Proxy Circular Building for the Future

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Overview of Corporate Financial Reporting CHAPTER 1

cc01OverviewOfCorporateFinancialReporting.indd01OverviewOfCorporateFinancialReporting.indd PagePage 1-11-1 19/01/1819/01/18 2:232:23 PMPM f-0157f-0157 //208/WB02258/9781119407003/ch01/text_s208/WB02258/9781119407003/ch01/text_s CHAPTER 1 kevin brine/Shutterstock Overview of Corporate Financial Reporting Dollar Store Business Is No than $420 million from issuing shares, and it had more than $2.9 billion in sales that year. Small Change Company management is continually looking for ways to increase sales and reduce costs. It recently increased the max- When Salim Rossy opened a general store in Montreal imum price of items from $3 to $4, widening the number of in 1910, he fi nanced it with his earnings from peddling suppliers it can use and boosting the types of products it can items like brooms and dishcloths in the countryside around carry. “Customers are responding positively to the off ering,” Montreal. By the time his grandson Larry took charge in said Neil Rossy, who took over from his father Larry as Chief 1973, S. Rossy Inc. had grown into a chain of 20 fi ve-and- Executive Offi cer in 2016. dime stores, with most items priced at either 5 or 10 cents. In Shareholders and others, such as banks and suppliers, use 1992, the company opened its fi rst Dollarama store, selling all a company’s fi nancial statements to see how the company has items for $1. Today, the business, now called Dollarama Inc., performed and what its future prospects might be. Sharehold- is Canada’s largest dollar store chain. It operates more than ers use them to make informed decisions about things such 1,000 stores in every province and now sells goods between as whether to sell their shares, hold onto them, or buy more. -

People | Purpose | Performance Corporate Profile

2015 ANNUAL REPORT People | Purpose | Performance Corporate Profile Canada Pension Plan Investment Board (CPPIB) is a professional investment management organization with a critical purpose – to help provide a foundation on which Canadians build financial security in retirement. We invest the assets of the Canada Pension Plan (CPP) not currently needed to pay pension, disability and survivor benefits. CPPIB is headquartered in Toronto with offices in Hong Kong, Scale and our long-term commitment make CPPIB a London, Luxembourg, New York and São Paulo. We invest valued business partner, allowing us to participate in some in public equities, private equities, bonds, private debt, real of the world’s largest investment transactions. Scale also estate, infrastructure, agriculture and other investment areas. creates investing efficiencies and provides the capacity Assets currently total $264.6 billion. The Investment Portfolio to build the necessary tools, systems and analytics that consists of 75.9% or $201.0 billion in global investments with support a global investment platform. the remaining 24.1% or $63.8 billion invested in Canada. The certainty of cash inflows from contributions means Our investments have become increasingly international, we can be flexible, patient investors able to take advantage as we diversify risk and seek growth opportunities in of opportunities in volatile markets when others face global markets. liquidity pressures. Our investment strategy ensures ideal Created by an Act of Parliament in 1997, CPPIB is diversification across asset classes, geographies and other accountable to Parliament and to the federal and provincial factors through defined target allocation ranges, and our finance ministers who serve as the CPP’s stewards. -

Gildan Activewear Nominates Four New Directors to Board

Gildan Activewear Nominates Four New Directors to Board Montreal, Thursday, March 29, 2018 - Gildan Activewear Inc. (GIL: TSX and NYSE) today announced that its Board of Directors has nominated Maryse Bertrand, Marc Caira, Charles M. Herington and Craig Leavitt as Director nominees to be voted on by the Company’s shareholders at its upcoming Annual Meeting of Shareholders to be held on May 3, 2018 in Montreal, Quebec. “The competitive dynamics in the apparel industry continue to evolve and these proposed director candidates are highly accomplished individuals who will bring a wealth of experience to the Board as the Company continues to grow” said Gildan’s Chairman Bill Anderson. Maryse Bertrand has had a career in law and business spanning over 35 years. Ms. Bertrand is currently an advisor in corporate governance and risk management and is a member of the Boards of Directors of National Bank of Canada, Canada’s sixth largest retail and commercial bank, and Metro Inc., a leader in the grocery and pharmaceutical distribution sectors in Canada. From 2016 to 2017, she was Strategic Advisor and Counsel to Borden Ladner Gervais LLP, and, prior to that she was Vice-President, Real Estate Services, Legal Services and General Counsel at CBC/Radio-Canada, Canada’s public broadcaster. Prior to 2009, Ms. Bertrand was a partner at Davies Ward Phillips and Vineberg LLP, where she specialized in M&A and corporate finance, and served on the firm’s National Management Committee. She was named as Advocatus emeritus (Ad. E.) in 2007 by the Quebec Bar in recognition of her exceptional contribution to the legal profession. -

