LTP Rates Information

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

T:Tm<NEW ZEALAND GAZETTE

T:tm<NEW ZEALAND GAZETTE Reg.No; I operator. Postal Addresss. CANTl!!BBUBY CONSlIIBVANOy-cooonuea 11 Pearson, G. IV., and Sons P.O. Box'14, Rangiora Southbrook. 104 Peninsular Sawmilling Co. Duvauchelle Bay. Banks Peninsula Duvauchelle Bay. 64 Petrie, R. Waiknku Waikuku. 21 Pinus Lumber Sawmilling Co., Ltd. 325 Blenheim Road, Christchurch Christchurch. 106 Plunkett, E. R. 29 ARens Road, Ashburton Ashburton. 66 Pullar Bros. 23 Smith Street, Waimate .. Waimate. 100 Reid, R. J. Cooper's Creek, Oxford Cooper's Creek. 84 Rose, De Lore, and Egerton , 95 Matipo Street, Riocarton Burnham. 16 Roud, G. J., and Son, Ltd. 242 Ferry Road, Christchurch Christchurch. 22 Scott, A. W ... Tancred Street, Rakaia Rakaia. 60 Scott, E. E. .. Geraldine Mayfield. 56 Selwyn Casewoods, Ltd. P.O. Box 1070, Christchurch Papanui. 14 Selwyn Sawmills, Ltd. 86 Manchester Street, Cliristchurch Hororata. 105 Simpson, R. G. 53. Creek Road, Ashburton ... Tinwald. 61 Smith, V. L ... Torqnay Street, Kaikoura Kaikoura. 92 Stonyhurst Sawmilling Co. Private Bag, Cheviot St?nyhurS~. 96 Sutherland and Co., Ltd. Mina. ,Mina. 77 Valetta Timber Co. Valetta R.D., Ashburton Valetta. 63 Waimate Timber Co •.. Queen Street, Waimate Waimate. 55 Wakelin, T., and Sons .. 78 Allen's Road, Ashburton Ashburton. 68 Webster Sawmills Tinwald, Ashburton Hinds. 89 West and Evers, Ltd... Leeliton .. Leeston. 95. Whiting, A. O. 68 Oxford :;!treet, Ashburton Ashburton. 34 Woodbury SawmillingCo. P.O; Box 53, Geraldine Woodbury. SOUTBL~D CONSERVANOY 166 Ashley Cooper, Ltd. P ..O. Box 227, Dunedin C. 1. Green Island. 157 Aubrey, D. C. Cattle Fla.t, Wanaka Cattle Flat. 68 Barrow Box Co. P.O ..Box 27, Invercargill Tapanui. -

Travel Report 2016-01-8-13 Tuatapere

8.1.2016 Tuatapere, Blue Cliffs Beach As we depart Lake Hauroko a big herd of sheep comes across our way. Due to our presence the sheep want to turn around immediately, but are forced to walk past us. The bravest sheep walks courageously in the front towards our car... Upon arriving in Tuatapere, the weather has changed completely. It is very windy and raining, so we decide to stop at the Cafe of the Last Light Lodge, which was very cozy and played funky music. Afterwards we head down to the rivermouth of the Waiau and despite the stormy weather Werner goes fishing. While we are parked there, three German tourists get stuck with their car next to us, the pebbles right next to the track are unexpectedly soft. Werner helps to push them out and we continue our way to the Blue Cliffs Beach – the sign has made us curious. We find a sheltered spot near the rivermouth so Werner can continue fishing. He comes back with an eel! Now we have to research eel recipes. 1 9.1.2016 Colac Bay, Riverton The very strong wind has blown away all the grey clouds and is pounding the waves against the beach. The rolling stones make such a noise, it’s hard to hear you own voice. Nature at work… Again we pass by the beautiful Red Hot Poker and finally have a chance to take a photo. We continue South on the 99, coming through Orepuki and Monkey Island. When the first settlers landed here a monkey supposedly helped to pull the boats ashore, hence the name Monkey Island. -

