Securities and Exchange Commission Form 8-K Current Report Simon Property Group, Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2006 Retail Slides

Old Dominion University Hampton Roads Real Estate Market Review and Forecast Retail Market Review 2006 Christopher E. Rouzie Senior Vice President Thalhimer Retail Review - Christopher E. Rouzie Managing Broker for Thalhimer Newport News Specializes in Retail Site Selection for National Retailers Recipient of the 2001, 2003, 2004 Presented by: CREC Gold Award and Top E.V. Williams Center Hampton Roads Producer for Thalhimer in 2001 and 2003 for Real Estate and Economic Development Hampton Roads – Retail Vacancy RETAIL MARKET REVIEW 15.00% 13.11%12.83% 13.00% 11.64% 11.19% 11.00% 9.41% 9.00% 7.55% 7.00% 5.00% 2001 2002 2003 2004 2005 2006 New Projects 1 Williamsburg Williamsburg Marketcenter Marketcenter Williamsburg Marketcenter Windsormeade Marketplace Windsormeade Marketplace Windsormeade Marketplace 2 Jefferson Commons Jefferson Commons Jefferson Commons Patrick Henry Mall Patrick Henry Mall Courthouse Marketplace 3 Courthouse Marketplace Courthouse Marketplace Berkley Commons Berkley Commons Berkley Commons Edinburgh Commons 4 Edinburgh Commons Edinburgh Commons Proposed Cahoon Commons Cahoon Commons Cahoon Commons Redevelopment 5 Mid-City Shopping Center - Portsmouth Tidewater Shopping Center - Norfolk Before After Crossways Center - Chesapeake Crossroads Center at Chesapeake Square - Chesapeake Before After Janaf Shopping Center - Norfolk Power Plant - Hampton 6 Shops at Yorktown - Yorktown Governor’s Green - Williamsburg Before Before After After New Town - Williamsburg Town Centers City Center – Newport News Coliseum Mall - Hampton 7 PeninsulaColiseum Town Mall Center - Hampton - Hampton Virginia Beach Town Center – Virginia Beach Dean Plaza – Virginia Beach City Walk at Virginia Beach – Virginia Beach Before Towne Place at Greenbrier - Chesapeake Harbour View Station Town Center - Suffolk 8 The Marquis Pipeline Benn’s Grant Bennett’s Creek The Market @ Harbor Heights Indian River & Ferrell Pkwy. -

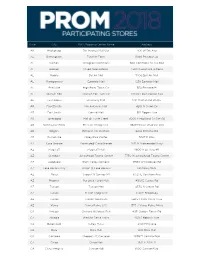

Prom 2018 Event Store List 1.17.18

State City Mall/Shopping Center Name Address AK Anchorage 5th Avenue Mall-Sur 406 W 5th Ave AL Birmingham Tutwiler Farm 5060 Pinnacle Sq AL Dothan Wiregrass Commons 900 Commons Dr Ste 900 AL Hoover Riverchase Galleria 2300 Riverchase Galleria AL Mobile Bel Air Mall 3400 Bell Air Mall AL Montgomery Eastdale Mall 1236 Eastdale Mall AL Prattville High Point Town Ctr 550 Pinnacle Pl AL Spanish Fort Spanish Fort Twn Ctr 22500 Town Center Ave AL Tuscaloosa University Mall 1701 Macfarland Blvd E AR Fayetteville Nw Arkansas Mall 4201 N Shiloh Dr AR Fort Smith Central Mall 5111 Rogers Ave AR Jonesboro Mall @ Turtle Creek 3000 E Highland Dr Ste 516 AR North Little Rock Mc Cain Shopg Cntr 3929 Mccain Blvd Ste 500 AR Rogers Pinnacle Hlls Promde 2202 Bellview Rd AR Russellville Valley Park Center 3057 E Main AZ Casa Grande Promnde@ Casa Grande 1041 N Promenade Pkwy AZ Flagstaff Flagstaff Mall 4600 N Us Hwy 89 AZ Glendale Arrowhead Towne Center 7750 W Arrowhead Towne Center AZ Goodyear Palm Valley Cornerst 13333 W Mcdowell Rd AZ Lake Havasu City Shops @ Lake Havasu 5651 Hwy 95 N AZ Mesa Superst'N Springs Ml 6525 E Southern Ave AZ Phoenix Paradise Valley Mall 4510 E Cactus Rd AZ Tucson Tucson Mall 4530 N Oracle Rd AZ Tucson El Con Shpg Cntr 3501 E Broadway AZ Tucson Tucson Spectrum 5265 S Calle Santa Cruz AZ Yuma Yuma Palms S/C 1375 S Yuma Palms Pkwy CA Antioch Orchard @Slatten Rch 4951 Slatten Ranch Rd CA Arcadia Westfld Santa Anita 400 S Baldwin Ave CA Bakersfield Valley Plaza 2501 Ming Ave CA Brea Brea Mall 400 Brea Mall CA Carlsbad Shoppes At Carlsbad -

