QIAGEN N.V. Annual Report 1999

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

OSB Representative Participant List by Industry

OSB Representative Participant List by Industry Aerospace • KAWASAKI • VOLVO • CATERPILLAR • ADVANCED COATING • KEDDEG COMPANY • XI'AN AIRCRAFT INDUSTRY • CHINA FAW GROUP TECHNOLOGIES GROUP • KOREAN AIRLINES • CHINA INTERNATIONAL Agriculture • AIRBUS MARINE CONTAINERS • L3 COMMUNICATIONS • AIRCELLE • AGRICOLA FORNACE • CHRYSLER • LOCKHEED MARTIN • ALLIANT TECHSYSTEMS • CARGILL • COMMERCIAL VEHICLE • M7 AEROSPACE GROUP • AVICHINA • E. RITTER & COMPANY • • MESSIER-BUGATTI- CONTINENTAL AIRLINES • BAE SYSTEMS • EXOPLAST DOWTY • CONTINENTAL • BE AEROSPACE • MITSUBISHI HEAVY • JOHN DEERE AUTOMOTIVE INDUSTRIES • • BELL HELICOPTER • MAUI PINEAPPLE CONTINENTAL • NASA COMPANY AUTOMOTIVE SYSTEMS • BOMBARDIER • • NGC INTEGRATED • USDA COOPER-STANDARD • CAE SYSTEMS AUTOMOTIVE Automotive • • CORNING • CESSNA AIRCRAFT NORTHROP GRUMMAN • AGCO • COMPANY • PRECISION CASTPARTS COSMA INDUSTRIAL DO • COBHAM CORP. • ALLIED SPECIALTY BRASIL • VEHICLES • CRP INDUSTRIES • COMAC RAYTHEON • AMSTED INDUSTRIES • • CUMMINS • DANAHER RAYTHEON E-SYSTEMS • ANHUI JIANGHUAI • • DAF TRUCKS • DASSAULT AVIATION RAYTHEON MISSLE AUTOMOBILE SYSTEMS COMPANY • • ARVINMERITOR DAIHATSU MOTOR • EATON • RAYTHEON NCS • • ASHOK LEYLAND DAIMLER • EMBRAER • RAYTHEON RMS • • ATC LOGISTICS & DALPHI METAL ESPANA • EUROPEAN AERONAUTIC • ROLLS-ROYCE DEFENCE AND SPACE ELECTRONICS • DANA HOLDING COMPANY • ROTORCRAFT • AUDI CORPORATION • FINMECCANICA ENTERPRISES • • AUTOZONE DANA INDÚSTRIAS • SAAB • FLIR SYSTEMS • • BAE SYSTEMS DELPHI • SMITH'S DETECTION • FUJI • • BECK/ARNLEY DENSO CORPORATION -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Incoming Letter: QIAGEN N.V

WACHTELL, LIPTON , ROSEN & KATZ MARTIN LIPTON STEVEN A. COHEN 51 W E S T 52N D S T R E E T DAVID E. SHAPIRO SABASTIAN V. NILES HERBERT M. WACHTELL DEBORAH L. PAUL DAMIAN G. DIDDEN ALISON ZIESKE PREISS THEODORE N. MIRVIS DAVID C. KARP NEW YORK, N.Y. 1 0 0 1 9 - 6 1 5 0 IAN B OC Z K O TIJANA J. DVORNIC EDWARD D. HERLIHY RICHARD K. KIM MATTHEW M. GUEST JENNA E. LEVINE DANIEL A. NEFF JOSHUA R. CAMMAKER TELEPHONE: (212) 403 -1000 DAVID E. KAHAN RYAN A. McLEOD ANDREW R. BROWNSTEIN MARK GORDON DAVID K. LAM ANITHA REDDY MARC WOLINSKY JOSEPH D. LARSON FACSIMILE: (212) 403 -2000 BENJAMIN M. ROTH JOHN L. ROBINSON STEVEN A. ROSENBLUM JEANNEMARIE O’BRIEN JOSHUA A. FELTMAN JOHN R. SOBOLEWSKI JOHN F. SAVARESE WAYNE M. CARLIN GEORGE A. KATZ (1965 -1 9 8 9) ELAINE P. GOLIN STEVEN WINTER SCOTT K. CHARLES STEPHEN R. D iPRIMA JAMES H. FOGELSON (1967 - 1 9 91) EMI L A. KLEINHAUS EMILY D. JOHNSON JODI J. SCHWARTZ NICHOLAS G. DEMMO LEONARD M. ROSEN (1965 - 2 0 14 ) KARESSA L. CAIN JACOB A. KLING ADAM O. EMMERICH IGOR KIRMAN RONALD C. CHEN RAAJ S. NARAYAN RALPH M. LEVENE JONATHAN M. MOSES OF C O UN S EL GORDON S. MOODIE VIKTOR SAPEZHNIKOV RICHARD G. MASON T. EIKO STANGE DONGJU SONG MICHAEL J. SCHOBEL MARTIN J.E. ARMS ERIC S. ROBINSON DAVID M. SILK JOHN F. LYNCH BRADLEY R. WILSON ELINA TETELBAUM MICHAEL H. BYOWITZ PATRICIA A. ROBINSON* ROBIN PANOVKA WILLIAM SAVITT GRAHAM W. -