Primary Health Care in Rural Southland

"Putting The Bricks In place"; primary Health Care Services in Rural Southland Executive Summary To determine what the challenges are to rural primary health care, and nlake reconlmendations to enhance sustainable service provision. My objective is to qualify the future needs of Community Health Trusts. They must nleet the Ministry of Health directives regarding Primary Healthcare. These are as stated in the back to back contracts between PHOs and inclividual medical practices. I have compiled; from a representative group of rural patients, doctors and other professionals, facts, experiences, opinions and wish lists regarding primary medical services and its impact upon them, now and into the future. The information was collected by survey and interview and these are summarised within the report. During the completion of the report, I have attempted to illustrate the nature of historical delivery of primary healthcare in rural Southland. The present position and the barriers that are imposed on service provision and sustainability I have also highlighted some of the issues regarding expectations of medical service providers and their clients, re funding and manning levels The Goal; "A well educated (re health matters) and healthy population serviced by effective providers". As stated by the Chris Farrelly of the Manaia PHO we must ask ourselves "Am I really concerned by inequalities and injustice? We find that in order to achieve the PHO goals (passed down to the local level) we must have; Additional health practitioners Sustainable funding And sound strategies for future actions through a collaborative model. EXECUTIVE SUMMARY PAGE 1 CONTACTS Mark Crawford Westridge 118 Aparima Road RD 1 Otautau 9653 Phone/ fax 032258755 e-mail [email protected] Acknowledgements In compiling the research for this project I would like to thank all the members of the conlmunity, health professionals and committee members who have generously given their time and shared their knowledge. -

Manapouri Tracks Brochure

Safety Adventure Kayak & Cruise Manapouri Tracks Plan carefully for your trip. Make sure Row boat hire for crossing the Waiau your group has a capable and experienced River to the Manapouri tracks. leader who knows bushcraft and survival Double and single sea kayaks for rental Fiordland National Park skills. on Lake Manapouri. Take adequate food and clothing on Guided kayak and cruise day and Lake Manapouri your trip and allow for weather changes overnight tours to Doubtful Sound. All and possible delays. safety and paddling equipment supplied. Adventure Kayak & Cruise, Let someone know where you are Waiau St., Manapouri. going and when you expect to return. Sign Ph (03) 249 6626, Fax (03) 249 6923 an intention form at the Fiordland National Web: www.fiordlandadventure.co.nz Park Visitor Centre and use the hut books. Take care with river crossings, espe- cially after rain. If in doubt, sit it out. Know the symptoms of exposure. React quickly by finding shelter and providing warmth. Keep to the tracks. If you become lost - stop, find shelter, stay calm and wait for searchers to find you. Don't leave the area unless you are absolutely sure where you are heading. Hut Tickets Everyone staying in Department of Conservation huts must pay hut fees. With the exception of the Moturau and Back Valley huts, all huts on these tracks are standard grade, requiring one back country hut ticket per person per night. The Moturau hut on the Kepler Track requires a For further information contact: booking during the summer season, or two Fiordland National Park Visitor Centre back country hut tickets per person per Department of Conservation night in the winter. -

FJ-Intro-Product-Boo

OUR TEAM YOUR GUIDE TO FUN Chris & Sue Co-owners Kia or a WELCOME TO FIORDLAND JET Assistant: Nala 100% Locally Owned & Operated Jerry & Kelli Co-owners At Fiordland Jet, it’s all about fun! Hop on board our unique range of experiences and journey into the heart of Fiordland National Park – a World Heritage area. Our tours operate on Lake Te Anau and the crystal-clear, trout filled waters of the Upper Waiau river, which features 3 Lord of the Rings film locations. Travel deeper into one of the world’s last untouched wildernesses to the isolated and stunning Lake Manapouri, surrounded by rugged mountains and ancient beech forest. Escape the crowds and immerse yourself into the laid-back Kiwi culture. Located on Te Anau’s lake front, Fiordland Jet is the ideal place to begin your Fiordland adventure. We have a phone charging station, WIFI, free parking and a passionate team standing by to welcome you and help plan your journey throughout Fiordland. As a local, family owned company and the only scenic jet boat operator on these waterways, we offer our customers an extremely personal and unique experience. We focus on being safe, sharing an unforgettable experience, and of course having FUN! Freephone 0800 2JETBOAT or 0800 253 826 • [email protected] • www.fjet.nz Our team (from left): Lex, Laura, Abby, Rebecca, Nathan & Sim PURE WILDERNESS Pure wilderness JOURNEY TO THE HEART OF FIORDLAND Jet boat down the Waiau River, across Lake Manapouri, to the ancient forest of the Fiordland National Park. Enjoy the thrill of jet boating down the majestic trout-filled Waiau River, to the serene Lake Manapouri. -

