Accounting Principles 8Th Edition

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

90 Significant Accounting Policies Cash and Cash Equivalents Cash

Significant Accounting Policies Cash and Cash Equivalents Cash and cash equivalents includes cash and due from banks, federal funds sold and resale agreements and interest-bearing deposits at other banks. Cash paid for interest for the years ended December 31, 2008, 2007 and 2006 was $4.0 billion, $4.5 billion and $2.9 billion, respectively. Cash paid for income taxes for the years ended December 31, 2008, 2007 and 2006 was $1.2 billion, $1.5 billion and $1.5 billion, respectively. Securities Available for Sale The Company considers the nature of investments in securities in order to determine the appropriate classification and currently treat investments in debt securities as securities available for sale. These securities are stated at fair value, with the unrealized gains and losses, net of tax, reported as a component of cumulative other comprehensive income. The fair value of securities is based on quoted market prices, or if quoted market prices are not available, then the fair value is estimated using the quoted market prices for similar securities, pricing models or discounted cash flow analyses, using observable market data where available. The amortized cost of debt securities is adjusted for amortization of premiums and accretion of discounts to maturity. Such amortization or accretion is included in interest income. Realized gains and losses on sales of securities are determined using the specific identification method. The Company evaluates its unrealized loss positions for impairment in accordance with SFAS 115, as amended by FSP No. 115-1, The Meaning of Other-Than-Temporary Impairment and its Application to Certain Investments and EITF 99-20, Recognition of Interest Income and Impairment on Purchased Beneficial Interests and Beneficial Interests That Continue to Be Held by a Transferor in Securitized Financial Assets and FSP EITF 99-20. -

Account Guidelines for Managers and Delegates

ACCOUNT/BUDGET GENERAL OPERATING PRINCIPLES for IU SOUTHEAST ACCOUNT MANAGERS / ACCOUNT DELEGATES The Fiscal Year runs from July 1 – June 30. Operating budgets are distributed in June/July. Accounts may not exceed their budgeted amounts within the fiscal year. Account managers will be required to develop a plan to bring the account in balance before the closing of the fiscal year or to carry forward the over- expenditures to the next fiscal year. Allocated funds do not carry forward to the next fiscal year. Unused funds are forfeited. Allocated funds should be spent to or close to zero. Every department has an organization code (contact Melissa Hill in Accounting Services, #2359). Examples: Student Affairs (SSER), Athletics (ATHL). A budget binder or file should be established for each account. All budget documents should be kept for the current fiscal year within the budget binder or file. Receipts/documentation must be kept for all expenditures. All budget documentation must be kept on file for seven years. Use of funds must conform to IU Financial Policies found on web site: http://www.indiana.edu/%7Epolicies/ The Financial Information System (FIS) is used for account transactions and account monitoring. Passwords and access are needed (contact IT or Accounting Services). If FIS training is needed, contact Melissa Hill in Accounting Services (#2359). Monthly operating statements should be printed from FIS (available first of month—notification comes by email) and account transactions should be reconciled by the account manager or delegate on a monthly basis at minimum. Each expenditure must be accounted for with receipts or other appropriate documentation. -

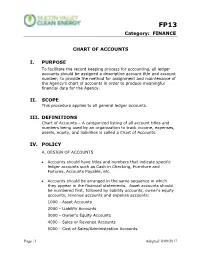

G&A101 Chart of Accounts

FP13 Category: FINANCE CHART OF ACCOUNTS I. PURPOSE To facilitate the record keeping process for accounting, all ledger accounts should be assigned a descriptive account title and account number; to provide the method for assignment and maintenance of the Agency’s chart of accounts in order to produce meaningful financial data for the Agency. II. SCOPE This procedure applies to all general ledger accounts. III. DEFINITIONS Chart of Accounts – A categorized listing of all account titles and numbers being used by an organization to track income, expenses, assets, equity, and liabilities is called a Chart of Accounts. IV. POLICY A. DESIGN OF ACCOUNTS • Accounts should have titles and numbers that indicate specific ledger accounts such as Cash in Checking, Furniture and Fixtures, Accounts Payable, etc. • Accounts should be arranged in the same sequence in which they appear in the financial statements. Asset accounts should be numbered first, followed by liability accounts, owner’s equity accounts, revenue accounts and expense accounts: 1000 - Asset Accounts 2000 - Liability Accounts 3000 - Owner’s Equity Accounts 4000 - Sales or Revenue Accounts 5000 - Cost of Sales/Administration Accounts Page | 1 Adopted: 8/09/2017 FP13 Category: FINANCE 6000 - Debt Service Accounts 8000 - Other Accounts B. DESCRIPTION OF ACCOUNTS • Each account should be given a short title description that is brief but will allow the reader to quickly ascertain the purpose of the account. • For training and consistent transaction coding, as well as to help other non-accounting managers understand why something is recorded as it is, each account should be defined. Definitions should be concise and meaningful. -

