THE MACERICH COMPANY (Exact Name of Registrant As Specified in Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

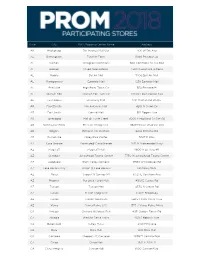

Prom 2018 Event Store List 1.17.18

State City Mall/Shopping Center Name Address AK Anchorage 5th Avenue Mall-Sur 406 W 5th Ave AL Birmingham Tutwiler Farm 5060 Pinnacle Sq AL Dothan Wiregrass Commons 900 Commons Dr Ste 900 AL Hoover Riverchase Galleria 2300 Riverchase Galleria AL Mobile Bel Air Mall 3400 Bell Air Mall AL Montgomery Eastdale Mall 1236 Eastdale Mall AL Prattville High Point Town Ctr 550 Pinnacle Pl AL Spanish Fort Spanish Fort Twn Ctr 22500 Town Center Ave AL Tuscaloosa University Mall 1701 Macfarland Blvd E AR Fayetteville Nw Arkansas Mall 4201 N Shiloh Dr AR Fort Smith Central Mall 5111 Rogers Ave AR Jonesboro Mall @ Turtle Creek 3000 E Highland Dr Ste 516 AR North Little Rock Mc Cain Shopg Cntr 3929 Mccain Blvd Ste 500 AR Rogers Pinnacle Hlls Promde 2202 Bellview Rd AR Russellville Valley Park Center 3057 E Main AZ Casa Grande Promnde@ Casa Grande 1041 N Promenade Pkwy AZ Flagstaff Flagstaff Mall 4600 N Us Hwy 89 AZ Glendale Arrowhead Towne Center 7750 W Arrowhead Towne Center AZ Goodyear Palm Valley Cornerst 13333 W Mcdowell Rd AZ Lake Havasu City Shops @ Lake Havasu 5651 Hwy 95 N AZ Mesa Superst'N Springs Ml 6525 E Southern Ave AZ Phoenix Paradise Valley Mall 4510 E Cactus Rd AZ Tucson Tucson Mall 4530 N Oracle Rd AZ Tucson El Con Shpg Cntr 3501 E Broadway AZ Tucson Tucson Spectrum 5265 S Calle Santa Cruz AZ Yuma Yuma Palms S/C 1375 S Yuma Palms Pkwy CA Antioch Orchard @Slatten Rch 4951 Slatten Ranch Rd CA Arcadia Westfld Santa Anita 400 S Baldwin Ave CA Bakersfield Valley Plaza 2501 Ming Ave CA Brea Brea Mall 400 Brea Mall CA Carlsbad Shoppes At Carlsbad -

Brea (Los Angeles), California Oil, Oranges & Opportunities

BUSINESS CARD DIE AREA 225 West Washington Street Indianapolis, IN 46204 (317) 636-1600 simon.com Information as of 5/1/16 Simon is a global leader in retail real estate ownership, management and development and an S&P 100 company (Simon Property Group, NYSE:SPG). BREA (LOS ANGELES), CALIFORNIA OIL, ORANGES & OPPORTUNITIES Brea Mall® is located in the heart of North Orange County, California, a few miles from California State University, Fullerton and their approximately 40,000 students and staff. — Brea and its surrounding communities are home to major corporations including American Suzuki Motor Corporation, Raytheon, Avery Dennison, Beckman Coulter and St. Jude Hospital. — The city’s Art in Public Places has integrated public art with private development. This nationally recognized collection features over 140 sculptures throughout the city including in Brea Mall. — The new master-planned communities of La Floresta and Blackstone, both in the city of Brea and less than four miles from Brea Mall, have added over 2,100 new luxury housing units to the area. — Brea City Hall and Chamber of Commerce offices are adjacent to the mall, located across the parking lot from Nordstrom and JCPenney. — One of the earliest communities in Orange County, Brea was incorporated in 1917 as the city of oil, oranges and opportunity. SOCAL STYLE Brea Mall has long served as a strategic fashion- focused shopping destination for the communities of North Orange County. The center continues in this tradition with a newly renovated property encompassing world-class shopping and dining. BY THE NUMBERS Anchored by Five Department Stores Nordstrom, Macy’s Women’s, Macy’s Men’s & Furniture Gallery, JCPenney Square Footage Brea Mall spans 1,319,000 square feet and attracts millions of visitors annually. -