The 2016 Annual Report of the Payday Lender Licensees Check Cashers

THE 2016 ANNUAL REPORT OF THE BUREAU OF FINANCIAL INSTITUTIONS PAYDAY LENDER LICENSEES CHECK CASHERS MOTOR VEHICLE TITLE LENDER LICENSEES OPERATING IN VIRGINIA AT THE CLOSE OF BUSINESS DECEMBER 31, 2016 BUREAU OF FINANCIAL INSTITUTIONS STATE CORPORATION COMMISSION COMMONWEALTH OF VIRGINIA STATE CORPORATION COMMISSION -- BUREAU OF FINANCIAL INSTITUTIONS 2016 ANNUAL REPORT Table of Contents Letter of Transmittal . 3. Personnel . .4 . Organizational Chart . 5. Organizational Overview . .6 . PAYDAY LENDERS Payday Lender Licensee Consolidated Operating Data . .7 . Applications Received and/or Acted Upon . 8. Status Changes . .9 . Licenses Surrendered . .1 .0 . List by Name . 1. 1. CHECK CASHERS List by Name . 1. 6. MOTOR VEHICLE TITLE LENDERS Motor Vehicle Title Lender Licensee Consolidated Operating Data . 6. 7. Applications Received and/or Acted Upon . 6. 9. Status Changes . .7 .1 . Licenses Surrendered . .7 .2 . List by Name . 7. 3. 2 STATE CORPORATION COMMISSION -- BUREAU OF FINANCIAL INSTITUTIONS 2016 ANNUAL REPORT STATE CORPORATION COMMISSION JAMES C. DIMITRI, Chairman JUDITH WILLIAMS JAGDMANN MARK C. CHRISTIE JOEL H. PECK, Clerk of the Commission Report of the Bureau of Financial Institutions Richmond, Virginia, December 31, 2016 TO THE STATE CORPORATION COMMISSION Richmond, Virginia GREETINGS: I have the honor to submit herewith the 2016 Annual Report of the Bureau of Financial Institutions - Payday Lender Licensees, Check Cashers and Motor Vehicle Title Lender Licensees. Respectfully, E. J. FACE, JR. Commissioner of Financial Institutions 3 STATE CORPORATION COMMISSION -- BUREAU OF FINANCIAL INSTITUTIONS 2016 ANNUAL REPORT BUREAU OF FINANCIAL INSTITUTIONS E. J. FACE, JR. Commissioner of Financial Institutions ADMINISTRATION & LICENSING GERALD E. FALLEN Deputy Commissioner DEPOSITORY SUPERVISION ROBERT W. HUGHES Deputy Commissioner NON-DEPOSITORY SUPERVISION SUSAN E. -

