Washington Prime Group Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

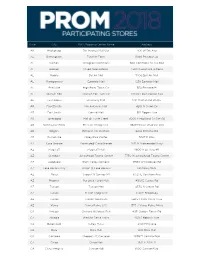

Prom 2018 Event Store List 1.17.18

State City Mall/Shopping Center Name Address AK Anchorage 5th Avenue Mall-Sur 406 W 5th Ave AL Birmingham Tutwiler Farm 5060 Pinnacle Sq AL Dothan Wiregrass Commons 900 Commons Dr Ste 900 AL Hoover Riverchase Galleria 2300 Riverchase Galleria AL Mobile Bel Air Mall 3400 Bell Air Mall AL Montgomery Eastdale Mall 1236 Eastdale Mall AL Prattville High Point Town Ctr 550 Pinnacle Pl AL Spanish Fort Spanish Fort Twn Ctr 22500 Town Center Ave AL Tuscaloosa University Mall 1701 Macfarland Blvd E AR Fayetteville Nw Arkansas Mall 4201 N Shiloh Dr AR Fort Smith Central Mall 5111 Rogers Ave AR Jonesboro Mall @ Turtle Creek 3000 E Highland Dr Ste 516 AR North Little Rock Mc Cain Shopg Cntr 3929 Mccain Blvd Ste 500 AR Rogers Pinnacle Hlls Promde 2202 Bellview Rd AR Russellville Valley Park Center 3057 E Main AZ Casa Grande Promnde@ Casa Grande 1041 N Promenade Pkwy AZ Flagstaff Flagstaff Mall 4600 N Us Hwy 89 AZ Glendale Arrowhead Towne Center 7750 W Arrowhead Towne Center AZ Goodyear Palm Valley Cornerst 13333 W Mcdowell Rd AZ Lake Havasu City Shops @ Lake Havasu 5651 Hwy 95 N AZ Mesa Superst'N Springs Ml 6525 E Southern Ave AZ Phoenix Paradise Valley Mall 4510 E Cactus Rd AZ Tucson Tucson Mall 4530 N Oracle Rd AZ Tucson El Con Shpg Cntr 3501 E Broadway AZ Tucson Tucson Spectrum 5265 S Calle Santa Cruz AZ Yuma Yuma Palms S/C 1375 S Yuma Palms Pkwy CA Antioch Orchard @Slatten Rch 4951 Slatten Ranch Rd CA Arcadia Westfld Santa Anita 400 S Baldwin Ave CA Bakersfield Valley Plaza 2501 Ming Ave CA Brea Brea Mall 400 Brea Mall CA Carlsbad Shoppes At Carlsbad -

FRANCESCA's HOLDINGS CORPORATION, Et Al.,1

Case 20-13076-BLS Doc 288 Filed 01/08/21 Page 1 of 8 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE In re: Chapter 11 Case No. 20-13076 (BLS) FRANCESCA’S HOLDINGS 1 CORPORATION, et al., (Jointly Administered) Debtors. Hearing Date: February 18, 2021 at 10:00 a.m. (ET) Objection Deadline: January 22, 2021 at 4:00 p.m. (ET) APPLICATION FOR ENTRY FOR AN ORDER PURSUANT TO 11 U.S.C. §§ 328(a) AND 1103 AUTHORIZING AND APPROVING THE EMPLOYMENT OF PROVINCE, LLC AS FINANCIAL ADVISOR TO THE OFFICIAL COMMITTEE OF UNSECURED CREDITORS NUNC PRO TUNC TO DECEMBER 14, 2020 The Official Committee of Unsecured Creditors (the “Committee”) of the above-captioned debtors and debtors-in-possession (collectively, the “Debtors”) hereby files this application (the “Application”) for entry of an order, substantially in the form attached hereto as Exhibit A, pursuant to sections 328(a) and 1103(a) of title 11 of the United States Code (the “Bankruptcy Code”), Rule 2014 of the Federal Rules of Bankruptcy Procedure (the “Bankruptcy Rules”), and Rule 2014-1 of the Local Rules of Bankruptcy Practice and Procedure of the United States Bankruptcy Court for the District of Delaware (the “Local Rules”) authorizing and approving the employment of Province, LLC (f/k/a Province, Inc.) (“Province” or the “Firm”) as financial advisor to the Committee in connection with the Debtors’ chapter 11 cases, effective as of December 14, 2020. In support of the Application, the Committee also files the declaration of Edward Kim (the “Kim Declaration”), attached hereto as Exhibit B and incorporated herein by reference. -

