KAKAO-TALK Through LWAPP

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Emerging Markets Equity Fund Q3 Portfolio Holdings

Putnam Emerging Markets Equity Fund The fund's portfolio 5/31/21 (Unaudited) COMMON STOCKS (98.8%)(a) Shares Value Airlines (0.9%) Copa Holdings SA Class A (Panama)(NON) 70,700 $5,815,782 5,815,782 Banks (5.7%) HDFC Bank, Ltd. (India)(NON) 889,339 18,568,792 Sberbank of Russia PJSC ADR (Russia) 548,845 9,261,759 TCS Group Holding PLC GDR 144A (Cyprus) 107,200 8,040,000 35,870,551 Capital markets (2.4%) B3 SA - Brasil Bolsa Balcao (Brazil) 3,151,700 10,607,061 Hong Kong Exchanges and Clearing, Ltd. (Hong Kong) 73,200 4,582,015 15,189,076 Chemicals (2.5%) Asian Paints, Ltd. (India) 184,575 7,592,754 LG Chem, Ltd. (South Korea) 11,537 8,471,983 16,064,737 Entertainment (1.7%) Sea, Ltd. ADR (Thailand)(NON) 42,300 10,712,052 10,712,052 Food and staples retail (3.0%) Dino Polska SA (Poland)(NON) 84,264 6,522,925 Wal-Mart de Mexico SAB de CV (Mexico) 3,834,400 12,620,909 19,143,834 Health-care equipment and supplies (1.4%) Shenzhen Mindray Bio-Medical Electronics Co., Ltd. Class A (China) 120,200 9,120,222 9,120,222 Health-care providers and services (3.0%) Apollo Hospitals Enterprise, Ltd. (India)(NON) 289,662 12,728,054 Universal Vision Biotechnology Co., Ltd. (Taiwan) 540,000 5,917,702 18,645,756 Hotels, restaurants, and leisure (2.7%) Jubilant Foodworks, Ltd. (India)(NON) 127,363 5,470,363 Yum China Holdings, Inc. -

Holdings-Report.Pdf

The Fund is a closed-end exchange traded management Investment company. This material is presented only to provide information and is not intended for trading purposes. Closed-end funds, unlike open-end funds are not continuously offered. After the initial public offering, shares are sold on the open market through a stock exchange. Changes to investment policies, current management fees, and other matters of interest to investors may be found in each closed-end fund's most recent report to shareholders. Holdings are subject to change daily. PORTFOLIO HOLDINGS FOR THE KOREA FUND as of July 31, 2021 *Note: Cash (including for these purposes cash equivalents) is not included. Security Description Shares/Par Value Base Market Value (USD) Percent of Base Market Value SAMSUNG ELECTRONICS CO 793,950 54,183,938.27 20.99 SK HYNIX INC COMMON 197,500 19,316,452.95 7.48 NAVER CORP COMMON STOCK 37,800 14,245,859.60 5.52 LG CHEM LTD COMMON STOCK 15,450 11,309,628.34 4.38 HANA FINANCIAL GROUP INC 225,900 8,533,236.25 3.31 SK INNOVATION CO LTD 38,200 8,402,173.44 3.26 KIA CORP COMMON STOCK 107,000 7,776,744.19 3.01 HYUNDAI MOBIS CO LTD 26,450 6,128,167.79 2.37 HYUNDAI MOTOR CO 66,700 6,030,688.98 2.34 NCSOFT CORP COMMON STOCK 8,100 5,802,564.66 2.25 SAMSUNG BIOLOGICS CO LTD 7,230 5,594,175.18 2.17 KB FINANCIAL GROUP INC 123,000 5,485,677.03 2.13 KAKAO CORP COMMON STOCK 42,700 5,456,987.61 2.11 HUGEL INC COMMON STOCK 24,900 5,169,415.34 2.00 SAMSUNG 29,900 4,990,915.02 1.93 SK TELECOM CO LTD COMMON 17,500 4,579,439.25 1.77 KOREA INVESTMENT 53,100 4,427,115.84 -

