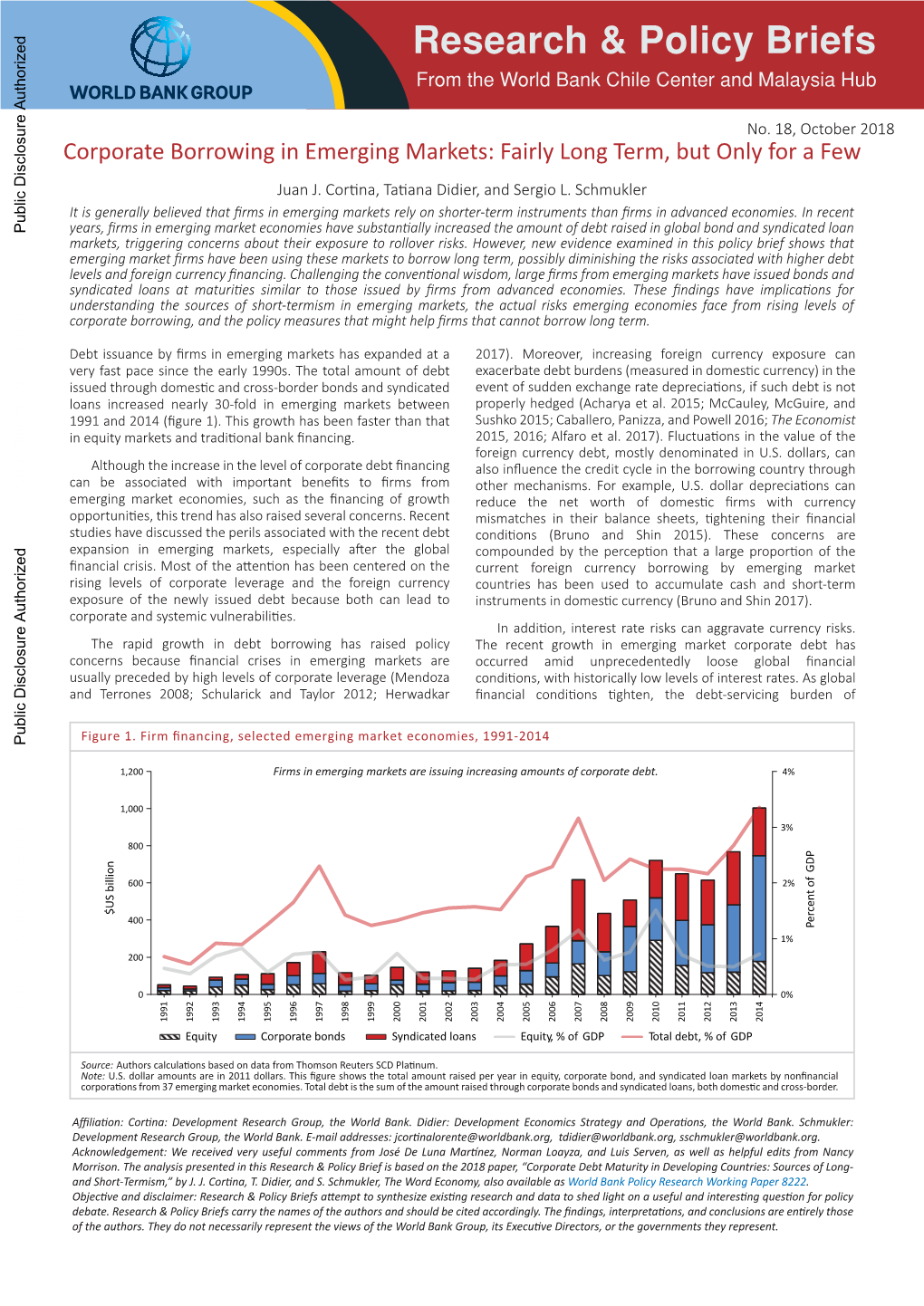

Corporate Borrowing in Emerging Markets: Fairly Long Term, but Only for a Few

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

34-66489; File No

SECURITIES AND EXCHANGE COMMISSION (Release No. 34-66489; File No. SR-NASDAQ-2012-004) February 29, 2012 Self-Regulatory Organizations; The NASDAQ Stock Market LLC; Order Granting Approval of Proposed Rule Change Relating to the Listing and Trading of Shares of the Emerging Markets Corporate Bond Fund of the WisdomTree Trust I. Introduction On January 4, 2012, The NASDAQ Stock Market LLC (“Nasdaq” or “Exchange”) filed with the Securities and Exchange Commission (“Commission”), pursuant to Section 19(b)(1) of the Securities Exchange Act of 1934 (“Act”)1 and Rule 19b-4 thereunder,2 a proposed rule change to list and trade the shares (“Shares”) of the WisdomTree Emerging Markets Corporate Bond Fund (“Fund”) of the WisdomTree Trust (“Trust”) under Nasdaq Rule 5735. The proposed rule change was published for comment in the Federal Register on January 24, 2012.3 The Commission received no comments on the proposal. This order grants approval of the proposed rule change. II. Description of the Proposed Rule Change The Exchange proposes to list and trade the Shares of the Fund under Nasdaq Rule 5735, which governs the listing and trading of Managed Fund Shares on the Exchange. The Fund will be an actively managed exchange-traded fund. The Shares will be offered by the Trust, which was established as a Delaware statutory trust on December 15, 2005. The Fund is registered with the Commission as an investment company and has filed a registration statement on Form N-1A 1 15 U.S.C. 78s(b)(1). 2 17 CFR 240.19b-4. 3 See Securities Exchange Act Release No. -

