WASHINGTON PRIME GROUP INC. (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

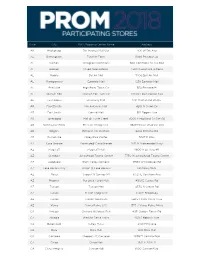

Prom 2018 Event Store List 1.17.18

State City Mall/Shopping Center Name Address AK Anchorage 5th Avenue Mall-Sur 406 W 5th Ave AL Birmingham Tutwiler Farm 5060 Pinnacle Sq AL Dothan Wiregrass Commons 900 Commons Dr Ste 900 AL Hoover Riverchase Galleria 2300 Riverchase Galleria AL Mobile Bel Air Mall 3400 Bell Air Mall AL Montgomery Eastdale Mall 1236 Eastdale Mall AL Prattville High Point Town Ctr 550 Pinnacle Pl AL Spanish Fort Spanish Fort Twn Ctr 22500 Town Center Ave AL Tuscaloosa University Mall 1701 Macfarland Blvd E AR Fayetteville Nw Arkansas Mall 4201 N Shiloh Dr AR Fort Smith Central Mall 5111 Rogers Ave AR Jonesboro Mall @ Turtle Creek 3000 E Highland Dr Ste 516 AR North Little Rock Mc Cain Shopg Cntr 3929 Mccain Blvd Ste 500 AR Rogers Pinnacle Hlls Promde 2202 Bellview Rd AR Russellville Valley Park Center 3057 E Main AZ Casa Grande Promnde@ Casa Grande 1041 N Promenade Pkwy AZ Flagstaff Flagstaff Mall 4600 N Us Hwy 89 AZ Glendale Arrowhead Towne Center 7750 W Arrowhead Towne Center AZ Goodyear Palm Valley Cornerst 13333 W Mcdowell Rd AZ Lake Havasu City Shops @ Lake Havasu 5651 Hwy 95 N AZ Mesa Superst'N Springs Ml 6525 E Southern Ave AZ Phoenix Paradise Valley Mall 4510 E Cactus Rd AZ Tucson Tucson Mall 4530 N Oracle Rd AZ Tucson El Con Shpg Cntr 3501 E Broadway AZ Tucson Tucson Spectrum 5265 S Calle Santa Cruz AZ Yuma Yuma Palms S/C 1375 S Yuma Palms Pkwy CA Antioch Orchard @Slatten Rch 4951 Slatten Ranch Rd CA Arcadia Westfld Santa Anita 400 S Baldwin Ave CA Bakersfield Valley Plaza 2501 Ming Ave CA Brea Brea Mall 400 Brea Mall CA Carlsbad Shoppes At Carlsbad -

Vision One Eyecare Savings Programs

FLORIDA (continued) Vision One Eyecare Savings Program for Blue Cross Miami JCP Miami SEA Port Richey SEA Port Richey WR□ and Blue Shield of Florida Employees International Mall International Mall Gulf View Square Mall Gulf View Square Mall Vision Typical (305) 470-7866 (813) 846-6235 (813) 849-6783 (305) 594-5865 One Cost Savings Miami SEA Miami JCP Sarasota JCP Sarasota SEA Townand Country Mall Cutler Ridge Mall Sarasota Square Mall Sarasota Square Mall FRAMES (305) 270-9255 (305) 252-2798 (813) 923-0178 (813) 921-8278 Up to $54.00 retail $20.00 60% N. Miami Beach BRO Naples SEA St Petersburg WR□ St Petersburg JCP From $55.00 to $74.00 retail $30.00 60% 1333 NE 163rd St Coastland Mall Crossroads S/C Tyrone Square Mall Over $74.00 retail 50% 50% (305) 940-4325 (813) 643-9334 (813) 347-9191 (813) 344-2611 LENSES (uncoated plastic) Ocala JCP Ocala SEA St Petersburg SEA Tallahassee JCP Single vision $30.00 50% Ppddock Mall Paddock Mall TyroneSquare Mall Governor's Square Mall Bifocal $52.00 40% (904) 237-0055 (904) 873-5270 (813) 341-7263 (904) 878-5721 Trifocal $62.00 45% Orange Park JCP Orange Park SEA Tallahassee SEA Tampa JCP Lenticular $97.00 60% Orange Park Mall Orange Park Mall Governor's Square Mall Eastlake Square Mall LENS OPTIONS (904) 264-7070 (904) 269-8239 (904) 671-6278 (813) 621-7551 (add to above lens prices) Orlando BRO Orlando JCP Tampa WR□ Tampa BRO Progressive (no line bifocals) $55.00 20% Fashion Square Mall Fashion Square Mall Eastlake Square Mall Tampa Bay Center Polycarbonate $30.00 40% (407) 896-5398 (407) 896-1006 (813) 621-5290 (813) 872-3185 Scratch resistant coating $15.00 25% Orlando SEA Orlando JCP Tampa SEA Tampa WR□ Ultra-violet coating $12.00 40% Fashion Square Mall Florida Mall Tampa Bay Center Tampa Bay Center Anti-Reflective Coating $38.00 25% (407) 228-6239 (407) 851-9133 (813) 878-9262 (813) 876-0445 Solid tint $ 8.00 33% Orlando SEA Ormond Beach SEA Tampa JCP Tampa SEA Gradient tint $12.00 20% Florida Mall 126 S. -

