Comparative Study of Bajaj V/S Hero Honda

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TRADING LIST.Xlsx

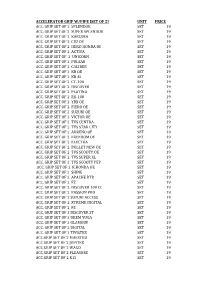

ACCELERATOR GRIP W/PIPE [SET OF 2] UNIT PRICE ACC. GRIP SET OF 2 SPLENDOR SET 19 ACC. GRIP SET OF 2 SUPER SPLENDOR SET 19 ACC. GRIP SET OF 2 KARIZMA SET 19 ACC. GRIP SET OF 2 CBZ OE SET 19 ACC. GRIP SET OF 2 HERO HONDA OE SET 19 ACC. GRIP SET OF 2 ACTIVA SET 19 ACC. GRIP SET OF 2 UNICORN SET 19 ACC. GRIP SET OF 2 PULSAR SET 19 ACC. GRIP SET OF 2 CALIBER SET 19 ACC. GRIP SET OF 2 KB OE SET 19 ACC. GRIP SET OF 2 KB 4S SET 19 ACC. GRIP SET OF 2 CT-100 SET 19 ACC. GRIP SET OF 2 DISCOVER SET 19 ACC. GRIP SET OF 2 PLATINA SET 19 ACC. GRIP SET OF 2 RX-100 SET 19 ACC. GRIP SET OF 2 YBX OE SET 19 ACC. GRIP SET OF 2 FIERO OE SET 19 ACC. GRIP SET OF 2 SUZUKI OE SET 19 ACC. GRIP SET OF 2 VICTOR OE SET 19 ACC. GRIP SET OF 2 TVS CENTRA SET 19 ACC. GRIP SET OF 2 TVS STAR CITY SET 19 ACC. GRIP SET OF 2 ADRENO OE SET 19 ACC. GRIP SET OF 2 FREEDOM OE SET 19 ACC. GRIP SET OF 2 ELECTRA SET 19 ACC. GRIP SET OF 2 BULLET NEW OE SET 19 ACC. GRIP SET OF 2 TVS SCOOTY OE SET 19 ACC. GRIP SET OF 2 TVS SUPER XL SET 19 ACC. GRIP SET OF 2 TVS SCOOTY PEP SET 19 ACC. GRIP SET OF 2 K.HONDA OE SET 19 ACC. -

Most Market Roundup.Pmd

MOSt Market Roundup 1st March 2019 EQUITY Market Sensex 36063.81 196.37 Nifty 10863.50 71.00 Cash Volumes (INR in Crores) Dealer's Diary Exchange Today Pev. Day Markets bounced back after falling for 3 trading sessions. Nifty climbed BSE (Cash) - 2,082 0.66% or 71 pts to close at 10863. Rally in the global markets and reduced NSE (Cash) 31,263 42,766 geo-political tensions, boosted the market sentiments. Moreover, Feb NSE(Derivatives) 4,05,084 17,00,963 mfg PMI which came at a 14-month high at 54.3, fall in USDINR and 10- Year G-Sec yield, also helped. China (up 1.5%), Nikkei and Hong Index Advance / Decline gained smartly, European markets advanced half to one percent and Group NIFTY 50 BSE 200 US Futures gained over half a percent. China reported impressive Advance 40 158 economy data and reduced trade war tension between US and China, Decline 10 41 boosted the global markets. India VIX slipped nearly 10%. Small-Cap Unchanged 0 2 Index rose close to 3%, followed by PSU Banks, Media, Auto and Metal stocks. Auto monthly sales for February was a mixed bag. Maruti and Top Nifty - 50 Index Gainers Ashok Leyland reported in-line Feb sales while Bajaj Auto announced lower than expected numbers. Escorts announced better-than- Scrip LTP % Change ZEEL 488 4.5 expected Feb sales. Bajaj Auto declined 1% to close at Rs2863, Maruti HINDPETRO 233 4.4 and Escorts gained 1% and 2% respectively. Tata Motors surged 2% to INDUSINDBK 1,517 2.9 close at Rs180 after the news that the company is likely to sell JLR BPCL 347 2.7 stake. -

