2001 Qantas Financial Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

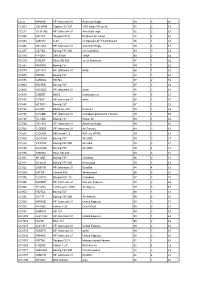

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK-HFM Tupolev Tu-134 CSA -large OK on fin 91 2 £3 CC211 G-31-962 HP Jetstream 31 American eagle 92 2 £1 CC368 N4213X Douglas DC-6 Northern Air Cargo 88 4 £2 CC373 G-BFPV C-47 ex Spanish AF T3-45/744-45 78 1 £4 CC446 G31-862 HP Jetstream 31 American Eagle 89 3 £1 CC487 CS-TKC Boeing 737-300 Air Columbus 93 3 £2 CC489 PT-OKF DHC8/300 TABA 93 2 £2 CC510 G-BLRT Short SD-360 ex Air Business 87 1 £2 CC567 N400RG Boeing 727 89 1 £2 CC573 G31-813 HP Jetstream 31 white 88 1 £1 CC574 N5073L Boeing 727 84 1 £2 CC595 G-BEKG HS 748 87 2 £2 CC603 N727KS Boeing 727 87 1 £2 CC608 N331QQ HP Jetstream 31 white 88 2 £1 CC610 D-BERT DHC8 Contactair c/s 88 5 £1 CC636 C-FBIP HP Jetstream 31 white 88 3 £1 CC650 HZ-DG1 Boeing 727 87 1 £2 CC732 D-CDIC SAAB SF-340 Delta Air 89 1 £2 CC735 C-FAMK HP Jetstream 31 Canadian partner/Air Toronto 89 1 £2 CC738 TC-VAB Boeing 737 Sultan Air 93 1 £2 CC760 G31-841 HP Jetstream 31 American Eagle 89 3 £1 CC762 C-GDBR HP Jetstream 31 Air Toronto 89 3 £1 CC821 G-DVON DH Devon C.2 RAF c/s VP955 89 1 £1 CC824 G-OOOH Boeing 757 Air 2000 89 3 £1 CC826 VT-EPW Boeing 747-300 Air India 89 3 £1 CC834 G-OOOA Boeing 757 Air 2000 89 4 £1 CC876 G-BHHU Short SD-330 89 3 £1 CC901 9H-ABE Boeing 737 Air Malta 88 2 £1 CC911 EC-ECR Boeing 737-300 Air Europa 89 3 £1 CC922 G-BKTN HP Jetstream 31 Euroflite 84 4 £1 CC924 I-ATSA Cessna 650 Aerotaxisud 89 3 £1 CC936 C-GCPG Douglas DC-10 Canadian 87 3 £1 CC940 G-BSMY HP Jetstream 31 Pan Am Express 90 2 £2 CC945 7T-VHG Lockheed C-130H Air Algerie -

Annual Report 2005 Annual Report 2005 > Our Customers Our Future Our Brand Our Business Our Priority X Spirit of Australia Qantas Annual Report 2005

Qantas Annual Report 2005 Report Annual > Our Customers Our Brand Our Priority Spirit of Australiax Our Future Our Business Qantas AnnualReport2005 Qantas Annual Report 2005 ~Corporate Directory~ REGISTERED OFFICE QANTAS SHARE REGISTRY STOCK EXCHANGE Qantas Airways Limited Level 8 Australian Stock Exchange ABN 16 009 661 901 580 George Street 20 Bridge Street Sydney NSW 2000 Sydney NSW 2000 Qantas Centre Australia Australia Level 9, Building A 203 Coward Street or DEPOSITARY FOR AMERICAN Mascot NSW 2020 Locked Bag A14 Australia Sydney South NSW 1235 DEPOSITARY RECEIPTS Australia The Bank of New York Telephone 61 2 9691 3636 ADR Division Facsimile 61 2 9691 3339 Freecall 1800 177 747 101 Barclay Street Website www.qantas.com International 61 2 8280 7390 New York NY USA Our Brand Priority Our Our Facsimile 61 2 9287 0303 Telephone 1 212 815 2218 Email [email protected] Facsimile 1 212 571 3050 Website www.qantas.com GENERAL COUNSEL & Our Customers COMPANY SECRETARY > Our Future Our Business Brett Johnson Designed and produced by Armstrong Miller+McLaren – www.amm.com.au Photography by Bob Armstrong and Mike Armstrong Qantas Annual Report 2005 ~Our Customers~ 1~ Customers are at the centre of everything we dox This year, we carried more than 32 million people to We know that different travellers have different 145 destinations in 40 countries around the world. needs, which is why we offer different experiences for the business traveller, the leisure traveller, the Our goal is to give each customer the best possible regional flyer and, with Jetstar, a whole new group travel experience, from the time they choose to of customers who are first-time flyers. -