Chapter 5 Questions Multiple Choice 1

Chapter 5 Question Review 1 Chapter 5 Questions Multiple Choice 1. At the beginning of the year, Paradise Co. had an inventory of $200,000. During the year, the company purchased goods costing $900,000. Paradise Co reported ending inventory of $300,000 at the end of the year. Their cost of goods sold is a. $1,000,000 b. $800,000 c. $1,400,000 d. $400,000 2. Under the perpetual inventory system, in addition to making the entry to record a sale, a company would a. debit Inventory and credit Cost of Goods Sold. b. debit Cost of Goods Sold and credit Purchases. c. debit Cost of Goods sold and credit Inventory. d. make no additional entry until the end of the period. 3. Gross profit equals the difference between net sales and a. operating expenses. b. cost of goods sold. c. net income. d. cost of goods sold plus operating expenses. 4. Income from operations appears on a. both a multiple-step and a single-step income statement. b. neither a multiple-step nor a single-step income statement. c. a single-step income statement. d. a multiple-step income statement. 5. The entry for a buyer to record the return of goods under a perpetual inventory system assuming the purchase was made on account would include a a. debit to inventory b. debit to purchase returns and allowances c. credit to accounts payable d. debit to accounts payable 6. Under the perpetual system, cash freight costs incurred by the buyer for the transporting of goods is recorded in which account? a. -

CONSOLIDATED FINANCIAL STATEMENTS December 31, 2020

CONSOLIDATED FINANCIAL STATEMENTS December 31, 2020 and 2019 With Independent Auditor's Report INDEPENDENT AUDITOR’S REPORT Board of Directors and Shareholders Ledyard Financial Group, Inc. and Subsidiary We have audited the accompanying consolidated financial statements of Ledyard Financial Group, Inc. and Subsidiary, which comprise the consolidated balance sheets as of December 31, 2020 and 2019, and the related consolidated statements of income, comprehensive income, changes in shareholders' equity and cash flows for the years then ended, and the related notes to the financial statements. Management's Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with U.S. generally accepted accounting principles; this includes the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. Auditor's Responsibility Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We conducted our audits in accordance with U.S. generally accepted auditing standards. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures -

Mark to Market Accounting: Does It Provide Information to Investors Charles Harter, Ph.D., CPA, Georgia Southern University, USA

The Journal of Applied Business Research – November/December 2009 Volume 25, Number 6 Mark To Market Accounting: Does It Provide Information To Investors Charles Harter, Ph.D., CPA, Georgia Southern University, USA ABSTRACT According to the financial press the recent financial problems of many firms is at least partially due to mark-to-market accounting. In this paper I ask the question -- if mark-to-market accounting is the reason for the financial distress of firms, why does the FASB require mark-to- market? I review accounting standards that require mark-to-market accounting and empirically test the relation between firm value and mark to market adjustments to provide evidence as to whether mark-to-market adjustments are useful to investors and creditors. The results provide evidence that mark-to-market adjustments impact firm value. Keywords: Mark-to-market, firm value, net charge-offs INTRODUCTION he current economic crisis has seen a significant numbers of firms in financial distress. These firms have asked for bailouts from the federal government, filed for bankruptcy, or liquidated. There are numerous reasons for the financial distress of these firms. However, according to the financial press, Tthe problems encountered by firms are exacerbated by mark-to-market accounting. In this paper I ask the question -- if mark-to-market accounting is the reason for the financial distress of firms, why does the FASB require mark-to- market? I review accounting standards that require mark-to-market accounting and empirically test the relation between firm value and mark to market adjustments to provide evidence as to whether mark-to-market adjustments are useful to investors and creditors. -

