Small and Medium Enterprise (SME) Credit Policies & Programmes

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Schumannianthus Dichotomus) Plantation

International Journal of Innovative Research International Journal of Innovative Research, 3(3): 94–99, 2018 ISSN 2520-5919 (online) www.irsbd.org RESEARCH PAPER Co-limitation of nitrogen and phosphorus causes culm shortness in the aged Murta (Schumannianthus dichotomus) plantation Shamim Mia1*, Eamad Mustafa1, Md. Mainul Hasan2, Md. Abdul Kayum2, Nasar Uddin Ahmed3 and Md. Harun- Or-Rashid1 1 Department of Agronomy, Patuakhali Science and Technology University, Dumki, Patuakhali-8602, Bangladesh. 2 Department of Agricultural Botany, Patuakhali Science and Technology University, Dumki, Patuakhali-8602, Bangladesh. 3 Department of Genetics and Plant Breeding, Patuakhali Science and Technology University, Dumki, Patuakhali-8602, Bangladesh. ARTICLE HISTORY ABSTRACT Received: October 05, 2018 Murta (Schumannianthus dichotomus), a forest species grown in the swamp Revised: December 02, 2018 lands of Eastern India and Bangladesh, is used for weaving traditional bed Accepted: December 05, 2018 mat, conventionally known as Sital Pati. Although long culm is a desirable Published: December 31, 2018 trait for Murta, culm shortening is a usual phenomenon in the aged plantation. However, the causes of culm shortening were not explored yet. Herein, we *Corresponding author: conducted a field experiment in five years old plantation using six treatments, -1 [email protected] i.e., F1=control, F2= cow dung @ 1500 kg ha , F3= urea, TSP and MoP @ -1 13.33, 16.66 and 8.33 kg ha respectively, F4 = combined application of F2 -1 and F3, but urea application at two equal splits, F5= cow dung @ 1500 kg ha and urea, TSP and MoP application respectively @ 16.66, 16.66 and 8.33 kg -1 -1 ha , urea application in three splits (6.67+6.67+3.33 kg ha ) and F6 = combined application of cow dung @ 1500 kg ha-1 and urea, TSP, MoP application @ 20, 16.66 and 8.33 respectively, urea application at three equal splits of 6.67 kg ha-1. -

Intangible-Cultural

National Workshop on Implementation of the UNESCO Convention for the Safeguarding of the Intangible Cultural Heritage in Bangladesh 1 National Workshop on Implementation of the UNESCO Convention for the Safeguarding of the Intangible Cultural Heritage in Bangladesh 3 4 National Workshop on Implementation of the UNESCO Convention for the Safeguarding of the Intangible Cultural Heritage in Bangladesh National Workshop on Implementation of the UNESCO Convention for the Safeguarding of the Intangible Cultural Heritage (ICH) in Bangladesh Published by Department of Archaeology Government of the People’s Republic of Bangladesh F-4/A, Agargaon Administrative Area Sher-e-Banglanagar, Dhaka-1207 Published in 2013 Copyright Department of Archaeology, Government of the People’s Republic of Bangladesh All rights reserved ISBN: 978-984-33-7860-6 The ideas and opinions expressed in this publication are those of the authors/experts; they are not necessarily those of the Department of Archaeology and do not commit the organization. Supervision, Edition and Coordination Sharif uddin Ahmed Supernumerary Professor Department of History University of Dhaka Dhaka, Bangladesh Assistant Supervision, Edition and Coordination Shahida Khanom Project Officer, Culture UNESCO Office Dhaka, Bangladesh Design and Published by Progressive Printers Pvt. Ltd Karmojeebi Mohila Hostel Market Neelkhet, Dhaka-1205, Bangladesh E-mail: [email protected] Photograph (Workshop) Tauhidun Nabi Department of Archaeology Bangladesh Printed in Bangladesh This publication has been -