Financial Performance of Indian Automobile Industry – with Special Reference to Selected Companies

Volume : 5 | Issue : 12 | December-2016 ISSN - 2250-1991 | IF : 5.215 | IC Value : 79.96 Original Research Paper Commerce Financial Performance of Indian Automobile Industry – with Special Reference to Selected Companies Research Scholar, Department of Commerce, Annamalai P.Manokaran University, Annamalai Nagar Tamilnadu Assistant Professor in Commerce, Department of Commerce, Dr.J.Paramasivam Annamalai University,Annamalai Nagar Tamilnadu The study was made with the objective to analyse financial performance of selected automobile companies in India. For this purpose the researcher selected six companies for the study period of ten years from 2005-06 to 2014-15 using Altman’s Z-score model. The study found that financial performance under Altman’s z-score model was good in case of Maruti Suzuki India Ltd., since calculated value of z-score was more than the standard norm during all the years of the study period. The calculated value of z-score of Mahindra and Mahindra Ltd. was more than the standard norm (2.99) during eight years and it was more than the standard norm during eight years in case of Bajaj Auto Ltd. and TVS Motor Company, since their ABSTRACT financial performance was satisfactory. Financial performance of Tata Motors Ltd. and Ashok Leyland Ltd., was good during four years, since their z-score was more than the standard norm during four years and during five years it was at grey zone and in one year it was poor. KEYWORDS financial performance, z-score, working capital, retained earnings and profit Introduction Methodology India is one of the fastest growing economies in the world. -

A Comparative Study of Fundamental and Technical Analysis on Selected

World Wide Journal of Multidisciplinary Research and Development WWJMRD 2018; 4(6): 102-105 www.wwjmrd.com International Journal Peer Reviewed Journal A Comparative Study of Fundamental and Technical Refereed Journal Indexed Journal Analysis on Selected Automobile Companies In India Impact Factor MJIF: 4.25 E-ISSN: 2454-6615 Dr.S.Kamalasaravanan Dr.S.Kamalasaravanan Associate Professor, Department of Management Abstract Sciences,Hindusthan College of The Automotive industry in India is one of the largest in the world with an annual production of 23.96 Engineering and Technology, million vehicles in FY (fiscal year) 2016–17. The Government of India aims to make automobile Coimbatore, Tamilnadu, India. manufacturing the main driver of "Make in India" initiative, as it expects the passenger vehicles market to triple to 9.4 million units by 2026, as highlighted in the Auto Mission Plan (AMP) 2016-26. So, There is wide opportunities occurs in automobile industry in share market, this study is helpful to investors for safe invest money in selected shares. Keywords: Fundamental analysis, Technical analysis, Automobile industry India, investment decisions, Risk and Return Analysis 1. Introduction Nowadays, Security Analysis and Portfolio Management concern itself with investment in financial assets with specific attention to the returns and risk associated with investing in securities. Traditional investment analysis, when applied to securities, emphasizes the projection of prices and dividends. That is, the potential price of a firm’s common stock and the future dividend stream are forecasted, and then discounted back to the present. This intrinsic value is then compared with the security’s current market price. -

Starter Motor

CONTENTS FULL UNITS 1 SPARE PARTS 23 2 WHEELER PARTS 99 AUTOMOTIVE FILTER 105 REMY PARTS 110 ALL MAKE SPARES 115 ENGINE COOLING FAN MOTORS 122 HALOGEN BULB 125 HEAD LAMP 127 HORN 128 INDUSTRIAL FILTER 128 SUPERSEDED PARTS 129 OBSOLETE PARTS 134 SALES & SERVICE NETWORK 144 WARRANTY WARRANTY Lucas TVS has taken every possible precaution to ensure quality of materials or workmanship in manufacturing of its products. In the event of any defects noticed within twelve months or 20,000 kilometers, whichever is earlier of its being put into use, Lucas TVS will either repair or replace components in exchange for those defective components under warranty at free of cost. This warranty does not cover misuse, modification, improper application, abuse, accident or negligence and failure of our products working in conjunction with non Lucas TVS Products. Also excluded from this warranty are parts which are subject to normal wear and tear, any labour cost incurred for removal and refitting to the vehicle or engine, and any other consequential expenses. The purchaser should contact the outlet where they originally purchased the product and should provide the purchase receipt, repair order or other proof that the product is within the warranty period, this will be required in order to honor the warranty claim. Lucas TVS reserve the right to refuse to consider claims if the components have been subject to repair or adjustment, and failures caused by unauthorized services or any component is returned incomplete. TERMS & CONDITIONS OF SALE TERMS & CONDITIONS OF SALE This revised edition supersedes all lists, amendments and additions earlier and is effective from 3rd October 2017 Price Bulletin upto 94/2017 are included in this book. -

