Data Collection Survey on Investment Promotion in the Democratic Republic of Congo

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Democratic Republic of the Congo (DRC) Reports Children in Need of Humanitarian Assistance Its First COVID-19 Confirmed Case

ef Democratic Republic of the Congo Humanitarian Situation Report No. 03 © UNICEF/UN0231603/Herrmann Reporting Period: March 2020 Highlights Situation in Numbers 9,100,000 • 10 March, the Democratic Republic of the Congo (DRC) reports children in need of humanitarian assistance its first COVID-19 confirmed case. As of 31 March 2020, 109 confirmed cases have been recorded, of which 9 deaths and 3 (OCHA, HNO 2020) recovered patients have been reported. During the reporting period, the virus has affected the province of Kinshasa and North Kivu 15,600,000 people in need • In addition to UNICEF’s Humanitarian Action for Children (HAC) (OCHA, HNO 2020) 2020 appeal of $262 million, UNICEF’s COVID-19 response plan has a funding appeal of $58 million to support UNICEF’s response 5,010,000 in WASH/Infection Prevention and Control, risk communication, and community engagement. UNICEF’s response to COVID-19 Internally displaced people can be found on the following link (HNO 2020) 6,297 • During the reporting period, 26,789 in cholera-prone zones and cases of cholera reported other epidemic-affected areas benefiting from prevention and since January response WASH packages (Ministry of Health) UNICEF’s Response and Funding Status UNICEF Appeal 2020 9% US$ 262 million 11% 21% Funding Status (in US$) 15% Funds Carry- received forward, 10% $5.5 M $28.8M 10% 49% 21% 15% Funding gap, 3% $229.3M 0% 20% 40% 60% 80% 100% 1 Funding Overview and Partnerships UNICEF appeals for US$ 262M to sustain the provision of humanitarian services for women and children in the Democratic Republic of the Congo (DRC). -

Kalemie L'oubliee Kalemie the Forgotten Mwiba Lodge, Le Safari Version Luxe Mexico Insolite Not a Stranger in a Familiar La

JUILLET-AOUT-SEPTEMBRE 2018 N° 20 TRIMESTRIEL N° 20 5 YEARS ANNIVERSARY 5 ANS DÉJÀ LE VOYAGE EN AFRIQUE TRAVEL in AFRICA LE VOYAGE EN AFRIQUE HAMAJI MAGAZINE N°20 • JUILLET-AOUT-SEPTEMBRE 2018 N°20 • JUILLET-AOUT-SEPTEMBRE HAMAJI MAGAZINE MEXICO INSOLITE Secret Mexico GRAND ANGLE MWIBA LODGE, LE SAFARI VERSION LUXE Mwiba Lodge, luxury safari at its most sumptuous VOYAGE NOT A STRANGER KALEMIE L’OUBLIEE IN A FAMILIAR LAND KALEMIE THE FORGOTTEN Par Sarah Waiswa Sur une plage du Tanganyika, l’ancienne Albertville — On the beach of Tanganyika, the old Albertville 1 | HAMAJI JUILLET N°20AOÛT SEPTEMBRE 2018 EDITOR’S NEWS 6 EDITO 7 CONTRIBUTEURS 8 CONTRIBUTORS OUR WORLD 12 ICONIC SPOT BY THE TRUST MERCHANT BANK OUT OF AFRICA 14 MWIBA LODGE : LE SAFARI DE LUXE À SON SUMMUM LUXURY SAFARI AT ITS MOST SUMPTUOUS ZOOM ECO ÉCONOMIE / ECONOMY TAUX D’INTÉRÊTS / INTEREST RATES AFRICA RDC 24 Taux d’intérêt moyen des prêts — Average loan interest rates, % KALEMIE L'OUBLIÉE — THE FORGOTTEN Taux d’intérêt moyen des dépôts d’épargne — Average interest TANZANIE - 428,8 30 % rates on saving deposits, % TANZANIA AT A GLANCE BALANCE DU COMPTE COURANT EN MILLION US$ 20 % CURRENT ACCOUNT AFRICA 34 A CHAQUE NUMERO HAMAJI MAGAZINE VOUS PROPOSE UN COUP D’OEIL BALANCE, MILLION US$ SUR L’ECONOMIE D’UN PAYS EN AFRIQUE — IN EVERY ISSUE HAMAJI MAGAZINE OFFERS 250 YOU A GLANCE AT AN AFRICAN COUNTRY’S ECONOMY 10 % TRENDY ACCRA, LA CAPITALE DU GHANA 0 SOURCE SOCIAL ECONOMICS OF TANZANIE 2016 -250 -500 0 DENSITÉ DE POPULATION PAR RÉGION / POPULATION DENSITY PER REGION 1996 -

