The Future of Finance 2 PART Redefining “The Way We Pay” in the Next Decade

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Financial Technology Sector Summary

Financial Technology Sector Summary June 3, 2015 Financial Technology Sector Summary Table of Contents I. GCA Savvian Overview II. Market Summary III. Payments / Banking IV. Securities / Capital Markets / Data & Analytics V. Healthcare / Insurance I. GCA Savvian Overview GCA Savvian Overview Highlights Firm Statistics GCA Savvian Focus . Over 225 professionals today Mergers & Acquisitions Private Capital Markets . Full spectrum of buy-side, sell- Agented private capital raiser Headquarters in San Francisco and Tokyo; offices in New side and strategic advisory York, London, Shanghai, Mumbai, Singapore, and Osaka . Equity and debt capital markets . Public and private company advisory services experience . Provides mergers and acquisitions advisory services, private . Core competency, with important capital & capital markets advisory services, and principal . Strategic early-stage growth relationships among the venture investing companies through industry capital and private equity defining, multi-billion dollar community transactions . Over 550 transactions completed . Publicly traded on the Tokyo Stock Exchange (2174) Senior level attention and focus, Relationships and market extensive transaction intelligence; a highly experienced team in experience and deep domain insight the industry Global Advisory Firm Market Positioning Bulge Bracket Growth Sector Focus Transaction Expertise . Senior Team with . Growth Company Focus Unparalleled Transaction . Sector Expertise / Domain Experience Knowledge . Highest Quality Client . Private Capital -

Industry Perspectives on Mobile/Digital Wallets and Channel Convergence

Mobile Payments Industry Workgroup (MPIW) December 3-4, 2014 Meeting Report Industry Perspectives on Mobile/Digital Wallets and Channel Convergence Elisa Tavilla Payment Strategies Industry Specialist Federal Reserve Bank of Boston March 2015 The author would like to thank the speakers at the December meeting and the members of the MPIW for their thoughtful comments and review of the report. The views expressed in this paper are solely those of the author and do not reflect official positions of the Federal Reserve Bank of Boston, the Federal Reserve Bank of Atlanta, or the Federal Reserve System. I. Introduction The Federal Reserve Banks of Boston and Atlanta1 convened a meeting of the Mobile Payments Industry Workgroup (MPIW) on December 3-4, 2014 to discuss (1) different wallet platforms; (2) how card networks and other payment service providers manage risks associated with converging digital and mobile channels; and (3) merchant strategies around building a mobile payment and shopping experience. Panelists considered how the mobile experience is converging with ecommerce and what new risks are emerging. They discussed how EMV,2 tokenization,3 and card-not-present (CNP)4 will impact mobile/digital wallets and shared their perspectives on how to overcome risk challenges in this environment, whether through tokenization, encryption, or the use of 3D Secure.5 MPIW members also discussed how various tokenization models can be supported in the digital environment, and the pros and cons of in-app solutions from both a merchant and consumer perspective. With the broad range of technologies available in the marketplace, merchants shared perspectives on how to address the emergence of multiple wallets and the expansion of mobile/digital commerce. -

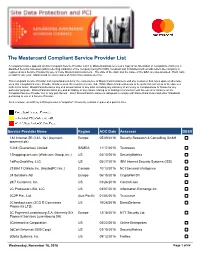

The Mastercard Compliant Service Provider List

The Mastercard Compliant Service Provider List A company’s name appears on this Compliant Service Provider List if (i) MasterCard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) MasterCard records reflect the company is registered as a Service Provider by one or more MasterCard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. MasterCard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of MasterCard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While MasterCard endeavors to keep the list current as of the date set forth in the footer, MasterCard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. MasterCard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each MasterCard Customer is obligated to comply with MasterCard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Service Provider Name Region AOC Date Assessor DESV 1&1 Internet SE (1&1, 1&1 ipayment, Europe 05/09/2016 Security Research & Consulting GmbH ipayment.de) 1Link (Guarantee) Limited SAMEA 11/17/2015 Trustwave 1Shoppingcart.com (Web.com Group, lnc.) US 04/13/2016 SecurityMetrics 1stPayGateWay, LLC US 05/27/2016 IBM Internet Security Systems (ISS) 2138617 Ontario Inc. -

1 BIDDER BEWARE TOWARD a FRAUD-FREE MARKETPLACE – BEST PRACTICES for the ONLINE AUCTION INDUSTRY Paula Selis Anita Ramasastry

