Stoxx® Europe 600 Equal Weight Index

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

OSB Representative Participant List by Industry

OSB Representative Participant List by Industry Aerospace • KAWASAKI • VOLVO • CATERPILLAR • ADVANCED COATING • KEDDEG COMPANY • XI'AN AIRCRAFT INDUSTRY • CHINA FAW GROUP TECHNOLOGIES GROUP • KOREAN AIRLINES • CHINA INTERNATIONAL Agriculture • AIRBUS MARINE CONTAINERS • L3 COMMUNICATIONS • AIRCELLE • AGRICOLA FORNACE • CHRYSLER • LOCKHEED MARTIN • ALLIANT TECHSYSTEMS • CARGILL • COMMERCIAL VEHICLE • M7 AEROSPACE GROUP • AVICHINA • E. RITTER & COMPANY • • MESSIER-BUGATTI- CONTINENTAL AIRLINES • BAE SYSTEMS • EXOPLAST DOWTY • CONTINENTAL • BE AEROSPACE • MITSUBISHI HEAVY • JOHN DEERE AUTOMOTIVE INDUSTRIES • • BELL HELICOPTER • MAUI PINEAPPLE CONTINENTAL • NASA COMPANY AUTOMOTIVE SYSTEMS • BOMBARDIER • • NGC INTEGRATED • USDA COOPER-STANDARD • CAE SYSTEMS AUTOMOTIVE Automotive • • CORNING • CESSNA AIRCRAFT NORTHROP GRUMMAN • AGCO • COMPANY • PRECISION CASTPARTS COSMA INDUSTRIAL DO • COBHAM CORP. • ALLIED SPECIALTY BRASIL • VEHICLES • CRP INDUSTRIES • COMAC RAYTHEON • AMSTED INDUSTRIES • • CUMMINS • DANAHER RAYTHEON E-SYSTEMS • ANHUI JIANGHUAI • • DAF TRUCKS • DASSAULT AVIATION RAYTHEON MISSLE AUTOMOBILE SYSTEMS COMPANY • • ARVINMERITOR DAIHATSU MOTOR • EATON • RAYTHEON NCS • • ASHOK LEYLAND DAIMLER • EMBRAER • RAYTHEON RMS • • ATC LOGISTICS & DALPHI METAL ESPANA • EUROPEAN AERONAUTIC • ROLLS-ROYCE DEFENCE AND SPACE ELECTRONICS • DANA HOLDING COMPANY • ROTORCRAFT • AUDI CORPORATION • FINMECCANICA ENTERPRISES • • AUTOZONE DANA INDÚSTRIAS • SAAB • FLIR SYSTEMS • • BAE SYSTEMS DELPHI • SMITH'S DETECTION • FUJI • • BECK/ARNLEY DENSO CORPORATION -

DXE Liquidity Provider Registered Firms

DXE Liquidity Provider Program Registered Securities European Equities TheCboe following Europe Limited list of symbols specifies which firms are registered to supply liquidity for each symbol in 2021-09-28: 1COVd - Covestro AG Citadel Securities GCS (Ireland) Limited (Program Three) DRW Europe B.V. (Program Three) HRTEU Limited (Program Two) Jane Street Financial Limited (Program Three) Jump Trading Europe B.V. (Program Three) Qube Master Fund Limited (Program One) Societe Generale SA (Program Three) 1U1d - 1&1 AG Citadel Securities GCS (Ireland) Limited (Program Three) HRTEU Limited (Program Two) Jane Street Financial Limited (Program Three) 2GBd - 2G Energy AG Citadel Securities GCS (Ireland) Limited (Program Three) Jane Street Financial Limited (Program Three) 3BALm - WisdomTree EURO STOXX Banks 3x Daily Leveraged HRTEU Limited (Program One) 3DELm - WisdomTree DAX 30 3x Daily Leveraged HRTEU Limited (Program One) 3ITLm - WisdomTree FTSE MIB 3x Daily Leveraged HRTEU Limited (Program One) 3ITSm - WisdomTree FTSE MIB 3x Daily Short HRTEU Limited (Program One) 8TRAd - Traton SE Jane Street Financial Limited (Program Three) 8TRAs - Traton SE Jane Street Financial Limited (Program Three) Cboe Europe Limited is a Recognised Investment Exchange regulated by the Financial Conduct Authority. Cboe Europe Limited is an indirect wholly-owned subsidiary of Cboe Global Markets, Inc. and is a company registered in England and Wales with Company Number 6547680 and registered office at 11 Monument Street, London EC3R 8AF. This document has been established for information purposes only. The data contained herein is believed to be reliable but is not guaranteed. None of the information concerning the services or products described in this document constitutes advice or a recommendation of any product or service. -

