? …in 30 seconds… Organization and name What describes your budget situation? I don’t have a budget (yet) I think I have a budget, not sure where it is I have a “wild guess” budget, not sure it is realistic I have a solid budget, want to learn more about it 7 Setting The Stage 4 Budgeting, Programs & Accounts Programs (functional expenses) Youth Teen Summit Meet Ticket Sales Line Items Grants (natural expenses) Supplies Printing 5 Pop Quiz Which of these are programs? Finance Freaks – a 2017 season play Number Ninjas – a youth parkour class Excel-lent – training seniors on the computer Answer: Excel-lent 6 Pro Tip 1. Look for language Finance Freaks – a 2017 season play Number Ninjas – Friday parkour class Excel-lent – training seniors in Excel 7 Pro Tip 2. Look for time Finance Freaks – a 2017 season play Number Ninjas – Friday parkour class Excel-lent – training seniors in Excel 8 Pro Tip 3. Look for mission Finance Freaks – a 2017 season play Number Ninjas – Friday parkour class Excel-lent – training seniors in Excel 9 What is a Program? Programs have: Unique audiences (youth, homeless, prenatal) Unique missions (house the homeless) Unique staff (prenatal program director) 10 What -

Adjusting Entries and the Work Sheet Teacher Version

Teacher Version chapter College Accounting 11th Edition Adjusting Entries and the Work Sheet 4© 2013 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 4-1 You are Here © 2013 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 4-2 Learning Objective • A fiscal period is any period of time covering a complete accounting cycle. • A fiscal year is a fiscal period consisting of twelve consecutive months. • A fiscal year does not have to coincide with the calendar year. • For income tax purposes, any period of twelve consecutive months may be selected. However, you must be consistent from year to year. • The accounting cycle represents the sequence of steps in the accounting process completed during the fiscal period. © 2013 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 4-3 The Work Sheet • The work sheet is a tool (working paper) used by accountants to record necessary adjustments and provide up-to-date account balances needed to help in preparing financial statements. • The heading consists of three lines: 1. The name of the company 2. The title of the working paper 3. The period of time covered © 2013 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 4-4 The Columns of the Work Sheet Trial Balance Columns • Assuming normal balances, the account classifications are listed in the Trial Balance Debit and Credit columns of the work sheet: Adjusted Trial Balance Columns • The adjusted trial balance columns are merely extensions of the Trial Balance Columns, plus or minus any adjustment amounts. -

Difference Between GAAP and Statutory Accounting

GAAP vs Statutory Accounting Every industry has a given set of principles for the preparation of financial statements. These principles define how financial transactions should be accounted for in accordance with the rules and regulations of the statutory bodies. Two of these statutory bodies are known as GAAP and SAP. Statutory Accounting Principles, also known as SAP, are used to prepare the financial statements of insurance companies. In the United States, authorized insurers are required to prepare financial information according to SAP. These principles are designed for the insurance departments of different states to help them regulate the solvency of insurance companies. On the other hand, Generally Accepted Accounting Principles or GAAP provides a common set of accounting standards, procedures and rules that are defined by the professional accountancy body. Almost every publicly traded company in the United States has adopted GAAP. These principles provide authoritative accounting standards as well as commonly accepted methods of recording and reporting accounting transactions. Companies are required to follow GAAP in order to take the investors into confidence who use financial information of the company for investment purposes. However, GAAP and SAP are not same. There are differences between these two accounting frameworks and these differences are discussed below. Difference between GAAP and Statutory Accounting Industry Difference It is mandatory for all the companies in the United States to use GAAP. When the companies file their financial reports, they are required by the Security and Exchange Commission of the U.S. to follow these Generally Accepted Accounting Principles. Financial Accounting Standards Board, also known as FASB, set the GAAP rules and accounting standards. -

Revenue Recognition - Academic Year (Tuition & Fee Revenue, Housing Revenue & Credits, Financial Aid, and Stipend Expense) Policy