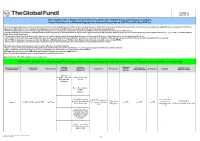

List of SARS-Cov-2 Diagnostic Test Kits and Equipments Eligible For

Version 33 2021-09-24 List of SARS-CoV-2 Diagnostic test kits and equipments eligible for procurement according to Board Decision on Additional Support for Country Responses to COVID-19 (GF/B42/EDP11) The following emergency procedures established by WHO and the Regulatory Authorities of the Founding Members of the GHTF have been identified by the QA Team and will be used to determine eligibility for procurement of COVID-19 diagnostics. The product, to be considered as eligible for procurement with GF resources, shall be listed in one of the below mentioned lists: - WHO Prequalification decisions made as per the Emergency Use Listing (EUL) procedure opened to candidate in vitro diagnostics (IVDs) to detect SARS-CoV-2; - The United States Food and Drug Administration’s (USFDA) general recommendations and procedures applicable to the authorization of the emergency use of certain medical products under sections 564, 564A, and 564B of the Federal Food, Drug, and Cosmetic Act; - The decisions taken based on the Canada’s Minister of Health interim order (IO) to expedite the review of these medical devices, including test kits used to diagnose COVID-19; - The COVID-19 diagnostic tests approved by the Therapeutic Goods Administration (TGA) for inclusion on the Australian Register of Therapeutic Goods (ARTG) on the basis of the Expedited TGA assessment - The COVID-19 diagnostic tests approved by the Ministry of Health, Labour and Welfare after March 2020 with prior scientific review by the PMDA - The COVID-19 diagnostic tests listed on the French -

Euro Stoxx® Multi Premia Index

EURO STOXX® MULTI PREMIA INDEX Components1 Company Supersector Country Weight (%) SARTORIUS STEDIM BIOTECH Health Care France 1.59 IMCD Chemicals Netherlands 1.25 VOPAK Industrial Goods & Services Netherlands 1.15 BIOMERIEUX Health Care France 1.04 REMY COINTREAU Food, Beverage & Tobacco France 1.03 EURONEXT Financial Services France 1.00 HERMES INTERNATIONAL Consumer Products & Services France 0.94 SUEZ ENVIRONNEMENT Utilities France 0.94 BRENNTAG Chemicals Germany 0.93 ENAGAS Energy Spain 0.90 ILIAD Telecommunications France 0.89 DEUTSCHE POST Industrial Goods & Services Germany 0.88 FUCHS PETROLUB PREF Chemicals Germany 0.88 SEB Consumer Products & Services France 0.87 SIGNIFY Construction & Materials Netherlands 0.86 CARL ZEISS MEDITEC Health Care Germany 0.80 SOFINA Financial Services Belgium 0.80 EUROFINS SCIENTIFIC Health Care France 0.80 RATIONAL Industrial Goods & Services Germany 0.80 AALBERTS Industrial Goods & Services Netherlands 0.74 KINGSPAN GRP Construction & Materials Ireland 0.73 GERRESHEIMER Health Care Germany 0.72 GLANBIA Food, Beverage & Tobacco Ireland 0.71 PUBLICIS GRP Media France 0.70 UNITED INTERNET Technology Germany 0.70 L'OREAL Consumer Products & Services France 0.70 KPN Telecommunications Netherlands 0.68 SARTORIUS PREF. Health Care Germany 0.68 BMW Automobiles & Parts Germany 0.68 VISCOFAN Food, Beverage & Tobacco Spain 0.67 SAINT GOBAIN Construction & Materials France 0.67 CORBION Food, Beverage & Tobacco Netherlands 0.66 DAIMLER Automobiles & Parts Germany 0.66 PROSIEBENSAT.1 MEDIA Media Germany 0.65 -