A Study on Portfolio Management

Vol 10, Issue 10, Oct / 2019 ISSN NO: 0377-9254 A STUDY ON PORTFOLIO MANAGEMENT 1CHITUKULLA RAVALI REDDY, 2CH. HEMABINDU 1MBA Student, 2Assistant Professor DEPARTMENT OF MBA DRK INSTITUTE OF SCIENCE AND TECHNOLOGY, HYDERABAD Abstract The earliest Portfolio Management techniques optimized projects' profitability or financial returns This paper is entitled to “A Study on using heuristic or mathematical models. However, Portfolio Management on Karvy Stock Broking” this approach paid little attention to balance or Portfolio Management is the responsibility of the aligning the portfolio to the organization's strategy. senior management team of an organization or Scoring techniques weight and score criteria to take business unit. This team, which might be called the into account investment requirements, profitability, Product Committee, meets regularly to manage the risk and strategic alignment. The shortcoming with product pipeline and make decisions about the this approach can be an over emphasis on financial product portfolio. Often, this is the same group that measures and an inability to optimize the mix of conducts the stage-gate reviews in the organization. projects. A logical starting point is to create a product I. INTRODUCTION strategy - markets, customers, products, strategy A portfolio is a collection of money relevant funds, approach, competitive emphasis, etc. The second for example, stocks, securities, wares, financial step is to understand the budget or resources guideline and money companion, just as their available to balance the portfolio against. Third, reserve associate, including shared, trade each project must be assessed for profitability exchanged and shut assets. The central focuses may (rewards), investment requirements (resources), be physical or cash related like offers, Bonds, risks, and other appropriate factors. -

Bajaj Auto Companyname

RESULT UPDATE BAJAJ AUTO Strong show in a tough environment India Equity Research| Automobiles COMPANYNAME Bajaj Auto’s (BJAUT) Q2FY20 EBITDA of INR12.7bn (down 6.6% YoY) EDELWEISS 4D RATINGS surpassed our estimate 15% driven by significant improvement in Absolute Rating HOLD realisation. Post a bleak Q2FY20, near-term demand outlook has Rating Relative to Sector Underperform improved, triggered by the festive season as well as clarity on GST rate Risk Rating Relative to Sector Low cut. With current inventory at 60 plus days and the BS VI transition Sector Relative to Market Overweight around the corner, sustained bounce-back in demand remains key. Near- term export growth is likely to find some support from new product launches (Pulsar NS) as well as resumption of 3W exports to a few key MARKET DATA (R: BAJA.BO, B: BJAUT IN) markets (Egypt). However, we expect margin to remain range bound as CMP : INR 3,163 Target Price : INR 3,177 sustained improvement in mix is likely to be offset by rising share of 52-week range (INR) : 3,237 / 2,400 exports and BS VI transition costs. Maintain ‘HOLD’ with revised TP of Share in issue (mn) : 289.4 INR3,163 (earlier INR2,988) as we roll over to 12x March 2021E EPS. M cap (INR bn/USD mn) : 915 / 12,905 Avg. Daily Vol.BSE/NSE(‘000) : 533.6 Q2FY20: Strong show Net revenue at INR77bn (down 4% YoY) was 5% ahead of estimate due to sharp 5% SHARE HOLDING PATTERN (%) QoQ improvement in ASP. Strong ASP growth was driven by higher share of 110/125cc Current Q1FY20 Q4FY19 motorcycles and domestic 3W sales. -