Simon Property Group, Inc

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2007 SIMON PROPERTY GROUP, INC. (Exact name of registrant as specified in its charter) Delaware 001-14469 04-6268599 (State or other jurisdiction of (Commission File No.) (I.R.S. Employer incorporation or organization) Identification No.) 225 West Washington Street Indianapolis, Indiana 46204 (Address of principal executive offices) (ZIP Code) (317) 636-1600 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12 (b) of the Act: Name of each exchange Title of each class on which registered Common stock, $0.0001 par value New York Stock Exchange 6% Series I Convertible Perpetual Preferred Stock, $0.0001 par value New York Stock Exchange 83⁄8% Series J Cumulative Redeemable Preferred Stock, $0.0001 par value New York Stock Exchange Securities registered pursuant to Section 12 (g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). Yes ፤ No អ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes អ No ፤ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Indianapolis, Indiana Indianapolis, Indiana

BUSINESSBUSINESS CARD CARD DIE DIE AREA AREA 225 West Washington Street Indianapolis, IN 46204 (317) 636 1600 simon.com 225 West Washington Street Indianapolis, IN 46204 (317) 636-1600 simon.com Simon Property Group (NYSE: SPG) is an S&P 100 company and a leader in the global retail real estate industry. INDIANAPOLIS, INDIANA Information as of 5/1/16 Simon is a global leader in retail real estate ownership, management and development and an S&P 100 company (Simon Property Group, NYSE:SPG). INDIANAPOLIS, INDIANA INDIANAPOLIS HOOSIER HOSPITALITY Nicknamed “The Crossroads of America” Indianapolis is at the junction of four major highways and six U.S. highways. The city is host to the largest single-day sporting event in the world - the Indianapolis 500. — Within five miles of many of the largest suburban office complexes in the market. — Employers such as FBI Headquarters Field Office, Roche Diagnostics, Community Health Network, Kroger, and Navient are located just minutes away. — Covers the affluent, growing suburbs of Zionsville, Carmel, Noblesville, Fishers, and Geist to the west, north and east respectively. — Reaches south to serve the established neighborhoods within the city of Indianapolis. A SHOPPING MAGNET Castleton Square Mall is the largest shopping center in the state of Indiana serving the northern Indianapolis metro area. — Strong anchors, a wide array of specialty stores, a diverse fast-casual eating area, and a Simon Kidgits Club® play area make Castleton Square Mall a popular destination. BY THE NUMBERS Anchored by Seven Major Retailers Von Maur, Macy’s, JCPenney, Sears, Dick’s Sporting Goods, Forever 21, H&M Square Footage Castleton Square Mall spans 1,382,000 square feet. -

