Individually and on Behalf of All Others Similarly Si

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

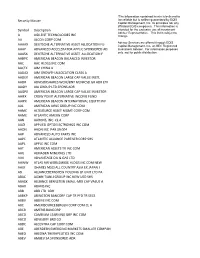

Security Master Symbol Description a AGILENT TECHNOLOGIES INC AA

*The information contained herein is believed to Security Master be reliable but is neither guaranteed by EQIS Capital Management, Inc. its principles nor any affiliated EQIS companies. This information is Symbol Description intended for the exclusive use of investment Adviser Representative. This list is subject to A AGILENT TECHNOLOGIES INC change. AA ALCOA CORP COM Advisor Services are offered through EQIS AAAAX DEUTSCHE ALTERNATIVE ASSET ALLOCATION FU Capital Management, Inc. an SEC Registered AAAP ADVANCED ACCELERATOR APPLIC SPONSORED AD Investment Adviser. For information purposes AAASX DEUTSCHE ALTERNATIVE ASSET ALLOCATION F only, not for public distribution. AABPX AMERICAN BEACON BALANCED INVESTOR AAC AAC HLDGS INC COM AACFX AIM CHINA A AADAX AIM GROWTH ALLOCATION CLASS A AADEX AMERICAN BEACON LARGE CAP VALUE INSTL AADR ADVISORSHARES WCM/BNY MLNFCSD GR ADR ETF AAGIY AIA GROUP LTD SPONS ADR AAGPX AMERICAN BEACON LARGE CAP VALUE INVESTOR AAIFX CROW POINT ALTERNATIVE INCOME FUND AAIPX AMERICAN BEACON INTERNATIONAL EQUITY INV AAL AMERICAN AIRLS GROUP INC COM AAMC ALTISOURCE ASSET MGMT CORP COM AAME ATLANTIC AMERN CORP AAN AARONS, INC. CL A AAOI APPLIED OPTOELECTRONICS INC COM AAON AAON INC PAR $0.004 AAP ADVANCED AUTO PARTS INC AAPC ATLANTIC ALLIANCE PARTNER CORP SHS AAPL APPLE INC COM AAT AMERICAN ASSETS TR INC COM AAU ALMADEN MINERALS LTD AAV ADVANTAGE OIL & GAS LTD AAWW ATLAS AIR WORLDWIDE HLDGS INC COM NEW AAXJ ISHARES MSCI ALL COUNTRY ASIA EX JAPAN I AB ALLIANCEBERNSTEIN HOLDING LP UNIT LTD PA ABAC AOXIN TIANLI GROUP INC NEW -

16-18 October 2019 Shanghai New International Expo Center Message from CTJPA President

Visitor Guide E6 16-18 October 2019 Shanghai New International Expo Center Message from CTJPA President Dear participants, On behalf of China Toy & Juvenile Products Association (CTJPA), the organizer of China Toy Expo (CTE), China Kids Expo (CKE), China Preschool Expo (CPE) and China Licensing Expo (CLE), I would like to extend our warmest welcome to all of you and express our sincere thanks for all your support. Launched in 2002, the grand event has been the preferred platform for leading brands from around the world to present their newest products and innovations, connect with customers and acquire new sales leads. In 2019, the show will feature 2,508 global exhibitors, 4,859 worldwide brands, 100,000 professional visitors from 134 countries and regions, showcasing the latest products and most creative designs in 230,000 m² exhibition space. It is not only a platform to boost trade between thousands of Chinese suppliers and international buyers, but also an efficient gateway for international brands to tap into the Chinese market and benefit from the huge market potential. CTJPA has designed the fair as a stage to show how upgraded made-in-China will influence the global market and present worldwide innovative designs and advanced technologies in products. Moreover, above 1800 most influential domestic and international IPs will converge at this grand event to empower the licensing industry. IP owners are offered opportunities to meet with consumer goods manufacturers, agents and licensees from multi-industries to promote brands and expand licensing business in China and even Asia. Whether you are looking to spot trends, build partnerships, or secure brand rights for your products, we have the answer. -

