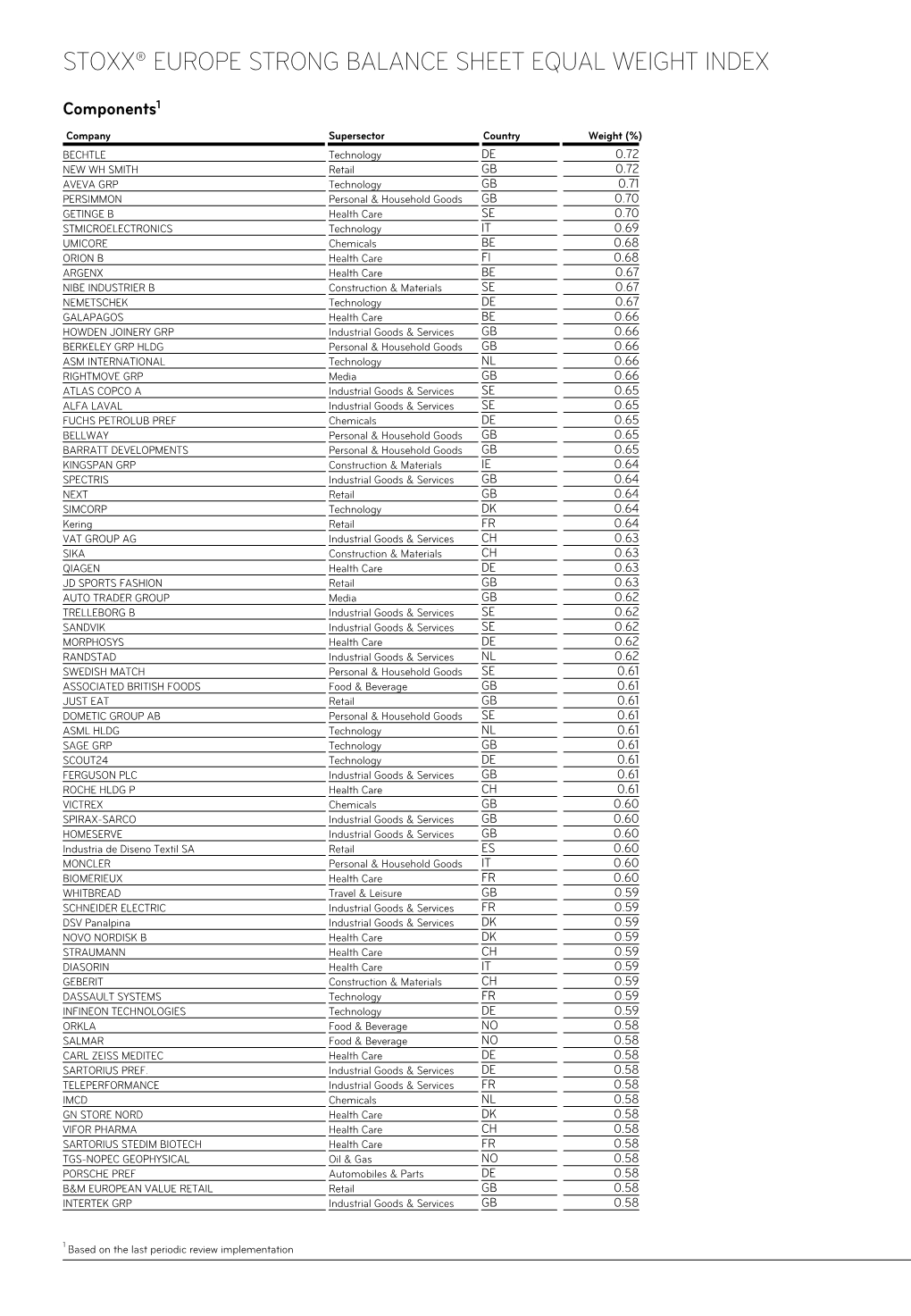

Stoxx® Europe Strong Balance Sheet Equal Weight Index

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Competitive Analysis & Two-Firm Comparison Paper Carlsberg Group