FRANCESCA's HOLDINGS CORPORATION, Et Al.,1

Case 20-13076-BLS Doc 288 Filed 01/08/21 Page 1 of 8 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE In re: Chapter 11 Case No. 20-13076 (BLS) FRANCESCA’S HOLDINGS 1 CORPORATION, et al., (Jointly Administered) Debtors. Hearing Date: February 18, 2021 at 10:00 a.m. (ET) Objection Deadline: January 22, 2021 at 4:00 p.m. (ET) APPLICATION FOR ENTRY FOR AN ORDER PURSUANT TO 11 U.S.C. §§ 328(a) AND 1103 AUTHORIZING AND APPROVING THE EMPLOYMENT OF PROVINCE, LLC AS FINANCIAL ADVISOR TO THE OFFICIAL COMMITTEE OF UNSECURED CREDITORS NUNC PRO TUNC TO DECEMBER 14, 2020 The Official Committee of Unsecured Creditors (the “Committee”) of the above-captioned debtors and debtors-in-possession (collectively, the “Debtors”) hereby files this application (the “Application”) for entry of an order, substantially in the form attached hereto as Exhibit A, pursuant to sections 328(a) and 1103(a) of title 11 of the United States Code (the “Bankruptcy Code”), Rule 2014 of the Federal Rules of Bankruptcy Procedure (the “Bankruptcy Rules”), and Rule 2014-1 of the Local Rules of Bankruptcy Practice and Procedure of the United States Bankruptcy Court for the District of Delaware (the “Local Rules”) authorizing and approving the employment of Province, LLC (f/k/a Province, Inc.) (“Province” or the “Firm”) as financial advisor to the Committee in connection with the Debtors’ chapter 11 cases, effective as of December 14, 2020. In support of the Application, the Committee also files the declaration of Edward Kim (the “Kim Declaration”), attached hereto as Exhibit B and incorporated herein by reference. -

State City Shopping Center Address

State City Shopping Center Address AK ANCHORAGE 5TH AVENUE MALL SUR 406 W 5TH AVE AL FULTONDALE PROMENADE FULTONDALE 3363 LOWERY PKWY AL HOOVER RIVERCHASE GALLERIA 2300 RIVERCHASE GALLERIA AL MOBILE BEL AIR MALL 3400 BELL AIR MALL AR FAYETTEVILLE NW ARKANSAS MALL 4201 N SHILOH DR AR FORT SMITH CENTRAL MALL 5111 ROGERS AVE AR JONESBORO MALL @ TURTLE CREEK 3000 E HIGHLAND DR STE 516 AR LITTLE ROCK SHACKLEFORD CROSSING 2600 S SHACKLEFORD RD AR NORTH LITTLE ROCK MC CAIN SHOPG CNTR 3929 MCCAIN BLVD STE 500 AR ROGERS PINNACLE HLLS PROMDE 2202 BELLVIEW RD AZ CHANDLER MILL CROSSING 2180 S GILBERT RD AZ FLAGSTAFF FLAGSTAFF MALL 4600 N US HWY 89 AZ GLENDALE ARROWHEAD TOWNE CTR 7750 W ARROWHEAD TOWNE CENTER AZ GOODYEAR PALM VALLEY CORNERST 13333 W MCDOWELL RD AZ LAKE HAVASU CITY SHOPS @ LAKE HAVASU 5651 HWY 95 N AZ MESA SUPERST'N SPRINGS ML 6525 E SOUTHERN AVE AZ NOGALES MARIPOSA WEST PLAZA 220 W MARIPOSA RD AZ PHOENIX AHWATUKEE FOOTHILLS 5050 E RAY RD AZ PHOENIX CHRISTOWN SPECTRUM 1727 W BETHANY HOME RD AZ PHOENIX PARADISE VALLEY MALL 4510 E CACTUS RD AZ TEMPE TEMPE MARKETPLACE 1900 E RIO SALADO PKWY STE 140 AZ TUCSON EL CON SHPG CNTR 3501 E BROADWAY AZ TUCSON TUCSON MALL 4530 N ORACLE RD AZ TUCSON TUCSON SPECTRUM 5265 S CALLE SANTA CRUZ AZ YUMA YUMA PALMS S C 1375 S YUMA PALMS PKWY CA ANTIOCH ORCHARD @SLATTEN RCH 4951 SLATTEN RANCH RD CA ARCADIA WESTFLD SANTA ANITA 400 S BALDWIN AVE CA BAKERSFIELD VALLEY PLAZA 2501 MING AVE CA BREA BREA MALL 400 BREA MALL CA CARLSBAD PLAZA CAMINO REAL 2555 EL CAMINO REAL CA CARSON SOUTHBAY PAV @CARSON 20700 AVALON -