No 69, 13 October 1949, 2427

1ltunb. 69 2'631 NEW ZEALAND THE NEW ZEALAND GAZETTE WELLINGTON, THURSDAY, NOVEMBER 10, 1949 Deelaring Certain Craw'll Land to be Subject to Part I of the Maori Allocating Land Taken for a Railway to the PurpoBu 01" Road 4t . La.nd Anumdment Act, 1936 Lilae River [L.S.} B. C. FREYBERG, Governor-General A PROCLAMATION [L.S.] B. C. FREYBERG, Governor-General URSUANT to sectiQIl five of the Maori Purposes Act, 1939, I, A PROCLAMATION P Lieutenant-Gene .... l Sir Bernard Cyril Freyberg, the Governor HEREAS the mnd described in the Schedule hereto :forms General of the Dominion of New Zealand, do hereby declare the W part of land taken for the purposes of the Htmm'Oi Crown land described in the Schedule hereto to be subject to Part I WaitaJd Railway (Little River Branch), and it is considered desirable of the Maori Land Amendment Act, 1936. to allocare such land to the purposes of a road ~ Now, therefore, I, Lieutenant-Geneml Sir Bematd Cyril SCHEDULE Freyberg, the Governor-General of the Dominion of New Zealand, in pursuance and exercise of the powers and authorities vested in AUCKLAND LAND DISTRICT me by section two hundred and twenty-six of the Public Works Act, ALL those areas in the County of Whakatane situated in Blook IV, 1928, and of every other power and authority in anywise _bling Waimana Snrvey District, containing by admeasnrement a tota! of me in this behalf, do hereby proclaim and declare that the l&1ld 1 rood and 18·6 perches, more or less, being portions of road closed described in the Schedule hereto shall, upon the publication hereof adjoining Section 21, Waimana Settlement, by Proclamation in the New Zealand Gazette, become a road, and that the said rOMl published in New Zealand Gazette No. -

Te Anau Area Community Response Plan 2019

Southland has NO Civil Defence sirens (fire brigade sirens are not used to warn of Civil Defence emergency) Please take note of natural warning signs as your first and best warning for any emergency. Te Anau Area Community Response Plan 2019 Find more information on how you can be prepared for an emergency www.cdsouthland.nz In the event of an emergency, communities may need to support themselves for up to 10 days before assistance arrives. Community Response Planning The more prepared a community is the more likely it is that the community will be able to look after themselves and others. This plan contains a short demographic description of information for the Te Anau area, including key hazards and risks, information about Community Emergency Hubs where the community can gather, and important contact information to help the community respond effectively. Members of the Te Anau and Manapouri Community Response Groups have developed the information contained in this plan and will be Emergency Management Southlands first points of community contact in an emergency. The Te Anau/Manapouri Response Group Procedure and Milford Sound Emergency Response Plan include details for specific response planning for the Te Anau and wider Fiordland areas. Demographic details • Te Anau and Manapouri are contained within the Southland District Council area. • Te Anau has a resident population of approx. 2,000 people. • Manapouri has a resident population of approx. 300 people • Te Anau Airport, Manapouri is located 15 km south of Te Anau and 5 km north of Manapouri, on State Highway 95 • The basin community has people from various service industries, tourism-related businesses, Department of Conservation, fishing, transport, food, catering, and farming. -

Whatever Happened to Tuatapere? a Study on a Small Rural Community Pam Smith

Whatever happened to Tuatapere? A study on a small rural community Pam Smith Pam Smith has worked in the social work field for the past 25 years. She has worked with children and families within the community both in statutory and non-government organisations. She has held social worker and supervisor roles and is currently a supervisory Team Leader at Family Works Southland. This article was based on Pam’s thesis for her Master of Philosophy in Social Work at Massey University. Abstract Social workers working in the rural community do so within a rural culture. This culture has developed from historical and cultural influences from the generations before, from the impact of social and familial changes over the years and from current internal and external influences. These changes and influences make the rural people who they are today. This study was carried out on a small rural community in Western Southland. The purpose was to examine the impact on the community of social changes over the past 50 years. Eight long-term residents were interviewed. The results will be discussed within this article. Introduction Government policies, changes in international trade and markets, environmental policies, globalisation, change in the structure of local and regional government and legislative changes, impacted on all New Zealanders during the past 50 years. The rural hinterland of New Zealand was affected in particular ways. The population in rural communities has been slowly decreasing over the years as ur- banisation has been a reality in New Zealand. Services within the area have diminished and younger families have moved away to seek employment elsewhere. -

