Managing the Three-Tier Distribu^On

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Food and Beverage Industry Update November 2013

Food and Beverage Industry Update November 2013 Member FINRA/SIPC www.harriswilliams.com Food and Beverage Industry Update November 2013 What We’re Seeing CONTENTS Food & Beverage in the Marketplace INDUSTRY VITAL SIGNS After an active finish to 2012 and a slow start to 2013, HW&Co. has seen pitch activity increase EQUITY MARKET OVERVIEW substantially across the food & beverage sector in the back half of 2013. Both strategic and private equity M&A MARKET OVERVIEW buyers continue to covet high quality food & beverage assets, and we expect that M&A activity at the beginning of 2014 with be at a “normal” level. The combination of strong financing markets, growth DEBT MARKET OVERVIEW oriented strategic buyers, and private equity fund expirations is fueling the strengthening market for food NOTABLE M&A ACTIVITY & beverage transactions. PUBLIC COMPARABLES What We’ve Been Doing EARNINGS CALENDAR Closed HW&Co. Transactions GROUP OVERVIEW Harris Williams & Co. is a leading advisor to the food and beverage a portfolio company of a portfolio company of a portfolio company of market. Our significant experience has divested a portfolio company of selected assets to covers a broad range of end has been acquired by has been acquired by has been acquired by markets, industries, and business has been acquired by and has been acquired by models. This particular report and focuses on trends and metrics in the following areas: • Agribusiness • Baked and Prepared Goods a portfolio company of • Beverages a portfolio company of a portfolio company of a portfolio -

Growth Vehicles

A PENTON MEDIA PUBLICATION supermarketnews.com | Monday February 11, 2013 | Vol. 61, No. 6 | $10.00 SNSUPERMARKET NEWS SUPPLY CHAIN CONFERENCE Ahold Will Share Data SN’s 2013 list of the With CPGs Growth Top 50 Small Chains and Independents refl ects By MICHAEL GARRY expansion by many of ORLANDO, Fla. — Ahold these operators — Page 16 USA, Quincy, Mass., plans Vehicles to launch a vendor collabo- ration initiative next month that will include sending POS, supply chain and mer- chandising data via a third- party to some number of its CPG suppliers in order to improve product availability and customer satisfaction. Ahold USA thus becomes the latest food retailer to fo- cus on exploiting the vast res- ervoir of data at its disposal. ILLUSTRATION BY SHUTTERSTOCK ILLUSTRATION See Ahold, Page 53 Delhaize Eliminates 500 Jobs as Part of Broad Restructure employees of the layoffs by Tuesday. The layoffs come in the wake of an execu- By JON SPRINGER tive restructuring announced last month that eliminated 25% of Delhaize’s SALISBURY, N.C. — The extensive organizational restructuring at Delhaize high-level leadership positions, as well as 45 store closures. America continued last week as offi cials said they would cut another 500 jobs. Roland Smith, Delhaize America’s chief executive offi cer, in a memo dis- The jobs, described as being “above the store manager level,” include 350 tributed to employees last week announcing forthcoming changes said “many current workers and 150 open positions. The company said it would inform of you will hear that your responsibilities will not change, some will learn about new opportunities and challenges, and some will hear the diffi cult news that you will be departing the organization. -

Thanksgiving – Turkey Dinners

USDA HOLIDAY RETAIL PROMOTIONS FEATURING POULTRY Advertised Prices effective through November 22, 2012 Thanksgiving 2012 This report provides a detailed breakdown of supermarket holiday promotions by region, state, and grocery chain including brand names, prices, and any special conditions for whole turkeys and bone-in turkey breasts; roaster chickens; capons; Cornish hens; chicken gizzards and livers; ducks and ducklings; geese; baking hens; rabbits; shell eggs and liquid eggs. Turkey Dinner Promotions - National Whole Turkeys ……………………………… 80 pages R Turkey Dinners ……………………………… 31 pages Northeast Region ……………………………… page 1 Southeast Region ……………………………… page 7 Midwest Region ……………………………… page 14 South Central Region ……………………………… page 22 Southwest Region ……………………………… page 28 Northwest Region ……………………………… page 30 Miscellaneous Poultry ……………………………… 40 pages Shell Eggs/Egg Products ……………………………… 37 pages Prices in U.S. dollars per pound unless otherwise noted. Note: BOGO = Buy one, get one free ABF = Antibitoic-free All information from publicly available sources including store circulars, newspaper ads, and retailer websites. USDA Agricultural Marketing Service, Poultry Market News & Analysis Division (202) 720-6911 - [email protected] HOLIDAY RETAIL PROMOTIONS FEATURING POULTRY (prices effective through November 22, 2012) Thanksgiving 2012 prices in US$ per complete dinner unless otherwise noted; information TURKEY DINNERS from publicly available sources including store circulars, newspaper ads, and retailer websites. Weight Item (whole -

