HR 4438 Don't Tax Higher Education

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2017 Official General Election Results

STATE OF ALABAMA Canvass of Results for the Special General Election held on December 12, 2017 Pursuant to Chapter 12 of Title 17 of the Code of Alabama, 1975, we, the undersigned, hereby certify that the results of the Special General Election for the office of United States Senator and for proposed constitutional amendments held in Alabama on Tuesday, December 12, 2017, were opened and counted by us and that the results so tabulated are recorded on the following pages with an appendix, organized by county, recording the write-in votes cast as certified by each applicable county for the office of United States Senator. In Testimony Whereby, I have hereunto set my hand and affixed the Great and Principal Seal of the State of Alabama at the State Capitol, in the City of Montgomery, on this the 28th day of December,· the year 2017. Steve Marshall Attorney General John Merrill °\ Secretary of State Special General Election Results December 12, 2017 U.S. Senate Geneva Amendment Lamar, Amendment #1 Lamar, Amendment #2 (Act 2017-313) (Act 2017-334) (Act 2017-339) Doug Jones (D) Roy Moore (R) Write-In Yes No Yes No Yes No Total 673,896 651,972 22,852 3,290 3,146 2,116 1,052 843 2,388 Autauga 5,615 8,762 253 Baldwin 22,261 38,566 1,703 Barbour 3,716 2,702 41 Bibb 1,567 3,599 66 Blount 2,408 11,631 180 Bullock 2,715 656 7 Butler 2,915 2,758 41 Calhoun 12,331 15,238 429 Chambers 4,257 3,312 67 Cherokee 1,529 4,006 109 Chilton 2,306 7,563 132 Choctaw 2,277 1,949 17 Clarke 4,363 3,995 43 Clay 990 2,589 19 Cleburne 600 2,468 30 Coffee 3,730 8,063 -

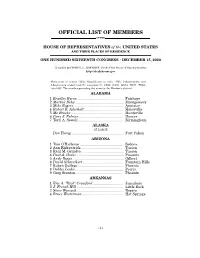

Official List of Members

OFFICIAL LIST OF MEMBERS OF THE HOUSE OF REPRESENTATIVES of the UNITED STATES AND THEIR PLACES OF RESIDENCE ONE HUNDRED SIXTEENTH CONGRESS • DECEMBER 15, 2020 Compiled by CHERYL L. JOHNSON, Clerk of the House of Representatives http://clerk.house.gov Democrats in roman (233); Republicans in italic (195); Independents and Libertarians underlined (2); vacancies (5) CA08, CA50, GA14, NC11, TX04; total 435. The number preceding the name is the Member's district. ALABAMA 1 Bradley Byrne .............................................. Fairhope 2 Martha Roby ................................................ Montgomery 3 Mike Rogers ................................................. Anniston 4 Robert B. Aderholt ....................................... Haleyville 5 Mo Brooks .................................................... Huntsville 6 Gary J. Palmer ............................................ Hoover 7 Terri A. Sewell ............................................. Birmingham ALASKA AT LARGE Don Young .................................................... Fort Yukon ARIZONA 1 Tom O'Halleran ........................................... Sedona 2 Ann Kirkpatrick .......................................... Tucson 3 Raúl M. Grijalva .......................................... Tucson 4 Paul A. Gosar ............................................... Prescott 5 Andy Biggs ................................................... Gilbert 6 David Schweikert ........................................ Fountain Hills 7 Ruben Gallego ............................................ -

Congressional Directory ALABAMA

2 Congressional Directory ALABAMA ALABAMA (Population 2010, 4,779,736) SENATORS RICHARD C. SHELBY, Republican, of Tuscaloosa, AL; born in Birmingham, AL, May 6, 1934; education: attended the public schools; B.A., University of Alabama, 1957; LL.B., University of Alabama School of Law, 1963; professional: attorney; admitted to the Alabama bar in 1961 and commenced practice in Tuscaloosa; member, Alabama State Senate, 1970–78; law clerk, Supreme Court of Alabama, 1961–62; city prosecutor, Tuscaloosa, 1963–71; U.S. Magistrate, Northern District of Alabama, 1966–70; special assistant Attorney General, State of Alabama, 1969–71; chairman, legislative council of the Alabama Legislature, 1977–78; former president, Tuscaloosa County Mental Health Association; member of Alabama Code Revision Committee, 1971–75; member: Phi Alpha Delta legal fraternity, Tuscaloosa County; Alabama and American bar associations; First Presbyterian Church of Tuscaloosa; Exchange Club; American Judicature Society; Alabama Law Institute; married: the former Annette Nevin in 1960; children: Richard C., Jr., and Claude Nevin; committees: chair, Banking, Housing, and Urban Affairs; Appropriations; Rules and Administration; elected to the 96th Congress on No- vember 7, 1978; reelected to the three succeeding Congresses; elected to the U.S. Senate on November 4, 1986; reelected to each succeeding Senate term. Office Listings http://shelby.senate.gov twitter: @senshelby 304 Russell Senate Office Building, Washington, DC 20510 .................................................. (202) 224–5744 Chief of Staff.—Alan Hanson. FAX: 224–3416 Personal Secretary / Appointments.—Anne Caldwell. Communications Director.—Torrie Miller. The Federal Building, 1118 Greensboro Avenue, #240, Tuscaloosa, AL 35401 ..................... (205) 759–5047 Vance Federal Building, Room 321, 1800 5th Avenue North, Birmingham, AL 35203 ....... -