Southeast Asia IPO Market Southeast Asian Bourses Show

Southeast Asia IPO market Southeast Asian bourses show strong performance in 2018 even as companies in region look beyond their local shores 2018 Report Brochure / report title goes here | Section title goes here Southeast Asia IPO market 03 Vietnam’s IPO market in 2018 09 Singapore’s IPO market in 2018 11 Contact us 18 02 Southeast Asia IPO market Southeast Asia IPO market Southeast Asia performance Capital markets across Southeast Asia have performed relatively well in 2018, compared to the past five years, with a record high market capitalisation ofS$62.2 billion, having produced 152 initial public offerings (IPOs) and raisingS$12.5 billion of funds. IPO Market Capitalisation by country 45,000 2014 2015 2016 2017 2018 ) s 40,000 n o i l 35,000 l i M 30,000 $ S ( p 25,000 a C t 20,000 e k r a 15,000 M O 10,000 P I 5,000 0 Indonesia Malaysia Philippines Singapore Thailand Vietnam ota 2014 5,153 6,736 2,167 15,303 11,998 1,207 42,564 2015 6,357 4,561 559 1,888 8,470 1,297 23,132 2016 5,950 1,285 5,479 4,396 6,237 2,324 25,671 2017 4,434 5,569 3,415 8,470 18,429 5,243 45,560 2018 8,107 918 1,042 2,883 7,887 41,368 62,205 30,001 19,069 12,662 32,940 53,021 51,439 199,132 The IPO market capitalisation in Southeast Asia increased by 36.5% from 2017’s S$45.6 billion to 2018’s S$62.2 billion. -

From Field Surgery to Advanced Robotics: Sino-Canadian Relations in Science and Technology, 1938 to 2018

Vol. 4, Issue No. 2 December 2017 china institute occasional paper series from field surgery to advanced robotics: sino-canadian relations in science and technology, 1938 to 2018 Margaret McCuaig-Johnston China Institute University of Alberta Edmonton, Alberta, Canada from field surgery to advanced robotics: sino-canadian relations in science and technology, 1938 to 2018 By Margaret McCuaig-Johnston Senior Fellow Senior Fellow Institute for Science, Society and Policy China Institute University of Ottawa University of Alberta Published by: foreword The China Institute is pleased to publish this technology collaboration with China. Policymakers, Occasional Paper on the subject of science and elected officials, academics, and industry leaders who technology development and partnerships between seek to operate and foster partnerships in China will China and Canada. This is the second publication by find this paper of importance. the China Institute on China’s science and technology. As the Trudeau Government seeks closer ties to Today, China is a leading innovator in many China, our own development will be reinforced by science-related fields, including robotics, artificial utilizing and strengthening the network of Canadian intelligence, medical technology, space exploration, and Chinese researchers, which after eight decades of and renewable energy production. However, interaction, continues to grow. China’s success story in science and technology was advanced, in part, by historical support and Beyond the acknowledgements listed in the -

UNIDO GEF 6 CCM Ceo End China 9226 Resubmission Signed.Pdf

GEF-6 REQUEST FOR PROJECT ENDORSEMENT/APPROVAL PROJECT TYPE: Full-sized Project TYPE OF TRUST FUND: GEF Trust Fund For more information about GEF, visit TheGEF.org PART I: PROJECT INFORMATION Project Title: Integrated Adoption of New Energy Vehicles in China Country(ies): China GEF Project ID: 9226 GEF Agency(ies): UNIDO GEF Agency Project ID: 150157 Other Executing Partner(s): Ministry of Industry and Information Submission Date: 03/21/2017 Technology (MIIT) Resubmission date: 04/11/2017 GEF Focal Area (s): Climate Change Project Duration (Months) 36 Integrated Approach Pilot IAP-Cities IAP-Commodities IAP-Food Security Corporate Program: SGP Name of Parent Program NA Agency Fee ($) 848,350 A. FOCAL AREA STRATEGY FRAMEWORK AND OTHER PROGRAM STRATEGIES (in $) Focal Area Trust GEF Co- Focal Area Outcomes Objectives/Programs Fund Project financing Financing CCM-2 Program 3 B. Policy, planning and regulatory frameworks foster GEFTF 8,930,000 117,000,000 accelerated low GHG development and emissions mitigation Total project costs 8,930,000 117,000,000 B. PROJECT DESCRIPTION SUMMARY Project Objective: Facilitation and scale-up of the integrated development of electric vehicles (EVs) with renewable energy (RE) in China (in $) Project Components/ Financing Trust GEF Confirmed Project Outcomes Project Outputs Programs Type Fund Project Co- Financing financing Component 1: TA Outcome 1: Drafted Output 1.1: GEFTF 1,475,000 4,000,000 Policies and Programs and recommended Recommended national- policies, technical level policy instruments standards, -