Organized Crime and Instability in Central Africa

Organized Crime and Instability in Central Africa: A Threat Assessment Vienna International Centre, PO Box 500, 1400 Vienna, Austria Tel: +(43) (1) 26060-0, Fax: +(43) (1) 26060-5866, www.unodc.org OrgAnIzed CrIme And Instability In CenTrAl AFrica A Threat Assessment United Nations publication printed in Slovenia October 2011 – 750 October 2011 UNITED NATIONS OFFICE ON DRUGS AND CRIME Vienna Organized Crime and Instability in Central Africa A Threat Assessment Copyright © 2011, United Nations Office on Drugs and Crime (UNODC). Acknowledgements This study was undertaken by the UNODC Studies and Threat Analysis Section (STAS), Division for Policy Analysis and Public Affairs (DPA). Researchers Ted Leggett (lead researcher, STAS) Jenna Dawson (STAS) Alexander Yearsley (consultant) Graphic design, mapping support and desktop publishing Suzanne Kunnen (STAS) Kristina Kuttnig (STAS) Supervision Sandeep Chawla (Director, DPA) Thibault le Pichon (Chief, STAS) The preparation of this report would not have been possible without the data and information reported by governments to UNODC and other international organizations. UNODC is particularly thankful to govern- ment and law enforcement officials met in the Democratic Republic of the Congo, Rwanda and Uganda while undertaking research. Special thanks go to all the UNODC staff members - at headquarters and field offices - who reviewed various sections of this report. The research team also gratefully acknowledges the information, advice and comments provided by a range of officials and experts, including those from the United Nations Group of Experts on the Democratic Republic of the Congo, MONUSCO (including the UN Police and JMAC), IPIS, Small Arms Survey, Partnership Africa Canada, the Polé Institute, ITRI and many others. -

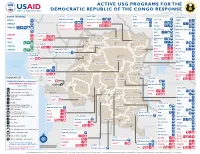

ACTIVE USG PROGRAMS for the DEMOCRATIC REPUBLIC of the CONGO RESPONSE Last Updated 07/27/20