Competitive Analysis & Two-Firm Comparison Paper Carlsberg Group | Sapporo Holdings Brandon Altman Professor Geraldine Wu International Studies Program: Europe Spring 2019 Word Count: 2393 – Excluding Titles 2 Table of Contents Part 1: Industry Analysis Pg. 3 Part 2: Firm Analysis Pg. 6 Part 3: Location Matters Pg. 9 References Pg. 12 ___________ Competitive Analysis & Two-Firm Comparison Paper 3 Part 1 Industry Analysis ______________________________________________________________________________ Competitive Analysis & Two-Firm Comparison Paper 4 Nature of Danish Beer Industry: The Danish beer market has proven to be an extremely attractive industry, as evidenced by the shocking increase in beer-firm numbers over the past two decades. According to Draft Mag, “at the end of the 20th century, Denmark had around a dozen breweries to its name, most conspicuously Carlsberg, one of the world’s largest brewers of industrial lager. A decade into the 21st century, the nation boasted almost 150 breweries.” This microbrewery boom brought in a large variety of craft beers that have tended to do especially well given that “the notoriously unstable Danish weather [caused] an increase in sales of craft beer due to people being driven away from the beaches and into bars or their own homes, where the consumption of craft and specialty beers is higher” (Euromonitor). On a competitive level, Denmark is a somewhat difficult market to compete in on a large scale. As stated by Euromonitor, “beer in Denmark continued to be highly consolidated with the two -

OSB Representative Participant List by Industry

OSB Representative Participant List by Industry Aerospace • KAWASAKI • VOLVO • CATERPILLAR • ADVANCED COATING • KEDDEG COMPANY • XI'AN AIRCRAFT INDUSTRY • CHINA FAW GROUP TECHNOLOGIES GROUP • KOREAN AIRLINES • CHINA INTERNATIONAL Agriculture • AIRBUS MARINE CONTAINERS • L3 COMMUNICATIONS • AIRCELLE • AGRICOLA FORNACE • CHRYSLER • LOCKHEED MARTIN • ALLIANT TECHSYSTEMS • CARGILL • COMMERCIAL VEHICLE • M7 AEROSPACE GROUP • AVICHINA • E. RITTER & COMPANY • • MESSIER-BUGATTI- CONTINENTAL AIRLINES • BAE SYSTEMS • EXOPLAST DOWTY • CONTINENTAL • BE AEROSPACE • MITSUBISHI HEAVY • JOHN DEERE AUTOMOTIVE INDUSTRIES • • BELL HELICOPTER • MAUI PINEAPPLE CONTINENTAL • NASA COMPANY AUTOMOTIVE SYSTEMS • BOMBARDIER • • NGC INTEGRATED • USDA COOPER-STANDARD • CAE SYSTEMS AUTOMOTIVE Automotive • • CORNING • CESSNA AIRCRAFT NORTHROP GRUMMAN • AGCO • COMPANY • PRECISION CASTPARTS COSMA INDUSTRIAL DO • COBHAM CORP. • ALLIED SPECIALTY BRASIL • VEHICLES • CRP INDUSTRIES • COMAC RAYTHEON • AMSTED INDUSTRIES • • CUMMINS • DANAHER RAYTHEON E-SYSTEMS • ANHUI JIANGHUAI • • DAF TRUCKS • DASSAULT AVIATION RAYTHEON MISSLE AUTOMOBILE SYSTEMS COMPANY • • ARVINMERITOR DAIHATSU MOTOR • EATON • RAYTHEON NCS • • ASHOK LEYLAND DAIMLER • EMBRAER • RAYTHEON RMS • • ATC LOGISTICS & DALPHI METAL ESPANA • EUROPEAN AERONAUTIC • ROLLS-ROYCE DEFENCE AND SPACE ELECTRONICS • DANA HOLDING COMPANY • ROTORCRAFT • AUDI CORPORATION • FINMECCANICA ENTERPRISES • • AUTOZONE DANA INDÚSTRIAS • SAAB • FLIR SYSTEMS • • BAE SYSTEMS DELPHI • SMITH'S DETECTION • FUJI • • BECK/ARNLEY DENSO CORPORATION -