BIDDER BEWARE TOWARD A FRAUD-FREE MARKETPLACE – BEST PRACTICES FOR THE ONLINE AUCTION INDUSTRY Paula Selis* Anita Ramasastry** Charles S. Wright*** Abstract: This report presents to businesses, consumers and government officials (including law enforcement) a “menu of options” for combating fraud in the online auction industry. By directly interviewing several major online auction sites and cataloging the features of other sites, the Washington Attorney General’s Office, in conjunction with the Center for Law Commerce and Technology at the University of Washington Law School, has attempted to identify a series of “best practices” in the online auction industry. The results of these interviews as well as findings from investigation of current practices on the Web are presented here. By identifying the most successful, innovative, and feasible practices, this report seeks to maximize the reach of industry solutions and thereby promote industry-wide self-regulation. Standardization is a powerful tool for eradicating fraud across the industry. However, divergent business models and differing consumer needs mean that there is no one size that fits all models. This report presents a pro-active collaboration between enforcement agencies, industry, and academia. It also suggests a menu of best practices from which users might choose to suit their needs, and invites comment, critique and improvement upon those practices. INTRODUCTION Produced by the Washington State Attorney General’s office and the Center for Law Commerce and Technology at the University of Washington Law School, this report surveys the current range of responses to the problem of online auction fraud. This report presents the results of that survey in the form of a menu of options for businesses and consumers. -

RISL) Procurement

Draft RFP for Selection201 of System7 Integrator for Rate Contract for establishment of IT Infrastructure for enabling Digital Payments cument History Overview Procurement PolicyRajCOMP Manual for RajCOMP Info Info Services Services Limited Limited Document Title RajCOMP Info Services Limited- Manual on Policies and Procedures for(RISL) Procurement Document Final Status Abstract This documentDraft provides RFP a forbroad Selection framework and ofguidelines System for RajCOMP Integrator Info for Services LimitedRate Staff inContract carrying out various for procurement establishment activities. of IT Infrastructure for enabling Digital Payments based on Open Competitive Bidding through e- Document Publication HistoryProcurement/ e-Tender Date Author Version Remark th 17 February 2011 Dr. S.S. Vaishnava V3 Final Version Distribution Version Name Location Final MD RajComp Info Services Limited RajComp Info Services Limited office, Jaipur Secretary (IT) RajComp Info Services Limited office, Jaipur Table of Contents Page 1 of 95 Draft RFP for Selection of System Integrator for Rate Contract for establishment of IT Infrastructure for enabling Digital Payments TABLE OF CONTENTS ABBREVIATIONS & DEFINITIONS ................................................................................................................................. 6 1. INVITATION FOR BID (IFB)& NOTICE INVITING BID (NIB) ....................................................................................... 9 2. PROJECT PROFILE &BACKGROUND INFORMATION ........................................................................................... -

In This Issue

Welcome to the January edition of ACT News. This complimentary service is provided by ACT Canada; "building an informed marketplace". Please feel free to forward this to your colleagues. In This Issue 1. Editorial - payment innovation: where is the bar? 2. Desjardins and MasterCard bring new payment options to Canadians 3. Nanopay acquires MintChip from the Royal Canadian Mint 4. Canadian payments market transition: a study by the Canadian Payments Association 5. Suretap and EnStream take big steps forward with Societe de Transport de Montreal in mobile ticketing 6. New credit union association launches in Canada: Canadian Credit Union Association 7. Global study shows increasing security risks to payment data and lack of confidence in securing mobile payment methods 8. Samsung Pay to move online in 2016 9. Elavon delivers Apple Pay for Canadian businesses 10. Beware alleged experts’ scare tactics on mobile payments 11. Ingenico Group accelerates EMV and NFC acceptance in unattended environments with new partner program 12. Paynet delivers a safer payment service with Fraudxpert to its customers 13. VeriFone expands services offering for large retailers in the US and Canada with agreement to acquire AJB Software 14. VISA checkout added to Starbucks, Walmart, Walgreens 15. Gemalto is world's first vendor to receive complete MasterCard approval for cloud based payments 16. ICC Solutions offers a time-saving method and free guide for training staff to process card payments correctly ready for the new year! 17. Walmart adds masterpass as online payment method 18. Equinox and ACCEO partner to deliver integrated retail payment solution 19. UL receives UnionPay qualification for Chinese domestic market 20. -

