View the Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Print Layout 1

TECHNICAL PROGRAM Monday, March 19 5:00 – 8:00 pm Welcome Reception Tuesday, March 20 8:00 – 10:00 Session 1: Setting the Conference Context and Drivers Chair: Geoff Slaff (Amgen) Roger Perlmutter (Amgen) Conquering the Innovation Deficit in Drug Discovery Helen Winkle (CDER, FDA) Regulatory Modernization 10:00 – 10:30 Break Vendor and poster review 10:30 – 12:30 Session 2: Rapid Cell Line Development and Improved Expression System Development Chairs: Timothy Charlebois (Wyeth) and John Joly (Genentech) Amy Shen (Genentech) Stable Antibody Production Cell-Line Development with an Improved Selection Process and Accelerated Timeline Mark Leonard (Wyeth) High-Performing Cell-Line Development within a Rapid and Integrated Platform Process Control Pranhitha Reddy (Amgen) Applying Quality-by-Design to Cell Line Development Lin Zhang (Pfizer) Development of a Fully-Integrated Automated System for High-Throughput Screening and Selection of Single Cells Expressing Monoclonal Antibodies 12:30 – 2:00 Lunch Vendor and poster review 2:00 – 4:30 Session 3: High-Throughput Bulk Process Development Chairs: Brian Kelley (Wyeth) and Jorg Thommes (Biogen Idec) Colette Ranucci (Merck) Development of a Multi-Well Plate System for High-Throughput Process Development Min Zhang (SAFC Biosciences) CHO Media Library – an Efficient Platform for Rapid Development and Optimization of Cell Culture Media Supporting High Production of Pharmaceutical Proteins in Chinese Hamster Ovary Cells Nigel Titchener-Hooker The Use of Ultra-Scale-Down Approaches to Enable Rapid Investigation -

Q1 Pharma Sector Snapshot

SPECIALTY & GENERIC PHARMA Q1 2021 Report Market Commentary – Debt Capital Markets Debt Markets ▪ 2020 saw increased amounts of debt used in buyouts across the board, resulting in the highest debt / EBITDA Median US Buyout Multiples levels since 2014 − The increased use of debt was driven by 2H20 back- end loaded lending activity (primarily 4Q20) as 16.0x 12.7x 14.1x 12.2x 12.0x 11.6x 11.5x certainty around the U.S. election and vaccination 11.1x 10.0x 9.8x 12.0x 9.7x expectations increased 9.4x 8.6x 8.3x 8.2x 7.5x 7.8x 5.2x 6.7x 5.7x 5.6x ▪ 8.0x 5.9x As the effects of COVID now begin to diminish, debt 5.4x 4.4x 4.1x 3.7x 4.6x 4.3x 3.8x markets have seemingly recovered, signaling that 3.6x lenders have become increasingly comfortable with 4.0x 4.3x 6.9x 6.5x 6.3x 6.0x 5.9x 5.7x 5.7x 5.7x 5.7x 5.6x 5.3x 4.5x 4.4x macroeconomic and company-specific fundamentals 4.3x 0.0x 3.2x − With increased confidence, lenders are currently looking to provide strong leverage for high-quality assets, particularly ones that have proven their Debt/EBITDA Equity/EBITDA EV/EBITDA stability through the recent market downturn Source: PitchBook ▪ The spread on U.S. high-yield debt has returned to pre- Historical US High Yield Debt Effective Yield COVID levels − 4.22% current effective yield compared with a 12.0% 11.4% 11.38% effective yield on March 23, 2020 (peak of the pandemic) 9.0% ▪ We expect increased activity by lenders in 2021 due to: 6.0% 4.2% − Pent-up demand in M&A activity driven by the impact of COVID 3.0% − Limited Partner agreements and investor -

