Annual Report 2011 Metro Awards 2010 S200042 Size A4 Mac.9 F-Koh

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sustainable Urban Transport in Singapore: a Balanced Scorecard

SUSTAINABLE URBAN TRANSPORT IN SINGAPORE: A BALANCED SCORECARD Md. Habibur Rahman a and Hoong Chor Chin b a, b Department of Civil and Environmental Engineering, National University of Singapore, Singapore a Corresponding author: [email protected] © Ontario International Development Agency. ISSN 1923-6654 (print) ISSN 1923-6662 (online). Available at http://www.ssrn.com/link/OIDA-Intl-Journal-Sustainable-Dev.html Abstract: Singapore is a city state nation with a small Keywords: Balanced Scorecard; Singapore; area of about 710 square kilometres yet a dense Sustainability; Sustainable Development; Urban population of 5 million with higher economic growth Transport and denser commercial activities. This Asian tiger nation is often recognized for its very high yet I. INTRODUCTION smartly maintained huge and smooth traffic flow on its urban streets. While the success and achievements ingapore’s urban transport has been recognized of Singapore land transport case can be a role-model as a global landmark due to its consistent success in maintaining an excessively high to follow for other cities there are still challenging S level of traffic through its smart operation that areas in its urban transport without a proper address ensures a smooth traffic flow on its urban streets. of which may hinder betterment of its sustainability While Singapore’s success and achievements in land in the long run. Therefore while on the one hand it is necessary to record the successful aspects and learn transport sector have been a role-model to follow for their root underlying factors it is also essential, on the other global cities there are challenging areas without other hand, to identify the major critical and a proper addressing of which may hinder betterment of its sustainability in the long run. -

Land Transport Authority, Singapore Singapore

Sample Profile LandSingapore Transport LTA Authority, Singapore Key information Current network Parameters Details System Details Ownership Fully government owned Metrorail Service area Singapore covering a population Line Length (km) Stations of 5.54 million (2015) North-South Line (Red) xxx xxx Modes Bus, MRT, LRT and taxi services operated East-West Line (Green) xxx xxx Operators of SMRT Corporation, SBS Transit Circle Line (Orange) xxx xxx bus and rail Circle Line Extension xxx xxx Modal share of public transport North-East Line (Purple) xxx xxx Downtown Line (Phase I) xxx xxx Rail, 31% Downtown Line (Phase II) xxx xxx Bus, 55% Total xxx xxx Taxi, 14% Light rail Line Length (km) Stations Bukit Panjang xxx xxx Key facts Sengkang xxx xxx • xxx% of all journeys in peak hours undertaken Punggol xxx xxx on public transport • xxx% of public transport journeys of less than Total xxx xxx 20 km completed within 60 minutes Bus • xxx in xxx households are within 10 minutes walk from a train station Total routes operated xxx Source: LTA Sample Profile Size and Growth Growth in network MRT network growth (km) 180 xxx • xxx xxx LTA’s MRT network has increased at a CAGR of xxx% during 160 xxx xxx 2010-2015. 140 xxx • However, the LRT network has remained constant at xxx km since 2005. 120 100 km Growth in ridership 80 60 40 20 4.5 xxx 5 4.4 0 xxx 4 4.3 xxx 2010 2011 2012 2013 2014 2015 4.2 3 4.1 % 4 2 Ridership trend 3.9 1 3.8 • System-wise average daily ridership has increased 3.7 0 steadily at a CAGR of xxx for MRT, xxx for LRT and xxx for 2011 (million) 2012 (million) 2013 (million) 2014 (million) buses, between 2011-2014. -