271 Filed 01/06/21 Page 1 of 5

Case 20-13076-BLS Doc 271 Filed 01/06/21 Page 1 of 5 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ------------------------------------------------------------ x : In re: : Chapter 11 : FRANCESCA’S HOLDINGS CORPORATION, Case No. 20-13076 (BLS) 1 : et al., : : Debtors. Jointly Administered : : Re: D.I. 45, 266 ------------------------------------------------------------ x NOTICE OF POTENTIAL ASSUMPTION AND ASSIGNMENT OF EXECUTORY CONTRACTS OR UNEXPIRED LEASES AND CURE AMOUNTS PLEASE TAKE NOTICE THAT: 1. The above-captioned debtors (collectively, the “Debtors”) each filed a voluntary petition for relief under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Delaware (the “Court”) on December 3, 2020. 2. On December 4, 2020, the Debtors filed the Motion of Debtors for Entry of Orders (I)(A) Approving Bidding Procedures for Sale of Substantially All of the Debtors’ Assets, (B) Approving Process for Designation of Stalking Horse Bidder and Provision of Bid Protections, (C) Scheduling Auction for, and Hearing to Approve, Sale of Substantially All of the Debtors’ Assets, (D) Approving Form and Manner of Notices of Sale, Auction and Sale Hearing, (E) Approving Assumption and Assignment Procedures and (F) Granting Related Relief and (II)(A) Approving Sale of Substantially All of the Debtors’ Assets Free and Clear of All Liens, Claims, Interests and Encumbrances, (B) Approving Assumption and Assignment of Executory Contracts and Unexpired Leases -

Store # State City Mall/Shopping Center Name Address Date

Store # State City Mall/Shopping Center Name Address Date 2918 AL ALABASTER COLONIAL PROMENADE 340 S COLONIAL DR Now Open! 2218 AL HOOVER RIVERCHASE GALLERIA 2300 RIVERCHASE GALLERIA Now Open! 219 AL MOBILE BEL AIR MALL MOBILE, AL 36606-3411 Now Open! 2840 AL MONTGOMERY EASTDALE MALL MONTGOMERY, AL 36117-2154 Now Open! 2956 AL PRATTVILLE HIGH POINT TOWN CENTER PRATTVILLE, AL 36066-6542 Now Open! 2875 AL SPANISH FORT SPANISH FORT TOWN CENTER 22500 TOWN CENTER AVE Now Open! 2869 AL TRUSSVILLE TUTWILER FARM 5060 PINNACLE SQ Now Open! 2709 AR FAYETTEVILLE NW ARKANSAS MALL 4201 N SHILOH DR Now Open! 1961 AR FORT SMITH CENTRAL MALL 5111 ROGERS AVE Now Open! 2914 AR LITTLE ROCK SHACKLEFORD CROSSING 2600 S SHACKLEFORD RD Now Open! 663 AR NORTH LITTLE ROCK MCCAIN SHOPPING CENTER 3929 MCCAIN BLVD STE 500 Now Open! 2879 AR ROGERS PINNACLE HLLS PROMDE 2202 BELLVIEW RD Now Open! 2936 AZ CASA GRANDE PROMNDE AT CASA GRANDE 1041 N PROMENADE PKWY Now Open! 157 AZ CHANDLER MILL CROSSING 2180 S GILBERT RD Now Open! 251 AZ GLENDALE ARROWHEAD TOWNE CENTER 7750 W ARROWHEAD TOWNE CENTER Now Open! 2842 AZ GOODYEAR PALM VALLEY CORNERST 13333 W MCDOWELL RD Now Open! 2940 AZ LAKE HAVASU CITY SHOPS AT LAKE HAVASU 5651 HWY 95 N Now Open! 2419 AZ MESA SUPERSTITION SPRINGS MALL 6525 E SOUTHERN AVE Now Open! 2846 AZ PHOENIX AHWATUKEE FOOTHILLS 5050 E RAY RD Now Open! 1480 AZ PHOENIX PARADISE VALLEY MALL 4510 E CACTUS RD Now Open! 2902 AZ TEMPE TEMPE MARKETPLACE 1900 E RIO SALADO PKWY STE 140 Now Open! 1130 AZ TUCSON EL CON SHOPPING CENTER 3501 E BROADWAY Now Open! 90 -

Store # Phone Number Store Shopping Center/Mall Address City ST Zip District Number 318 (907) 522-1254 Gamestop Dimond Center 80

