1054 PLG Journal Issue 21 01.04.Indd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Corporate Social Responsibility Report 2016 Walgreens Boots Alliance Is the First Global Pharmacy-Led, Health and Wellbeing Enterprise

Corporate Social Responsibility Report 2016 Walgreens Boots Alliance is the first global pharmacy-led, health and wellbeing enterprise. Our purpose is to help people across the world lead healthier and happier lives. Our 2016 Corporate Social Responsibility Report covers the fiscal year that ended 31 August 2016. In this year’s report: Overview Marketplace Introduction ...................................................1 Our CSR goals .............................................2 28 Our vision, purpose and values ................3 Our approach to CSR .................................4 Contributing to the United Nations Sustainable Development Goals .............6 Transparency ........................................... 30 Our impact ...................................................8 Ethical Sourcing ...................................... 30 ........................... About our Company ................................. 10 External Stakeholders 31 Stakeholder engagement ....................... 12 Workplace Community 32 14 Employee Health and Wellbeing ........ 34 Equal Opportunities .............................. 36 Health and Wellbeing ............................. 16 Health and Safety ...................................37 Young People ........................................... 17 ...................................... Cancer Programs .....................................20 About this report 38 Data management process ................ 38 Environment Data ............................................................ 38 Community data -

OSB Participant List by Research Area

OSB Participant List by Research Area Contact Centers (CC) • AARP • Air Products and • American Drug Stores Chemicals • AAA • ABB • American Electric Power • Airbus • Accor • Abbott • American Express • Alcatel Lucent • American Electric Power • Abengoa • American International • Alcoa Group • American International • Abu Dhabi National Group Energy Company • Alcon • American Stores Company • Austin Energy • ACC Limited • Alfa • American Water • Bank of America • Access Insurance Holdings • Algonquin Power & • Amgen Utilities • Blue Cross Blue Shield • Accord Holdings • AMIL • ALH Group • Charles Schwab & • ACE • AmInvestment Bank Company • Alitalia • Acea • AMR • Citigroup • ALK Abello • Acer • Amssi • Citizens Gas • Alkermes • Acxiom • Amtran Logistics • Clarke American • Allergan • Adelaide Clinic Holdings • Andrew Corporation • CPS Energy • Alliance & Leicester • Adidas • Anglian Water Services • Direct Energy • Alliance Boots • Advance Food Company • Anritsu • Federal Reserve Bank of • Alliant Techsystems Minneapolis • Advance Publications • Anschutz • Allianz • John Deere • Advanced Coating • Apache • Allied Irish Banks • Technologies Louisville Water Company • Apex Equity Holdings • Advanced Semiconductor • Allstate Insurance • Manila Electric Company Engineering Company • Apple • • • Mellon Financial Adventist Health System Ally Financial • Arcadia Housing • • • MetLife Aegon Alon USA Energy • Arcos Dorados Holdings • • • Morgan Stanley AEON AlpTransit Gotthard • Ardent Health Services • • • NetBank Aera Energy Alstom • Argos • -

Local Businesses – Large and Small

Local Businesses – Large and Small The details of the local businesses documented below have been researched by the Local History Group. Thomas Glover & Son Thomas Glover & Son, elastic web and fabric manufacturers appeared in the Post Office Directory for Nottinghamshire in 1855. The company is recorded as having several addresses in Nottingham, however it had disappeared from the directory by 1900, returning in 1925 described as a surgical hosier in Chesterfield Street, Carlton. The firm remained at that address until the 1970s. The company’s buildings were on both sides of Chesterfield Street but are now demolished, new houses being built on the side. Turney Brothers In 1861 two brothers, Edward and John Turney built a tannery and began to make leather on a site next to the River Trent and the adjacent canal in Nottingham, known as Sneinton Island. The first buildings took up only a fraction of the space that by the 1920s had developed into a large site with labour-saving machinery imported from many countries. They traded under the name of Turney Brothers and had offices in London, Leicester and Manchester. Edward left some years after the commencement of the company and the driving force was John Turney who was in sole charge for over a quarter of a century. In 1888 the company re-organised into a Limited Company, John being chairman. John led an exceptionally distinguished social, political and commercial life. He was a member of Nottingham Corporation for 46 years, and became Sheriff and then Alderman in 1879 and Mayor for two years 1886 – 1888. -

