Survey of Large-Scale Office Building Market in Tokyo's 23 Wards

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kaigan1 Hamamatsucho 2 Kaigan1 Hamamatsucho 2

Pokémon Center Tokyo Area Map ▲ To/From Shinagawa Area Hamamatsucho 2 Toei Asakusa Line Tokyo Gas Building TSUKI South Exit Tokyo Monorail Zojoji Temple Hamamatsucho Station To/From Hotel Tokyo Tower Area InterContinental JR World Trade Hamamatsucho Center Toei Oedo Line Tokyo Bay Kyu-Shibarikyu TIS Building Station Building North Onshi Teien (Garden) Exit West Daimon Station Exit B2 Exit Central Circular Route North Exit Yurikamome B1 Exit Hamamatsucho New Pier Takeshiba Takeshiba Square Station Tokyo Tokyo South Tower Tokyo Tousho (islands) Kaikan Metropolitan Trade Nippon Cultural Weights and Archives Center Broadcasting inc. Measures Inspection Office East Exit Shiodome Shibarikyu Building 2F Takeshibafutoh Park ▼ To/From Tokyo Area Kaigan1 Tokyo Metropolitan Shiba Commercial Pokémon Center Tokyo High School Address Shiodome Shibarikyu Building 2F 1-2-3 Kaigan, Minato-ku, Tokyo Azur Takeshiba Opening Weekdays : 11:00 - 20:00 Hours Sat, Sun, and National Holidays : 10:00 - 19:00 Telephone 03-6430-7733 New Pier Takeshiba Seaside Hotel JR East Japan North Tower Shiba Yayoi Kaikan Shiki Theatre About 85 minutes from Narita Airport, JR Narita Airport Station ~ JR Tokyo Station ~ JR Hamamatsucho Station, about 2 minutes walk from the North Exit Access About 25 minutes from Haneda Airport, Haneda Airport Terminal 1, Terminal 2 Station on Tokyo Monorail ~ Hamamatsucho Station on Tokyo Monorail, about 3 minutes walk from the North Exit About 6 minutes of train journey from JR Tokyo Station to "Hamamatsucho" Station by JR Yamanote Line/Keihin Tohoku Line and about 2 minutes walk from North Exit of JR Hamamatsucho Station About 3 minutes walk from Daimon Station on Toei Oedo Line About 4 minutes walk from Daimon Station on Toei Asakusa Line About 5 minutes walk from East Exit of Takeshiba Station on Yurikamome © 2009 Pokémon. -

List of Certified Facilities (Cooking)

List of certified facilities (Cooking) Prefectures Name of Facility Category Municipalities name Location name Kasumigaseki restaurant Tokyo Chiyoda-ku Second floor,Tokyo-club Building,3-2-6,Kasumigaseki,Chiyoda-ku Second floor,Sakura terrace,Iidabashi Grand Bloom,2-10- ALOHA TABLE iidabashi restaurant Tokyo Chiyoda-ku 2,Fujimi,Chiyoda-ku The Peninsula Tokyo hotel Tokyo Chiyoda-ku 1-8-1 Yurakucho, Chiyoda-ku banquet kitchen The Peninsula Tokyo hotel Tokyo Chiyoda-ku 24th floor, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku Peter The Peninsula Tokyo hotel Tokyo Chiyoda-ku Boutique & Café First basement, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku The Peninsula Tokyo hotel Tokyo Chiyoda-ku Second floor, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku Hei Fung Terrace The Peninsula Tokyo hotel Tokyo Chiyoda-ku First floor, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku The Lobby 1-1-1,Uchisaiwai-cho,Chiyoda-ku TORAYA Imperial Hotel Store restaurant Tokyo Chiyoda-ku (Imperial Hotel of Tokyo,Main Building,Basement floor) mihashi First basement, First Avenu Tokyo Station,1-9-1 marunouchi, restaurant Tokyo Chiyoda-ku (First Avenu Tokyo Station Store) Chiyoda-ku PALACE HOTEL TOKYO(Hot hotel Tokyo Chiyoda-ku 1-1-1 Marunouchi, Chiyoda-ku Kitchen,Cold Kitchen) PALACE HOTEL TOKYO(Preparation) hotel Tokyo Chiyoda-ku 1-1-1 Marunouchi, Chiyoda-ku LE PORC DE VERSAILLES restaurant Tokyo Chiyoda-ku First~3rd floor, Florence Kudan, 1-2-7, Kudankita, Chiyoda-ku Kudanshita 8th floor, Yodobashi Akiba Building, 1-1, Kanda-hanaoka-cho, Grand Breton Café -

