SYNOPSIS of DEBATES (Proceedings Other Than Questions & Answers) ______

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

District Election Office Harda

P a g e | 1 District Election Management Plan District Election Office Harda Madhya Pradesh Loksabha Election 2019 भारत नि셍ााचि आयोग Election Commission of India P a g e | 2 DISTRICT ELECTION MANAGEMENT PLAN (DEMP) (HARDA M.P.) INDEX 1. DISTRICT BRIEF PROFILE a. DISTRICT POLITICAL MAP b. KEY STATISTICS c. BRIEF NOTES ON THE DISTRICT • GENERAL • ADMINISTRATIVE 12.1.1.1 • DEMOGRAPHY • TERRAIN • SOCIO-ECONOMIC-CULTURAL • INFRASTRUCTURE AVAILABILITY • RESOURCE AVAILABILITY • WEATHER, PERIODS OF INACCESSIBILITY & INACCESSIBLE PLACES • GENERALLY INACCESSIBLE OR DIFFICULT TO REACH PLACES d. CONSTITUENCY WISE LAW AND ORDER SITUATION e. Election Management Machinery 2. POLLING STATIONS a. POLLING STATION LOCATIONS AND BREAKUP ACCORDING TO NO. OF PS AT PSL b. POLLING STATION OVERVIEW-ACCESSIBILITY c. POLLING STATION OVERVIEW–TELECOM CONNECTIVITY d. POLLING STATION OVERVIEW–BASIC MINIMUM FACILITIES e. POLLING STATION OVERVIEW – INFRASTRUCTURE f. VULNERABLE PS/ELECTORS g. POLLING STATION LOCATION WISE ACCESSIBILITY & REACH DETAILS h. POLLING STATION WISE BASIC DETAILS PROFILING AND WORK TO BE DONE 3. MANPOWER PLAN a. CADRE WISE PERSONNEL AVAILABILITY FOR EACH CATEGORY b. VARIOUS TEAMS REQUIRED-EEM c. VARIOUS TEAMS REQUIRED - OTHERS d. POLLING PERSONNEL REQUIRED e. OTHER PERSONNEL REQUIRED f. PERSONNEL REQUIREMENT & AVAILABILITY P a g e | 3 g. LIST OF ZONAL OFFICERS h. LOGISTIC ARRANGEMENTS FOR POLLING PERSONNEL A TPSL LOGISTICS i. ARRANGEMENTS FOR SECURITY PERSONNEL 4. TRAINING PLAN OVERVIEW a. TRAINING PLAN FOR ELECTION PERSONNEL b. TRAINING PLAN FOR POLICE ELECTION 5. MOVEMENT PLAN a. OVERVIEW OF ROUTES AND NUMBER OF SECTOR OFFICERS AND ASSISTANT SECTOR OFFICERS ROUTE DETAILS WITH MAPS b. SECTOR OFFICER TRIPS PLANNED VEHICLE REQUIREMENT & AVAILABILITY 6. -

