$1,936,855,000

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chicago Transit Authority (CTA)

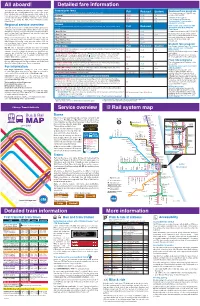

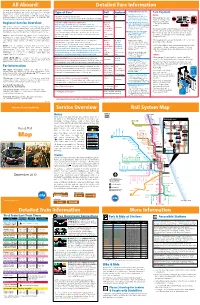

06JN023apr 2006.qxp 6/21/2006 12:37 PM Page 1 All Aboard! Detailed Fare Information First Bus / Last Bus Times All CTA and Pace buses are accessible X to people with disabilities. This map gives detailed information about Chicago Transit # ROUTE & TERMINALS WEEKDAYS SATURDAY SUNDAY/HOL. # ROUTE & TERMINALS WEEKDAYS SATURDAY SUNDAY/HOL. # ROUTE & TERMINALS WEEKDAYS SATURDAY SUNDAY/HOL. Authority bus and elevated/subway train service, and shows Type of Fare* Full Reduced Reduced fares are for: You can use this chart to determine days, hours and frequency of service, and Fare Payment Farareboebox Topop where each route begins and ends. BROADWAY DIVISION ILLINOIS CENTER/NORTH WESTERN EXPRESS Pace suburban bus and Metra commuter train routes in the 36 70 Division/Austin east to Division/Clark 4:50a-12:40a 5:05a-12:40a 5:05a-12:40a 122 CASH FARE Accepted on buses only. $2 $1 Devon/Clark south to Polk/Clark 4:00a-12:10a 4:20a-12:00m 4:20a-12:15a Canal/Washington east to Wacker/Columbus 6:40a-9:15a & CTA service area. It is updated twice a year, and available at CTA Children 7 through 11 BUSES: CarCardsds It shows the first and last buses in each direction on each route, traveling Polk/Clark north to Devon/Clark 4:55a-1:20a 4:55a-1:05a 4:50a-1:15a Division/Clark west to Division/Austin 5:30a-1:20a 5:40a-1:20a 5:45a-1:20a 3:40p-6:10p Exact fare (both coins and bills accepted). No cash transfers available. years old. -

Alternate Service Information

Project Overview Project Benefits CTA understands that our customers CTA is rebuilding the south Red Line Why is this work will experience longer-than-normal from just north of Cermak-Chinatown to commuting times during the Red Line South 95th/Dan Ryan. necessary? Reconstruction Project. Our goal is to provide a number of convenient travel options, and to The work will benefit Red Line riders for The Dan Ryan Branch opened in 1969, minimize the project’s impact as much decades to come—through faster travel when Richard Nixon was in the White House, as possible. times, increased reliability, and spruced-up a gallon of gas cost 35 cents and Gale Sayers stations with a variety of improvements. won the NFL rushing title. The original tracks To help guide you through your travel are well beyond their expected lifespan, and alternatives, CTA is providing a number Starting this May, the Red Line will be call for a complete replacement. Because of of travel options. You can read about completely closed for five months, from the the poor track condition, trains must travel the alternative service options for your Cermak-Chinatown station to the 95th Street slower—meaning trips are longer. Without neighborhood inside this brochure. Alternate Service station. CTA will offer several alternative travel rehabilitation, rail service will become even options during this closure to minimize the slower and the cost for replacement will In addition, to make travel easier for South Information impact on customers as much as possible continue to grow. Side residents during the project, CTA is (see other side of this brochure). -