271 Filed 01/06/21 Page 1 of 5

Case 20-13076-BLS Doc 271 Filed 01/06/21 Page 1 of 5 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ------------------------------------------------------------ x : In re: : Chapter 11 : FRANCESCA’S HOLDINGS CORPORATION, Case No. 20-13076 (BLS) 1 : et al., : : Debtors. Jointly Administered : : Re: D.I. 45, 266 ------------------------------------------------------------ x NOTICE OF POTENTIAL ASSUMPTION AND ASSIGNMENT OF EXECUTORY CONTRACTS OR UNEXPIRED LEASES AND CURE AMOUNTS PLEASE TAKE NOTICE THAT: 1. The above-captioned debtors (collectively, the “Debtors”) each filed a voluntary petition for relief under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Delaware (the “Court”) on December 3, 2020. 2. On December 4, 2020, the Debtors filed the Motion of Debtors for Entry of Orders (I)(A) Approving Bidding Procedures for Sale of Substantially All of the Debtors’ Assets, (B) Approving Process for Designation of Stalking Horse Bidder and Provision of Bid Protections, (C) Scheduling Auction for, and Hearing to Approve, Sale of Substantially All of the Debtors’ Assets, (D) Approving Form and Manner of Notices of Sale, Auction and Sale Hearing, (E) Approving Assumption and Assignment Procedures and (F) Granting Related Relief and (II)(A) Approving Sale of Substantially All of the Debtors’ Assets Free and Clear of All Liens, Claims, Interests and Encumbrances, (B) Approving Assumption and Assignment of Executory Contracts and Unexpired Leases -

Ticketmaster and Simon Property Group Bring Tickets to Shopping Malls Across the Country

TICKETMASTER AND SIMON PROPERTY GROUP BRING TICKETS TO SHOPPING MALLS ACROSS THE COUNTRY - Ticketmaster Tickets Now Available at More Than 70 Simon Mall Locations Nationwide - LOS ANGELES – November 2, 2011 – Ticketmaster, a Live Nation Entertainment company (NYSE:LYV), and Simon Property Group, Inc. (NYSE:SPG), the country's largest owner, developer and manager of high quality retail real estate have extended and expanded their unique relationship, opening twenty-two additional Ticketmaster ticket purchasing locations in Simon malls, for a total of seventy-two Simon Malls now offering Ticketmaster event tickets at Guest Services. “Ticketmaster’s retail outlets at our Guest Service locations have been a convenient amenity for millions of our shoppers. We are pleased to be extending and expanding our relationship with Ticketmaster,” said Dennis Tietjen, senior vice president of Simon Brand Ventures, a division of Simon Property Group. “Recognizing the strategic value of Simon as a distribution channel, we worked together, to deliver a solution that would raise awareness of events and provide an onsite ticket purchasing option for our fans in their neighborhood shopping mall,” said Sandy Gaare, executive vice president of retail partners, Ticketmaster. “Ticketmaster is committed to providing convenient ticket purchasing options through our online store and our thousands of retail outlets.” In each of the seventy-two participating Simon malls, fans may purchase tickets at the Guest Service desk from a Simon associate. Tickets are printed on traditional ticket stock and are produced on location. Ticketmaster Retail Centers in Simon Malls: Apple Blossom Mall (Winchester, VA) Coral Square (Coral Springs, FL) Arsenal Mall® (Watertown, MA) Crystal Mall (Waterford, CT) Arundel Mills (Hanover, MD) Dadeland Mall (Miami, FL) Auburn Mall (Auburn, MA) DeSoto Square (Bradenton, FL) Battlefield Mall (Springfield, MO) Edison Mall (Ft. -