State District Branch Address Centre Ifsc Contact1 Contact2

STATE DISTRICT BRANCH ADDRESS CENTRE IFSC CONTACT1 CONTACT2 SURVEY NO.1053 & 1054, ATS SHOPPING COMPLEX, ANDAMAN TRUNK ROAD, GARACHAR MA, PORT ANDAMAN BLAIR, AND SOUTH NICOBAR ANDAMAN ISLAND ANDAMAN Garacharma -744105 PORT BLAIR CNRB000521403192-251114 Krishna ANDAMAN House, AND Aberdeen NICOBAR PORT BLAIR Bazar, Port ISLAND ANDAMAN ANDAMAN Blair 744 104 PORT BLAIR CNRB000118503192-233085 [email protected] CANARA BANK, H NO 9 - 420, TEACHERS COLONY, DASNAPUR - 504001, ADILABAD DIST, ANDHRA ANDHRA PRADESH ADILABAD DASNAPUR PRADESH ADILABAD CNRB0003872 [email protected] H No.4-47/5, Bellampally Road MANCHERIA L 504208 , ANDHRA MANCHERIA ADILABAD MANCHERIY cb4169@can PRADESH ADILABAD L DIST., A P AL CNRB0004169arabank.com Main Road NIRMAL ANDHRA ADILABAD cb4176@can PRADESH ADILABAD Nirmal DISTRICT NIRMAL CNRB0004176arabank.com DOOR NO 11/176,SUBH ASH ROAD,, NEAROLD TOWN BRIDGE,, ANDHRA ANANTAPUR 08554 PRADESH ANANTAPUR ANANTAPUR - 515001. ANANTAPUR CNRB0000659-222464 [email protected] BANGALORE - HYDERABAD HIGHWAY,, CHENNAKOT HAPALLI , DIST ANDHRA CHENNEKOT ANANTHPUR CHENNAKOT PRADESH ANANTAPUR HAPALLI (A P) -515 101 HAPALLI CNRB000013808559-240328 [email protected] MANJU COMPLEX,, ANDHRA DHARMAVAR DHARMAVAR DHARMAVAR PRADESH ANANTAPUR AM AM 515671, , AM CNRB000085108559-223029 [email protected] LALAPPA GARDEN, NH - 7,, GARLADINN E , DIST ANDHRA GARLADINN ANANTPUR, GARLADINN PRADESH ANANTAPUR E (A P) - 515731 E CNRB000097908551-286430 [email protected] D.NO:1/30 KOTAVEEDHI RAPTHADU MANDAL ANANTAPUR DISTRICT ANDHRA -

