Chinese Construction Bank

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Interim Report 2018

Stock Code: 6098 碧桂園服務控股有限公司 碧桂園服務控股有限公司 Country Garden Services Holdings Company Limited Country Garden Services Holdings Company Limited Services Company Holdings Garden Country (Incorporated in the Cayman Islands with limited liability) 2018 INTERIM REPORT 2018 INTERIM REPORT Contents 2 Corporate Information 3 Awards and Honours 4 Chairman’s Statement 6 Management Discussion and Analysis 20 Corporate Governance and Other Information 22 Interests Disclosure 25 Interim Condensed Consolidated Statement of Comprehensive Income 26 Interim Condensed Consolidated Balance Sheet 28 Interim Condensed Consolidated Statement of Changes in Equity 29 Interim Condensed Consolidated Statement of Cash Flows 30 Notes to the Interim Financial Information CORPORATE INFORMATION BOARD OF DIRECTORS CAYMAN ISLANDS PRINCIPAL SHARE REGISTRAR Executive Directors AND TRANSFER OFFICE Mr. Li Changjiang Conyers Trust Company (Cayman) Limited Mr. Xiao Hua Cricket Square, Hutchins Drive Mr. Guo Zhanjun P.O. Box 2681 Grand Cayman Non-executive Directors KY1-1111 Ms. Yang Huiyan (Chairman) Cayman Islands Mr. Yang Zhicheng HONG KONG BRANCH SHARE REGISTRAR Ms. Wu Bijun Tricor Investor Services Limited Level 22, Hopewell Centre Independent Non-executive Directors 183 Queen’s Road East, Hong Kong Mr. Mei Wenjue Mr. Rui Meng AUDITORS Mr. Chen Weiru PricewaterhouseCoopers Certifi ed Public Accountants AUDIT COMMITTEE 22nd Floor, Prince’s Building, Central, Hong Kong Mr. Rui Meng (Chairman) Mr. Mei Wenjue COMPLIANCE ADVISOR Mr. Chen Weiru Somerley Capital Limited 20/F, China Building, 29 Queen’s Road Central, REMUNERATION COMMITTEE Central, Hong Kong Mr. Chen Weiru (Chairman) Ms. Yang Huiyan LEGAL ADVISERS Mr. Mei Wenjue As to Hong Kong laws: Woo Kwan Lee & Lo NOMINATION COMMITTEE 26/F, Jardine House. -

The Public Banks and People's Bank of China: Confronting

Chapter 13 Godfrey Yeung THE PUBLIC BANKS AND PEOPLE’S BANK OF CHINA: CONFRONTING COVID-19 (IF NOT WITHOUT CONTROVERSY) he outbreak of Covid-19 in Wuhan and its subsequent dom- ino effects due to the lock-down in major cities have had a devastating effect on the Chinese economy. China is an Tinteresting case to illustrate what policy instruments the central bank can deploy through state-owned commercial banks (a form of ‘hybrid’ public banks) to buffer the economic shock during times of crisis. In addition to the standardized practice of liquidity injection into the banking system to maintain its financial viability, the Chi- nese central bank issued two top-down and explicit administra- tive directives to state-owned commercial banks: the minimum quota on lending to small- and medium-sized enterprises (MSEs) and non-profitable lending. Notwithstanding its controversy on loopholes related to such lending practices, these pro-active policy directives provide counter-cyclical lending and appear able to pro- vide short-term relief for SMEs from the Covid-19 shock in a timely manner. This has helped to mitigate the devastating impacts of the pandemic on the Chinese economy. 283 Godfrey Yeung INTRODUCTION The outbreak of Covid-19 leading to the lock-down in Wuhan on January 23, 2020 and the subsequent pandemic had significant im- pacts on the Chinese economy. China’s policy response regarding the banking system has helped to mitigate the devastating impacts of pandemic on the Chinese economy. Before we review the measures implemented by the Chinese gov- ernment, it is important for us to give a brief overview of the roles of two major group of actors (institutions) in the banking system. -