EXTEL 2018 Investor Relations Rankings for Germany

EXTEL 2018 Investor Relations rankings for Germany June 2018 1. EXECUTIVE OVERVIEW & COMMENTARY This year marks the 13th Anniversary of the partnership between DIRK – Deutsche Investor Relations Verband - and Extel, an Institutional Investor Company. Every year, this successful collaboration produces the highly lauded Investor Relations Study, which takes its data from Extel’s comprehensive annual Pan-European Survey. The survey measures IR excellence and includes insightful views and trend information from investment professionals globally who are either invested in or cover the German equity market. The results of the study form the basis of the ‘Deutsche Investor Relations Preis’, presented during the DIRK annual conference in Frankfurt in June 2018. As part of its annual Pan-European Survey, year. The leading MDAX IR Professional Extel undertook this study from 14th March to was Burkhard Sawazki of LEG Immobilien 27th April, 2018; seeking ratings and rankings where 136 individuals received for IR excellence, at a company level and nominations. separately for IR professionals. From the In the SDAX category Hapag-Lloyd moved overall sector contributions, we derived up from 11th last year to 1st place. For the distinct rankings for the main German equity individual IR Professional ranking in SDAX, indices constituents – DAX30, MDAX, SDAX and Stephan Haas of SAF-HOLLAND was TecDAX. The study was undertaken almost ranked 1st, out of 61 individuals receiving exclusively through direct online votes. nominations. Telefonica Deutschland held on to top Since the beginning of the Extel and DIRK’s spot as the highly regarded TecDAX partnership in 2006, responses have increased company for IR. -

MFS® Research International Fund (Class R6 Shares) Second Quarter 2021 Investment Report

MFS® Research International Fund (Class R6 Shares) Second quarter 2021 investment report NOT FDIC INSURED MAY LOSE VALUE NOT A DEPOSIT Before investing, consider the fund's investment objectives, risks, charges, and expenses. For a prospectus, or summary prospectus, containing this and other information, contact MFS or view online at mfs.com. Please read it carefully. ©2021 MFS Fund Distributors, Inc., 111 Huntington Avenue, Boston, MA 02199. FOR DEALER AND INSTITUTIONAL USE ONLY. Not to be shown, quoted, or distributed to the public. PRPEQ-RIF-30-Jun-21 34135 Table of Contents Contents Page Fund Risks 1 Disciplined Investment Approach 2 Market Overview 3 Executive Summary 4 Performance 5 Attribution 6 Significant Transactions 10 Portfolio Positioning 11 Characteristics 13 Portfolio Outlook 14 Portfolio Holdings 18 Additional Disclosures 21 Country and region information contained in this report is based upon MFS classification methodology which may differ from the methodology used by individual benchmark providers. Performance and attribution results are for the fund or share class depicted and do not reflect the impact of your contributions and withdrawals. Your personal performance results may differ. Portfolio characteristics are based on equivalent exposure, which measures how a portfolio's value would change due to price changes in an asset held either directly or, in the case of a derivative contract, indirectly. The market value of the holding may differ. 0 FOR DEALER AND INSTITUTIONAL USE ONLY. - MFS Research International Fund PRPEQ-RIF-30-Jun-21 Fund Risks The fund may not achieve its objective and/or you could lose money on your investment in the fund. -

Euro Stoxx® International Exposure Index

EURO STOXX® INTERNATIONAL EXPOSURE INDEX Components1 Company Supersector Country Weight (%) ASML HLDG Technology Netherlands 6.02 LVMH MOET HENNESSY Consumer Products & Services France 4.99 LINDE Chemicals Germany 3.79 SAP Technology Germany 3.62 SANOFI Health Care France 3.20 IBERDROLA Utilities Spain 3.04 SIEMENS Industrial Goods & Services Germany 2.63 AIR LIQUIDE Chemicals France 2.17 SCHNEIDER ELECTRIC Industrial Goods & Services France 2.10 L'OREAL Consumer Products & Services France 2.05 ANHEUSER-BUSCH INBEV Food, Beverage & Tobacco Belgium 1.99 BASF Chemicals Germany 1.89 ADIDAS Consumer Products & Services Germany 1.76 AIRBUS Industrial Goods & Services France 1.68 DAIMLER Automobiles & Parts Germany 1.65 BAYER Health Care Germany 1.61 PHILIPS Health Care Netherlands 1.51 ADYEN Industrial Goods & Services Netherlands 1.49 ESSILORLUXOTTICA Health Care France 1.40 DEUTSCHE TELEKOM Telecommunications Germany 1.36 INFINEON TECHNOLOGIES Technology Germany 1.35 Kering Retail France 1.35 BCO SANTANDER Banks Spain 1.29 SAFRAN Industrial Goods & Services France 1.26 HERMES INTERNATIONAL Consumer Products & Services France 1.10 PERNOD RICARD Food, Beverage & Tobacco France 1.09 CRH Construction & Materials Ireland 1.09 DEUTSCHE POST Industrial Goods & Services Germany 1.05 BCO BILBAO VIZCAYA ARGENTARIA Banks Spain 1.03 FLUTTER ENTERTAINMENT Travel & Leisure Ireland 1.02 DANONE Food, Beverage & Tobacco France 1.00 MUENCHENER RUECK Insurance Germany 0.99 VOLKSWAGEN PREF Automobiles & Parts Germany 0.82 BMW Automobiles & Parts Germany 0.80 -