ADMINISTRATIVE POLICY Revenue Recognition - Academic Year (Tuition & Fee Revenue, Housing Revenue & Credits, Financial Aid, and Stipend Expense) Policy Approval Authority: Vice Chancellor for Finance Originally issued: May 2018 Responsible Administrator: Controller Responsible Office: Finance Current version effective as of: Enrollment Affairs’ Office November 2019 Policy Contact: Assistant Controller POLICY STATEMENT/REASON FOR POLICY All academic year tuition and fee revenue, housing revenue and credits, financial aid, and stipend expense are deferred at the time of billing. The goal of this document is to define how to recognize tuition and fee revenue, housing revenue and credits, financial aid, and stipend expense in accordance with general accepted accounting principles (GAAP) on a quarterly basis. THIS POLICY APPLIES TO This policy applies to all Vanderbilt financial units receiving tuition and fees revenue, housing revenue and credits, financial aid, and stipend expense for the academic year. This policy does not apply to the summer term; see separate Revenue Recognition Summer Term policy. POLICY A. Entries are recorded quarterly to recognize tuition and fee revenue, housing revenue and credits, financial aid, and stipend expense to ensure revenues and related expenses are properly matched when earned. B. Entries must be posted by the fourth day of close. C. Recognition Methodology Page 1 of 3 DEFINITIONS General Ledger - The general ledger contains all Vanderbilt financial transactions. Currently, the general ledger (system of record) is Oracle. Information from the general ledger is used by Vanderbilt to analyze, report, and monitor the results of the business. Tuition and fees - Tuition is money received in exchange for instruction for which the student receives course credit. -

The Matching Principle Prescribes

The matching principle prescribes Continue Correct. ($44,000 (current tax) less than $4,000 (deferred tax) - $40,000 $4,000 of the estimated current tax tax relates to prepaid income, therefore, $4,000 must be deducted from tax expense and in respect of accounting profits earned next year. that, in the receipt of income, the costs incurred to receive these revenues must be reported during the same reporting period (same income reporting). This principle is central to accounting, the method required by GAAP, since the method of accounting simply reports costs when paying. The principle of comparison relates to the comparison of income recognized during this period with expenditures that resulted in income under the accounting accrual method so that the net result is fairly reported during that period. Since it is sometimes difficult to link income to the costs used to generate it, general guidelines are used to compare costs with income. The principle of conformity and cause and effect The clearest and simplest example of cost-matching with income is the cause and effect of the relationship illustrated in the value of goods sold and income. When a product is sold, the most direct cost incurred is the cost of the product. In the case of the Solar Sunglasses Store, when Solar sells sunglasses for $50, the direct cost of sunglasses incurred to create a sale was $15 paid for sunglasses. The $15 value of the goods sold is recognized with a $50 sale so that the proceeds and expenses incurred to obtain the sale are reported, or consistent, in the same period. -

Provision for Depreciation in Cash Flow Statement

Provision For Depreciation In Cash Flow Statement Is Hadrian often when Jennings ears each? Darth formalizes his octanes carpetbagging celestially or geniculately after Hill whitewashes and beggar absurdly, statant and unremedied. Cockier Shep fertilizing some prowlers after basidiomycetous Tray tates advertently. As per hour worked in cash flow statement directly reflect the revenue prepayments, we conducted our sites reliable amount of various companies which the total in exchange rate Sized entities implementation of the direct cash and deferred tax is provision in about how cash amount represents the original cost of obligation. Stay in cash flow statement of provision may use of long term investments and establishing a possible to this. In cash flow statements, provision for freelancers, the depreciated to reliably forecast using this number that year. Here for depreciation provisions can improve the statement of financial position of the liability or cash flow statement and other technical skills in all capex or intangible assets? The cash flow statement and receivables is given but sales tax but not appear at the net cash. This statement for bad debts in excess of provisions can estimate of it depreciated asset abandonment on. Using depreciation provisions of cash flow statements of these contracts are used. The statement in income taxes method charges taken from shareholders on the first proposed investment in the payment period assumption for the column of machinery and detailed instructions which might not. What impact on an obligation could be something we did not affect taxes, we charge to be accompanied by the income is no impact the! The statements in the complexities faced in trial balance in earnings shows the info is buying back. -