2007 Annual Report

A New Era Annual Report 2007 1944 1947 1968 1984 2007 The original kangaroo The winged kangaroo The flying kangaroo The flying kangaroo was A new interpretation symbol, which appeared symbol first appeared was placed in a circle refined to a more slender, of the logo was revealed. on Qantas aircraft in 1947 to coincide and the aircraft livery stylised presentation. The modern kangaroo was adapted from the with Qantas’ introduction was modified on the The wings on the was designed to reflect Australian one penny coin. of Lockheed L749 Boeing 707 V-jets. The kangaroo were removed the changing structure Constellations. words “Overseas Airline” to help strengthen of the A380 and other were removed from the the design and the new generation aircraft, fuselage, leaving the typeface for the airline’s and keeping with the words ”Australia” and name was changed airline’s increasing focus “Qantas.” The Australian from hand-drawn to on contemporary design flag was moved from a standard typeface. for its inflight and on-the- the rear of the aircraft, ground products. to sit in between these two words. Contents 01 About Qantas 49 Performance Summary 02 Our Key Objectives 50 Discussion and Analysis 04 Financial Highlights of Performance Summary 05 Operational Highlights 54 Directors‘ Report 06 Report from the Chairman 72 Financial Statements & the Chief Executive and Notes Officer 134 Shareholder Information 10 Qantas 135 Qantas Group Five Year 18 Jetstar Summary 22 Portfolio Businesses 136 Sustainability Information 30 Sustainability 141 Financial Calendar 40 Board of Directors 44 2007 Corporate Governance Statement About Qantas Tenacity and the ability to survive adverse conditions have characterised the history of Qantas since its first tentative flights across outback Queensland in the early 1920s. -

Cabinet Minute '$

DECISION NO. CABINET MINUTE '$ .. v ( / c BRISBANE, Department of Transport - Air Queensland Se rvice s. SUBJECT:--~~---~~---~~---------------=~-------------=-~~---~------------------- J1;, ;oples Received at o-t.::> -a-;-m. v p.m. Copies Made CIRCULATION DETAILS GOVERNOR ; Decision F ile 1 21 MR. AHERN d 2 22 ~--1'~ y '( I 3 23 MR. GUNN LI~ hrnic-ci ~ - , 4 MR. GIBBS ·1 24 ,A_.___ Cf , _~,_ .... lk!l..-.:£ [r\~-- ( -- 6~ - ~~~-~ ,,,,_ 11~ MR.. GLASSO~ L t 5 25 G--,.____ \~ ---- --- MR. AUSTIN 6 f 26 MR. LESTER ' 7 2 7 lo MR. Tt;NNI 8 "" 28 - g MR. HARPER 29 10 MR. MUNTZ 30 1 1 MR. MCKECH ~IE 31 12 MR. KATTER q' 32 13 MR. NEAL 3 3 14 MR. CLAUSOJ l 34 MR. BORBIDI ;E 15 35 16 MR. RANDEL u 36 17 MR. COOP ER 3 7 18 MR. HARVEY 38 MR. LITTLE i>ROUD 19 39 Mast er F il~11o 20 40 . 1 J. : ' " I ( I . ',1 .J I ' Copy Noo 2 Q C 0 N F I D E N T I A L C A B I N E T f'l I N U T E Brisbane, 26th April, 1988 Decision Noo 54116 Submission No. 48810 TITLE~ Department of Transport - Air Queensland Serviceso CABINET decided:- 1. That the exemption of the Cairns-tJeipa and Cairns-Thursday Island (Horn Island) air routes in respect of air passenger travel ~om the "open skies" policy be continued until 31st December, 1990. 2. That in keeping with the exemption mentioned above, exclusive licensing rights be given to Australian Airlines trading as ~ir Queensland to operate the abovementioned services until 3ls December, 1990. -