Moderna Vaccine Day Presentation

Zika Encoded VLP mRNA(s) RSV CMV + EBV SARS-CoV- RSV-ped 2 Flu hMPV/PIV3 H7N9 Encoded mRNA(s) Ribosome Protein chain(s) First Vaccines Day April 14, 2020 © 2020 M oderna Therapeutics Forward-looking statements and disclaimers This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended including, but not limited to, statements concerning; the impact of the SARS-CoV-2 pandemic on the Company’s clinical trials and operations; the timing and finalization of a dose-confirmation Phase 2 study and planning for a pivotal Phase 3 study for mRNA-1647; the status and outcome of the Phase 1 clinical trial for mRNA-1273 being conducted by NIH; the next steps and ultimate commercial plan for mRNA-1273; the size of the potential market opportunity for mRNA-1273; the size of the potential commercial market for novel vaccines produced by Moderna or others; the potential peak sales for the Company’s wholly-owned vaccines; the probability of success of the Company’s vaccines individually and as a portfolio; and the ability of the Company to accelerate the research and development timeline for any individual product or the platform as a whole. In some cases, forward-looking statements can be identified by terminology such as “will,” “may,” “should,” “expects,” “intends,” “plans,” “aims,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. The forward-looking statements in this press release are neither promises nor guarantees, and you should not place undue reliance on these forward-looking statements because they involve known and unknown risks, uncertainties, and other factors, many of which are beyond Moderna’s control and which could cause actual results to differ materially from those expressed or implied by these forward-looking statements. -

Wyeth Pharmaceuticals Inc., a Subsidiary of Pfizer Inc Mylotarg

Mylotarg FDA ODAC Briefing Document 11 July 2017 WYETH PHARMACEUTICALS INC., A SUBSIDIARY OF PFIZER INC MYLOTARG (gemtuzumab ozogamicin; PF-05208747) In combination with chemotherapy for the treatment of previously untreated de novo CD33-positive acute myeloid leukemia and as monotherapy for the treatment of CD33-positive acute myeloid leukemia in first relapse FDA ONCOLOGIC DRUGS ADVISORY COMMITTEE BRIEFING DOCUMENT (BLA 761060) Meeting Date: 11 July 2017 ADVISORY COMMITTEE BRIEFING MATERIALS: AVAILABLE FOR PUBLIC RELEASE 090177e18c1aa788\Approved\Approved On: 12-Jun-2017 13:05 (GMT) Page 1 Mylotarg FDA ODAC Briefing Document 11 July 2017 TABLE OF CONTENTS TABLE OF CONTENTS...........................................................................................................2 LIST OF TABLES.....................................................................................................................5 LIST OF FIGURES ...................................................................................................................6 1. EXECUTIVE SUMMARY .................................................................................................7 1.1. Introduction..............................................................................................................7 1.2. Rationale for Mylotarg Dosing Regimens ...............................................................8 1.3. Mylotarg in Patients With Previously Untreated De Novo AML............................9 1.4. Mylotarg in Patients With AML in First Relapse..................................................11 -

COVID-19 Treatment and Vaccine Tracker This Document Contains an Aggregation of Publicly Available Information from Validated Sources

COVID-19 Treatment and Vaccine Tracker This document contains an aggregation of publicly available information from validated sources. It is not an endorsement of one approach or treatment over another but simply a list of all treatments and vaccines currently in development. TREATMENTS Current Type of FDA-Approved Clinical Trials for Funding Clinical Trials for Anticipated Next Number Developer/Researcher Stage of Published Results Sources Product - Treatment Indications Other Diseases Sources COVID-19 Steps Timing Development ANTIBODIES PhRMA Begin Phase 1 trials in late Polyclonal hyperimmune Alliance among Takeda, CSL Behring, Wall Street Journal spring. To patients between 1 globulin (H-IG), formerly N/A Biotest AG, Bio Products Laboratory, Pre-clinical Pink Sheet December 2020 and December known at TAK-888 LFB, and Octapharma Press release from the 2021 alliance Biomedical Stat News Advanced MarketWatch Antibodies from mice, Research and Reuters 2 REGN3048-3051, against the N/A Regeneron Pre-clinical Start Phase 1 June 2020 Development Bloomberg News spike protein Authority FierceBiotech (BARDA) FiercePharma Korea Herald Antibodies from recovered 3 N/A Celltrion Pre-clinical Start Phase 1 in July 2020 UPI COVID-19 patients Celltrion press release Super-antibody or antibody 4 cocktail to target potential N/A Celltrion Pre-clinical Celltrion press release mutations of SARS-CoV-2 Antibodies from recovered BioSpace 5 N/A Kamada Pre-clinical COVID-19 patients AbbVie Stat News Antibodies from recovered 6 N/A Vir Biotech/WuXi Biologics/Biogen Pre-clinical Start Phase 1 ~ July 2020 Vir Biotech COVID-19 patients Vir Biotech * Indicates updated or new field This document contains an aggregation of publicly available information from validated sources. -

Amgen and Wyeth Statement on FDA Announcement About Tumor Necrosis Factor (TNF) Blockers