Allahabad Division)-2018

List of Sixteen Lok Sabha- Members (Allahabad Division)-2018 S. Constituency/ Name of Member Permanent Address & Mobile No. Present N. Party Address & Mobile No. 1 CNB/BJP Dr. Murli Manohar Joshi 9/10-A tagore Nagar, Anukul 6, Raisina Road. New Chandra Banerjee Road, Allahabad- Delhi-110001 211002,(UP) Tel.No. (011) C/O Mr. Lalit Singh, 15/96 H Civil 23718444, 23326080 Lines, Kanpur-208001 Phone No. 0512-2399555 2 ALD/BJP Sri Shyama Charan Gupta. 44- Thornhill Road, Allahabad A-5, Gulmohar Park, .211002 (U.P) Khelgaon Road, New Ph.N0. (0532)2468585 & 86 Delhi-110049 Mob.No. 09415235305(M) Fax.N. (0532)2468579 Tels. No.(011)26532666, 26527359 3 Akbarpur Sri Devendra Singh Bhole 117/P/17 Kakadev, Kanpur (CNB/Dehat)/ Mob No.9415042234 BJP Tel. No. 0512-2500021 4 Rewa/BJP Sri Janardan Mishra Villagae & Post- Hinauta Distt.- Rewa Mob. No.-9926984118 5 Chanduli/BJP Dr. Mahendra Nath Pandey B 22/157-7, Sarswati Nagar New Maharastra Vinayaka, Distt.- Varanasi (UP) Sadan Mob. No. 09415023457 K.G. Marg, New Delhi- 110001 6 Banda/BJP Sri Bhairon Prasad Mishra Gandhiganj, Allahabad Road Karvi, Distt.-Chitrakut Mob. No.-09919020862 7 ETAH/BJP Sri Rajveer Singh A-10 Raj Palace, Mains Road, Ashok Hotel, (Raju Bhaiya) Aligarh, Uttar Pradesh Chankayank Puri New (0571) 2504040,09457011111, Delhi-110021 09756077777(M) 8 Gautam Buddha Dr. Mahesh Sharma 404 Sector- 15-A Nagar/BJP Noida-201301 (UP) Tel No.(102)- 2486666, 2444444 Mob. No.09873444255 9 Agra/BJP Dr. Ram Shankar Katheriya 1,Teachers home University Campus 43, North Avenue, Khandari, New Delhi-110001 Agra-02 (UP) Mob. -

S N. Name of TAC/ Telecom District Name of Nominee [Sh./Smt./Ms

Name of Nominated TAC members for TAC (2020-22) Name of TAC/ S N. Name of Nominee [Sh./Smt./Ms] Hon’ble MP (LS/RS) Telecom District 1 Allahabad Prof. Rita Bahuguna Joshi, Hon’ble MP (LS) 2 Allahabad Smt. Keshari Devi Patel, Hon’ble MP (LS) 3 Allahabad Sh. Vinod Kumar Sonkar, Hon’ble MP (LS) 4 Allahabad Sh. Rewati Raman Singh, Hon’ble MP (RS) 5 Azamgarh Smt. Sangeeta Azad, Hon’ble MP (LS) 6 Azamgarh Sh. Akhilesh Yadav, Hon’ble MP (LS) 7 Azamgarh Sh. Rajaram, Hon’ble MP (RS) 8 Ballia Sh. Virendra Singh, Hon’ble MP (LS) 9 Ballia Sh. Sakaldeep Rajbhar, Hon’ble MP (RS) 10 Ballia Sh. Neeraj Shekhar, Hon’ble MP (RS) 11 Banda Sh. R.K. Singh Patel, Hon’ble MP (LS) 12 Banda Sh. Vishambhar Prasad Nishad, Hon’ble MP (RS) 13 Barabanki Sh. Upendra Singh Rawat, Hon’ble MP (LS) 14 Barabanki Sh. P.L. Punia, Hon’ble MP (RS) 15 Basti Sh. Harish Dwivedi, Hon’ble MP (LS) 16 Basti Sh. Praveen Kumar Nishad, Hon’ble MP (LS) 17 Basti Sh. Jagdambika Pal, Hon’ble MP (LS) 18 Behraich Sh. Ram Shiromani Verma, Hon’ble MP (LS) 19 Behraich Sh. Brijbhushan Sharan Singh, Hon’ble MP (LS) 20 Behraich Sh. Akshaibar Lal, Hon’ble MP (LS) 21 Deoria Sh. Vijay Kumar Dubey, Hon’ble MP (LS) 22 Deoria Sh. Ravindra Kushawaha, Hon’ble MP (LS) 23 Deoria Sh. Ramapati Ram Tripathi, Hon’ble MP (LS) 24 Faizabad Sh. Ritesh Pandey, Hon’ble MP (LS) 25 Faizabad Sh. Lallu Singh, Hon’ble MP (LS) 26 Farrukhabad Sh. -

CBSE One-Paper Folly on Arihant BASANTKUMAR Done Away with the Practice of Boards