Equity Method and Joint Ventures Topic Applies to All Entities

A Roadmap to Accounting for Equity Method Investments and Joint Ventures 2019 The FASB Accounting Standards Codification® material is copyrighted by the Financial Accounting Foundation, 401 Merritt 7, PO Box 5116, Norwalk, CT 06856-5116, and is reproduced with permission. This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor. Deloitte shall not be responsible for any loss sustained by any person who relies on this publication. As used in this document, “Deloitte” means Deloitte & Touche LLP, Deloitte Consulting LLP, Deloitte Tax LLP, and Deloitte Financial Advisory Services LLP, which are separate subsidiaries of Deloitte LLP. Please see www.deloitte.com/us/about for a detailed description of our legal structure. Certain services may not be available to attest clients under the rules and regulations of public accounting. Copyright © 2019 Deloitte Development LLC. All rights reserved. Other Publications in Deloitte’s Roadmap Series Business Combinations Business Combinations — SEC Reporting Considerations Carve-Out Transactions Consolidation — Identifying a Controlling Financial Interest -

Frs139-Guide.Pdf

The KPMG Guide: FRS 139, Financial Instruments: Recognition and Measurement i Contents Introduction 1 Executive summary 2 1. Scope of FRS 139 1.1 Financial instruments outside the scope of FRS 139 3 1.2 Definitions 3 2. Classifications and their accounting treatments 2.1 Designation on initial recognition and subsequently 5 2.2 Accounting treatments applicable to each class 5 2.3 Financial instruments at “fair value through profit or loss” 5 2.4 “Held to maturity” investments 6 2.5 “Loans and receivables” 7 2.6 “Available for sale” 8 3. Other recognition and measurement issues 3.1 Initial recognition 9 3.2 Fair value 9 3.3 Impairment of financial assets 10 4. Derecognition 4.1 Derecognition of financial assets 11 4.2 Transfer of a financial asset 11 4.3 Evaluation of risks and rewards 12 4.4 Derecognition of financial liabilities 13 5. Embedded derivatives 5.1 When to separate embedded derivatives from host contracts 14 5.2 Foreign currency embedded derivatives 15 5.3 Accounting for separable embedded derivatives 16 5.4 Accounting for more than one embedded derivative 16 6. Hedge accounting 17 7. Transitional provisions 19 8. Action to be taken in the first year of adoption 20 Appendices 1: Accounting treatment required for financial instruments under their required or chosen classification 21 2: Derecognition of a financial asset 24 3: Financial Reporting Standards and accounting pronouncements 25 1 The KPMG Guide: FRS 139, Financial Instruments: Recognition and Measurement Introduction This KPMG Guide introduces the requirements of the new FRS 139, Financial Instruments: Recognition and Measurement. -

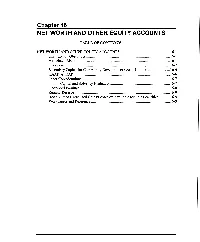

Chapter 16 NET WORTH and OTHER EQUITY ACCOUNTS

Chapter 16 NET WORTH AND OTHER EQUITY ACCOUNTS TABLE OF CONTENTS NET WORTH AND OTHER EQUITY ACCOUNTS .................................................... 16. 1 Examination Objectives ....................................................................................... 16-1 Associated Risks .................................................................................................. 16. 1 Overview ............................................................................................................. .1 6.2 Secondary Capital for Community Development Credit Unions ....................... 16-4 GAAP vs . RAP .................................................................................................... 16-6 Other Considerations ........................................................................................... 16-7 Capital and Solvency Evaluation ............................................................. 16.7 Undivided Earnings ............................................................................................. 16-8 Regular Reserve .................................................................................................... 6-9 Accumulated Unrealized GainsLosses on Available for Sale Securities............ 16-9 Workpapers and References................................................................................. 16-9 Chapter 16 NET WORTH AND OTHER EQUITY ACCOUNTS Examination 0 Determine whether the credit union complies with Regulation D, Objectives if applicable 0 Ascertain compliance with -

