Download Annual Report 2013

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Corporate Social Responsibility Report 2016 Walgreens Boots Alliance Is the First Global Pharmacy-Led, Health and Wellbeing Enterprise

Corporate Social Responsibility Report 2016 Walgreens Boots Alliance is the first global pharmacy-led, health and wellbeing enterprise. Our purpose is to help people across the world lead healthier and happier lives. Our 2016 Corporate Social Responsibility Report covers the fiscal year that ended 31 August 2016. In this year’s report: Overview Marketplace Introduction ...................................................1 Our CSR goals .............................................2 28 Our vision, purpose and values ................3 Our approach to CSR .................................4 Contributing to the United Nations Sustainable Development Goals .............6 Transparency ........................................... 30 Our impact ...................................................8 Ethical Sourcing ...................................... 30 ........................... About our Company ................................. 10 External Stakeholders 31 Stakeholder engagement ....................... 12 Workplace Community 32 14 Employee Health and Wellbeing ........ 34 Equal Opportunities .............................. 36 Health and Wellbeing ............................. 16 Health and Safety ...................................37 Young People ........................................... 17 ...................................... Cancer Programs .....................................20 About this report 38 Data management process ................ 38 Environment Data ............................................................ 38 Community data -

OSB Participant List by Research Area

OSB Participant List by Research Area Contact Centers (CC) • AARP • Air Products and • American Drug Stores Chemicals • AAA • ABB • American Electric Power • Airbus • Accor • Abbott • American Express • Alcatel Lucent • American Electric Power • Abengoa • American International • Alcoa Group • American International • Abu Dhabi National Group Energy Company • Alcon • American Stores Company • Austin Energy • ACC Limited • Alfa • American Water • Bank of America • Access Insurance Holdings • Algonquin Power & • Amgen Utilities • Blue Cross Blue Shield • Accord Holdings • AMIL • ALH Group • Charles Schwab & • ACE • AmInvestment Bank Company • Alitalia • Acea • AMR • Citigroup • ALK Abello • Acer • Amssi • Citizens Gas • Alkermes • Acxiom • Amtran Logistics • Clarke American • Allergan • Adelaide Clinic Holdings • Andrew Corporation • CPS Energy • Alliance & Leicester • Adidas • Anglian Water Services • Direct Energy • Alliance Boots • Advance Food Company • Anritsu • Federal Reserve Bank of • Alliant Techsystems Minneapolis • Advance Publications • Anschutz • Allianz • John Deere • Advanced Coating • Apache • Allied Irish Banks • Technologies Louisville Water Company • Apex Equity Holdings • Advanced Semiconductor • Allstate Insurance • Manila Electric Company Engineering Company • Apple • • • Mellon Financial Adventist Health System Ally Financial • Arcadia Housing • • • MetLife Aegon Alon USA Energy • Arcos Dorados Holdings • • • Morgan Stanley AEON AlpTransit Gotthard • Ardent Health Services • • • NetBank Aera Energy Alstom • Argos • -

Local Businesses – Large and Small

Local Businesses – Large and Small The details of the local businesses documented below have been researched by the Local History Group. Thomas Glover & Son Thomas Glover & Son, elastic web and fabric manufacturers appeared in the Post Office Directory for Nottinghamshire in 1855. The company is recorded as having several addresses in Nottingham, however it had disappeared from the directory by 1900, returning in 1925 described as a surgical hosier in Chesterfield Street, Carlton. The firm remained at that address until the 1970s. The company’s buildings were on both sides of Chesterfield Street but are now demolished, new houses being built on the side. Turney Brothers In 1861 two brothers, Edward and John Turney built a tannery and began to make leather on a site next to the River Trent and the adjacent canal in Nottingham, known as Sneinton Island. The first buildings took up only a fraction of the space that by the 1920s had developed into a large site with labour-saving machinery imported from many countries. They traded under the name of Turney Brothers and had offices in London, Leicester and Manchester. Edward left some years after the commencement of the company and the driving force was John Turney who was in sole charge for over a quarter of a century. In 1888 the company re-organised into a Limited Company, John being chairman. John led an exceptionally distinguished social, political and commercial life. He was a member of Nottingham Corporation for 46 years, and became Sheriff and then Alderman in 1879 and Mayor for two years 1886 – 1888. -