1. 1.1 February 1.2 Conducte 2. 2.1 Between Their Ide 3. 3.1 Will Act 3.2

ISTF/1-IP/1 27/02/12 International Civil Aviation Organization FIRST MEETING OF IONOSPHERIC STUDIES TAKS FORCE (ISTF/1) 27-29 February 2012, Tokayo, Japan MEETING BULLETIN 1. Schedule of meeting 1.1 The opening session of the meeting will be held at 0930 hours on Monday, 27 February 2012 at the Mita Kaigisho, (Mita Conference Hall), Tokyo, Japan. 1.2 The technical tour to Electronic Navigation Research Institute (ENRI) will be conducted from 1000 to 1200 hours on Wednesday, 29 February 2012. 2. Registration of participants 2.1 Participants are requested to register at the Registration Desk of the Mita Kaigisho between 0915 - 0930 hours on the opening day of the meeting. Participants are also requested to wear their identification badge all the time inside the Mita Kaigisho. 3. Officers and Secretariat concerned with the meeting 3.1 Mr. Sujan K. Saraswati, Regional Officer CNS of the ICAO Asia and Pacific Office will act as Secretary of the meeting. His contact address is as follows: Mr. Sujan K. Saraswati, Regional Officer CNS Tel: +66 (2) 537 8189 to 97 Ext. 155 Fax: +66 (2) 537 8199 E-mail: [email protected] 3.2 The daily meeting service is the responsibility of Dr. Susumu Saito. Dr. Saito will provide secretarial support. The contact address is as follows: Dr. Susumu Saito, Senior Researcher, CNS Department Electronic Navigation Research Institute (ENRI) Tel: +81 422 413 191 Fax: +81 422 413 199 E-mail: [email protected] 4. Meeting documents for distribution 4.1 Participants wishing to make presentations or present papers for distribution during the meeting are requested to submit electronic copies to the Secretariat as early as possible, and preferably no later than 13 Febrruary 2012 at the following email addresses: [email protected] and cc: [email protected] ISTF/1-IP/1 -2- 27/02/12 5. -

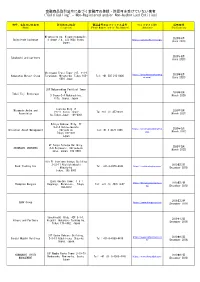

金融商品取引法令に基づく金融庁の登録・許認可を受けていない業者 ("Cold Calling" - Non-Registered And/Or Non-Authorized Entities)

金融商品取引法令に基づく金融庁の登録・許認可を受けていない業者 ("Cold Calling" - Non-Registered and/or Non-Authorized Entities) 商号、名称又は氏名等 所在地又は住所 電話番号又はファックス番号 ウェブサイトURL 掲載時期 (Name) (Location) (Phone Number and/or Fax Number) (Website) (Publication) Miyakojima-ku, Higashinodamachi, 2020年6月 SwissTrade Exchange 4-chōme−7−4, 534-0024 Osaka, https://swisstrade.exchange/ (June 2020) Japan 2020年6月 Takahashi and partners (June 2020) Shiroyama Trust Tower 21F, 4-3-1 https://www.hamamatsumerg 2020年6月 Hamamatsu Merger Group Toranomon, Minato-ku, Tokyo 105- Tel: +81 505 213 0406 er.com/ (June 2020) 0001 Japan 28F Nakanoshima Festival Tower W. 2020年3月 Tokai Fuji Brokerage 3 Chome-2-4 Nakanoshima. (March 2020) Kita. Osaka. Japan Toshida Bldg 7F Miyamoto Asuka and 2020年3月 1-6-11 Ginza, Chuo- Tel:+81 (3) 45720321 Associates (March 2021) ku,Tokyo,Japan. 104-0061 Hibiya Kokusai Bldg, 7F 2-2-3 Uchisaiwaicho https://universalassetmgmt.c 2020年3月 Universal Asset Management Chiyoda-ku Tel:+81 3 4578 1998 om/ (March 2022) Tokyo 100-0011 Japan 9F Tokyu Yotsuya Building, 2020年3月 SHINBASHI VENTURES 6-6 Kojimachi, Chiyoda-ku (March 2023) Tokyo, Japan, 102-0083 9th Fl Onarimon Odakyu Building 3-23-11 Nishishinbashi 2019年12月 Rock Trading Inc Tel: +81-3-4579-0344 https://rocktradinginc.com/ Minato-ku (December 2019) Tokyo, 105-0003 Izumi Garden Tower, 1-6-1 https://thompsonmergers.co 2019年12月 Thompson Mergers Roppongi, Minato-ku, Tokyo, Tel: +81 (3) 4578 0657 m/ (December 2019) 106-6012 2019年12月 SBAV Group https://www.sbavgroup.com (December 2019) Sunshine60 Bldg. 42F 3-1-1, 2019年12月 Hikaro and Partners Higashi-ikebukuro Toshima-ku, (December 2019) Tokyo 170-6042, Japan 31F Osaka Kokusai Building, https://www.smhpartners.co 2019年12月 Sendai Mubuki Holdings 2-3-13 Azuchi-cho, Chuo-ku, Tel: +81-6-4560-4410 m/ (December 2019) Osaka, Japan. -

