Efficient Credit Policies in a Housing Debt Crisis

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Down Payment and Closing Cost Assistance

STATE HOUSING FINANCE AGENCIES Down Payment and Closing Cost Assistance OVERVIEW STRUCTURE For many low- and moderate-income people, the The structure of down payment assistance programs most significant barrier to homeownership is the down varies by state with some programs offering fully payment and closing costs associated with getting a amortizing, repayable second mortgages, while other mortgage loan. For that reason, most HFAs offer some programs offer deferred payment and/or forgivable form of down payment and closing cost assistance second mortgages, and still other programs offer grant (DPA) to eligible low- and moderate-income home- funds with no repayment requirement. buyers in their states. The vast majority of HFA down payment assistance programs must be used in combi DPA SECOND MORTGAGES (AMORTIZING) nation with a first-lien mortgage product offered by the A second mortgage loan is subordinate to the first HFA. A few states offer stand-alone down payment and mortgage and is used to cover down payment and closing cost assistance that borrowers can combine closing costs. It is repayable over a given term. The with any non-HFA eligible mortgage product. Some interest rates and terms of the loans vary by state. DPA programs are targeted toward specific popula In some programs, the interest rate on the second tions, such as first-time homebuyers, active military mortgage matches that of the first mortgage. Other personnel and veterans, or teachers. Others offer programs offer more deeply subsidized rates on their assistance for any homebuyer who meets the income second mortgage down payment assistance. Some and purchase price limitations of their programs. -

Commercial Mortgage Loans

STRATEGY INSIGHTS MAY 2014 Commercial Mortgage Loans: A Mature Asset Offering Yield Potential and IG Credit Quality by Jack Maher, Managing Director, Head of Private Real Estate Mark Hopkins, CFA, Vice President, Senior Research Analyst Commercial mortgage loans (CMLs) have emerged as a desirable option within a well-diversified fixed income portfolio for their ability to provide incremental yield while maintaining the portfolio’s credit quality. CMLs are privately negotiated debt instruments and do not carry risk ratings commonly associated with public bonds. However, our paper attempts to document that CMLs generally available to institutional investors have a credit profile similar to that of an A-rated corporate bond, while also historically providing an additional 100 bps in yield over A-rated industrials. CMLs differ from public securities such as corporate bonds in the types of protections they offer investors, most notably the mortgage itself, a benefit that affords lenders significant leverage in the relationship with borrowers. The mortgage is backed by a hard, tangible asset – a property – that helps lenders see very clearly the collateral behind their investment. The mortgage, along with other protections, has helped generate historical recovery from defaulted CMLs that is significantly higher than recovery from defaulted corporate bonds. The private CML market also provides greater flexibility for lenders and borrowers to structure mortgages that meet specific needs such as maturity, loan amount, interest terms and amortization. Real estate as an asset class has become more popular among institutional investors such as pension funds, insurance companies, open-end funds and foreign investors. These investors, along with public real estate investment trusts (REITs), generally invest in higher quality properties with lower leverage. -

Second Annual Women in Macro Conference May 31 – June 1, 2019 Gleacher Center 450 Cityfront Plaza Drive, Chicago, IL, 60611

Second Annual Women in Macro Conference May 31 – June 1, 2019 Gleacher Center 450 Cityfront Plaza Drive, Chicago, IL, 60611 Conference Organizers: Marina Azzimonti, Stony Brook University Alessandra Fogli, Federal Reserve Bank of Minneapolis Veronica Guerrieri, University of Chicago Friday, May 31st – Room 404 10:00 – 11:00 Laura Veldkamp, Professor of Finance, Columbia University “Might Uncertainty Promote International Trade?” joint with Isaac Baley and Michael Waugh Discussant: Claudia Steinwender, Assistant Professor of Applied Economics, Massachusetts Institute of Technology 11:00 – 12:00 Hélène Rey, Professor of Economics, London Business School; Member of the Commission Economique de la Nation (France) “Answering the Queen: Online Machine Learning and Financial Crises” joint with Misaki Matsumura Discussant: Şebnem Kalemli-Özcan, Professor of Economics and Finance, University of Maryland 12:00 – 1:30 Lunch – Room 450 1:30 – 3:15 Policy Panel on “The Global Economy: Challenges and Solutions” Participants: Janice Eberly, Professor of Finance, Northwestern University; former Chief Economist of the United States Department of Treasury Silvana Tenreyro, Professor of Economics, London School of Economics; Monetary Policy Committee Member, Central Bank of England Hélène Rey, Professor of Economics, London Business School; Member of the Commission Economique de la Nation, France Moderator: Şebnem Kalemli-Özcan, Professor of Economics and Finance, University of Maryland 3:15 – 3:30 Break 3:30 – 4:30 Monika Piazzesi, Professor of Economics, -