Share Financing Collateral Grading List for the Month of September 2021

Share Financing collateral grading list for the month of October 2021 Stock code Counter name Mkt Grade Stock code Counter name Mkt Grade Stock code Counter name Mkt Grade SBIF ABF SINGAPORE BOND INDX FUND SG 3 AIT ASCENDAS INDIA TRUST SG 1 BOCJ BOUSTEAD PROJECTS LTD SG 3 ABR ABR HOLDINGS LTD SG 3 AREIT ASCENDAS REAL ESTATE INV TRT SG 1 BOCS BOUSTEAD SINGAPORE LTD SG 3 ADI ABUNDANCE INTERNATIONAL LTD SG 4 ART ASCOTT RESIDENCE TRUST SG 1 BRC BRC ASIA LTD SG 3 ACP ACESIAN PARTNERS LTD SG 3 ASEH ASIA ENTERPRISES HOLDING LTD SG 3 BWAY BROADWAY INDUSTRIAL GRP LTD SG 3 ACM ACMA LTD SG 4 AVH ASIA VETS HOLDINGS LTD SG 3 BS BUKIT SEMBAWANG ESTATES LTD SG 3 ACRO ACROMEC LTD SG 3 AMAT ASIAMEDIC LTD SG 4 BAL BUMITAMA AGRI LTD SG 3 ADDV ADDVALUE TECHNOLOGIES LTD SG 3 AHSP ASIAN HEALTHCARE SPECIALISTS SG 3 BCI BUND CENTER INVESTMENT LTD SG 3 ADV ADVANCED HOLDINGS LTD SG 4 AMH ASIAN MICRO HOLDINGS LTD SG 3 CAH CAPALLIANZ HOLDINGS LTD SG 4 ADGL ADVANCER GLOBAL LTD SG 3 APTT ASIAN PAY TELEVISION TRUST SG 3 CLCT CAPITALAND CHINA TRUST SG 1 ADVT ADVENTUS HOLDINGS LTD SG 4 APHOS ASIAPHOS LTD SG 4 CICT CAPITALAND INTEGRATED COMMER SG 1 ADGE AEDGE GROUP LTD SG 3 ATG ASIATIC GROUP HOLDINGS LTD SG 4 CLI CAPITALAND INVESTMENT LTD/SI SG 1 AEM AEM HOLDINGS LTD SG 3 ASPEN ASPEN GROUP HOLDINGS LTD SG 3 CAP CAPTII LTD SG 3 AFG AF GLOBAL LTD SG 3 ASP ASPIAL CORP LTD SG 3 CDREIT CDL HOSPITALITY TRUSTS SG 1 AAREIT AIMS APAC REIT SG 3 ASTLC 4 A1 ASTLC 4 A1 SG 2 CDW CDW HOLDING LTD SG 3 APW AIMS PROPERTY SECURITIES FUN SG 3 ASTLC 5 A1 ASTLC 5 A1 SG 2 CENT CENTURION CORP -

Study on Value Chain and Manufacturing Competitiveness Analysis for Hydrogen and Fuel Cells Technologies FCH Contract 192

Study on Value Chain and Manufacturing Competitiveness Analysis for Hydrogen and Fuel Cells Technologies FCH contract 192 Evidence Report E4tech (UK) Ltd for FCH 2 JU in partnership with Ecorys and Strategic Analysis Inc. September 2019 Incorporated in England and Wales E4tech (UK) Ltd 83 Victoria Street Company no. 4142898 London SW1H 0HW Registered address: United Kingdom 133-137 Alexandra Road, Wimbledon, London SW19 7JY Tel: +44 20 3008 6140 United Kingdom Fax: +44 20 7078 6180 www.e4tech.com This report was prepared for the Fuel Cells and Hydrogen 2 Joint Undertaking. Copies of this document can be downloaded from fch.europa.eu The report and supporting study was undertaken by E4tech for FCH 2 JU in partnership with Ecorys and Strategic Analysis Inc. The research underpinning the study was undertaken between January to October 2018 ©FCH 2 JU, 2019. Reproduction is authorised provided that the source is acknowledged. “The information and views set out in this study are those of the author(s) and do not necessarily reflect the official opinion of the FCH 2 JU. The FCH 2 JU does not guarantee the accuracy of the data included in this study. Neither the FCH 2 JU nor any person acting on the FCH 2 JU’s behalf may be held responsible for the use which may be made of the information contained therein.” Contents 1 Introduction ......................................................................................................................... 15 1.1 This ‘Evidence’ report ........................................................................................................................................... -