Dancing Spirits of Roppongi 1

Community Information Paper Vol.35 June 2016 Issued by Azabu Regional City Office Edited by The Azabu Editing Office 5-16-45 Roppongi, Minato City, Tokyo 106-8515 Tel: 03-5114-8812 Fax: 03-3583-3782 Please contact Minato Call (City Information Service) for inquiries regarding Residents’ Life Support. Tel: 03-5472-3710 A community information paper created and edited by Azabu residents Fascinated by Artistic Azabu 9 Dancing Spirits of Roppongi 1 The mural titled “PRIMAL BEAT” (photos #1 and #2) located close to Roppongi Station on the Oedo Line Metropolitan Subway really attracts our attention. The mysterious figures have been watching as many as 100,000 people a day (✽1), coming and going, since the opening of the station. We asked the artist, Mr. Masayuki Tokunaga, for his comment 2 on particular points regarding this work of art. The mural is located inside the ticket gates close to the Roppongi Crossing. A Radical Vision of Roppongi from this that the work gets its title: “PRIMAL BEAT”. The artist wants us to feel the “excellence in the combination of heavy and solemn materials such as Engraving Granite and Attaching Foil for 3 black granite, gold foil and silver foil, and contrast- Finishing ing light, easy and free figures.” He did not intend it to give any kind of oppressive impression. When he In order to help the stonemason to visualize the im- started working on this in 1999, his image of Rop- age in Mr. Tokunaga’s imagination, he patiently ex- pongi was an area “full of energy.” However, he also plained what he hoped for concerning the depth of had a personal impression of it as “a bit of a dirty the engraving and the texture (smooth or rough) of town with an air of ostentation.” On the other hand, the engraved surface. -

