Financial Highlights

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Xtrackers Etfs

Xtrackers*/** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2018 to 30 June 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. * Effective 16 February 2018, db x-trackers changed name to Xtrackers. **This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2018 28 Statement of Investments as at 30 June 2018 50 Xtrackers MSCI WORLD SWAP UCITS ETF* 50 Xtrackers MSCI EUROPE UCITS ETF 56 Xtrackers MSCI JAPAN UCITS ETF 68 Xtrackers MSCI USA SWAP UCITS ETF* 75 Xtrackers EURO STOXX 50 UCITS ETF 80 Xtrackers DAX UCITS ETF 82 Xtrackers FTSE MIB UCITS ETF 83 Xtrackers SWITZERLAND UCITS ETF 85 Xtrackers FTSE 100 INCOME UCITS ETF 86 Xtrackers FTSE 250 UCITS ETF 89 Xtrackers FTSE ALL-SHARE UCITS ETF 96 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 111 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 115 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 117 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 118 Xtrackers MSCI TAIWAN UCITS ETF 120 Xtrackers MSCI BRAZIL UCITS ETF 123 Xtrackers NIFTY 50 SWAP UCITS ETF* 125 Xtrackers MSCI KOREA UCITS ETF 127 Xtrackers FTSE CHINA 50 UCITS ETF 130 Xtrackers EURO STOXX QUALITY -

Rotork Annual Report 2006

2006 Annual Report & Accounts Rotork 2006 Annual Report & Accounts Rotork p.l.c. Rotork House Brassmill Lane Bath BA1 3JQ www.rotork.com Celebrating fifty years of innovation 2006 Annual Report & Accounts Rotork 2006 Annual Report & Accounts Rotork p.l.c. Rotork House Brassmill Lane Bath BA1 3JQ www.rotork.com Celebrating fifty years of innovation FINANCIAL HIGHLIGHTSRotork Annual Report & Accounts 2006 01. Financial Highlights Order Intake The fifties: page 05 • Order intake up 19% at £223m • Revenue up 18% at £206.7m £223m • Operating profit up 23% at £45.1m up 19% The sixties: page 07 • Recommended final dividend of 11.65p, up 18% • £8m additional interim dividend during 2007 Order book Operational Highlights £76m The seventies: page 08 up 19% • Continued strong growth achieved in Rotork Fluid System The eighties: page 11 • Chinese market still buoyant • New Shanghai manufacturing plant commenced production on schedule in the year • Increased focus on Service and Support with new @ management structure The nineties: page 12 The Noughties: page 15 Financial Highlights 01 Revenue (£m) Chairman’s Statement 02 Business Review 04 Geographical Review 16 206.7 Operating Profit - (£m) (£m) Rotork Marketing 18 continuing operations Board of Directors 20 Order Input 223.4 174.8 45.1 Report of the Directors 21 136.0 146.9 Corporate Governance 23 7.7 133.5 18 36.5 Corporate Social Responsibility 26 Remuneration Report 28 30.4 151.8 28.4 Independent Auditors’ Report 35 136.9 26.6 131.3 Consolidated Income Statement 36 Consolidated Balance Sheet 37 Consolidated Statement of Cash Flows 38 Consolidated Statement of Recognised Income and Expense 39 Notes to the Group Financial Statements 40 02 03 04 05 06 Rotork p.l.c. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