An Organization Study O CMR Institute N Organization Study on Hero

An Organization Study on Hero MotoCorp Limited (18MBAOS307) Submitted by MONCY PAUL 1CR19MBA51 Submitted to VISVESVARAYA TECHNOLOGICAL UNIVERSITY, BELAGAVI In partial fulfillment of the requirement for the award of the degree of MASTER OF BUSINESS ADMINISTRATION Under Guidance of Internal Guide Prof. Manjunatha. S Assistant Professor Department of Management Studies CMR Institute of Technology Bangalore Department of Management Studies and Research Center CMR Institute of Technology #132, AECS Layout, Kundalahalli, Bengaluru - 560037 Class of 2019-21 1 2 DECLARATION I, Mr. Moncy Paul bearing USN 1CR19MBA51 hereby declare that the organization study conducted at Herp MotoCorp is record of independent work carried out by me under the guidance of Prof. Manjunatha.S faculty of M.B.A Department of CMR Institute of Technology, Bengaluru. I also declare that this report is prepared in partial fulfilment of the university Regulations for the award of degree of Master of Business Administration by Visvesvaraya Technological University, Belagavi. I have undergone an organization study for a period of four weeks. I further declare that this report is based on the original study undertaken by me and has not been submitted for the award of any degree/diploma from any other University/Institution. Disclaimer The enclosed document is the outcome of a student academic assignment, and does not represent the opinions/views of the University or the institution or the department or any other individuals referenced or acknowledged within the document. The data and Information studied and presented in this report have been accessed in good faith from secondary sources/web sources/public domain, including the organisation’s website, solely and exclusively for academic purposes, without any consent/permission, express or implied from the organization concerned. -

A Study on Customer Satisfaction on Hero Moto Crop

A PROJECT REPORTON “A STUDY ON CUSTOMER SATISFACTION ON HERO MOTOCORP” Submitted in partial fulfillment of the requirement of the award of the degree of “bachelor of Business management’’ of Bangalore University Submitted by MR. P.HARISH KUMAR (Reg.no.13VFC24067) Under the Guidance of MRS.MANJULA NEW HORIZON COLLEGE MARATHALLI BANGALORE -560103 2015-2016 `STUDENT DECLARATION I, P.HARISH KUMAR student of bachelor of business management, NEW HORIZON COLLEGE BANGALORE, bearing registration number 13VFC24067 declare this project entitled “A STUDY ONCUSTOMER SATISFACTION ON HERO MOTOCORP” was prepared by me during by me during the year 2015-2016 and was submitted in partial fulfillment for the award of bachelor of business management to Bangalore University, I also declare that this project is original and genuine and has not been submitted to any other university/ institution for the award of any degree, diploma or other similar titles or purposes Place: Bangalore Name:P.HARISH KUMARDate: Reg.no.13VFC24067 GUIDE CERTIFICATE Certified that the project report entitled“A STUDY ON CUSTOMER SATISFACTION ON HERO MOTOCORP’ submitted by MR.P.HARISHKUMAR bearing registration no. 13VFC24084 to bangalore university in partial fulfillment for the award of “Bachelor of Business Management” of Bangalore University, Bangalore is a record of independent project work under taken by him, under my supervision and guidance and the project has not be submitted either in part or whole for the award of any other degree or diploma of any university. Place: Bangalore MRS. SREEJA NAIR Date: (Assistant Professor HOD CERTIFICATE This is to certify that P.HARISH KUMAR(13VFC24084) isbonafide student of bachelor of business management. -

Eria-Dp-2015-24

ERIA-DP-2015-24 ERIA Discussion Paper Series The Indian Automotive Industry and the ASEAN Supply Chain Relations Tristan Leo Dallo AGUSTIN Mitsubishi Fuso Martin SCHRÖDER Research Institute of Auto Parts Industries, Waseda University March 2015 Abstract: The topic of automotive supply chains has been increasingly studied as it raises questions of economic development, especially from the perspectives of simultaneous globalisation and regionalisation, and trade. While ASEAN is a prime example of intraregional production networks, supply chains that connect ASEAN and India have not been studied indepth. Therefore, this paper investigates the Indian automotive industry, which is composed of automobile original equipment manufacturers (OEMs) and parts and components producers, and other supply chain connections to the neighbouring ASEAN region. This study is structured as follows. First, we will take a look at the historic development of the automotive industry in India, as it provides the context for the development of companies and their capabilities that are crucial determinants for their ability to join supply chains. The investigation will not be limited to Indian firms because as case studies of the ASEAN region forcefully demonstrate, foreign OEMs and parts suppliers may use developing and emerging markets as specialised production bases of their global and regional supply chains. Second, against the historic background, the current condition of the automotive industry in India will be analysed by discussing industry data. Third, we will conduct case studies of automotive companies from India, Japan, and South Korea to investigate how India and ASEAN are connected through supply chains and determine which chains integrate Indian companies. -