The Biggest Short Buy and Maintain Investors May Wish to Consider

March 2021 | The biggest short For professional clients only. Not to be distributed to retail clients. The biggest short Why we believe buy and maintain investors may wish to consider allocating to emerging market debt. Mark Vickery Client Director John Gray Emerging Markets Portfolio Manager Active Fixed Income For defined benefit (DB) pension schemes, particularly those of greater maturity, buy and maintain allocations have been increasing in popularity and are now widely adopted. Business centre, Moscow, Russia Buy and maintain investment generally involves: believe that allocating to emerging market corporate bonds, • an active selection of high quality global bonds to hold, ideally alongside traditional developed market corporate bonds, is one until maturity; of the key tools in creating high quality buy and maintain • reduced trading costs resulting from low turnover; portfolios. • duration targeting to help mitigate interest rate risks, affecting schemes’ liabilities; In this article, we present five reasons why we believe DB • yield generation above gilts to improve funding positions; pension schemes may wish to consider including emerging • and for those schemes whose ultimate target is buyout, market bonds in their portfolios as they progress along their corporate bonds can also provide a reduction in the cost of journey to their chosen endgame. their transaction. In order to achieve all this, schemes invest on a global basis in corporate bonds. However, UK DB pension schemes in fact remain significantly short of emerging market exposure. We The value of an investment and any income taken from it is not guaranteed and can go down as well as up, you may not get back the amount you originally invested. -