Divest Invest February 2018 (Compressed)

Divest from the past, invest in the future. www.divestinvest.org Disclaimer: Divest Invest assumes no legal or financial responsibility for the practices, products, or services of any businesses listed. The funds listed are examples, not recommendations. Please read all materials carefully prior to investing. This presentation will cover: • What the Paris Agreement means for investors 3 • What is Divest Invest 7 • Divest Invest is the prudent financial choice 12 • Divest Invest fulfills fiduciary duty 21 • Fossil free investing: from niche to mainstream 27 • Divest Invest options for every asset class 31 2 What the Paris Agreement means for investors WHAT THE PARIS AGREEMENT MEANS FOR INVESTORS Under the Paris Agreement, world governments commit to keep global temperature rise to well below 2°C and to pursue efforts to limit it to 1.5°C. To achieve this, up to 80% of fossil fuel reserves can’t be burned. They are stranded assets whose economic value won’t be realized. Investors are sitting on a carbon bubble. Climate risks, including stranded assets, pose a material threat to investor portfolios now, say a growing chorus of financial regulators, asset managers, analysts, policymakers and … oil companies: 4 WHAT THE PARIS AGREEMENT MEANS FOR INVESTORS The Paris Agreement Mark Carney Warns Investors Face signals to markets that ‘Huge’ Climate Change Losses (9/29/15) the global clean energy transition is underway and accelerating. Shell CEO Ben Van Beurden Has Seen Prudent investors are The Future—And It’s Several Shades heeding the call. -

USDA Single Family Housing Guaranteed Loan Program

USDA Single Family Housing Guaranteed Loan Program No down payment loans for rural borrowers with incomes below 115 percent of area median income as defined by USDA BACKGROUND AND PURPOSE BORROWER CRITERIA The U.S. Department of Agriculture’s (USDA) Income limits: This program is limited to borrowers Single Family Housing Guaranteed Loan Program with incomes up to 115 percent of AMI (as defined by (Guaranteed Loan Program) is designed to serve eli- USDA). Approximately 30 percent of Guaranteed Loans gible rural residents with incomes below 115 percent are made to families with incomes below 80 percent of of area median income or AMI (see USDA definition in AMI. An applicant must have dependable income that overview) who are unable to obtain adequate hous- is adequate to support the mortgage. ing through conventional financing. Guaranteed Loans Credit: Borrowers must have reasonable credit his- are originated, underwritten, and closed by a USDA tories and an income that is dependable enough to approved private sector or commercial lender. The support the loans but be unable to obtain reasonable Rural Housing Service (RHS) guarantees the loan at credit from another source. 100 percent of the loss for the first 35 percent of the original loan and 85 percent of the loss on the remain- First-time homebuyers: If funding levels are limited ing 65 percent. The program is entirely supported by near the end of a fiscal year, applications are prioritized the upfront and annual guarantee fees collected at the to accommodate first-time homebuyers. time of loan origination. Occupancy and ownership of other properties: The dwelling purchased with a Guaranteed Loan must be PROGRAM NAME Single Family Housing Guaranteed Loan Program AGENCY U.S. -

How to Find the Best Credit Card for You

How to find the best credit card for you Why should you shop around? Comparing offers before applying for a credit card helps you find the right card for your needs, and helps make sure you’re not paying higher fees or interest rates than you have to. Consider two credit cards: One carries an 18 percent interest rate, the other 15 percent. If you owed $3,000 on each and could only afford to pay $100 per month, it would cost more and take longer 1. Decide how you plan to pay off the higher-rate card. to use the card The table below shows examples of what it might You may plan to pay off your take to pay off a $3,000 credit card balance, paying balance every month to avoid $100 per month, at two different interest rates. interest charges. But the reality is, many credit card holders don’t. If you already have a credit card, let APR Interest Months history be your guide. If you have carried balances in the past, or think 18% = $1,015 41 you are likely to do so, consider 15% = $783 38 credit cards that have the lowest interest rates. These cards typically do not offer rewards and do not The higher-rate card would cost you an extra charge an annual fee. $232. If you pay only the minimum payment every month, it would cost you even more. If you have consistently paid off your balance every month, then you So, not shopping around could be more expensive may want to focus more on fees and than you think. -

