Five Reasons to Be Bullish on Local-Currency Emerging-Market Debt

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

34-66489; File No

SECURITIES AND EXCHANGE COMMISSION (Release No. 34-66489; File No. SR-NASDAQ-2012-004) February 29, 2012 Self-Regulatory Organizations; The NASDAQ Stock Market LLC; Order Granting Approval of Proposed Rule Change Relating to the Listing and Trading of Shares of the Emerging Markets Corporate Bond Fund of the WisdomTree Trust I. Introduction On January 4, 2012, The NASDAQ Stock Market LLC (“Nasdaq” or “Exchange”) filed with the Securities and Exchange Commission (“Commission”), pursuant to Section 19(b)(1) of the Securities Exchange Act of 1934 (“Act”)1 and Rule 19b-4 thereunder,2 a proposed rule change to list and trade the shares (“Shares”) of the WisdomTree Emerging Markets Corporate Bond Fund (“Fund”) of the WisdomTree Trust (“Trust”) under Nasdaq Rule 5735. The proposed rule change was published for comment in the Federal Register on January 24, 2012.3 The Commission received no comments on the proposal. This order grants approval of the proposed rule change. II. Description of the Proposed Rule Change The Exchange proposes to list and trade the Shares of the Fund under Nasdaq Rule 5735, which governs the listing and trading of Managed Fund Shares on the Exchange. The Fund will be an actively managed exchange-traded fund. The Shares will be offered by the Trust, which was established as a Delaware statutory trust on December 15, 2005. The Fund is registered with the Commission as an investment company and has filed a registration statement on Form N-1A 1 15 U.S.C. 78s(b)(1). 2 17 CFR 240.19b-4. 3 See Securities Exchange Act Release No. -

Complementary Currencies: Mutual Credit Currency Systems and the Challenge of Globalization

Complementary Currencies: Mutual Credit Currency Systems and the Challenge of Globalization Clare Lascelles1 Abstract Complementary currencies—currencies operating alongside the official currency—have taken many forms throughout the last century or so. While their existence has a rich history, complementary currencies are increasingly viewed as anachronistic in a world where the forces of globalization promote further integration between economies and societies. Even so, towns across the globe have recently witnessed the introduction of complementary currencies in their region, which connotes a renewed emphasis on local identity. This paper explores the rationale behind the modern-day adoption of complementary currencies in a globalized system. I. Introduction Coined money has two sides: heads and tails. ‘Heads’ represents the state authority that issued the coin, while ‘tails’ displays the value of the coin as a medium of exchange. This duality—the “product of social organization both from the top down (‘states’) and from the bottom up (‘markets’)”—reveals the coin as “both a token of authority and a commodity with a price” (Hart, 1986). Yet, even as side ‘heads’ reminds us of the central authority that underwrote the coin, currency can exist outside state control. Indeed, as globalization exerts pressure toward financial integration, complementary currencies—currencies existing alongside the official currency—have become common in small towns and regions. This paper examines the rationale behind complementary currencies, with a focus on mutual credit currency, and concludes that the modern-day adoption of complementary currencies can be attributed to the depersonalizing force of globalization. II. Literature Review Money is certainly not a topic unstudied. -