Federal Register/Vol. 77, No. 187/Wednesday, September 26

59168 Federal Register / Vol. 77, No. 187 / Wednesday, September 26, 2012 / Notices DEPARTMENT OF COMMERCE Such submissions are subject to provide a citation to the proceeding in verification in accordance with section which they were collapsed. Further, if International Trade Administration 782(i) of the Tariff Act of 1930, as companies are requested to complete amended (‘‘Act’’). Further, in the Quantity and Value Questionnaire Initiation of Antidumping and accordance with 19 CFR for purposes of respondent selection, in Countervailing Duty Administrative 351.303(f)(3)(ii), a copy of each request general each company must report Reviews and Request for Revocation must be served on the petitioner and volume and value data separately for in Part each exporter or producer specified in itself. Parties should not include data AGENCY: Import Administration, the request. for any other party, even if they believe they should be treated as a single entity International Trade Administration, Respondent Selection Department of Commerce. with that other party. If a company was In the event the Department limits the SUMMARY: The Department of Commerce collapsed with another company or number of respondents for individual (‘‘the Department’’) has received companies in the most recently examination for administrative reviews, requests to conduct administrative completed segment of this proceeding the Department intends to select reviews of various antidumping and where the Department considered respondents based on U.S. Customs and countervailing duty orders and findings collapsing that entity, complete quantity Border Protection (‘‘CBP’’) data for U.S. with August anniversary dates. In and value data for that collapsed entity imports during the POR. -

Companies That Exploit Animals ©2019 Crueltyfreeinvesting.Org Title Stock Exchange Stock Symbol Animal Usage 1-800 FLOWERS.COM, Inc

Companies That Exploit Animals ©2019 CrueltyFreeInvesting.org Title Stock Exchange Stock Symbol Animal Usage 1-800 FLOWERS.COM, Inc. NASDAQ FLWS Meat/Dairy/Eggs 22nd Century Group, Inc AMEX XXII Animal Testing 3M Company NYSE MMM Animal Testing 500.com Limited NYSE WBAI Entertainment|Tangential A. Schulman, Inc. NASDAQ SHLM Animal Testing ABAXIS, Inc. NASDAQ ABAX Animal Testing ABB Ltd NYSE ABB Tangential Abbott Laboratories NYSE ABT Animal Testing|By-product AbbVie Inc. NYSE ABBV Animal Testing Abeona Therapeutics Inc. NASDAQ ABEO Animal Testing Abercrombie & Fitch Company NYSE ANF Leather/Hide/Fur ABIOMED, Inc. NASDAQ ABMD Animal Testing AC Immune SA NASDAQ ACIU Animal Testing Acacia Research Corporation NASDAQ ACTG Animal Testing ACADIA Pharmaceuticals Inc. NASDAQ ACAD Animal Testing Acasti Pharma, Inc. NASDAQ ACST Animal Testing B&G Foods, Inc. NASDAQ BGS Meat/Dairy/Eggs Balchem Corporation NASDAQ BCPC Animal Testing|By-product|Pet Industry Alexion Pharmaceuticals, Inc. NASDAQ ALXN Animal Testing|Meat/Dairy/Eggs Amazon.com, Inc. NASDAQ AMZN Entertainment|Leather/Hide/Fur|Meat/Dairy/Eggs American Airlines Group, Inc. NASDAQ AAL Meat/Dairy/Eggs Amgen Inc. NASDAQ AMGN Animal Testing Bed Bath & Beyond Inc. NASDAQ BBBY Animal Testing|By-product|Leather/Hide/Fur|Tangential Biogen Inc. NASDAQ BIIB Animal Testing C.H. Robinson Worldwide, Inc. NASDAQ CHRW Meat/Dairy/Eggs|Tangential Celgene Corporation NASDAQ CELG Animal Testing Costco Wholesale Corporation NASDAQ COST Leather/Hide/Fur|Meat/Dairy/Eggs DENTSPLY SIRONA Inc. NASDAQ XRAY Animal Testing Dollar Tree, Inc. NASDAQ DLTR Leather/Hide/Fur|Meat/Dairy/Eggs eBay Inc. NASDAQ EBAY Leather/Hide/Fur|Meat/Dairy/Eggs|Pet Industry Endo International plc NASDAQ ENDP Animal Testing Garmin Ltd. -

Canada-China Science and Technology Relations: an 80-Year History of Collaboration