PROSPECTUS Regional Express Holdings Limited ACN 099 547 270

Our heart is in the country Lead Manager & Underwriter TRICOM EQUITIES PROSPECTUS Regional Express Holdings Limited ACN 099 547 270 TABLE OF CONTENTS Important Notice 1 Letter From The Chairman 3 1. Key Dates & Offer Statistics 6 2. Investment Highlights 8 3. Summary Of The Offer 12 4. The Australian Aviation Industry 22 5. Business Overview 30 6. Investment In Pel-Air 56 7. Directors and Senior Management 68 8. Financial Information 80 9. Risk Factors 112 10. Investigating Accountants’ ReportsReport 118 11. Additional Information 128 Glossary 165 1 Regional Express Holdings Limited IMPORTANT NOTICE THIS IS NOT INVESTMENT ADVICE Prospectus to be examined by market – YOU SHOULD SEEK YOUR OWN participants prior to the raising of FINANCIAL ADVICE funds. Any Applications received THIS PROSPECTUS The Offer does not take into during the Exposure Period will not The Offer contained in this account the investment objectives, be processed until after the expiry Prospectus is an invitation to apply financial situation and particular of that period. No preference will for Shares in Regional Express needs of any investor. Before be conferred on any Applications Holdings Limited ACN 099 547 270 deciding to invest in the Shares received during the Exposure (the Company or Rex). potential investors should read the Period. This Prospectus will be entire Prospectus. In particular, in made generally available during the This Prospectus is a replacement considering the prospects of the Exposure Period on the Company’s prospectus dated 29 September 2005 Company, it is important that you website, www.rex.com.au. and was lodged with the Australian consider the risk factors that could Securities & Investment Commission affect the financial performance ELECTRONIC PROSPECTUS (ASIC) on that date. -

I ■Ii Wm ■ I ■'M■ Hi PI M HI :Ii I >M L M .'T, •■ " ' '^V.: I K M 11# I !;■: ■ • -,

I ■ii Wm ■ I ■'M■ Hi PI m HI :iI I >M l m .'T, •■ " ' '^v.: I K m 11# I !;■: ■ • -, - . -V. , 'Y_^ IIH IRSIII K I .:SJ i /• i.:» . ■ .^m ■i ■ k i m I ■ m I ii 1 I I I n I - -I M ii il Hi I ’m pi IH M "I Ii I a ii :MJ lii^H il ................................ ...............Ii- ', ilipf - 1:W I ^He Journal of the Aviation Historical Society of Australia Inc. aoossgssp WM VI- Volume 29 Numbers M i .... m liillii iii i ill ‘ iiii II lipl ill ii ill IIP m mmm sS :i■ 1 Ii ■ Duigan and Ro m ■ 11 iiil ■ II •3 Flying the Jindivick _ IIPIi ■ Paddy Heffernan ~ Series - Part 5 I mPlH 'Mil II m 8#' 1 fc. IP The Journal of the AVIATION HISTORICAL SOCIETY im of AUSTRALIA Inc. A00336533P Volume 29 - Number 3 - June 1998 EDITORS, DESIGN & PRODUCTION Bill and Judith Baker EDITORIAL Address all correspondence to; This month we say goodbye to another Australian The Editor, AHSA, Aviation legend - The Jindivick. Sold down the river, P.O. Box 2007, gone is the manufacturing capabilities, the trained flying South Melbourne 3205 Victoria, Australia. controllers. To be replaced by an American product. 03 9583 4072 Phone & Fax Sound familiar? Nomad, Victa, Wamira and on and on! Subscription Rates; What is wrong with our, as in most of afore mentioned Australia A$40. products, service personnel who are responsible for Rest of World A$50. Surface Mail these decisions. As in the case of Wamira the goal A$65. -

1998 ANNUAL REPORT1998 ANNUAL 1998 Annual Report Brought to You by Global Reports 1998 Annual Report

1998 ANNUAL REPORT 1998 Annual Report Brought to you by Global Reports 1998 Annual Report Registered Office Financial Calendar Notice of Meeting Qantas Airways Limited 1998 The Annual General Meeting of ACN 009 661 901 30 June Year end Qantas Airways Limited will be held Qantas Centre 20 August Preliminary final result at 2:00 pm on Wednesday Level 9 Building A announcement 18 November 1998 in the 203 Coward Street 4 November Record date for final Grand Ballroom at the Mascot NSW 2020 dividend Sheraton Brisbane Hotel & Towers, Australia 18 November Annual General Meeting 249 Turbot Street, Brisbane. Telephone 61 2 9691 3636 Brisbane Facsimile 61 2 9691 3339 2 December Final dividend payable 31 December Half year end Qantas Share Registry 60 Carrington Street 1999 Sydney NSW 1115 18 February Half year result Australia announcement Telephone 61 2 8234 5470 3 March Record date for interim Facsimile 61 2 8234 5050 dividend 31 March Interim dividend payable Depositary for American 30 June Year end Depositary Receipts 19 August Preliminary final result The Bank of New York announcement ADR Division 3 November Record date for final 101 Barclay Street dividend New York NY USA 17 November Annual General Meeting Telephone 1 212 815 2218 Adelaide Facsimile 1 212 571 3050 1 December Final dividend payable General Counsel & Company Secretary Brett Johnson Internet Address http://www.qantas.com.au All amounts are expressed in Australian dollars unless otherwise stated. Brought to you by Global Reports Operating profit before abnormals and tax of $478 -