Store # Phone Number Store Shopping Center/Mall Address City ST Zip District Number 318 (907) 522-1254 GameStop Dimond Center 800 East Dimond Boulevard #3-118 Anchorage AK 99515 665 1703 (907) 272-7341 GameStop Anchorage 5th Ave. Mall 320 W. 5th Ave, Suite 172 Anchorage AK 99501 665 6139 (907) 332-0000 GameStop Tikahtnu Commons 11118 N. Muldoon Rd. ste. 165 Anchorage AK 99504 665 6803 (907) 868-1688 GameStop Elmendorf AFB 5800 Westover Dr. Elmendorf AK 99506 75 1833 (907) 474-4550 GameStop Bentley Mall 32 College Rd. Fairbanks AK 99701 665 3219 (907) 456-5700 GameStop & Movies, Too Fairbanks Center 419 Merhar Avenue Suite A Fairbanks AK 99701 665 6140 (907) 357-5775 GameStop Cottonwood Creek Place 1867 E. George Parks Hwy Wasilla AK 99654 665 5601 (205) 621-3131 GameStop Colonial Promenade Alabaster 300 Colonial Prom Pkwy, #3100 Alabaster AL 35007 701 3915 (256) 233-3167 GameStop French Farm Pavillions 229 French Farm Blvd. Unit M Athens AL 35611 705 2989 (256) 538-2397 GameStop Attalia Plaza 977 Gilbert Ferry Rd. SE Attalla AL 35954 705 4115 (334) 887-0333 GameStop Colonial University Village 1627-28a Opelika Rd Auburn AL 36830 707 3917 (205) 425-4985 GameStop Colonial Promenade Tannehill 4933 Promenade Parkway, Suite 147 Bessemer AL 35022 701 1595 (205) 661-6010 GameStop Trussville S/C 5964 Chalkville Mountain Rd Birmingham AL 35235 700 3431 (205) 836-4717 GameStop Roebuck Center 9256 Parkway East, Suite C Birmingham AL 35206 700 3534 (205) 788-4035 GameStop & Movies, Too Five Pointes West S/C 2239 Bessemer Rd., Suite 14 Birmingham AL 35208 700 3693 (205) 957-2600 GameStop The Shops at Eastwood 1632 Montclair Blvd. -

WASHINGTON PRIME GROUP INC. Washington Prime Group, L.P

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number 001-36252 (Washington Prime Group Inc.) 333-205859 (Washington Prime Group, L.P.) WASHINGTON PRIME GROUP INC. Washington Prime Group, L.P. (Exact name of Registrant as specified in its charter) Indiana (Both Registrants) 46-4323686 (Washington Prime Group Inc.) (State of incorporation or organization) 46-4674640 (Washington Prime Group, L.P.) (I.R.S. Employer Identification No.) 180 East Broad Street Columbus Ohio 43215 (Address of principal executive offices) (614) 621-9000 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Washington Prime Group Inc.: Title of each class Trading Symbols Name of each exchange on which registered Common Stock, $0.0001 par value per share WPG New York Stock Exchange 7.5% Series H Cumulative Redeemable Preferred Stock, par value $0.0001 per share WPGPRH New York Stock Exchange 6.875% Series I Cumulative Redeemable Preferred Stock, par value $0.0001 per share WPGPRI New York Stock Exchange Washington Prime Group, L.P.: None Securities registered pursuant to Section 12(g) of the Act: Washington Prime Group Inc.: None Washington Prime Group, L.P.: Units of limited partnership interest (432,414 units outstanding as of March 15, 2021) Indicate by check mark if the Registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). -