Nordstrom to Open New Store at Santa Monica Place

Nordstrom to Open New Store at Santa Monica Place July 15, 2008 In Partnership with Macerich, Nordstrom also Announces New Plans for Two Existing Stores in California SEATTLE, July 15, 2008 /PRNewswire-FirstCall/ -- Seattle-based Nordstrom, Inc. (NYSE: JWN), a leading fashion specialty retailer, announced it has signed a letter of intent with Macerich(R) (NYSE: MAC) to open a new Nordstrom store at Santa Monica Place in Santa Monica, Calif. The three-level, 122,000-square-foot store is scheduled to open in fall 2010. The company also announced plans to relocate its existing Cerritos store at Los Cerritos Center and complete a remodel and expansion for its Broadway Plaza store in Walnut Creek, Calif. Santa Monica Place "Santa Monica is a wonderful community and an exciting retail environment where many of our customers visit, live and work," said Erik Nordstrom, president of stores for Nordstrom. "We compliment Macerich on their vision for the new Santa Monica Place, which we anticipate to be an outstanding shopping experience." "We're very pleased to welcome Nordstrom to the new Santa Monica Place," said Randy Brant, executive vice president, real estate, for Macerich. "The extraordinary appeal of Nordstrom is a great match for this exceptional market, and for what we believe will be a one-of-a-kind retail project two blocks from the beach in downtown Santa Monica." Santa Monica Place is being completely transformed from an existing 1980s-era, enclosed shopping center to a three-level, open-air retail destination that will include a signature rooftop dining deck. Re-opening in fall 2009, the 550,000-square-foot Santa Monica Place is adjacent to the popular Third Street Promenade, three city blocks of retail stores, restaurants and entertainment. -

INLAND CENTER Rooftop Mounted Solar Installation

INLAND CENTER Rooftop Mounted Solar Installation CHALLENGE OVERVIEW Macerich is a fully integrated self-managed and self-administered Deliver a full turn-key renewable energy power facility real estate investment trust, which focuses on the acquisition, leasing, management, development and redevelopment of regional malls Design and install solar module arrangement and support throughout the United States. In the fall of 2012, Macerich aligned with structures Panasonic to begin the first phase of a multi-property retail real estate solar power program to include solar installations at multiple Macerich Design and install performance monitoring system shopping centers in Arizona, California, New York and Connecticut with an expectation to yield over 10.2MW of clean energy capacity – enough power for approximately 10,000 homes. SOLUTION n (4676) solar modules comprised of a mix of 240W and Located in San Bernardino, California along the southwest border 250W adjacent to Interstate 215 and the city of Colton, Inland Center is a n part of the first wave of completed installations. At over 1MW, the retail (2) Advanced Energy 333NX and (1) 250NX central center is one of the largest systems in the Macerich portfolio, and the inverters second largest rooftop array. With an approximately two month active n (2) DAS Service Performance Monitoring Systems: build schedule and a peak construction workforce of 38, the 1,134.56 solar monitoring from Draker and a custom solution kW photovoltaic solar installation is comprised of 4,676 solar PV panels. that communicates with Macerich’s existing Utility The design and install was optimized for local conditions that included Management System multiple roof surfaces, different east & west tilt angles, and shade mitigation strategies. -

I Amtrak~ II Amtrak~ ~ CJCJ CJCJ CJCJ CJC)

CAMDEN COUNTY PUBLIC TRANSPORTATION PLAN DDDDDI '\ YTRANSIT D 0 0 DO 0 0 D D 0 0 DO 0 0 D ==- :::::::::: PATCO- PATCO I Amtrak~ II Amtrak~ ~ CJCJ CJCJ CJCJ CJC) DELAWARE VALLEY REGIONAL PLANNING COMMISSION DECEMBER 1997 CAMDEN COUNTY PUBLIC TRANSPORTATION PLAN Final Document DELAWARE VALLEY REGIONAL PLANNING COMMISSION The Bourse Building 21 South 5th Street, Philadelphia, PA 19106 DECEMBER 1997 This Report is Printed on Recycled Paper CAMDEN COUNTY BOARD OF CHOSEN FREEHOLDERS Jeffrey L. Nash, Freeholder Director Annette Castiglione-Degan, Freeholder Deputy Director Scott M. Goldberg, Freeholder, Department of Public Works (Divisions of Engineering and Planning) Riletta Cream Edward T. McDonnell Bernard A. Platt Frank Spencer CAMDEN COUNTY PLANNING BOARD Jeffrey L. Nash, Freeholder Director Scott M. Goldberg, Freeholder Frank Spencer, Freeholder Barry Malesich, Board Chairperson Carole Miller, Board Vice-Chairperson Robert E. Kelly, P.E., County Engineer Thomas Quackenbush William J. Controvich William J. Snyder Margaret A. Young Joseph Forte George Jones Michael Brennan, Esquire, Board Solicitor CAMDEN COUNTY DEPARTMENT OF PUBLIC WORKS: Dominic J. Vesper, Jr., Director George C. Fallon, Supervisor of Roads DIVISION OF ENGINEERING: Robert E. Kelly, P.E., County Engineer DIVISION OF PLANNING: 1. Douglas Griffith, P.P., AICP, Planning Director Thomas B. Chamberlin, Supervising Planner Land Development and Review Gail Elbert, Supervising Planner Ronald Jernegan, Data Processing Technician Louise M. Sawchuk, Principal Clerk Typist DELA W ARE -