Tuatapere Amenities Trust Fund Sponsored

Western Wanderer COLAC BAY OREPUKI TUATAPERE CLIFDEN ORAWIA BLACKMOUNT MONOWAI Tuatapere Amenities Trust Fund Sponsored Printed by Waiau Area School (03) 226-6285 ISSUE NUMBER: 178 Editor: Ph 027 462 9527 e-Mail: [email protected] APRIL2015 Closing Date for next copy: Friday, 8TH MAY2015 I hope everyone had a great Easter Inside this issue: and break away, just like to thank Councillor Community Board Notice everyone again for all their patience 2 and support while I get my head Community Notice Board 3/4 Midwife-Isobel / Comm Worker/ around the wanderer. wildthings/Toy Library sewing & mending/WD Joinery 5 Cheers. Loretta. Ross Burgess/Accounting/ Drake plumbling Waiau Town & Country Club Citizens Advice/Shirley Whyte 6 TJS tractor servicing/ 7 H&L Gill Fencing/Ann Sutherland / 25th April Anzac Day library Fowle/Tuatapere Handyman 8/9 Local Anzac Day services will be at Orawia at 7 00 Otautau Vets Ltd Electrician/Promotions/Forde 10/11 am followed by a cup of tea and a small bite to eat Shearing/Sutherland Contracting/ Waihape Photography/Tui Ameni- at the Orawia community hall which will then be ties Trust/ The Beauty Room followed by the Tuatapere service at 10 am which Crack 12 Dagwood Dagging/ Canterbury 13/14 will also be followed by a cup of tea and a bite to Cars/ Clifton Trading and Repairs Colac Bay Tavern eat at the RSA hall where we will have a guest Last light/ Target shooting/ 15/16 harvest festival/Playcentre/ 17/18 speaker present, please come along and pay your Highway 99/ growplan/D Unahi respects to our fallen soldiers and past and present Ryal Bush/ISBT Therapy/ 19/20 Budget Advice/ Waiau health 21/22 service members. -

Regional Services Committee (Ropu Tiaki Waka-A-Rohe)

Committee Members Cr Jeremy McPhail (Chair) Cr Peter McDonald Cr Lloyd Esler Cr Eric Roy Cr Lyndal Ludlow Cr David Stevens Cr Lloyd McCallum Chairman Nicol Horrell (ex officio) Regional Services Committee (Ropu Tiaki Waka-a-Rohe) Environment Southland Council Chambers and via Zoom digital link 1.00 pm 03 September 2020 A G E N D A (Rarangi Take) 1. Welcome (Haere mai) 2. Apologies (Nga pa pouri) 3. Declarations of Interest 4. Public Forum, Petitions and Deputations (He Huinga tuku korero) 5. Confirmation of Minutes (Whakau korero) – 11 June 2020 6. Notification of Extraordinary and Urgent Business (He Panui Autaia hei Totoia Pakihi) 6.1 Supplementary Reports 6.2 Other 7. Questions (Patai) 8. Chairman and Councillors’ Reports (Nga Purongo-a-Tumuaki me nga Kaunihera) 9. Acting General Manager, Operations Report – 20/RS/71 Item 1 – Annual Report of the Land and Water Services Division ..................................12 Item 2 – Biosecurity & Biodiversity Operations Annual Report ......................................32 Item 3 – 2019/20 Rating District Works Programme – Annual Report ...........................60 Item 4 – Catchment Management Work Programmes ...................................................97 Item 5 – Contracts and Progress on Works .....................................................................98 Item 6 – Lease Inspection Reports – March and June 2020 Quarters ............................105 1 Regional Services Committee – 03 September 2020 10. Department of Conservation Verbal Update 11. Extraordinary and -

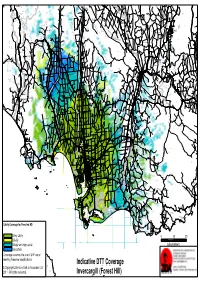

Indicative DTT Coverage Invercargill (Forest Hill)