Important Notice the Depository Trust Company

Important Notice The Depository Trust Company B #: 12945-20 Date: February 10, 2020 To: All Participants Category: Dividends | International From: Global Tax Services Attention: Managing Partner/Officer, Cashier, Dividend Mgr., Tax Mgr. BNY Mellon | ADRs | Qualified Dividends for Tax Year 2019 Subject: Bank of New York Mellon Corporation (“BNYM”), as depositary for these issues listed below has reviewed and determined if they met the criteria for reduced U.S. tax rate as “qualified dividends” for tax year 2019. The Depository Trust Company received the attached correspondence containing Tax Information. If applicable, please consult your tax advisor to ensure proper treatment of these events. Non-Confidential DTCC Public (White) 2019 DIVIDEND CERTIFICATION CUSIP DR Name Country Exchange Qualified 000304105 AAC TECHNOLOGIES HLDGS INC CAYMAN ISLANDS OTC N 000380105 ABCAM PLC UNITED KINGDOM OTC Y 001201102 AGL ENERGY LTD AUSTRALIA OTC Y 001317205 AIA GROUP LTD HONG KONG OTC N 002482107 A2A SPA ITALY OTC Y 003381100 ABERTIS INFRAESTRUCTURAS S A SPAIN OTC Y 003725306 ABOITIZ EQUITY VENTURES INC PHILIPPINES OTC Y 003730108 ABOITIZ PWR CORP PHILIPPINES OTC Y 004563102 ACKERMANS & VAN HAAREN BELGIUM OTC Y 004845202 ACOM CO. JAPAN OTC Y 006754204 ADECCO GROUP AG SWITZERLAND OTC Y 007192107 ADMIRAL GROUP UNITED KINGDOM OTC Y 007627102 AEON CO LTD JAPAN OTC Y 008712200 AIDA ENGR LTD JAPAN OTC Y 009126202 AIR LIQUIDE FRANCE OTC Y 009279100 AIRBUS SE NETHERLANDS OTC Y 009707100 AJINOMOTO INC JAPAN OTC Y 015096209 ALEXANDRIA MINERAL - REG. S EGYPT None N 015393101 ALFA LAVAL AB SWEDEN SWEDEN OTC Y 021090204 ALPS ELEC LTD JAPAN OTC Y 021244207 ALSTOM FRANCE OTC Y 022205108 ALUMINA LTD AUSTRALIA OTC Y 022631204 AMADA HLDGS CO LTD JAPAN OTC Y 023511207 AMER GROUP HOLDING - REG. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Quarterly Investor Letter March 2015

Quarterly investor letter March 2015 ‘In the short term the market is like a voting machine tallying up which firms are popular and unpopular. In the long run, the mar- ket is like a weighing machine—assessing the substance of a company.’ Benjamin Graham Dear fellow shareholders, As long term investors, the partners at Castlebay are wary of measuring investment performance over short periods of time, such as a calendar quarter or even a year. Our approach to this quarterly letter is to set out for you our investment philosophy and to update you along the way, in what we hope will be a long and prosperous investment journey with us. As stock-pickers we shall highlight one or two stock examples in each letter. Through our commentary we aim to explain clearly how we ‘assess the substance of the companies’ in which we invest, whilst ignoring the market herd who ‘vote’ with increasing frequency and cost, due to their myopia. The value of investments can fall as well as rise and you might not get back what you have invested. Our guiding principles are set out below and we hope you enjoy the read! Our guiding principles: Transparency & alignment of best interests with our fellow shareholders Adherence to our investment philosophy and process—high quality & supportive valuations Independence of thought in order to avoid the market herd A focus on costs: management fees capped, low turnover of companies in the fund The Portfolio in the first quarter 2015 The launch of the fund at the end of January coincided with a strong recovery in Petrofac which had sold off heavily in the final quarter of 2014 as the price of oil plummeted & investors became irrational sellers of all oil related companies. -