Investing in Emerging Market Debt

FALL 2020 VOLUME 30 NUMBER 2 (Systematic) Investing in Emerging Market Debt THE JOURNAL OF JORDAN BROOKS, SCOTT RICHARDSON, AND ZHIKAI XU JFI.PM-RESEARCH.COM permission. Publisher without electronically post to or user, unauthorized an to forward article, this of copies unauthorized make to illegal is It (Systematic) Investing in Emerging Market Debt JORDAN BROOKS, SCOTT RICHARDSON, AND ZHIKAI XU permission. Publisher without JORDAN BROOKS is at AQR Capital KEY FINDINGS Management LLC • We find that a systematic approach to active risk taking “works” in emerging market (EM) electronically in Greenwich, CT. fixed income. Exposures linked to carry, defensive, momentum and valuation themes post [email protected] have been well compensated in EM markets. to or • We further find that an excess of benchmark returns for incumbent EM managers contains SCOTT RICHARDSON a lot of traditional beta and significant macroeconomic sensitivities. user, is a professor at the • There is potentially a large diversification benefit for a well-crafted systematic long-only London Business School portfolio of EM bonds. and is affiliated with AQR Capital Management LLC unauthorized in Greenwich, CT. an [email protected] to ABSTR ACT: The authors extend the analysis of (corporate and sovereign) domiciled in systematic investment approaches to emerging market emerging markets and can be issued in local ZHIKAI XU forward (EM) fixed income. They focus on hard currency and hard (typically USD) currency. J. P. is at AQR Capital Management LLC bonds issued by emerging sovereign and quasi-sovereign Morgan’s global EM indices, which capture article, in Greenwich, CT. entities. They find that systematic exposures linked to the investible section of EM markets, have this [email protected] carry, defensive, momentum, and valuation themes are increased from around 350 billion USD in of well compensated and lowly correlated in EM mar- 2002 to nearly 2.5 trillion by the end of copies kets. -

Reinvigorating Credit Growth in Central, Eastern, and Southern European Economies

Haverford College Haverford Scholarship Faculty Publications Economics 2015 Reinvigorating Credit Growth in Central, Eastern, and Southern European Economies Bosjan Jazbec Cristopher Towe Marco Pinon Biswajit Banerjee Haverford College Follow this and additional works at: https://scholarship.haverford.edu/economics_facpubs Repository Citation Bostjan Jazbec, Christopher M. Towe, Marco Pinon, and Biswajit Banerjee, Eds. Reinvigorating Credit Growth in Central, Eastern, and Southern European Economies: Proceedings of a Conference Jointly Organized by the Bank of Slovenia and the International Monetary Fund. Washington, D.C.: International Monetary Fund, Publication Services, 2015. This Conference Proceeding is brought to you for free and open access by the Economics at Haverford Scholarship. It has been accepted for inclusion in Faculty Publications by an authorized administrator of Haverford Scholarship. For more information, please contact [email protected]. In Central, Eastern, and Southern European Economies In Central,Eastern,andSouthernEuropean Reinvigorating CreditGrowth REINVIGORATING CREDIT GROWTH In Central, Eastern, and Southern European Economies Edited by Boštjan Jazbec, Christopher M. Towe, Marco Piñón, and Biswajit Banerjee Marco Piñón, and Biswajit Banerjee Marco Piñón,andBiswajit ChristopherM.Towe, Edited byBoštjanJazbec, Reinvigorating Credit Growth Proceedings of a conference jointly organized In Central, Eastern, and Southern European Economies RCGMCMEA by the Bank of Slovenia and the International Monetary Fund -

Emerging Market Debt Market Commentary

Marketing Communication 1 Emerging Market Debt Market Commentary Second Quarter 2020 The unprecedentedly rapid and large monetary and fiscal stimulus put in place by the major global economies fuelled a sharp rebound in emerging bond markets over the quarter. As a result, Q2 Emerging Market Debt (EMD) returns were able to offset to a great extent the losses witnessed in the first quarter. With developed market (DM) central banks signalling that their accommodative policies will not be reversed anytime soon, the appetite for risk assets and the hunt for higher yield gained traction. As a result, towards the end of Q2 we witnessed the return of flows into EM bond funds, with investors marginally favouring hard currency over local currency EM debt. Figure 1 - Emerging Market Debt Index Returns – As of 30 June, 20201 1m 3m 6m YTD 12m 3yrs 5yrs In USD GBI-EM GD (EM Local Currency) 0.47% 9.82% -6.89% -6.89% -2.82% 1.14% 2.34% EMBI GD (EM Hard Currency) 3.51% 12.26% -2.76% -2.76% 0.49% 3.60% 5.30% CEMBI BD (EM Corporates) 2.75% 11.15% -0.16% -0.16% 3.74% 4.52% 5.13% In EUR GBI-EM GD (EM Local Currency) -0.50% 7.28% -6.94% -6.94% -1.47% 1.66% 2.18% EMBI GD (EM Hard Currency) 2.52% 9.67% -2.82% -2.82% 1.89% 4.13% 5.13% CEMBI BD (EM Corporates) 1.76% 8.58% -0.22% -0.22% 5.19% 5.05% 4.96% Sources: State Street Global Advisors, Bloomberg, JP Morgan as of 30 June 2020. -