THURSDAY29MARCH 2018 6 NATION XXCE Leak hits more students because of pattern shift IN BRIEF Govt silent CBSE one-paper folly on Arihant BASANTKUMAR done away with the practice of boards. The moderation is paredness must have been MOHANTY multiple sets of question pa- done to compensate for the dif- thoroughly verified, he said. ‘repairs’ pers in the board examina- ficulty levels across sets of The All India Parents As- NewDelhi: All 20 lakh stu- tions. Had they followed the question papers and also to sociation(AIPA), an organisa- ■ NEW DELHI: The govern- dents would not have had to practice, the number of affect- match the pass rate of the pre- tion fighting for admission and ment on Wednesday de- take the CBSE math and eco- ed students would have been vious year. Under moderation, the right to education of chil- clined to give information nomics re-exam had the board confined to afew regions, and all students are awarded extra dren, alsosuspected the revo- on the extent of damage apparently not deviated from not the whole country,” he marks subject to aceiling. cation of multiple sets of ques- to or cost of repairs of the its practice of different sets of said over phone. After beingproddedbythe tion papers. indigenously-built nu- question papers for different Usually, the board pre- human resource development “The board has certainly clear submarine INS Ari- regions,aformer chairperson pares multiple sets of question ministry, all boards agreedto adopted asingle set of question hant, stating it could not said on Wednesday. papers and sends different sets do away with moderation. -

(2016-2017) (Sixteenth Lok Sabha) Ministry of Minority Affairs

39 STANDING COMMITTEE ON SOCIAL JUSTICE AND EMPOWERMENT (2016-2017) (SIXTEENTH LOK SABHA) MINISTRY OF MINORITY AFFAIRS DEMANDS FOR GRANTS (2017-2018) THIRTY-NINTH REPORT LOK SABHA SECRETARIAT NEW DELHI March, 2017/Phalguna, 1938 (Saka) i THIRTY-NINTH REPORT STANDING COMMITTEE ON SOCIAL JUSTICE AND EMPOWERMENT (2016-2017) (SIXTEENTH LOK SABHA) MINISTRY OF MINORITY AFFAIRS DEMANDS FOR GRANTS (2017-2018) Presented to Lok Sabha on 17.03.2017 Laid in Rajya Sabha on 17.03.2017 LOK SABHA SECRETARIAT NEW DELHI March, 2017/Phalguna, 1938 (Saka) ii CONTENTS PAGE(s) COMPOSITION OF THE COMMITTEE (2016-17) (iv) INTRODUCTION (vi) REPORT CHAPTER - I INTRODUCTORY 1 CHAPTER - II GENERAL PERFORMANCE OF MINISTRY 4 CHAPTER - III FREE COACHING AND ALLIED SCHEME 26 CHAPTER - IV RESEARCH STUDIES MONITORING & 33 EVALUATION OF DEVELOPMENT SCHEME FOR MINORITIES CHAPTER - V SKILL DEVELOPMENT INITIATIVE 36 (SEEKHO AUR KAMAO SCHEME) CHAPTER - VI HAJ DIVISION 50 ANNEXURES I. MINUTES OF THE ELEVENTH SITTING OF 82 THE STANDING COMMITTEE ON SOCIAL JUSTICE AND EMPOWERMENT (2016-17) HELD ON TUESDAY, 28th FEBRUARY, 2017. II. MINUTES OF THE TWELFTH SITTING OF THE 85 STANDING COMMITTEE ON SOCIAL JUSTICE AND EMPOWERMENT (2016-17) HELD ON THURSDAY, 16th MARCH, 2017. APPENDIX STATEMENT OF OBSERVATIONS/ 87 RECOMMENDATIONS iii COMPOSITION OF THE STANDING COMMITTEE ON SOCIAL JUSTICE AND EMPOWERMENT (2016-2017) SHRI RAMESH BAIS - CHAIRPERSON MEMBERS LOK SABHA 2. Shri Kantilal Bhuria 3. Shri Santokh Singh Chaudhary 4. Shri Sher Singh Ghubaya 5. Shri Jhina Hikaka 6. Shri Sadashiv Kisan Lokhande 7. Smt. K. Maragatham 8. Shri Kariya Munda 9. Prof. Seetaram Azmeera Naik 10. Shri Asaduddin Owaisi 11. -

Agriculture Marketing and Role of Weekly Gramin Haats"