Chapter 11 Case No. 21-10632 (MBK)

Case 21-10632-MBK Doc 249 Filed 04/06/21 Entered 04/06/21 16:21:35 Desc Main Document Page 1 of 92 UNITED STATES BANKRUPTCY COURT DISTRICT OF NEW JERSEY In re: Chapter 11 L’OCCITANE, INC., Case No. 21-10632 (MBK) Debtor. Judge: Hon. Michael B. Kaplan CERTIFICATE OF SERVICE I, Ana M. Galvan, depose and say that I am employed by Stretto, the claims and noticing agent for the Debtors in the above-captioned case. On April 2, 2021, at my direction and under my supervision, employees of Stretto caused the following documents to be served via first-class mail on the service list attached hereto as Exhibit A, and via electronic mail on the service list attached hereto as Exhibit B: Notice of Deadline for Filing Proofs of Claim Against the Debtor L’Occitane, Inc. (attached hereto as Exhibit C) [Customized] Official Form 410 Proof of Claim (attached hereto as Exhibit D) Official Form 410 Instructions for Proof of Claim (attached hereto as Exhibit E) Dated: April 6, 2021 /s/ Ana M. Galvan Ana M. Galvan STRETTO 410 Exchange, Suite 100 Irvine, CA 92602 Telephone: 855-434-5886 Email: [email protected] Case 21-10632-MBK Doc 249 Filed 04/06/21 Entered 04/06/21 16:21:35 Desc Main Document Page 2 of 92 Exhibit A Case 21-10632-MBK Doc 249 Filed 04/06/21 Entered 04/06/21 16:21:35 Desc Main Document Page 3 of 92 Exhibit A Served via First-Class Mail Name Attention Address 1 Address 2 Address 3 City State Zip Country 1046 Madison Ave LLC c/o HMH Realty Co., Inc., Rexton Realty Co. -

Inland Empire Family Resource Center Coalition (Iefrcc)

2012 INLAND EMPIRE Update June 1 Inland Empire Directory of FAMILY RESOURCE CENTERS J ~A{ /ilL I mily Re ourc C nt r FAMILY Hearts&Lives RESOURCE CENTER Resource Directory is provided by the Inland Empire Family Resource Center Coalition (ieFRCC) 2012 The Directory of Family Resource Centers in the Inland Empire is a compilation of known Family Resource Centers operating in the Inland Empire. The purpose is to improve the delivery of client services in San Bernardino County and Riverside County. The following Family Resource Centers are provided as a resource and not a referral. It is a collaborative process and every effort is made to represent each Family Resource Center with their most current services and contact information. However funding, staff transitions, and changes in client services in the Inland Empire can make it challenging for the Directory to be current at time of printing and online updates. Family Resource Centers that do not contain complete contact information & description of services have not been confirmed prior to printing of this Directory. Updates to the Directory are quarterly during the following months: January, April, July, and October. To download the most recent copy visit www.ieFRC.org Your help in keeping the Directory most current is appreciated and can help service providers that are using the Directory link clients more effectively and efficiently. To edit or add information please email [email protected] Family Resource Centers that are presented in the directory in bold and underlined are current members of the Inland Empire Family Resource Center Coalition (ieFRCC); creator and administer of the Directory. -