2018 July Newsletter

1 Visit our website at ALGOP.org Dear Alabama Republican, Thank you for your support of the Alabama Republican Party and all our candidates during this primary election season. We are proud of every ALGOP candidate who sacrificed their valuable time to run for public office. Are you ready to help us keep Alabama Red? With the primary elections behind us, the ALGOP is united and ready to move forward as one team to defeat the democrats on November 6th. We would love to have you help us volunteer to ensure a victory this fall. Sign up to volunteer with the ALGOP here. It’s great to be a Republican, Terry Lathan Chairman, Alabama Republican Party 2 In Memory of… Bridgett Marshall ALGOP Statement on President Trump Wife of Alabama Attorney General Nominating Judge Brett Kavanaugh to Steve Marshall the United States Supreme Court George Noblin Montgomery, AL READ MORE HERE ALGOP State Executive Alabama Republican Party Chairman Committee Member Terry Lathan Comments on the Betty Callahan Alabama Republican Primary Runoff Mobile, AL Election Results Wife of former AL State Senator George Callahan READ MORE HERE Lee James Mobile,AL Republicans upbeat about November Republican elections despite Trump-Putin uproar activist READ MORE HERE At RNC meeting, no one is sweating Trump-Putin summit READ MORE HERE Blue Hope, Tough Math: Alabama Democrats Eye November READ MORE HERE CONNECT WITH US ON SOCIAL MEDIA Alabama Republican Party Alabama Republican Party Chairman Terry Lathan @ALGOP Registration Deadline: @ChairmanLathan Thursday, August 2nd @alabamagop @chairmanlathan Cullman location: click here. Montgomery location: click here. -

List of Government Officials (May 2020)

Updated 12/07/2020 GOVERNMENT OFFICIALS PRESIDENT President Donald John Trump VICE PRESIDENT Vice President Michael Richard Pence HEADS OF EXECUTIVE DEPARTMENTS Secretary of Health and Human Services Alex Azar II Attorney General William Barr Secretary of Interior David Bernhardt Secretary of Energy Danny Ray Brouillette Secretary of Housing and Urban Development Benjamin Carson Sr. Secretary of Transportation Elaine Chao Secretary of Education Elisabeth DeVos (Acting) Secretary of Defense Christopher D. Miller Secretary of Treasury Steven Mnuchin Secretary of Agriculture George “Sonny” Perdue III Secretary of State Michael Pompeo Secretary of Commerce Wilbur Ross Jr. Secretary of Labor Eugene Scalia Secretary of Veterans Affairs Robert Wilkie Jr. (Acting) Secretary of Homeland Security Chad Wolf MEMBERS OF CONGRESS Ralph Abraham Jr. Alma Adams Robert Aderholt Peter Aguilar Andrew Lamar Alexander Jr. Richard “Rick” Allen Colin Allred Justin Amash Mark Amodei Kelly Armstrong Jodey Arrington Cynthia “Cindy” Axne Brian Babin Donald Bacon James “Jim” Baird William Troy Balderson Tammy Baldwin James “Jim” Edward Banks Garland Hale “Andy” Barr Nanette Barragán John Barrasso III Karen Bass Joyce Beatty Michael Bennet Amerish Babulal “Ami” Bera John Warren “Jack” Bergman Donald Sternoff Beyer Jr. Andrew Steven “Andy” Biggs Gus M. Bilirakis James Daniel Bishop Robert Bishop Sanford Bishop Jr. Marsha Blackburn Earl Blumenauer Richard Blumenthal Roy Blunt Lisa Blunt Rochester Suzanne Bonamici Cory Booker John Boozman Michael Bost Brendan Boyle Kevin Brady Michael K. Braun Anthony Brindisi Morris Jackson “Mo” Brooks Jr. Susan Brooks Anthony G. Brown Sherrod Brown Julia Brownley Vernon G. Buchanan Kenneth Buck Larry Bucshon Theodore “Ted” Budd Timothy Burchett Michael C. -