STANDING COMMITTEE ON AGRICULTURE (2018-2019) 62 SIXTEENTH LOK SABHA MINISTRY OF AGRICULTURE AND FARMERS WELFARE (DEPARTMENT OF AGRICULTURE, COOPERATION AND FARMERS WELFARE) SIXTY SECOND REPORT "AGRICULTURE MARKETING AND ROLE OF WEEKLY GRAMIN HAATS" LOK SABHA SECRETARIAT NEW DELHI January, 2019/Pausha, 1940 (Saka) Page 1 of 81 SIXTY SECOND REPORT STANDING COMMITTEE ON AGRICULTURE (2018-2019) (SIXTEENTH LOK SABHA) MINISTRY OF AGRICULTURE AND FARMERS WELFARE (DEPARTMENT OF AGRICULTURE, COOPERATION AND FARMERS WELFARE) "Agriculture Marketing and Role of Weekly Gramin Haats" Presented to Lok Sabha on 03.01.2019 Laid on the Table of Rajya Sabha on 03.01.2019 LOK SABHA SECRETARIAT NEW DELHI January, 2019/Pausha, 1940 (Saka) Page 2 of 81 COA No. 392 Price : Rs. © 2018 By Lok Sabha Secretariat Published under Rule 382 of the Rules of Procedure and Conduct of Business in Lok Sabha (Fourteenth Edition) and Printed by Page 3 of 81 <CONTENTS> PAGE No. COMPOSITION OF THE COMMITTEE (2016-17)………………………… (iii) COMPOSITION OF THE COMMITTEE (2017-18)………………………… (iv) COMPOSITION OF THE COMMITTEE (2018-19)………………………… (v) INTRODUCTION…………………………………………………………… (vi) REPORT PART- I Chapter - I Introduction A Procurement vis a vis Production of Agriculture Produce B Marketing Platform for Agriculture Produce C Functioning of Agriculture Produce Marketing Committee (APMCs) D Reform in Agriculture Produce Marketing sector E Relevance of Gramin Haat as Platform for Agriculture Marketing F Implementation of GrAM Scheme G Implementation of e-NAM scheme PART-II RECOMMENDATIONS AND OBSERVATIONS OF THE COMMITTEE ANNEXURES I. Status of Adoption of Marketing Reforms as on 18.06.2018 II. Major Recommendations of the Committee. APPENDICES I. -

