A New Merger Model Supermedia and Dex One

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Federal Register/Vol. 80, No. 158/Monday, August 17, 2015/Notices

Federal Register / Vol. 80, No. 158 / Monday, August 17, 2015 / Notices 49269 and downloaded at this Justice 2015, Public Law 114–27. In accordance before January 1, 2014. If eligible under Department Web site: http:// with Section 405(a) of TAARA 2015, these requirements, OTAA will certify www.justice.gov/enrd/consent-decrees. which amended the Trade Act of 1974, the group of workers as eligible to apply We will provide a paper copy of the Public Law 93–618 (‘‘the Trade Act’’), for adjustment assistance under title II Consent Decree upon written request the Director of the Office of Trade of the Trade Act. and payment of reproduction costs. Adjustment Assistance, Employment Further, worker groups that did not Please mail your request and payment and Training Administration (OTAA) submit petitions between January 1, to: Consent Decree Library, U.S. DOJ— has taken the following action for 2014 and June 29, 2015, but wish to be petitions that were filed with the ENRD, P.O. Box 7611, Washington, DC considered under the group eligibility Secretary of Labor under section 221(a) 20044–7611. for workers based on the 2015 Program of the Trade Act on or after January 1, Please enclose a check or money order may file a new petition within 90 days for $5.00 (25 cents per page 2014, and before June 29, 2015, and are of enactment of the new 2015 law which reproduction cost) payable to the United identified in the Appendices to this was signed by President Barak Obama States Treasury. notice. OTAA has reopened investigations of on June 29, 2015. -

Notice of 2013 Annual Meeting of Shareholders and Proxy Statement

Notice of 2013 Annual Meeting of Shareholders and Proxy Statement THE TIMKEN COMPANY Canton, Ohio U.S.A. 1300100_1_64sc.pdf 2 3/14/13 5:01 PM TABLE OF CONTENTS PAGE Chairman’s Letter ……………………………………………………………………………….… 2 Notice of Annual Meeting ………………………………………………………………………... 3 Proxy Statement ………………………………………………………………………………….. 5 Election of Directors ………………………………………………………………………… 5 Election of Directors (Item No. 1) ………………………………………..……………. 5 Nominees ………………………………………………………………………………… 6 Director Compensation ………………………………….………………………………….. 11 2012 Director Compensation Table………………………………………………………… 12 Board Leadership Structure ………………………………………………………………... 13 Risk Oversight ……………………………………………………………………………….. 13 Audit Committee ……………………………………………………………………………... 14 Audit Committee Report ………………………………………………………………..…… 14 Compensation Committee ………………………………………………………………….. 14 Compensation Committee Report ……………………………………………………….… 15 Nominating and Corporate Governance Committee ………………………………….…. 16 Beneficial Ownership of Common Stock ………………………………………………….. 17 Compensation Discussion and Analysis ……………………………………….……….… 20 Executive Compensation …………………………………………………………….…..…. 32 Ratification of Appointment of Independent Auditors (Item No. 2) ……………………... 44 Auditors ……………………………………………………………………………………….. 45 Shareholder Advisory Vote on Named Executive Officer Compensation (Item No. 3).. 45 Amendments to the Company’s Amended Articles of Incorporation to Reduce Certain Shareholder Voting Requirements (Item No. 4)……………………………….… 46 Amendments to the Company’s Amended -

The Information Age Was Born In

INDUSTRY CLUSTERS NUMBERNumber OF HIGH of TECHAdvanced INDUSTRY Services BUSINESSES Businesses HIGH TECH THE INFORMATION AGE WAS BORN IN DFW 75 In 1958, Dallas led the nation into the new 1 17 88 35E 1 60 760 121 era of information and communication TOP SEMICONDUCTOR & SEMICONDUCTOR TOP COMPUTER SYSTEMS & SOFTWARE MACHINERY MANUFACTURERS WITH COMPANIES WITH OPERATIONS IN DFW technologies with Nobel Laureate Jack 35W OPERATIONS IN DFW Kilby’s invention of the microchip at Texas Accenture [Irving] Creation Technologies [Plano] Instruments. This invention allowed Capgemini [Dallas] Maxim Integrated Products [Dallas] Cognizant [Irving] the development of laptop computers, Texas Instruments [Dallas, Plano, Richardson] Computer Sciences Corp [Irving] smartphones, and space travel. | Qorvo [Richardson] HP Enterprise Services [Plano] 190 The DFW technology industry IBM [Dallas] HIGH TECHHIGH encompasses four general categories: Infosys [Plano] manufacturing, information services, TOP FABLESS SEMICONDUCTOR COMPANIES WITH OPERATIONS IN DFW L-3 Communications [Rockwall] professional technical services, and bio-life Diodes Inc. [Plano] Microsoft [Irving] sciences. The region’s activity in key emerging Micron Technology [Allen] NTT Data [Plano] technologies such as next generation wireless Qorvo [Richardson] Oracle [Dallas] 30 and broadband communications, artifi cial STMicroelectronics [Coppell] Raytheon [Garland, McKinney] 635 intelligence, and virtual reality as well as RealPage [Richardson] 820 183 medical, bio, and life sciences, is gaining SAP AG [Irving] TOP TELECOM COMPANIES Siemens PLM Software [Plano] increasing national recognition. WITH OPERATIONS IN DFW 360 AT&T [Dallas] TEKsystems [Irving] 30 BT Global Services [Dallas] Trend Micro NA [Irving] Xerox [Dallas] 12 TH Cisco Systems [Richardson] 20 THE 7 LARGEST CONCENTRATION OF Ericsson [Plano] HIGHTECH JOBS IN THE U.S. -