Journal of Contemporary Eastern Asia ISSN 2383-9449

Journal of Contemporary Eastern Asia ISSN 2383-9449 Tim Dwyer and Jonathon Hutchinson Through the Looking Glass: The Role of Portals in South Korea’s Online News Media Ecology Journal of Contemporary Eastern Asia Vol. 18, No. 2: 16-32 DOI: 10.17477/jcea.2019.18.2.016 www.jceasia.org www.watef.org Open Access Publication Creative Commons License Deed Attribution-No Derivative Works 3.0 Journal of Contemporary Eastern Asia Vol. 18, No. 2: 16-32 DOI: 10.17477/jcea.2019.18.2.016 Through the Looking Glass: The Role of Portals in South Korea’s Online News Media Ecology Tim Dwyer 1, Jonathon Hutchinson23 Media manipulation of breaking news through article selection, ranking and tweaking of social media data and comment streams is a growing concern for society. We argue that the combination of human and machine curation on media portals marks a new period for news media and journalism. Although intermediary platforms routinely claim that they are merely the neutral technological platform which facilitates news and information flows, rejecting any criticisms that they are operating as de facto media organisations; instead, we argue for an alternative, more active interpretation of their roles. In this article we provide a contemporary account of the South Korean (‘Korean’) online news media ecology as an exemplar of how contemporary media technologies, and in particular portals and algorithmic recommender systems, perform a powerful role in shaping the kind of news and information that citizens access. By highlighting the key stakeholders and their positions within the production, publication and distribution of news media, we argue that the overall impact of the major portal platforms of Naver and Kakao is far more consequential than simply providing an entertaining media diet for consumers. -

Integrating Existing Identity Solutions Into Mobile Connect SK Telecom SKT – Integrating Existing Identity Solutions Into Mobile Connect

Integrating existing identity solutions into Mobile Connect SK Telecom SKT – integrating existing identity solutions into Mobile Connect SKT – integrating existing identity solutions into Mobile Connect Contents Summary: SKT harnesses Mobile Connect to go global 1 SKT’s existing identity services 2 Why integrate with Mobile Connect? 3 How to integrate with Mobile Connect 4 Conclusion and next steps 5 Copyright © 2017 GSMA. The Mobile Connect logo, whether registered or unregistered, is a trade mark owned by GSMA. All rights reserved. Edition 1.0 April 2017 SKT – integrating existing identity solutions into Mobile Connect 1 Summary: SKT harnesses Mobile Connect to go global A new initiative in authentication driven by mobile operators around the globe, Mobile Connect provides convenient, secure and privacy- protecting authentication, authorisation and identity services. SKT is the largest mobile operator in South Korea SKT now plans to leverage the international serving 28 million of the country’s 57 million interoperability offered by Mobile Connect to enable subscribers. By November 2016, SKT’s T-Auth more service providers both in Korea and abroad authentication solution had 13 million monthly users to benefit from its authentication services. Looking making 650 million transactions annually with 27,000 forward, SKT plans to add authorisation – and service providers, including content providers and ultimately identity – capabilities to its third-party social media. Moreover, more than 11 million subscribers product portfolio to address service provider demand were using SKT’s T-ID identity solution to access one or for more specific use cases. more of 15 applications operated by SKT. In December 2016, SKT adapted both T-Auth and T-ID to comply with the Mobile Connect specifications. -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS Columbia Variable Portfolio – Emerging Markets Fund, March 31, 2021 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 95.6% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Argentina 1.3% Meituan, Class B(a) 70,800 2,762,913 Globant SA(a) 8,606 1,786,691 Midea Group Co., Ltd., Class A 222,100 2,798,518 MercadoLibre, Inc.(a) 2,762 4,066,051 NetEase, Inc., ADR 32,781 3,384,966 Total 5,852,742 New Horizon Health Ltd.(a) 279,500 2,092,448 Brazil 6.2% New Oriental Education & Technology Group, Inc., ADR(a) 261,380 3,659,320 Afya Ltd., Class A(a) 127,133 2,363,402 Ping An Insurance Group Co. of China Ltd., Class H 337,000 4,030,977 Arco Platform Ltd., Class A(a) 43,990 1,114,706 Shenzhou International Group Holdings Ltd. 198,900 4,160,302 Banco BTG Pactual SA 143,368 2,465,604 Silergy Corp. 35,000 2,886,855 BK Brasil Operacao e Assessoria a Restaurantes SA(a) 536,978 920,618 Skshu Paint Co., Ltd. 59,395 1,809,367 Hapvida Participacoes e Investimentos SA 379,189 1,000,410 Songcheng Performance Development Co., Ltd., Itaú Unibanco Holding SA, ADR 343,833 1,705,412 Class A 855,600 2,805,282 Localiza Rent a Car SA 254,180 2,706,786 TAL Education Group, ADR(a) 61,838 3,329,976 Locaweb Servicos de Internet SA 395,358 1,608,503 Tencent Holdings Ltd. -