Equity Outlook

ECONOMIC & STRATEGY RESEARCH 10 April 2017 Equity Research Extract from a report Equity Outlook Global equity market gets the green light ■ The global stock market followed its successful final quarter of last year and Miroslav Frayer shares also grew in 1Q17. The MSCI world equity index has increased more than (420) 222 008 567 miroslav_ frayer @kb.cz 6% since the beginning of the year. Richard Miřátský ■ The PSE’s PX index has slightly surpassed the performance of major U.S. and (420) 222 008 560 [email protected] European indexes. It has added more than 6% since January. In comparison with Jana Steckerová regional competitors, the Polish WIG20 became a clear winner, jumping 15%. On the (420) 222 008 524 jana _steckerova @kb.cz contrary, the Hungarian BUX’s profit of less than 1.5% has not enthused investors. ■ A positive for the PSE is the fact that we have found no company whose shares remained in the red in the first quarter of the year. Shares of petrochemical group Unipetrol became a clear winner, on the contrary, the largest issuance, CEZ, added the smallest gains from the Prague peloton. ■ The average daily trading volume for the past two quarters was more volatile. Nevertheless, it is evident that Moneta Money Bank’s entry supported trading activity on the domestic market. For the first three months, the newcomer became the No. 1 among the most traded stocks on the Prague Stock Exchange. ■ SG increased the weight of equities in its global portfolio from 58% to 63%. Improving macroeconomic environment, reflation and the structural switch from monetary to fiscal policy impetus in developed countries are strong incentives for investors to switch out of expensive bonds into equities. -

Corporate Finance Guide 2021 CORPORATE FINANCE GUIDE SPECIAL | CORPORATE

01/06/2021 15:30 15:30 01/06/2021 01/06/2021 1 1 cover.indd cover.indd Guide Guide Finance Finance Corporate Corporate MIDLANDS BUSINESS INSIDER www.midlandsbusinessinsider.com JULY 2021 JULY midlands businessinsider WEST ™ MIDLANDS insiderEDITION VOL.29 NO.7 £10 JULY 2021 West Midlands Mayor What does business want from Andy Street’s second term? CITY OF CULTURE CITY OFCULTURE Wolverhampton The new home of green construction | SMEGUIDE Mental health | MENTAL HEALTH HEALTH MENTAL Helping a colleague on the edge | RESIDENTIAL AWARDS RESIDENTIALAWARDS | CORPORATE FINANCEGUIDESPECIAL CORPORATE Guide Guide 2021 Corporate Finance Corporate MIDLANDS | CIRCULARECONOMY FIREDHOW A YEAR AS CITY OF CULTURE UP! IS VOL.29 N VOL.29 SPARKING GROWTH IN COVENTRY O 7 MBI July 2021 cover MASTER.indd 1 02/06/2021 15:00 Optimising outcomes for our clients no matter what their destination DLA Piper has been the No 1 M&A law firm, both in the UK and globally, for each of the past 11 years. Trusted adviser to: Put simply, we do things that other law firms cannot. Times 2 SISTERS FOOD GROUP may change, but our qualities do not. Our clients trust us with Advised on the GBP246m sale of part of Fox’s Biscuits to their most important, strategic and transformational M&A and Ferrero Group. ECM transactions. We use our market and sector intelligence and unrivalled deal execution experience to drive and obtain NOBLE GROUP optimal outcomes for our clients, no matter what the deal type, Advised on the sale of chilled dessert brand Gü to Exponent the transaction process, the geography or the counter-party. -