Merdeka Generation Package $100 Top-Up Benefit

Merdeka Generation Package $100 Top-Up Benefit The Merdeka Generation (MG) One-Time $100 Top-Up will be available from 01 July 2019 onwards. Apart from the top-up locations at the MRT stations and bus interchanges, temporary top-up booths at selected Community Clubs/ Centres will be set up to provide even greater convenience to our MGs with their top ups. a) TransitLink Ticket Offices Operating Hours TransitLink Ticket Offices Public Location Weekdays Saturdays Sundays Holidays 1 Aljunied MRT Station * 1200 - 1930 Closed 2 Ang Mo Kio MRT Station 0800 - 2100 3 Bayfront MRT Station (CCL)* Closed 1200 - 2000 4 Bedok Bus Interchange 1000 - 2000 1000 - 1700 Closed 5 Bedok MRT Station * 1200 - 2000 6 Bishan MRT Station * 1200 - 1930 Closed 7 Boon Lay Bus Interchange 0800 - 2100 8 Bugis MRT Station 1000 - 2100 9 Bukit Batok MRT Station * 1200 - 1930 10 Bukit Merah Bus Interchange * 1200 - 1930 11 Changi Airport MRT Station ~ 0800 - 2100 12 Chinatown MRT Station ~@ 0800 - 2100 13 City Hall MRT Station 0900 - 2100 14 Clementi MRT Station 0800 - 2100 15 Eunos MRT Station * 1200 - 1930 1200 - 1800 Closed 16 Farrer Park MRT Station * 1200 - 1930 17 HarbourFront MRT Station ~ 0800 - 2100 Updated as of 2 July 2019 Operating Hours TransitLink Ticket Offices Public Location Weekdays Saturdays Sundays Holidays 18 Hougang MRT Station * 1200 - 1930 19 Jurong East MRT Station * 1200 - 1930 20 Kranji MRT Station * 1230 - 1930 # 1230 - 1930 ## Closed## 21 Lakeside MRT Station * 1200 - 1930 22 Lavender MRT Station * 1200 - 1930 Closed 23 Novena MRT Station -

Report of the Delegation of the Panel on Transport on Its Duty Visit To

LC Paper No. CB(4)823/14-15 The Legislative Council of the Hong Kong Special Administrative Region ___________________________________________ Delegation of the Panel on Transport Report on the duty visit to Singapore to study its experience in development and provision of public transport facilities and traffic control measures 23 to 26 September 2014 ___________________________________________ TABLE OF CONTENTS Page Chapter 1 Introduction 1.1 Purpose of the report 1 1.2 Background of the visit 1 1.3 Objectives of the visit 2 1.4 Membership of the delegation 3 1.5 Visit programme 3 2 Overview of the transport strategy in Singapore 2.1 Overview 4 2.2 Building up a quality public transport system 5 2.3 Maximizing road network efficiency capacity 6 2.4 Establishing a bike-friendly city 7 2.5 Enhancing accessibility to public transport 7 3 Visits and exchanges 3.1 Meeting with the Minister for Transport 8 3.2 Meeting with the representatives of the Land Transport 14 Authority 3.3 Meeting with the Chairman and Deputy Chairman of 23 the Government Parliamentary Committee for Transport 3.4 Meeting with the representatives of the SBS Transit and 29 visit to the North East Line's Operations Control Centre and the Sengkang Integrated Transport Hub 3.5 Meeting with the Director of the Hong Kong Economic 39 and Trade Office in Singapore 3.6 Visit to the Marina Bay Cruise Centre Singapore and its 43 connecting transport facilities 3.7 Visit to cycling facilities near Pasir Ris Town 47 4 Observations and conclusions 4.1 Observations 51 4.2 Conclusions 55 TABLE OF CONTENTS Acknowledgements 56 Acronyms and Abbreviations 57 Appendices I Visit programme 58 II List of the organizations and persons met by the delegation 59 References 61 CHAPTER 1 — INTRODUCTION 1.1 Purpose of the report 1.1.1 A delegation of the Panel on Transport ("the Panel") of the Legislative Council visited Singapore from 23 to 26 September 2014 to study the country's experience in development and provision of public transport facilities and traffic control measures. -

Operations Review

OPERATIONS REVIEW SINGAPORE PUBLIC TRANSPORT SERVICES (BUS & RAIL) • TAXI AUTOMOTIVE ENGINEERING SERVICES • INSPECTION & TESTING SERVICES DRIVING CENTRE • CAR RENTAL & LEASING • INSURANCE BROKING SERVICES OUTDOOR ADVERTISING Public Transport Services The inaugural On-Demand Public Bus ComfortDelGro Corporation Limited is Services trial, where SBS Transit operated a leading provider of land transport and five bus routes – three in the Joo Koon area related services in Singapore. and two in the Marina-Downtown area – for 2.26 the LTA ended in June 2019. Conducted REVENUE Scheduled Bus during off-peak hours on weekdays, (S$BILLION) SBS Transit Ltd entered into its fourth year commuters could book a ride with an app of operating under the Bus Contracting and request to be picked up and dropped Model (BCM) in 2019, where the provision off at any bus stop within the defined areas. of bus services and the corresponding It was concluded by the LTA that such bus standards are all determined by the Land services were not cost-effective due to Transport Authority (LTA). Under this model, the high technology costs required in the Government retains the fare revenue scaling up. and owns all infrastructure and operating assets such as depots and buses. A major highlight in 2019 was SBS Transit’s active involvement in the three-month long 17,358 Bus routes in Singapore are bundled into public trial of driverless buses on Sentosa TOTAL OPERATING 14 bus packages. Of these, SBS Transit Island with ST Engineering. Operated as an FLEET SIZE operated nine. During the year, it continued on-demand service, visitors on the island to be the biggest public bus operator with could book a shuttle ride on any of the a market share of 61.1%. -