Fintech South Korea Market Intelligence Report Contents

Fintech South Korea Market Intelligence Report Contents 1. Introduction 2 2. Korea: An Overview 3 3. Korea’s Fintech Ecosystem 4 Traditional Banks 5 Online-only Banks 6 4. Korea’s Fintech Markets 7 Digital Payment Platforms 7 P2P Loans and Crowdfunding 10 Blockchain 12 AI in Finance 14 Insurtech 15 Regtech 15 5. Regulations 16 6. Government Initiatives and Policy Roadmap 18 Regulatory Sandbox Program 18 UK-Korea FinTech Bridge 19 Open Banking 21 MyData 21 P2P Lending 21 Regtech Platform 21 7. Market Entry Strategies 22 Associations and Exhibitions 25 Contact details 26 Fintech South Korea – Market Intelligence Report 1 About Intralink Intralink is an international business development consultancy with a deep specialism in East Asia. Our mission is to make companies’ growth in overseas markets fast, easy and cost effective. We have 80 multilingual employees, a 30-year track record and offices in London, Silicon Valley, Boston, Shanghai, Tokyo, Seoul and Taipei. We enable Western companies to expand in Asia, and Asian companies in the West. We do this by providing the in-country expertise to identify a company’s market opportunity, secure sales and drive its business growth. Our teams are immersed in the business practices, cultures and customs of their local markets. And we are different from other consultancies as we do not just develop market expansion strategies for our clients — we play a hands-on role in building their businesses. Through our Surrogate Sales Program™, we close deals, generate revenues and, when a client is ready, help them set up a permanent in-country presence through a local subsidiary, partnership or acquisition. -

SK Telecom Announces 1Q 2021 Earnings Results

FOR IMMEDIATE RELEASE SK Telecom Announces 1Q 2021 Earnings Results - The company posts revenue of KRW 4.781 trillion, operating income of KRW 388.8 billion, and net income of KRW 572.0 billion. - Compared to the same period last year, the revenues of Media, Safety & Care and Commerce businesses increased by 17.6%, 20.3% and 7%, respectively. - The company catered to diverse needs of customers by launching new 5G price plans and subscription-based services in areas including education and rental. Seoul, Korea, May 11, 2021 – SK Telecom (NYSE:SKM, hereinafter referred to as “SKT”) today announced its earnings for the first quarter of 2021 on a K-IFRS consolidated basis: revenue of KRW 4.781 trillion, operating income of KRW 388.8 billion, and net income of KRW 572.0 billion. Compared to the same period last year, SKT’s consolidated revenue and operating income increased by 7.4% and 29%, respectively, backed by the growth of its New ICT businesses including Media, Safety & Care (formerly Security) and Commerce. The combined total revenue of SKT’s New ICT Businesses has increased by 16.7% year-on- year (YoY) to KRW 1.521 trillion, taking up 31.8% of SKT’s total revenue for the first quarter. Their combined total operating income expanded by 64.1% YoY to KRW 103.4 billion. Net income grew by 86.9% YoY affected by factors including increased equity method gains from SK Hynix. The Media business achieved remarkable growth in both revenue and operating income affected by the growth of the IPTV business and SK Broadband’s merger with T-broad. -

Top 10 Relative Contributors and Detractors Equity Funds Quarter End As of June 30, 2021

Top 10 Relative Contributors and Detractors Equity Funds Quarter End as of June 30, 2021 Holdings are subject to change. The information below is derived using the portfolio's holdings as of the beginning of each month included in the quarter ending on the date indicated, does not reflect intramonth trading activities, and may not be representative of the current or future investments of the portfolio. Portfolio and index weights below are average weights in each company over the period as represented by the portfolio's holdings or the index's constituents as of the beginning of each month included in the quarter. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy or sell the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. To obtain a list showing every holding as a percentage of the portfolio at the end of the most recent publicly available disclosure period, visit www.dimensional.com. Relative Contribution Difference reflects how the portfolio's holdings impacted return relative to the benchmark. Relative Contribution Difference compares the performance of a security in the portfolio to the benchmark’s total return, factoring in the difference in weight of that security in the benchmark. Returns are calculated using daily security returns and month end weights. In aggregate, portfolio return estimates are gross of advisory fees, may exclude certain derivatives and will differ from actual fund performance. -