Final Terms Dated •

MIFID II PRODUCT GOVERNANCE / TARGET MARKET - Solely for the purposes of the manufacturer’s product approval process, the target market assessment in respect of the Notes has led to the conclusion that: (i) the target market for the Notes is eligible counterparties and professional clients only, each as defined in Directive EU 2014/65 (as amended, “MiFID II”); and (ii) all channels for distribution of the Notes to eligible counterparties and professional clients are appropriate. Any person subsequently offering, selling or recommending the Notes (a “distributor”) should take into consideration the manufacturer’s target market assessment; however, a distributor subject to MiFID II is responsible for undertaking its own target market assessment in respect of the Notes (by either adopting or refining the manufacturer’s target market assessment) and determining appropriate distribution channels. PRIIPS REGULATION PROHIBITION OF SALES TO EEA RETAIL INVESTORS - The Notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the European Economic Area (“EEA”) or in the United Kingdom. For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of MiFID II; (ii) a customer within the meaning of Directive (EU) 2016/97 (as amended), where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or (iii) not a qualified investor as defined in Regulation (EU) 2017/1129 (as amended) (the “Prospectus Regulation”). -

Manulife Fidelity True North Fund

CANADIAN LARGE CAP EQUITY Code 7143 Volatility meter Low High Manulife Fidelity True North Fund Fund (6) Benchmark (9) Based on 3 year standard deviation How the underlying fund is invested UNDERLYING FUND -> Fidelity True North Fund - O Objective The Fund aims to achieve long term capital growth by investing primarily in Canadian Composition equity securities. Canadian Equity 78.50% United States Equity 9.08% Managed by FIAM LLC Cash & Equivalents 8.47% Fund managers Maxime Lemieux Foreign Equity 2.88% Other 1.07% Inception date February 2001 Manulife inception date January 2009 Total assets $5,079.1 million Underlying fund operating expense (2015) in IMF Equity Industry Financials 17.69% Energy 16.87% Consumer Staples 10.82% Consumer Discretionary 9.79% Industrials 9.30% Information Technology 8.17% Materials 6.24% Other 21.12% Overall past performance This graph shows how a $10,000 investment in this fund would have changed in value over time, Geographic split based on gross returns. Gross rates of return are shown before investment management Canada 78.56% fees have been deducted. The shaded returns represent the underlying fund returns prior to the United States 9.04% Manulife Fund’s inception date. United Kingdom 0.77% Israel 0.55% Japan 0.51% Manulife Fidelity True North Fund - ($18,950) Ireland 0.51% S&P/TSX Composite Cap TR - ($14,386) Bermuda 0.45% Fidelity True North Fund Series O Other 9.61% Top holdings within the underlying fund (As at June 30, 2016) 15,000 Toronto-Dominion Bank 7.41% Loblaw Companies -

IMS Health Announces Completion of Acquisition by Affiliates of TPG and IMS in the News the CPP Investment Board