China Construction Bank 2018 Reduced U.S. Resolution Plan Public Section

China Construction Bank 2018 Reduced U.S. Resolution Plan Public Section 1 Table of Contents Introduction .................................................................................................................................................. 3 Overview of China Construction Bank Corporation ...................................................................................... 3 1. Material Entities .................................................................................................................................... 4 2. Core Business Lines ............................................................................................................................... 4 3. Financial Information Regarding Assets, Liabilities, Capital and Major Funding Sources .................... 5 3.1 Balance Sheet Information ........................................................................................................... 5 3.2 Major Funding Sources ................................................................................................................. 8 3.3 Capital ........................................................................................................................................... 8 4. Derivatives Activities and Hedging Activities ........................................................................................ 8 5. Memberships in Material Payment, Clearing and Settlement Systems ............................................... 8 6. Description of Foreign Operations ....................................................................................................... -

Annual Report 2009 Corporate Profi Le

This report does not constitute an offer to sell or the solicitation of an offer to buy any securities in the United States or any other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualifi cation under the securities laws of any such jurisdiction. No securities may be offered or sold in the United States absent registration or an applicable exemption from registration requirements. Any public offering of securities to be made in the United States will be made by means of a prospectus. Such prospectus will contain detailed information about the company making the offer and its management and fi nancial statements. No public offer of securities is to be made by the Company in the United States. 本報告僅供參考,並不構成在美國或任何其他司法權區提呈出售建議或招攬購買任何證券的建議,倘根據任何該等司法權區的 證券法未進行登記或獲批准而於上述地區進行該建議,招攬或發售即屬違法。未辦理登記手續或未獲適用登記規定豁免前,不得 在美國提呈或發售任何證券。凡在美國公開發售任何證券。均須以刊發招股章程的方式進行。該招股章程須載有提出有關發售的 公司、其管理層及財務報表的詳盡資料。本公司不會在美國公開發售任何證券。 Contents 2 Corporate Profi le 3 Chairman’s Statement 6 Business Overview 15 Management Discussion and Analysis 19 Biographical Details of Directors and Senior Management 23 Corporate Governance Report 28 Report of the Directors 41 Independent Auditor’s Report 43 Consolidated Balance Sheet 45 Balance Sheet 47 Consolidated Statement of Comprehensive Income 48 Consolidated Statement of Changes in Equity 49 Consolidated Cash Flow Statement 50 Notes to the Consolidated Financial Statements 142 Financial Summary 143 Corporate Information Country Garden Holdings Company Limited • Annual Report 2009 Corporate Profi le Country Garden Holdings Company Limited (“Country Garden” or the “Company”) together with its subsidiaries, (collectively, the “Group”) (stock code: 2007.HK) is one of China’s leading integrated property developers. The Group runs a centralized and standardized business model that comprises construction, decoration, project development, property management, as well as hotel development and management. -

Digital Transformation of Traditional Chinese Banks

Open Journal of Business and Management, 2020, 8, 68-77 https://www.scirp.org/journal/ojbm ISSN Online: 2329-3292 ISSN Print: 2329-3284 Digital Transformation of Traditional Chinese Banks Ziyun Shu1*#, Shuk-Yu Tsang2*, Taoxuan Zhao3* 1Sichuan International Studies University, Chongqing, China 2Po Leung Kuk Celine Ho Yam Tong College, Hongkong, China 3Tianjin Yaohua High School, Tianjin, China How to cite this paper: Shu, Z.Y., Tsang, Abstract S.-Y. and Zhao, T.X. (2020) Digital Trans- formation of Traditional Chinese Banks. The paper examines the status quo of traditional Chinese banks under the at- Open Journal of Business and Manage- tack of the new digital giants in China—Alibaba (Alipay) and Tencent (We- ment, 8, 68-77. Chat). Traditional banks urgently need their own analysis and corresponding https://doi.org/10.4236/ojbm.2020.81005 changes in order to stand out in the tide of the times and not be oppressed by Received: September 16, 2019 digital giants. Banks have also launched their own e-commerce platform, but Accepted: December 6, 2019 there are many shortcomings. Based on the analysis of characteristics of digi- Published: December 9, 2019 tal platforms, the paper put forward corresponding suggestions to banks in Copyright © 2020 by author(s) and the ecosystem to better cope with future opportunities and challenges. Using Scientific Research Publishing Inc. a case study approach showing the traditional services provided by CCB’s This work is licensed under the Creative mobile banking (China Construction Bank, one of the famous traditional Commons Attribution-NonCommercial International License (CC BY-NC 4.0). -