2020 Election Recap

2020 Election Recap Below NACCHO summarizes election results and changes expected for 2021. Democrats will continue to lead the House of Representatives…but with a smaller majority. This means that many of the key committees for public health will continue to be chaired by the same members, with notable exceptions of the Appropriations Committee, where Chair Nita Lowey (D-NY) did not run for reelection; the Agriculture Committee, which has some jurisdiction around food safety and nutrition, whose Chair, Colin Peterson (D-MN) lost, as well as the Ranking Member for the Energy and Commerce Committee, Rep. Greg Walden, (R-OR) who did not run for reelection. After the 117th Congress convenes in January, internal leadership elections will determine who heads these and other committees. The following new Representatives and Senators are confirmed as of January 7. House of Representatives Note: All House of Representative seats were up for re-election. We list only those where a new member will be coming to Congress below. AL-1: Republican Jerry Carl beat Democrat James Averhart (open seat) Carl has served a member of the Mobile County Commission since 2012. He lists veterans’ health care and border security as policy priorities. Rep. Bradley Byrne (R-AL) vacated the seat to run for Senate. AL-2: Republican Barry Moore beat Democrat Phyllis Harvey-Hall (open seat) Moore served in the Alabama House of Representatives from 2010 to 2018. The seat was vacated by Rep. Martha Roby (R-AL) who retired. CA-8 Republican Jay Obernolte beat Democrat Christine Bubser (open seat) Jay Obsernolte served in the California State Assembly since 2014. -

114Th Congress 3

ALABAMA 114th Congress 3 Office Listings—Continued State Director.—Rick Dearborn. REPRESENTATIVES FIRST DISTRICT BRADLEY BYRNE, Republican, of Fairhope, AL; born in Mobile, AL, February 16, 1955; education: B.A. in public policy and history, Duke University, 1977; J.D., the University of Alabama, 1980; professional: Alabama State Board of Education; Chancellor of two-year col- lege system, Alabama State Senate / Organizations: Leadership Alabama, Alabama PTA, U.S. Supreme Court Bar, Alabama State Workforce Planning Council; chair / awards: Council for Leaders in Alabama Schools Legislative Leadership Award (2007); Alabama Wildlife Founda- tion Legislator of the Year Award (2005); South Alabama Literacy Champion Award (2006); religion: Episcopalian; wife: Rebecca; children: Patrick, Laura, Kathleen, and Colin; commit- tees: Armed Services; Education and the Workforce; Rules; elected by special election to the 113th Congress on December 17, 2013, to fill the vacancy caused by the resignation of United States Representative Jo Bonner; reelected to the 114th Congress on November 4, 2014. Office Listings http://byrne.house.gov 119 Cannon House Office Building, Washington, DC 20515 .................................................. (202) 225–4931 Chief of Staff.—Alex Schriver. FAX: 225–0562 Legislative Director.—Matt Weinstein. Communications Director.—Seth Morrow. Scheduler.—Errical Bryant. 11 North Water Street, Suite 15290, Mobile, AL 36602 .......................................................... (251) 690–2811 502 West Lee Street, Summerdale, -

1 in the Shadow of Trump: How the 2016 Presidential Contest Affected

In the Shadow of Trump: How the 2016 Presidential Contest Affected House and Senate Primaries Prepared for the 2017 State of the Parties Conference, Akron, Ohio Robert G. Boatright, Clark University [email protected] The presidential race did not quite monopolize all of the uncivil or bizarre moments of the summer of 2016. One of the more interesting exchanges took place in Arizona in August of 2016, during the weeks before the state’s Senate primary election. Senator John McCain, always a somewhat unpredictable politician, has had difficulties in his last two primaries. Perhaps because he was perceived as having strayed too far toward the political center, or perhaps simply because his presidential bid had created some distance between McCain and Arizonans, he faced a vigorous challenge in 2010 from conservative talk show host and former Congressman J. D. Hayworth. McCain ultimately beat back Hayworth’s challenge, 56 percent to 32 percent, but only after a bitter campaign in which McCain spent a total of over $21 million and abandoned much of his “maverick” positioning and presented himself as a staunch conservative and a fierce opponent of illegal immigration (Steinhauer 2010). His task was made easier by his ability to attack Hayworth’s own checkered career in Congress. In 2016, McCain again faced a competitive primary opponent, physician, Tea Party activist, and two-term State Senator Kelli Ward. Ward, like Hayworth, argued that McCain was not conservative enough for Arizona. Ward was (and is), however, a decade younger than Hayworth, and her shorter tenure in political office made it harder for McCain to attack her. -