Office Address 705 Sims Drive #04-16B Shun Li Industrial

MAIN OFFICE ADDRESS 705 SIMS DRIVE #04-16B SHUN LI INDUSTRIAL COMPLEX SINGAPORE 387384 Tel : 6844 2298 Fax : 6513 2843 Stores Day Bus Hrs Ops Hrs 1 Aljunied MRT (AJM) Mon - Fri 0700 - 2030 0630 - 2100 81 Geylang Lorong 25 Sat/Sun/PH 0800 - 2000 0730 - 2030 #01-12 Aljunied MRT Station Singapore 388310 Tel: 6747 1850 2 Ang Mo Kio Hub 2 (AMH 2) Mon - Sun 0700 - 2200 0600 - 2230 53 Ang Mo Kio Avenue 3 #01-19 Ang Mo Kio Hub Singapore 569933 Tel: 6853 1747 3 Bukit Gombak MRT (BGM) Mon - Sun 0630 - 2230 0600 - 2300 802 Bukit Batok West Avenue 5 #01-03 Bukit Gombak MRT Station Singapore 659083 Tel: 6560 1385 4 Buangkok Square (BKS) Wed - Sun 1300 - 2000 1200 - 2030 991 Buangkok Link Mon/Tue Closed Closed #01-04 Singapore 530991 Tel: 6957 0311 5 Boon Lay MRT (BL3) Mon - Sat 0600 - 2100 0500 - 2130 301 Boon Lay Way Sun & PH 0630 - 2100 0530 - 2130 #01-23 Boon Lay MRT Station Singapore 649846 Tel: 6793 1358 6 Bedok Mall (BM) Mon - Sun 0900 - 2100 0830 - 2130 311 New Upper Changi Road #B2-K2 Bedok Mall Singapore 467360 Tel: 6384 4405 7 Bukit Panjang Plaza (BP) Mon - Sun 0830 - 2130 0800 - 2200 1 Jelebu Road #01-19 Bukit Panjang Plaza Singapore 677743 Tel: 6760 4929 8 Choa Chu Kang MRT (CCK) Mon - Fri 0630 - 2200 0530 - 2230 10 Choa Chu Kang Ave 4 Sat / Sun / PH 0630 - 2200 0600 - 2230 #01-03 Choa Chu Kang MRT Station Singapore 689810 Tel: 6767 8343 9 Changi City Point (CCP) Mon - Fri 0730 - 2100 0700-2130 5 Changi Business Park Central 1 Sat 0930-2100 0900-2130 #B1-21 Changi City Point Sun / PH 1030-2100 1000-2130 Singapore 486038 Tel: 6636 1290 -

Geotechnical Services

GGeeooAAlllliiaannccee CCoonnssuullttaannttss PPttee LLttdd WHO WE ARE GeoAlliance Consultants Pte Ltd is a specialist ground engineering consultancy established by a group of registered professional engineers in Singapore. Our team has wide hands-on experience in both design and supervision of civil engineering and geotechnical engineering works in Singapore and overseas. Our team members have been involved in projects on the MRT Northeast Line, MRT Circle Line, MRT Downtown Line and Marina Coastal Expressway, and Kim Chuan Sewerage Plant, Changi Outfall in each of their own capacities. Merging our skill sets, experience and resources, we endeavour to provide innovative technical solutions for geotechnical and underground space projects. WHY GeoAlliance Professional Engineers with PE(Civil), PE(Geo) and AC(Geo) registrations Experience with local building authority, international consultants and contractors “Can-do” attitude Innovative, cost-effective and practical solutions Efficient and excellent services Reliable business & project partner Potential integration with client’s team WHAT WE DO Our team has an extensive range of knowledge and experience. Professional services by GeoAlliance Consultants Pte Ltd can be provided at all stages of project implementation, including: Planning Analysis and Design Feasibility Studies Geotechnical Interpretative Studies Planning of Geotechnical Investigations Earth Retaining Structures (ERSS or Engineering Support for Project Tenders TERS) Preliminary Designs for Cost Estimates Geotechnical -