Docket No. 16-0066 Dex Media, Inc. Exhibit 1

Docket No. 16-0066 Dex Media, Inc. Exhibit 1 CORRECTED TESTIMONY OF JERONIMOS “MIKE” KONIDARIS DEX MEDIA, INC. IN THE MATTER OF DEX MEDIA, INC., as agent for ILLINOIS BELL TELEPHONE CO., and as agent for FRONTIER NORTH, INC., FRONTIER COMMUNICATIONS OF THE CAROLINAS, LLC, CITIZENS TELECOMMUNICATIONS COMPANY OF ILLINOIS D/B/A FRONTIER CITIZENS COMMUNICATIONS OF ILLINOIS, FRONTIER COMMUNICATIONS – MIDLAND, INC., FRONTIER COMMUNICATIONS – PRAIRIE, INC., FRONTIER COMMUNICATIONS – SCHUYLER, INC., FRONTIER COMMUNICATIONS OF DEPUE, INC., FRONTIER COMMUNICATIONS OF ILLINOIS, INC., FRONTIER COMMUNICATIONS OF LAKESIDE, INC., FRONTIER COMMUNICATIONS OF MT. PULASKI, INC., and FRONTIER COMMUNICATIONS OF ORION, INC. PETITION FOR WAIVERS OF SECTIONS 732.50(a) and (c), 735.180(a)(1), 735.180(d), and 735.180(1), and Section 756.110 of Title 83 of the Administrative Code. Docket No. 16-0066 February 8, 2016 Docket No. 16-0066 Dex Media, Inc. Exhibit 1 1 Witness Information & Introduction 2 Q: Please state your full name and business address. 3 A: Jeronimos (“Mike”) Konidaris 4 2200 West Airfield Drive 5 P.O. Box 619810 6 DFW Airport, TX 75261 7 Q: By whom are you employed and in what capacity? 8 A: I am the Director of Telco Relations, Listing Acquisition and Print Services of Dex 9 Media, Inc., the successor to Dex One Corporation. 10 Q: Describe Dex Media’s involvement in the business of publishing telephone 11 directories. 12 A: Dex Media and its predecessors and affiliates have been in the business of publishing 13 telephone directories since 1886. Dex Media and affiliate companies are successors to the 14 publishing arms of a number of local exchange carriers (“LECs”), including AT&T 15 Illinois and Frontier in Illinois. -