THE RAJPUT CO-OP (U) THRIFT & CREDIT SOCIETY LTD. E-331,Ist

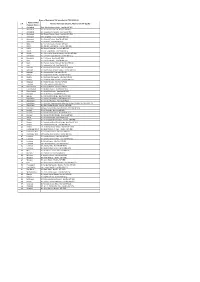

THE RAJPUT CO-OP (U) THRIFT & CREDIT SOCIETY LTD. E-331,Ist FLOOR, GALI NO. 75, MAHAVIR ENCLAVE, PART-III, UTTAM NAGAR, NEW DELHI-110059 LIST OF VALID MEMBER AS ON 05.03.2019 FORM NO. 8 S.NO. A/C NO. NAME OF THE MEMBERS FATHERS/HUSBAND NAME ADDRESS NOMINEE 1 2 RAJ KUMARI W/O SURAJ PRAKASH E-509, GALI NO.79, MAHAVIR ENCLAVE SURAJ PRAKASH MAHAVIR ENCLAVE, PART-III, NEW DELHI 2 3 KUMARI RUCHI S/O SURAJ PRAKASH E-509, GALI NO.79, MAHAVIR ENCLAVE, SURAJ PRAKASH PART MAHAVIR ENCLAVE, P-III, NEW DELHI- 110059 NEW DELHI 3 5 PARDEEP KUMAR S/O SH ROOP CHAND D-269, VIR BAZAR ROAD, MAHAVIR SUMAN DEVI ENCLAVE, PART-III, NEWLHI- 4 6 NEERAJ KUMAR S/O SH. RAJ SINGH A-33-A, MADHU VIHAR, UTTAM NAGAR, OM WATI NEW DELHI 5 8 SUMAN BALA W/O SH SATISH KUMAR D-282, NAWADA HOUSING COMPLEX, SATISH KUMAR KAKROLA MOR, UTTAM NAGAR, NEW DELHI 6 9 SURESH CHAND S/O ROSHAN LAL E-347, GALI NO.75, MAHAVIR ENCLAVE, P-III, KUSUM DEVI NEW DELHI- 7 10 KUSUM S/O SH SURESH CHAND E-347, GALI NO.75, MAHAVIR ENCLAVE, P-III, SURESH CHAND NEW DELHI- 8 11 PARHLAD S/O SH SURESH CHAND E-347, GALI NO.75, MAHAVIR ENCLAVE, SURESH CHAND PART-III, NEW DELHI- 9 12 MAMTA S/O SH SURESH CHAND E-347, GALI NO.75, MAHAVIR ENCLAVE, SURESH CHAND PART-III, NEW DELHI- 10 13 MONIKA S/O SH SURESH CHAND E-347, GALI NO.75, MAHAVIR ENCLAVE, SURESH CHAND PART-III NEW DELHI- 11 14 SANJAY KUMAR S/O SH OM PARKASH E-314, GALI NO.75, MAHAVIR ENCLAVE, P-III, SANGEETA NEW DELHI- 12 15 SANGITA W/O SH SANJAY KUMAR E-314, GALI NO.75, MAHAVIR ENCLAVE, SANJAY KUMAR PART-III, NEW DELHI- 13 16 PARVINDER KUMAR S/O SH RAM -

List of the Selected Students Under AICTE-Pragati Scholarship Scheme (Diploma) 2020-21

List of the Selected Students under AICTE-Pragati Scholarship Scheme (Diploma) 2020-21 S.No. Institute_State/ UT Application_ID Applicant_Name Institution_Name AISHE_Code Institute_Address 1 ANDAMAN AND AN202021011795780 POOJA BISWAS Dr.B.R. Ambedkar C-6528 Pahargaon, Junglighat Post office Pin 744103, South NICOBAR Institute of Technology Andaman District, Port Blair. (Id: C-6528) 2 ANDAMAN AND AN202021011566460 J DIVYA RANI Dr.B.R. Ambedkar C-6528 Pahargaon, Junglighat Post office Pin 744103, South NICOBAR Institute of Technology Andaman District, Port Blair. (Id: C-6528) 3 ANDAMAN AND AN202021011113799 P SAVITHRI Dr.B.R. Ambedkar C-6528 Pahargaon, Junglighat Post office Pin 744103, South NICOBAR Institute of Technology Andaman District, Port Blair. (Id: C-6528) 4 ANDHRA PRADESH AP202021012111782 ANNURU NEEHARIKA SRI PADMAVATHI S-644 NEAR SV DAIRY FORM, SV UNIVERSITY ROAD, TIRUPATI WOMENS POLYTECHNIC 5 ANDHRA PRADESH AP202021012009522 KUSUMURU SUMITRA GOVERNMENT S-15368 GOVERNMENT POLYTECHNIC, M.R.NAGAR, POLYTECHNIC PARVATHIPURAM ,VIZIANAGARAM DISTRICT, ANDHRA PARVATHIPURAM PRADESH- 535 522 6 ANDHRA PRADESH AP202021012109572 KOMMU SUSMITHA SRI PADMAVATHI S-644 NEAR SV DAIRY FORM, SV UNIVERSITY ROAD, TIRUPATI WOMENS POLYTECHNIC 7 ANDHRA PRADESH AP202021012110923 LAFFREY VARSHA SRI PADMAVATHI S-644 NEAR SV DAIRY FORM, SV UNIVERSITY ROAD, TIRUPATI REBECCA WOMENS POLYTECHNIC 8 ANDHRA PRADESH AP202021011488570 MALIREDDY NIRMALA Prasanthi Polytechnic S-15804 PUDIMADAKA ROAD, ATCHUTAPURAM 9 ANDHRA PRADESH AP202021011641515 SIVALANKA BHAGYA -