Corporate Finance Guide 2021 CORPORATE FINANCE GUIDE SPECIAL | CORPORATE

01/06/2021 15:30 15:30 01/06/2021 01/06/2021 1 1 cover.indd cover.indd Guide Guide Finance Finance Corporate Corporate MIDLANDS BUSINESS INSIDER www.midlandsbusinessinsider.com JULY 2021 JULY midlands businessinsider WEST ™ MIDLANDS insiderEDITION VOL.29 NO.7 £10 JULY 2021 West Midlands Mayor What does business want from Andy Street’s second term? CITY OF CULTURE CITY OFCULTURE Wolverhampton The new home of green construction | SMEGUIDE Mental health | MENTAL HEALTH HEALTH MENTAL Helping a colleague on the edge | RESIDENTIAL AWARDS RESIDENTIALAWARDS | CORPORATE FINANCEGUIDESPECIAL CORPORATE Guide Guide 2021 Corporate Finance Corporate MIDLANDS | CIRCULARECONOMY FIREDHOW A YEAR AS CITY OF CULTURE UP! IS VOL.29 N VOL.29 SPARKING GROWTH IN COVENTRY O 7 MBI July 2021 cover MASTER.indd 1 02/06/2021 15:00 Optimising outcomes for our clients no matter what their destination DLA Piper has been the No 1 M&A law firm, both in the UK and globally, for each of the past 11 years. Trusted adviser to: Put simply, we do things that other law firms cannot. Times 2 SISTERS FOOD GROUP may change, but our qualities do not. Our clients trust us with Advised on the GBP246m sale of part of Fox’s Biscuits to their most important, strategic and transformational M&A and Ferrero Group. ECM transactions. We use our market and sector intelligence and unrivalled deal execution experience to drive and obtain NOBLE GROUP optimal outcomes for our clients, no matter what the deal type, Advised on the sale of chilled dessert brand Gü to Exponent the transaction process, the geography or the counter-party. -

Download Annual Report 2013

Annual Report 2013 Our goal Our goal is to become Central and Eastern Europe’s leading spirits company – commanding a major stake in each of our core operating markets and making our presence felt in the wider global market. Contents Strategic report Chairman’s statement 02 Group at a glance 04 Our “millionaire” brands 06 Our heritage 08 Chief Executive Officer’s statement 10 Our business model 14 Strategy and KPIs 16 Our markets 18 HIGHLIGHTS Spirits market overview 20 Regional reviews Poland 22 17.4 m €340.5m Czech Republic 24 Italy 26 9 LITRE CASES NET SALES REVENUE Other 27 +11.4% +16.4% Operations 28 2012: 15.6m 9 litre cases 2012: €292.4m Our people 29 Corporate responsibility 30 €83.7m €47.7m Financial review 32 Principal risks 36 ADJUSTED EBITDA* OPERATING PROFIT Directors and +22.3% -44.2% Company Secretary 42 2012: €68.4m 2012: €85.4m Senior management 44 Corporate governance 46 Chairman’s letter 46 €74.4 m €8.9m Corporate governance framework 47 ADJUSTED EBIT* PROFIT FOR THE YEAR Audit Committee report 52 +26.7% -66.0% 2012: €58.7m 2012: €26.2m Nomination Committee report 56 Directors’ remuneration * Stock Spirits Group uses alternative performance measures as key financial indicators to assess the underlying performance of the Group. These include adjusted EBITDA, adjusted EBIT and adjusted free cash flow. report 57 The narrative in the Annual Report & Accounts is based on these alternative measures and an explanation is set out in note 7 to the consolidated financial statements included in the Annual Report & Accounts. -