Store # State City Mall/Shopping Center Name Address Date 2918

Store # State City Mall/Shopping Center Name Address Date 2918 AL ALABASTER COLONIAL PROMENADE 340 S COLONIAL DR Coming Soon in September 2016! 2218 AL HOOVER RIVERCHASE GALLERIA 2300 RIVERCHASE GALLERIA Coming Soon in September 2016! 2131 AL HUNTSVILLE MADISON SQUARE 5901 UNIVERSITY DR Coming Soon in September 2016! 219 AL MOBILE BEL AIR MALL MOBILE, AL 36606-3411 Coming Soon in September 2016! 2840 AL MONTGOMERY EASTDALE MALL MONTGOMERY, AL 36117-2154 Coming Soon in September 2016! 2956 AL PRATTVILLE HIGH POINT TOWN CENTER PRATTVILLE, AL 36066-6542 Coming Soon in September 2016! 2875 AL SPANISH FORT SPANISH FORT TOWN CENTER 22500 TOWN CENTER AVE Coming Soon in September 2016! 2869 AL TRUSSVILLE TUTWILER FARM 5060 PINNACLE SQ Coming Soon in September 2016! 2709 AR FAYETTEVILLE NW ARKANSAS MALL 4201 N SHILOH DR Coming Soon in September 2016! 1961 AR FORT SMITH CENTRAL MALL 5111 ROGERS AVE Coming Soon in September 2016! 2914 AR LITTLE ROCK SHACKLEFORD CROSSING 2600 S SHACKLEFORD RD Coming Soon in July 2016! 663 AR NORTH LITTLE ROCK MC CAIN SHOPPING CENTER 3929 MCCAIN BLVD STE 500 Coming Soon in July 2016! 2879 AR ROGERS PINNACLE HLLS PROMDE 2202 BELLVIEW RD Coming Soon in September 2016! 2936 AZ CASA GRANDE PROMNDE AT CASA GRANDE 1041 N PROMENADE PKWY Coming Soon in September 2016! 157 AZ CHANDLER MILL CROSSING 2180 S GILBERT RD Coming Soon in September 2016! 251 AZ GLENDALE ARROWHEAD TOWNE CENTER 7750 W ARROWHEAD TOWNE CENTER Coming Soon in September 2016! 2842 AZ GOODYEAR PALM VALLEY CORNERST 13333 W MCDOWELL RD Coming Soon in September -

Store # State City Mall/Shopping Center Name Address Date

Store # State City Mall/Shopping Center Name Address Date 2918 AL ALABASTER COLONIAL PROMENADE 340 S COLONIAL DR Now Open! 2218 AL HOOVER RIVERCHASE GALLERIA 2300 RIVERCHASE GALLERIA Now Open! 219 AL MOBILE BEL AIR MALL MOBILE, AL 36606-3411 Now Open! 2840 AL MONTGOMERY EASTDALE MALL MONTGOMERY, AL 36117-2154 Now Open! 2956 AL PRATTVILLE HIGH POINT TOWN CENTER PRATTVILLE, AL 36066-6542 Now Open! 2875 AL SPANISH FORT SPANISH FORT TOWN CENTER 22500 TOWN CENTER AVE Now Open! 2869 AL TRUSSVILLE TUTWILER FARM 5060 PINNACLE SQ Now Open! 2709 AR FAYETTEVILLE NW ARKANSAS MALL 4201 N SHILOH DR Now Open! 1961 AR FORT SMITH CENTRAL MALL 5111 ROGERS AVE Now Open! 2914 AR LITTLE ROCK SHACKLEFORD CROSSING 2600 S SHACKLEFORD RD Now Open! 663 AR NORTH LITTLE ROCK MCCAIN SHOPPING CENTER 3929 MCCAIN BLVD STE 500 Now Open! 2879 AR ROGERS PINNACLE HLLS PROMDE 2202 BELLVIEW RD Now Open! 2936 AZ CASA GRANDE PROMNDE AT CASA GRANDE 1041 N PROMENADE PKWY Now Open! 157 AZ CHANDLER MILL CROSSING 2180 S GILBERT RD Now Open! 251 AZ GLENDALE ARROWHEAD TOWNE CENTER 7750 W ARROWHEAD TOWNE CENTER Now Open! 2842 AZ GOODYEAR PALM VALLEY CORNERST 13333 W MCDOWELL RD Now Open! 2940 AZ LAKE HAVASU CITY SHOPS AT LAKE HAVASU 5651 HWY 95 N Now Open! 2419 AZ MESA SUPERSTITION SPRINGS MALL 6525 E SOUTHERN AVE Now Open! 2846 AZ PHOENIX AHWATUKEE FOOTHILLS 5050 E RAY RD Now Open! 1480 AZ PHOENIX PARADISE VALLEY MALL 4510 E CACTUS RD Now Open! 2902 AZ TEMPE TEMPE MARKETPLACE 1900 E RIO SALADO PKWY STE 140 Now Open! 1130 AZ TUCSON EL CON SHOPPING CENTER 3501 E BROADWAY Now Open! 90 -