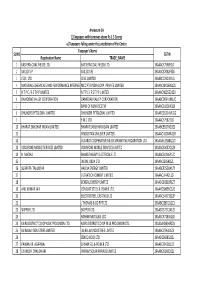

FINAL DISTRIBUTION.Xlsx

Annexure-1A 1)Taxpayers with turnover above Rs 1.5 Crores a) Taxpayers falling under the jurisdiction of the Centre Taxpayer's Name SL NO GSTIN Registration Name TRADE_NAME 1 EASTERN COAL FIELDS LTD. EASTERN COAL FIELDS LTD. 19AAACE7590E1ZI 2 SAIL (D.S.P) SAIL (D.S.P) 19AAACS7062F6Z6 3 CESC LTD. CESC LIMITED 19AABCC2903N1ZL 4 MATERIALS CHEMICALS AND PERFORMANCE INTERMEDIARIESMCC PTA PRIVATE INDIA CORP.LIMITED PRIVATE LIMITED 19AAACM9169K1ZU 5 N T P C / F S T P P LIMITED N T P C / F S T P P LIMITED 19AAACN0255D1ZV 6 DAMODAR VALLEY CORPORATION DAMODAR VALLEY CORPORATION 19AABCD0541M1ZO 7 BANK OF NOVA SCOTIA 19AAACB1536H1ZX 8 DHUNSERI PETGLOBAL LIMITED DHUNSERI PETGLOBAL LIMITED 19AAFCD5214M1ZG 9 E M C LTD 19AAACE7582J1Z7 10 BHARAT SANCHAR NIGAM LIMITED BHARAT SANCHAR NIGAM LIMITED 19AABCB5576G3ZG 11 HINDUSTAN UNILEVER LIMITED 19AAACH1004N1ZR 12 GUJARAT COOPERATIVE MILKS MARKETING FEDARATION LTD 19AAAAG5588Q1ZT 13 VODAFONE MOBILE SERVICES LIMITED VODAFONE MOBILE SERVICES LIMITED 19AAACS4457Q1ZN 14 N MADHU BHARAT HEAVY ELECTRICALS LTD 19AAACB4146P1ZC 15 JINDAL INDIA LTD 19AAACJ2054J1ZL 16 SUBRATA TALUKDAR HALDIA ENERGY LIMITED 19AABCR2530A1ZY 17 ULTRATECH CEMENT LIMITED 19AAACL6442L1Z7 18 BENGAL ENERGY LIMITED 19AADCB1581F1ZT 19 ANIL KUMAR JAIN CONCAST STEEL & POWER LTD.. 19AAHCS8656C1Z0 20 ELECTROSTEEL CASTINGS LTD 19AAACE4975B1ZP 21 J THOMAS & CO PVT LTD 19AABCJ2851Q1Z1 22 SKIPPER LTD. SKIPPER LTD. 19AADCS7272A1ZE 23 RASHMI METALIKS LTD 19AACCR7183E1Z6 24 KAIRA DISTRICT CO-OP MILK PRO.UNION LTD. KAIRA DISTRICT CO-OP MILK PRO.UNION LTD. 19AAAAK8694F2Z6 25 JAI BALAJI INDUSTRIES LIMITED JAI BALAJI INDUSTRIES LIMITED 19AAACJ7961J1Z3 26 SENCO GOLD LTD. 19AADCS6985J1ZL 27 PAWAN KR. AGARWAL SHYAM SEL & POWER LTD. 19AAECS9421J1ZZ 28 GYANESH CHAUDHARY VIKRAM SOLAR PRIVATE LIMITED 19AABCI5168D1ZL 29 KARUNA MANAGEMENT SERVICES LIMITED 19AABCK1666L1Z7 30 SHIVANANDAN TOSHNIWAL AMBUJA CEMENTS LIMITED 19AAACG0569P1Z4 31 SHALIMAR HATCHERIES LIMITED SHALIMAR HATCHERIES LTD 19AADCS6537J1ZX 32 FIDDLE IRON & STEEL PVT. -

(ICH) and NATURAL DISASTER in BANGLADESH: EXISTING POLICIES and STRATEGIES for SAFEGUARDING Md

INTANGIBLE CULTURAL HERITAGE (ICH) AND NATURAL DISASTER IN BANGLADESH: EXISTING POLICIES AND STRATEGIES FOR SAFEGUARDING Md. Amanullah Bin Mahmood1 Introduc� on Bangladesh is a country with rich cultural diversity. It has a great deal of Intangible Cultural Heritage (ICH), which contributes to strengthening social beliefs, building resilience and recreati on as well as economic development. Of the ICH of Bangladesh, four elements have already been added to UNESCO’s Lists. Bangladesh, however, is one of the world’s most vulnerable countries in terms of the adverse eff ects of disaster and climate change. Among other disasters, Bangladesh is the country most vulnerable to tropical cyclones and the sixth most vulnerable to fl ooding (BCCSAP 2009). Its unique geographical locati on makes the country more vulnerable to diff erent natural disasters and climate change. The country has a rich variety of ICH, but a number of ICH properti es are under threat due to the effects of disaster and climate change. Presently, Bangladesh is implementi ng two important related conventi ons, the Conventi on for the Safeguarding of the Intangible Cultural Heritage (2003) and the Sendai Framework for Disaster Risk Reducti on 2015–2030. Moreover, a newly prepared disaster-related plan, the Nati onal Plan for Disaster Management 2016–2020, is also at the implementati on stage. Although disaster management is one of the most pressing issues in the country, few drawbacks exist at the policy level for safeguarding ICH against disaster and climate risk. Where the issues of safeguarding ICH from the eff ects of disaster and climate change are addressed, this is done so indiscriminately and indirectly in diff erent related policies. -