Final CFFA Merchandiser Report Southeast Ken Meyer

Season recap Final CFFA Merchandiser Report Southeast Ken Meyer Executive Summary This was my first season with CFFA and it was full of ups and downs. Weather problems, shipping problems, dock strikes; all made retailers on edge during the season. Some retailers reported to me that it was one of the worst years in recent memory. Many complained that they could not get to the price point that they needed to have to move good volumes of fruit. This resulted in a number of cancelled promotions. Kroger Memphis, Kroger Atlanta, Harris Teeter, Winn- Dixie/BI-LO, Merchants Distributing, Ingles, and Belle Foods all decided not to run promotions that they had previously committed to. The reasons given were inconsistent supplies and quality. On the other hand Hitchcock’s of Florida, Houchen’s of Kentucky, Piggly Wiggly of South Carolina, and the Defense Commissary Agency ran display contests…some of them for the first time ever. And results were very positive. Retail tags for our TV ads went out to Tampa and Jacksonville Florida, Nashville, Tennessee, and Charlotte, North Carolina. We separated timing of the commercials in Jacksonville and Tampa markets. Publix asked us for a separate commercial from the normal TV ad and so both Tampa and Jacksonville got one ad for Publix and Winn Dixie got the other ad. Harris Teeter got the tag line in Charlotte, with Food Lion turning it down. Thousands of points of sales materials were sent to retailers throughout the Southwest. Many of retailers commented that they had never seen this material before and really liked the colorful displays they could make from our POS. -

Greers Invest Board of Advisors in Local Grocery Chain ADVANCED TECHNOLOGY IS: Fiber Optic Data That Doesn’T Slow You Down

Mobile Area Chamber of Commerce AUGUST 2014 the FREE Business Expo, Aug. 27 5th Generation of Meet the Chamber’s Greers Invest Board of Advisors in Local Grocery Chain ADVANCED TECHNOLOGY IS: Fiber optic data that doesn’t slow you down C SPIRE BUSINESS SOLUTIONS CONNECTS YOUR BUSINESS. • Guaranteed speeds up to 100x faster than your current connection. • Synchronous transfer rates for sending and receiving data. • Reliable connections even during major weather events. CLOUD SERVICES Get Advanced Technology Now. Advanced Technology. Personal Service. 1.855.212.7271 | cspirebusiness.com 2 the business view AUGUST 2014 the Mobile Area Chamber of Commerce AUGUST 2014 | In this issue ON THE COVER The G-5s – the fifth generation to help run From the Publisher - Bill Sisson Autry Greer & Sons, Mobile’s only locally owned grocery store chain, are pictured here at a store on Cottage Hill Road. They are, from left to right, Stephen Thomas, Jackson Business Expo is Your Chance to Network Thomas, Gray Fobes, Les Buerger and Lucy Networking means something This year’s exhibitors Greer Cheriogotis. See pages 12-13 to learn different to just about everyone. represent an even more varied more about the company. Photo by Jeff Tesney. Doing it is an exercise that gets easier cross-section of businesses from over time, with lots of practice. throughout our region. We’re This month, challenge yourself particularly proud of this event, 4 News You Can Use to attend the Mobile Area billed as Mobile’s largest one-day Chamber’s Business Expo on networking event. Spanning five 7 Small Business of the Month: Wednesday, Aug. -