Lok Sabha Debates

Uncorrected – Not for Publication LSS-D-I LOK SABHA DEBATES (Part I -- Proceedings with Questions and Answers) Wednesday, November 27, 2019 / Agrahayana 6, 1941 (Saka) LOK SABHA DEBATES PART I – QUESTIONS AND ANSWERS Wednesday, November 27, 2019 / Agrahayana 6, 1941 (Saka) CONTENTS PAGES RE: BIRTHDAY WISHES 1 ORAL ANSWERS TO STARRED QUESTIONS 1A-27 (S.Q. NO. 121-140) OBSERVATION RE: COMPLETION OF QUESTION LIST 28-30 WRITTEN ANSWERS TO UNSTARRED QUESTIONS 31-280 (U.S.Q. NO. 1381-1610) Uncorrected – Not for Publication LSS-D-II LOK SABHA DEBATES (Part II - Proceedings other than Questions and Answers) Wednesday, November 27, 2019 / Agrahayana 6, 1941 (Saka) (Please see the supplement) LOK SABHA DEBATES PART II –PROCEEDINGS OTHER THAN QUESTIONS AND ANSWERS Wednesday, November 27, 2019 / Agrahayana 6, 1941 (Saka) C ON T E N T S P A G E S PAPERS LAID ON THE TABLE 281-88 STANDING COMMITTEE ON HEALTH AND FAMILY WELFARE 289 th th 115 and 116 Reports MOTION RE: 9TH REPORT OF BUSINESS ADVISORY 289 COMMITTEE BILL WITHDRAWAN 290-91 Jammu and Kashmir Reservation (Second Amendment) Bill FELICITATIONS TO ISRO TEAM ON SUCCESSFUL 292 LAUNCH OF PSLV ROCKET RULING RE: NOTICES OF ADJOURMENT MOTION 292 SPECIAL MENTIONS 293-99 MATTERS UNDER RULE 377 300-24 Dr. Subhas Sarkar 300 Shri Raja Amareshwara Naik 301 Shri Vinod Lakhamshi Chavda 302 Shri Tejasvi Surya 303 Shri G.S. Basavaraj 304 Shri Kirti Vardhan Singh 305 Shri Tirath Singh Rawat 306 Shri Ramdas Tadas 307 Shri Mukesh Rajput 307 Shri Jual Oram 308 Shri Ashok Kumar Rawat 309 Shri Gopal Jee Thakur 310 Shrimati Darshana Vikram Jardosh 311 Shri Arjun Lal Meena 312 Shri Suresh Kodikunnil 313 Shri Vincent H. -

SIXTEENTH Notice of Question of Privil Savitri Bai Phoole Bahraich

COMMITTEE OF PRIVILEGES (SIXTEENTH LOK SABHA) 6 SIXTH REPORT Notice of question of privilege dated 29.02.2016 by Sushree Sadhvi Savitri Bai Phoole, MP against the District/Police administration, Bahraich, UP for obstructing her while she was heading for Delhi to attend the Budget Session of Parliament. [Presented to the Speaker, Lok Sabha on13 December, 2017] [ Laid on the Table on 20 December, 2017] LOK SABHA SECRETARIAT NEW DELHI December, 2017/Agrahayana, 1939 (Saka) i COMMITTEE OF PRIVILEGES (SIXTEENTH LOK SABHA) SIXTH REPORT Notice of question of privilege dated 29.02.2016 by Sushree Sadhvi Savitri Bai Phoole, MP against the District/Police administration, Bahraich, UP for obstructing her while she was heading for Delhi to attend the Budget Session of Parliament. [Presented to the Speaker, Lok Sabha on 13 December, 2017] [Laid on the Table on 20 December, 2017] LOK SABHA SECRETARIAT NEW DELHI December, 2017/Agrahayana, 1939 (Saka) ii CONTENTS PAGE Personnel of the Committee of Privileges . (iv) Report . ……1 Minutes . ….21 Appendices………………………………………………………..........30 iii PERSONNEL OF THE COMMITTEE OF PRIVILEGES (2017-2018) Shri Smt. Meenakashi Lekhi- Chairperson MEMBERS 2. Shri Anandrao Adsul 3. Shri Kalyan Banerjee 4. Shri Anant Kumar Hegde 5. Shri Srinivas Kesineni 6. Shri J.J.T. Natterjee 7. Shri Jagdambika Pal 8. Shri Konda Vishweshwar Reddy 9. Shri Tathagata Satpathy 10. Shri Jyotiraditya M. Scindia 11. Shri Raj Kumar Singh 12. Shri Rakesh Singh 13. Shri Sushil Kumar Singh 14. Dr. Kirit Somaiya 15. Prof. (Dr.) Ram Shankar, MP Secretariat 1. Shri Ravindra Garimella - Joint Secretary 2. Shri M.K. Madhusudhan - Director 3. -