Amgen and Wyeth Statement on FDA Announcement About Tumor Necrosis Factor (TNF) Blockers August 4, 2009 THOUSAND OAKS, Calif. and COLLEGEVILLE, Pa., Aug. 4 /PRNewswire-FirstCall/ -- Amgen (Nasdaq: AMGN) and Wyeth Pharmaceuticals, a division of Wyeth (NYSE: WYE), issued a statement in response to the Food and Drug Administration (FDA) announcement regarding the results of a safety review of Tumor Necrosis Factor (TNF) blockers [marketed as Remicade (infliximab), Enbrel (etanercept), Humira (adalimumab), Cimzia (certolizumab pegol) and Simponi (golimumab)]. This safety review was the subject of an FDA Early Communication in June 2008 pertaining to cases of malignancy in pediatric patients exposed to a TNF blocker. As a result of this review, the FDA has required strengthened warnings about the occurrence of lymphoma and other cancers in children and young adults using these medicines. AMGEN AND WYETH STATEMENT: Amgen and Wyeth believe that ENBREL continues to offer a favorable benefit-risk relationship for patients with the diseases for which it is indicated to treat, including moderate to severe Juvenile Idiopathic Arthritis (JIA). JIA can be a serious and potentially debilitating condition. Amgen will work with the FDA to update the U.S. Prescribing Information, and Medication Guide for ENBREL as described in the FDA communication which can be read at http://www.fda.gov/NewsEvents/Newsroom/PressAnnouncements/ucm175803.htm. In addition, Amgen and Wyeth will communicate the revised product labeling to both physicians and patients. ENBREL was first approved for JIA in the U.S. in 1999. It is estimated through postmarketing data that approximately 13,847 pediatric patients have been treated with ENBREL globally through February 2009, accounting for approximately 44,600 patient-years of exposure. -

Companies in Attendance

COMPANIES IN ATTENDANCE Abbott Diabetes Care Archbow Consulting LLC Business One Technologies Abbott Laboratories ARKRAY USA BusinessOneTech AbbVie Armory Hill Advocates, LLC CastiaRX ACADIA Artia Solutions Catalyst Acaria Health Asembia Celgene Accredo Assertio Therapeutics Celltrion Acer Therapeutics AssistRx Center for Creative Leadership Acorda Therapeutics Astellas Pharma US Inc. Cigna Actelion AstraZeneca Cigna Specialty Pharmacy AdhereTech Athenex Oncology Circassia Advantage Point Solutions Avanir Coeus Consulting Group Aerie Pharmaceuticals Avella Coherus Biosciences AGIOS AveXis Collaborative Associates LLC Aimmune Theraputics Bank of America Collegium Akcea Therapeutics Bausch Health Corsica Life Sciences Akebia Therapeutics Bayer U.S. CoverMyMeds Alder BioPharmaceuticals Becton Dickinson Creehan & Company, Inc., an Inovalon Company Alexion Biofrontera CSL Behring Alkermes Biogen Curant Health Allergan Biohaven CVS Health Almirall BioMarin D2 Consulting Alnylam BioMatrix Specialty Pharmacy Daiichi Sankyo Amarin BioPlus Specialty Pharmacy DBV Technologies Amber Pharmacy Bioventus Deloitte Consulting LLP AmerisourceBergen Blue Cross Blue Shield Association Dendreon Amgen Blue Fin Group Dermira Amicus Therapeutics bluebird bio Dexcom Amneal Boehringer Ingelheim Diplomat Pharmacy Anthem Boston Biomedical Dova Applied Policy Bowler and Company Decision Resources Group Aquestive Therapeutics Braeburn Eisai Arbor Pharmaceuticals Bristol-Myers Squibb 1 electroCore Indivior Merz Pharmaceuticals EMD Serono Inside Rx Milliman Encore Dermatology, -