United States [Change] Press Room Careers Shareholder Services Customer Portal Contact Us Home Solutions Insights Innovation About IMS PRESS ROOM PRESS RELEASES Press Releases Press Releases IMS Health Announces Completion of Acquisition by Affiliates of TPG and IMS in the News the CPP Investment Board Top-Line Market Data Prescription Data Restriction Laws Contacts: Darcie Peck Investor Relations Share: (203) 845-5237 [email protected] Gary Gatyas Communications (610) 834-5338 [email protected] NORWALK, CT, February 26, 2010 – IMS Health, the world’s leading provider of market intelligence to the pharmaceutical and healthcare industries, today announced the completion of its acquisition by entities created by certain affiliates of TPG Capital, L.P. (“TPG”) and the CPP Investment Board (“CPPIB”). “This transaction has delivered significant value to our shareholders and is a strong endorsement of our business model, our teams and the leadership position we have built,” said IMS Health Chairman and CEO David R. Carlucci. “As a private company, we will continue to innovate for client needs and look forward to working with our new partners as we capitalize on our expanding opportunity in the healthcare market.” “We are delighted to be working with the talented IMS management team to drive growth by expanding the company’s market intelligence offerings, which are crucial to the healthcare industry,” said James Coulter, founding partner, TPG. Mark Wiseman, senior vice-president, Private Investments, CPP Investment Board said, “IMS is a world- class company with a strong management team and excellent growth prospects. We look forward to working with management to position IMS for success over the long term.” Pursuant to the terms of the merger agreement, IMS Health’s stockholders are entitled to receive $22.00 in cash, without interest, less any applicable withholding taxes, for each share of IMS Health common stock owned by them. -

Lessons from Canada's Pension Plan

Risk pooling and the market crash: Lessons from Canada's pension plan Authors: Ashby Monk, Steven A. Sass Persistent link: http://hdl.handle.net/2345/bc-ir:104270 This work is posted on eScholarship@BC, Boston College University Libraries. Chestnut Hill, Mass.: Center for Retirement Research at Boston College, June 2009 These materials are made available for use in research, teaching and private study, pursuant to U.S. Copyright Law. The user must assume full responsibility for any use of the materials, including but not limited to, infringement of copyright and publication rights of reproduced materials. Any materials used for academic research or otherwise should be fully credited with the source. The publisher or original authors may retain copyright to the materials. June 2009, Number 9-12 RISK POOLING AND THE MARKET CRASH: LESSONS FROM CANADA’S PENSION PLAN By Ashby H.B. Monk and Steven A. Sass* Introduction Defined contribution plans are now the nation’s provides reasonably secure and reliable incomes in primary private retirement income program and retirement. One approach would make individual repository of retirement savings. About two thirds of retirement accounts more secure and reliable through the assets held in such plans are invested in equities, the use of mandates, defaults, guarantees, or risk- as is the case in the defined benefit plans they largely sharing arrangements.2 This brief offers a different replaced. Equities can dramatically reduce the cost approach, examining the Canada Pension Plan (CPP) of providing retirement incomes, given their high and how it manages the risk that comes with invest- expected returns. -

Stock-Table-Canada-Newsletter.Pdf

The table below displays stock information as of February 1, 2021. Stock information for March will be available by March 5, 2021. EDWARD JONES STOCKS § Ticker Symbol Ticker Current Opinion Price Recent Forward Est. on Based P/E Forward Est. L-T EPS Growth Estimate PEGY DividendsAnnual Dividend Yield L-T Dividend Growth Estimate DividendsCash Since Invested $10,000 10 Years Ago CategoryInvestment Important Disclosures (High – Low) EPS AS OF 02/01/21 Range Price 52-week S&P / TSX Composite 17692.45 18058.61 - 11172.73 1215.59 14.6 6 1.6 538.38 3.04 12,902 COMMUNICATION SERVICES (8%) Alphabet - US GOOGL BUY 1893.07 1932.08 - 1008.87 61.74 30.7 15 2.0 0.00 0.0 NA 61,902 G AT&T - US T BUY 28.65 38.82 - 26.08 3.33 8.6 3 0.8 2.08 7.3 0 1984 17,934 G/I 12 BCE - Canada BCE.T BUY 54.51 65.28 - 46.03 3.43 15.9 4 1.6 3.33 6.1 4 1881 25,056 G/I Omnicom Group - US OMC BUY 62.86 80.25 - 44.50 5.96 10.5 7 1.0 2.60 4.1 5 1986 18,340 G Rogers Communications - Canada RCI.B.T HOLD 58.05 66.87 - 46.81 3.74 15.5 4 2.1 2.00 3.4 0 2003 23,801 G/I Shaw Communications - Canada SJR.B.T BUY 22.17 26.64 - 17.77 1.47 15.1 4 1.6 1.19 5.4 0 1982 16,259 G/I TELUS - Canada T.T BUY 26.54 27.74 - 18.55 1.30 20.4 5 2.1 1.24 4.7 5 1993 32,613 G/I Verizon Communications - US VZ BUY 54.28 61.95 - 48.84 4.93 11.0 4 1.3 2.51 4.6 2 1984 23,620 G/I CONSUMER DISCRETIONARY (8%) Amazon - US AMZN BUY 3342.88 3552.25 - 1626.03 45.00 74.3 30 2.5 0.00 0.0 NA 194,229 G Canadian Tire - Canada CTC.A.T HOLD 171.48 181.57 - 67.15 12.00 14.3 8 1.3 4.70 2.7 10 1996 33,245 G/I Dollarama - Canada -