Final Report on the Unesco Workshop on Nominations to the Lists of the 2003 Unesco 2003 Convention for the Safeguarding of the Intangible Cultural Heritage

FINAL REPORT ON THE UNESCO WORKSHOP ON NOMINATIONS TO THE LISTS OF THE 2003 UNESCO 2003 CONVENTION FOR THE SAFEGUARDING OF THE INTANGIBLE CULTURAL HERITAGE. Held at the Shilpakala Academy, Dhaka, Bangladesh, 5 – 9 May 2018 Prepared by the facilitators: Noriko Aikawa and Suzanne Ogge Submitted: 9 June 2018 Introduction The workshop was the third in a series organized by the UNESO Dhaka Office within the framework of a two-year project aimed at strengthening national capacities for the safeguarding of intangible cultural heritage (ICH). Funded by the UNESCO/Azerbaijan Funds-in-Trust, the project1 is implemented by UNESCO Dhaka in cooperation with the Ministry of Cultural Affairs (MoCA), the Department of Archaeology, Bangladesh Shilpakala Academy and other stakeholders. The first workshop took place in January/February 2017 on implementing the 2003 Convention, and the second in September 2017 on community-based inventorying. The present workshop focused on nominations under the Convention, with a focus on the Urgent Safeguarding (USL) and Representative Lists (RL). A final workshop is slated for September 2018, with a focus on safeguarding. The facilitators wish to thank the UNESO Dhaka Office, and especially Ms Beatrice Kaldun, Director, and Ms Kizzy Tahnin, for their strong support with all aspects of the workshops, from giving informed advising on content to assuring smooth logistics throughout. 1 The full project title is ‘The UNESCO/Azerbaijan Funds-in-Trust project for Safeguarding National Capacities for Safeguarding Intangible Cultural Heritage for Sustainable Development in Bangladesh.’ 1 1. COUNTRY CONTEXT 1.1 Introduction to the Cultural Context Note: Section 1.1 of this report draws on the information given in the previous two workshop reports. -