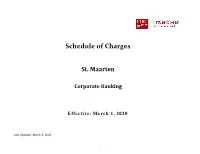

St. Maarten Corporate

Schedule of Charges St. Maarten Corporate Banking Effective: March 1, 2020 Last Updated: March 1, 2020 1 Schedule of Charges CONTENTS 1 CORPORATE DEPOSIT AND TRANSACTION ACCOUNTS - LOCAL CURRENCY 2 CORPORATE DEPOSIT AND TRANSACTION ACCOUNTS - FOREIGN CURRENCY 3 SUNDRY SERVICES 4 LENDING AND CARD SERVICES 5 CORPORATE SERVICES 6 TRADE SERVICES 2 Schedule of Charges CORPORATE DEPOSIT AND TRANSACTION ACCOUNTS - LOCAL CURRENCY Business Current Accounts Call Accounts Minimum monthly service fee $12.50 Minimum monthly service fee $12.50 Withdrawals / Cheques per entry $1.75 Withdrawals / Debits per entry 1 free, thereafter $1.00 Deposits / Credits per entry $1.25 Deposits / Credits per entry 1 free, thereafter $1.00 Business Premium Accounts Fixed Deposit Accounts Minimum monthly service fee $12.50 Transfer to another internal account on maturity No Charge Withdrawals / Cheques per entry 1 free, thereafter $2.00 Transfer to another institution on maturity Draft or Wire Fee Deposits / Credits per entry 1 free, thereafter $2.00 Notes: 1. * - Product/Service Not offered to new clients 2. All figures are quoted in Netherlands Antillean Guilder unless otherwise stated. 3 Schedule of Charges CORPORATE DEPOSIT AND TRANSACTION ACCOUNTS - FOREIGN CURRENCY UNITED STATES DOLLARS (USD) EURO DOLLARS (EUR$) USD Chequing Accounts EUR Business Current Accounts Minimum monthly service fee USD $10.00 Minimum monthly service fee € 10.00 Withdrawals / Cheques per entry 2 free, thereafter USD $0.75 Withdrawals / Cheques per entry 2 free, thereafter €1.00 Deposits / Credits per entry 2 free, thereafter USD $0.75 Deposits / Credits per entry 2 free, thereafter €1.00 USD Business Premium Accounts EUR Business Call Accounts Minimum monthly service fee USD $5.00 Minimum monthly service fee € 10.00 Withdrawals / Cheques per entry 2 free, thereafter USD $1.00 Withdrawals / Cheques per entry 4 free, thereafter €0.40 Deposits / Credits per entry 2 free, thereafter USD $1.00 Deposits / Credits per entry No Charge EUR deposit charge 0.7% p.a. -

Our Monthly View on Asset Allocation

ASSET ALLOCATION INSIGHTS April 2019 OUR MONTHLY VIEW ON ASSET ALLOCATION FINANCIAL REPRESSION, SEASON 2 Artificial business cycle Thanks to a new dose of monetary policy accommodation, central banks in developed markets should extension brings be able to extend the business cycle – although somewhat artificially, as they refuse to normalise rates goldilocks back in order to properly flush out the system. There is still too much debt, following a decade of financial repression, and not enough nominal growth, despite a decade of ultra-loose monetary policy. Economic growth in developed economies is now expected to bottom out around the end of the first quarter, before nearing potential economic growth further down the line. While this is not ideal, it will not be But it’s too late enough to trigger inflation concerns. So we are back in a kind of goldilocks scenario with no recession, to chase momentum low inflation and no interest rate hikes. The extra liquidity has annihilated volatility, reflated asset valuations and triggered a new run-to-carry. However, as the influence of monetary stimulus will soon fade, and valuations are not overly appealing, it is now too late to blindly chase the rally. Minor allocation changes As a result, we did not alter our allocation very much this month. We continue to look for carry, growth this month stories, relatively cheap valuations and diversification. In this context, we favour hard currency emerging market (EM) debt and subordinated debt for their carry and relatively cheap valuations. Meanwhile, we Dovish Fed should benefit are warming up to EM local currency debt because of the Federal Reserve’s very patient dovish attitude, which should cap both US rates and dollar strength. -

The Biggest Short Buy and Maintain Investors May Wish to Consider

March 2021 | The biggest short For professional clients only. Not to be distributed to retail clients. The biggest short Why we believe buy and maintain investors may wish to consider allocating to emerging market debt. Mark Vickery Client Director John Gray Emerging Markets Portfolio Manager Active Fixed Income For defined benefit (DB) pension schemes, particularly those of greater maturity, buy and maintain allocations have been increasing in popularity and are now widely adopted. Business centre, Moscow, Russia Buy and maintain investment generally involves: believe that allocating to emerging market corporate bonds, • an active selection of high quality global bonds to hold, ideally alongside traditional developed market corporate bonds, is one until maturity; of the key tools in creating high quality buy and maintain • reduced trading costs resulting from low turnover; portfolios. • duration targeting to help mitigate interest rate risks, affecting schemes’ liabilities; In this article, we present five reasons why we believe DB • yield generation above gilts to improve funding positions; pension schemes may wish to consider including emerging • and for those schemes whose ultimate target is buyout, market bonds in their portfolios as they progress along their corporate bonds can also provide a reduction in the cost of journey to their chosen endgame. their transaction. In order to achieve all this, schemes invest on a global basis in corporate bonds. However, UK DB pension schemes in fact remain significantly short of emerging market exposure. We The value of an investment and any income taken from it is not guaranteed and can go down as well as up, you may not get back the amount you originally invested. -