Euro Stoxx® Total Market Index

EURO STOXX® TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) ASML HLDG Technology Netherlands 3.45 LVMH MOET HENNESSY Consumer Products & Services France 2.76 LINDE Chemicals Germany 2.40 SAP Technology Germany 2.38 TOTAL Energy France 1.99 SANOFI Health Care France 1.88 SIEMENS Industrial Goods & Services Germany 1.84 ALLIANZ Insurance Germany 1.74 L'OREAL Consumer Products & Services France 1.55 IBERDROLA Utilities Spain 1.38 SCHNEIDER ELECTRIC Industrial Goods & Services France 1.35 AIR LIQUIDE Chemicals France 1.33 ENEL Utilities Italy 1.32 BASF Chemicals Germany 1.23 ADYEN Industrial Goods & Services Netherlands 1.13 ADIDAS Consumer Products & Services Germany 1.13 AIRBUS Industrial Goods & Services France 1.08 BNP PARIBAS Banks France 1.05 DAIMLER Automobiles & Parts Germany 1.03 ANHEUSER-BUSCH INBEV Food, Beverage & Tobacco Belgium 1.02 DEUTSCHE TELEKOM Telecommunications Germany 1.02 BAYER Health Care Germany 1.00 VINCI Construction & Materials France 0.98 BCO SANTANDER Banks Spain 0.93 Kering Retail France 0.87 AXA Insurance France 0.86 PHILIPS Health Care Netherlands 0.85 SAFRAN Industrial Goods & Services France 0.85 DEUTSCHE POST Industrial Goods & Services Germany 0.84 INFINEON TECHNOLOGIES Technology Germany 0.84 Prosus Technology Netherlands 0.83 ESSILORLUXOTTICA Health Care France 0.80 DANONE Food, Beverage & Tobacco France 0.73 INTESA SANPAOLO Banks Italy 0.73 MUENCHENER RUECK Insurance Germany 0.72 PERNOD RICARD Food, Beverage & Tobacco France 0.66 ING GRP Banks Netherlands 0.64 HERMES INTERNATIONAL -

Incoming Letter: QIAGEN N.V

WACHTELL, LIPTON , ROSEN & KATZ MARTIN LIPTON STEVEN A. COHEN 51 W E S T 52N D S T R E E T DAVID E. SHAPIRO SABASTIAN V. NILES HERBERT M. WACHTELL DEBORAH L. PAUL DAMIAN G. DIDDEN ALISON ZIESKE PREISS THEODORE N. MIRVIS DAVID C. KARP NEW YORK, N.Y. 1 0 0 1 9 - 6 1 5 0 IAN B OC Z K O TIJANA J. DVORNIC EDWARD D. HERLIHY RICHARD K. KIM MATTHEW M. GUEST JENNA E. LEVINE DANIEL A. NEFF JOSHUA R. CAMMAKER TELEPHONE: (212) 403 -1000 DAVID E. KAHAN RYAN A. McLEOD ANDREW R. BROWNSTEIN MARK GORDON DAVID K. LAM ANITHA REDDY MARC WOLINSKY JOSEPH D. LARSON FACSIMILE: (212) 403 -2000 BENJAMIN M. ROTH JOHN L. ROBINSON STEVEN A. ROSENBLUM JEANNEMARIE O’BRIEN JOSHUA A. FELTMAN JOHN R. SOBOLEWSKI JOHN F. SAVARESE WAYNE M. CARLIN GEORGE A. KATZ (1965 -1 9 8 9) ELAINE P. GOLIN STEVEN WINTER SCOTT K. CHARLES STEPHEN R. D iPRIMA JAMES H. FOGELSON (1967 - 1 9 91) EMI L A. KLEINHAUS EMILY D. JOHNSON JODI J. SCHWARTZ NICHOLAS G. DEMMO LEONARD M. ROSEN (1965 - 2 0 14 ) KARESSA L. CAIN JACOB A. KLING ADAM O. EMMERICH IGOR KIRMAN RONALD C. CHEN RAAJ S. NARAYAN RALPH M. LEVENE JONATHAN M. MOSES OF C O UN S EL GORDON S. MOODIE VIKTOR SAPEZHNIKOV RICHARD G. MASON T. EIKO STANGE DONGJU SONG MICHAEL J. SCHOBEL MARTIN J.E. ARMS ERIC S. ROBINSON DAVID M. SILK JOHN F. LYNCH BRADLEY R. WILSON ELINA TETELBAUM MICHAEL H. BYOWITZ PATRICIA A. ROBINSON* ROBIN PANOVKA WILLIAM SAVITT GRAHAM W. -