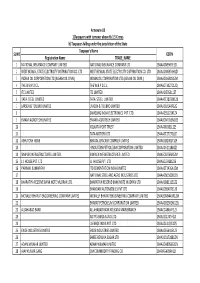

FINAL DISTRIBUTION.Xlsx

Annexure-1B 1)Taxpayers with turnover above Rs 1.5 Crores b) Taxpayers falling under the jurisdiction of the State Taxpayer's Name SL NO GSTIN Registration Name TRADE_NAME 1 NATIONAL INSURANCE COMPANY LIMITED NATIONAL INSURANCE COMPANY LTD 19AAACN9967E1Z0 2 WEST BENGAL STATE ELECTRICITY DISTRIBUTION CO. LTD WEST BENGAL STATE ELECTRICITY DISTRIBUTION CO. LTD 19AAACW6953H1ZX 3 INDIAN OIL CORPORATION LTD.(ASSAM OIL DIVN.) INDIAN OIL CORPORATION LTD.(ASSAM OIL DIVN.) 19AAACI1681G1ZM 4 THE W.B.P.D.C.L. THE W.B.P.D.C.L. 19AABCT3027C1ZQ 5 ITC LIMITED ITC LIMITED 19AAACI5950L1Z7 6 TATA STEEL LIMITED TATA STEEL LIMITED 19AAACT2803M1Z8 7 LARSEN & TOUBRO LIMITED LARSEN & TOUBRO LIMITED 19AAACL0140P1ZG 8 SAMSUNG INDIA ELECTRONICS PVT. LTD. 19AAACS5123K1ZA 9 EMAMI AGROTECH LIMITED EMAMI AGROTECH LIMITED 19AABCN7953M1ZS 10 KOLKATA PORT TRUST 19AAAJK0361L1Z3 11 TATA MOTORS LTD 19AAACT2727Q1ZT 12 ASHUTOSH BOSE BENGAL CRACKER COMPLEX LIMITED 19AAGCB2001F1Z9 13 HINDUSTAN PETROLEUM CORPORATION LIMITED. 19AAACH1118B1Z9 14 SIMPLEX INFRASTRUCTURES LIMITED. SIMPLEX INFRASTRUCTURES LIMITED. 19AAECS0765R1ZM 15 J.J. HOUSE PVT. LTD J.J. HOUSE PVT. LTD 19AABCJ5928J2Z6 16 PARIMAL KUMAR RAY ITD CEMENTATION INDIA LIMITED 19AAACT1426A1ZW 17 NATIONAL STEEL AND AGRO INDUSTRIES LTD 19AAACN1500B1Z9 18 BHARATIYA RESERVE BANK NOTE MUDRAN LTD. BHARATIYA RESERVE BANK NOTE MUDRAN LTD. 19AAACB8111E1Z2 19 BHANDARI AUTOMOBILES PVT LTD 19AABCB5407E1Z0 20 MCNALLY BHARAT ENGGINEERING COMPANY LIMITED MCNALLY BHARAT ENGGINEERING COMPANY LIMITED 19AABCM9443R1ZM 21 BHARAT PETROLEUM CORPORATION LIMITED 19AAACB2902M1ZQ 22 ALLAHABAD BANK ALLAHABAD BANK KOLKATA MAIN BRANCH 19AACCA8464F1ZJ 23 ADITYA BIRLA NUVO LTD. 19AAACI1747H1ZL 24 LAFARGE INDIA PVT. LTD. 19AAACL4159L1Z5 25 EXIDE INDUSTRIES LIMITED EXIDE INDUSTRIES LIMITED 19AAACE6641E1ZS 26 SHREE RENUKA SUGAR LTD. 19AADCS1728B1ZN 27 ADANI WILMAR LIMITED ADANI WILMAR LIMITED 19AABCA8056G1ZM 28 AJAY KUMAR GARG OM COMMODITY TRADING CO. -

Amar Ekushey Book Fair 2019 Inaugural Session Speech By

Amar Ekushey Book Fair 2019 Inaugural Session Speech by Sheikh Hasina Prime Minister Government of the People’s Republic of Bangladesh Bangla Academy, Dhaka, Friday, 19 Magh 1425, 1 February 2019 Bismillahir Rahmanir Rahim Hon’ble Chair, Members of the Cabinet, Diplomats, Respectable Fellows, Life Members, Members and Employees of Bangla Academy, Respected guests from overseas, authors and journalists , Ladies and Gentlemen. Assalamu Alaikum and a very good afternoon to you all. I convey my greetings of February, the month of Language Movement. I do remember with respect all the Language Martyrs, including Salam, Barkat, Rafique, Jabbar and Shafiur, who laid their lives for the cause of our mother tongue Bangla. I recall all the deceased and living veterans of the Language Movement. I pay my deep homage to the one of the pioneer of Language Movement, the Greatest Bangalee of All times, Bangabandhu Sheikh Mujibur Rahman. We have gotten an independent Bangladesh in lieu of his 24-year of political struggle, imprisonment and oppression. I pay my respect to the 4-national leaders, 3 million martyrs and 200 thousand persecuted women of the war of liberation. I congratulate the distinguished writers who have been awarded Bangla Academy Literary Award 2018 for your outstanding contributions in different fields of literature. Ladies and Gentlemen, Many spread distorted information on the history of Language Movement let alone the Great War of Liberation. We observe a trend of highlighting themselves and undermining others in their write-ups/books of many politicians and writers. I think the misgivings have largely been addressed through the two books - The Unfinished Memoirs of Bangabandhu and the Secret Documents of the Intelligence Branch on the Father of the Nation Bangabandhu Sheikh Mujibur Rahman. -