ACTIVE USG PROGRAMS FOR THE DEMOCRATIC REPUBLIC OF THE CONGO RESPONSE Last Updated 07/27/20 BAS-UELE HAUT-UELE ITURI S O U T H S U D A N COUNTRYWIDE NORTH KIVU OCHA IMA World Health Samaritan’s Purse AIRD Internews CARE C.A.R. Samaritan’s Purse Samaritan’s Purse IMA World Health IOM UNHAS CAMEROON DCA ACTED WFP INSO Medair FHI 360 UNICEF Samaritan’s Purse Mercy Corps IMA World Health NRC NORD-UBANGI IMC UNICEF Gbadolite Oxfam ACTED INSO NORD-UBANGI Samaritan’s WFP WFP Gemena BAS-UELE Internews HAUT-UELE Purse ICRC Buta SCF IOM SUD-UBANGI SUD-UBANGI UNHAS MONGALA Isiro Tearfund IRC WFP Lisala ACF Medair UNHCR MONGALA ITURI U Bunia Mercy Corps Mercy Corps IMA World Health G A EQUATEUR Samaritan’s NRC EQUATEUR Kisangani N Purse WFP D WFPaa Oxfam Boende A REPUBLIC OF Mbandaka TSHOPO Samaritan’s ATLANTIC NORTH GABON THE CONGO TSHUAPA Purse TSHOPO KIVU Lake OCEAN Tearfund IMA World Health Goma Victoria Inongo WHH Samaritan’s Purse RWANDA Mercy Corps BURUNDI Samaritan’s Purse MAI-NDOMBE Kindu Bukavu Samaritan’s Purse PROGRAM KEY KINSHASA SOUTH MANIEMA SANKURU MANIEMA KIVU WFP USAID/BHA Non-Food Assistance* WFP ACTED USAID/BHA Food Assistance** SA ! A IMA World Health TA N Z A N I A Kinshasa SH State/PRM KIN KASAÏ Lusambo KWILU Oxfam Kenge TANGANYIKA Agriculture and Food Security KONGO CENTRAL Kananga ACTED CRS Cash Transfers For Food Matadi LOMAMI Kalemie KASAÏ- Kabinda WFP Concern Economic Recovery and Market Tshikapa ORIENTAL Systems KWANGO Mbuji T IMA World Health KWANGO Mayi TANGANYIKA a KASAÏ- n Food Vouchers g WFP a n IMC CENTRAL y i k -

Democratic Republic of Congo Democratic Republic of Congo Gis Unit, Monuc Africa

Map No.SP. 103 ADMINISTRATIVE MAP OF THE DEMOCRATIC REPUBLIC OF CONGO DEMOCRATIC REPUBLIC OF CONGO GIS UNIT, MONUC AFRICA 12°30'0"E 15°0'0"E 17°30'0"E 20°0'0"E 22°30'0"E 25°0'0"E 27°30'0"E 30°0'0"E Central African Republic N N " " 0 0 ' Sudan ' 0 0 ° ° 5 5 Z o n g oBangui Mobayi Bosobolo Gbadolite Yakoma Ango Yaounde Bondo Nord Ubangi Niangara Faradje Cameroon Libenge Bas Uele Dungu Bambesa Businga G e m e n a Haut Uele Poko Rungu Watsa Sud Ubangi Aru Aketi B u tt a II s ii rr o r e Kungu Budjala v N i N " R " 0 0 ' i ' g 0 n 0 3 a 3 ° b Mahagi ° 2 U L ii s a ll a Bumba Wamba 2 Orientale Mongala Co Djugu ng o R i Makanza v Banalia B u n ii a Lake Albert Bongandanga er Irumu Bomongo MambasaIturi B a s a n k u s u Basoko Yahuma Bafwasende Equateur Isangi Djolu Yangambi K i s a n g a n i Bolomba Befale Tshopa K i s a n g a n i Beni Uganda M b a n d a k a N N " Equateur " 0 0 ' ' 0 0 ° Lubero ° 0 Ingende B o e n d e 0 Gabon Ubundu Lake Edward Opala Bikoro Bokungu Lubutu North Kivu Congo Tshuapa Lukolela Ikela Rutshuru Kiri Punia Walikale Masisi Monkoto G o m a Yumbi II n o n g o Kigali Bolobo Lake Kivu Rwanda Lomela Kalehe S S " KabareB u k a v u " 0 0 ' ' 0 Kailo Walungu 0 3 3 ° Shabunda ° 2 2 Mai Ndombe K ii n d u Mushie Mwenga Kwamouth Maniema Pangi B a n d u n d u Bujumbura Oshwe Katako-Kombe South Kivu Uvira Dekese Kole Sankuru Burundi Kas ai R Bagata iver Kibombo Brazzaville Ilebo Fizi Kinshasa Kasongo KasanguluKinshasa Bandundu Bulungu Kasai Oriental Kabambare K e n g e Mweka Lubefu S Luozi L u s a m b o S " Tshela Madimba Kwilu Kasai -

