Technical Analysis from a to Z

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Free Stock Screener Page 1

Free Stock Screener www.dojispace.com Page 1 Disclaimer The information provided is not to be considered as a recommendation to buy certain stocks and is provided solely as an information resource to help traders make their own decisions. Past performance is no guarantee of future success. It is important to note that no system or methodology has ever been developed that can guarantee profits or ensure freedom from losses. No representation or implication is being made that using The Shocking Indicator will provide information that guarantees profits or ensures freedom from losses. Copyright © 2005-2012. All rights reserved. No part of this book may be reproduced or transmitted in any form or by any means, electronic or mechanical, without written prior permission from the author. Free Stock Screener www.dojispace.com Page 2 Bullish Engulfing Pattern is one of the strongest patterns that generates a buying signal in candlestick charting and is one of my favorites. The following figure shows how the Bullish Engulfing Pattern looks like. The following conditions must be met for a pattern to be a bullish engulfing. 1. The stock is in a downtrend (short term or long term) 2. The first candle is a red candle (down day) and the second candle must be white (up day) 3. The body of the second candle must completely engulfs the first candle. The following conditions strengthen the buy signal 1. The trading volume is higher than usual on the engulfing day 2. The engulfing candle engulfs multiple previous down days. 3. The stock gap up or trading higher the next day after the bullish engulfing pattern is formed. -

Tradescript.Pdf

Service Disclaimer This manual was written for use with the TradeScript™ language. This manual and the product described in it are copyrighted, with all rights reserved. This manual and the TradeScript™ outputs (charts, images, data, market quotes, and other features belonging to the product) may not be copied, except as otherwise provided in your license or as expressly permitted in writing by Modulus Financial Engineering, Inc. Export of this technology may be controlled by the United States Government. Diversion contrary to U.S. law prohibited. Copyright © 2006 by Modulus Financial Engineering, Inc. All rights reserved. Modulus Financial Engineering and TradeScript™ are registered trademarks of Modulus Financial Engineering, Inc. in the United States and other countries. All other trademarks and service marks are the property of their respective owners. Use of the TradeScript™ product and other services accompanying your license and its documentation are governed by the terms set forth in your license. Such use is at your sole risk. The service and its documentation (including this manual) are provided "AS IS" and without warranty of any kind and Modulus Financial Engineering, Inc. AND ITS LICENSORS (HEREINAFTER COLLECTIVELY REFERRED TO AS “MFE”) EXPRESSLY DISCLAIM ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO THE IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE AND AGAINST INFRINGEMENT. MFE DOES NOT WARRANT THAT THE FUNCTIONS CONTAINED IN THE SERVICE WILL MEET YOUR REQUIREMENTS, OR THAT THE OPERATION OF THE SERVICE WILL BE UNINTERRUPTED OR ERROR-FREE, OR THAT DEFECTS IN THE SERVICE OR ERRORS IN THE DATA WILL BE CORRECTED. FURTHERMORE, MFE DOES NOT WARRANT OR MAKE ANY REPRESENTATIONS REGARDING THE USE OR THE RESULTS OF THE USE OF THE SERVICE OR ITS DOCUMENTATION IN TERMS OF THEIR CORRECTNESS, ACCURACY, RELIABILITY, OR OTHERWISE. -

Intermediate Indicators Section Review Questions

Section 9 Intermediate Indicators Section Review Questions Question 1 Which of the following statements about Average Directional Index (ADX) is NOT true? a) The ADX measures trend strength without regard to trend direction b) +DI and –DI are used to define directional movement when interpreting ADX c) The DI crossover system can be used to identify potential buy and sell signals d) A strong trending market is present when the ADX is above 50 Question 2 Which of the following are commonly used potential buy and sell signals when interpreting Moving Average Convergence Divergence (MACD)? a) Signal Line Crossover b) Centerline Crossover c) Divergences d) All of the above Question 3 The Money Flow Index (MFI) is also known as: a) Volume-weighted ADX b) Volume-weighted RSI c) Price-weighted Stochastics d) Price-weighted MACD Question 4 The default look-back period for calculating the Relative Strength Index (RSI) is? a) 12 b) 20 c) 14 d) 10 Question 5 When looking at the following indicators, which one is in overbought territory based on the traditional settings for each indicator? a) Slow Stochastics b) Money Flow Index c) Relative Strength Index d) All of the above Question 6 Which of the following statements is NOT true concerning On Balance Volume (OBV)? a) OBV is based on the theory that volume precedes price b) OBV was developed by Joe Granville c) Divergences should NOT be used to anticipate trend reversals when analyzing OBV d) OBV can be used to confirm a price trend Question 7 Which of the following are considered Market Breadth Indicators? a) Advance-Decline Line b) McClellan Oscillator c) Arms Index d) All of the above Section 9 Intermediate Indicators Section Review Answers 1) d 2) d 3) b 4) c 5) a 6) c 7) d . -