APPENDIX-I Dr. Ganesh Nandi's Interview Conducted on 24.05.2014

APPENDIX-I Dr. Ganesh Nandi’s interview conducted on 24.05.2014 Q.1 What do you think about the existing art and craft of Barak valley? A. The art and culture of Barak valley has a long past, there are two divisions in art, for instance, folk art and modern art. When and how the folk art had been started in this region, is not sure. But it is fact that it has come into existence along with the different tribes. Barak valley is the land of many tribes. Art and craft of any tribe is the part and parcel of their life and also of social system. All the crafts came into existence for the purposes of daily life. Crafts of various tribes of this region have been receiving good responses now, for instance, the Dimasa textiles as well as shital pati of Barak are getting good response from outside. Even these art and craft has given the economic support to the natives of this region. The industrial materials strongly influenced the peoples of this valley. Therefore, it is more or less disturbing the traditional art and craft industries of this region. Q.2 What you feel about the importance of museum in this region? A. I think museum is the part and parcel of education and any education is not possible without museum. I personally believe on this concept, because if anybody wants to know their history, they must know the background of their ancestors. Museum is such a medium which can tell you about the material culture of different phases of the society. -

Proposing Strategies Against the Loss of Intangible Cultural Heritage in the Era of Globalization Student Officer: Bill Michalis Position: Chair

Committee: Social, Humanitarian and Cultural Issue: Proposing strategies against the loss of intangible cultural heritage in the era of globalization Student Officer: Bill Michalis Position: Chair Introduction One of the most important aspects of our everyday lives is culture, as it not only concerns each person individually, but also several groups of people as well, either large or small. Culture plays a role in shaping a person’s character. However, culture is not just big monuments and artifacts of historical importance· it is also the tradition behind a civilization, which carves people’s identity. The monuments, the objects, the places are described as Tangible Cultural Heritage. The practices and the traditions are described as Intangible Cultural Heritage and sometimes include objects etc. that are part of the Tangible Cultural Heritage. To understand the importance of preserving the Intangible Cultural Heritage we have to comprehend exactly what it is. Intangible Cultural Heritage is a term that describes anything considered by UNESCO as a part of a nation’s cultural heritage and tradition. It includes any practice that is considered by the people as part of their cultural heritage and it includes any Tangible Cultural Heritage, Figure 1 - The Hat Mon festival at the Hat Mon temple in meaning objects, places, etc. that are Vietnam associated with such practices. In 2001, UNESCO made an effort to define Intangible Cultural Heritage and in 2003, the Convention for the Safeguarding of Intangible Cultural Heritage (CSICH) was drafted by NGOs and UNESCO member states for the protection and the promotion of Intangible Cultural Heritage. Intangible Cultural Heritage is defined by the 2nd article of the aforementioned Convention as “the practices, representations, expressions, knowledge, skills —as well as the instruments, objects, artefacts and cultural spaces associated therewith— that communities, groups and, in some cases, individuals recognize as part of their cultural heritage. -