World Watch Report

CONFIDENTIAL WORLD WATCH® REPORT ON France Date: 05/07/2019 13:57:02 GMT / UTC UnitedHealthcare Global Risk | 14141 Southwest Freeway, Suite 500 | Sugar Land, Texas 77478 ph: (713) 4307300 | email: [email protected] | url: www.uhcglobal.com World Watch® is confidential and is intended solely for the information and use of UnitedHealthcare Global's clients. Given the nature of the information, UnitedHealthcare Global does not guarantee the accuracy or completeness of the information because agencies outside the control of UnitedHealthcare Global contribute information to World Watch®. While UnitedHealthcare Global vets and verifies all information with the utmost care and consideration for the end user, UnitedHealthcare Global does not guarantee the accuracy or completeness of the information and specifically disclaims all responsibility for any liability, loss or risk, personal or otherwise, which is incurred as a consequence, directly or indirectly, of the use and application of, or reliance upon, any of the information on this site, including customized reports created by clients. Any alteration or modification of the content of World Watch®, either from the website or via printed reports, is strictly prohibited. For more information, please contact us at [email protected] or visit www.uhcglobal.com. Copyright © 2019 UnitedHealthcare Global. All rights reserved. For Terms and Conditions go to Terms Of Use World Watch® Report from UnitedHealthcare Global France Executive Summary for France France is a stable democracy located in Western Europe. To the southwest, the country borders Spain, and to the east, it borders Belgium, Germany, Italy, Luxembourg, Monaco and Switzerland. The semipresidential government is comprised of 96 mainland départements, and also has five overseas départements: French Guiana, Guadeloupe, Martinique, Mayotte and Réunion. -

Offshore Markets for the Domestic Currency: Monetary and Financial Stability Issues

BIS Working Papers No 320 Offshore markets for the domestic currency: monetary and financial stability issues by Dong He and Robert N McCauley Monetary and Economic Department September 2010 JEL classification: E51; E58; F33 Keywords: offshore markets; currency internationalisation; monetary stability; financial stability BIS Working Papers are written by members of the Monetary and Economic Department of the Bank for International Settlements, and from time to time by other economists, and are published by the Bank. The papers are on subjects of topical interest and are technical in character. The views expressed in them are those of their authors and not necessarily the views of the BIS. Copies of publications are available from: Bank for International Settlements Communications CH-4002 Basel, Switzerland E-mail: [email protected] Fax: +41 61 280 9100 and +41 61 280 8100 This publication is available on the BIS website (www.bis.org). © Bank for International Settlements 2010. All rights reserved. Brief excerpts may be reproduced or translated provided the source is stated. ISSN 1020-0959 (print) ISBN 1682-7678 (online) Abstract We show in this paper that offshore markets intermediate a large chunk of financial transactions in major reserve currencies such as the US dollar. We argue that, for emerging market economies that are interested in seeing some international use of their currencies, offshore markets can help to increase the recognition and acceptance of the currency while still allowing the authorities to retain a measure of control over the pace of capital account liberalisation. The development of offshore markets could pose risks to monetary and financial stability in the home economy which need to be prudently managed. -