Dr Congo Humanitarian Crisis International Organization for Migration

DR CONGO HUMANITARIAN CRISIS INTERNATIONAL ORGANIZATION FOR MIGRATION SITUATION REPORT 20 April - 16 May 2018 IOM staff monitoring the construction of transitional shelters in Katanika displacement site. Highlights © IOM 2018 (Photo: Carin Atterby) IOM constructed 200 emergency IOM trained 30 staff on the To date, IOM has transferred 3,154 IDPs shelters in Katanika displacement site and Displacement Tracking Matrix in from collective centres in Kalemie to provided in collaboration with the UNHCR preparation for the second baseline study displacement sites, and provided and the RRMP 1,748 IDP households in in seven provinces. voluntary return assistance to 390 IDPs to Kikumbe displacement site with shelter return to their areas of origin. kits. Situation Overview During the reporting period, Ebola Virus Disease was declared on 8 May 2018 in the North-Western province of Equateur in the Democratic Republic of the Congo (DRC). The disease was detected in the village of Bikoro and has since reached urban areas in the city of Mbandaka where the first cases were detected on 11 May 2018. This is the ninth outbreak in this area since the virus was discovered in 1976. The humanitarian community is working alongside the Congolese authorities to mitigate the spreading of the disease. IOM aims to respond by focusing on the surveillance of Point of Entries (POE) to cities and by doing risk communication and promoting sanitary control. IOM in partnership with the World Health Organization (WHO), has already started mapping population mobility (both by using qualitative and quantitative methodologies) through participatory mapping exercises, as well as point surveillance at the selected key POEs including those in Kinshasa. -

From Resource War to ‘Violent Peace’ Transition in the Democratic Republic of the Congo (DRC) from Resource War to ‘Violent Peace’

paper 50 From Resource War to ‘Violent Peace’ Transition in the Democratic Republic of the Congo (DRC) From Resource War to ‘Violent Peace’ Transition in the Democratic Republic of Congo (DRC) by Björn Aust and Willem Jaspers Published by ©BICC, Bonn 2006 Bonn International Center for Conversion Director: Peter J. Croll An der Elisabethkirche 25 D-53113 Bonn Germany Phone: +49-228-911960 Fax: +49-228-241215 E-mail: [email protected] Internet: www.bicc.de Cover Photo: Willem Jaspers From Resource War to ‘Violent Peace’ Table of contents Summary 4 List of Acronyms 6 Introduction 8 War and war economy in the DRC (1998–2002) 10 Post-war economy and transition in the DRC 12 Aim and structure of the paper 14 1. The Congolese peace process 16 1.1 Power shifts and developments leading to the peace agreement 17 Prologue: Africa’s ‘First World War’ and its war economy 18 Power shifts and the spoils of (formal) peace 24 1.2 Political transition: Structural challenges and spoiler problems 29 Humanitarian Situation and International Assistance 30 ‘Spoiler problems’ and political stalemate in the TNG 34 Systemic Corruption and its Impact on Transition 40 1.3 ‘Violent peace’ and security-related liabilities to transition 56 MONUC and its contribution to peace in the DRC 57 Security-related developments in different parts of the DRC since 2002 60 1.4 Fragility of security sector reform 70 Power struggles between institutions and parallel command structures 76 2. A Tale of two cities: Goma and Bukavu as case studies of the transition in North and South Kivu -