€30.0M €147.7M €68.8M €28.1M €274.6M

A leading owner and producer of premium branded spirits and liqueurs that are sold principally in Central and Eastern Europe Over 45 brands, exporting to more than Capitalising on key consumer trends 50 countries worldwide through own driving growth in spirits value in rd 1 distribution and 3 party arrangements Central and Eastern Europe: Global sales volumes total over 115 • Premiumisation million litres per year1 • Diversification of drinking occasions • Growing confidence in local provenance Wholly owned operations in Poland, the Czech Republic, Slovakia, Italy, Croatia and Bosnia & Herzegovina #2 in Poland in clear vodka and #1 in flavoured vodka and 2 State of the art production facilities in vodka-based liqueurs Poland, the Czech Republic and Germany #1 in the Czech Republic in spirits, rum, bitters and vodka3 Listed on the main market of the London #1 in Italy in vodka, vodka-based Stock Exchange liqueurs, limoncello, #2 in brandy4 Primary Markets 100% 54% 25% 10% 11% €274.6m €147.7m €68.8m €28.1m €30.0m 2016: €261.0m 2016: €136.9m 2016: €63.2m 2016: €29.4m 2016: €31.5m Group Poland Czech Republic Italy Other Stock Spirits Group No. 2 in vodka with No. 1 in spirits with 33.6% No.1 in vodka, flavoured Slovakia, Croatia, Bosnia is headquartered in 26.7% value share5 value share6 vodka-based liqueurs and and Herzegovina. the UK Core categories: vodka, Core categories: rum, limoncello. 5.6% value International exports: USA, flavoured vodka-based bitters, vodka, flavoured share of spirits7 Germany, Canada, UK, liqueurs, whisky vodka-based liqueurs, Core categories: vodka, Slovenia and other Balkan whisky flavoured vodka-based countries liqueurs, limoncello, brandy Sources 1. -

Stock Spirits Group PLC Results for the Six Months Ended 31 March

Stock Spirits Group PLC Results for the six months ended 31 March 2021 Continued resilience in a challenging trading environment 12 May 2021: Stock Spirits Group PLC (“Stock Spirits” or the “Company” or the “Group”), a leading owner and producer of branded spirits and liqueurs that are principally sold in Central and Eastern Europe and Italy, announces its results for the six months ended 31 March 2021. Financial and operational highlights Reported Reported All values in € millions unless otherwise six months six months stated to March to March % 2021 2020 Movement Volume (millions 9 litre cases) 8.3 8.1 +2.0% Revenue 183.4 189.6 -3.3% Revenue at constant currency1 +0.3% Adjusted EBITDA2 44.5 45.6 -2.4% Adjusted EBITDA at constant currency +1.7% Operating profit before exceptional items 37.9 38.8 -2.3% Profit for the period 28.1 14.7 +91.6% Earnings per share – basic (€ cents per 14.11 7.41 +90.4% share) Adjusted EPS – basic3 (€ cents per share) 14.11 14.38 -1.9% Net debt 38.3 55.4 -30.9% • Year-on-year growth in market shares in the off-trade in our core markets of Poland and the Czech Republic - a resilient performance despite COVID-19 lockdowns closing or heavily restricting the on-trade channel for almost the entire period (6% of the Group’s revenue in the first half compared to a normal level of 15%) • Continuing positive momentum in Poland, our largest market (57% of Group revenue), achieving a five-year-high value market share of 30.7% as at March 20214 in the important vodka category, with revenue up +4.3% and EBITDA up +6.8% on a constant currency basis • Czech business (25% of Group revenue) has been impacted the most by on-trade closure, and local competition has increased: revenue declined by 13.6% and EBITDA by 21.2% both 1 Constant currency is calculated by converting the prior period results at current period FX rates 2 The Company and its subsidiaries, Stock Spirits Group (the “Group”) uses alternative performance measures as key financial indicators to assess underlying performance of the Group. -