Agent List - East Zone

Agent List - East Zone OFFICE_ AGENT_COD AGENT_NAME ADDRESS PINCODE CONTACT_NO PAN_NO DATE_OF_ENROLLMENT CODE E 1 NO.TOWN,PURANI MASJIDSUBHASH MARG,BARA 210405 AGD0116231 AAFTAB ALAM 825301 9308975372 AKQPA9346P 22/07/2014 BAZAR 260400 AGD0050974 ABANISH PANDA BHABANI FIELDDHANUPALISAMBALPUR 768005 9437175339 AHCPP5325L 08/01/2002 130200 AGI0027715 ABDUL MUEZE CHOWDHURY ARUN PRAKASH MANSION 781005 9435041413 AEHPC0112J 25/06/2011 270500 AGD0081237 ABDUL GANI ISMAIL 34, RDA COLONY, SANJAY NAGAR, RAIPUR 492001 7587050021 AJJPG6250E 27/04/2012 130604 AGD0057842 ABDUL HALIM VILL.JOYPUR,P.O.JOYPUR BAZAR,P.S.B 783101 9401159982 ABUPH7432A 01/01/2010 031602 AGD0005761 ABDUL HAMID MONDAL SHIKRA , SHIKRA P.O.-PADDAMALA, DI 741101 9732546545 AJHPM7840E 28/03/2002 131001 AGD0120342 ABDUL HANNAN MAIRABARI, NAGAON 782125 9854783857 AFHPH9273G 30/01/2012 VILL:DINKAR, P.O: KAMALPUR, VIA: BAIHATA CHARIALI, 130184 AGD0117607 ABDUL JALIL 600014 9854509487 AFOPJ2805H 23/09/2013 P.S: KAMALPUR,DIST: KAMRUP ,ASSAM. 130602 AGD0030284 ABDUL KADDUS ALI AHMED VILL.:SATRAKANARA 6 NO.SIT,PO.:SAT 781315 9954255369 AKZPA0506E 14/09/2007 210604 AGD0101517 ABDUL LATIF DR. B.N COMPLEX 834002 9955120720 ABEPL9090Q 16/01/2011 031402 AGD0113910 ABDUL MOID BABUYA S/O- ABANI GHOSH 742202 9153084278 AGMPB8612P 14/05/2012 260300 AGD0078062 ABDUL RAHMAN KHAN B-V-88,KRISHAN NAGAR, KAPURTHALA 144001 9778860153 AGWPK7612E 22/10/2013 035101 AGD0006006 ABDUL SALEK ALI SIBESWAR,GOBRA CHHRA,DINHATA,COOCH 736101 9547393135 AGIPA6197J 26/12/2012 130604 AGD0086068 ABDUL WAHHAB KHANDAKAR VILL.KALLYANPUR,P.O.BAGUAN 783121 9954321568 BAGPK0467E 12/08/2011 130681 AGD0102894 ABDULKHALEQUE SAGUNMARIPT.-II,P.O.BILASIPARA,DT.DHUBRI 783348 9957084509 AWMPK1267F 11/09/2007 VILL.ANANDANAGAR,W/NO.1,P.O.BILASIPARA,DIST.DHUB 130681 AGD0102652 ABDULLAALMAMUN 783348 9954648114 AYRPM1481A 29/09/2007 RI,ASSAM-783348 S/O.LT.MAHEJALI.AHMED,MENDHIRJHAR,WARDNO.8,P.O. -

Representative List of the Intangible Cultural Heritage of Humanity (As of 2018)

Representative List of the Intangible Cultural Heritage of Humanity (As of 2018) 2018 Art of dry stone walling, knowledge and techniques Croatia – Cyprus – France – Greece – Italy – Slovenia – Spain – Switzerland As-Samer in Jordan Jordan Avalanche risk management Switzerland – Austria Blaudruck/Modrotisk/Kékfestés/Modrotlač, resist block printing Austria – Czechia – and indigo dyeing in Europe Germany – Hungary – Slovakia Bobbin lacemaking in Slovenia Slovenia Celebration in honor of the Budslaŭ icon of Our Lady (Budslaŭ Belarus fest) Chakan, embroidery art in the Republic of Tajikistan Tajikistan Chidaoba, wrestling in Georgia Georgia Dondang Sayang Malaysia Festivity of Las Parrandas in the centre of Cuba Cuba Heritage of Dede Qorqud/Korkyt Ata/Dede Korkut, epic Azerbaijan – culture, folk tales and music Kazakhstan – Turkey Horse and camel Ardhah Oman Hurling Ireland Khon, masked dance drama in Thailand Thailand La Romería (the pilgrimage): ritual cycle of 'La llevada' (the Mexico carrying) of the Virgin of Zapopan Lum medicinal bathing of Sowa Rigpa, knowledge and China practices concerning life, health and illness prevention and treatment among the Tibetan people in China Međimurska popevka, a folksong from Međimurje Croatia Mooba dance of the Lenje ethnic group of Central Province of Zambia Zambia Mwinoghe, joyous dance Malawi Nativity scene (szopka) tradition in Krakow Poland Picking of iva grass on Ozren mountain Bosnia and Herzegovi na Pottery skills of the women of Sejnane Tunisia Raiho-shin, ritual visits of deities in masks