Glaxosmithkline Aims to Divest Many OTC Brands

OTC11-02-11p1&28FIN.qxd 8/2/11 11:52 Page 1 11 February 2011 COMPANY NEWS 3 GlaxoSmithKline aims to Valeant expands in CEE 3 with PharmaSwiss deal J&J loses sales of US$1.1bn 4 Boots faces up to tough market 5 divest many OTC brands Key brands boost Novartis OTC sales 6 GSK consumer races ahead 7 laxoSmithKline intends to divest non- to divest the non-core brands as soon as pos- Taisho holds steady in weak market 8 Gcore OTC brands with combined an- sible – hopefully before the end of the year – Vicks shipments lift OTC at P&G 9 nual sales of £500 million (C593 million). depending on buyer interest. Perrigo plans spring Allegra launch 10 Chief executive officer Andrew Witty said The announcement came as GlaxoSmith- Consumer Care grows at Merck & Co 11 the move would enable the company’s Con- Kline reported a 7% rise – 5% at constant ex- Omega reports strong quarter 12 sumer Healthcare division to focus more effec- change rates – in 2010 sales at the Consumer Winter woes hit Boiron 13 tively on its “priority or global” brands as well Healthcare division to £5.01 billion. Sales in Pfizer wants Consumer 14 as its operations in emerging markets. Consumer Healthcare’s OTC Medicines busi- to prove worth A spokesperson for GlaxoSmithKline told ness grew by 5% – 3% at constant exchange OTC bulletin that the company was currently rates – to £2.46 billion. GENERAL NEWS 15 compiling the lists of priority and non-core OTC brands, and hoped to release more details Recent deals with Meda and Valeant Perrigo faces lawsuit over 15 in the second quarter of the year. -

Management Stakeholders

Hyperglycaemia in acute coronary syndromes: management Stakeholders 15 Healthcare 2gether NHS Foundation Trust 3M Health Care UK 4Children 5 Boroughs Partnership NHS Foundation Trust A.Menarini Pharma U.K. S.R.L. Abbott Diabetes Care Abbott Diagnostics Division Abbott Diagnostics Division Abbott Laboratories Abbott Vascular Devices Abbott Vascular Devices AbbVie AbbVie Abertawe Bro Morgannwg University NHS Trust Achieving for Children Action Heart Action on Addiction Action on Hearing Loss Action on Smoking & Health Action on Smoking and Health Addaction Addenbrookes Hospital Addiction Today ADFAM Adults Strategy and Commissioning Unit Advisory Committee for Community Dentistry Advisory Council on the Misuse of Drugs Afiya Trust African Health Policy Network Aintree University Hospital NHS Foundation Trust Alcohol and Drug service Alcohol Focus Scotland Alcohol Use Disorders: Clinical Management Guideline Development Group Alcoholics Anonymous Alder Hey Children's NHS Foundation Trust Alere Alere Alere International Alere Ltd Alere Ltd Alkermes Inc All Party Parliamentary Group on Vascular Disease Allergan Ltd UK Alliance Boots plc Allocate Software PLC Alpha Medical American Medical Systems Inc. American Medical Systems Inc. American Medical Systems UK Ltd AMORE health Ltd AMORE health Ltd AMORE Studies Group AMORE Studies Group Aneurin Bevan University Health Board anglia community leisure Anglia University Anglian Community Enterprise Ark Therapeutics Ltd Arrhythmia Alliance Arrowe Park Hospital Assocation of NHS Occupational Physicians -

WALGREENS BOOTS ALLIANCE, INC . (Exact Name of Registrant As Specified in Its Charter) Delaware 47-1758322 (State of Incorporation) (I.R.S

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended August 31, 2016 ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition Period From ____________ to ___________ Commission file number 001-36759 WALGREENS BOOTS ALLIANCE, INC . (Exact name of registrant as specified in its charter) Delaware 47-1758322 (State of incorporation) (I.R.S. Employer Identification No.) 108 Wilmot Road, Deerfield, Illinois 60015 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (847) 315-2500 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock ($.01 Par Value) The NASDAQ Stock Market LLC 2.875% Notes due 2020 New York Stock Exchange 3.600% Notes due 2025 New York Stock Exchange 2.125% Notes due 2026 New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. -