Kakao Games to Overshoot to the Upside

[Korea] September 10, 2020 Game s (Overweight/Maintain) Kakao Games to overshoot to the upside Mirae Asset Daewoo Co., Ltd. Chang-kwean Kim [email protected] HeeSeok Lim [email protected] Game performance trends Analysis of game performance trends in July and August (Sensor Tower data) We analyzed the revenue trends of major titles using data from mobile app data provider Sensor Tower. Our figures are based on a statistical analysis and may differ from actual revenue, depending on the time series and sample size. Thus, our figures should be viewed as a reference for the performance trends of each title, rather than as absolute values. New title expectations to drive Initiate our coverage on Kakao Games with a Buy rating and TP of W42,000 momentum The release schedule for blockbuster titles is the most important variable in the valuation of game companies. Generally speaking, game stocks trade at high P/Es when frequent new releases provide sustained momentum. Shares of NCsoft, Netmarble (251270 KS/CP: W189,000), and Pearl Abyss (263750 KQ/CP: W196,700) have traded at average P/Es of 24x, 50x, and 14x, respectively, since their IPOs. Notably, expectations for blockbuster titles caused the valuations of Netmarble and Pearl Abyss to surge right after their IPOs (with P/Es reaching 80x and 200x, respectively). Kakao Games’ offering price implies a 2020F P/E of 19x; our target price implies a P/E of 30x. Notable stocks in 3Q20: Webzen Small/mid -sized game stocks to monitor in 2H20: Webzen and JoyCity and JoyCity The market is expecting both Webzen (069080 KQ/CP: W36,750) and JoyCity (067000 KQ/CP: W22,250) to deliver record revenue, backed by the solid performance of existing titles and the commercial success of new titles. -

Schedule of Investments the Korea Fund, Inc

Page 1 of 2 Schedule of Investments The Korea Fund, Inc. September 30, 2020 (unaudited) Shares Value^ COMMON STOCK—97.0% Air Freight & Logistics—1.1% 15,728 Hyundai Glovis Co., Ltd. $ 1,933,849 Auto Components—2.4% 21,783 Hyundai Mobis Co., Ltd. 4,273,472 Automobiles—7.7% 71,626 Hyundai Motor Co. 10,910,079 68,360 Kia Motors Corp. 2,741,368 13,651,447 Banks—3.6% 56,329 Hana Financial Group, Inc. 1,353,195 81,721 KB Financial Group, Inc. 2,631,415 99,489 Shinhan Financial Group Co., Ltd. 2,334,068 6,318,678 Biotechnology—4.6% 23,163 Celltrion, Inc. (e) 5,095,026 20,037 Hugel, Inc. (e) 3,122,677 8,217,703 Capital Markets—1.2% 35,388 Korea Investment Holdings Co., Ltd. 2,187,132 Chemicals—7.2% 42,710 Kumho Petrochemical Co., Ltd. 4,006,770 14,149 LG Chem Ltd. 7,897,545 16,749 OCI Co., Ltd. 812,057 12,716,372 Electronic Equipment, Instruments & Components—4.6% 4,395 LG Innotek Co., Ltd. 579,998 15,493 Samsung Electro-Mechanics Co., Ltd. 1,836,064 15,472 Samsung SDI Co., Ltd. 5,715,641 8,131,703 Entertainment—2.7% 1,452 Big Hit Entertainment Co., Ltd. (c)(d)(e) 167,610 6,724 NCSoft Corp. 4,633,731 4,801,341 Food & Staples Retailing—0.4% 6,380 E-MART, Inc. 770,839 Healthcare Providers & Services—0.4% 8,660 Celltrion Healthcare Co., Ltd. (e) 649,605 Hotels, Restaurants & Leisure—0.4% 40,808 Kangwon Land, Inc. -

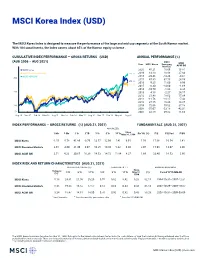

MSCI Korea Index (USD)