A N N U a L R E P O

ANNUAL REPORT Message from the Mayor Inside I am happy to present our annual report of Chesapeake’s achievements and successes. 3 Community Overview Despite challenging economic times, Chesapeake had a six percent increase in business investment with more than $143 4 Business Overview million and 667 new jobs created in 2010. Of special note, 33 existing companies renewed their office leases, choosing to keep their businesses and 1,846 jobs in Chesapeake. 6 Small Business 2011 has also started off on a positive note as Northrop Grumman — America’s largest 7 Business Districts shipbuilder — and the Spanish-headquartered Gamesa Corporation — the world’s third largest wind developer — decided to make Chesapeake the home of their new Offshore 12 Retail Wind Technology Center. With this announcement and other foreign investment, Chesapeake remains No. 1 in the Hampton Roads region with the largest concentration of 13 Workforce international firms. 14 Transportation But big business isn’t the only thing that gets our attention in Chesapeake. We believe that doing business in our city shouldn’t be a chore, and that it’s our job to turn 15 Port & Airport stumbling blocks into stepping stones that will lead to a bright future for those just starting 16 Technology out and those seeking to grow. Among other things, we’re moving as rapidly as possible to use the internet to make it easier to do business in Chesapeake, and we are hopeful that 17 Green Initiatives legislation working its way through the General Assembly will make it possible for new businesses to get a two-year break on BPOL taxes. -

Complete Annual Report

2 Comprehensive Annual Financial Report For the Year Ended June 30, 2007 County of San Diego CONTENTS Introductory Section Letter of Transmittal ................................................................................... 7 GFOA Certificate of Achievement ........................................................ 21 Board of Supervisors................................................................................ 22 Organizational Chart .............................................................................. 23 Other Elected and Appointed Officials................................................. 25 Financial Section Independent Auditor’s Report................................................................ 27 Management’s Discussion and Analysis ........................................29 Basic Financial Statements: .............................................................47 Government-wide Financial Statements: Statement of Net Assets ...........................................................................................48 Statement of Activities .............................................................................................49 Fund Financial Statements: Balance Sheet Governmental Funds .....................................................................51 Reconciliation of the Governmental Funds Balance Sheet to the Government-wide Statement of Net Assets .....................................................52 Statement of Revenues, Expenditures, and Changes in Fund Balances - Governmental Funds...........................................................................................53 -

Simon Property Group, Inc

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2007 SIMON PROPERTY GROUP, INC. (Exact name of registrant as specified in its charter) Delaware 001-14469 04-6268599 (State or other jurisdiction of (Commission File No.) (I.R.S. Employer incorporation or organization) Identification No.) 225 West Washington Street Indianapolis, Indiana 46204 (Address of principal executive offices) (ZIP Code) (317) 636-1600 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12 (b) of the Act: Name of each exchange Title of each class on which registered Common stock, $0.0001 par value New York Stock Exchange 6% Series I Convertible Perpetual Preferred Stock, $0.0001 par value New York Stock Exchange 83⁄8% Series J Cumulative Redeemable Preferred Stock, $0.0001 par value New York Stock Exchange Securities registered pursuant to Section 12 (g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). Yes ፤ No អ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes អ No ፤ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

2017 Annual Report Simon Property Group, Inc

WorldReginfo - b17aae64-640b-4ba7-878c-aa92dcbb46fe - WorldReginfo 2017 ANNUAL REPORT ANNUAL 2017 SIMON PROPERTY GROUP, INC. 2017 ANNUAL REPORT INNOVATING THE FUTURE OF THE SHOPPING EXPERIENCE CONTENTS From the Chairman & CEO ii Financial Highlights iv Sustainability Highlights xi Investment Highlights xii Board of Directors & Management xiv 10-K 1 Management’s Discussion & Analysis 55 Financial Statements 75 Simon Property Group, Inc. (NYSE: SPG) is an S&P100 company and a global leader in the ownership of premier shopping, dining, entertainment and mixed-use destinations. WorldReginfo - b17aae64-640b-4ba7-878c-aa92dcbb46fe ICONIC SHOPPING FOR EVERY STYLE AND TASTE THE SHOPS AT CLEARFORK Ft. Worth, Texas WorldReginfo - b17aae64-640b-4ba7-878c-aa92dcbb46fe ii SIMON PROPERTY GROUP, INC. FROM THE CHAIRMAN & CEO Dear Fellow Shareholders, As we enter our 25th year as a public company (58th year in total!), I could start this letter describing how we have changed for the better, but the real purpose of this letter is to reinforce to you, our shareholders, that we are focused on the future. Certainly our success in transforming our business since 1993 (our first year as a public company) is a good indicator that we are always adjusting and improving. Our organization lives for challenges, is driven to succeed, and is among the best-of-breed. We started our public company as a middle market mall company with 56 regional malls that were 85% occupied and generated approximately $250 in sales per square foot. Then our change began and I assure you will always continue. David Simon We led our industry in leasing, development ■ Industry-leading financial results. -