State City Shopping Center Address

State City Shopping Center Address AK ANCHORAGE 5TH AVENUE MALL SUR 406 W 5TH AVE AL FULTONDALE PROMENADE FULTONDALE 3363 LOWERY PKWY AL HOOVER RIVERCHASE GALLERIA 2300 RIVERCHASE GALLERIA AL MOBILE BEL AIR MALL 3400 BELL AIR MALL AR FAYETTEVILLE NW ARKANSAS MALL 4201 N SHILOH DR AR FORT SMITH CENTRAL MALL 5111 ROGERS AVE AR JONESBORO MALL @ TURTLE CREEK 3000 E HIGHLAND DR STE 516 AR LITTLE ROCK SHACKLEFORD CROSSING 2600 S SHACKLEFORD RD AR NORTH LITTLE ROCK MC CAIN SHOPG CNTR 3929 MCCAIN BLVD STE 500 AR ROGERS PINNACLE HLLS PROMDE 2202 BELLVIEW RD AZ CHANDLER MILL CROSSING 2180 S GILBERT RD AZ FLAGSTAFF FLAGSTAFF MALL 4600 N US HWY 89 AZ GLENDALE ARROWHEAD TOWNE CTR 7750 W ARROWHEAD TOWNE CENTER AZ GOODYEAR PALM VALLEY CORNERST 13333 W MCDOWELL RD AZ LAKE HAVASU CITY SHOPS @ LAKE HAVASU 5651 HWY 95 N AZ MESA SUPERST'N SPRINGS ML 6525 E SOUTHERN AVE AZ NOGALES MARIPOSA WEST PLAZA 220 W MARIPOSA RD AZ PHOENIX AHWATUKEE FOOTHILLS 5050 E RAY RD AZ PHOENIX CHRISTOWN SPECTRUM 1727 W BETHANY HOME RD AZ PHOENIX PARADISE VALLEY MALL 4510 E CACTUS RD AZ TEMPE TEMPE MARKETPLACE 1900 E RIO SALADO PKWY STE 140 AZ TUCSON EL CON SHPG CNTR 3501 E BROADWAY AZ TUCSON TUCSON MALL 4530 N ORACLE RD AZ TUCSON TUCSON SPECTRUM 5265 S CALLE SANTA CRUZ AZ YUMA YUMA PALMS S C 1375 S YUMA PALMS PKWY CA ANTIOCH ORCHARD @SLATTEN RCH 4951 SLATTEN RANCH RD CA ARCADIA WESTFLD SANTA ANITA 400 S BALDWIN AVE CA BAKERSFIELD VALLEY PLAZA 2501 MING AVE CA BREA BREA MALL 400 BREA MALL CA CARLSBAD PLAZA CAMINO REAL 2555 EL CAMINO REAL CA CARSON SOUTHBAY PAV @CARSON 20700 AVALON -

Printmgr File

Exhibit 99.2 Supplemental Financial Information For the three months ended March 31, 2019 The Macerich Company Supplemental Financial and Operating Information Table of Contents All information included in this supplemental financial package is unaudited, unless otherwise indicated. Page No. Corporate Overview 1-4 Overview 1-2 Capital Information and Market Capitalization 3 Changes in Total Common and Equivalent Shares/Units 4 Financial Data 5-11 Consolidated Statements of Operations (Unaudited) 5 Consolidated Balance Sheet (Unaudited) 6 Non-GAAP Pro Rata Financial Information (Unaudited) 7-9 2019 Guidance Range 10 Supplemental FFO Information 11 Capital Expenditures 12 Operational Data 13-27 Sales Per Square Foot 13 Sales Per Square Foot by Property Ranking 14-17 Occupancy 18 Average Base Rent Per Square Foot 19 Cost of Occupancy 20 Percentage of Net Operating Income by State 21 Property Listing 22-25 Joint Venture List 26-27 Debt Tables 28-30 Debt Summary 28 Outstanding Debt by Maturity Date 29-30 Development Pipeline 31 Corporate Information 32 This Supplemental Financial Information should be read in connection with the Company’s first quarter 2019 earnings announcement (included as Exhibit 99.1 of the Company’s Current Report on 8-K, event date May 2, 2019) as certain disclosures, definitions and reconciliations in such announcement have not been included in this Supplemental Financial Information. The Macerich Company Supplemental Financial and Operating Information Overview The Macerich Company (the “Company”) is involved in the acquisition, ownership, development, redevelopment, management and leasing of regional shopping centers located in the United States in many of the country’s most attractive, densely populated markets with significant presence on the West Coast, Arizona, Chicago and the Metro New York to Washington, DC corridor. -