Retail Consignees for Recall 025-2013

United States Food Safety Department of and Inspection Agriculture Service RETAIL CONSIGNEES FOR FSIS RECALL 025-2013 FSIS has reason to believe that the following retail location(s) received frozen chicken quesadilla and various other heat treated, not fully cooked frozen mini meals and snack items products that have been recalled by Rich Products Corporation. This list may not include all retail locations that have received the recalled product or may include retail locations that did not actually receive the recalled product. Therefore, it is important that you use the product-specific identification information, available at http://www.fsis.usda.gov/News_&_Events/Recall_025_2013_Release/index.asp http://www.fsis.usda.gov/News_&_Events/Recall_025_2013_Expanded/index.asp, in addition to this list of retail stores, to check meat or poultry products in your possession to see if they have been recalled. Retail List for Recall Number: 025-2013, Frozen Snack Products List Current As Of: 18-Apr-13 Nationwide, State-Wide, or Area-Wide Distribution Retailer Name Location 1 A&P Stores in NJ and NY Albertson's Stores in AR, ID, LA, MT, ND, NV, OR, TX, WA 2 and WY 3 Alco Nationwide 4 Apple Market Stores in KS, MO and NE 5 Big Y Stores in CT, and MA 6 Bi-Lo Stores in GA, NC, PA, SC and TN Stores in CT, DE, FL, MA, ME, MD, NH, NJ, NC, 7 BJs NY, OH, PA, and VA 8 Brookshire Brothers Stores in AR, LA, and TX 9 Bruno's Stores in AL 10 Coborn's Stores in MN 11 Country Mart Stores in AR, KS KY, MO, and OK 12 Dahl's Stores in IA 13 Demoulas Markets Stores -

FIRST NEWS Your Daily Food Industry Update

The Right Information. Right Now. Tuesday - 07/03/2012 - Page 1 FIRST NEWS Your daily food industry update other minority holders -- Smart Balance said the acquisition, as well as the COLLECTIONS PLACED refinancing of existing outstanding debt, was funded with the proceeds of a new $280 million senior secured credit facility -- Based in Denver, CO, Udi's Latin American Grill Doral -- Miami, FL (#853174) -- $5,555 Healthy Foods marketed gluten-free products under the Udi's Gluten Free Foods brand in the retail market and foodservice channels -- According to Smart Balance, for the 12 months ended March 31, Udi's Healthy Foods' RATING CHANGES sales were $60.9 million -- Smart Balance said the inclusion of Udi's Healthy Food in its portfolio of health and wellness brands will position the business Better Class Foods, Inc. -- dba People's Choice -- L to I as a leader in gluten-free, accelerate its growth rate and further diversify its Brooklyn, NY (#73013) mix toward high-growth natural brands (#852620) R=Recommended L=Limited I=Inconclusive C=Cautionary Status H=High Risk T=Too New to Score S=Significant Event U=Unable to Score NEWS DIGEST SPECIAL UPDATE Belle Foods, LLC -- Birmingham, AL -- Belle Food completes purchase of Southern Family Markets P.F. Chang's China Bistro, Inc. dba P.F. Chang's China Bistro - - Scottsdale, AZ -- P.F. Chang's China Bistro Inc and Centerbridge Partners LP announced July 2 that Wok Acquisition Corp successfully A representative of Belle Foods LLC, a recently established completed the tender offer for all outstanding shares of P.F. -

Exclusivebrandsourcing Retailer/Wholesaler Database

EXCLUSIVEBRANDSOURCING RETAILER/WHOLESALER DATABASE Copyright 2015 © Exclusive Brands LLC N/A = Not Available or Not Applicable A.S. WATSON GROUP 1-5 Wo Liu Hang Road, Fo Tan, New Territories, Hong Kong, CHINA Tel: +852 2606-8833 Fax: +852 2695-3664 www.aswatson.com Total 2012 Revenues: $18.9 Billion(HK$ 146.6 Billion) +4 % Percentage of Sales in Exclusive Brands: N/A Principal Business: A.S. Watson is the retail group owned by Hutchison Whampoa Limited, a HK $ 398.4 billion ($51.3 billion) +4%, multi-national conglomerate, which is also active in port investments, infrastructure (energy, transportation, water, etc.), telecommunications, and finance. The company roots trace back to 1829 as a small dispensary, offering free medicine to poor Chinese in the province of Guangdong (Canton). A.S. Watson, now contributes 36.8% of total parent company revenues, through its operation of 10,865 retail outlets under some 20 banners located in 33 markets, specifically in 22 European countries and 20 countries in Asia. This business encompasses a diverse portfolio: health and beauty stores, luxury perfumeries and cosmetic outlets, supermarkets, consumer electronics and electrical appliances stores, and airport duty free shops. Divided into five sub-divisions, the company operates Health and Beauty China (HK$ 15.4 billion +17%) with 1,438 stores; Health and Beauty Asia (excluding mainland China) (HK$ 18.1 billion +7%) with 1,684 stores; Health and Beauty Europe (HK$ 61.6 billion +1%) with 5,599 stores; Luxury Europe (HK$ 16.6 billion -7%) with 1,656 stores; and Other Retail & Manufacturing (HK$ 36.9 billion +6%) with 488 stores and production of water and juices. -