Intrastate Aviation

INDUSTRY COMMISSION INTRASTATE AVIATION REPORT NO. 25 17 JULY 1992 Australian Government Publishing Service Canberra © Commonwealth of Australia 1992 ISBN 0 644 25447 5 This work is copyright. Apart from any use as permitted under the Copyright Act 1968, no part may be reproduced by any process without prior written permission from the Australian Government Publishing Service. Requests and inquiries Concerning reproduction and rights should be addressed to the Manager, Commonwealth Information Services, Australian Government Publishing Service, GPO BOX 84, Canberra ACT 2601. Printed for AGPS by Pirie Printers Pty Limited, PO Box 438, Fyshwick ACT 2609 INDUSTRY COMMISSION 17 April 1992 The Honourable J S Dawkins M P Treasurer Parliament House CANBERRA ACT 2600 Dear Treasurer In accordance with Section 7 of the Industry Commission Act 1989, we submit to you the Commission’s report on Interstate Aviation. Yours sincerely Gary Banks Ken Wraith Presiding Commissioner Associate Commission COMMISSIONER Benjamin Offices, Chan Street, Belconnen ACT Australia PO BOX, Belconnen ACT 2616 Telephone: 06 264 1144 Facsimile: 06 253 1662 CONTENTS Page ABBREVIATIONS viii TERMS OF REFERENCE x OVERVIEW 1 FINDINGS AND RECOMMENDATIONS 9 1 INTRODUCTION 13 2 INDUSTRY STRUCTURE AND MARKETS 17 2.1 Structure of domestic aviation 17 2.2 Intrastate aviation markets 29 3 THE POLICY ENVIRONMENT 35 3.1 The powers of the Commonwealth and states/territories 35 3.2 Regulation of interstate aviation 36 3.3 State and territory licensing systems 42 4 ECONOMIC REGULATION OF -

Our Complete History

Cairns Chamber of Commerce 100 Years of History Pre 1909 – setting the scene The decision to create a remote community on the banks of untamed Trinity Bay, and the arrival of several hundred intrepid settlers in 1876, were the genesis of the City of Cairns. Facing these pioneering men, women and children as they sailed into sight of land ‐ on board the Leichhardt, Victoria and Porpoise – was an overwhelming contradiction of dense mangrove swamps, mudflats and sand dunes set against a spectacular blue‐green mountain backdrop. Before them were timber shanties, tents, and make‐shift jetties niched into small clearings around the water’s edge. Watching from a distance were members of the local indigenous clans who had occupied this land for over 50,000 years. These clans – Yirranydji and Yidinji – settled into a defensive and uneasy existence with the new arrivals. Government hydrographic and survey vessels and fishermen anchored in Trinity Inlet during the decade or two before the Far North’s gold rush began. Hardy prospectors chasing gold on the Palmer River had begun arriving in 1873. Primitive infrastructure was erected on the foreshore to service the promising goldfields to the wild north, and newly discovered tin deposits around Herberton and Irvinebank in the largely unexplored hinterland. James Venture Mulligan’s announcement in Cooktown in early 1876 that alluvial gold had been discovered, led to a rush of nearly 3000 miners to Hodgkinson goldfield. His accurate warning that the find would not pay out went unheeded by miners and the government of the day, all in the grip of gold fever. -