Annual Report 2019 Mobility

(a joint stock limited company incorporated in the People’s Republic of China with limited liability) Stock Code: 1766 Annual Report Annual Report 2019 Mobility 2019 for Future Connection Important 1 The Board and the Supervisory Committee of the Company and its Directors, Supervisors and Senior Management warrant that there are no false representations, misleading statements contained in or material omissions from this annual report and they will assume joint and several legal liabilities for the truthfulness, accuracy and completeness of the contents disclosed herein. 2 This report has been considered and approved at the seventeenth meeting of the second session of the Board of the Company. All Directors attended the Board meeting. 3 Deloitte Touche Tohmatsu CPA LLP has issued standard unqualified audit report for the Company’s financial statements prepared under the China Accounting Standards for Business Enterprises in accordance with PRC Auditing Standards. 4 Liu Hualong, the Chairman of the Company, Li Zheng, the Chief Financial Officer and Wang Jian, the head of the Accounting Department (person in charge of accounting affairs) warrant the truthfulness, accuracy and completeness of the financial statements in this annual report. 5 Statement for the risks involved in the forward-looking statements: this report contains forward-looking statements that involve future plans and development strategies which do not constitute a substantive commitment by the Company to investors. Investors should be aware of the investment risks. 6 The Company has proposed to distribute a cash dividend of RMB0.15 (tax inclusive) per share to all Shareholders based on the total share capital of the Company of 28,698,864,088 shares as at 31 December 2019. -

Inward Remittance — Quick Reference Guide

Inward Remittance — Quick Reference Guide How to instruct a Remitting Bank to remit funds to your account with BOCHK Please instruct the Remitting Bank to send a detailed payment instruction in SWIFT MT103 format to us using the below SWIFT BIC of BOCHK. To designate BOCHK as the Beneficiary’s bank, please provide below details. SWIFT BIC: BKCHHKHHXXX Bank Name: BANK OF CHINA (HONG KONG) LIMITED, HONG KONG Main Address: BANK OF CHINA TOWER, 1 GARDEN ROAD, CENTRAL, HONG KONG Bank Code: 012 (for local bank transfer CHATS / RTGS only) Please provide details of your account for depositing the remittance proceeds. Beneficiary’s Account Number: Please provide the 14-digit account number to deposit the incoming funds. (Please refer to Part 3 for further explanation.) Beneficiary’s Name: Please provide the name of the above account number as in our record. Major Clearing Arrangement and Correspondent Banks of BOCHK CCY SWIFT BIC Name of Bank Details Bank of China (Hong Kong) Ltd - RMB BKCHHKHH838 BOCHK’s CNAPS No.: 9895 8400 1207 Clearing Centre CNY BKCHCNBJXXX Bank of China Head Office, Beijing Direct Participant of CIPS (Payment through CIPS) BKCHCNBJS00 Bank of China, Shanghai Correspondent Bank of BOCHK in the mainland CCY SWIFT BIC Name of Bank CCY SWIFT BIC Name of Bank AUD BKCHAU2SXXX Bank of China, Sydney NOK DNBANOKKXXX DNB Bank ASA, Oslo Bank Islam Brunei Darussalam NZD BND BIBDBNBBXXX ANZBNZ22XXX ANZ National Bank Ltd, Wellington Berhad CAD BKCHCATTXXX Bank of China (Canada), Toronto SEK NDEASESSXXX Nordea Bank AB (Publ), Stockholm CHF UBSWCHZH80A UBS Switzerland AG, Zurich SGD BKCHSGSGXXX Bank of China, Singapore DKK DABADKKKXXX Danske Bank A/S, Copenhagen THB BKKBTHBKXXX Bangkok Bank Public Co Ltd, Bangkok Commerzbank AG, Frankfurt AM COBADEFFXXX CHASUS33XXX JPMorgan Chase Bank NA, New York EUR Main BKCHDEFFXXX Bank of China, Frankfurt USD CITIUS33XXX Citibank New York GBP BKCHGB2LXXX Bank of China, London BOFAUS3NXXX Bank of America, N.A. -