Store # Phone Number Store Shopping Center/Mall Address City ST Zip District Number 318 (907) 522-1254 Gamestop Dimond Center 80

Store # Phone Number Store Shopping Center/Mall Address City ST Zip District Number 318 (907) 522-1254 GameStop Dimond Center 800 East Dimond Boulevard #3-118 Anchorage AK 99515 665 1703 (907) 272-7341 GameStop Anchorage 5th Ave. Mall 320 W. 5th Ave, Suite 172 Anchorage AK 99501 665 6139 (907) 332-0000 GameStop Tikahtnu Commons 11118 N. Muldoon Rd. ste. 165 Anchorage AK 99504 665 6803 (907) 868-1688 GameStop Elmendorf AFB 5800 Westover Dr. Elmendorf AK 99506 75 1833 (907) 474-4550 GameStop Bentley Mall 32 College Rd. Fairbanks AK 99701 665 3219 (907) 456-5700 GameStop & Movies, Too Fairbanks Center 419 Merhar Avenue Suite A Fairbanks AK 99701 665 6140 (907) 357-5775 GameStop Cottonwood Creek Place 1867 E. George Parks Hwy Wasilla AK 99654 665 5601 (205) 621-3131 GameStop Colonial Promenade Alabaster 300 Colonial Prom Pkwy, #3100 Alabaster AL 35007 701 3915 (256) 233-3167 GameStop French Farm Pavillions 229 French Farm Blvd. Unit M Athens AL 35611 705 2989 (256) 538-2397 GameStop Attalia Plaza 977 Gilbert Ferry Rd. SE Attalla AL 35954 705 4115 (334) 887-0333 GameStop Colonial University Village 1627-28a Opelika Rd Auburn AL 36830 707 3917 (205) 425-4985 GameStop Colonial Promenade Tannehill 4933 Promenade Parkway, Suite 147 Bessemer AL 35022 701 1595 (205) 661-6010 GameStop Trussville S/C 5964 Chalkville Mountain Rd Birmingham AL 35235 700 3431 (205) 836-4717 GameStop Roebuck Center 9256 Parkway East, Suite C Birmingham AL 35206 700 3534 (205) 788-4035 GameStop & Movies, Too Five Pointes West S/C 2239 Bessemer Rd., Suite 14 Birmingham AL 35208 700 3693 (205) 957-2600 GameStop The Shops at Eastwood 1632 Montclair Blvd. -

WASHINGTON PRIME GROUP INC. Washington Prime Group, L.P

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number 001-36252 (Washington Prime Group Inc.) 333-205859 (Washington Prime Group, L.P.) WASHINGTON PRIME GROUP INC. Washington Prime Group, L.P. (Exact name of Registrant as specified in its charter) Indiana (Both Registrants) 46-4323686 (Washington Prime Group Inc.) (State of incorporation or organization) 46-4674640 (Washington Prime Group, L.P.) (I.R.S. Employer Identification No.) 180 East Broad Street Columbus Ohio 43215 (Address of principal executive offices) (614) 621-9000 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Washington Prime Group Inc.: Title of each class Trading Symbols Name of each exchange on which registered Common Stock, $0.0001 par value per share WPG New York Stock Exchange 7.5% Series H Cumulative Redeemable Preferred Stock, par value $0.0001 per share WPGPRH New York Stock Exchange 6.875% Series I Cumulative Redeemable Preferred Stock, par value $0.0001 per share WPGPRI New York Stock Exchange Washington Prime Group, L.P.: None Securities registered pursuant to Section 12(g) of the Act: Washington Prime Group Inc.: None Washington Prime Group, L.P.: Units of limited partnership interest (432,414 units outstanding as of March 15, 2021) Indicate by check mark if the Registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act).