Download Brochure

Celebrating UNESCO Chair for 17 Human Rights, Democracy, Peace & Tolerance Years of Academic Excellence World Peace Centre (Alandi) Pune, India India's First School to Create Future Polical Leaders ELECTORAL Politics to FUNCTIONAL Politics We Make Common Man, Panchayat to Parliament 'a Leader' ! Political Leadership begins here... -Rahul V. Karad Your Pathway to a Great Career in Politics ! Two-Year MASTER'S PROGRAM IN POLITICAL LEADERSHIP AND GOVERNMENT MPG Batch-17 (2021-23) UGC Approved Under The Aegis of mitsog.org I mitwpu.edu.in Seed Thought MIT School of Government (MIT-SOG) is dedicated to impart leadership training to the youth of India, desirous of making a CONTENTS career in politics and government. The School has the clear § Message by President, MIT World Peace University . 2 objective of creating a pool of ethical, spirited, committed and § Message by Principal Advisor and Chairman, Academic Advisory Board . 3 trained political leadership for the country by taking the § A Humble Tribute to 1st Chairman & Mentor, MIT-SOG . 4 aspirants through a program designed methodically. This § Message by Initiator . 5 exposes them to various governmental, political, social and § Messages by Vice-Chancellor and Advisor, MIT-WPU . 6 democratic processes, and infuses in them a sense of national § Messages by Academic Advisor and Associate Director, MIT-SOG . 7 pride, democratic values and leadership qualities. § Members of Academic Advisory Board MIT-SOG . 8 § Political Opportunities for Youth (Political Leadership diagram). 9 Rahul V. Karad § About MIT World Peace University . 10 Initiator, MIT-SOG § About MIT School of Government. 11 § Ladder of Leadership in Democracy . 13 § Why MIT School of Government. -

IJRSS May19 Special Issue.Pdf

International Journal of Research in Social Sciences Vol. 9 Issue 5, May 2019, (Special Issue) ISSN: 2249-2496 Impact Factor: 7.081 Journal Homepage: http://www.ijmra.us, Email: [email protected] Double-Blind Peer Reviewed Refereed Open Access International Journal - Included in the International Serial Directories Indexed & Listed at: Ulrich's Periodicals Directory ©, U.S.A., Open J-Gate as well as in Cabell‘s Directories of Publishing Opportunities, U.S.A One-Day National-Level Conference Literatures of Resistance: Voices of the Marginalised 25th April 2019 Organised by Department of English Seshadripuram College No. 27, Nagappa Street, Seshadripuram, Bengaluru – 560 020 NAAC Acreditted ‗A‘ www.spmcollege.ac.in 1 International Journal of Research in Social Sciences http://www.ijmra.us, Email: [email protected] ISSN: 2249-2496Impact Factor: 7.081 ABOUT THE CONFERENCE „I would have liked to tell you the story… Had they not slit my lips‟ --Samih al-Qassim The word ‗Resistance‘ was observed for the first time in 1996 in Palestinian Literature as written by the Palestinian writer and critic, Ghassan Kanafani. ‗Resistance‘ means to counter an ideology or action or raise objections to the existing dominant, hegemonic dogmas and practices that are hierarchical and only subjugate the inferior furthermore. Resistance is bi-dimensional, carried out both through reading and writing of texts and may be applied to a gamut of discourses such as: colonial discourse, imperial culture, gender issues, caste and class differences, imbalances due to cultural clashes and so on. Resistance has existed as long as human history and culture that it attempts to counter and will continue to exist as long as civilisation does.