Your Step-By-Step Mortgage Guide

Your Step-by-Step Mortgage Guide From Application to Closing Table of Contents In this Guide, you will learn about one of the most important steps in the homebuying process — obtaining a mortgage. The materials in this Guide will take you from application to closing and they’ll even address the first months of homeownership to show you the kinds of things you need to do to keep your home. Knowing what to expect will give you the confidence you need to make the best decisions about your home purchase. 1. Overview of the Mortgage Process ...................................................................Page 1 2. Understanding the People and Their Services ...................................................Page 3 3. What You Should Know About Your Mortgage Loan Application .......................Page 5 4. Understanding Your Costs Through Estimates, Disclosures and More ...............Page 8 5. What You Should Know About Your Closing .....................................................Page 11 6. Owning and Keeping Your Home ......................................................................Page 13 7. Glossary of Mortgage Terms .............................................................................Page 15 Your Step-by-Step Mortgage Guide your financial readiness. Or you can contact a Freddie Mac 1. Overview of the Borrower Help Center or Network which are trusted non- profit intermediaries with HUD-certified counselors on staff Mortgage Process that offer prepurchase homebuyer education as well as financial literacy using tools such as the Freddie Mac CreditSmart® curriculum to help achieve successful and Taking the Right Steps sustainable homeownership. Visit http://myhome.fred- diemac.com/resources/borrowerhelpcenters.html for a to Buy Your New Home directory and more information on their services. Next, Buying a home is an exciting experience, but it can be talk to a loan officer to review your income and expenses, one of the most challenging if you don’t understand which can be used to determine the type and amount of the mortgage process. -

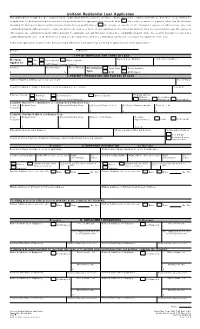

Sample Mortgage Application (PDF)

Uniform Residential Loan Application This application is designed to be completed by the applicant(s) with the Lender's assistance. Applicants should complete this form as "Borrower" or "Co-Borrower," as applicable. Co-Borrower information must also be provided (and the appropriate box checked) when the income or assets of a person other than the Borrower (including the Borrower's spouse) will be used as a basis for loan qualification or the income or assets of the Borrower's spouse or other person who has community property rights pursuant to state law will not be used as a basis for loan qualification, but his or her liabilities must be considered because the spouse or other person has community property rights pursuant to applicable law and Borrower resides in a community property state, the security property is located in a community property state, or the Borrower is relying on other property located in a community property state as a basis for repayment of the loan. If this is an application for joint credit, Borrower and Co-Borrower each agree that we intend to apply for joint credit (sign below): Borrower Co-Borrower I. TYPE OF MORTGAGE AND TERMS OF LOAN Agency Case Number Lender Case Number Mortgage VA Conventional Other (explain): Applied for: FHA USDA/Rural Housing Service Amount Interest Rate No. of Months Amortization Fixed Rate Other (explain): $%Type: GPM ARM (type): II. PROPERTY INFORMATION AND PURPOSE OF LOAN Subject Property Address (street, city, state & ZIP) No. of Units Legal Description of Subject Property (attach description if necessary) Year Built Purpose of Loan Purchase Construction Other (explain): Property will be: Primary Secondary Refinance Construction-Permanent Residence Residence Investment Complete this line if construction or construction-permanent loan. -

Single Family Home Loan Guarantees

Together, America Prospers Single Family Home Loan Guarantees What does this Who may apply for this program? What are applicant qualifications? Applicants must: • Income. Non-Self-Employed: program do? One-year history required. • Have a household income that does not exceed 115% of median Self-Employed and Seasonal: This no downpayment, household income.* Two-year history required. 100% financing program assists • Agree to occupy the dwelling as • Assets. No downpayment or approved lenders in providing their primary residence. reserves required. low- and moderate-income • Be a U.S. citizen, U.S. non-citizen • Credit. Must demonstrate a households the opportunity to national, or Qualified Alien. willingness and ability to repay debts. No set score requirement. • Be unable to obtain conventional own adequate, modest, decent, Alternative credit allowable for those financing with no private mortgage safe and sanitary dwellings as with no traditional credit. insurance (PMI). their primary residence in eligible • Monthly housing payment. Total • Not be suspended or debarred from payment (principal, interest, taxes, rural areas. participation in federal programs. insurance, HOA dues, RD annual fee) typically should not exceed Eligible applicants may purchase What properties are eligible? 29% of gross monthly income. existing homes (which may • Must be located within an eligible • All monthly debt payments. All rural area.* include costs to rehabilitate, payments included on credit report, • Must be a single-family dwelling including proposed new mortgage improve or relocate the dwelling) (may include detached, attached, payment, typically should not exceed or build new. PUD, condo, modular, and 41% of gross monthly income. manufactured). Student loan payments. Fixed USDA provides a loan note • Must meet HUD 4000.1 payment: use actual payment or 1% of loan balance. -