TOKYO TRAIN & SUBWAY MAP JR Yamanote

JR Yamanote Hibiya line TOKYO TRAIN & SUBWAY MAP Ginza line Chiyoda line © Tokyo Pocket Guide Tozai line JR Takasaka Kana JR Saikyo Line Koma line Marunouchi line mecho Otsuka Sugamo gome Hanzomon line Tabata Namboku line Ikebukuro Yurakucho line Shin- Hon- Mita Line line A Otsuka Koma Nishi-Nippori Oedo line Meijiro Sengoku gome Higashi Shinjuku line Takada Zoshigaya Ikebukuro Fukutoshin line nobaba Todai Hakusan Mae JR Joban Asakusa Nippori Line Waseda Sendagi Gokokuji Nishi Myogadani Iriya Tawara Shin Waseda Nezu machi Okubo Uguisu Seibu Kagurazaka dani Inaricho JR Shinjuku Edo- Hongo Chuo gawa San- Ueno bashi Kasuga chome Naka- Line Higashi Wakamatsu Okachimachi Shinjuku Kawada Ushigome Yushima Yanagicho Korakuen Shin-Okachi Ushigome machi Kagurazaka B Shinjuku Shinjuku Ueno Hirokoji Okachimachi San-chome Akebono- Keio bashi Line Iidabashi Suehirocho Suido- Shin Gyoen- Ocha Odakyu mae Bashi Ocha nomizu JR Line Yotsuya Ichigaya no AkihabaraSobu Sanchome mizu Line Sendagaya Kodemmacho Yoyogi Yotsuya Kojimachi Kudanshita Shinano- Ogawa machi Ogawa Kanda Hanzomon Jinbucho machi Kokuritsu Ningyo Kita Awajicho -cho Sando Kyogijo Naga Takebashi tacho Mitsu koshi Harajuku Mae Aoyama Imperial Otemachi C Meiji- Itchome Kokkai Jingumae Akasaka Gijido Palace Nihonbashi mae Inoka- Mitsuke Sakura Kaya Niju- bacho shira Gaien damon bashi bacho Tameike mae Tokyo Line mae Sanno Akasaka Kasumi Shibuya Hibiya gaseki Kyobashi Roppongi Yurakucho Omotesando Nogizaka Ichome Daikan Toranomon Takaracho yama Uchi- saiwai- Hachi Ebisu Hiroo Roppongi Kamiyacho -

Snehal Desai

East West Players and Japanese American Cultural & Community Center (JACCC) By Special Arrangement with Sing Out, Louise! Productions & ATA PRESENT BOOK BY Marc Acito, Jay Kuo, and Lorenzo Thione MUSIC AND LYRICS BY Jay Kuo STARRING George Takei Eymard Cabling, Cesar Cipriano, Janelle Dote, Jordan Goodsell, Ethan Le Phong, Sharline Liu, Natalie Holt MacDonald, Miyuki Miyagi, Glenn Shiroma, Chad Takeda, Elena Wang, Greg Watanabe, Scott Watanabe, and Grace Yoo. SCENIC DESIGN COSTUME DESIGN LIGHTING DESIGN SOUND DESIGN PROJECTION DESIGN PROPERTY DESIGN Se Hyun Halei Karyn Cricket S Adam Glenn Michael Oh Parker Lawrence Myers Flemming Baker FIGHT ALLEGIANCE ARATANI THEATRE PRODUCTION CHOREOGRAPHY PRODUCTION MANAGER PRODUCTION MANAGER STAGE MANAGER Cesar Cipriano Andy Lowe Bobby DeLuca Morgan Zupanski COMPANY MANAGER GENERAL MANAGER ARATANI THEATRE GENERAL MANAGER Jade Cagalawan Nora DeVeau-Rosen Carol Onaga PRESS REPRESENTATIVE MARKETING GRAPHIC DESIGN Davidson & Jim Royce, Nishita Doshi Choy Publicity Anticipation Marketing EXECUTIVE PRODUCER MUSIC DIRECTOR ORCHESTRATIONS AND CHOREOGRAPHER ARRANGEMENTS Alison M. Marc Rumi Lynne Shankel De La Cruz Macalintal Oyama DIRECTED BY Snehal Desai The original Broadway production of Allegiance opened on November 8th, 2015 at the Longacre Theatre in NYC and was produced by Sing Out, Louise! Productions and ATA with Mark Mugiishi/Hawaii HUI, Hunter Arnold, Ken Davenport, Elliott Masie, Sandi Moran, Mabuhay Productions, Barbara Freitag/Eric & Marsi Gardiner, Valiant Ventures, Wendy Gillespie, David Hiatt Kraft, Norm & Diane Blumenthal, M. Bradley Calobrace, Karen Tanz, Gregory Rae/Mike Karns in association with Jas Grewal, Peter Landin, and Ron Polson. World Premiere at the Old Globe Theater, San Diego, California. Barry Edelstein, Artistic Director; Michael G. -