People Purpose Performance

ANNUAL REPORT 2013 People Purpose Performance Toronto London Hong Kong Corporate Profile Canada Pension Plan Investment Board (CPPIB) is a professional investment management organization with a critical purpose – to help provide a foundation on which Canadians build financial security in retirement. We invest the assets of the Canada Pension Plan (CPP) not currently needed to pay pension, disability and survivor benefits. — CPPIB is headquartered in Toronto with offices in London and Hong Kong. We invest in public equities, private equities, bonds, private debt, real estate, infrastructure and other areas. Assets currently total $183.3 billion. Of this total, 36.7% or $67.4 billion is invested in Canada and the rest globally at 63.3% or $116.1 billion of the portfolio. Our investments have become increasingly international as we diversify risk and seek growth opportunities in growing global markets. Created by an Act of Parliament in 1997, CPPIB is accountable to Parliament and to the federal and provincial finance ministers who serve as the CPP’s stewards. However, we are governed and managed independently from the CPP, operating at arm’s length from governments with a singular objective: to maximize returns without undue risk of loss. The funds that we invest belong to the 18 million Canadians who are current and future CPP beneficiaries. We adhere to high standards of transparency and accountability. The CPP Fund ranks among the world’s 10 largest retirement funds. In managing the Fund, CPPIB pursues a diverse set of investment programs that contribute to the long-term sustainability of the CPP. The most recent triennial report by the Chief Actuary of Canada indicated that the CPP is sustainable over a 75-year projection period, and that contributions to the Fund will exceed benefits paid until 2021. -

Linde Equity Research TSX Performance Review

Linde Equity Research TSX Performance Review 2008 Q2: TSX has strong second quarter thanks to Energy, Materials Canadian market among best performers in the world in Q2 2008 Q2 Sector Returns Energy 24.21% Materials 17 . 16 % S&P/TSX Composite 8.37% Utilities 4.59% Industrials 3.42% Information Technology 2.04% Telecommunications Services 1. 3 1% Consumer Staples 0.17% -5.20% Financials -7.63% Health Care - 11. 4 5 % Consumer Discretionary -15% -10% -5% 0% 5% 10% 15% 20% 25% 30% • TSX 60 (large cap) stocks continued to 2008 Index Returns Q2 YTD outperform the broader market, a trend which S&P/TSX Composite 8.37% 4.58% began in Q2 2007. • The Canadian market again outperformed the US S&P/TSX 60 (Large Cap) 10.18% 6.76% market (S&P 500) in Q2. The S&P/TSX S&P/TSX Mid Cap 2.53% -2.32% Composite returned 8.4% versus -3.2% for the S&P/TSX Small Cap 2.85% -2.22% S&P 500 (-3.9% in Canadian dollar terms). • The dramatic spike in oil prices to around $140 per barrel by quarter-end drove strong Q2 Biggest Contributors Q2 Biggest Detractors performance in energy stocks throughout the Potash Corporation Manulife Financial world. The large weighting of Energy stocks in the Canadian market was the primary reason for Cdn Natural Resources CIBC Canada’s strong relative performance. EnCana Sun Life Financial • Materials stocks were also a strong driver of Suncor Energy Centerra Gold performance. The Canadian Materials sector performed better than comparable sectors in Husky Energy Royal Bank of Canada other countries due its higher exposure to Agrium Magna International fertilizer and gold stocks. -