Largest Indianapolis-Area Commercial Property Management Firms (Ranked by Gross Leasable Area Managed Locally (1))

Largest Indianapolis-Area Commercial Property Management Firms (Ranked by gross leasable area managed locally (1)) LOCAL FTE: BROKERS / PERCENT LOCAL PROPERTIES AGENTS HQ LOCATION RANK FIRM GLA MANAGED(1): OFFICE MANAGED HEAD(S) OF LOCAL EMPLOYEES: OF OWNERS: ESTAB. 2009 ADDRESS LOCALLY RETAIL LARGEST INDIANAPOLIS-AREA % OF SPACE OPERATIONS, TITLE(S) PROPERTY MGT. % INDIANA LOCALLY rank TELEPHONE / FAX / WEB SITE NATIONALLY INDUSTRIAL PROPERTIES MANAGED OWNED BY FIRM LOCAL DIRECTOR(S) TOTAL % OTHER HQ CITY Cassidy Turley (2) 29.7 million 30 Keystone at the Crossing, 156 Jeffrey L. Henry, 48 26 1918 One American Square, Suite 1300, 46282 420.0 million 4 Precedent Office Park, 0 managing principal 142 74 St. Louis 1 (317) 634-6363 / fax (317) 639-0504 / cassidyturley.com 66 Castleton Park Timothy J. Michel 199 1 Duke Realty Corp. 28.5 million 20 AllPoints Midwest Bldg. 1, 187 Don Dunbar, EVP; 10 DND 1972 600 E. 96th St., Suite 100, 46240 141.9 million 0 Lebanon Building 12, 87 Charlie E. Podell, SVP 20 DND Indianapolis 2 (317) 808-6000 / fax (317) 808-6770 / dukerealty.com 80 Lebanon Building 2 Ryan Rothacker; Chris Yeakey 400 2 CB Richard Ellis 13.0 million DND Intech Park, DND David L. Reed, 33 DND 1981 101 W. Washington St., Suite 1000E, 46204 11.5 million DND Capital Center, DND managing director 31 DND Los Angeles 3 (317) 269-1000 / fax (317) 637-4404 / cbre.com DND Metropolis Andy Banister 99 4 Prologis 10.5 million DND 715 AirTech Parkway, 55 Elizabeth A. Kauchak, DND DND 1994 8102 Zionsville Road, 46268 DND DND 281 AirTech Parkway, 100 vice president, market officer DND DND Denver 4 (317) 228-6200 / fax (317) 228-6201 / prologis.com 100 558 AirTech Parkway Susan Harvey DND 3 Kite Realty Group Trust 8.8 million 57 Eli Lilly and Co., 75 John A. -