Advance Warning an Introduction to Drop Catching

2 Advance warning The Initial Coin Offering (“ICO”) project presented by the company DomRaider is an unregulated fundraising operation. It poses several risks to buyers, in particular, that of losing all amounts traded for tokens issued by DomRaider. Only people who are fully aware of these risks should participate in the ICO. Note also that the ICO excludes certain groups of people such as consumers and “U.S. Person” (within the meaning of “Regulation S” of the Securities Act 1933 in U.S. law), Canadian and Singapore citizen”. An introduction to Drop Catching The secondary market for domain names Presently, there are close to 330 million active domain names throughout the world (see: https://investor.verisign.com/releasedetail.cfm?releaseid=1015020). They are divided into approximately 2,500 domain name extensions or TLDs (Top-Level Domains). ICANN (The Internet Corporation for Assigned Names and Numbers), the non- profit regulatory organization, has delegated their management to different registries throughout the world, including: • 300 generic domain name extensions (.com, .net, .org,….) • 260 country code domain name extensions (.cn, .de, .co.uk, .fr,….) • 1,930 new domain name extensions (.club, .xyz, .global,….) created in 2012 by ICANN and launched since 2014. 3 DISTRIBUTION OF THE DOMAIN NAMES IN MILLIONS 400 350 28 11 300 38 4 36 35 250 131 200 127 119 150 100 141 141 124 50 0 2014 2015 2016 ccTLD’s .com Other historical TLD’s nTLD‘S The worldwide market has been driven by new gTLDs (Generic Top-Level Domains: which correspond to extensions such as .com, .net, etc…) wich grew by 6.8% in 2017. -

How Mpos Helps Food Trucks Keep up with Modern Customers

FEBRUARY 2019 How mPOS Helps Food Trucks Keep Up With Modern Customers How mPOS solutions Fiserv to acquire First Data How mPOS helps drive food truck supermarkets compete (News and Trends) vendors’ businesses (Deep Dive) 7 (Feature Story) 11 16 mPOS Tracker™ © 2019 PYMNTS.com All Rights Reserved TABLEOFCONTENTS 03 07 11 What’s Inside Feature Story News and Trends Customers demand smooth cross- Nhon Ma, co-founder and co-owner The latest mPOS industry headlines channel experiences, providers of Belgian waffle company Zinneken’s, push mPOS solutions in cash-scarce and Frank Sacchetti, CEO of Frosty Ice societies and First Data will be Cream, discuss the mPOS features that acquired power their food truck operations 16 23 181 Deep Dive Scorecard About Faced with fierce eTailer competition, The results are in. See the top Information on PYMNTS.com supermarkets are turning to customer- scorers and a provider directory and Mobeewave facing scan-and-go-apps or equipping featuring 314 players in the space, employees with handheld devices to including four additions. make purchasing more convenient and win new business ACKNOWLEDGMENT The mPOS Tracker™ was done in collaboration with Mobeewave, and PYMNTS is grateful for the company’s support and insight. PYMNTS.com retains full editorial control over the findings presented, as well as the methodology and data analysis. mPOS Tracker™ © 2019 PYMNTS.com All Rights Reserved February 2019 | 2 WHAT’S INSIDE Whether in store or online, catering to modern consumers means providing them with a unified retail experience. Consumers want to smoothly transition from online shopping to browsing a physical retail store, and 56 percent say they would be more likely to patronize a store that offered them a shared cart across channels. -

United States House of Representatives Financial Services Committee

United States House of Representatives Financial Services Committee Task Force on Financial Technology Is Cash Still King? Reviewing the Rise of Mobile Payments Testimony of Christina Tetreault Senior Policy Counsel Consumer Reports January 30, 2020 1 Introduction Chairman Lynch and Ranking Member Emmer and Members of the Financial Technology Task Force, thank you for the invitation to appear today. I am Christina Tetreault, senior policy counsel on Consumer Reports’ financial services policy team. Consumer Reports is an expert, independent, non-profit organization whose mission is to work for a fair, just, and safe marketplace for all consumers and to empower consumers to protect themselves. Consumers Reports works for pro-consumer policies in the areas of financial services and marketplace practices, antitrust and competition policy, privacy and data security, food and product safety, telecommunications and technology, travel, and other consumer issues in Washington, DC, in the states, and in the marketplace. Consumer Reports is the world’s largest independent product-testing organization, using its dozens of labs, auto test center, and survey research department to rate thousands of products and services annually. Founded in 1936, Consumer Reports has over 6 million members and publishes its magazine, website, and other publications. Consumer Reports (CR) has a long history of working to improve payments protections for consumers. In 2008, the then-leader of CR’s financial services policy team, Gail Hillebrand, published a comprehensive -

How Financial Technologies Are Revolutionizing the Financial Industry

HOW FINANCIAL TECHNOLOGIES ARE REVOLUTIONIZING THE FINANCIAL INDUSTRY Lucie Duval Dissertation submitted as partial requirement for the conferral of Master in Finance Supervisor: António Freitas Miguel, Assistant Professor of Finance, Department of Finance, ISCTE Business School September 2016 NIZING THE THE FINANCIAL NIZING INDUSTRY Lucie Duval LOGIES ARE LOGIESREVOLUTIO ARE HOW FINANCIALTECHNO Abstract Financial technologies (fintech) have known an incredible exposure over the last years, attracting investments of large billions of dollars. Fintech can be seen as the match between finance and technology and they are imposing a way of thinking in all the branches of the financial industry. The main aim of this dissertation is to study how the financial technologies are revolutionizing the financial industry. After the financial crisis of 2008, customers have changed their ways of seeing “Finance” and, more particularly, “Banks”, looking for products and services responding to their needs. Moreover, the financial crisis has highlighted a relevant number of dysfunctions of the banking sector and on the financial regulation. Regulators have strengthened their requirements for banks, particularly in their relations with clients. These have opened a breach for Fintech companies and they are using it. Fintech companies rely on a different value proposition to clients that is based on a timesaving, fast and clear experience. Indeed they are proposing majors innovation in products and also in the processes. Fintech companies have put the customer back at the center of all their attention; customer becomes again the top priority. Financial technologies have already revolutionized the finance industry even if their impact on the market, for the moment may still be seen as trivial. -