The Inversion Experience in the United States

The Inversion Experience in the United States ITPF/TPC Conference on Corporate Inversions and Tax Policy Paul W. Oosterhuis Skadden, Arps, Slate, Meagher & Flom Washington, D.C. January 23, 2015 Beijing Houston Palo Alto Tokyo Boston London Paris Toronto Brussels Los Angeles São Paulo Washington, D.C. Chicago Moscow Shanghai Wilmington Frankfurt Munich Singapore Hong Kong New York Sydney │1 Skadden, Arps, Slate, Meagher & Flom LLP EVOLUTION OF INVERSION TRANSACTIONS Edit│2 on Slide Master │2 Skadden, Arps, Slate, Meagher & Flom LLP INTRODUCTION • This presentation provides background regarding various “inversion” related transactions, and the evolution of those transactions in response to the changing legal landscape. • The basic concept of an inversion is a transaction in which a U.S. parent becomes a subsidiary of a new foreign parent corporation (“NFP”). − If done alone under NFP this is a “self inversion” (Aon, Ensco, etc.). − If done in connection with a target (typically foreign) under NFP this is a combination migration transaction (Eaton/Cooper, Medtronic/Covidien, etc.). • Inversions offer fours main areas of potential tax benefits: 1) Future foreign expansion under NFP outside of the U.S. tax “net” 2) Tax efficient leverage on the group’s U.S. operations 3) Restructuring of legacy foreign operations owned by the U.S. group 4) Better access to offshore cash for NFP dividends, share buybacks, etc. │3 Skadden, Arps, Slate, Meagher & Flom LLP THE START: MCDEROMOTT TRANSACTION (1980’s) Public Public Public McDermott McDermott McDermott -

An Insight Into Our Life Sciences and Healthcare Sector

An insight into our Life Sciences and Healthcare Sector 2020 allenovery.com 2 An insight into our Life Sciences and Healthcare Sector | 2020 © Allen & Overy LLP 2020 3 Contents Introducing Allen & Overy 04 Full service, international support for the life sciences and healthcare sector 05 M&A/corporate finance 06 Licensing and collaborations 09 Patent litigation 11 Regulatory 13 Dispute resolution/arbitration 14 Equity and debt financing 15 Restructuring 16 Key contacts 17 allenovery.com 4 An insight into our Life Sciences and Healthcare Sector | 2020 Introducing Allen & Overy GEOGRAPHIC SPLIT BY TOTAL NUMBER OF LAWYERS† 141 Central & Eastern Europe 1,016 UK 929 Western Europe 440 129 Asia Pacific 185 Middle East North, Central & South America 77 Africa GLOBAL PRESENCE NORTH AMERICA EUROPE AFRICA ASIA PACIFIC New York Amsterdam Istanbul Casablanca Bangkok Seoul Washington, D.C. Antwerp London Johannesburg Beijing Shanghai Barcelona Luxembourg Hanoi Singapore CENTRAL & Belfast Madrid MIDDLE EAST Ho Chi Minh City Sydney SOUTH AMERICA Bratislava Milan Abu Dhabi Hong Kong Tokyo São Paulo Brussels Moscow Dubai Jakarta* Yangon Bucharest* Munich Perth * Associated office Budapest Paris ** Cooperation office Düsseldorf Prague † All figures represent the Frankfurt Rome financial year 2016/17 Hamburg Warsaw Source: Regional active headcount October 2018 KEY STATISTICS 5,400 2,300 550 40+ Number of staff Number of lawyers Number of partners Offices around the world © Allen & Overy LLP 2020 5 Full service, international support for the life sciences and healthcare sector Our global Life Sciences and Healthcare sector comprises a multi-disciplinary team. We act for companies and their investors across the industry, including in the pharmaceuticals, biotech, animal health, consumer health, med tech, and diagnostics sectors. -