FTSE Factsheet

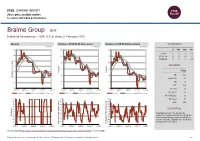

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 21 February 2020 Braime Group BMT Industrial Engineering — GBP 17.5 at close 21 February 2020 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 21-Feb-2020 21-Feb-2020 21-Feb-2020 26 110 120 1D WTD MTD YTD Absolute 0.0 0.0 6.1 -5.4 24 100 110 Rel.Sector 0.8 0.4 4.7 -1.1 Rel.Market 0.4 0.1 4.1 -3.9 22 90 100 VALUATION 20 80 90 Trailing 18 RelativePrice RelativePrice 70 80 PE 10.9 Absolute(localPrice currency) 16 EV/EBITDA 6.0 60 70 14 PB 1.7 PCF 10.7 12 50 60 Div Yield 0.7 Feb-2019 May-2019 Aug-2019 Nov-2019 Feb-2020 Feb-2019 May-2019 Aug-2019 Nov-2019 Feb-2020 Feb-2019 May-2019 Aug-2019 Nov-2019 Feb-2020 Price/Sales 0.7 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.2 100 90 100 Div Payout 7.0 90 80 90 ROE 17.4 80 70 80 70 Index) Share 70 Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 40 The principal activities of the group are the 40 40 RSI RSI (Absolute) 30 manufacture of metal presswork and the distribution 30 30 of bulk material handling components, trading from 20 20 20 locations in Australia, England, France, South Africa, 10 10 10 Thailand and the United States. -

UK Annual Report 2015 (Including the Transparency Report)

Investing to become the Clear Choice UK Annual Report 2015 (including the Transparency Report) December 2015 KPMG.com/uk Highlights Strategic report Profit before tax and Revenue members’ profit shares £1,958m £383m (2014: £1,909m) (2014: £414m) +2.6% -7% 2013 2014 2015 2013 2014 2015 Average partner Total tax payable remuneration to HMRC £623k £786m (2014: £715K) (2014: £711m) -13% +11% 2013 2014 2015 2013 2014 2015 Contribution Our people UK employees KPMG LLP Annual Report 2015 Annual Report KPMG LLP 11,652 Audit Advisory Partners Tax 617 Community support Organisations supported Audit Tax Advisory Contribution Contribution Contribution £197m £151m £308m (2014: £181m) (2014: £129m) (2014: £324m) 1,049 +9% +17% –5% (2014: 878) © 2015 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Strategic report Contents Strategic report 4 Chairman’s statement 10 Strategy 12 Our business model 16 Financial overview 18 Audit 22 Solutions 28 International Markets and Government 32 National Markets 36 People and resources 40 Corporate Responsibility 46 Our taxes paid and collected 47 Independent limited assurance report Governance 52 Our structure and governance 54 LLP governance 58 Activities of the Audit & Risk Committee in the year 59 Activities of the Nomination & Remuneration Committee in the year KPMG in the UK is one of 60 Activities of the Ethics Committee in the year 61 Quality and risk management the largest member firms 2015 Annual Report KPMG LLP 61 Risk, potential impact and mitigations of KPMG’s global network 63 Audit quality indicators 66 Statement by the Board of KPMG LLP providing Audit, Tax and on effectiveness of internal controls and independence Advisory services. -

Fiscal Quarter-End Holdings (Pdf)

Quarterly Schedules of Portfolio Holdings International & Global Funds July 31, 2020 Retirement Institutional Administrative Investor Class Class Class Class Harbor Diversified International All Cap Fund HNIDX HAIDX HRIDX HIIDX Harbor Emerging Markets Equity Fund HNEMX HAEMX HREMX HIEEX Harbor Focused International Fund HNFRX HNFSX HNFDX HNFIX Harbor Global Leaders Fund HNGIX HGGAX HRGAX HGGIX Harbor International Fund HNINX HAINX HRINX HIINX Harbor International Growth Fund HNGFX HAIGX HRIGX HIIGX Harbor International Small Cap Fund HNISX HAISX HRISX HIISX Harbor Overseas Fund HAORX HAOSX HAOAX HAONX Table of Contents Portfolios of Investments HARBOR DIVERSIFIED INTERNATIONAL ALL CAP FUND. ..... 1 HARBOR EMERGING MARKETS EQUITY FUND . .......... 8 HARBOR FOCUSED INTERNATIONAL FUND. ................................. 11 HARBOR GLOBAL LEADERS FUND. ................. 13 HARBOR INTERNATIONAL FUND . 15 HARBOR INTERNATIONAL GROWTH FUND . ........................ 21 HARBOR INTERNATIONAL SMALL CAP FUND. ................. 24 HARBOR OVERSEAS FUND . ............................................ 26 Notes to Portfolios of Investments ..................................... 31 Harbor Diversified International All Cap Fund PORTFOLIO OF INVESTMENTS—July 31, 2020 (Unaudited) Value, Cost, and Principal Amounts in Thousands COMMON STOCKS—96.4% COMMON STOCKS—Continued Shares Value Shares Value AEROSPACE & DEFENSE—0.7% BANKS—Continued 28,553 Airbus SE (France)* .............................. $ 2,090 236,142 Svenska Handelsbanken AB (Sweden) ............... $ -