Die Zukunft Des (Mobilen) Zahlungsverkehrs 5

Aktuelle Themen Globale Finanzmärkte Die Zukunft des (mobilen) Zahlungsverkehrs 5. Februar 2013 Banken im Wettbewerb mit neuen Internet-Dienstleistern Autoren Seit geraumer Zeit gerät die Finanzbranche immer stärker unter Druck: Thomas F. Dapp Die rasante Entwicklung webbasierter Technologien stellt die klassischen Ban- +49 69 910-31752 [email protected] ken insbesondere in den Bereichen Einlagen und Zahlungsverkehr vor große Herausforderungen. Gleichzeitig sorgen schärfere regulatorische Auflagen und Antje Stobbe steigender Kostendruck dafür, dass viele Banken an Innovationskraft verlieren. +49 69 910-31847 [email protected] Der Markt für digitale (mobile) Bezahlsysteme steckt noch in den Kinder- schuhen. Selbst Unternehmen in den USA, die neben Japan Vorreiter sind, Patricia Wruuck +49 69 910-31832 arbeiten erst seit ein bis zwei Jahren an relevanten Geschäftsmodellen. [email protected] Viel Aufmerksamkeit richtet sich derzeit auf die Strategien neuer Wettbewerber Weitere Beiträge: wie Google, Apple, PayPal oder Amazon. Die Netzgiganten strecken verstärkt Bryan Keane ihre Fühler in Branchen außerhalb ihres bisherigen Kerngeschäfts aus, z.B. in Jason Napier den Markt für (mobile) Bezahlsysteme. Ashish Sabadra Yoshinobu Yamada Die Banken sind gut beraten, die großen Internetunternehmen, die Kreditkarten- sowie die Telekommunikationsunternehmen im Auge zu behalten. Vier in dieser Editor Studie erarbeitete Szenarien zeigen mögliche Entwicklungen im Bereich digitaler Bernhard Speyer (mobiler) Finanzdienstleistungen in den nächsten 3-5 Jahren: Das „Early-Bird“- Deutsche Bank AG Szenario ist gekennzeichnet durch eine hohe Akzeptanz digitaler Bezahlsyste- DB Research me, ein aktives Vorgehen der Banken und einen moderaten Verdrängungswett- Frankfurt am Main bewerb. Gelingt es den Banken jedoch nicht, adäquate webbasierte, mobile Fi- Deutschland E-Mail: [email protected] nanzdienste anzubieten, drohen Verluste bei den Marktanteilen („Nachzügler“- Fax: +49 69 910-31877 Szenario). -

Bitcoin and Cryptocurrencies Law Enforcement Investigative Guide

2018-46528652 Regional Organized Crime Information Center Special Research Report Bitcoin and Cryptocurrencies Law Enforcement Investigative Guide Ref # 8091-4ee9-ae43-3d3759fc46fb 2018-46528652 Regional Organized Crime Information Center Special Research Report Bitcoin and Cryptocurrencies Law Enforcement Investigative Guide verybody’s heard about Bitcoin by now. How the value of this new virtual currency wildly swings with the latest industry news or even rumors. Criminals use Bitcoin for money laundering and other Enefarious activities because they think it can’t be traced and can be used with anonymity. How speculators are making millions dealing in this trend or fad that seems more like fanciful digital technology than real paper money or currency. Some critics call Bitcoin a scam in and of itself, a new high-tech vehicle for bilking the masses. But what are the facts? What exactly is Bitcoin and how is it regulated? How can criminal investigators track its usage and use transactions as evidence of money laundering or other financial crimes? Is Bitcoin itself fraudulent? Ref # 8091-4ee9-ae43-3d3759fc46fb 2018-46528652 Bitcoin Basics Law Enforcement Needs to Know About Cryptocurrencies aw enforcement will need to gain at least a basic Bitcoins was determined by its creator (a person Lunderstanding of cyptocurrencies because or entity known only as Satoshi Nakamoto) and criminals are using cryptocurrencies to launder money is controlled by its inherent formula or algorithm. and make transactions contrary to law, many of them The total possible number of Bitcoins is 21 million, believing that cryptocurrencies cannot be tracked or estimated to be reached in the year 2140.