ST/LIFE/PAGE<LIF-008>

D8 life happenings | THE STRAITS TIMES | FRIDAY, MAY 4, 2018 | FILMS The Straits Times recommends The Empty Hands (2017, M18) Daughter of a karate coach, half-Chinese and half-Japanese Picks Mari Hirakawa, hates the martial art and cannot wait to sell the dojo after her father’s death. But he had left Film her only 49 per cent ownership of the property and 51 per cent to Chan Keung, one of his worst students. He challenges her to win a martial arts competition, upon which he would give her his majority share. Stars Stephy Tang. WHERE: GV Suntec City, 03-373 Suntec City Mall, 3 Temasek Boulevard MRT: Esplanade/ Promenade WHEN: Today, 7 - 9pm ADMISSION: Singapore Film Society membership, from $18 a month TEL: 9017-0160 INFO: E-mail [email protected] The Square (2017, M18) Christian is the respected curator of a contemporary art museum, a divorced but devoted father of two who drives an electric car and supports good causes. His next show is The Square, an installation which reminds passers-by of their role as responsible human beings. But his foolish response to the theft of his phone drags him into shameful WES ANDERSON FILMS Darjeeling Limited (2007), which stars Owen Wilson, Adrien PHOTOS: WARNER BROS ENTERTAINMENT situations. Stars Claes Bang. American film-maker Wes Anderson’s latest film, Isle Of Brody and Jason Schwartzman as three brothers who INC, SHAW ORGANISATION, WHERE: The Projector, Green Room, Dogs, opens only next week, but audiences can first get a travel across India a year after their father’s funeral. -

GIS Data Hub Data Collection Specification - Part 2

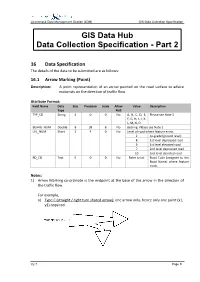

Licensing & Data Management Section (LDM) GIS Data Collection Specification GIS Data Hub Data Collection Specification - Part 2 16 Data Specification The details of the data to be submitted are as follows: 16.1 Arrow Marking (Point) Description: A point representation of an arrow painted on the road surface to advice motorists on the direction of traffic flow. Attribute Format: Field Name Data Size Precision Scale Allow Value Description Type Null TYP_CD String 4 0 0 No A, B, C, D, E, Please see Note 3 F, G, H, I, J, K, L, M, N, O BEARG_NUM Double 8 38 8 No Bearing. Please see Note 2 LVL_NUM Short 2 4 0 No Level of road where feature exists 2 At-grade (ground level) 8 1st level depressed road 9 1st level elevated road 7 2nd level depressed road 10 2nd level elevated road RD_CD Text 6 0 0 No Refer to list Road Code (assigned to the Road Name) where feature exists Notes: 1) Arrow Marking co-ordinate is the midpoint at the base of the arrow in the direction of the traffic flow. For example, a) Type C (straight / right turn shared arrow): one arrow only, hence only one point (x1, y1) required. V2.7 Page 9 Licensing & Data Management Section (LDM) GIS Data Collection Specification b) Types G (left converging arrow) & H (right converging arrow): two arrows, hence two points (x1, y1) and (x2, y2) are required. 2) The bearing should correspond with the bearing of each individual road. For example, if the bearing of the road is 97 degrees, then the bearing of arrow markings A is 97 degrees and the bearing of arrow markings B is 277 degrees respectively. -

GENERAL FAQ 1. What Is Sentosa Fun Pass?