42 China-Malawi Relations

Issue 4 AFRICAN December 2014 EAST-ASIAN AFFAIRS THE CHINA MONITOR China-Malawi relations: an analysis of trade patterns and development impli- cations by Theodora C. Thindwa* Centre for Security Studies, Mzuzu University Mzuzu, Malawi Abstract As China is emerging as a force to reckon with in the 21st century it has formed economic and political partnerships with a number of countries especially in Africa, including Malawi. There are contending views on China’s role in Africa with some viewing it as a neo-colonial power and others as Africa’s development partner. This paper investigates how China-Malawi relationship has contributed to economic development in Malawi. This limits the scope of the study to Chinese Government investments directly dealing with the Malawi Government. The article analyses Chi- na-Malawi trade patterns, the number of jobs created by Chinese investments and other contributions by China. Exploratory research design, aspects of descriptive research and mixed methods of analysis is employed to uncover the nature of China-Malawi relations between 2007 and 2012. Using secondary data sources and interviews with principal trade officers, the study found both positive and negative trends. The level of Malawian exports to China is low compared to Chinese exports to Malawi. This entails trade losses for Malawi which in turn has implications for development and also for the society that *Theodora C. Thindwa is a Staff Associate at the Centre for Security Studies at Mzuzu University in Malawi. © Centre for Chinese Studies, Stellenbosch University All Rights Reserved. 42 Theodora C. Thindwa AFRICAN “China-Malawi relations: an analysis of trade patterns and development implications“ EAST-ASIAN AFFAIRS THE CHINA MONITOR Malawi is evolving into. -

Musebe Artisanal Mine, Katanga Democratic Republic of Congo

Gold baseline study one: Musebe artisanal mine, Katanga Democratic Republic of Congo Gregory Mthembu-Salter, Phuzumoya Consulting About the OECD The OECD is a forum in which governments compare and exchange policy experiences, identify good practices in light of emerging challenges, and promote decisions and recommendations to produce better policies for better lives. The OECD’s mission is to promote policies that improve economic and social well-being of people around the world. About the OECD Due Diligence Guidance The OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (OECD Due Diligence Guidance) provides detailed recommendations to help companies respect human rights and avoid contributing to conflict through their mineral purchasing decisions and practices. The OECD Due Diligence Guidance is for use by any company potentially sourcing minerals or metals from conflict-affected and high-risk areas. It is one of the only international frameworks available to help companies meet their due diligence reporting requirements. About this study This gold baseline study is the first of five studies intended to identify and assess potential traceable “conflict-free” supply chains of artisanally-mined Congolese gold and to identify the challenges to implementation of supply chain due diligence. The study was carried out in Musebe, Haut Katanga, Democratic Republic of Congo. This study served as background material for the 7th ICGLR-OECD-UN GoE Forum on Responsible Mineral Supply Chains in Paris on 26-28 May 2014. It was prepared by Gregory Mthembu-Salter of Phuzumoya Consulting, working as a consultant for the OECD Secretariat. -

THE EDITED of the 13Th WEDG CONFERENCE

velopment Centre ough University of Technology Leicestershire England THE EDITED OF THE 13th WEDG CONFERENCE • •• ''• RWRAIJ WATER AND IN AFRICA •':ri'i'l''i'>"i-M'> • < Malawi April 1987 • I I published by WEDC ', University of Technology LOUGHBOROUGH • Leicestershire LE11 3TU ; ' | England : February 1988 , ISBN O 9O6O55 19 9 softback I Printed by the University Printing Unit. I I I I I I I I 13th WEDC Conference Contents Rural development in Africa Malawi: 1987 I CONTENTS LIST OF PARTICIPANTS INTRODUCTION TO CONFERENCE I C Clark OBE Permanent Secretary, Ministry of Works and Supplies OPENING ADDRESS I Hon L J Chimango MP, Minister of Health .KEYNOTE ADDRESS I L A H Msukwa, Director Centre for Social Research SESSION 1 IRRIGATION I Small-scale irrigation in Zambia 13 J A Stoutjesdijk and Josy B Siakantu I Damho resource use in Zimbabwe 16 Patricia Hotchkiss and Morag Bell Micro-scale irrigation in Africa 20 I R A Lambert and others UP.9A.RY, INTERNATIONAL V(ZF[:2'T.U0E Discussion C::rJ";:;L: R)R GO^AAATY WATMR SUPPLY 24 I A, ;;•) ,'.,AN;;Y.T:O:: f'.•••'.:;} SESSION 2 SANITATION F'-'::'' • -' "••; :'•••- •-•••0::; AD Y.i-3 ;;;.:qu« I Choices in pit latrine emptying 28 Chris Williams L0: Single and double pits in Lesotho I S N Makhatha Low volume flush we design 36 I RHM Wakelin, J A Swaffield and R A Bocarro I Discussion 40 SESSION 3 WATER SUPPLY I Natural coagulants in water clarification G K Folkard, j P Sutherland and W D Grant Guidelines for extraordinary earth dams T F Stephens I Discussion 4.9 I SESSION 4 RURAL WATER SUPPLY Low-cost -