Blackmount Caroline Balfour Waipounamu Kingston Crossing Greenvale Avondale Wendon Caroline Valley Glenure Kelso Riversdale Crossans Corner Dipton Waikaka Chatton North Beaumont Pyramid Tapanui Merino Downs Kaweku Koni Glenkenich Fleming Otama Mt Linton Rongahere Ohai Chatton East Birchwood Opio Chatton Maitland Waikoikoi Motumote Tua Mandeville Nightcaps Benmore Pomahaka Otahu Otamita Knapdale Rankleburn Eastern Bush Pukemutu Waikaka Valley Wharetoa Wairio Kauana Wreys Bush Dunearn Lill Burn Valley Feldwick Croydon Conical Hill Howe Benio Otapiri Gorge Woodlaw Centre Bush Otapiri Whiterigg South Hillend McNab Clifden Limehills Lora Gorge Croydon Bush Popotunoa Scotts Gap Gordon Otikerama Heenans Corner Pukerau Orawia Aparima Waipahi Upper Charlton Gore Merrivale Arthurton Heddon Bush South Gore Lady Barkly Alton Valley Pukemaori Bayswater Gore Saleyards Taumata Waikouro Waimumu Wairuna Raymonds Gap Hokonui Ashley Charlton Oreti Plains Kaiwera Gladfield Pikopiko Winton Browns Drummond Happy Valley Five Roads Otautau Ferndale Tuatapere Gap Road Waitane Clinton Te Tipua Otaraia Kuriwao Waiwera Papatotara Forest Hill Springhills Mataura Ringway Thomsons Crossing Glencoe Hedgehope Pebbly Hills Te Tua Lochiel Isla Bank Waikana Northope Forest Hill Te Waewae Fairfax Pourakino Valley Tuturau Otahuti Gropers Bush Tussock Creek Waiarikiki Wilsons Crossing Brydone Spar Bush Ermedale Ryal Bush Ota Creek Waihoaka Hazletts Taramoa Mabel Bush Flints Bush Grove Bush Mimihau Thornbury Oporo Branxholme Edendale Dacre Oware Orepuki Waimatuku Gummies Bush -

The New Zealand Gazette. 873

APRIL l.] THE NEW ZEALAND GAZETTE. 873 POSTAL DISTRICT OF INVERCARGILL-contvnued. lli ______ s_•_rvl_oe.______ -c'l_1_1_· -i'----l'r-•q_n_•_nc_y_.___ .!.___Cml_~_0:_;_~_•_•·_.1.I _N_ame__ o_!_Co_ntra_otor __ • -'----f_u~_1_r_. ---,'-~-:_L_ua_=_IRI £ s. d. 41 Invercargill and Putangahau (r u r a 1 131 Daily Motor-car Southland N e w s 35 0 0 delivery) Co., Ltd. 42 Invercargill and Toa 15 Daily Omnibus Southland News, 5 0 0 Co., Ltd. 43 Invercargill, Tokanui, Niagara, and 140 Daily Omnibus Messrs. H. &H. 130 0 0 31/12/40 Waikawa (part rural delivery) Motors, Ltd. 44 Invercargill, Otatara, Makarewa, and 43 Daily Motor-car Southland Times 161 0 0 31/12/40 West Plains (part rural delivery) Co., Ltd. 45 Invercargill Railway-station and Chief i As required Motor-truck W. A. Bamford .. 175 0 0 31/12/40 Post-office 46 Invercargill, Kingston, and Queenstown 119 Daily Motor-car N.Z. Railways 500 0 0 Road Services 47* KapukaRailway-stationandPost-office 440 yd Daily Foot Miss L. H. Robin- son 48* Lochiel Railway-station and Post-office ! Twice daily Foot A. D. McKerchar 49 Longwood and Poukino • 24 Daily Sawmill loco- T.More 9 10 0 motive 50* Lower Shotover, Main Road, and 88 yd Daily Foot Mrs. M. Smith Post-office 51 LumsdenandCastlerock(ruraldelivery) 21 Five times weekly Omnibus or J.B. Monk 76 0 0 31/12/40 motor-car 52 Lumsden and Mossburn 24 Four times weekly (ser Motor-car .. N.Z. Railways 30 0 0 vice to rural boxes Road Services thrice weekly) 53 Lumsden and Te Anau- Lumsden, The Key, Manapouri, Te 236 Twice weekly (Hollyford Motor-car N.Z.