Annual Report 2001 13.02.2002 2.75 MB

Umschl_GeBe_e.qxd 25.04.2002 18:38 Uhr Seite 2 Building the Future Annual Report 2001 Umschl_GeBe_e.qxd 25.04.2002 18:39 Uhr Seite 3 Nemetschek Group at a Glance 2001 2000 Change in million DM in million DM % Sales revenue 243.4 247.7 – 1.7 % Operating income 247.9 253.1 – 2.1 % Gross profit 217.6 210.7 3.3 % as % of sales revenue 89.4 % 85.1 % EBITDA 12.2 16.4 – 25.6 % as % of sales revenue 5.0 % 6.6 % EBIT – 86.8 –8.3 945.8 % as % of sales revenue – 35.7 % – 3.4 % Net income/DVFA/SG profit after goodwill amortisation – 90.9 –10.7 749.5 % per share in DM – 9.44 – 1.11 DVFA/SG result before goodwill amortisation and equity-results –2.2 8.2 – 126.8 % per share in DM – 0.23 0.85 Umschl_GeBe_e.qxd 25.04.2002 18:39 Uhr Seite 5 Nemetschek. Present Worldwide 160,000 customers world-wide. Represented in 142 countries. 14 international subsidiaries. 400 sales partners. More than 1,000 employees world-wide. Three European development centers. Nemetschek Country Representation (without Sales Partners) Image_GeBe_e_Einzelseiten.qxd 25.04.2002 18:41 Uhr Seite 3 DESIGN BUILD MANAGE POTENTIALS Foreword 4 Building the Future 6 Design 10 Build 14 Manage 18 Potentials 20 Consolidated Financial Statements of Nemetschek AG 25 Management Report 26 Report of the Supervisory Board 31 Balance Sheet 32 Profit and Loss Statement 34 Statement of Changes in Equity 35 Cashflow Statement 36 Notes to the Accounts 37 Development of Fixed Assets 58 Report of Independent Auditors 60 The Management 62 Masthead 65 3 Image_GeBe_e_Einzelseiten.qxd 25.04.2002 18:41 Uhr Seite 4 Gerhardt Merkel Chief Executive Officer Image_GeBe_e_Einzelseiten.qxd 25.04.2002 18:41 Uhr Seite 5 FOREWORD Setting the course for the future. -

DXE Liquidity Provider Registered Firms

DXE Liquidity Provider Program Registered Securities European Equities TheCboe following Europe Limited list of symbols specifies which firms are registered to supply liquidity for each symbol in 2021-09-28: 1COVd - Covestro AG Citadel Securities GCS (Ireland) Limited (Program Three) DRW Europe B.V. (Program Three) HRTEU Limited (Program Two) Jane Street Financial Limited (Program Three) Jump Trading Europe B.V. (Program Three) Qube Master Fund Limited (Program One) Societe Generale SA (Program Three) 1U1d - 1&1 AG Citadel Securities GCS (Ireland) Limited (Program Three) HRTEU Limited (Program Two) Jane Street Financial Limited (Program Three) 2GBd - 2G Energy AG Citadel Securities GCS (Ireland) Limited (Program Three) Jane Street Financial Limited (Program Three) 3BALm - WisdomTree EURO STOXX Banks 3x Daily Leveraged HRTEU Limited (Program One) 3DELm - WisdomTree DAX 30 3x Daily Leveraged HRTEU Limited (Program One) 3ITLm - WisdomTree FTSE MIB 3x Daily Leveraged HRTEU Limited (Program One) 3ITSm - WisdomTree FTSE MIB 3x Daily Short HRTEU Limited (Program One) 8TRAd - Traton SE Jane Street Financial Limited (Program Three) 8TRAs - Traton SE Jane Street Financial Limited (Program Three) Cboe Europe Limited is a Recognised Investment Exchange regulated by the Financial Conduct Authority. Cboe Europe Limited is an indirect wholly-owned subsidiary of Cboe Global Markets, Inc. and is a company registered in England and Wales with Company Number 6547680 and registered office at 11 Monument Street, London EC3R 8AF. This document has been established for information purposes only. The data contained herein is believed to be reliable but is not guaranteed. None of the information concerning the services or products described in this document constitutes advice or a recommendation of any product or service. -