Michael Kors® Make Your Move at Sunglass Hut®

Michael Kors® Make Your Move at Sunglass Hut® Official Rules NO PURCHASE OR PAYMENT OF ANY KIND IS NECESSARY TO ENTER OR WIN. A PURCHASE OR PAYMENT WILL NOT INCREASE YOUR CHANCES OF WINNING. VOID WHERE PROHIBITED BY LAW OR REGULATION and outside the fifty United States (and the District of ColuMbia). Subject to all federal, state, and local laws, regulations, and ordinances. This Gift ProMotion (“Gift Promotion”) is open only to residents of the fifty (50) United States and the District of ColuMbia ("U.S.") who are at least eighteen (18) years old at the tiMe of entry (each who enters, an “Entrant”). 1. GIFT PROMOTION TIMING: Michael Kors® Make Your Move at Sunglass Hut® Gift Promotion (the “Gift ProMotion”) begins on Friday, March 22, 2019 at 12:01 a.m. Eastern Time (“ET”) and ends at 11:59:59 p.m. ET on Wednesday, April 3, 2019 (the “Gift Period”). Participation in the Gift Promotion does not constitute entry into any other promotion, contest or game. By participating in the Gift Promotion, each Entrant unconditionally accepts and agrees to comply with and abide by these Official Rules and the decisions of Luxottica of America Inc., 4000 Luxottica Place, Mason, OH 45040 d/b/a Sunglass Hut (the “Sponsor”) and WYNG, 360 Park Avenue S., 20th Floor, NY, NY 10010 (the “AdMinistrator”), whose decisions shall be final and legally binding in all respects. 2. ELIGIBILITY: Employees, officers, and directors of Sponsor, Administrator, and each of their respective directors, officers, shareholders, and employees, affiliates, subsidiaries, distributors, -

Shop California Insider Tips 2020

SHOP CALIFORNIA INSIDER TIPS 2020 ENJOY THE ULTIMATE SHOPPING AND DINING EXPERIENCES! Exciting Shopping and Dining Tour Packages at ShopAmericaTours.com/shop-California Purchase with code ShopCA for 10% discount. Rodeo Drive 2 THROUGHOUT CALIFORNIA From revitalizing beauty services, to wine, spirits and chocolate tastings, DFS offers unexpected, BLOOMINGDALE’S complimentary and convenient benefits to its See all the stylish sights – starting with a visit to shoppers. Join the DFS worldwide membership Bloomingdale’s. Since 1872, Bloomingdale’s has program, LOYAL T, to begin enjoying members- been at the center of style, carrying the most only benefits while you travel.DFS.com coveted designer fashions, shoes, handbags, cosmetics, fine jewelry and gifts in the world. MACERICH SHOPPING DESTINATIONS When you visit our stores, you’ll enjoy exclusive Explore the U.S.’ best shopping, dining, and personal touches – like multilingual associates entertainment experiences at Macerich’s shopping and special visitor services – that ensure you feel destinations. With centers located in the heart welcome, pampered and at home. These are just of California’s gateway destinations, immerse a few of the things that make Bloomingdale’s like yourself in the latest fashion trends, hottest no other store in the world. Tourism services cuisine, and an unrivaled, engaging environment. include unique group events and programs, Macerich locations provide a variety of benefits special visitor offers and more, available at our to visitors, including customized shopping, 11 stores in California including San Francisco experiential packages, visitor perks and more. Centre, South Coast Plaza, Century City, Beverly To learn more about Macerich and the exclusive Center, Santa Monica Place, Fashion Valley and visitor experiences, visit macerichtourism.com. -

DOUGLAS PARK REZONE PROJECT (Formerly the Pacificenter @ Long Beach)

ADDENDUM to the Final Environmental Impact Report DOUGLAS PARK REZONE PROJECT (Formerly the PacifiCenter @ Long Beach) SCH No. 2001051048 AUGUST 2009 Lead Agency: City of Long Beach Page _ ADDENDUM to the Final Environmental Impact Report DOUGLAS PARK REZONE PROJECT (Formerly the PacifiCenter @ Long Beach) SCH No. 2001051048 AUGUST 2009 Lead Agency: City of Long Beach Development Services 333 West Ocean Boulevard Long Beach, California 90802 Contact: Meredith Elguira (562) 570-5237 Page _ TABLE OF CONTENTS Page SECTION I INTRODUCTION ............................................................................................ I-1 A. Background .......................................................................................... I-1 B. CEQA Authority for the Addendum ...................................................... I-2 C. General Format of the Addendum Analysis ......................................... I-3 D. Summary of Addendum Conclusion .................................................... I-4 SECTION II PROJECT DESCRIPTION .............................................................................. II-1 A. Project Location and Setting ............................................................... II-1 B. Description of the Approved Project .................................................... II-3 C. Description of the Revised Project ...................................................... II-9 SECTION III ENVIRONMENTAL IMPACT ANALYSIS ........................................................... III-1 A. Aesthetics .........................................................................................