Glaxosmithkline Aims to Divest Many OTC Brands

OTC11-02-11p1&28FIN.qxd 8/2/11 11:52 Page 1 11 February 2011 COMPANY NEWS 3 GlaxoSmithKline aims to Valeant expands in CEE 3 with PharmaSwiss deal J&J loses sales of US$1.1bn 4 Boots faces up to tough market 5 divest many OTC brands Key brands boost Novartis OTC sales 6 GSK consumer races ahead 7 laxoSmithKline intends to divest non- to divest the non-core brands as soon as pos- Taisho holds steady in weak market 8 Gcore OTC brands with combined an- sible – hopefully before the end of the year – Vicks shipments lift OTC at P&G 9 nual sales of £500 million (C593 million). depending on buyer interest. Perrigo plans spring Allegra launch 10 Chief executive officer Andrew Witty said The announcement came as GlaxoSmith- Consumer Care grows at Merck & Co 11 the move would enable the company’s Con- Kline reported a 7% rise – 5% at constant ex- Omega reports strong quarter 12 sumer Healthcare division to focus more effec- change rates – in 2010 sales at the Consumer Winter woes hit Boiron 13 tively on its “priority or global” brands as well Healthcare division to £5.01 billion. Sales in Pfizer wants Consumer 14 as its operations in emerging markets. Consumer Healthcare’s OTC Medicines busi- to prove worth A spokesperson for GlaxoSmithKline told ness grew by 5% – 3% at constant exchange OTC bulletin that the company was currently rates – to £2.46 billion. GENERAL NEWS 15 compiling the lists of priority and non-core OTC brands, and hoped to release more details Recent deals with Meda and Valeant Perrigo faces lawsuit over 15 in the second quarter of the year. -

Management Stakeholders

Hyperglycaemia in acute coronary syndromes: management Stakeholders 15 Healthcare 2gether NHS Foundation Trust 3M Health Care UK 4Children 5 Boroughs Partnership NHS Foundation Trust A.Menarini Pharma U.K. S.R.L. Abbott Diabetes Care Abbott Diagnostics Division Abbott Diagnostics Division Abbott Laboratories Abbott Vascular Devices Abbott Vascular Devices AbbVie AbbVie Abertawe Bro Morgannwg University NHS Trust Achieving for Children Action Heart Action on Addiction Action on Hearing Loss Action on Smoking & Health Action on Smoking and Health Addaction Addenbrookes Hospital Addiction Today ADFAM Adults Strategy and Commissioning Unit Advisory Committee for Community Dentistry Advisory Council on the Misuse of Drugs Afiya Trust African Health Policy Network Aintree University Hospital NHS Foundation Trust Alcohol and Drug service Alcohol Focus Scotland Alcohol Use Disorders: Clinical Management Guideline Development Group Alcoholics Anonymous Alder Hey Children's NHS Foundation Trust Alere Alere Alere International Alere Ltd Alere Ltd Alkermes Inc All Party Parliamentary Group on Vascular Disease Allergan Ltd UK Alliance Boots plc Allocate Software PLC Alpha Medical American Medical Systems Inc. American Medical Systems Inc. American Medical Systems UK Ltd AMORE health Ltd AMORE health Ltd AMORE Studies Group AMORE Studies Group Aneurin Bevan University Health Board anglia community leisure Anglia University Anglian Community Enterprise Ark Therapeutics Ltd Arrhythmia Alliance Arrowe Park Hospital Assocation of NHS Occupational Physicians -