Financial Statements of Nemetschek SE for 2020

Building Lifecycle Intelligence FINANCIAL STATEMENTS (GERMAN COMMERCIAL CODE) NEMETSCHEK SE 2020 Financial Statements Nemetschek SE 2 4 Management Report 56 Balance Sheet Nemetschek SE 58 Profit and Loss Account Nemetschek SE 60 Notes to the Financial Statement ofNemetschek SE 61 Accounting policies 61 Notes to the Balance Sheet 65 Notes to the Profit and Loss Account 66 Other disclosures 68 Supervisory board 69 Executive board 70 Statementoffixedassets Nemetschek SE 72 Declaration of the members of the body authorized to represent the company 72 Inde pendent auditor’s report 78 Publication Details 3 Group Management Report 4 6 About This Report 6 Group Principles 6 Group Business Model 10 Targets and Strategy 12 Corporate Management and Governance 13 Research and Development 14 Non-Financial Declaration 14 Principles 14 Corporate Social Responsibility (CSR) at the N emetschek Group 15 Key Non-Financial Issues 16 ain Risks M Group Management Report Group 16 Key CSR Issues 22 Economic Report 22 Macroeconomic and Industry-Specific Conditions 25 Business Performance in 2020 and Key Events Influencing the Company’s Business Performance 26 Results of Operations, Financial Position and Net Assets of the Nemetschek Group 36 Results of Operations, Financial Position and Net Assets of Nemetschek SE 38 Comparison of Actual and Forecast Business Performance of the Nemetschek Group 39 Opportunity and Risk Report 46 Outlook 2021 50 O ther Disclosures, Remuneration Report 50 Corporate Governance Declaration 50 Explanatory Report of the Executive Board on Disclosures Pursuant to Sections 289a and 315a of the HGB 52 Remuneration Report 5 Combined Management Report for the 2020 Financial Year About This Report The management report of Nemetschek SE and the Group The legal corporate structure is presented in the notes of the con- managementreportforthe2020financialyearhavebeenconso- solidatedfinancialstatementsonpage124. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Annual Report 2017

Annual Report 2017 Royal Unibrew A/S CVR no. 41 95 67 12 Contents MANAGEMENT REPORT | SIGNATURES | CONSOLIDATED FINANCIAL STATEMENTS | PARENT COMPANY FINANCIAL STATEMENTS | OTHER INFORMATION ROYAL UNIBREW ANNUAL REPORT 2017 CONTENTS MANAGEMENT REPORT 2 Contents Royal Unibrew at a Glance Corporate Social Responsibility CEO Letter: Efficient Royal Unibrew in brief 4 Corporate Social Responsibility 50 strategy execution delivers Results for 2017 and Outlook for 2018 5 continued progress Financial Highlights and Ratios 6 Management's Statement and Auditor's Report Page 7 CEO Letter: Efficient strategy execution Management's Statement on delivers continued progress 7 the Annual Report 61 Independent Auditor's Report 62 Strategy and targets Strategy 10 Consolidated Financial Statements Market outlook 11 Income Statement 66 Royal Unibrew and consumers 12 Statement of Comprehensive Income 66 Strategy Royal Unibrew and innovation 13 Balance Sheet 67 Page 9 Craft and specialty beer at Royal Unibrew 14 Cash Flow Statement 68 Terme di Crodo and LemonSoda 15 Statement of Changes in Equity 69 Royal Unibrew and efficiency 16 Contents of Notes 71 Financial targets, capital structure and distribution policy 17 Parent Company Financial Statements Outlook for 2018 18 Income Statement 102 Statement of Comprehensive Income 102 Performance Balance Sheet 103 Financial Review 21 Cash Flow Statement 104 Western Europe 25 Statement of Changes in Equity 105 Italy: Aquisition of Baltic Sea 28 Contents of Notes 107 LemonSoda Malt and Exports 31 from Gruppo Other Information Campari Governance Group Structure 119 Page 15 Shareholder Information 34 Quarterly Financial Highlights and Ratios 120 Corporate Governance 37 Definitions of Financial Highlights and Ratios 121 Risk Management 40 Disclaimer 122 Remuneration 44 Board of Directors and Executive Board 46 The Annual Report has been prepared in Danish and English. -

MDAX—2019 Supervisory Board Study Key Insights from This Year’S Analysis by Russell Reynolds Associates