List of SARS-Cov-2 Diagnostic Test Kits and Equipments Eligible For

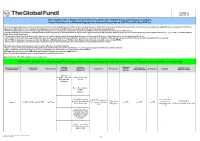

Version 33 2021-09-24 List of SARS-CoV-2 Diagnostic test kits and equipments eligible for procurement according to Board Decision on Additional Support for Country Responses to COVID-19 (GF/B42/EDP11) The following emergency procedures established by WHO and the Regulatory Authorities of the Founding Members of the GHTF have been identified by the QA Team and will be used to determine eligibility for procurement of COVID-19 diagnostics. The product, to be considered as eligible for procurement with GF resources, shall be listed in one of the below mentioned lists: - WHO Prequalification decisions made as per the Emergency Use Listing (EUL) procedure opened to candidate in vitro diagnostics (IVDs) to detect SARS-CoV-2; - The United States Food and Drug Administration’s (USFDA) general recommendations and procedures applicable to the authorization of the emergency use of certain medical products under sections 564, 564A, and 564B of the Federal Food, Drug, and Cosmetic Act; - The decisions taken based on the Canada’s Minister of Health interim order (IO) to expedite the review of these medical devices, including test kits used to diagnose COVID-19; - The COVID-19 diagnostic tests approved by the Therapeutic Goods Administration (TGA) for inclusion on the Australian Register of Therapeutic Goods (ARTG) on the basis of the Expedited TGA assessment - The COVID-19 diagnostic tests approved by the Ministry of Health, Labour and Welfare after March 2020 with prior scientific review by the PMDA - The COVID-19 diagnostic tests listed on the French -

Euro Stoxx® Multi Premia Index

EURO STOXX® MULTI PREMIA INDEX Components1 Company Supersector Country Weight (%) SARTORIUS STEDIM BIOTECH Health Care France 1.59 IMCD Chemicals Netherlands 1.25 VOPAK Industrial Goods & Services Netherlands 1.15 BIOMERIEUX Health Care France 1.04 REMY COINTREAU Food, Beverage & Tobacco France 1.03 EURONEXT Financial Services France 1.00 HERMES INTERNATIONAL Consumer Products & Services France 0.94 SUEZ ENVIRONNEMENT Utilities France 0.94 BRENNTAG Chemicals Germany 0.93 ENAGAS Energy Spain 0.90 ILIAD Telecommunications France 0.89 DEUTSCHE POST Industrial Goods & Services Germany 0.88 FUCHS PETROLUB PREF Chemicals Germany 0.88 SEB Consumer Products & Services France 0.87 SIGNIFY Construction & Materials Netherlands 0.86 CARL ZEISS MEDITEC Health Care Germany 0.80 SOFINA Financial Services Belgium 0.80 EUROFINS SCIENTIFIC Health Care France 0.80 RATIONAL Industrial Goods & Services Germany 0.80 AALBERTS Industrial Goods & Services Netherlands 0.74 KINGSPAN GRP Construction & Materials Ireland 0.73 GERRESHEIMER Health Care Germany 0.72 GLANBIA Food, Beverage & Tobacco Ireland 0.71 PUBLICIS GRP Media France 0.70 UNITED INTERNET Technology Germany 0.70 L'OREAL Consumer Products & Services France 0.70 KPN Telecommunications Netherlands 0.68 SARTORIUS PREF. Health Care Germany 0.68 BMW Automobiles & Parts Germany 0.68 VISCOFAN Food, Beverage & Tobacco Spain 0.67 SAINT GOBAIN Construction & Materials France 0.67 CORBION Food, Beverage & Tobacco Netherlands 0.66 DAIMLER Automobiles & Parts Germany 0.66 PROSIEBENSAT.1 MEDIA Media Germany 0.65 -