Forecasting Direction of Exchange Rate Fluctuations with Two Dimensional Patterns and Currency Strength

FORECASTING DIRECTION OF EXCHANGE RATE FLUCTUATIONS WITH TWO DIMENSIONAL PATTERNS AND CURRENCY STRENGTH A THESIS SUBMITTED TO THE GRADUATE SCHOOL OF NATURAL AND APPLIED SCIENCES OF MIDDLE EAST TECHNICAL UNIVERSITY BY MUSTAFA ONUR ÖZORHAN IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF DOCTOR OF PILOSOPHY IN COMPUTER ENGINEERING MAY 2017 Approval of the thesis: FORECASTING DIRECTION OF EXCHANGE RATE FLUCTUATIONS WITH TWO DIMENSIONAL PATTERNS AND CURRENCY STRENGTH submitted by MUSTAFA ONUR ÖZORHAN in partial fulfillment of the requirements for the degree of Doctor of Philosophy in Computer Engineering Department, Middle East Technical University by, Prof. Dr. Gülbin Dural Ünver _______________ Dean, Graduate School of Natural and Applied Sciences Prof. Dr. Adnan Yazıcı _______________ Head of Department, Computer Engineering Prof. Dr. İsmail Hakkı Toroslu _______________ Supervisor, Computer Engineering Department, METU Examining Committee Members: Prof. Dr. Tolga Can _______________ Computer Engineering Department, METU Prof. Dr. İsmail Hakkı Toroslu _______________ Computer Engineering Department, METU Assoc. Prof. Dr. Cem İyigün _______________ Industrial Engineering Department, METU Assoc. Prof. Dr. Tansel Özyer _______________ Computer Engineering Department, TOBB University of Economics and Technology Assist. Prof. Dr. Murat Özbayoğlu _______________ Computer Engineering Department, TOBB University of Economics and Technology Date: ___24.05.2017___ I hereby declare that all information in this document has been obtained and presented in accordance with academic rules and ethical conduct. I also declare that, as required by these rules and conduct, I have fully cited and referenced all material and results that are not original to this work. Name, Last name: MUSTAFA ONUR ÖZORHAN Signature: iv ABSTRACT FORECASTING DIRECTION OF EXCHANGE RATE FLUCTUATIONS WITH TWO DIMENSIONAL PATTERNS AND CURRENCY STRENGTH Özorhan, Mustafa Onur Ph.D., Department of Computer Engineering Supervisor: Prof. -

Stairstops Using Magee’S Basing Points to Ratchet Stops in Trends

StairStops Using Magee’s Basing Points to Ratchet Stops in Trends This may be the most important book on stops of this decade for the general investor. Professor Henry Pruden, PhD. Golden Gate University W.H.C. Bassetti Coauthor/Editor Edwards & Magee’s Technical Analysis of Stock Trends, 9th Edition This book contains information obtained from authentic and highly regarded sources. Reprinted material is quoted with permission, and sources are indicated. A wide variety of references are listed. Reasonable efforts have been made to publish reliable date and information, but the author and the publisher cannot assume responsibility for the validity of all materials or for the consequences of their use. Neither this book nor any part may be reproduced or transmitted in any form by any means, electronic or mechanical, including photocopying, microfilming, and recording, or by any information storage or retrieval system, without prior permission in writing from the publisher. The consent of MaoMao Press LLC does not extend to copying for general distribution, for promotion, for creating new works, or for resale. Specific permission must be obtained in writing from MaoMao Press LLC for such copying. Direct all inquiries to MaoMao Press LLC, POB 88, San Geronimo, CA 94963-0088 Trademark Notice: Product or corporate names may be trademarks or registered trademarks, and are used only for identification and explanation, without intent to infringe. Dow–JonesSM, The DowSM, Dow–Jones Industrial AverageSM, and DJIASM are service marks of Dow– Jones & Company, Inc., and have been licensed for use for certain purposes by the Board of Trade of the City of Chicago (CBOT®). -