MDAX—2019 Supervisory Board Study Key insights from this year’s analysis by Russell Reynolds Associates Summary Over the past year, Germany's MDAX companies have experienced significant change. The number of companies in the index increased by 10, bringing the overall total to 60. Moreover, 11 "old economy" firms, including Jungheinrich, Krones, Leoni, Salzgitter and Schaeffler, were ousted by pharma, med and biotech risers, such as Evotec, Morphosys, Qiagen, Sartorius and Siemens Healthineers, as well as "new economy" powerhouses like Dialog, Nemetschek, Software AG, Telefonica D, and United Internet. This was also an exceptional election year, with 106 shareholder representative positions expiring. All positions were filled. A total of 67 board members were re-elected, while 36 were replaced. The three remaining roles were absorbed by changes to board sizes. Female shareholder representation surpasses 30 percent For the first time, the share of female shareholder representatives surpassed the required quota, reaching 30.6 percent. Including employee representatives, women now make up 32 percent of supervisory board members. A total of three boards are now chaired by women. However, there is still a major gender discrepancy concerning positions of power when comparing chairpersonships and especially executive board positions. Only four companies can boast more than 30 percent of female executives, while 40 MDAX companies do not have a single woman in a leadership role. Accelerated increase in digital directors The number of digital directors on MDAX supervisory boards showed a significant 30 percent year- on-year increase. However, digital expertise is still unevenly spread in the MDAX. Seven companies have three or more digital directors, while 57 percent of boards completely lack digital expertise. -

Incoming Letter: QIAGEN N.V

WACHTELL, LIPTON , ROSEN & KATZ MARTIN LIPTON STEVEN A. COHEN 51 W E S T 52N D S T R E E T DAVID E. SHAPIRO SABASTIAN V. NILES HERBERT M. WACHTELL DEBORAH L. PAUL DAMIAN G. DIDDEN ALISON ZIESKE PREISS THEODORE N. MIRVIS DAVID C. KARP NEW YORK, N.Y. 1 0 0 1 9 - 6 1 5 0 IAN B OC Z K O TIJANA J. DVORNIC EDWARD D. HERLIHY RICHARD K. KIM MATTHEW M. GUEST JENNA E. LEVINE DANIEL A. NEFF JOSHUA R. CAMMAKER TELEPHONE: (212) 403 -1000 DAVID E. KAHAN RYAN A. McLEOD ANDREW R. BROWNSTEIN MARK GORDON DAVID K. LAM ANITHA REDDY MARC WOLINSKY JOSEPH D. LARSON FACSIMILE: (212) 403 -2000 BENJAMIN M. ROTH JOHN L. ROBINSON STEVEN A. ROSENBLUM JEANNEMARIE O’BRIEN JOSHUA A. FELTMAN JOHN R. SOBOLEWSKI JOHN F. SAVARESE WAYNE M. CARLIN GEORGE A. KATZ (1965 -1 9 8 9) ELAINE P. GOLIN STEVEN WINTER SCOTT K. CHARLES STEPHEN R. D iPRIMA JAMES H. FOGELSON (1967 - 1 9 91) EMI L A. KLEINHAUS EMILY D. JOHNSON JODI J. SCHWARTZ NICHOLAS G. DEMMO LEONARD M. ROSEN (1965 - 2 0 14 ) KARESSA L. CAIN JACOB A. KLING ADAM O. EMMERICH IGOR KIRMAN RONALD C. CHEN RAAJ S. NARAYAN RALPH M. LEVENE JONATHAN M. MOSES OF C O UN S EL GORDON S. MOODIE VIKTOR SAPEZHNIKOV RICHARD G. MASON T. EIKO STANGE DONGJU SONG MICHAEL J. SCHOBEL MARTIN J.E. ARMS ERIC S. ROBINSON DAVID M. SILK JOHN F. LYNCH BRADLEY R. WILSON ELINA TETELBAUM MICHAEL H. BYOWITZ PATRICIA A. ROBINSON* ROBIN PANOVKA WILLIAM SAVITT GRAHAM W. -