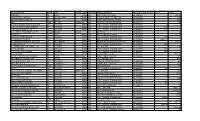

Supplier Name State City Postal Code Country

SUPPLIER NAME STATE CITY POSTAL CODE COUNTRY STREET ADDRESS 1 TAX ID # or D&B Number Spend CHECK 158 NORTH IL JOLIET 60432 USA 158 N CHICAGO STREET 20-3110126 280.55 22ND CENTURY MEDIA IL ORLAND PARK 60467 USA 11516 W. 183RD ST. UNIT SW 20-1981583 2704 24/7 SECURED BOARD-UP IL JOLIET 60435 USA 2364 ESSINGTON RD, STE 264 27-0384206 2450 3M MN ST PAUL 55133-3225 USA 3M CENTER BLDG. 225-58-08 41-0417775 100 7/10 THE NEWS JOURNAL CREDIT R IL CHICAGO 60603 USA 115 S. LASALLE 12TH FLR WEST 13-4941092 20 7/12 US1.00 HO INTERNT CREDIT IL CHICAGO 60603 USA 115 S. LASALLE 12TH FLR WEST 13-4941092 -0.07 7/16 ERROR CORRECTION IL CHICAGO 60603 USA 115 S. LASALLE 12TH FLR WEST 13-4941092 0.07 9-1-1 PUBLIC EDUCATOR'S OF TX (blank) (blank) (blank) USA OF TEXAS 75-6049012 30 A BEEP, LLC IL JOLIET 60432 USA 452 N. CHICAGO STREET 36-4087404 847.95 A BETTER LIMOUSINE SER IL CHICAGO 60603 USA 115 S. LASALLE 12TH FLR WEST 13-4941092 252 A CORPORATE PRINTIN IL CHICAGO 60603 USA 115 S. LASALLE 12TH FLR WEST 13-4941092 10833.69 A CORPORATE PRINTING SRVCE INC IL WOODRIDGE 60517 USA 6808 HOBSON VALLEY DR UNIT 101 36-3749546 7104.7 A EAGLE OUTFTR IL CHICAGO 60603 USA 115 S. LASALLE 12TH FLR WEST 13-4941092 335 A FOLDING MACHINE SERVICE, INC IL GILBERTS 60136 USA P.O. BOX 194 36-3775093 232.85 A KIDS KITCHEN IL CHICAGO 60603 USA 115 S. -

Complaints by Practice, Business, and Year Based on Complaint by Practice

Complaints By Practice, Business, and Year Based on Complaint By Practice OpenedYear PracticeName 2013 Abandonment of MH 2020 Abandonment of MH 2021 Abandonment of MH 2014 Abandonment of MH 2013 Abandonment of MH 2014 Abandonment of MH 2013 Abandonment of MH 2021 Abandonment of MH 2015 Abandonment of MH 2018 ADA (Americans w/Disabilities Act) 2019 ADA (Americans w/Disabilities Act) 2020 ADA (Americans w/Disabilities Act) 2021 ADA (Americans w/Disabilities Act) 2019 ADA (Americans w/Disabilities Act) 2020 ADA (Americans w/Disabilities Act) 2021 ADA (Americans w/Disabilities Act) 2018 ADA (Americans w/Disabilities Act) 2020 ADA (Americans w/Disabilities Act) 2020 ADA (Americans w/Disabilities Act) 2020 ADA (Americans w/Disabilities Act) Page 1 of 480 09/25/2021 Complaints By Practice, Business, and Year Based on Complaint By Practice BusinessName id 3 1 1 Comcast 1 Easy Acres Mobile Home Park 1 Leisure Estates 1 Pinecroft Mobile Home Park 1 T-Mobile 1 1 3 1 6 2 Baths Only fka Nathan Construction 1 Clallam Bay Corrections Center 1 Disability Rights Washington 1 Fidelity Investments 1 Fred Meyer 1 JAMS Mediation Arbitration and ADR Services 1 King County Metro 1 Page 2 of 480 09/25/2021 Complaints By Practice, Business, and Year Based on Complaint By Practice 2019 ADA (Americans w/Disabilities Act) 2020 ADA (Americans w/Disabilities Act) 2021 ADA (Americans w/Disabilities Act) 2019 ADA (Americans w/Disabilities Act) 2020 ADA (Americans w/Disabilities Act) 2019 ADA (Americans w/Disabilities Act) 2019 ADA (Americans w/Disabilities Act) 2021 -

Division of Investment Department of the Treasury State of New Jersey Pension Fund June 30, 2009 and 2008 (With Independent Auditors’ Report Thereon)

F INANCIAL S TATEMENTS, M ANAGEMENT’ S D ISCUSSION AND A NALYSIS AND S UPPLEMENTAL S CHEDULES Division of Investment Department of the Treasury State of New Jersey Pension Fund June 30, 2009 and 2008 (With Independent Auditors’ Report Thereon) Division of Investment Department of the Treasury State of New Jersey Pension Fund Financial Statements June 30, 2009 and 2008 Contents Independent Auditors’ Report ..........................................................................................................1 Management’s Discussion and Analysis .........................................................................................3 Basic Financial Statements: Statements of Net Assets .................................................................................................................7 Statements of Changes in Net Assets...............................................................................................8 Notes to Financial Statements ..........................................................................................................9 Supplemental Schedules: Schedule 1 – Combining Schedule of Net Assets ..........................................................................31 Schedule 2 – Combining Schedule of Changes in Net Assets .......................................................32 Schedule 3 – Portfolio of Investments – Common Fund A ...........................................................33 Schedule 4 – Portfolio of Investments – Common Fund B ...........................................................57 -