MSCI Korea Index (USD) The MSCI Korea Index is designed to measure the performance of the large and mid cap segments of the South Korean market. With 104 constituents, the index covers about 85% of the Korean equity universe . CUMULATIVE INDEX PERFORMANCE — GROSS RETURNS (USD) ANNUAL PERFORMANCE (%) (AUG 2006 – AUG 2021) MSCI Year MSCI Korea Emerging MSCI Markets ACWI IMI MSCI Korea 2020 45.21 18.69 16.81 MSCI Emerging Markets 330.11 2019 13.10 18.88 27.04 MSCI ACWI IMI 2018 -20.46 -14.24 -9.61 300 2017 47.80 37.75 24.58 275.40 2016 9.25 11.60 8.96 252.73 2015 -6.30 -14.60 -1.68 2014 -10.70 -1.82 4.36 200 2013 4.18 -2.27 24.17 2012 21.48 18.63 17.04 2011 -11.76 -18.17 -7.43 2010 27.15 19.20 14.87 100 2009 72.06 79.02 37.18 2008 -55.07 -53.18 -42.01 50 2007 32.58 39.82 11.66 Aug 06 Nov 07 Feb 09 May 10 Aug 11 Nov 12 Feb 14 May 15 Aug 16 Nov 17 Feb 19 May 20 Aug 21 INDEX PERFORMANCE — GROSS RETURNS (%) (AUG 31, 2021) FUNDAMENTALS (AUG 31, 2021) ANNUALIZED Since 1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr May 31, 1994 Div Yld (%) P/E P/E Fwd P/BV MSCI Korea -1.55 -5.78 41.80 -0.79 12.57 12.96 7.41 6.91 1.56 17.06 10.54 1.41 MSCI Emerging Markets 2.65 -4.00 21.49 3.07 10.25 10.80 5.22 6.30 2.07 15.98 13.07 2.00 MSCI ACWI IMI 2.51 4.33 30.65 16.38 14.53 14.72 11.84 8.27 1.69 23.40 18.53 2.90 INDEX RISK AND RETURN CHARACTERISTICS (AUG 31, 2021) ANNUALIZED STD DEV (%) 2 SHARPE RATIO 2 , 3 MAXIMUM DRAWDOWN Turnover Since 1 3 Yr 5 Yr 10 Yr 3 Yr 5 Yr 10 Yr May 31, (%) Period YYYY-MM-DD (%) 1994 MSCI Korea 5.18 24.61 21.00 20.20 0.55 0.62 0.42 0.28 82.15 1994-10-31—1997-12-31 MSCI Emerging Markets 8.45 19.23 16.52 17.57 0.54 0.63 0.34 0.43 65.14 2007-10-29—2008-10-27 MSCI ACWI IMI 3.24 18.47 14.81 14.00 0.76 0.92 0.82 0.43 58.28 2007-10-31—2009-03-09 1 Last 12 months 2 Based on monthly gross returns data 3 Based on ICE LIBOR 1M The MSCI Korea Index was launched on Mar 31, 1989. -

Morning the Most Recent Monthly Price List When Purchasing a Car and Contact a Sales Representative

Kia maintains the same prices and sales conditions nationwide to safeguard customers' trust. Discrepancies between the brochure and products sold may occur due to changes since the time of printing. Specifications may change due to suppliers’ conditions. Photographs may depict optional features. Please refer to Morning the most recent monthly price list when purchasing a car and contact a sales representative. •Colors depicted in photographs may differ from the actual colors due to printing limitations. •Navigation functions and information displayed may differ according to the time of the navigation system update. •Drive efficiently: 1.Do not accelerate or stop abruptly. 2.Use only genuine parts to optimize product performance and extend life expectancy. •Caution: Please read the car manual before initial use for safe driving. •Please recycle this booklet and protect the environment. •Customer center: 080-200-2000 This PDF file is for reference only Discrepancies between the brochure and products sold may occur due to the time of printing. Please refer to the most recent monthly price list when purchasing a car and contact a sales master. 07 / 0 1 2021 the publication date PDF REFERENCE _ Jul 1, 2021. PDF REFERENCE _ Jul 1, 2021. MORNING Urban 02 / 03 Joyful Adventurous Stylish Delicious Keep cool under pressure, Spice up your day with rhythm, Be smart with stuffy routines. City life can be a hundred times more fun when it's spent together with Morning. Urban mobility made for you Specifications may vary according to the trim and options that are selected. PDF REFERENCE _ Jul 1, 2021. PDF REFERENCE _ Jul 1, 2021.