Guideline for Community Development

Peripheral Area of Tamachi Station West Exit/Fudanotsuji Crossing Guideline for Community Development February 2013 Minato City The community, from Edo to Tokyo, continues creating a future where comfortable and active living blends in with bustling streets, bringing splendid harmony Greetings, The peripheral area of Tamachi Station West Exit/Fudanotsuji Crossing (hereinafter referred to as “the District”) used to be an area with a place called “Fudanotsuji” where there was a place to post a notice board called “kosatsuba,” and functioned as the main entrance of Edo City. In this area, there was also a kurayashiki (warehouse-residence) of Satsuma domain where Ta- kamori Saigo and Kaishu Katsu had an interview for negotiating the bloodless surrender of Edo Castle. As time goes by after the Edo Period, the District and its surrounding areas have experienced various changes in the community; firstly, a number of educational and academic institutions were built, factories which supported the living of the residents were built afterwards, and now the community has become a business-oriented area. In the meantime, we have a great city- scape with rich greenery on the hilltop of Takanawa, as well as a bustling shopping street full of vitality. The District, along with the peripheral area of Tamachi Station East Exit, is designated as a national “Area to be Emergently Developed for Specified City Reproduction,” and expected to form a new hub district where a variety of functions are integrated in order to strengthen Tokyo’s global competitiveness. Taking this opportunity to promote future reconstruction in Minato City, we have prepared the “Peripheral area of Tamachi Station West/Fudanotsuji Crossing Guideline for Community De- velopment” as a manual in order to solve problems and to develop a comfortable and attractive community. -

Sixteenth Mitsui Fudosan Sports Academy for Tokyo 2020 Basketball

April 3, 2019 For immediate release Mitsui Fudosan Co., Ltd. Mitsui Fudosan Residential Co., Ltd. Mitsui Fudosan supports the Tokyo 2020 Olympic and Paralympic Games as a Tokyo 2020 Gold Partner in the category of Real Estate Development. Mitsui Fudosan Residential Co., Ltd. is a Mitsui Fudosan Group company. Creating Neighborhoods while Utilizing the “Power of Sports” Sixteenth Mitsui Fudosan Sports Academy for Tokyo 2020 ~ Movement Toward the Tokyo 2020 Olympic and Paralympic Games ~ Basketball Academy to be Held Tokyo, Japan, April 3, 2019 - Mitsui Fudosan Co., Ltd., a leading global real estate company headquartered in Tokyo, and Mitsui Fudosan Residential Co., Ltd. will hold a Mitsui Fudosan Sports Academy event for Tokyo 2020 on Sunday, May 5, 2019 as part of movement toward the Tokyo 2020 Olympic and Paralympic Games. Mitsui Fudosan, a Tokyo 2020 Gold Partner in the category of Real Estate Development, holds the Mitsui Fudosan Sports Academy for Tokyo 2020, a one-day sports classroom conducted with the cooperation of The Tokyo Organising Committee of the Olympic and Paralympic Games (hereafter “Tokyo 2020 Organising Committee”). Top-class athletes are invited to be instructors, and with their guidance participants experience Olympic and Paralympic sport events. Mitsui Fudosan will host the basketball at its own retail facility Mitsui Shopping Park URBAN DOCK LaLaport TOYOSU with instructor Yuko Oga, who represented Japan for basketball in the 2004 Olympics in Athens as the youngest member of the team at age 21. Holding the academy in an area where Mitsui Fudosan is engaged in neighborhood creation will help to invigorate the community and foster enthusiasm for the Tokyo 2020 Olympic and Paralympic Games. -

Shiodome Shiba-Rikyu Building, Kaigan, Minato-Ku, Tokyo

Shiodome Shiba-Rikyu Building, Kaigan, Minato-ku, Tokyo View this office online at: https://www.newofficeasia.com/details/offices-shiodome-shiba-rikyu-kaigan-to kyo This serviced office centre at the heart of Shiodome offers completely white-label offices with a professional team of admin and IT staff to keep things running smoothly. The offices boast exceptional views over Rainbow Bridge and Shibarikyu Park as well as an enviable list of facilities including conference / meeting rooms, a video conferencing system and 24 hour access. Transport links Nearest tube: Daimon Station Nearest railway station: JR Hamamatsu-cho Station Nearest road: Daimon Station Nearest airport: Daimon Station Key features 24 hour access Access to multiple centres nation-wide Access to multiple centres world-wide Administrative support AV equipment Business park setting Car parking spaces Close to railway station Conference rooms Conference rooms High speed internet High-speed internet IT support available Meeting rooms Modern interiors Near to subway / underground station Reception staff Security system Telephone answering service Town centre location Video conference facilities Location The Shiodome district offers an exceptionally convenient location, especially for international travelers, with the Henada airport just 14 minutes away. There are numerous shops and hotels in the surrounding area and the rest of the city / country can be easily reached thanks to the Daimon tube and the JR Hamamatsu-cho Station. Points of interest within 1000 metres Hamamatsuchō (railway station) -