Made in China, Financed in Hong Kong

China Perspectives 2007/2 | 2007 Hong Kong. Ten Years Later Made in China, financed in Hong Kong Anne-Laure Delatte et Maud Savary-Mornet Édition électronique URL : http://journals.openedition.org/chinaperspectives/1703 DOI : 10.4000/chinaperspectives.1703 ISSN : 1996-4617 Éditeur Centre d'étude français sur la Chine contemporaine Édition imprimée Date de publication : 15 avril 2007 ISSN : 2070-3449 Référence électronique Anne-Laure Delatte et Maud Savary-Mornet, « Made in China, financed in Hong Kong », China Perspectives [En ligne], 2007/2 | 2007, mis en ligne le 08 avril 2008, consulté le 28 octobre 2019. URL : http://journals.openedition.org/chinaperspectives/1703 ; DOI : 10.4000/chinaperspectives.1703 © All rights reserved Special feature s e v Made In China, Financed i a t c n i e In Hong Kong h p s c r e ANNE-LAURE DELATTE p AND MAUD SAVARY-MORNET Later, I saw the outside world, and I began to wonder how economic zones and then progressively the Pearl River it could be that the English, who were foreigners, were Delta area. In 1990, total Hong Kong investments repre - able to achieve what they had achieved over 70 or 80 sented 80% of all foreign investment in the Chinese years with the sterile rock of Hong Kong, while China had province. The Hong Kong economy experienced an accel - produced nothing to equal it in 4,000 years… We must erated transformation—instead of an Asian dragon specialis - draw inspiration from the English and transpose their ex - ing in electronics, it became a service economy (90% of ample of good government into every region of China. -

June 2021 Trade Bulletin

June 21, 2021 Highlights of This Month’s Edition • U.S.-China Trade: In April 2021, U.S. goods exports to China were up 36.7 percent year-on-year, continuing a marked recovery from the pandemic in spite of ongoing bilateral trade tensions. • New EO Redefines and Expands Investment Restrictions: The Biden Administration has revised and expanded prohibitions on U.S. investment in Chinese companies which act contrary to U.S. national security; the list of companies subject to restrictions has grown from 44 to 59, with 18 companies removed and 33 added.* • Multilateral and Bilateral Developments: G7 joint statement highlights shared concerns about Chinese economic and human rights policies; APEC communiqué expresses common desire to improve vaccine access for Asia-Pacific economies; U.S. economic trade officials hold calls with their Chinese counterparts. • Commodity Prices Surge: China’s National Development and Reform Commission published a five-year action plan on pricing reform while regulators attempt to address spiking commodities prices. • In Focus – Wealth Management: Wall Street seizes on China’s $18.9 trillion asset management market as the Chinese government accelerates regulatory approvals to attract foreign capital and expertise. Contents U.S.-China Goods Trade Continues to Show Strong Recovery .................................................................................2 U.S. Ban on Investment in Chinese Military Companies Expands ............................................................................2 On China, Biden Administration Rallies Partners and Initiates Bilateral Dialog .......................................................5 CCP Seeks to Strengthen Commodity Price Controls ................................................................................................6 In Focus: Wall Street Seizes on China’s Burgeoning Wealth Management Sector ...................................................7 * Correction: An earlier version of the June 2021 Economics and Trade Bulletin said 17 companies were removed and 32 added. -

Announcement on the Resolutions of the Meeting of the Board of Directors (21 July 2020)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. (A joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 939) (USD Preference Shares Stock Code: 4606) Announcement on the Resolutions of the Meeting of the Board of Directors (21 July 2020) The meeting (the “Meeting”) of the board of directors (the “Board”) of China Construction Bank Corporation (the “Bank”) was held onsite on 21 July 2020 in Beijing. The Meeting was chaired by Mr. Tian Guoli, chairman of the Board. 14 directors were eligible to attend the Meeting and 13 of them attended the Meeting in person. Mr. Zhang Gengsheng appointed Mr. Tian Guoli as his proxy to attend the Meeting and vote on his behalf. The Meeting was convened in compliance with the provisions of the Company Law of the People’s Republic of China and the Articles of Association of China Construction Bank Corporation (the “Articles of Association”) and other relevant rules. The following resolutions were considered and approved at the Meeting: I. Proposal regarding the Appointment of Mr. Lyu Jiajin as Executive Vice President of the Bank Voting results: voted in favour: 14 votes, voted against: 0 vote, abstained from voting: 0 vote. Opinion of the independent non-executive directors in respect of this resolution: Agreed. -