Dow Theory for the 21St Century Schannep Timing Indicator COMPOSITE Indicator

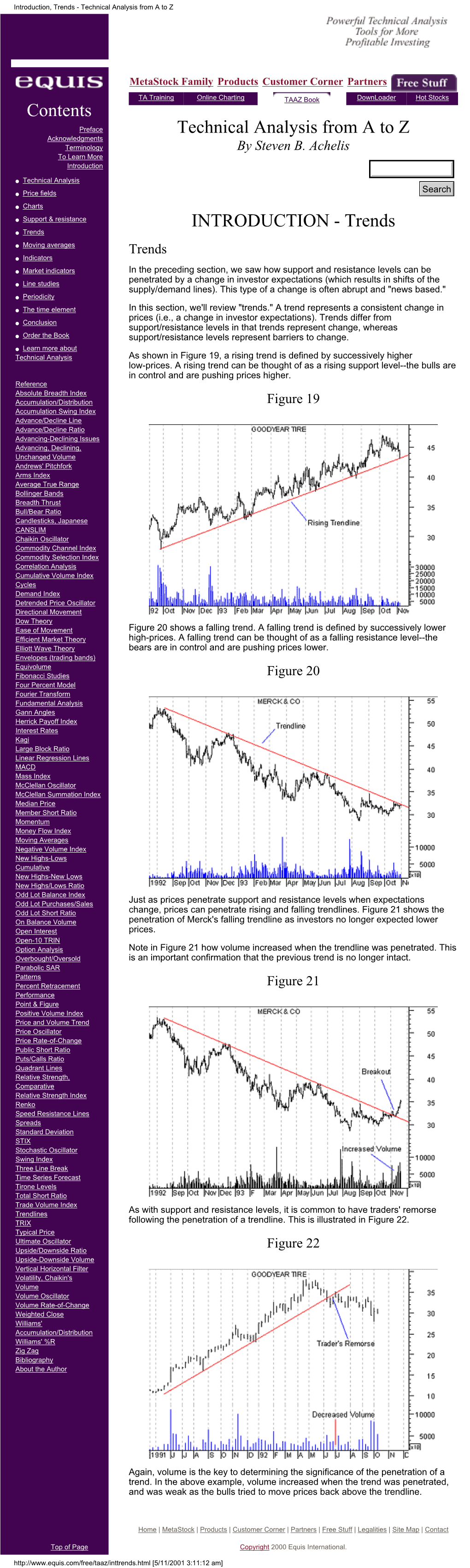

st April 1 , 2015 Dow Theory for the 21st Century Schannep Timing Indicator COMPOSITE Indicator Charting a Course of Caution Dow Jones: 17,776.12 S&P 500: 2,067.88 OVERVIEW: There are many stock market and economic indicators ‘out NYSE: 11,062.79 there’, and we can’t follow them all. But every so often we see something that causes us to take a look. Recently a couple of lesser known, or followed, indicators have given us pause in our bullishness. A MarketWatch column by Mark Hulbert about an indicator described by Norman Fosback in his 1976 ‘classic’ Stock Market Logic is intriguing. In years prior to those shown in the chart below, Fosback states that from 1942 to 1975, the "tops of 1946, '56, '59, '61, '66, '68, and '73 were all accompanied or preceded by turns in margin debt". All but 1959 were major bull market tops, as you can see at the Historic Record on our website. The concept illustrated is that ‘sophisticated’ investors aggressively use margin in bull markets, but pull in their horns when stocks start going down. Fosback further stated that when the trend is down, there is a 59% chance a bear market is in progress (41% a bull market is in progress) - not good odds. That implies the bull market topped out earlier this last month on March 2nd at 18,288.63! How’s that for a cloudy outlook? On the other hand, when margin debt is rising there is an 85% probability that a bull market is in progress – as has been the case since 2011, until now. -

Nikkei 225 Kagi Chart with MACD Applied (Charts: Tradingview)