First Bus All Aboard! Rail System Map Detailed Fare in for Ma Tion Service

All aboard! Detailed fare in for ma tion First bus / last bus times This map gives detailed information about Chica go Transit Base/regular fares All CTA and Pace buses are accessible to people with disabilities. # ROUTE & TERMINALS WEEKDAYS SATURDAY SUN./HOL. # ROUTE & TERMINALS WEEKDAYS SATURDAY SUN./HOL. # ROUTE & TERMINALS WEEKDAYS SATURDAY SUN./HOL. Authority bus and el e vat ed/sub way train ser vice, and shows Full Reduced Student Reduced fare program X Pay-per-ride fares, as deducted from value in a Ventra Transit Account Use this chart to determine days, hours of service, where each Pace subur ban bus and Metra commut er train routes in the The following groups are eligible to pay a reduced fare on CTA: CTA ser vice area. It is up dat ed regularly, and avail able at ‘L’ train fare $2.50* $1.25 75¢ route begins and ends, and first and last buses in each direction Wallace/Racine West Lawrence Inner Drive/Michigan Express 44 Racine/87th north to Halsted (Orange) 4:30a-9:40p 8:00a-6:00p 9:00a-6:00p 81W Cumberland (Blue) east to Jeff Park (Blue) 5:25a-10:25p 5:20a-10:20p 8:45a-10:15p 14 6 Berwyn (Red) south to Museum Campus 5:55a-10:40p 6:00a-10:40p 6:00a-10:40p † on each route. X X X CTA rail stations, Metra down town terminals, visitor cen ters, Bus fare $2.25 $1.10 75¢ Children 7 through 11 Halsted (Orange) south to Racine/87th 5:15a-10:25p 8:50a-6:45p 9:45a-6:45p Museum Campus north to Berwyn (Red) 7:00a-11:35p 6:50a-11:40p 6:50a-11:35p X Jeff Park X (Blue) west to Cumberland X (Blue) 4:55a-9:55p 4:50a-9:50p 8:20a-9:50p air ports, or by calling the RTA. -

Service Overview Rail System Map Detailed Fare in for Ma Tion

All Aboard! Detailed Fare In for ma tion This map gives detailed information about Chi ca go Transit Authority Reduced fares are for: bus and el e vat ed/sub way train ser vice, and shows Pace suburban Type of Fare* Full Reduced Fare Pay ment bus and Metra com mut er train routes in the CTA service area. It is 1 Children 7 through 11 BUSES: Farebox Top up dat ed twice a year, and avail able at CTA rail stations, Metra Each child pays a reduced fare. Cash Fare Accepted on buses only. $2.25 $1 down town terminals, visitor cen ters, air ports, or by calling the RTA Children under 7 ride free • When using a Chicago a Travel In for ma tion Cen ter num ber below. Exact fare (both coins and bills accepted). No cash transfers available. C with a fare-paying customer. Card® or Chicago Card P Plus®, touch the card a ® ® 2 Grade & high school students CHICAGO CARD /CHICAGO CARD PLUS Deducts Regional Service Overview with CTA Student Riding Permit to the designated pad Buy Chicago Card and Chicago Card Plus online at 1st ride Obtain through school; otherwise and go. a CTA runs buses (routes 1 to 206) and elevated/subway trains serving chicago-card.com. Call 1-888-YOUR-CTA (1-888-968-7282); TTY: $2 (Bus) ________ call 312-932-2923. Valid 5:30am the city and 40 nearby sub urbs. Most routes run daily through late 1-888-CTA-TTY1 (1-888-282-8891) for more information. $2.25 (Rail) to 8pm on school days. -

CTA: CTA Ser Vice Area

All Aboard! Detailed Fare In for ma tion This map gives detailed information about Chica go Transit Base/Regular Fares Full Reduced Student Reduced Fare Program Authority bus and el e vat ed/sub way train ser vice, and shows (Deducted from Transit Value in a Ventra Transit Account on a Ventra Card or personal bankcard. Pace subur ban bus and Metra comm ut er train routes in the The following groups are eligible to pay a reduced fare on CTA: CTA ser vice area. It is up dat ed regularly, and avail able at ‘L’ train fare $2.25* $1.10 75¢ CTA rail stations, Metra down town terminals, visitor cen ters, Bus fare† $2 $1 75¢ Children 7 through 11 air ports, or by calling the RTA. Travel In for ma tion Cen ter Each child pays a reduced fare. num ber below. Transfer (up to two additional ‘L’ train or bus rides within two hours) 25¢ 15¢ 15¢ Children under 7 ride free with a fare-paying customer. Passes Regional Service Overview Seniors 65+ and customers with (Loaded onto a Ventra Transit Account on a Ventra Card or personal bankcard. Provides unlimited Full Reduced CTA runs buses (routes 1 to 206) and elevated/subway trains disabilities with RTA Reduced rides for period of pass beginning with first use). serving the city and 35 nearby sub urbs. Most routes run daily Fare Permit through late evening, ev ery 10 to 20 minutes. Sunday schedules 1-Day CTA Pass $10 –––– –––– For application information, call 312-913-3110. apply on New Year’s Day, Memorial Day, July 4th, Labor Day, 3-Day CTA Pass $20 –––– –––– Qualifying riders can pay a reduced fare Thanksgiving and Christmas.