2016 POLITICAL DONATIONS Made by WEYERHAEUSER POLITICAL ACTION COMMITTEE (WPAC)

2016 POLITICAL DONATIONS made by WEYERHAEUSER POLITICAL ACTION COMMITTEE (WPAC) ALABAMA U.S. Senate Sen. Richard Shelby $2,500 U.S. House Rep. Robert Aderholt $5,000 Rep. Bradley Byrne $1,500 Rep. Elect Gary Palmer $1,000 Rep. Martha Roby $2,000 Rep. Terri Sewell $3,500 ARKANSAS U.S. Senate Sen. John Boozman $2,000 Sen. Tom Cotton $2,000 U.S. House Rep. Elect Bruce Westerman $4,500 FLORIDA U.S. House Rep. Vern Buchanan $2,500 Rep. Ted Yoho $1,000 GEORGIA U.S. Senate Sen. Johnny Isakson $3,000 U.S. House Rep. Rick Allen $1,500 Rep. Sanford Bishop $2,500 Rep. Elect Buddy Carter $2,500 Rep. Tom Graves $2,000 Rep. Tom Price $2,500 Rep. Austin Scott $1,500 IDAHO U.S. Senate Sen. Mike Crapo $2,500 LOUISIANA U.S. Senate Sen. Bill Cassidy $1,500 U.S. House Rep. Ralph Abraham $5,000 Rep. Charles Boustany $5,000 Rep. Garret Graves $1,000 Rep. John Kennedy $2,500 Rep. Stephen Scalise $3,000 MAINE U.S. Senate Sen. Susan Collins $1,500 Sen. Angus King $2,500 U.S. House Rep. Bruce Poliquin $2,500 MICHIGAN U.S. Senate Sen. Gary Peters $1,500 Sen. Debbie Stabenow $2,000 MINNESOTA U.S. Senate Sen. Amy Klobuchar $2,000 U.S. House Rep. Rick Nolan $1,000 Rep. Erik Paulsen $1,000 Rep. Collin Peterson $1,500 MISSISSIPPI U.S. Senate Sen. Roger Wicker $4,000 U.S. House Rep. Gregg Harper $4,000 Rep. Trent Kelly $3,000 Rep. -

Reagan National Defense Forum Peace Through Strength in an Era of Competition

REAGAN NATIONAL DEFENSE FORUM PEACE THROUGH STRENGTH IN AN ERA OF COMPETITION NOVEMBER 30 - DECEMBER 1, 2018 THE RONALD REAGAN PRESIDENTIAL LIBRARY SIMI VALLEY, CALIFORNIA Confirmed Speakers and Guests Subject to change Mr. John D. Heubusch Mr. Gordon Lubold Senator Jeanne Shaheen Ms. Kathy Warden The Honorable James N. Mattis Executive Director, The Ronald Reagan National Security and Pentagon Reporter, The Wall Street Journal U.S. Senate, New Hampshire President and COO, Northrop Grumman Corporation Presidential Foundation and Institute U.S. Secretary of Defense Mr. Palmer Luckey Ms. Barbara Starr The Rt. Honourable Gavin Williamson CBE MP The Honorable Kathleen Hicks Founder, Anduril Industries Pentagon Correspondent, CNN Minister of Defence for the United Kingdom SVP; Henry A. Kissinger Chair; Congressman Don Bacon Mr. Jonathan Cheng Director, Int'l Security Program, Center for Strategic & Int'l Studies The Honorable Susan R. McCaw Congresswoman Elise Stefanik The Honorable Heather Wilson U.S. House of Representatives, Nebraska Seoul Bureau Chief, The Wall Street Journal Former U.S. Ambassador to the Republic of Austria; U.S. House of Representatives, New York Secretary of the Air Force Mr. Raanan I. Horowitz Board Member, The Ronald Reagan Presidential Foundation and Institute; Mr. Bret Baier Mr. Eric Chewning President and CEO,Elbit Systems of America LLC President, COM Investments The Honorable Andrea L. Thompson Congressman Joe Wilson Chief Political Anchor, Fox News Deputy Assistant Secretary of Defense, Industrial Policy Under Secretary of State for Arms Control and International Security U.S. House of Representatives, South Carolina The Honorable Jeh Johnson Congressman Paul Mitchell Congressman Jim Banks Congressman Jim Cooper Former U.S. -