The Food Partners, Capital IQ, News Releases 90 MERGERS & ACQUISITIONS Transactions

www.thefoodpartners.com Mergers & Acquisitions PRESENTED BY THE FOOD PARTNERS February 2018 MERGERS & ACQUISITIONS MERGERS & ACQUISITIONS The Times They Are A Changin’ Shifting • Millennials – the tip of the iceberg Consumer • Healthy meal solutions are finally in vogue Tastes and • Consumers are on the move and experimenting Preferences • Consumers are coming out of the closet • These changes are accelerating with momentum The Retail • Ecommerce – the evil force that has invaded every market in the U.S. Landscape • Expansion of Dollar store formats taking a small bite at a time • Retailers have changed what is in the box more in the last twenty four months than in the last ten years 85 MERGERS & ACQUISITIONS Year in Review • August 2016 – Walmart acquires Jet.com for $3 billion • June 16, 2017 - the retail grocery sector was turned upside down when Amazon announced the acquisition of Whole Foods for $13.4 billion ➢ Amazon’s acquisition of Whole Foods will have a minimal direct impact at retail, but will be the catalyst to cause radical change in the industry • September 2017 – Albertsons announces the acquisition of Plated for $200 million • June 2017 to January 2018 – Instacart announces that it has partnerships with Aldi, Albertsons, BJ’s Market, Costco, CVS, Food Lion, Loblaw, Kroger, Price Chopper, Sprouts, Stater Bros., Wakefern, Wegmans and other retailers • November 2017 – Instacart secures $400 million of additional capital to fund growth – the company is valued at $3.4 billion – workers strike for several days and claim they -

2013 List of Registrants

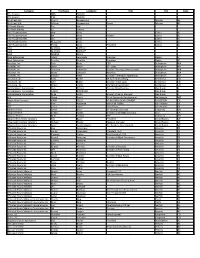

Company FirstName LastName Title City State 4T's Grocery ANN TAYLOR 4T's Grocery TIM TAYLOR 5th Street IGA Sherry Huenemann Minden NE 5th Street IGA William Huenemann Owner Minden NE 99 Ranch Market Tee Jaw 99 Ranch Market Ty Truong A & R Supermarkets Ann Davis Calera AL A & R Supermarkets Bill Davis Partner Calera AL A & R Supermarkets Jan Davis Calera AL A & R Supermarkets Margarita Davis Calera AL A & R Supermarkets Phillip Davis President Calera AL AAIA MICHAEL BARRATT AAIA MICHAEL BARRATT AAIA ARLENE DAVIS Abco Enterprises Adam Sepulveda Manager Ogden VT Abco Enterprises Suzette Sharifan President Ogden VT Accelitec, Inc. Tom Bartz CEO Bellingham WA Accelitec, Inc. Steve Byron VP - Sales Bellingham WA Accelitec, Inc. Christine Schneider Director -Business Development Bellingham WA Accelitec, Inc. Marty Schroder Accelitec Bellingham WA Accelitec, Inc. Edward West Director - Merchant Operations Bellingham WA AccuCode, Inc. Todd Baillie VP Sales & Marketing Centennial CO AccuCode, Inc. John Butler Director of AO: Apps Centennial CO AccuCode, Inc. Robyn Crotty Marketing Coordinator Centennial CO Ace Hardware Corporation Curt DeHart Director New Business Oak Brook IL Ace Hardware Corporation CARLO MORANDO Oak Brook IL Ace Hardware Corporation Mike Smith Grocery Channel Manager Oak Brook IL ACS Chuck Daniel Dir of Corporate Development Nottingham MD Action Retail Services JOHN GILLIS VP BUSINESS DEVELOPMENT FULLERTON CA ADT Teal Hausman Jack of all Trades San Antonio TX ADT Cesar Lopez Sales/Buyer San Antonio TX Advance Pierre David Minx VP Strategic Sourcing Cincinnati OH Advance Pierre Shawn Sparks Director of Strategic Sourcing Enid OK Advance Pierre Mike Zelkind SVP Cincinnati OH Advanced Inventory Solutions Tim Bayer President Grand Rapids MI Advanced Inventory Solutions Richard Heetai Regional Manager Grand Rapids MI Advanced Inventory Solutions Steve Southerington Dir. -