Statutory Budget

TOWN OF EAST FREMANTLE BUDGET FOR THE YEAR ENDED 30TH JUNE 2011 TABLE OF CONTENTS Statement of Comprehensive Income by Nature or Type 2 Statement of Comprehensive Income by Program 3 Statement of Cash Flows 4 Rate Setting Statement 5 Notes to and Forming Part of the Budget 6 to 27 TOWN OF EAST FREMANTLE STATEMENT OF COMPEREHENSIVE INCOME BY NATURE OR TYPE FOR THE YEAR ENDED 30TH JUNE 2011 NOTE 2010/11 2009/10 2009/10 Budget Actual Budget $$$ REVENUE Rates 8 5,104,693 4,780,733 4,795,777 Operating Grants, Subsidies and Contributions 779,944 765,016 837,211 Fees and Charges 11 1,076,480 1,539,872 893,327 Service Charges 10 0 0 0 Interest Earnings 2(a) 162,000 223,891 107,000 Other Revenue 108,200 248,964 166,700 7,231,317 7,558,476 6,800,015 EXPENSES Employee Costs (2,695,372) (1,996,865) (2,220,359) Materials and Contracts (3,275,369) (2,990,202) (3,075,660) Utility Charges (190,500) (265,214) (275,031) Depreciation 2(a) (702,205) (704,033) (670,670) Interest Expenses 2(a) (35,827) (45,006) (45,603) Insurance Expenses (201,180) (196,218) (184,700) Other Expenditure (99,900) (137,391) (99,500) (7,200,353) (6,334,929) (6,571,523) Non-Operating Grants, Subsidies and Contributions 787,922 251,240 424,862 Profit on Asset Disposals 4 46,000 16,330 40,170 Loss on Asset Disposals 4 (1,470) 0 NET RESULT 863,416 1,491,117 693,524 Other Comprehensive Income 000 TOTAL COMPREHENSIVE INCOME 863,416 1,491,117 693,524 Please note, Other Comprehensive Income (if any) is impacted upon by external forces and is not able to be reliably estimated. -

When to Debit and Credit in Accounting

When to Debit and Credit in Accounting Journal entries show a firm’s transactions throughout a period of time; for example, when a company purchases supplies a journal entry will show the amount of supplies bought and money spent. According to the practice of double-entry accounting, every journal entry must: • Include at least two distinct accounts with at least one debit and one credit. • Have the total monetary amount of debits equal to the total monetary amount of credits. • Be consistent with the accounting equation, Assets = Liabilities + Equity. (Wild, Shaw, and Chiappetta, 55) An asset is loosely defined as a resource with economic value that a particular firm has, and includes accounts such as cash, accounts receivable, and office supplies. Liabilities are the debts and obligations a company accumulates in operating the business; it includes accounts such as accounts payable, wages payable, and interest payable. Equity represents the amount of ownership in an asset that is not financed through debt. Equity begins with the owner’s capital, which are personal investments of assets by the owner, and grows as revenues are accrued over the course of business operations. Equity shrinks when the owner withdrawals capital and/or expenses are incurred. Thus the accounting equation, Assets = Liabilities + Equity, can be roughly translated as, “things we have are backed by things we owe and things we own.” A chart of accounts, which list commonly used accounts and their type, is included as an appendix in most accounting text books. The following diagram depicts the accounting equation such that equity is broken down into the component accounts of Capital, Withdrawals, Revenue, and Expenses, and illustrates how each type of account reacts to debits and credits. -

Basic Financial Accounting Review

4259_Jagels_01.qxd 4/11/03 5:01 PM Page 1 CHAPTER 1 BASIC FINANCIAL ACCOUNTING REVIEW INTRODUCTION Every profit or nonprofit business en- transactions, to add, subtract, summa- tity requires a reliable internal system rize, and check for errors. The rapid of accountability. A business account- advancement of computer technology ing system provides this accountabil- has increased operating speed, data ity by recording all activities regard- storage, and reliability accompanied ing the creation of monetary inflows by a significant cost reduction. Inex- of revenue and monetary outflows pensive microcomputers and account- of expenses resulting from operating ing software programs have advanced activities. The accounting system to the point where all of the records provides the financial information posting, calculations, error checking, needed to evaluate the effectiveness and financial reports are provided of current and past operations. In ad- quickly by the computerized system. dition, the accounting system main- The efficiency and cost-effectiveness tains data required to present reports of supporting computer software al- showing the status of asset resources, lows management to maintain direct creditor liabilities, and ownership eq- personal control of the accounting uities of the business entity. system. In the past, much of the work re- To effectively understand con- quired to maintain an effective ac- cepts and analysis techniques dis- counting system required extensive cussed within this text, it is essential individual manual effort that was te- that the reader have a conceptual as dious, aggravating, and time consum- well as a practical understanding ing. Such systems relied on individ- of accounting fundamentals. This ual effort to continually record chapter reviews basic accounting 4259_Jagels_01.qxd 4/11/03 5:01 PM Page 2 2 CHAPTER 1 BASIC FINANCIAL ACCOUNTING REVIEW principles, concepts, conventions, and has taken an introductory accounting practices.