Mobile Yellow Pages Market Driven by the Increase in Smartphone Usage

Oct 26, 2012 10:31 BST Mobile Yellow Pages market driven by the increase in smartphone usage The mobile Yellow Pages market has been forecast to hit a valuation of US$28.8 billion by the year 2018, with the industry being predominantly driven by the ever growing usage of mobile phones, in particular the use of smartphones for local business searches. This growing trend is becoming ever more popular that local searches through mobile devices are set to surpass desktop PCs in the near future. Mobile communication devices particularly mobile phones have become ever-present, with their usage growing constantly year by year, they are rapidly becoming the preferred platform for searching local content among a large number of consumers. Due to its relatively recent origin in the market, the mobile yellow pages segment is currently in the early stages of development, with the potential to emerge as a vibrant market in the foreseeable future. Key factors expected to contribute to growth within the mobile Yellow Pages market include faster mobile Internet, the growing penetration rates of smart phones, the increased adoption of location based searches and the rising awareness of the advantages of location based advertising. The United States dominates as the largest region within the mobile Yellow Pages market. Large scale market penetration in the country is driven primarily by the growing adoption of the mobile yellow pages platform by businesses for enhancing their reach in the market. Key players currently dominating the mobile Yellow Pages market include, AT&T, YP Holdings LLC, Dex One Corporation, Pages Jaunes Groupe, Seat Paigne Gialle, SuperMedia Inc., hibu Plc, Yellowbook, and Yellow Pages Group. -

Fox Valley Park District List of Bills Month Ending August 31, 2015

FOX VALLEY PARK DISTRICT BOARD OF TRUSTEES Serving the Fox Valley Park District Kane, DuPage, Kendall and Will Counties, Illinois OPEN SESSION MEETING AGENDA September 21, 2015 Prisco Community Center 150 W. Illinois Avenue, Aurora 6:00 p.m. 1.0 CALL MEETING TO ORDER President Vaughan 2.0 PLEDGE OF ALLEGIANCE AND MOMENT OF SILENCE President Vaughan 3.0 ROLL CALL President Vaughan 4.0 ADDENDA TO THE AGENDA President Vaughan 5.0 CONSENT AGENDA President Vaughan 5.1 Approve the Open Session meeting minutes of 08/17/15. 5.2 Approve payables 08/31/15 in the amount of $1,119,607.96. 5.3 Approve statement of estimated revenues and expenses for period ending 07/31/15. 5.4 Approve Executive Director, Department Heads and other reports. 5.5 Capital projects permitting fees and charges, cost summaries and project bid schedule report. 5.6 Approve the extension of the license agreement for three years with Reuland Food Service, Inc. to provide concession services at the outdoor aquatic centers and Blackberry Farm. 5.7 Approve the Asphalt and Paving Projects at various sites throughout the District in the amount of $$261,000 from Evans and Son Blacktop, Inc. 5.8 Approve the License Agreement between the Fox Valley Park District and Copley Memorial Hospital, Inc. for a sidewalk access connection to the Waubonsie Creek Trail. 5.9 Approve the amendment to the agreement with Ellis and Associates exercising the option to extend the Vaughan Athletic Center aquatics operating agreement for three years (through the 2019 fiscal year). 5.10 Approve the amendment to the agreement with Ellis and Associates exercising the option to extend the operating agreement for the outdoor aquatic centers for three years (through the 2018 season). -

Appellant Michael J. Riccelli P.S. Petition for Review

.. FILED FEB 2 4 1017 COURT OF APPEALS DIVISION III STATEBy ____ OF WASHP.IiGTON_ No. 345432 SUPREME COURT OF THE STATE OF WASHINGTON MICHAEL J. RICCELLI, P.S., Appellant, v. DEX MEDIA WEST, INC, Respondents. APPELLANT MICHAEL J. RICCELLI P.S. PETITION FOR REVIEW Michael J. Riccelli, WSBA #7492 Attorney for Appellant 400 South Jefferson St., #112 Spokane, W A 99204 (509) 323-1120 e-mail [email protected] TABLE OF CONTENTS I. IDENTITY OF PETITIONER ........................................... 1 II. DECISIONS BELOW ..................................................... 1 III. ISSUES PRESENTED FOR REVIEW ................................ 1 IV. STATEMENT OF THE CASE .......................................... 2 A. Procedural Background ......................................... .2 B. Facts ................................................................ 5 V. ARGUMENT ..............................................................9 A. The Court Must Consider the Facts as Pled .................. 9 B. In Washington the Court Decides Whether an .............. 10 Agreement to Arbitrate is Enforceable Prior to Ordering Arbitration C. Under the FAA, Courts Decide Whether an ................ 11 Agreement to Arbitrate is Enforceable Prior to Ordering Arbitration D. The Arbitration's Provisions are Substantially and ........ l2 Procedurally Unconscionable E. The Agreement to Arbitrate in the Instant Case is ......... 15 Not Subject to the FAA Because the Parties have Not Engaged in a Transaction Bearing on Interstate Commerce VI. CONCLUSION ........................................................... 20 APPENDIX Division III Court of Appeals Order Denying Motion ........... A-1 to Modify Commissioner's Ruling filed January 20, 2017 -1- Division III Court of Appeals Commissioner's ...............A-2 Ruling filed October 11, 2016 Trial Court's Order Granting Defendant DEX .................. A-3 Media West, Inc. 's Motion to Dismiss Amended Complaint, or in the Alternative, Compel Arbitration filed March 4, 2016 Trial Court's Opinion on Reconsideration ....................... -