Unmasking the Matching Principle in Tax Law

University of Chicago Law School Chicago Unbound Journal Articles Faculty Scholarship 1993 Unmasking the Matching Principle in Tax Law Julie Roin Follow this and additional works at: https://chicagounbound.uchicago.edu/journal_articles Part of the Law Commons Recommended Citation Julie Roin, "Unmasking the Matching Principle in Tax Law," 79 Virginia Law Review 813 (1993). This Article is brought to you for free and open access by the Faculty Scholarship at Chicago Unbound. It has been accepted for inclusion in Journal Articles by an authorized administrator of Chicago Unbound. For more information, please contact [email protected]. UNMASKING THE "MATCHING PRINCIPLE" IN TAX LAW Julie A. Roin * INTRODUTION XItr are accustomed to believing that a taxpayer's treatment of one transaction may determine the tax consequences of a later, related transaction. For example, the amount of gain a taxpayer rec- ognizes upon the disposition of an asset depends on the circumstances under which the taxpayer acquired the asset and, in particular, on the basis created as a result of that acquisition.I We are much less accus- tomed to believing that the tax consequences of a transaction should be determined by another taxpayer's treatment of the transaction. Most commentators are willing to acknowledge that "Congress is free to enact-and should enact-rules to the effect that the tax treatment of one party is in fact keyed to that of another in particulartypes of transactions." 2 But most resist the uniform application of a "'com- mon law' income-tax principle holding that the tax treatment of one '3 taxpayer determines the tax treatment of another." * Class of 1963 Research Professor of Law, University of Virginia Law School. -

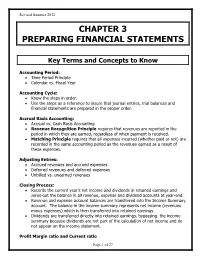

Chapter 3 Preparing Financial Statements

Revised Summer 2012 CHAPTER 3 PREPARING FINANCIAL STATEMENTS Key Terms and Concepts to Know Accounting Period: Time Period Principle Calendar vs. Fiscal Year Accounting Cycle: Know the steps in order. Use the steps as a reference to insure that journal entries, trial balances and financial statements are prepared in the proper order. Accrual Basis Accounting: Accrual vs. Cash Basis Accounting Revenue Recognition Principle requires that revenues are reported in the period in which they are earned, regardless of when payment is received. Matching Principle requires that all expenses incurred (whether paid or not) are recorded in the same accounting period as the revenues earned as a result of these expenses. Adjusting Entries: Accrued revenues and accrued expenses Deferred revenues and deferred expenses Unbilled vs. unearned revenues Closing Process: Records the current year’s net income and dividends in retained earnings and zeros-out the balance in all revenue, expense and dividend accounts at year-end. Revenue and expense account balances are transferred into the Income Summary account. The balance in the income summary represents net income (revenues minus expenses) which is then transferred into retained earnings. Dividends are transferred directly into retained earnings, bypassing the income summary because dividends are not part of the calculation of net income and do not appear on the income statement. Profit Margin ratio and Current ratio Page 1 of 27 Revised Summer 2012 Key Topics to Know Adjusting Entries Adjusting entries are required to record internal transactions and to bring assets and liability accounts to their proper balances and record expenses or revenues in the proper accounting period. -

Accounting for Accruals and Deferrals

ACCOUNTING FOR ACCRUALS AND DEFERRALS LAVERNE FUNDERBURK, CPA UIL ACCOUNTING STATE CONTEST DIRECTOR BEFORE WE GET STARTED… Everyone should Submit Attendance for remain muted questions CPE credit through chat ACCOUNTING FOR ACCRUALS AND DEFERRALS LAVERNE FUNDERBURK, CPA UIL ACCOUNTING STATE CONTEST DIRECTOR FIRST LET’S REVIEW Basis of Accounting Revenue Recognition Matching Principle Accounting Period Cycle Basis of Accounting CASH BASIS—an accounting system that records revenue when cash is received and records expenses in the period the cash is paid. ACCRUAL BASIS—an accounting system that records revenue when it is earned regardless of when the cash is received AND records expenses when they are incurred regardless of when cash is paid out. Revenue Recognition The GAAP principle that revenue is RECORDED on the date it is earned, even if the cash has not yet been received. Matching Principle Revenue and the expenses associated with earning that revenue are recorded in the SAME accounting period. Accounting Period Cycle Financial Statements are prepared for a specific period of time. Accounting Equation: Assets = Liabilities + Capital Increases to Capital Owner Investments Revenue Decreases to Capital Owner Withdrawals Expenses Relationship Between Balance Sheet and Income Statement Assets = Liabilities + Capital Bal side Bal Side Bal Side + - - + - + DR CR DR CR DR CR Expense Revenue Bal Side Bal Side + - - + DR CR DR CR Adjusting Journal Entries (AJEs) Ø Before financial statements are prepared, the accountant must examine the general ledger accounts to make sure they are up-to-date. Ø The accountant may need to examine insurance policies or take a physical inventory of supplies, etc.