Sun Life Guaranteed Investment Funds (Gifs)

Sun Life Guaranteed Investment Funds (GIFs) ANNUAL FINANCIAL STATEMENTS SUN LIFE ASSURANCE COMPANY OF CANADA December 31, 2015 Life’s brighter under the sun Sun Life Assurance Company of Canada is a member of the Sun Life Financial group of companies. © Sun Life Assurance Company of Canada, 2016. 36D-0092-02-16 Table of Contents Independent Auditors' Report 3 Sun MFS Dividend Income 196 Sun Beutel Goodman Canadian Bond 5 Sun MFS Global Growth 200 Sun BlackRock Canadian Balanced 10 Sun MFS Global Total Return 204 Sun BlackRock Canadian Composite Equity 15 Sun MFS Global Value 209 Sun BlackRock Canadian Equity 20 Sun MFS Global Value Bundle 214 Sun BlackRock Canadian Equity Bundle 25 Sun MFS International Growth 218 Sun BlackRock Cdn Composite Eq Bundle 29 Sun MFS International Growth Bundle 222 Sun BlackRock Cdn Universe Bond 33 Sun MFS International Value 226 Sun Canadian Balanced Bundle 38 Sun MFS International Value Bundle 230 Sun CI Cambridge Canadian Equity 42 Sun MFS Monthly Income 234 Sun CI Cambridge Cdn Asset Allocation 46 Sun MFS US Equity 238 Sun CI Cambridge Global Equity 50 Sun MFS US Equity Bundle 242 Sun CI Cambridge/MFS Canadian Bundle 54 Sun MFS US Growth 246 Sun CI Cambridge/MFS Global Bundle 58 Sun MFS US Value 250 Sun CI Signature Diversified Yield II 62 Sun MFS US Value Bundle 255 Sun CI Signature High Income 66 Sun Money Market 259 Sun CI Signature Income & Growth 70 Sun NWQ Flexible Income 264 Sun Daily Interest 74 Sun PH&N Short Term Bond and Mortgage 268 Sun Dollar Cost Average Daily Interest 78 Sun RBC Global High -

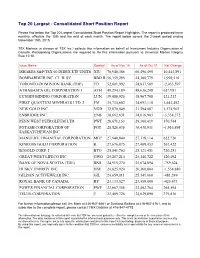

Top 20 Largest - Consolidated Short Position Report

Top 20 Largest - Consolidated Short Position Report Please find below the Top 20 Largest Consolidated Short Position Report Highlights. The report is produced twice monthly, effective the 15th and the end of each month. The report below covers the 2-week period ending November 15th, 2015. TSX Markets (a division of TSX Inc.) collects this information on behalf of Investment Industry Organization of Canada. Participating Organizations are required to file this information pursuant to Universal Market Integrity Rule 10.10. Issue Name Symbol As of Nov 15 As of Oct 31 Net Change ISHARES S&P/TSX 60 INDEX ETF UNITS XIU 70,940,386 60,496,495 10,443,891 BOMBARDIER INC. CL 'B' SV BBD.B 56,359,295 54,360,779 1,998,516 TORONTO-DOMINION BANK (THE) TD 52,801,992 54,837,589 -2,035,597 ATHABASCA OIL CORPORATION J ATH 49,294,189 48,636,208 657,981 LUNDIN MINING CORPORATION LUN 39,088,920 38,967,708 121,212 FIRST QUANTUM MINERALS LTD. J FM 35,734,602 34,091,110 1,643,492 NEW GOLD INC. NGD 32,870,049 31,294,087 1,575,962 ENBRIDGE INC. ENB 30,662,631 34,016,903 -3,354,272 PENN WEST PETROLEUM LTD. PWT 28,671,163 28,300,419 370,744 POTASH CORPORATION OF POT 28,520,036 30,436,931 -1,916,895 SASKATCHEWAN INC. MANULIFE FINANCIAL CORPORATION MFC 27,940,840 27,318,114 622,726 KINROSS GOLD CORPORATION K 27,676,875 27,409,453 267,422 B2GOLD CORP.