Virtus Allianzgi International Small-Cap Fund

Virtus AllianzGI International Small-Cap Fund as of : 08/31/2021 (Unaudited) SECURITY SHARES TRADED MARKET VALUE % OF PORTFOLIO ASMedia Technology Inc 23,000 $1,722,085 2.04 % Unimicron Technology Corp 319,000 $1,697,819 2.01 % Evotec SE 33,494 $1,664,973 1.97 % Georg Fischer AG 954 $1,565,779 1.85 % Grafton Group PLC 80,693 $1,549,843 1.83 % Elkem ASA 361,810 $1,541,414 1.82 % Genus PLC 18,880 $1,540,558 1.82 % Howden Joinery Group PLC 118,070 $1,534,979 1.82 % Interroll Holding AG 340 $1,511,111 1.79 % Cancom SE 22,963 $1,510,768 1.79 % Spectris PLC 27,520 $1,490,733 1.76 % ASM International NV 3,841 $1,490,287 1.76 % Soitec 6,191 $1,479,549 1.75 % Intermediate Capital Group PLC 48,932 $1,478,686 1.75 % Aperam SA 23,199 $1,423,300 1.68 % Fuji Electric Co Ltd 32,600 $1,411,980 1.67 % Wienerberger AG 35,448 $1,391,268 1.65 % Bechtle AG 19,089 $1,379,858 1.63 % Jungheinrich AG Pref 24,964 $1,348,243 1.60 % Storebrand ASA 151,651 $1,346,924 1.59 % JMDC Inc 19,500 $1,336,454 1.58 % 1 SECURITY SHARES TRADED MARKET VALUE % OF PORTFOLIO Industrial & Infrastructure Fund Investment Corp 653 $1,312,945 1.55 % ValueCommerce Co Ltd 31,900 $1,309,171 1.55 % Jeol Ltd 17,700 $1,308,013 1.55 % Tokyu Fudosan Holdings Corp 225,200 $1,303,935 1.54 % ASR Nederland NV 28,191 $1,288,854 1.53 % Huhtamaki Oyj 24,096 $1,286,286 1.52 % Crest Nicholson Holdings plc 221,947 $1,280,994 1.52 % Aak Ab 53,435 $1,278,063 1.51 % Jenoptik AG 35,252 $1,272,856 1.51 % Auto Trader Group PLC 146,909 $1,270,441 1.50 % Elis SA 71,514 $1,264,914 1.50 % Sojitz Corp 415,100 $1,218,718 -