FS IISGFIF 20210331 Class a Instintfi 464011

31 March 2021 Russell Investments Global Fixed Interest Fund Fund facts Rolling 1 year performance history Inception date Fund Benchmark 16% 21 December 2011 12% Benchmark Bloomberg Barclays Global 8% Aggregate Index ($NZ 4% Hedged) Currency 0% 2012 2013 2014 2015 2016 2017 2018 2019 2020 NZD Performance review Period ending 31/03/2021 1 3 1 3 5 Since month months year years years inception % % % %p.a. %p.a. %p.a. Gross fund performance -0.1 -2.5 6.4 4.9 4.8 6.4 Benchmark return -0.4 -2.5 1.4 4.0 3.6 5.2 Excess return 0.3 0.0 5.0 0.9 1.2 1.3 Past performance is not a reliable indicator of future performance. Performance data shown is gross of fees, charges or taxes and is not in any way an indicator of the net return to you as an investor. Performance is calculated on exit price. Fund commentary The Russell Investments Global Bond Fund (NZD hedged) performed in line with the benchmark in the March quarter. This was primarily driven by currency and credit positioning. In active currencies, the overweight to the US dollar and underweights to Swiss franc and Swedish krona, generated strong gains. The underweight to the Chinese renminbi was a slight detractor. In credit positioning, overweights to US non-agency CMBS and hard currency emerging market debt (Europe, Middle East), added to performance. This was slightly held back by the overweight to Latin American hard currency emerging market debt. In rates positioning, the overweight in Australia slightly offset the gains generated through an underweight in the US and UK. -

Five Reasons to Be Bullish on Local-Currency Emerging-Market Debt

February 2021 Five reasons to be bullish on local-currency emerging-market debt We are broadly bullish on emerging-market debt Michael Cirami Director of Global Income (EMD) – particularly local-currency EMD – as we Eaton Vance Management expect the notably positive turn in the macro Matthew Murphy Jr., CFA, CAIA Senior Institutional Portfolio Manager environment to continue. Global Income Team Eaton Vance Management EM economic growth is leading the global economic recovery, yet EM returns in 2020 lagged the asset gains in developed markets. EM economies did not shut down to the same degree as developed economies in 2020, nor are they shutting down as aggressively now. Developed-market monetary policies will continue to anchor core interest rates at extremely low levels, including around U.S.$18 trillion of negative-yielding debt. Combined with ballooning deficits in the U.S., the dollar is likely to remain weak. Crossover buyers into EMD, along with widespread interest in the higher yields available in the asset class, will likely continue to provide support. Some countries are experiencing a debt buildup. Successful investment in this diverse asset class requires, in our view, proper due diligence and attention to country-specific risk. 2 | Five reasons to be bullish on local-currency emerging-market debt | February 2021 Introduction a handful of EM countries between April and October 2020. Relative to the outlook for developed economies, Eaton Vance is currently upbeat about the investment the International Monetary Fund (IMF) projects a prospects for local-currency-denominated emerging- stronger rebound in emerging economies in 2021.² See market debt (EMD). -