Opticianry Employers - USA

www.Jobcorpsbook.org - Opticianry Employers - USA Company Business Street City State Zip Phone Fax Web Page Anchorage Opticians 600 E Northern Lights Boulevard, # 175 Anchorage AK 99503 (907) 277-8431 (907) 277-8724 LensCrafters - Anchorage Fifth Avenue Mall 320 West Fifth Avenue Ste, #174 Anchorage AK 99501 (907) 272-1102 (907) 272-1104 LensCrafters - Dimond Center 800 East Dimond Boulevard, #3-138 Anchorage AK 99515 (907) 344-5366 (907) 344-6607 http://www.lenscrafters.com LensCrafters - Sears Mall 600 E Northern Lights Boulevard Anchorage AK 99503 (907) 258-6920 (907) 278-7325 http://www.lenscrafters.com Sears Optical - Sears Mall 700 E Northern Lght Anchorage AK 99503 (907) 272-1622 Vista Optical Centers 12001 Business Boulevard Eagle River AK 99577 (907) 694-4743 Sears Optical - Fairbanks (Airport Way) 3115 Airportway Fairbanks AK 99709 (907) 474-4480 http://www.searsoptical.com Wal-Mart Vision Center 537 Johansen Expressway Fairbanks AK 99701 (907) 451-9938 Optical Shoppe 1501 E Parks Hy Wasilla AK 99654 (907) 357-1455 Sears Optical - Wasilla 1000 Seward Meridian Wasilla AK 99654 (907) 357-7620 Wal-Mart Vision Center 2643 Highway 280 West Alexander City AL 35010 (256) 234-3962 Wal-Mart Vision Center 973 Gilbert Ferry Road Southeast Attalla AL 35954 (256) 538-7902 Beckum Opticians 1805 Lakeside Circle Auburn AL 36830 (334) 466-0453 Wal-Mart Vision Center 750 Academy Drive Bessemer AL 35022 (205) 424-5810 Jim Clay Optician 1705 10th Avenue South Birmingham AL 35205 (205) 933-8615 John Sasser Opticians 1009 Montgomery Highway, # 101 -

Radio Shack Closing Locations

Radio Shack Closing Locations Address Address2 City State Zip Gadsden Mall Shop Ctr 1001 Rainbow Dr Ste 42b Gadsden AL 35901 John T Reid Pkwy Ste C 24765 John T Reid Pkwy #C Scottsboro AL 35768 1906 Glenn Blvd Sw #200 - Ft Payne AL 35968 3288 Bel Air Mall - Mobile AL 36606 2498 Government Blvd - Mobile AL 36606 Ambassador Plaza 312 Schillinger Rd Ste G Mobile AL 36608 3913 Airport Blvd - Mobile AL 36608 1097 Industrial Pkwy #A - Saraland AL 36571 2254 Bessemer Rd Ste 104 - Birmingham AL 35208 Festival Center 7001 Crestwood Blvd #116 Birmingham AL 35210 700 Quintard Mall Ste 20 - Oxford AL 36203 Legacy Marketplace Ste C 2785 Carl T Jones Dr Se Huntsville AL 35802 Jasper Mall 300 Hwy 78 E Ste 264 Jasper AL 35501 Centerpoint S C 2338 Center Point Rd Center Point AL 35215 Town Square S C 1652 Town Sq Shpg Ctr Sw Cullman AL 35055 Riverchase Galleria #292 2000 Riverchase Galleria Hoover AL 35244 Huntsville Commons 2250 Sparkman Dr Huntsville AL 35810 Leeds Village 8525 Whitfield Ave #121 Leeds AL 35094 760 Academy Dr Ste 104 - Bessemer AL 35022 2798 John Hawkins Pky 104 - Hoover AL 35244 University Mall 1701 Mcfarland Blvd #162 Tuscaloosa AL 35404 4618 Hwy 280 Ste 110 - Birmingham AL 35243 Calera Crossing 297 Supercenter Dr Calera AL 35040 Wildwood North Shop Ctr 220 State Farm Pkwy # B2 Birmingham AL 35209 Center Troy Shopping Ctr 1412 Hwy 231 South Troy AL 36081 965 Ann St - Montgomery AL 36107 3897 Eastern Blvd - Montgomery AL 36116 Premier Place 1931 Cobbs Ford Rd Prattville AL 36066 2516 Berryhill Rd - Montgomery AL 36117 2017 280 Bypass -

Cookie Booth Guide

2021 Cookie Program January 3 - March 21 COOKIE BOOTH GUIDE Cookie Booths – We’ve Got This! Cookie booths are one of the most eagerly anticipated aspects of Girls can choose any combination of the following options: the Girl Scout Cookie Program. Girls learn important • Traditional cookie booths give girls the opportunity to set up communication skills and how to network and manage their own fun and eye-catching tables at approved public locations, business while bringing sweet cookie treats to the public. The reach new customers and meet their goals. Page 2 of this Cookie Booth Phase of the 2021 cookie program begins Feb. 12 and guide outlines the options for cookie booths this year. runs through the last day of the cookie program, March 21. Cookie booth signups begin in eBudde Jan. 23 at 8 a.m. • Mobile booths or walkabouts are when girls take their cookies on the go, charting a course through their Discuss safety with caregivers before signing up for cookie booths. neighborhood and fulfilling socially distant cookie orders. Page Every girl’s participation will not look the same — some families 3 of this guide outlines the options for walkabouts in more may be comfortable and available for traditional booths and others detail. may want to keep their cookie program virtual. Involve girls in the discussion and empower them to practice problem solving while • Virtual booths can be held individually to engage family thinking creatively about how to stay safe and take charge of their and friends or as a troop and are a new and exciting experience! way. -