State Delegations

STATE DELEGATIONS Number before names designates Congressional district. Senate Republicans in roman; Senate Democrats in italic; Senate Independents in SMALL CAPS; House Democrats in roman; House Republicans in italic; House Libertarians in SMALL CAPS; Resident Commissioner and Delegates in boldface. ALABAMA SENATORS 3. Mike Rogers Richard C. Shelby 4. Robert B. Aderholt Doug Jones 5. Mo Brooks REPRESENTATIVES 6. Gary J. Palmer [Democrat 1, Republicans 6] 7. Terri A. Sewell 1. Bradley Byrne 2. Martha Roby ALASKA SENATORS REPRESENTATIVE Lisa Murkowski [Republican 1] Dan Sullivan At Large – Don Young ARIZONA SENATORS 3. Rau´l M. Grijalva Kyrsten Sinema 4. Paul A. Gosar Martha McSally 5. Andy Biggs REPRESENTATIVES 6. David Schweikert [Democrats 5, Republicans 4] 7. Ruben Gallego 1. Tom O’Halleran 8. Debbie Lesko 2. Ann Kirkpatrick 9. Greg Stanton ARKANSAS SENATORS REPRESENTATIVES John Boozman [Republicans 4] Tom Cotton 1. Eric A. ‘‘Rick’’ Crawford 2. J. French Hill 3. Steve Womack 4. Bruce Westerman CALIFORNIA SENATORS 1. Doug LaMalfa Dianne Feinstein 2. Jared Huffman Kamala D. Harris 3. John Garamendi 4. Tom McClintock REPRESENTATIVES 5. Mike Thompson [Democrats 45, Republicans 7, 6. Doris O. Matsui Vacant 1] 7. Ami Bera 309 310 Congressional Directory 8. Paul Cook 31. Pete Aguilar 9. Jerry McNerney 32. Grace F. Napolitano 10. Josh Harder 33. Ted Lieu 11. Mark DeSaulnier 34. Jimmy Gomez 12. Nancy Pelosi 35. Norma J. Torres 13. Barbara Lee 36. Raul Ruiz 14. Jackie Speier 37. Karen Bass 15. Eric Swalwell 38. Linda T. Sa´nchez 16. Jim Costa 39. Gilbert Ray Cisneros, Jr. 17. Ro Khanna 40. Lucille Roybal-Allard 18. -

Committee Assignments for the 115Th Congress Senate Committee Assignments for the 115Th Congress

Committee Assignments for the 115th Congress Senate Committee Assignments for the 115th Congress AGRICULTURE, NUTRITION AND FORESTRY BANKING, HOUSING, AND URBAN AFFAIRS REPUBLICAN DEMOCRATIC REPUBLICAN DEMOCRATIC Pat Roberts, Kansas Debbie Stabenow, Michigan Mike Crapo, Idaho Sherrod Brown, Ohio Thad Cochran, Mississippi Patrick Leahy, Vermont Richard Shelby, Alabama Jack Reed, Rhode Island Mitch McConnell, Kentucky Sherrod Brown, Ohio Bob Corker, Tennessee Bob Menendez, New Jersey John Boozman, Arkansas Amy Klobuchar, Minnesota Pat Toomey, Pennsylvania Jon Tester, Montana John Hoeven, North Dakota Michael Bennet, Colorado Dean Heller, Nevada Mark Warner, Virginia Joni Ernst, Iowa Kirsten Gillibrand, New York Tim Scott, South Carolina Elizabeth Warren, Massachusetts Chuck Grassley, Iowa Joe Donnelly, Indiana Ben Sasse, Nebraska Heidi Heitkamp, North Dakota John Thune, South Dakota Heidi Heitkamp, North Dakota Tom Cotton, Arkansas Joe Donnelly, Indiana Steve Daines, Montana Bob Casey, Pennsylvania Mike Rounds, South Dakota Brian Schatz, Hawaii David Perdue, Georgia Chris Van Hollen, Maryland David Perdue, Georgia Chris Van Hollen, Maryland Luther Strange, Alabama Thom Tillis, North Carolina Catherine Cortez Masto, Nevada APPROPRIATIONS John Kennedy, Louisiana REPUBLICAN DEMOCRATIC BUDGET Thad Cochran, Mississippi Patrick Leahy, Vermont REPUBLICAN DEMOCRATIC Mitch McConnell, Patty Murray, Kentucky Washington Mike Enzi, Wyoming Bernie Sanders, Vermont Richard Shelby, Dianne Feinstein, Alabama California Chuck Grassley, Iowa Patty Murray,