2019 Annual Report

Keeping the world flowing for future generations Annual Report 2019 Rotork is a market-leading global provider of mission- critical flow control and instrumentation solutions for oil and gas, water and wastewater, power, chemical process and industrial applications. We help customers around the world to improve efficiency, reduce emissions, minimise their environmental impact and assure safety. Cover story Rotork’s energy-efficient actuators can be powered by solar panels and batteries enabling the reliable management of water, including in remote locations Highlights Financial £669m KPI Revenue 2019 £669.3m 2018 £695.7m 2017 £642.2m 2016 00% £151m Adjusted* operating profit 2019 £151.0m 2018 £146.0m 2017 £130.2m 2016 00% 22.6% KPI Adjusted* operating profit margin 2019 22.6% 2018 21.0% 2017 20.3% 2016 00% £124m KPI Profit before tax 2019 £124.1m 2018 £120.7m 2017 £80.6m 2016 00% * Adjusted figures exclude the amortisation of acquired intangible assets and net restructuring costs See our full KPIs on page 48 Contents Non-financial 50%+ 23% Employees owning shares Women in senior roles 7.3 6.2 Engagement survey score Pace of change survey score -9% -22% KPI Carbon emissions (YoY) KPI Lost time injury rate (YoY) • Rotork is proud to have well above average employee share ownership. We offer employees the opportunity to own Rotork shares in all geographic locations where it is practicable to do so • Our Hampton-Alexander ‘Women on Executive Committee and Direct Reports’ figure increased in 2019 to 23.1%, from 17.4% in 2018 Overview • The ‘engagement’ survey question asks employees how they rate Rotork as 2 Rotork at a glance a place to work. -

Sustainable Investment Report Second Quarter 2020

Sustainable Investment Report Second quarter 2020 For Financial Intermediary, Institutional and Consultant Use Only. Not for redistribution under any circumstances. Contents 1 12 Introduction Stewardship Insights Is the time ripe for virtual AGMs? Engagement in practice: Barclays’ climate shareholder resolution Engagement in practice: Contributing to influencing the boards of big banks Engagement in practice: Drax’s transition to cleaner power 2 17 Sustainability Insights Stewardship Activity A new social contract – how are Engagement in numbers companies treating their employees as the Covid-19 crisis unfolds? Voting in numbers Keeping food on the table during Total company engagement Covid-19, but at what cost? Engagement progress Will Covid-19 prove a pivotal moment for climate change? How climate change may impact financial markets As we begin the process of unwinding global lockdown, the inevitable scrutiny of what we could have done better is underway. There are plenty of ways we can learn from the crisis and perhaps when the anticipated second wave comes, we will be better prepared. Sustainable investing has been under the spotlight throughout the crisis; we now look to what this might mean in a post- Covid-19 world. Hannah Simons Head of Sustainability Strategy For many people, sustainable investment has historically focused In a Q&A with two of our economists, Craig Botham and Irene on environmental considerations. The crisis has seen a rise in the Lauro, we also unveil our latest long-term market forecasts, which focus on the ‘S’ part of ESG. We’ve long argued that companies for the first time incorporate the impact of climate change. -

Quarterly Commentary—Artisan Non-U.S. Small

QUARTERLY Artisan Non-U.S. Small-Mid Growth Strategy FactCommentary Sheet As of 30 June 2020 Investment Process We seek long-term investments in high-quality businesses exposed to structural growth themes that can be acquired at sensible valuations in a contrarian fashion and are led by excellent management teams. Investing with Tailwinds We identify structural themes at the intersection of growth and change with the objective of investing in companies having meaningful exposure to these trends. Themes can be identified from both bottom-up and top-down perspectives. High-Quality Businesses We seek future leaders with attractive growth characteristics that we can own for the long term. Our fundamental analysis focuses on those companies exhibiting unique and defensible business models, high barriers to entry, proven management teams, favorable positions within their industry value chains and high or improving returns on capital. In short, we look to invest in small companies that have potential to become large. A Contrarian Approach to Valuation We seek to invest in high-quality businesses in a contrarian fashion. Mismatches between stock price and long-term business value are created by market dislocations, temporary slowdowns in individual businesses or misperceptions in the investment community. We also examine business transformation brought about by management change or restructuring. Manage Unique Risks of International Small- and Mid-Cap Equities International small- and mid-cap equities are exposed to unique investment risks that require managing. We define risk as permanent loss of capital, not share price volatility. We manage this risk by having a long-term ownership focus, understanding the direct and indirect security risks for each business, constructing the portfolio on a well-diversified basis and sizing positions according to individual risk characteristics. -