The Two Previous Issues of the Global

SELECTED TOPIC: THE ROLE OF FINANCIAL CHAPTER IV DERIVATIVES IN EMERGING MARKETS he two previous issues of the Global in global derivatives markets. Local derivatives Financial Stability Report contained markets in emerging market economies differ chapters on local equity and fixed- greatly in their sizes, both in absolute terms and income markets in emerging market relative to cash markets. Compared to mature Teconomies, with particular focus on the role of markets, the ratio of outstanding notionals in local markets as a substitute for international bond and equity derivatives to market capitaliza- markets for raising funds. This chapter presents tion of the underlying asset markets is fairly original estimates of the scale of the derivatives small in most emerging economies (see Table trading activity in the major emerging markets 4.1). The most common problems that constrain and compares developments in these markets the development of local derivatives markets are with global trends. In addition to providing a (1) relatively underdeveloped markets for brief overview of the local derivatives markets, underlying instruments; (2) weak/inadequate this chapter focuses on how derivatives facili- legal and market infrastructure; and (3) restric- tated capital flows to emerging market tions on the use of derivatives by local and for- economies and on the role of derivatives in past eign entities. emerging market crises. Financial derivatives allow investors to unbun- Currency Derivatives dle and redistribute various risks—foreign exchange, interest rate, market, and default Most of the currency derivatives trading risks—and thus, facilitate cross-border capital around the world takes place through the over- flows and create more opportunities for portfo- the-counter (OTC) markets, with foreign lio diversification. -

Emerging Market Debt Fund (Formerly, Federated Emerging Market Debt Fund)

Statem ent of Additional Information January 31, 2021 Share Class | Ticker A | IHIAX C | IHICX Institutional | EMDIX Federated Hermes Emerging Market Debt Fund (formerly, Federated Emerging Market Debt Fund) A Portfolio of Federated Hermes World Investment Series, Inc. (formerly, Federated World Investments Series, Inc.) This Statement of Additional Information (SAI) is not a Prospectus. Read this SAI in conjunction with the Prospectus for Federated Hermes Emerging Market Debt Fund (the “Fund”), dated January 31, 2021. This SAI incorporates by reference the Fund’s Annual Report. Obtain the Prospectus or the Annual Report without charge by calling 1-800-341-7400. Contents 1 How is the Fund Organized? 1 Securities in Which the Fund Invests 12 Investment Risks 16 Investment Objective and Investment Limitations 17 What Do Shares Cost? 20 How is the Fund Sold? 23 Purchases In-Kind 23 Redemption In-Kind 23 Account and Share Information 24 Tax Information 25 Who Manages and Provides Services to the Fund? 41 Financial Information 41 Investment Ratings 46 Addresses 47 Appendix Federated Hermes Emerging Market Debt Fund Federated Hermes Funds 4000 Ericsson Drive Warrendale, PA 15086-7561 Contact us at FederatedInvestors.com or call 1-800-341-7400. Federated Securities Corp., Distributor G01745-02 (1/21) © 2021 Federated Hermes, Inc. How is the Fund Organized? The Fund is a non-diversified portfolio of Federated Hermes World Investment Series, Inc. (the “Corporation”). The Corporation is an open-end, management investment company that was established under the laws of the state of Maryland on January 25, 1994. The Corporation may offer separate series of shares representing interests in separate portfolios of securities. -