Why Retail Is a Bright Spot in Food Industry M & A

Why Retail is a Bright Spot in Food Industry M & A March 21, 2019 Brian Todd President The Food Institute WWW.FOODINSTITUTE.COM MISSION The Food Institute (FI) is the single source for information, analysis and reporting for the food industry ‘from farm to fork’. FI provides balanced coverage of food trends through multiple channels so that industry professionals worldwide can tap in when and how they choose. Overall Food Industry M & A Slowed In 2018 591 527 503 505 410 316 311 2012 2013 2014 2015 2016 2017 2018 Source: Proprietary data from The Food Institute. Food Processors Account For 30% Of Deals Retailers Make Up 17%! 16% 30% Food Processors 3% Investment Firms & Banks 5% Foodservice & Restaurants Retailers Diversified Firms Wholesalers 17% Others 14% 15% Proprietary Information: Food Institute LLC, Upper Saddle River, NJ A Few Of The Findings • ConAgra acquired Pinnacle Brands • Ferrero acquired Nestles U.S. confections • General Mills and Smuckers invest in pets • Tyson buys lab-grown meat startups Supermarket M&A Rebounded In ’18… 36 36 36 29 28 22 19 1999 2012 2013 2014 2015 2016 2017 Proprietary Information: Food Institute LLC, Upper Saddle River, NJ On the Retail Side UNFI • SUPERVALU LIDL • Best Markets Walmart • Flipkart Spartan Nash • Martins Proprietary Information: Food Institute LLC, Upper Saddle River, NJ Available Soon at www.foodinstitute.com Contact Info Brian Todd [email protected] www.thefoodpartners.com Why Retail is a Bright Spot in M&A PRESENTED BY THE FOOD PARTNERS March 2019 MERGERS & ACQUISITIONS Retail Landscape • Amazon’s acquisition of Whole Foods was the catalyst for several major competitors radically altering their strategic plans • Amazon and Walmart are like two elephants wrestling and all of the other retailers in the U.S. -

Food and Beverage Industry Update December 2013

Food and Beverage Industry Update December 2013 Member FINRA/SIPC www.harriswilliams.com Food and Beverage Industry Update December 2013 What We’re Seeing CONTENTS Market Update INDUSTRY VITAL SIGNS November was a busy trade show month with the Restaurant Finance and Development Conference and EQUITY MARKET OVERVIEW Private Label Manufacturers Association show. While the weather hampered many people’s travel to the M&A MARKET OVERVIEW PLMA in Chicago, we were able to catch up with many of you on the floor at each event. We came away with the impression that strategic buyers in the Food & Beverage and Restaurant segments are actively DEBT MARKET OVERVIEW looking to grow through M&A, but have more focused strategies than ever and will be very “picky” about NOTABLE M&A ACTIVITY which deals they decide to pursue next year. The private equity community’s interest in both sectors PUBLIC COMPARABLES continues to be strong and consistent feedback is that the lack of high quality opportunities in the market EARNINGS CALENDAR still persists. Many expected M&A activity in 2013 to bounce back faster due to a rush of sellers looking to take advantage of aggressive financing markets, but that wave of deals is more like a slowly rising GROUP OVERVIEW tide. With our current backlog and pitch activity in the Food & Beverage and Restaurant sectors, we continue to believe that 2014 will represent a more normalized M&A environment. Harris Williams & Co. is a leading advisor to the food and beverage What We’ve Been Doing market. Our significant experience covers a broad range of end Closed HW&Co.