FTSE Publications

2 FTSE Russell Publications FTSE EDHEC-Risk Efficient 19 August 2021 Eurozone Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 AG 0.12 GERMANY Continental 0.79 GERMANY Henkel KG Pref 0.21 GERMANY A2A 0.25 ITALY Covestro AG 0.22 GERMANY Henkel Kgaa ORD 0.1 GERMANY Aalberts NV 0.31 NETHERLANDS Covivio 0.24 FRANCE Hera 0.19 ITALY ABN AMRO Bank NV 0.45 NETHERLANDS Credit Agricole 0.18 FRANCE Hermes International S.C.A. 0.86 FRANCE Acciona S.A. 0.33 SPAIN Cts Eventim 0.22 GERMANY Hochtief 0.15 GERMANY Accor 0.15 FRANCE Daimler AG 0.17 GERMANY Huhtamaki 0.2 FINLAND Ackermans & Van Haaren 0.66 BELGIUM Danone 0.64 FRANCE Iberdrola 0.1 SPAIN ACS Actividades Cons y Serv 0.13 SPAIN Dassault Aviation S.A. 0.14 FRANCE Icade 0.42 FRANCE Adidas 0.11 GERMANY Dassault Systemes 0.15 FRANCE Iliad 0.39 FRANCE Adyen 0.46 NETHERLANDS Delivery Hero SE 0.35 GERMANY IMCD NV 0.23 NETHERLANDS Aegon NV 0.18 NETHERLANDS Deutsche Bank 0.16 GERMANY Imerys 0.24 FRANCE Aena SME SA 0.23 SPAIN Deutsche Boerse 0.25 GERMANY Inditex 0.14 SPAIN Aeroports de Paris 0.28 FRANCE Deutsche Lufthansa AG 0.53 GERMANY Infineon Technologies AG 0.36 GERMANY Ageas 0.43 BELGIUM Deutsche Post 0.14 GERMANY ING Group CVA 0.18 NETHERLANDS Ahold Delhaize 0.36 NETHERLANDS Deutsche Telekom 0.12 GERMANY Inmobiliaria Colonial S.A. -