A Student Study Abroad Survival Guide University of Rhode Island Japanese International Engineering Program

A Student Study Abroad Survival Guide University of Rhode Island Japanese International Engineering Program Table of Contents Pre-Departure Preparation……………………………………………………………2-6 Academic Year …………………………………………………………………. 2 Course Requirements………………………………………………………….. 2 Timeline for Preparing for your Year Abroad ……………………………… 2 Scholarships ………………………………………………………………….... 2 Additional Japanese Language Study Opportunities………..……………… 3 Visa Process……………………………………………….…………………….3 Summer ………………………………………………………………………...4 Travel……………….………………………………………………….. 4 Packing ………………………………………………………………… 5 Banking and Money ………………………………………………….. 6 Year Abroad …………………………………………………………………………... 7 Things to do upon arrival …………………………………………………….. 7 Leaving the Airport ………………………………………………….. 7 Establish Residency …………………………………………………… 8 Housing............………………………………………………………… 8 Communication and Cell Phones ……………………………………. 8 Banking ………………………………………………………………... 8 Orientation …………………………………………………………………….. 9 Life in Tokyo ………………………………………………………………….. 9 Transportation ……………………………………………………….. 10 Groceries ……………………………………………………………… 10 Nightlife ………………………………………………………………. 11 Day Trips ……………………………………………………………… 11 Cultural Integration ………………………………………………… 11 Health and Safety Tips…………………………………………... …………...12 Academics ……………………………………………………………………... 12 Internships ...…………………………………………………………………... 13 After Returning ……………………………………………………………………….. 14 Sharing Your Experiences! …………………………………………………... 14 Pre-departure Preparation This Survival Guide has been developed and maintained by students -

Meguro Walking Map

Meguro Walking Map Meguro Walking Map Primary print number No. 31-30 Published February 2, 2020 December 6, 2019 Published by Meguro City Edited by Health Promotion Section, Health Promotion Department; Sports Promotion Section, Culture and Sports Department, Meguro City 2-19-15 Kamimeguro, Meguro City, Tokyo Phone 03-3715-1111 Cooperation provided by Meguro Walking Association Produced by Chuo Geomatics Co., Ltd. Meguro City Total Area Course Map Contents Walking Course 7 Meguro Walking Courses Meguro Walking Course Higashi-Kitazawa Sta. Total Area Course Map C2 Walking 7 Meguro Walking Courses P2 Course 1: Meguro-dori Ave. Ikenoue Sta. Ke Walk dazzling Meguro-dori Ave. P3 io Inok Map ashira Line Komaba-todaimae Sta. Course 2: Komaba/Aobadai area Shinsen Sta. Walk the ties between Meguro and Fuji P7 0 100 500 1,000m Awas hima-dori St. 3 Course 3: Kakinokizaka/Higashigaoka area Kyuyamate-dori Ave. Walk the 1964 Tokyo Olympics P11 2 Komaba/Aobadai area Walk the ties between Meguro and Fuji Shibuya City Tamagawa-dori Ave. Course 4: Himon-ya/Meguro-honcho area Ikejiri-ohashi Sta. Meguro/Shimomeguro area Walk among the history and greenery of Himon-ya P15 5 Walk among Edo period townscape Daikan-yama Sta. Course 5: Meguro/Shimomeguro area Tokyu Den-en-toshi Line Walk among Edo period townscape P19 Ebisu Sta. kyo Me e To tro Hibiya Lin Course 6: Yakumo/Midorigaoka area Naka-meguro Sta. J R Walk a green road born from a culvert P23 Y Yutenji/Chuo-cho area a m 7 Yamate-dori Ave. a Walk Yutenji and the vestiges of the old horse track n o Course 7: Yutenji/Chuo-cho area t e L Meguro City Office i Walk Yutenji and the vestiges of the old horse track n P27 e / S 2 a i k Minato e y Kakinokizaka/Higashigaoka area o in City Small efforts, L Yutenji Sta.