Investing in Emerging Market Debt

FALL 2020 VOLUME 30 NUMBER 2 (Systematic) Investing in Emerging Market Debt THE JOURNAL OF JORDAN BROOKS, SCOTT RICHARDSON, AND ZHIKAI XU JFI.PM-RESEARCH.COM permission. Publisher without electronically post to or user, unauthorized an to forward article, this of copies unauthorized make to illegal is It (Systematic) Investing in Emerging Market Debt JORDAN BROOKS, SCOTT RICHARDSON, AND ZHIKAI XU permission. Publisher without JORDAN BROOKS is at AQR Capital KEY FINDINGS Management LLC • We find that a systematic approach to active risk taking “works” in emerging market (EM) electronically in Greenwich, CT. fixed income. Exposures linked to carry, defensive, momentum and valuation themes post [email protected] have been well compensated in EM markets. to or • We further find that an excess of benchmark returns for incumbent EM managers contains SCOTT RICHARDSON a lot of traditional beta and significant macroeconomic sensitivities. user, is a professor at the • There is potentially a large diversification benefit for a well-crafted systematic long-only London Business School portfolio of EM bonds. and is affiliated with AQR Capital Management LLC unauthorized in Greenwich, CT. an [email protected] to ABSTR ACT: The authors extend the analysis of (corporate and sovereign) domiciled in systematic investment approaches to emerging market emerging markets and can be issued in local ZHIKAI XU forward (EM) fixed income. They focus on hard currency and hard (typically USD) currency. J. P. is at AQR Capital Management LLC bonds issued by emerging sovereign and quasi-sovereign Morgan’s global EM indices, which capture article, in Greenwich, CT. entities. They find that systematic exposures linked to the investible section of EM markets, have this [email protected] carry, defensive, momentum, and valuation themes are increased from around 350 billion USD in of well compensated and lowly correlated in EM mar- 2002 to nearly 2.5 trillion by the end of copies kets. -

JTL|RELIT Vol

B T P S Journal of Transport Literature JTL|RELIT Vol. 7, n. 4, pp. 50-74, Oct. 2013 Brazilian Transportation www.transport-literature.org Planning Society Research Directory ISSN 2238-1031 The effect of social stigma on fare evasion in Stockholm's public transport [O efeito do estigma social sobre evasão de tarifa no transporte público de Estocolmo] Adeline Sterner, Shu Sheng* Stockholm School of Economics - Sweden Submitted 29 Dec 2012; received in revised form 14 Jan 2013; accepted 21 Jan 2013 Abstract This study examines if there is any social stigma associated with ticket-controls in Stockholm’s subway. We used a survey- based model that measures the willingness to pay for a subway card given different types and number of ticket-controls. By comparing the willingness to pay between the different scenarios we obtained the perceived social stigma in local currency (SEK). Our main result is an increase in the willingness to pay for a subway card of SEK 612 per year when controls are associated with social stigma. However, already fare evading respondents do not react as heavily to social stigma as non-fare evaders. These finding suggest that investing in more stigmatizing ticket controls is not preferable since fare evaders will not be affected by it. Key words: social stigma, fare evasion, free-rider problem, public transport, social norms. Resumo Este estudo examina se há algum problema de estigma social associado aos controles de bilhete no metrô de Estocolmo. Usamos um modelo baseado em pesquisas que mede a disposição a pagar por um cartão de metrô dados diferentes tipos e números de controles de bilhetes. -

Exchange Rates, Local Currency Pricing and International Tax Policies

NBER WORKING PAPER SERIES EXCHANGE RATES, LOCAL CURRENCY PRICING AND INTERNATIONAL TAX POLICIES Sihao Chen Michael B. Devereux Jenny Xu Kang Shi Working Paper 25111 http://www.nber.org/papers/w25111 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 September 2018 Devereux acknowledges financial support from the Social Sciences and Research Council of Canada. Xu would like to thank the Hong Kong Research Grants Council (GRF No. 644810) for financial support. The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research. NBER working papers are circulated for discussion and comment purposes. They have not been peer-reviewed or been subject to the review by the NBER Board of Directors that accompanies official NBER publications. © 2018 by Sihao Chen, Michael B. Devereux, Jenny Xu, and Kang Shi. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. Exchange Rates, Local Currency Pricing and International Tax Policies Sihao Chen, Michael B. Devereux, Jenny Xu, and Kang Shi NBER Working Paper No. 25111 September 2018 JEL No. F3,F4 ABSTRACT Empirical evidence suggests that for many countries, retail prices of traded goods are sticky in national currencies. Movements in exchange rates then cause deviations from the law of one price, and exchange rate ëmisalignmentí, which cannot be corrected by monetary policy alone. This paper shows that a state contingent international tax policy can be combined with monetary policy to eliminate exchange rate misalignment and sustain a fully efficient welfare outcome. -