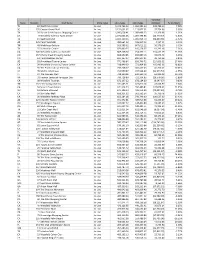

State Storeno Mall Name Store Type 2015 Sales 2014 Sales Variance

Variance State StoreNo Mall Name Store Type 2015 Sales 2014 Sales Inc/(Dec) % Inc/(Dec) TX 83 NorthPark Center In-Line 1,472,766.00 1,363,984.00 108,782.00 7.98% SC 135 Coastal Grand Mall In-Line 1,151,631.67 1,113,877.31 37,754.36 3.39% TX 20 Barton Creek Square Shopping Center In-Line 1,096,658.41 1,083,499.33 13,159.08 1.21% CA 8 Westfield Valencia Town Center In-Line 1,071,022.26 1,087,795.83 (16,773.57) -1.54% TX 19 Baybrook Mall In-Line 1,025,120.43 1,055,953.79 (30,833.36) -2.92% AZ 125 Park Place Mall In-Line 950,664.23 946,527.12 4,137.11 0.44% TN 48 Wolfchase Galleria In-Line 923,588.32 867,012.22 56,576.10 6.53% TX 55 Stonebriar Centre In-Line 876,800.55 815,558.37 61,242.18 7.51% CA 126 Westfield Galleria at Roseville In-Line 869,168.30 754,757.11 114,411.19 15.16% CO 167 Cherry Creek Shopping Center In-Line 868,959.85 835,887.13 33,072.72 3.96% CO 61 Park Meadows Center In-Line 831,157.07 800,397.91 30,759.16 3.84% AZ 28 Arrowhead Towne Center In-Line 771,406.64 656,746.72 114,659.92 17.46% CA 39 Westfield University Towne Center In-Line 738,949.33 573,464.00 165,485.33 28.86% CA 35 The Promenade at Temecula In-Line 733,268.27 666,557.65 66,710.62 10.01% KY 78 Mall St. -

Local Shopper Wins Big at Simon's Ross Park Mall

Local Shopper Wins Big At Simon's Ross Park Mall February 4, 2015 Grand prize winner in Simon Rewards Program wins keys to a Mercedes-Benz PITTSBURGH, Feb. 4, 2015 /PRNewswire/ -- Shoppers all over the country have already enjoyed prizes, discounts, and other perks as a result of the recently launched Simon Rewards program. And now, Eugene Cresta of Gibsonia, Pennsylvania has won the Grand Prize: a three-year lease for a Mercedes-Benz CLA 250. Cresta accumulated Simon Rewards points for his shopping at Ross Park Mall, which has been offering the Simon Rewards program to Pittsburgh area shoppers since last June. He accepted the grand prize during a presentation at the mall on Tuesday, February 3, along with several other Simon Rewards program prize winners from Ross Park Mall. "The Simon Rewards Program offers shoppers around the country extra benefits for what they already love to do - shop!" said Mike Gianoutsos, director of marketing and business development at Ross Park Mall. "We are very excited for Mr. Cresta and are obviously thrilled that the Simon Rewards Grand Prize winner earned his points shopping at Ross Park Mall." Simon Rewards is a unique loyalty program that invites guests to earn points for shopping, dining and visiting the mall, which can then be redeemed for chances to win a variety of prizes, including gift cards, electronics, vacations and even a luxury car. As shoppers accumulate points, they are also eligible for perks including exclusive offers and access to reserved parking. The program is currently offered at Ross Park Mall, Mall of Georgia, Orland Square Mall, South Hills Village, Woodfield Mall and The Westchester with plans to further expand in 2015. -