Democratic Republic of the Congo

DEMOCRATIC REPUBLIC OF THE CONGO MONTHLY REFUGEE STATISTICS Situation as of November 30, 2020 Type Age 0-4 5-11 12-17 18-59 60+ Total % Total Rural (out of camp) 75,821 105,155 62,321 131,723 9,121 384,141 73.3% Total Camps/Sites 23,501 39,046 20,860 47,419 2,981 133,807 25.5% Total 524,302 Total Urban 620 1,487 1,132 2,939 176 6,354 1.2% Grand Total 99,942 145,688 84,313 182,081 12,278 524,302 Refugee Population in DRC Refugee Population by Province in DRC Country Female Male Total % Province Main Location Type Female Male Total Angola** 179 235 414 0.08% Bas Uele Ango & Bondo Rural 22,519 17,697 40,216 Burundi* 25,022 23,530 48,552 9.26% Equateur Disperced Rural 143 213 356 CAR* 91,469 79,582 171,051 32.62% Haut Katanga Lubumbashi & Urb. & Rur. 1,742 Arounds 808 934 Rep.Congo 251 386 637 0.12% Haut Uele Dungu, Doruma Rural 22,311 19,394 41,705 Rwanda*** 107,534 106,440 213,974 40.81% Ituri Aru & Ariwara Rural 25,506 22,351 47,857 S. Sudan* 47,837 41,737 89,574 17.08% Kasai Oriental Tshiala Rural 2 6 8 Kinshasa & Sudan 8 24 32 0.01% Kinshasa Urb. & Rur. 790 outskirts 375 415 Bas Fleuve, Uganda 13 10 23 0.004% Kongo Central Rural 817 MbanzaNg. & Kimaza 328 489 Somalia 7 7 14 0.003% Lomami Luila &MweneDitu Rural 430 456 886 Ivory Coast 4 3 7 0.001% Lualaba Dilolo,Sandoa &Kolwezi Rural 590 596 1,186 Other 10 14 24 0.005% Maniema Pangi, Kailo&Lukolo Rural 203 269 472 Lubero, Masisi, Total 272,334 251,968 524,302 100% Nord Kivu Urb. -

MALAWI Government Releases Many Political Prisoners Jack Mapanje

April 24, 1991 MALAWI Government releases many political prisoners Jack Mapanje and others still held Africa Watch welcomes the release of 87 political prisoners in Malawi, including some 25 held under presidential detention orders. The releases represent a significant step by the government towards complying with Malawi's legal obligations under the African Charter on Human and Peoples' Rights, which it ratified a year ago. However, in other respects Malawi's performance still falls far short of the standards required by the Charter. In particular Africa Watch remains concerned about the fate of about 19 prisoners still detained without charge at Mikuyu prison, who include the internationally-renowned poet Jack Mapanje. The release of political prisoners began at the beginning of January, when George Mtafu, Margaret Marango Banda, Blaise Machila and William Masiku were set free: George Mtafu, who had been held without charge at Chichiri Prison, is Malawi's only neurosurgeon. He was arrested in February 1989 because he had criticized discrimination against civil servants who originated from Malawi's northern region, in particular the forcible redeployment of school teachers to their district of origin. Margaret Marango Banda, a former announcer with the Malawi Broadcasting Corporation, was an official of the Chitukuko Cha Amai mu Malawi (CCAM), the national women's organization. She is believed to have criticized corruption in the CCAM, which is headed by Cecilia Tamanda Kadzamira, the country's "Official Hostess." She was arrested in July 1988 and held without charge at Zomba Prison. Blaise Machila used to be a lecturer in English at Chancellor College in the University of Malawi.