Representative Participant List by Alpha

Open Standards Benchmarking® Representative Participant List 0-9 2 SISTERS EUROPE A ADOBE SYSTEMS 3M ADP 3S SOLVAY ADRENALIN ESYSTEMS 50HERTZ TRANSMISSION ADVA OPTICAL NETWORKING 7-ELEVEN ADVANCE FOOD COMPANY A AAA ADVANCE PUBLICATIONS AARP ADVANCED BUSINESS GRAPHICS ABB ADVANCED COATING TECHNOLOGIES ABBOTT ADVANCED MICRO DEVICES ABBOTT PRODUCTS ADVANCED SEMICONDUCTOR ENGINEERING ABENGOA ADVENTIST HEALTH SYSTEM ABERCROMBIE & FITCH ADVERTISING RESOURCES ABERTIS TELECOM AEGON ABU DHABI NATIONAL ENERGY COMPANY AEON AC NIELSEN AERA ENERGY ACC LIMITED AERO INVENTORY ACCESS INSURANCE HOLDINGS AEROLÍNEAS ARGENTINA ACCIONA ENERGÍA AES ELETROPAULO ACCOR AETNA ACCORD HOLDINGS AFFILIATED FOODS ACCUITY AFFILIATES MANAGEMENT COMPANY ACCUTEK PACKAGING EQUIPMENT AFH STORES ACE AFLAC INCORPORATED ACE INA INSURANCE AFRICAN DEVELOPMENT BANK ACEA AFRISAM CEMENT ACER AFTONBLADET HIERTA ACME INDUSTRIES AGCO ACTARIS AGF BRASIL INSURANCE ACTEGA TERRA AGFA HEALTHCARE ACXIOM AGFA-GEVAERT ADAPTEC AGGREGATE INDUSTRIES ADELAIDE CLINIC HOLDINGS AGGREKO INTERNATIONAL ADI AGILENT TECHNOLOGIES ADIDAS AGL TORRENS ISLAND HOLDINGS ADITYA BIRLA NUVO LIMITED AGRICOLA FORNACE ADMIRAL INSURANCE COMPANY AGRICULTURAL BANK OF CHINA © 2017 APQC Generated on 12/4/2017 Open Standards Benchmarking® Representative Participant List A AGRO-ON A ALIGN TECHNOLOGY, INC. AICHI BANK ALIMENTATION COUCHE-TARD AIG SEGUROS ALIMENTOS POLAR AIOI NISSAY DOWA INSURANCE ALITALIA AIR CANADA ALK ABELLO AIR CHINA ALKERMES AIR FRANCE ALLAHABAD BANK AIR LIQUIDE ALLEGHANY CORPORATION AIR PRODUCTS ALLEGIANCE -

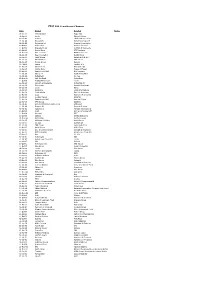

FTSE 100 Constituent History Updated

FTSE 100 Constituent Changes Date Added Deleted Notes 19-Jan-84 CJ Rothschild Eagle Star 02-Apr-84 Lonrho Magnet Sthrns. 02-Jul-84 Reuters Edinburgh Inv. Trust 02-Jul-84 Woolworths Barrat Development 19-Jul-84 Enterprise Oil Bowater Corporation 01-Oct-84 Willis Faber Wimpey (George) 01-Oct-84 Granada Group Scottish & Newcastle 01-Oct-84 Dowty Group MFI Furniture 04-Dec-84 Brit. Telecom Matthey Johnson 02-Jan-85 Dee Corporation Dowty Group 02-Jan-85 Argyll Group Berisford (S.& W.) 02-Jan-85 MFI Furniture RMC Group 02-Jan-85 Dixons Group Dalgety 01-Feb-85 Jaguar Hambro Life 01-Apr-85 Guinness (A) Enterprise Oil 01-Apr-85 Smiths Inds. House of Fraser 01-Apr-85 Ranks Hovis McD. MFI Furniture 01-Jul-85 Abbey Life Ranks Hovis McD. 01-Jul-85 Debenhams I.C. Gas 06-Aug-85 Bnk. Scotland Debenhams 01-Oct-85 Habitat Mothercare Lonrho 02-Jan-86 Scottish & Newcastle Rothschild (J) 08-Jan-86 Storehouse Habitat Mothercare 08-Jan-86 Lonrho B.H.S. 01-Apr-86 Wellcome EXCO International 01-Apr-86 Coats Viyella Sun Life Assurance 01-Apr-86 Lucas Harrisons & Crosfield 01-Apr-86 Cookson Group Ultramar 21-Apr-86 Ranks Hovis McD. Imperial Group 22-Apr-86 RMC Group Distillers 01-Jul-86 British Printing & Comms. Corp Abbey Life 01-Jul-86 Burmah Oil Bank of Scotland 01-Jul-86 Saatchi & S. Ferranti International 01-Oct-86 Bunzl Brit. & Commonwealth 01-Oct-86 Amstrad BICC 01-Oct-86 Unigate Smiths Industries 09-Dec-86 British Gas Northern Foods 02-Jan-87 Hillsdown Holdings Argyll Group 02-Jan-87 I.C.