State City Shopping Center Address

State City Shopping Center Address AK ANCHORAGE 5TH AVENUE MALL SUR 406 W 5TH AVE AL FULTONDALE PROMENADE FULTONDALE 3363 LOWERY PKWY AL HOOVER RIVERCHASE GALLERIA 2300 RIVERCHASE GALLERIA AL MOBILE BEL AIR MALL 3400 BELL AIR MALL AR FAYETTEVILLE NW ARKANSAS MALL 4201 N SHILOH DR AR FORT SMITH CENTRAL MALL 5111 ROGERS AVE AR JONESBORO MALL @ TURTLE CREEK 3000 E HIGHLAND DR STE 516 AR LITTLE ROCK SHACKLEFORD CROSSING 2600 S SHACKLEFORD RD AR NORTH LITTLE ROCK MC CAIN SHOPG CNTR 3929 MCCAIN BLVD STE 500 AR ROGERS PINNACLE HLLS PROMDE 2202 BELLVIEW RD AZ CHANDLER MILL CROSSING 2180 S GILBERT RD AZ FLAGSTAFF FLAGSTAFF MALL 4600 N US HWY 89 AZ GLENDALE ARROWHEAD TOWNE CTR 7750 W ARROWHEAD TOWNE CENTER AZ GOODYEAR PALM VALLEY CORNERST 13333 W MCDOWELL RD AZ LAKE HAVASU CITY SHOPS @ LAKE HAVASU 5651 HWY 95 N AZ MESA SUPERST'N SPRINGS ML 6525 E SOUTHERN AVE AZ NOGALES MARIPOSA WEST PLAZA 220 W MARIPOSA RD AZ PHOENIX AHWATUKEE FOOTHILLS 5050 E RAY RD AZ PHOENIX CHRISTOWN SPECTRUM 1727 W BETHANY HOME RD AZ PHOENIX PARADISE VALLEY MALL 4510 E CACTUS RD AZ TEMPE TEMPE MARKETPLACE 1900 E RIO SALADO PKWY STE 140 AZ TUCSON EL CON SHPG CNTR 3501 E BROADWAY AZ TUCSON TUCSON MALL 4530 N ORACLE RD AZ TUCSON TUCSON SPECTRUM 5265 S CALLE SANTA CRUZ AZ YUMA YUMA PALMS S C 1375 S YUMA PALMS PKWY CA ANTIOCH ORCHARD @SLATTEN RCH 4951 SLATTEN RANCH RD CA ARCADIA WESTFLD SANTA ANITA 400 S BALDWIN AVE CA BAKERSFIELD VALLEY PLAZA 2501 MING AVE CA BREA BREA MALL 400 BREA MALL CA CARLSBAD PLAZA CAMINO REAL 2555 EL CAMINO REAL CA CARSON SOUTHBAY PAV @CARSON 20700 AVALON -

Milebymile.Com Personal Road Trip Guide Indiana Interstate Highway #465

MileByMile.com Personal Road Trip Guide Indiana Interstate Highway #465 Miles ITEM SUMMARY 2.0 Exit 2A Interstate Highway #74, United State Highway #31, Southside Park, University of Indianapolis, Garfield Park, Longacre Park, Community of Homecroft, Indiana, Community of Southport, Indiana, Southpointe Center, Greenwood Place, Community of Greenwood, Indiana, Greenwood Municipal Airport, St.Francis Hospital Indianapolis, Greenwood Park Mall, Greenwood Public Library, Craig Park, 2.0 Exit 2B United State Highway #135, East Tron Avenue, West Thompson Road, Southern Plaza Shopping Center, Bluff Park, Communities of Imperial Hills, Indiana - Hendricks, Indiana - El Dorado, Indiana, 4.0 Exit 4 State Highway #37, West Troy Avenue, West County Line Road, Indianapolis Power and Light, Indianapolis Sports Park, Glenns Valley Nature Park, Southern Dunes Golf Course, Community of Smith Valley, Indiana, 7.0 Exit 7 Mann Road, South Kentucky Avenue, West Southport Road, Buffer Park Golf Course, Winding River Golf Course, Community of Landersdale, Indiana, 8.0 Exit 8 State Highway #67, South Kentucky Road, South Lynhurst Drive, Community of Camby, Indiana, Community of Friendswood, Indiana, Carson Park, Heartland Crossing Golf Links, Community of Mooreville, Indiana, Communities of Young, Indiana - Ridgewood, Indiana, 9.0 Exit 9A-B Interstate Highway #70, Friendswood Golf Course. 9.0 Exit 9A Interstate Highway #70, Community of Joppa, Indiana. 9.0 Exit 9B Interstate Highway #70, Rand Road, Indianapolis International Airport. 11.0 Exit 11A Airport Expressway, Interstate Highway #70, West Raymond Street, Indianapolis International Airport. 11.0 Exit 11B Airport Expressway, West Raymond Street, South Holt Road, South Belmont Avenue. 11.0 11B-A Interstate Highway #70, Airport Expressway, South Lynhurst Drive.