Danske Bank Copenhagen Winter Seminar 4 December 2018

Danske Bank Copenhagen Winter Seminar 4 December 2018 Royal Unibrew A/S Hans Savonije, President & CEO Strong development on our strategic agenda • Maintaining the good momentum in the business • High level of M&A activities − Integrations of Lorina and Terme di Crodo are progressing as planned − Distribution of Nohrlund cocktails for the on-trade segment commenced in Q4 − Approval of CULT acquisition with the Danish competition authorities awaiting • Strong focus on price/pack strategies and premiumization − Craft and specialty remain a key focus area with investments in new tap wall system at restaurants and bars and opening of our new Anarkist brewpub earlier this year − High level of new product line extensions launched both domestically and abroad • Investments in commercial initiatives to improve sales and brands − Successful development within our sponsored events − Key brand initiatives with new packaging formats for our Crodo products in Italy, Supermalt Ginger beer in the UK, Jaffa low-sugar range in Finland and non/low alcohol products with Royal Organic 2.3% and Heineken 0.0% − Continued investments to increase our commercial presence internationally Danske Bank – Copenhagen Winter Seminar 4 December 2018 2 Consistent commercial execution and historical warm summer drive solid earnings growth Net revenue of DKKm 5,624 after 9 months 2018 (+16%) EBIT margin improved to 19.4% after 9 months 2018 Volume up 10.5% to 8.4m HL from 7.6m HL last year Overall market shares improved in the third quarter; mainly due to superior logistical -

Customized Brewery Solutions with Timely Project Execution

CASE STORY Customized brewery solutions with timely project execution Royal Unibrew, Faxe, Denmark Most breweries know Alfa Laval’s wide range of processing technologies. But the equipment is really just the tip of the iceberg. Thanks to decades of industry experience, Alfa Laval is also able to help breweries around the world design and install complete solutions customized according to their specific needs. That record of engineering expertise and proven project management was exactly what European beverage manufacturer Royal Unibrew was looking for. They turned to Alfa Laval to deliver a complete solution for the cold block at their 120-year-old brewery in Faxe, Denmark, including a new filtration line and bright beer tank area. The success of these first installations have resulted in a growing partnership between the two companies, with a number of new projects now underway. Royal Unibrew is a small group with an increasingly A better solution for yield and sustainability diverse product portfolio. Their operation includes both The Faxe Brewery’s first major project was the installation large mainstream breweries and smaller craft breweries of a membrane filtration line to replace their reliance spread throughout Denmark, Finland, Lithuania, Estonia, on kieselguhr filtration. The goals of the project were France and Italy. twofold. On one hand, the brewery wanted to improve sustainability by phasing out the use of the environmen- “Royal Unibrew as a company started in 1989, but tally harmful kieselguhr. Second, and critically, they also the Faxe Brewery has been in operation since 1901,” wanted to reduce beer loss during batch changeovers explains Anders Nielsen, Brewhouse Manager at Faxe to be able to better meet volume and flexibility needs. -

List of SARS-Cov-2 Diagnostic Test Kits and Equipments Eligible For

Version 33 2021-09-24 List of SARS-CoV-2 Diagnostic test kits and equipments eligible for procurement according to Board Decision on Additional Support for Country Responses to COVID-19 (GF/B42/EDP11) The following emergency procedures established by WHO and the Regulatory Authorities of the Founding Members of the GHTF have been identified by the QA Team and will be used to determine eligibility for procurement of COVID-19 diagnostics. The product, to be considered as eligible for procurement with GF resources, shall be listed in one of the below mentioned lists: - WHO Prequalification decisions made as per the Emergency Use Listing (EUL) procedure opened to candidate in vitro diagnostics (IVDs) to detect SARS-CoV-2; - The United States Food and Drug Administration’s (USFDA) general recommendations and procedures applicable to the authorization of the emergency use of certain medical products under sections 564, 564A, and 564B of the Federal Food, Drug, and Cosmetic Act; - The decisions taken based on the Canada’s Minister of Health interim order (IO) to expedite the review of these medical devices, including test kits used to diagnose COVID-19; - The COVID-19 diagnostic tests approved by the Therapeutic Goods Administration (TGA) for inclusion on the Australian Register of Therapeutic Goods (ARTG) on the basis of the Expedited TGA assessment - The COVID-19 diagnostic tests approved by the Ministry of Health, Labour and Welfare after March 2020 with prior scientific review by the PMDA - The COVID-19 diagnostic tests listed on the French