Multi-Asset Income Fund

SEPTEMBER 30 INFO SHEET 2019 Multi-Asset Income Fund INVESTMENT GOALS • Focus on diversified sources of yield/income with attractive total return potential while managing drawdown risk • Enhance a traditional 60% Equity/40% Fixed Income portfolio due to the fund’s emphasis on income and its use of non-traditional asset classes WHY CONSIDER MULTI-ASSET GENERATED INCOME • Fixed income has traditionally been a core driver of total return, but fixed income alone may not be the best way to realize income and total return going forward • For 20 year rolling periods from 1926-2014, 99% of US fixed income total return has come from yields* • With current yields on fixed income investments so low (negative in some cases), we believe it is important to diversify income sources to help achieve goals • Multiple sources of income can help weather many varied market environments HOW TO USE IT? • As a standalone fund - provides risk-adjusted income potential as a way to seek income without falling into possible yield traps • As a complement to a balanced fund - pursuing active and tactical diversification can help to mitigate risk when seeking income • As a complement to an equity fund - managing risk when equities may look stretched on a relative basis • As a complement to a high yield fund - seeking equity-like returns with less than equity-like risk WHY LOOMIS SAYLES? • Leverage the core research engines at Loomis Sayles - Top-down cyclical approach based on macro and sovereign research - Bottom-up security selection utilizes fundamental credit and equity research analyst expertise - Risk management harnesses the power of Loomis’s Quantitative Research and Risk Analysis team • The team has worked together since 2010 • Portfolio construction is key: our experienced portfolio managers seek to optimize and diversify returns with many sources of income • We seek to protect capital by overweighting assets that offer more yield potential per unit of risk and underweighting those that offer less yield potential per unit of risk. -

The Case for a Core Allocation to Emerging Market Debt

Marketing material for professional investors and advisers only In focus The case for a core allocation to emerging market debt June 2019 A commonly held, but misplaced, belief that emerging market debt (EMD) is an obscure, risky, outpost of the fixed income universe has resulted in it being under-represented in many portfolios. Within each category (hard or local currency EMD), however, it has qualities that are similar to, or even Duncan Lamont, CFA Peter Ozelius, CFA better than, other core fixed income Head of Research and Analytics Assistant Portfolio Manager, Emerging Market Debt allocations. Our analysis demonstrates Relative team that a strategic allocation to EMD should improve risk-adjusted return potential for At a basic level, the underlying drivers of returns vary across the portfolios of all degrees of sophistication. main EMD components. Hard and corporate EMD relate to the US dollar borrowings of EM sovereigns, quasi-sovereigns and companies. Yields are a combination of US Treasury yields and Emerging markets have grown in prominence and now represent a credit spread. As a result, returns are directly influenced by around 40% of global GDP,1 twice their level at the turn of the movements in US interest rates and whether those moves are millennium. In addition, emerging market debt now represents growth or inflation-fuelled, along with changing perceptions 18% of the global bond market.2 Despite that, many investors about the creditworthiness of EM borrowers. Rising US rates hold far less and portfolios with no money allocated to EMD at all have typically been associated with falling returns and vice versa. -

Yale ICF Working Paper No. 0706 Collateralized Debt Obligations And

Yale ICF Working Paper No. 0706 Collateralized Debt Obligations and Credit Risk Transfer Douglas J. Lucas, Executive Director, CDO Research, UBS Laurie S. Goodman, CoHead, Global Fixed Income Research, UBS Frank J. Fabozzi, Professor in the Practice of Finance, Yale University, School of Management and International Center for Finance This paper can be downloaded without charge from the Social Science Research Network Electronic Paper Collection: http://ssrn.com/abstract=997276 Collateralized debt obligations and credit risk transfer Douglas J. Lucas, Executive director and head of CDO Research, UBS Laurie S. Goodman, Managing director and CoHead of Global Fixed Income Research, UBS Frank J. Fabozzi, Professor in the Practice of Finance, School of Management, Yale University ABSTRACT Several studies have reported how new credit risk transfer vehicles have made it easier to reallocate large amounts of credit risk from the financial sector to the nonfinancial sector of the capital markets. In this article, we describe one of these new credit risk transfer vehicles, the collateralized debt obligation. Synthetic credit debt obligations utilize credit default swaps, another relatively new credit risk transfer vehicle. Financial institutions face five major risks: credit, interest rate, price, currency, and liquidity. The development of the derivatives markets prior to 1990 provided financial institutions with efficient vehicles for the transfer of interest rate, price, and currency risks, as well as enhancing the liquidity of the underlying assets. However, it is only in recent years that the market for the efficient transfer of credit risk has developed. Credit risk is the risk that a debt instrument will decline in value as a result of the borrower’s inability (real or perceived) to satisfy the contractual terms of its borrowing arrangement.