Valeant Pharmaceuticals International, Inc. 2012 Annual Report Valeant Inc

Valeant Pharmaceuticals International, Inc. 2012 Annual Report Valeant Pharmaceuticals International, Inc. 2012 Annual Report Valeant Gathering Momentum Company Overview Valeant Pharmaceuticals International, Inc. (NYSE/TSX:VRX) is a multinational specialty pharmaceutical company that develops and markets prescription and non-prescription pharmaceutical products that make a meaningful difference in patients’ lives. Valeant’s primary focus is principally in the areas of dermatology and neurology. The Company’s growth strategy is to acquire, develop and commercialize new products through strategic partnerships, and build on the company’s strength in dermatology and neurology. Valeant plans to strategically expand its pipeline by adding new compounds or products through product or company acquisitions and will maximize its pipeline through strategic partnering to optimize its research and development assets and strengthen ongoing internal development capabilities. Valeant’s strategic markets are primarily in the United States, Canada, Central and Eastern Europe, Latin America, Australia and South East Asia. Headquartered in Montreal, Quebec, Valeant has approximately 7,000 employees worldwide. FORWARD-LOOKING Statements In addition to current and historical information, this Annual Report contains forward-looking statements, including, without limitation, statements regarding our strategy, expected future revenue, the prospects for approval of product candidates and the timing of regulatory approvals, and the growth and future development of the company, its business units and its products. Words such as “expects,” “anticipates,” “intends,” “plans,” “should,” “could,” “would,” “may,” “will,” “believes,” “estimates,” “potential,” or “continue” or similar language identify forward-looking statements. Forward-looking statements involve known and unknown risks and uncertainties. Our actual results may differ materially from those contemplated by the forward-looking statements. -

Fidelity® Select Portfolio® Pharmaceuticals Portfolio

Quarterly Holdings Report for Fidelity® Select Portfolio® Pharmaceuticals Portfolio November 30, 2020 PHR-QTLY-0121 1.810707.116 Schedule of Investments November 30, 2020 (Unaudited) Showing Percentage of Net Assets Common Stocks – 98.3% Shares Value Shares Value Biotechnology – 17.6% Bausch Health Cos., Inc. (Canada) (a) 535,300 $ 9,937,694 Biotechnology – 17.6% Bristol‑Myers Squibb Co. 1,295,680 80,850,432 Acceleron Pharma, Inc. (a) 128,800 $ 15,207,416 Catalent, Inc. (a) 75,400 7,248,956 Amgen, Inc. 137,400 30,508,296 Elanco Animal Health, Inc. (a) 172,400 5,273,716 Argenx SE (a) 17,400 4,983,924 Eli Lilly & Co. 416,961 60,730,370 Ascendis Pharma A/S sponsored ADR (a) 51,300 8,655,849 GlaxoSmithKline PLC sponsored ADR 348,300 12,813,957 Atea Pharmaceuticals, Inc. 39,800 1,326,136 Harmony Biosciences Holdings, Inc. 133,077 5,467,801 Athenex, Inc. (a) (b) 166,800 2,273,484 Horizon Therapeutics PLC (a) 316,100 22,262,923 BioNTech SE ADR (a) (b) 50,148 6,230,388 Intra‑Cellular Therapies, Inc. (a) 107,000 2,529,480 Blueprint Medicines Corp. (a) 80,300 8,678,824 Johnson & Johnson 337,850 48,880,138 ChemoCentryx, Inc. (a) 6,400 352,960 Merck & Co., Inc. 515,936 41,476,095 Galapagos Genomics NV sponsored ADR (a) 36,900 4,524,309 Nektar Therapeutics (a) (b) 368,233 6,035,339 Generation Bio Co. (b) 16,738 807,106 Novartis AG sponsored ADR 441,496 40,101,082 Generation Bio Co. -

Case 5:19-Cv-01087-OLG Document 55 Filed 05/07/20 Page 1 of 11

Case 5:19-cv-01087-OLG Document 55 Filed 05/07/20 Page 1 of 11 UNITED STATES DISTRICT COURT WESTERN DISTRICT OF TEXAS SAN ANTONIO DIVISION RAMON D. JOHNSON, II, § Plaintiffs, § § v. § § Civil Action No. 5:19-cv-01087-OLG NOVARTIS PHARMACEUTICALS § CORPORATION; TARO § PHARMACEUTICALS USA, INC.; § BAUSCH HEALTH US, LLC; SUN § PHARMACEUTICAL INDUSTRIES § LTD.; and TORRENT PHARMA, INC., § Defendants. § ORDER On this day, the Court considered the status of the above-captioned case. Currently pending before the Court are Defendants Sun Pharmaceutical Industries and Tara Pharmaceuticals USA’s Motion to Dismiss (docket no. 8); Defendant Novartis Pharmaceuticals Corporation’s Motion to Dismiss (docket no. 9); Defendant Torrent Pharma, Inc.’s Motion to Dismiss (docket no. 12); and Defendant Bausch Health US, LLC’s Motion to Dismiss (docket no. 23). Also pending are Plaintiff’s Motion for Leave to File a Combined Rebuttal to Defendants’ Replies in Support of their Motions to Dismiss (docket no. 44) and Plaintiff’s Motion for Leave to File a First Amended Complaint for a Civil Case and To Edit the Style of the Case (docket no. 47). Having considered each of these Motions and the record, the Court finds that Defendants’ Motions to Dismiss should be GRANTED. BACKGROUND On September 10, 2019, Plaintiff Ramon D. Johnson II (“Plaintiff”) initiated this lawsuit alleging that he suffered personal injuries resulting from his use of two drugs: Minocycline and Carbamazepine. See docket no. 1. Specifically, Plaintiff alleges that he was prescribed 1 Case 5:19-cv-01087-OLG Document 55 Filed 05/07/20 Page 2 of 11 Minocycline in April 2013 for an unrelated condition. -