FICO Mortgage Credit Risk Managers Handbook

FICO Mortgage Credit Risk Manager’s Best Practices Handbook Craig Focardi Senior Research Director Consumer Lending, TowerGroup September 2009 Executive Summary The mortgage credit and liquidity crisis has triggered a downward spiral of job losses, declining home prices, and rising mortgage delinquencies and foreclosures. The residential mortgage lending industry faces intense pressures. Mortgage servicers must better manage the rising tide of defaults and return financial institutions to profitability while responding quickly to increased internal, regulatory, and investor reporting requirements. These circumstances have moved management of mortgage credit risk from backstage to center stage. The risk management function cuts across the loan origination, collections, and portfolio risk management departments and is now a focus in mortgage servicers’ strategic planning, financial management, and lending operations. The imperative for strategic focus on credit risk management as well as information technology (IT) resource allocation to this function may seem obvious today. However, as recently as June 2007, mortgage lenders continued to originate subprime and other risky mortgages while investing little in new mortgage collections and infrastructure, technology, and training for mortgage portfolio management. Moreover, survey results presented in this Handbook reveal that although many mortgage servicers have increased mortgage collections and loss mitigation staffing, few servicers have invested sufficiently in data management, predictive analytics, scoring and reporting technology to identify the borrowers most at risk, implement appropriate treatments for different customer segments, and reduce mortgage re-defaults and foreclosures. The content of this Handbook is based on a survey that FICO, a leader in decision management, analytics, and scoring, commissioned from TowerGroup, a leading research and advisory firm focusing on the strategic application of technology in financial services. -

Money Talks, Banks Are Talking: Dakota Access Pipeline Finance Aftermath

UCLA The Indigenous Peoples’ Journal of Law, Culture & Resistance Title Money Talks, Banks are Talking: Dakota Access Pipeline Finance Aftermath Permalink https://escholarship.org/uc/item/1043285c Journal The Indigenous Peoples’ Journal of Law, Culture & Resistance, 6(1) ISSN 2575-4270 Authors Cook, Michelle MacMillan, Hugh Publication Date 2020 DOI 10.5070/P661051237 eScholarship.org Powered by the California Digital Library University of California MONEY TALKS, BANKS ARE TALKING: Dakota Access Pipeline Finance Aftermath Michelle Cook* and Hugh MacMillan+ Abstract This Article provides a Dakota Access Pipeline (DAPL) finance and divestment campaign retrospective. The Article explains: 1) how DAPL was financed, highlighting the dynamic in which banks take fees for the privilege of financing and refinancing pipeline debt; and 2) how joint venture ownership structures and corporate finance arrangements buffered against efforts to hold DAPL banks accountable. At the same time, many of the same banks finance gun industry and prison industry growth, alongside increased police militarization. Although, intersec- tional visibility of these financial ties is a start, victims of the financial industry lack enforceable corporate accountability mechanisms for seek- ing redress. DAPL banks managed to deflect divestment pressure and avoid meaningful remedial actions. These observations point to the need for systemic changes in corporate accountability mechanisms but also to reclaim and reimagine a world outside of capital, of future self-de- termined -

1 I. Introduction Interest Rates, Financial Leverage, and Asset Values Are

I. Introduction Interest rates, financial leverage, and asset values are among the most important variables in the economy. Many economists, policy makers, and investors believe that these variables may affect each other; therefore, manipulation of some variables may cause desired changes in the others. While interest rates are traditionally the variable that the Federal Reserve monitors and tries to influence, research on the recent financial crisis highlights the importance of financial leverage in the economy (see, e.g. Geanakoplos (2009), Acharya and Viswanathan (2011), among others). Recognizing this, Federal Reserve researchers are investigating whether changing requirements for mortgages’ loan-to-value ratios based on the economic environment could improve financial stability.1 The effectiveness of such policies would depend on how the loan to value ratios and property values exactly interact with each other, as well as whether and how they are endogenously determined. For example, if the two variables are only endogenously correlated and do not affect each other, policies that tries to manipulate the loan to value ratios to affect property values would have little effect. A natural starting point to understand the interactions between the loan to value ratios and property values is to understand their long-run equilibrium relationship. However, the existing literature is virtually silent on this very important issue. 1 See the speech by Ben S. Bernanke at the Annual Meeting of the American Economic Association at Philadelphia: http://www.federalreserve.gov/newsevents/speech/bernanke20140103a.htm. 1 This paper develops a very simple theoretical model in which commercial real estate mortgage interest rates, leverage, and property values are jointly determined.