Final Programme

Final Programme 11th European Congress of Trauma & Emergency Surgery Building Bridges May 15 -18, 2010 Brussels / Belgium, SQUARE © asbl Atomium/VBK, Wien 2008 Organised by European Society for Trauma & Emergency Surgery Belgian Trauma Society www.estesonline.org Turned Turned to stay! «Together with a team of European surgeons we have been working on further optimisation of our proven inverse concept. Our new Affinis Inverse includes many innovations: standardised reduction of inferior notching and poly- ethylene wear, simple, safe instrumentation and addi- tional size gradients for an individual and optimal soft tissue balance. Curious? Interested? Contact us at: [email protected]. We’ll be glad to show you how we have turned things upside down.» 2OGER "AUMGARTNER s 'ROUP MANAGER MARKETING UPPER EXTREMITIES &RANK$ALLMANNs(EADOFDEVELOPMENTSHOULDER -ATHYS,TD"ETTLACHs'àTERSTRASSEs0/"OXs#( "ETTLACHs3WITZERLANDsWWWMATHYSMEDICALCOM TABLE OF CONTENTS Belgian Trauma Society Welcome . 2–3 Important Addresses . 4 Organisation & Committees . 4 ESTES Board of Directors . 5 Acknowledgements of Guest Societies . 6 Sponsor Acknowledgements . .7 Registration Area . 8–9 Congress Information . 10–11 Congress Guidelines & Information . 12 Opening Hours Preview Centre . 12 If you are a Chairperson . 12 If you are a Speaker / E-Poster Presenter in a Session . 12 If you have submitted an E-Poster . 12 Official Social Programme . 13–15 Tours & Excursions . 15 General Information Brussels . 16–17 ESTES Society . 18 ESTES General Assembly . 18 ESTES Individual Membership . 18 ESTES International Village . 18 Exhibition . 19 Scientific Congress Programme at a Glance . 21–23 Scientific Congress Programme . 25 Sunday, May 16, 2010 . 25–44 Monday, May 17, 2010 . 45–63 Tuesday, May 18, 2010 . -

Corporate Borrowing in Emerging Markets: Fairly Long Term, but Only for a Few

Research & Policy Briefs From the World Bank Chile Center and Malaysia Hub No. 18, October 2018 Corporate Borrowing in Emerging Markets: Fairly Long Term, but Only for a Few Juan J. Cortina, Tatiana Didier, and Sergio L. Schmukler It is generally believed that firms in emerging markets rely on shorter-term instruments than firms in advanced economies. In recent Public Disclosure Authorized years, firms in emerging market economies have substantially increased the amount of debt raised in global bond and syndicated loan markets, triggering concerns about their exposure to rollover risks. However, new evidence examined in this policy brief shows that emerging market firms have been using these markets to borrow long term, possibly diminishing the risks associated with higher debt levels and foreign currency financing. Challenging the conventional wisdom, large firms from emerging markets have issued bonds and syndicated loans at maturities similar to those issued by firms from advanced economies. These findings have implications for understanding the sources of short-termism in emerging markets, the actual risks emerging economies face from rising levels of corporate borrowing, and the policy measures that might help firms that cannot borrow long term. Debt issuance by firms in emerging markets has expanded at a 2017). Moreover, increasing foreign currency exposure can very fast pace since the early 1990s. The total amount of debt exacerbate debt burdens (measured in domestic currency) in the issued through domestic and cross-border bonds and syndicated event of sudden exchange rate depreciations, if such debt is not loans increased nearly 30-fold in emerging markets between properly hedged (Acharya et al.