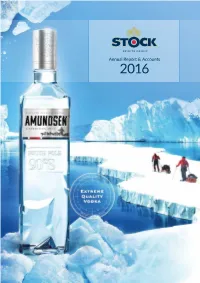

Annual Report & Accounts

Stock Spirits Group PLC Solar House Stock Spirits Group PLC Mercury Park Wooburn Green Buckinghamshire HP10 0HH United Kingdom Annual Report & Accounts www.stockspirits.com Tel: +44 1628 648500 Fax: +44 1628 521366 2016 Annual Report & Accounts 2016 Our goal is to become Central and Eastern Europe’s leading spirits company, commanding a major stae in each o or core operan markets and making our presence felt in the wider global market. Strategic reviewGroup at a glance Our core brands Regional reviews Financial statements Page 02 Page 00 Page 26 Page 30 Page 102 Strategic review eional reies Governance Financial statements Chairman’s statement 05 Poland 30 Directors and Company Consolidated income ie ecutie cers Czech Republic 34 Secretary 56 statement 104 statement 09 Italy 36 Senior Management 58 Consolidated statement o comreensie income 10 Group at a glance 16 ter 3 ororate oernance Consolidated statement ur business model 1 erations 3 airmans leer 60 o nancial osition 106 Strategy and KPIs 20 ur eole 3 ororate oernance Consolidated statement ur marets 22 framework 61 Corporate responsibility 40 of changes in equity 108 irits maret oerie 2 udit ommiee reort 6 Financial reie 3 Consolidated statement omination ommiee ur core brands 26 rincial riss and iabilit o cas os 10 reort 3 statement 48 Notes to the consolidated Directors remuneration nancial statements 110 reort Shareholders’ Directors’ report 91 inormaon 171 Statement of Directors’ seul lins 12 resonsibilities Independent auditor’s report 96 trateic reie oernance Financial statements Stock Spirits Group Annual Report & Accounts 2016 01 erie Financial highlights 12.3m €261.0 m 9 litre cases otal net sales reenue (2015: 11.8 million 9 litre cases) (2015: €262.6 million) €40.1m €28.4m eratin rot rot or te ear 201 1million (2015: €19.4 million) 19. -

WALGREENS BOOTS ALLIANCE, INC . (Exact Name of Registrant As Specified in Its Charter) Delaware 47-1758322 (State of Incorporation) (I.R.S

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended August 31, 2016 ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition Period From ____________ to ___________ Commission file number 001-36759 WALGREENS BOOTS ALLIANCE, INC . (Exact name of registrant as specified in its charter) Delaware 47-1758322 (State of incorporation) (I.R.S. Employer Identification No.) 108 Wilmot Road, Deerfield, Illinois 60015 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (847) 315-2500 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock ($.01 Par Value) The NASDAQ Stock Market LLC 2.875% Notes due 2020 New York Stock Exchange 3.600% Notes due 2025 New York Stock Exchange 2.125% Notes due 2026 New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. -

Erste Stock Europe Emerging

ERSTE STOCK EUROPE EMERGING Jointly owned fund pursuant to the InvFG Semi-Annual Report 2020 ERSTE STOCK EUROPE EMERGING Contents General Information about the Investment Firm ������������������������������������������������������������������������������������������������������������������ 3 Asset Allocation ����������������������������������������������������������������������������������������������������������������������������������������������������������������������� 4 Statement of Assets and Liabilities as of 30 November 2020 �������������������������������������������������������������������������������������������� 5 2 Semi-Annual Report 2020 General Information about the Investment Firm The company Erste Asset Management GmbH Am Belvedere 1, A-1100 Vienna Telephone: +43 05 0100-19777, fax: +43 05 0100-919777 Registered capital EUR 2�50 million Shareholders Erste Group Bank AG (64�67%) Erste Bank der österreichischen Sparkassen AG (22�17%) Steiermärkische Bank und Sparkassen Aktiengesellschaft (3�30%) Tiroler Sparkasse Bankaktiengesellschaft Innsbruck (1�74%) DekaBank Deutsche Girozentrale, Frankfurt (1�65%) „Die Kärntner“ Trust-Vermögensverwaltungsgesellschaft m� b� H� & Co KG (1�65%) Salzburger Sparkasse Bank Aktiengesellschaft (1�65%) Sieben Tiroler Sparkassen Beteiligungsgesellschaft m� b� H� (1�65%) NÖ-Sparkassen Beteiligungsgesellschaft m� b� H� (0�76%) VIENNA INSURANCE GROUP AG Wiener Versicherung Gruppe (0�76%) Supervisory Board Rudolf SAGMEISTER (Chairman) Thomas SCHAUFLER (Deputy Chairman) Harald GASSER Gerhard GRABNER