Kagi What is it? • Created in Japan, • Been around since 1870’s. • Used to give a much more transparent picture of where the price of an individual asset was headed independent of time. • Ignores time and focus solely on price changes that meet a minimum requirement. • Great for taking the ‘noise’ out of the charts; another great ‘psychological’ helping chart! • Instead of using 'X's and O's like point and figure charts, the Kagi chart simply uses lines. These lines are known as the Yin and Yang lines. • The other fundamental concept of these charts, is that of the reversal in price. The lines change direction once the price moves a set amount. 1 Below you can see a typical example based on the S&P500 stock index (Charts: TradingView). In this example the thicker black line signifies up bullish periods (Yang line) and the thinner red line signifies bearish periods (Yin Line): 2 Also take a look at the same period on the Kagi S&P 500 chart versus the traditional candlestick chart S&P 500 chart. See how much less noise there is on the Kagi chart (Charts: TradingView): 3 Basics: • It is the study of pure price movement i.e. it doesn’t take into consideration ‘time’ when constructing its charts. • Uses simple lines known as ‘Yin’ and ‘Yang’ to measure price. • The lines change direction once the price moves a set amount. • Kagi charting is all about the price reversal. • Normally: Black (thicker) lines indicate bullish periods (Yang Line), Red (thin) lines signify bearish periods (Yin Line) • In my examples: Going Black to Red = Sell, Going Red to Black = Buy 4 Construction: • Step 1 is to calculate the reversal amount. -

Stock Market Explained

Stock Market Explained A Beginner's Guide to Investing and Trading in the Modern Stock Market © Ardi Aaziznia www.PeakCapitalTrading.com Copyrighted Material © Peak Capital Trading CHAPTER 1 Copyrighted Material © Peak Capital Trading Figure 1.1: “covid-19” and “stock market” keyword Google search trends between April 2019 and April 2020. As you can see, there is a clear correlation. As the stock market drop hit the news cycles, people started searching more and more about the stock market in Google! Copyrighted Material © Peak Capital Trading COVID-19 Bear Market 2019 Bull Market 2020 recession due to pandemic v Figure 1.2: Comparison between the bull market of 2019 and the bear market of 2020, as shown by the change in share value of 500 of the largest American companies. These companies are tracked by the S&P 500 and are traded in an exchange-traded fund known as the SPDR S&P 500 ETF Trust (ticker: SPY). For your information, S&P refers to Standard & Poor’s, one of the indices which used to track this information. Copyrighted Material © Peak Capital Trading Figure 1.3: How this book is organized. Chapters 1-4 and 7-11 are written by me. Chapters 5 and 6 on day trading are written by Andrew Aziz. Copyrighted Material © Peak Capital Trading CHAPTER 2 Copyrighted Material © Peak Capital Trading Figure 2.1: The return on investing $100 in an exchange-traded fund known as the SPDR S&P 500 ETF Trust (ticker: SPY) (which tracks the share value of 500 of the largest American companies (as rated by the S&P 500)) vs. -

3 Ways to Spot Trend Reversals with the Mass Index

3 Ways to Spot Trend Reversals with the Mass Index If you carefully observe any bar chart, you can see that even when the stock price is trending upwards or downwards, the price is actually ranging. The only difference between trending and ranging markets is the direction of the range. Once you draw an equidistant channel on any price chart, the ranging nature of price becomes more evident. Figure 1: Theory Behind the Mass Index Indicator When Donald Dorsey developed the Mass Index indicator, his rationale was that if the prevailing trend were going to change, the price range would have to widen. If you are having difficulty imagining the situation, look at figure 1, do you see what we mean? Although the Mass Index is great at signaling a potential change in the trend, it will not tell you which direction the trend is changing. After all, an uptrend can gain additional bullish momentum and that will also help make the range much wider. You have to remember that when the Mass Index technical indicator line is going up, the climbing line is only signaling that the volatility of the stock is going up. However, the Mass Index indicator line does not signify any directional bias of the stock. That’s why you need to incorporate other technical analysis tools into your mass index trading strategies in order to identify the change of direction of the prevailing trend. Consider an analogy for a moment, you are driving a car and the mass index calculator, which shows volatility of the stock, is your speedometer. -