Mvx List.Pdf

MVX_CODE manufacturer_name Notes status last updated date manufacturer_id AB Abbott Laboratories includes Ross Products Division, Solvay Inactive 16-Nov-17 1 ACA Acambis, Inc acquired by sanofi in sept 2008 Inactive 28-May-10 2 AD Adams Laboratories, Inc. Inactive 16-Nov-17 3 ALP Alpha Therapeutic Corporation Inactive 16-Nov-17 4 AR Armour part of CSL Inactive 28-May-10 5 AVB Aventis Behring L.L.C. part of CSL Inactive 28-May-10 6 AVI Aviron acquired by Medimmune Inactive 28-May-10 7 BA Baxter Healthcare Corporation-inactive Inactive 28-May-10 8 BAH Baxter Healthcare Corporation includes Hyland Immuno, Immuno International AG,and North American Vaccine, Inc./acquired somInactive 16-Nov-17 9 BAY Bayer Corporation Bayer Biologicals now owned by Talecris Inactive 28-May-10 10 BP Berna Products Inactive 28-May-10 11 BPC Berna Products Corporation includes Swiss Serum and Vaccine Institute Berne Inactive 16-Nov-17 12 BTP Biotest Pharmaceuticals Corporation New owner of NABI HB as of December 2007, Does NOT replace NABI Biopharmaceuticals in this codActive 28-May-10 13 MIP Emergent BioSolutions Formerly Emergent BioDefense Operations Lansing and Michigan Biologic Products Institute Active 16-Nov-17 14 CSL bioCSL bioCSL a part of Seqirus Inactive 26-Sep-16 15 CNJ Cangene Corporation Purchased by Emergent Biosolutions Inactive 29-Apr-14 16 CMP Celltech Medeva Pharmaceuticals Part of Novartis Inactive 28-May-10 17 CEN Centeon L.L.C. Inactive 28-May-10 18 CHI Chiron Corporation Part of Novartis Inactive 28-May-10 19 CON Connaught acquired by Merieux Inactive 28-May-10 21 DVC DynPort Vaccine Company, LLC Active 28-May-10 22 EVN Evans Medical Limited Part of Novartis Inactive 28-May-10 23 GEO GeoVax Labs, Inc. -

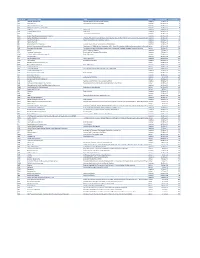

FDA Listing of Authorized Generics As of July 1, 2021

FDA Listing of Authorized Generics as of July 1, 2021 Note: This list of authorized generic drugs (AGs) was created from a manual review of FDA’s database of annual reports submitted to the FDA since January 1, 1999 by sponsors of new drug applications (NDAs). Because the annual reports seldom indicate the date an AG initially entered the market, the column headed “Date Authorized Generic Entered Market” reflects the period covered by the annual report in which the AG was first reported. Subsequent marketing dates by the same firm or other firms are not included in this listing. As noted, in many cases FDA does not have information on whether the AG is still marketed and, if not still marketed, the date marketing ceased. Although attempts have been made to ensure that this list is as accurate as possible, given the volume of d ata reviewed and the possibility of database limitations or errors, users of this list are cautioned to independently verify the information on the list. We welcome comments on and suggested changes (e.g., additions and deletions) to the list, but the list may include only information that is included in an annual report. Please send suggested changes to the list, along with any supporting documentation to: [email protected] A B C D E F G H I J K L M N O P Q R S T U V X Y Z NDA Applicant Date Authorized Generic Proprietary Name Dosage Form Strength Name Entered the Market 1 ACANYA Gel 1.2% / 2.5% Bausch Health 07/2018 Americas, Inc.