Washington Prime Group Inc. Annual Report 2018

Washington Prime Group Inc. Annual Report 2018 Form 10-K (NYSE:WPG) Published: February 22nd, 2018 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2017 Washington Prime Group Inc. Washington Prime Group, L.P. (Exact name of Registrant as specified in its charter) Indiana (Both Registrants) (State or other jurisdiction of incorporation or organization) 001-36252 (Washington Prime Group Inc.) 180 East Broad Street 333-205859 (Washington Prime Group, Columbus, Ohio 43215 L.P.) (Address of principal executive offices) (Commission File No.) 46-4323686 (Washington Prime Group Inc.) 46-4674640 (Washington Prime Group, (614) 621-9000 L.P.) (Registrants' telephone number, including (I.R.S. Employer Identification No.) area code) Securities registered pursuant to Section 12(b) of the Act: Washington Prime Group Inc.: Name of each exchange on which Title of each class registered Common Stock, $0.0001 par value per share New York Stock Exchange 7.5% Series H Cumulative Redeemable Preferred Stock, par value $0.0001 New York Stock Exchange per share 6.875% Series I Cumulative Redeemable Preferred Stock, par value $0.0001 New York Stock Exchange per share Washington Prime Group, L.P.: None Securities registered pursuant to Section 12(g) of the Act: Washington Prime Group Inc.: None Washington Prime Group, L.P.: Units of limited partnership interest (34,760,026 units outstanding as of February 21, 2018) Indicate by check mark if the Registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). -

Annual Report 2006

Annual Report 2006 1 Annual Report 2006 Corporate PROFILE Simon Property Group, Inc. (NYSE: SPG), headquartered in Indianapolis, Indiana, is the largest public real estate company in the United States. We operate from four major retail real estate platforms – regional malls, Premium Outlet Centers®, community/lifestyle centers and international properties. Through our subsidiary partnership, as of December 31, 2006, we owned or had an interest in 286 properties comprising 201 million square feet in 38 states plus Puerto Rico. We also held interests in 53 European shopping centers in France, Italy and Poland; five Premium Outlet Centers in Japan; and one Premium Outlet Center in Mexico. Simon Property Group is an S&P 500 Company. Additional Simon Property Group information is available at www.simon.com. Table of Contents Corporate Profile 1 Financial Highlights 2 From the CEO 3 Regional Malls 6 Premium Outlet Centers 11 Community/Lifestyle Centers 14 International Properties 16 Balance Sheet and Capital Markets 18 Selected Financial Data 21 Management’s Discussion & Analysis 22 Consolidated Financial Statements 41 Notes to Consolidated Financial Statements 46 Properties 77 Board of Directors 80 Executive Officers and Members of Senior Management 82 Investor Information 83 Regional Malls Premium Outlet Centers Community/Lifestyle Centers International Properties Simon Property Group, Inc. FINANCIAL HIGHLIGHTS Percent Change 2006 2005 2006 vs. 2005 Operating Data (in millions) Consolidated Revenue $ 3,332 $ 3,167 5.2% Funds from Operations -

WPG-20Q3-Supplementalv3.Pdf

SAFE HARBOR: Some of the information contained in this presentation includes forward looking statements. Such statements are subject to a number of risks and uncertainties which could cause actual results in the future to differ materially and adversely from those described in the forward-looking statements. Investors should consult the Company’s filings with the Securities and Exchange Commission for a description of the various risks and uncertainties which could cause such a difference before deciding whether to invest. Table of Contents Page Financial Statement Data Consolidated statements of operations (unaudited) 1 Consolidated balance sheets (unaudited) 2 Supplemental balance sheet detail 3 Components of rental income, other income and corporate overhead 4 Reconciliation of funds from operations - including pro-rata share of unconsolidated properties 5 Reconciliation of net operating income growth for comparable properties - including pro-rata share of unconsolidated properties 6 Debt Information Summary of debt 7 EBITDAre 8 Operational Data Operating metrics 9 Leasing results and base rent psf 10 Releasing spreads 11 Top 10 tenants 12 Lease expirations 13 Development Activity Capital expenditures 14 Redevelopment projects 15 Department store repositioning status 16 Property Information Property information 17-19 Other Non-GAAP pro-rata financial information 20 Proportionate share of unconsolidated properties - statements of operations (unaudited) 21 Proportionate share of unconsolidated properties - balance sheet (unaudited) 22