Suprajit Engineering Ltd

RUDRA SHARES & STOCK BROKERS LTD. Dated : 20th May, 2016 DARK HORSE - SUPRAJIT ENGINEERING LTD. BUY Investment Rationale Price ` 162 Increasing the Cable production capacity Accumulate With new plants in Gujarat & Tamil Nadu, company is planning to increase the cable production Upside NA capacity from 150 M to 225 M cables per year, is progressing smoothly (as was expected to be Div Yield NA completed by March 2016). With this, it will have presence in 7 states with 15 Plants in India. Tenure 2-3 Years Note:- Cable production capacity during the FY 15 stood at 175 M. Sensex 25452.31 Merger Accretive to Suprajit’s Earning Per share from day one, Developing Synergies Nifty 7793.20 Company on April, 2016, has signed a share purchase Agreement & acquired majority stake in Group/Index B / S&P BSE Phoenix Lamps Ltd. Phoenix is the leader in Indian Automotive Industry for halogen headlamps with SmallCap significant market share in every segment. It has two European subsidiaries- Trifa & Luxlite, through which it has a good market share of Europe & many other countries in South America, Africa, & Middle East. This is an exciting new range of products to de-risk Suprajit's growth model, so far dependent Stock Details on one product, CABLES. With this acquisition, Phoenix would bring multiple synergies, & offer M.cap (` in cr) 2127 Suprajit's group a strong presence in the Indian auto component Industry. Equity (` In cr) 13.13 52 wk H/L ` 165/118 Benefits Post Acquisition Face Value ` 1 The consolidated sales of combined entity for the current year is expected to be in excess of NSE code SUPRAJIT `1100 crores with good financial ratios. -

Introduction: COMPANY PROFILE: Founder: Munjal Brothers: Mr

Introduction: COMPANY PROFILE: Founder: Munjal Brothers: Mr. Satyanand Munjal, Mr. Brijmohan Lall Munjal and Mr. O. P. Munjal. Year of Establishment:1984 (The Hero Group was established in 1956) Foundational Work: Before the establish ment of the Hero Group in 1956,Munjal Brothers use to manufacture bicycle components in the early 1940's. Industry: Automotive - Two Wheelers Business Group: The Hero Group Capitalization Ratio: Hero Group - 26% Honda Motor Co., Ltd. - 26% Others - 48% (listing) Listings & its codes : BSE - Code: 500182 NSE - Code: HERO HONDA Bloomberg - Code: HH@IN No. of Sales Outlets: 1500+ Joint Venture:The Hero Group (India) with Honda Motor Co., Ltd. (Japan) Registered & Corporate : Office34, Community Centre Basant Lok, Vasant Vihar New Delhi - 110057 Tel.: +(91)-(11)-26142451 - 59 Hero Honda Motors Limited is a two wheeler manufacturer based in India. Hero Honda is a joint venture between the Hero Group of India and Honda of Japan. The company is the largest two wheeler manufacturer in India. The 2006 Forbes 200 Most Respected companies list has Hero Honda Motors ranked at 108. ͞Hero͟ is the brand name used by the Munjal brothers for their flagship company Hero Cycles Ltd. A joint venture between the Hero Group and Honda Motor Company was established in 1984 as the Hero Honda Motors Limited At Dharuhera India. Munjal family and Honda group both own 26% stake in the Company. In 2010, it was reported that Honda planned to sell its stake in the venture to the Munjal family. During the 1980s, the company introduced motorcycles that were popular in India for their fuel economy and low cost.