GENERAL FAQ 1. What is Sentosa Fun Pass? Sentosa Fun Pass is an attraction bundle package that offers up to 60% discounts as compared to ala-carte attraction tickets. 2. Which attractions can I visit with Sentosa Fun Pass? Refer to “List of Redeemable Items” 3. What are the operating hours of the attractions? Due to the progressive reopening of attractions during Phase 2 in Singapore, please visit the website of the respective attractions for the latest information regarding their reopening dates and operating hours. Reopening Attraction Website Status as of 19 July 2020 AJ Hackett Sentosa https://www.ajhackett.com/sentosa/ Open Go Green https://gogreenholdings.com/ Open HeadRock VR https://www.headrockvr.sg/ Open iFLY Singapore https://www.iflysingapore.com/ Open Madame Tussauds Singapore https://www.madametussauds.com/singapore/en/ Open Mega Adventure Park https://sg.megaadventure.com/ Open http://www.shangri- Nestopia la.com/singapore/rasasentosaresort/for- Open kids/nestopia/ https://www.rwsentosa.com/en/attractions/sea- S.E.A Aquarium Open aquarium/explore https://www.onefabergroup.com/sentosa-island- Sentosa Island Bus Tour Open bus-tour https://www.onefabergroup.com/singapore-cable- Singapore Cable Car Open car-sky-network Trick Eye Museum https://trickeye.com/singapore/ Open 4D Adventure Land http://4dadventureland.com.sg/ Closed Butterfly Park & Insect Kingdom https://jungle.com.sg/ Closed Ola Beach Club https://www.olabeachclub.com/ Closed Wings of Time https://www.onefabergroup.com/wings-of-time Closed SENTOSA DEVELOPMENT CORPORATION Updated as of 19 July 2020 GENERAL FAQ 4. Are the attractions suitable for my child? Most of the attractions listed in Sentosa Fun Pass are children-friendly. -

Handbook Final3.Indd

1 Contents Singapore Introduction Your Business Partner For India I. Message from President, June 05 - May 06 Singapore Business Federation 14 II. Message from President, Mr George Abraham Federation of Indian Chambers of Commerce & Industry (FICCI) 16 Chairman & M.D. [email protected] III. Message from Publisher, Mr Paul Tan East & Asia Pacifi c Trade & Industry Publications Pte Ltd 18 Business Development Consultant [email protected] 1. Singapore, Facts & Figures Ms Anne-Marie Research & Publications Executive 1.1. General Information 28 [email protected] 1.2. Facts, Figures and Graphs 29 Mr Dennis Tan Design & Multimedia Executive [email protected] 2. Why Establish a Business in Singapore Mr Leslie Choo 2.1. Advantages of starting a business in Singapore 33 Business Development Executive [email protected] Ms Christine Li 3. Recent Developments in Singapore-India Relations Administration & Circulations Executive 3.1. Singapore’s Ongoing Free Trade Agreement with India (CECA) 37 [email protected] 3.2. Bilateral Relations 38 Mr Gopal Prabhakaran 3.3. Trade Statistics 39 Audit & Accounts Consultant [email protected] Published by: 4. How to Set Up A Business in Singapore East & Asia Pacifi c Trade & Industry Publications Pte Ltd 4.1 Policy for Government Approval 55 No.1 Shenton Way, #11-06 Singapore 068803 4.2 Type of Companies 56 Tel: (65) 6423 1078 4.3 Registering a Foreign Company Branch 57 Fax: (65) 6423 1079 www.gagrp.com 4.4 New Application for Representative Offi ce 58 4.5 Government Financing Schemes 58 Printed by: Markono Print Media Pte Ltd 21 Neythal Road, Singapore 628586 5. -

Annual City Development 2014 Brochure 2

Hilton Singapore The future is not in the hands 19 th – 21st November 2014 of fate but in ours. Jules Jusserand Building a vibrant and sustainable city to draw more investments and enhance your city’s liveability for a higher quality of urban living Featuring Government, Regulatory Authorities & Statutory Bodies: Ken Ong City Councillor & Chair of the Planning Committee Dr. Saleem Janjua National Project Manager – PAKSTRAN Mardiana Rahayu M. Afran SVP, Planning City of Melbourne, Australia Project & Development “ World’s Most Liveable City for 3 years in a row , Economist UNDP, Pakistan 1Malaysian Development Berhad (1MDB), Malaysia Intelligence Unit (EIU) 2013” Frven Lim Deputy MD & Director, Design Emma Martini President Director Dave Ong Kwang Leong Deputy Director, Passenger Service Surbana, Singapore PT Sarana Multi Infrastruktur (Persero), Indonesia SMRT Corporation, Singapore Paromita Roy Deputy Director, Architecture Joseph D’ Cruz Regional Team Leader – Inclusive Growth Mohd Azharuddin Mat Sah Director – Urban Public Transport Delhi Development Authority (DDA) – Ministry of Urban United Nations Development Program (UNDP), Thailand Performance Management Delivery Unit (PEMANDU) Development, India Dr. Olivia Jensen Senior Research Fellow, Institute of Prime Minister’s Department, Malaysia Member Water Policy Stephen Ashford Executive Director High Court Special Task Force on Urban Transportation & National University of Singapore Vendor Policy under Chief Secretary, Delhi 1Malaysian Development Berhad (1MDB), Malaysia Joris van