Your Guide Directors' Remuneration in FTSE 250 Companies

Your guide Directors’ remuneration in FTSE 250 companies The Deloitte Academy: Promoting excellence in the boardroom October 2018 Contents Overview from Mitul Shah 1 1. Introduction 4 2. Main findings 8 3. The current environment 12 4. Salary 32 5. Annual bonus plans 40 6. Long term incentive plans 52 7. Total compensation 66 8. Malus and clawback 70 9. Pensions 74 10. Exit and recruitment policy 78 11. Shareholding 82 12. Non-executive directors’ fees 88 Appendix 1 – Useful websites 96 Appendix 2 – Sample composition 97 Appendix 3 – Methodology 100 Your guide | Directors’ remuneration in FTSE 250 companies Overview from Mitul Shah It has been a year since the Government announced its intention to implement a package of corporate governance reforms designed to “maintain the UK’s reputation for being a ‘dependable and confident place in which to do business’1, and in recent months we have seen details of how these will be effected. The new UK Corporate Governance Code, to take effect for accounting periods beginning on or after 1 January 2019, includes some far reaching changes, and the year ahead will be a period of review and change for many companies. Remuneration committees must look at how best to adapt to an expanded remit around workforce remuneration, as well as a greater focus on how judgment is used to ensure that pay outcomes are justified and supported by performance. Against this backdrop, 2018 has been a mixed year in the FTSE 250 executive pay environment. In terms of pay outcomes, the picture is relatively stable. Overall pay levels have fallen for FTSE 250 chief executives and we have seen continued momentum in companies adopting executive alignment features such as holding periods, as well as strengthening shareholding guidelines for executives. -

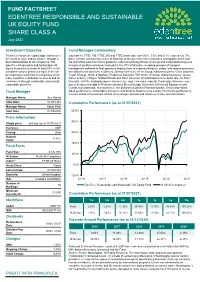

EDENTREE RESPONSIBLE and SUSTAINABLE UK EQUITY FUND SHARE CLASS a July 2021

FUND FACTSHEET EDENTREE RESPONSIBLE AND SUSTAINABLE UK EQUITY FUND SHARE CLASS A July 2021 Investment Objective Fund Manager Commentary To achieve long-term capital appreciation over July saw the FTSE 100, FTSE 250 and FTSE small cap return 0.6%, 3.0% and 0.1% respectively. The five years or more and an income, through a prime minister announced a move to step four of the government’s coronavirus easing plan which saw diversified portfolio of UK companies. The the end of the work from home guidance, enforced wearing of face coverings and social distancing rules. EdenTree Responsible and Sustainable UK In terms of portfolio activity we took part in the IPO of Microlise, a leading provider of transport Equity Fund aims to invest at least 80% in UK management software to fleet operators helping them to improve efficiency, safety, and reduce emissions. companies whose primary listing is in the UK We added to the positions in Spectris, Johnson Services, Keller Group, National Express, Close Brothers, by investing in a portfolio of companies which Taylor Wimpey, Smith & Nephew, Prudential, Bioventix, WH Smith, IP Group, Sabre Insurance, James make a positive contribution to society and the Fisher & Sons, Clinigen, Mattioli Woods and Hotel Chocolat. We participated in a capital raise by Hotel environment through sustainable and socially Chocolat, with the funding being used to increase long term sales capacity. Fund outperformance was responsible practices. due to being overweight in Pharmaceuticals & Biotechnology, Electronic & Electrical Equipment and Construction Materials. At a stock level, the positions in Dechra Pharmaceuticals, Genus and Halma Fund Manager aided performance, whilst Sabre Insurance and Smith & Nephew were a drag.