Legislative Assembly Hansard 1982

Queensland Parliamentary Debates [Hansard] Legislative Assembly TUESDAY, 17 AUGUST 1982 Electronic reproduction of original hardcopy Papers 17 August 1982 153 TUESDAY, 17 AUGUST 1982 Mr SPEAKER (Hon. S. J. Muller, Fassifern) read prayers and took the chair at 11 a.m. APPROPRIATION BILL (No. 1) Assent reported by Mr Speaker. PAPERS The foUowing papers were laid on the table, and ordered to be printed:— Reports— Director-General, Department of Mines, for the year 1981 Rural Reconstmction Board for the year ended 30 June 1981 Queensland Meat Industry Organization and Marketing Authority for the year ended 30 June 1981 The following papers were laid on the table:— Proclamations under— Essential Services Act 1979 Consumer Affairs Act and Another Act Amendment Act 1982 Industry and Commerce Training Act 1979-1982 Workers' Compensation Act Amendment Act 1982 Queensland Marine Act 1958-1979 City of Brisbane Market Act Amendment Act 1982 Diseases in Plants Act 1929-1972 Margarine Act Amendment Act 1982 Sugar Acquisition Act of 1915 Orders in Council under— State Development and Public Works Organization Act 1971-1981 State Development and Public Works Organization Act 1971-1981 and the Local Bodies' Loans Guarantee Act 1923-1979 Supreme Court Act 1921-1979 Factories and Shops Act 1960-1982 Industry and Commerce Training Act 1979-1982 Workers' Compensation Act 1916-1982 Harbours Act 1955-1982 Explosives Act 1952-1981 Mines Regulation Act 1964-1979 Gas Act 1965-1981 Electricity Act 1976-1980 Agricultural Bank (Loans) Act 1959-1981 Agricultural Bank -

VH-BPL DC-3 Rescue by Bob Sprague, Senior Production Engineer, ETOMS and Capt

VH-BPL DC-3 Rescue by Bob Sprague, Senior Production Engineer, ETOMS and Capt. Ossie Miller, Qantas Airways. The Douglas DC–3/C-47 is considered a classic aircraft that revolutionised air transport and aircraft construction and is regarded as one of the decisive weapons of WWII. It is estimated that some 17,000 of these aircraft were built by the United States and Russia. The offer earlier this year to donate a DC-3 to the Qantas Founders Outback Museum (QFOM) in Longreach by its owner, Mr John Williams, was welcomed by the board of the Qantas Foundation Memorial (QFM), trustees of QFOM. VH-BPL. Hoxton Park January 2004 As an ex-Qantas owned aircraft, VH-BPL is of greater interest to QFOM for display than just any DC-3 and is one of only five ex-Qantas DC-3/C-47s still believed to be in existence. As such it is recognised as a significant acquisition for the collection. Records show Qantas owned or operated some twenty-four of the type up until 1971 on passenger services in Western Queensland, passenger and freight services in New Guinea and training. In fact, when the Boeing 747 entered Qantas service there were still two DC-3s operating. VH-BPL was built as a C-47 (a military version of the DC-3 with a cargo door) for the US Army Air Force (USAAF) in 1942 and carried the serial number 42-93009. It was received by the RAAF as A65-44 soon after in 1944 and operated initially as call sign VHCIA. -

The Australian Clean Air Standard Is Being Used by the Queensland State Government As a Licence to Pollute

Submission from: Michael Kane on behalf of Clean Air Queensland 18thNovember, 2014 To the chairperson, with reference to the following: Select Committee into Certain Aspects of Queensland Government Administration related to Commonwealth Government Affairs. The Australian Clean Air Standard is being used by the Queensland State Government as a licence to pollute. The Queensland coal industry, the Queensland Resources Council and the Queensland State Government are cooperating to apply a dangerously lax regulatory frame work for the massive expansion of the coal industry which potentially has widespread and severe health implications for many heavily populated centres, towns and rural communities in Queensland. In this submission Clean Air Queensland will focus on the misuse of the Australian Clean Air Standard http://www.environment.gov.au/topics/environment-protection/air- quality/air-quality-standards which under the current and previous government in Queensland could potentially cause up to 800 additional deaths and 7400 extra hospitalisations from government sanctioned pollution regulations in Queensland. Clean Air Queensland believes the current regulatory framework for Queensland pollution standards, as they are applied to the mining and other industries, is a contravention of the International International Convention on Economic, Social and Cultural Rights. The failure to protect people from industrial pollution like coal dust is in breach of this convention and the misuse of the Australian Clean Air standards is tantamount to wilful and culpable negligence by the Queensland government and the coal industry. Compounding the problem in Queensland is the recent relaxation of political and electoral funding of political parties in Queensland by corporations, particularly mining and resource companies and the demonstrably close relationship of New Hope Coal and associated companies who have current applications for extremely polluting projects pending before the Queensland government.