![8 Best Bearish Candlestick Patterns for Day Trading [Free Guide & Video]](https://docslib.b-cdn.net/cover/5489/8-best-bearish-candlestick-patterns-for-day-trading-free-guide-video-595489.webp)

8 Best Bearish Candlestick Patterns for Day Trading [Free Guide & Video]

8 Best Bearish Candlestick Patterns for Day Trading [Free Guide & Video] Recently, we discussed the general history of candlesticks and their patterns in a prior post. We also have a great tutorial on the most reliable bullish patterns. But for today, we’re going to dig deeper, and more practical, explaining 8 bearish candlestick patterns every day trader should know. We’ll cover the following: What these patterns look like The criteria for confirming them The story these candles tell How to set entries and risk for each Some common mistakes when interpreting them. 8 Bearish Candlesticks Video Tutorial If you have a few minutes, our in-house trading expert, Aiman Almansoori has cut out a lot of the leg-work for us in this fantastic webinar. We’ve time-stamped the exact spot in the recording where he begins speaking about these 8 bearish candlestick patterns. Have a watch while you read! Also, feel free to use our quick reference guide below for bearish candlestick patterns! Be sure to save the image for your use with your trading and training in the market! What Bearish Candlesticks Tell Us Hopefully at this point in your trading career you’ve come to know that candlesticks are important. Not only do they provide a visual representation of price on a chart, but they tell a story. Behind this story is the belief that the chart tells us everything we need to know: the what being more important than the why. Each candlestick is a representation of buyers and sellers and their emotions, regardless of the underlying “value” of the stock. -

An Interview with John Bollinger

® AIQ Opening BellMonthly IN THIS ISSUE VOL. 6 ISSUE 2 FEBRUARY 1997 TRADING TECHNIQUES Feature John Bollinger discusses his Bollinger Bands .................. 1 AN INTERVIEW WITH JOHN BOLLINGER Se ctions account program, what percent of the By David Vomund investments are in equities and what is Price Volume Divergence your average holding period? Report .................................. 5 his month we are pleased to JB: We are primarily equity Market Review ..................... 8 present an interview with John investors. We dont buy any futures. Data Maintenance ............... 8 Bollinger, a keynote speaker at Our growth model is currently allo- Tour March seminar in Dallas. Mr. cated approximately 60% to the stock Bollinger is market, 20% to the president of bond market, and Bollinger Capital 20% to the interna- Management. He tional stock mar- provides money ket. We are management primarily interme- services and diate term traders. publishes the Our research tends Capital Growth to center on a Letter. He is best holding period of known for his three to six months Bollinger Bands, with most of the which is a feature emphasis on six in TradingExpert. months. However, For information on that doesnt Bollinger Capital preclude us from The Opening Bell Monthly Managements John Bollinger, CFA, CMT taking advantage is a publication of products and of short term AIQ Incorporated services, call 310-798-8855 or write to opportunities, for example when we see David Vomund, Chief Analyst P.O. Box 3358, Manhattan Beach, CA an attractive technical non-confirma- P.O. Box 7530 90266. Send e-mail to tion. Incline Village, Nevada 89452 [email protected]. -

Investing with Bollinger Bands

Investing with Bollinger Bands This article was written some years ago, but is very relevant to today. The charts used to illustrate the text are now somewhat dated, but still relevant for the present purpose of teaching a technique. As moving averages became more popular, some analysts noticed that when prices were moving upward, they had a tendency to rise only so far above the moving average. When prices were falling they tended to fall only so far below the moving average. How far they rose or fell seemed to vary from stock to stock and also from time to time. However, the tendency was so consistent that it could be useful to both traders and investors. These early analysts hit on the idea of drawing lines a certain percentage of the moving average above and below the moving average line. They selected the percentage stock-by-stock so that it seemed to catch most of the price action on the chart, typically 90% or more of the price action. GWT - GWA INTERNATIONAL > -2 to 291 D @ D 020103-070604 320 MOV AVS 22(0) 5 band 310 300 290 280 270 260 250 240 230 JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC JAN FEB MAR APR MAY JUN 03 04 Chart 1: Daily Line Chart of GWA International with a 22-day Moving Average and 5% Bands The result was something like Chart 1, where we have a daily line chart, on which is drawn a 22-day moving average, with 5% bands above and below it.