Innovation and Development Policy 1 (2019) 39-72 Editor-in-Chief: Rongping Mu Innovation and Development Policy Journal homepage: http://idp.casisd.cn/ Canada-China Science and Technology Relations: An 80-Year History of Collaboration Margaret McCuaig-Johnston* China Institute, University of Alberta, Edmonton T6G 2R3, Canada Institute for Science, Society & Policy, University of Ottawa, Ottawa K1N 6N5, Canada Duke Kunshan University, Kunshan 215316, China Asia Pacific Foundation of Canada, Toronto M5G 2J5, Canada Abstract For eight decades, China and Canada have engaged in an increasingly rich and comprehensive collaboration in science, technology and innovation. Beginning with the personal engagement of some of the most prominent innovators in both countries in the 1930s through the 1970s, it was realized that China was building on millennia of leadership in innovation, while Canada was in the forefront of Western advances in key areas of research. As China began to open up to the West in the late 1970s, Canada’s development agencies focused on helping China build capacity. University collaborations have also been strong, facilitated by the large Chinese diaspora in the Canadian research community. Canadian companies have had long-standing relations in China, and start-up incubators and accelerators in both countries have linkages with their counterparts. Over the years, Canadian and Chinese governments have deepened their S&T engagement, with an Agreement for Science and Technology Collaboration signed in 2007, and the Canada-China Joint Committee on S&T (CCJC) established to guide joint initiatives including a funded program for collaborative research. The most recent events were the inaugural meeting of the Sino-Canadian Innovation Dialogue held on October 29, 2018 and the CCJC meeting on October 30, 2018. -

Fueling the Future of Mobility: Hydrogen and Fuel Cell Solutions

Fueling the Future of Mobility Hydrogen and fuel cell solutions for transportation Volume 1 Deloitte China Powering the Future of Mobility | Executive summary Executive summary Jointly written and published by Deloitte vehicle, down to the nuts and bolts of results show that, in 2019, FCEVs are and Ballard, this white paper seeks to drivetrain, fuel system, and others, approximately 40% and 90% more introduce the wondrous technology but also at operational costs such expensive than BEVs and ICE vehicles, of fuel cell vehicles, as well as their as fuel, infrastructure, maintenance, on a per 100km basis considering commercial applications. Through in and so forth. We believe that this acquisition and operational costs depth research and analysis, this paper approach is not only unique in the together. From an acquisitions provides answers to the most pertinent marketplace, but also offers our cost perspective, the higher cost questions from industry executives readers a perspective that can be is primarily due to high cost of and laypeople alike - how economically applied to almost any operational the fuel cell system, as well as a viable are fuel cell vehicles, and what is business model. Indeed, we applied markup on other components due their impact on the environment? our model to 3 specific case scenarios to lower economies of scale. From of Fuel Cell Electric Vehicle (“FCEV”) an operational cost perspective, the Hydrogen is the single most use today – focusing on an logistics higher cost is primarily driven by the abundant substance in the universe. operator in Shanghai, a drayage truck cost of hydrogen fuel. -

新成立/ 註冊及已更改名稱的公司名單list of Newly Incorporated / Registered Companies and Companies Which Have C

This is the text version of a report with Reference Number "RNC063" and entitled "List of Newly Incorporated /Registered Companies and Companies which have changed Names". The report was created on 03-03-2014 and covers a total of 4994 related records from 24-02-2014 to 02-03-2014. 這是報告編號為「RNC063」,名稱為「新成立 / 註冊及已更改名稱的公司名單」的純文字版報告。這份報告在 2014 年 3 月 3 日建立,包含從 2014 年 2 月 24 日到 2014 年 3 月 2 日到共 4994 個相關紀錄。 Each record in this report is presented in a single row with 6 data fields. Each data field is separated by a "Tab". The order of the 6 data fields are "Sequence Number", "Current Company Name in English", "Current Company Name in Chinese", "C.R. Number", "Date of Incorporation / Registration (D-M-Y)" and "Date of Change of Name (D-M-Y)". 每個紀錄會在報告內被設置成一行,每行細分為 6 個資料。 每個資料會被一個「Tab 符號」分開,6 個資料的次序為「順序編號」、「現用英文公司名稱」、「現用中文公司名稱」、「公司註冊編號」、「成立/註 冊日期(日-月-年)」、「更改名稱日期(日-月-年)」。 Below are the details of records in this report. 以下是這份報告的紀錄詳情。 1. (HONGKONG) LUO BO TE ARTIFICIAL INTELLIGENCE TECHNOLOGY CO., LIMITED (香港)羅博特人工智能科技有限公司 2042983 27-02-2014 2. 1 WORLD LIMITED 2041562 25-02-2014 3. 108 Plus Limited 一零八有限公司 2044018 28-02-2014 4. 123 VEHICLES SCRAPPING CO. LIMITED 123 拆車有限公司 2006489 27-02-2014 5. 168 PROFESSIONAL SERVICES LIMITED 一路發專業服務有限公司 2041370 25-02-2014 6. 168 TECHNOLOGY (ASIA) LIMITED 168 科技(亞太)有限公司 2041001 24-02-2014 7. 1A EQUIPMENT LIMITED 2043143 27-02-2014 8. 3D Forge Limited 科捷立體有限公司 2015840 24-02-2014 9.