Dex One Current and Proposed Configuration for Printed Directories November 2011

Dex One Exhibit 2.0 STATE OF ILLINOIS ILLINOIS COMMERCE COMMISSION R.H. DONNELLEY INC. d/b/a DEX ONE ) as agent for ILLINOIS BELL TELEPHONE ) COMPANY ) ) Docket No. 11-0668 Petition for Variance of Section 735.180 ) of the Illinois Administrative Code ) Responsive Testimony of DAVID DAVIDSON Senior Manager of Marketing On behalf of Dex One December 21, 2011 1 Q. Please state your full name and business address. 2 A. My name is David Davidson. My business address is 9380 Station Street, Lone Tree, 3 Colorado 80124. 4 Q. Are you the same David Davidson who filed direct testimony in this docket on 5 September 30, 2011? 6 A. Yes. 7 Q. What is the purpose of your testimony? 8 A. I am responding to the Direct Testimony of Joan Howard filed on behalf of the 9 Commission Staff on November 30, 2011. 10 Q. Do you have any observations about Ms. Howard’s testimony? 11 A. Yes. I think Ms. Howard overstates the extent of the changes Dex One is seeking, both in 12 terms of how particular directories will change and the geographies in which Dex One 13 intends to make the change. I also think Ms. Howard overstates the value of survey data 14 in the face of numerous real-market instances of this approach. 15 Q. At pages 2 and 3 of her Direct Testimony, Ms. Howard states the following: 16 My understanding is that RHD / Dex One as agent for AT&T seeks 17 approval to distribute “white pages” directories only upon customer 18 request. -

Ar 464, Comments/Response, 2/7/2005

BEFORE THE PUBLIC UTILITY COMMISSION OF OREGON Docket No. AR 464 IN THE MATTER OF A PROPOSED COMMENTS OF DEX MEDIA, INC., RULEMAKING FOR INCLUSION OF OPPOSING A PROPOSED RULEMAKING HUMAN SERVICES LISTINGS IN FOR INCLUSION OF HUMAN SERVICES TELEPHONE DIRECTORIES. PETITION LISTINGS IN TELEPHONE FILED BY JIM LONG. DIRECTORIES I. INTRODUCTION Dex Media, Inc. ("Dex"), appreciates having this opportunity to submit comments regarding the proposed rulemaking by the Oregon Public Utility Commission (the "Commission"). As discussed in greater detail below, Dex opposes any Commission regulation of the formatting and editorial content of directories, including one that mandates or encourages the inclusion of "human services" listings in the government blue-bordered section of telephone directories (commonly known as "blue pages") published by regulated carriers and independent publishers. The business of directory publication is neither a "utility" service nor a monopoly that would justify Commission regulation. Dex opposed the proposed rule for a number of reasons: (1) the current format in Dex's directories already contains the desired listings searchable by a user-friendly index; (2) there is no need for a blue pages rule because of the availability of other sources; (3) a blue pages Page 1 - Comments of Dex Media, Inc., Opposing a Proposed Rulemaking for Inclusion of Human Services Listings in Telephone Directories PDXDOCS:1447006.3 MILLER NASH LLP ATTORNEYS AT LAW TELEPHONE (503) 224-5858 3400 U.S. BANCORP TOWER 111 S.W. FIFTH AVENUE, PORTLAND, OREGON 97204-3699 rule would increase confusion among the majority of users; (4) a blue pages rule would unnecessarily increase costs for the regulated carriers and publisher affected by the rule; and (5) the Commission does not have authority to promulgate a blue pages rule.