Fund Holdings

Wilmington International Fund as of 7/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS ISHARES MSCI CANADA ETF 3.48% TAIWAN SEMICONDUCTOR MANUFACTURING CO LTD 2.61% DREYFUS GOVT CASH MGMT-I 1.83% SAMSUNG ELECTRONICS CO LTD 1.79% SPDR S&P GLOBAL NATURAL RESOURCES ETF 1.67% MSCI INDIA FUTURE SEP21 1.58% TENCENT HOLDINGS LTD 1.39% ASML HOLDING NV 1.29% DSV PANALPINA A/S 0.99% HDFC BANK LTD 0.86% AIA GROUP LTD 0.86% ALIBABA GROUP HOLDING LTD 0.82% TECHTRONIC INDUSTRIES CO LTD 0.79% JAMES HARDIE INDUSTRIES PLC 0.78% DREYFUS GOVT CASH MGMT-I 0.75% INFINEON TECHNOLOGIES AG 0.74% SIKA AG 0.72% NOVO NORDISK A/S 0.71% BHP GROUP LTD 0.69% PARTNERS GROUP HOLDING AG 0.65% NAVER CORP 0.61% HUTCHMED CHINA LTD 0.59% LVMH MOET HENNESSY LOUIS VUITTON SE 0.59% TOYOTA MOTOR CORP 0.59% HEXAGON AB 0.57% SAP SE 0.57% SK MATERIALS CO LTD 0.55% MEDIATEK INC 0.55% ADIDAS AG 0.54% ZALANDO SE 0.54% RIO TINTO LTD 0.52% MERIDA INDUSTRY CO LTD 0.52% HITACHI LTD 0.51% CSL LTD 0.51% SONY GROUP CORP 0.50% ATLAS COPCO AB 0.49% DASSAULT SYSTEMES SE 0.49% OVERSEA-CHINESE BANKING CORP LTD 0.49% KINGSPAN GROUP PLC 0.48% L'OREAL SA 0.48% ASSA ABLOY AB 0.46% JD.COM INC 0.46% RESMED INC 0.44% COLOPLAST A/S 0.44% CRODA INTERNATIONAL PLC 0.41% AUSTRALIA & NEW ZEALAND BANKING GROUP LTD 0.41% STRAUMANN HOLDING AG 0.41% AMBU A/S 0.40% LG CHEM LTD 0.40% LVMH MOET HENNESSY LOUIS VUITTON SE 0.39% SOFTBANK GROUP CORP 0.39% NOVARTIS AG 0.38% HONDA MOTOR CO LTD 0.37% TOMRA SYSTEMS ASA 0.37% IMCD NV 0.37% HONG KONG EXCHANGES & CLEARING LTD 0.36% AGC INC 0.36% ADYEN -

FACTSHEET - AS of 28-Sep-2021 Solactive Mittelstand & Midcap Deutschland Index (TRN)

FACTSHEET - AS OF 28-Sep-2021 Solactive Mittelstand & MidCap Deutschland Index (TRN) DESCRIPTION The Index reflects the net total return performance of 70 medium/smaller capitalisation companies incorporated in Germany. Weights are based on free float market capitalisation and are increased if significant holdings in a company can be attributed to currentmgmtor company founders. HISTORICAL PERFORMANCE 350 300 250 200 150 100 50 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 Jan-2020 Jan-2022 Solactive Mittelstand & MidCap Deutschland Index (TRN) CHARACTERISTICS ISIN / WKN DE000SLA1MN9 / SLA1MN Base Value / Base Date 100 Points / 19.09.2008 Bloomberg / Reuters MTTLSTRN Index / .MTTLSTRN Last Price 342.52 Index Calculator Solactive AG Dividends Included (Performance Index) Index Type Equity Calculation 08:00am to 06:00pm (CET), every 15 seconds Index Currency EUR History Available daily back to 19.09.2008 Index Members 70 FACTSHEET - AS OF 28-Sep-2021 Solactive Mittelstand & MidCap Deutschland Index (TRN) STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -3.69% 3.12% 7.26% 27.72% 12.73% 242.52% Performance (p.a.) - - - - - 9.91% Volatility (p.a.) 13.05% 12.12% 12.48% 13.60% 12.90% 21.43% High 357.49 357.49 357.49 357.49 357.49 357.49 Low 342.52 329.86 315.93 251.01 305.77 52.12 Sharpe Ratio -2.77 1.14 1.27 2.11 1.40 0.49 Max. Drawdown -4.19% -4.19% -4.19% -9.62% -5.56% -47.88% VaR 95 \ 99 -21.5% \ -35.8% -34.5% \ -64.0% CVaR 95 \ 99 -31.5% \ -46.8% -53.5% \ -89.0% COMPOSITION BY CURRENCIES COMPOSITION BY COUNTRIES EUR 100.0% DE