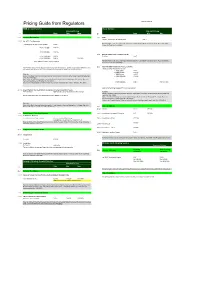

Pricing Guide from Regulators Version 2013-03

Pricing Guide from Regulators Version 2013-03 RMB Account Service Trade Service Standard Pricing Standard Pricing Z1 Rate Min. Max. Z3 Rate Min. Max. Z1.1 Outward Remittance Z3.1 Draft Issuance of Bank Accepted Draft (BAD) 0.05% Z1.1.1 Via HVPS - Per Transaction Ruled by: Notice of the State Planning Commission and the People's Bank of China on further Rules of Banking - Handling Fee: Amount <= CNY10,000.- CNY5.- Settlement Tariff (No. 184 [1996]) <= CNY100,000.- CNY10.- <= CNY500,000.- CNY15.- Z3.2 Bank Accepted Draft / Commercial Draft <= CNY1,000,000.- CNY20.- Per Batch CNY7.- > CNY1,000,000.- 0.002% CNY200.- Ruled by: Notice of the State Planning Commission and the People's Bank of China on further Rules of Banking Plus additional handling charge CNY0.50.- Settlement Tariff (No. 184 [1996]) Z3.3 Domestic RMB Remittance (Through CNAPS) Note: The bank will use the best approach to process your payment instruction. However, the procedure in different city may vary, which in term affects our price. We encourage you to check with the related branch for the exact price. Handling Charge: Transaction Amount <= RMB10,000.- CNY5.- <= RMB100,000.- CNY10.- Ruled by: <= RMB500,000.- CNY15.- Notice of the State Planning Commission and the People's Bank of China on further Rules of Banking Settlement <= RMB1,000,000.- CNY20.- Tariff (No. 184 [1996]) Notice of the State Planning Commission and the People's Bank of China on Making the Fee Charge Rates for Electronic Remittance and Transfer (No. 791 [2001]). > RMB1,000,000.- 0.002% Flat CNY200.- Notice of the People's Bank of China on Rules of Electronic Remittance and Transfe Tariff (No. -

Bank of China (UK) Limited for Apparent Violations of the Sudan Sanctions Regulations

DEPARTMENT OF THE TREASURY WASHINGTON, D.C. Enforcement Release: August 26, 2021 OFAC Enters Into a $2,329,991 Settlement with Bank of China (UK) Limited for Apparent Violations of the Sudan Sanctions Regulations Bank of China (UK) Limited (“BOC UK”), located in London, the United Kingdom, has agreed to remit $2,329,991 to settle its potential civil liability for processing transactions in apparent violation of OFAC’s now-repealed Sudan sanctions program, which prohibited the exportation, directly or indirectly, to Sudan of any goods, technology, or services from the United States. Specifically, between September 4, 2014 and February 24, 2016, BOC UK exported financial services from the U.S. by processing 111 commercial transactions totaling $40,599,184 through the U.S. financial system on behalf of parties in Sudan. This settlement amount reflects OFAC’s determination that BOC UK’s self-identified apparent violations were voluntarily self-disclosed and constitute a non- egregious case. Description of the Conduct Leading to the Apparent Violations As a result of an internal investigation triggered by a Sudanese customer’s request to process a payment, BOC UK conducted a lookback review to identify potential Sudan-related transactions. That review identified two customers of BOC UK who had engaged in Sudan-related transactions that BOC UK processed through the U.S. financial system. One of the customers was an entity incorporated outside of Sudan that maintained a branch in Sudan that, in 2014, became the instructing party and account signatory to transactions processed by BOC UK on behalf of the entity. Written communications from that customer contained references to the location of the branch in Sudan.