FTSE Developed Europe

2 FTSE Russell Publications 19 August 2021 FTSE Developed Europe Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 AG 0.01 GERMANY Avast 0.03 UNITED Cnp Assurance 0.02 FRANCE 3i Group 0.14 UNITED KINGDOM Coca-Cola HBC AG 0.06 UNITED KINGDOM Aveva Group 0.05 UNITED KINGDOM A P Moller - Maersk A 0.1 DENMARK KINGDOM Coloplast B 0.19 DENMARK A P Moller - Maersk B 0.15 DENMARK Aviva 0.19 UNITED Colruyt 0.03 BELGIUM A2A 0.03 ITALY KINGDOM Commerzbank 0.07 GERMANY Aalberts NV 0.05 NETHERLANDS AXA 0.43 FRANCE Compagnie Financiere Richemont SA 0.55 SWITZERLAND ABB 0.51 SWITZERLAND B&M European Value Retail 0.06 UNITED Compass Group 0.33 UNITED KINGDOM ABN AMRO Bank NV 0.04 NETHERLANDS KINGDOM BAE Systems 0.21 UNITED Acciona S.A. 0.03 SPAIN Continental 0.14 GERMANY KINGDOM Accor 0.06 FRANCE ConvaTec Group 0.05 UNITED Baloise 0.06 SWITZERLAND Ackermans & Van Haaren 0.03 BELGIUM KINGDOM Banca Mediolanum 0.02 ITALY ACS Actividades Cons y Serv 0.06 SPAIN Covestro AG 0.1 GERMANY Banco Bilbao Vizcaya Argentaria 0.36 SPAIN Adecco Group AG 0.09 SWITZERLAND Covivio 0.04 FRANCE Banco Santander 0.58 SPAIN Adevinta 0.04 NORWAY Credit Agricole 0.14 FRANCE Bank Pekao 0.03 POLAND Adidas 0.63 GERMANY Credit Suisse Group 0.22 SWITZERLAND Bankinter 0.03 SPAIN Admiral Group 0.08 UNITED CRH 0.35 UNITED Banque Cantonale Vaudoise 0.02 SWITZERLAND KINGDOM KINGDOM Barclays 0.35 UNITED Adyen 0.62 NETHERLANDS Croda International 0.12 UNITED KINGDOM KINGDOM Aegon NV 0.06 NETHERLANDS Barratt Developments 0.09 UNITED Cts Eventim 0.03 GERMANY Aena SME SA 0.1 SPAIN KINGDOM Cyfrowy Polsat SA 0.02 POLAND Aeroports de Paris 0.03 FRANCE Barry Callebaut 0.07 SWITZERLAND Daimler AG 0.66 GERMANY Ageas 0.09 BELGIUM BASF 0.64 GERMANY Danone 0.37 FRANCE Ahold Delhaize 0.26 NETHERLANDS Bayer AG 0.53 GERMANY Danske Bank A/S 0.1 DENMARK AIB Group 0.02 IRELAND Bechtle 0.04 GERMANY Dassault Aviation S.A. -

Corporate Governance Presentation Forward-Looking Statements

April 2021 Corporate Governance Presentation Forward-Looking Statements This communication contains certain forward-looking statements concerning the MorphoSys group of companies, including the expectations regarding tafasitamab’s ability to treat patients with relapsed or refractory diffuse large B-cell lymphoma, the further clinical development of tafasitamab, including ongoing confirmatory trials, additional interactions with regulatory authorities and expectations regarding future regulatory filings and possible additional approvals for tafasitamab as well as the commercial performance of Monjuvi. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “would,” “could,” “potential,” “possible,” “hope” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. The forward-looking statements contained herein represent the judgment of MorphoSys as of the date of this release and involve known and unknown risks and uncertainties, which might cause the actual results, financial condition and liquidity, performance or achievements of MorphoSys, or industry results, to be materially different from any historic or future results, financial conditions and liquidity, performance or achievements expressed or implied by such forward-looking statements. In addition, even if MorphoSys' results, performance, financial condition and liquidity, and the development of the industry in which it operates are consistent -

COMMON STOCKS - 95.94% Australia - 4.43% (A)

Yeah Brown Capital Management International Equity Fund Schedule of Investments As of June 30, 2020 (Unaudited) Shares Value (Note 1) COMMON STOCKS - 95.94% Australia - 4.43% (a) 483 Atlassian Corp. PLC $ 87,070 7,426 Cochlear, Ltd. 968,203 5,944 REA Group, Ltd. 442,518 1,497,791 Canada - 1.89% (a) 12,124 Descartes Systems Group, Inc. 640,046 Denmark - 7.16% 9,068 Chr Hansen Holding A/S 935,170 15,091 Novo Nordisk A/S - Class B 977,018 4,724 SimCorp A/S 509,259 2,421,447 France - 6.31% 7,521 Dassault Systemes SE 1,297,890 (a) 3,819 EssilorLuxottica SA 490,204 4,055 Ipsen SA 344,644 2,132,738 Germany - 9.22% (a) 12,528 Carl Zeiss Meditec AG 1,221,722 1,034 Rational AG 578,988 9,410 SAP SE 1,314,321 3,115,031 Hong Kong - 6.00% 611,146 Kingdee International Software Group Co., Ltd. 1,420,922 130,443 Kingsoft Corp., Ltd. 606,731 2,027,653 Ireland - 9.27% 11,472 DCC PLC 956,663 (a) 5,800 Flutter Entertainment PLC 762,404 (a) 8,387 ICON PLC 1,412,874 3,131,941 Israel - 2.34% (a) 4,998 Check Point Software Technologies, Ltd. 536,935 (a) 2,564 CyberArk Software, Ltd. 254,528 791,463 Italy - 1.47% 29,099 Azimut Holding SpA 497,254 Japan - 12.81% 16,000 CyberAgent, Inc. 783,885 4,500 GMO Payment Gateway, Inc. 468,442 17,000 Kakaku.com, Inc. 429,664 24,300 M3, Inc.