The Time for Private Equity Divestments in Spain 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mutual Funds As Venture Capitalists? Evidence from Unicorns

NBER WORKING PAPER SERIES MUTUAL FUNDS AS VENTURE CAPITALISTS? EVIDENCE FROM UNICORNS Sergey Chernenko Josh Lerner Yao Zeng Working Paper 23981 http://www.nber.org/papers/w23981 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 October 2017 We thank Slava Fos (discussant), Jesse Fried, Jarrad Harford, William Mann, Ramana Nanda, Morten Sorensen, Xiaoyun Yu (discussant), and conference participants at the Southern California Private Equity Conference, London Business School Private Equity Symposium, and the FRA Meeting for helpful comments. We thank Michael Ostendorff for access to the certificates of incorporation collected by VCExperts. We are grateful to Jennifer Fan for helping us better interpret and code the certificates of incorporation. We thank Quentin Dupont, Luna Qin, Bingyu Yan, and Wyatt Zimbelman for excellent research assistance. Lerner periodically receives compensation for advising institutional investors, private equity firms, corporate venturing groups, and government agencies on topics related to entrepreneurship, innovation, and private capital. Lerner acknowledges support from the Division of Research of Harvard Business School. Zeng acknowledges support from the Foster School of Business Research Fund. The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research. NBER working papers are circulated for discussion and comment purposes. They have not been peer-reviewed or been subject to the review by the NBER Board of Directors that accompanies official NBER publications. © 2017 by Sergey Chernenko, Josh Lerner, and Yao Zeng. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. -

Corporate Governance Positions and Responsibilities of the Directors and Nominees to the Board of Directors

CORPORATE GOVERNANCE POSITIONS AND RESPONSIBILITIES OF THE DIRECTORS AND NOMINEES TO THE BOARD OF DIRECTORS LIONEL ZINSOU -DERLIN (a) Born on October 23, 1954 Positions and responsibilities as of December 31, 2014 Age: 60 Positions Companies Countries Director (term of office DANONE SA (b) France from April 29, 2014 to the end of the Shareholders’ Meeting to approve the 2016 financial statements) Chairman and Chair- PAI PARTNERS SAS France man of the Executive Business address: Committee 232, rue de Rivoli – 75001 Paris – France Member of the Number of DANONE shares held Investment Committee as of December 31, 2014: 4,000 Director INVESTISSEURS & PARTENAIRES Mauritius Independent Director I&P AFRIQUE ENTREPRENEURS Mauritius Dual French and Beninese nationality KAUFMAN & BROAD SA (b) France PAI SYNDICATION GENERAL PARTNER LIMITED Guernsey Principal responsibility: Chairman of PAI partners SAS PAI EUROPE III GENERAL PARTNER LIMITED Guernsey Personal backGround – PAI EUROPE IV GENERAL PARTNER LIMITED Guernsey experience and expertise: Lionel ZINSOU-DERLIN, of French and Beninese PAI EUROPE V GENERAL PARTNER LIMITED Guernsey nationality, is a graduate from the Ecole Normale PAI EUROPE VI GENERAL PARTNER LIMITED Guernsey Supérieure (Ulm), the London School of Economics and the Institut d’Etudes Politiques of Paris. He holds Chairman and Member LES DOMAINES BARONS DE ROTHSCHILD SCA France a master degree in Economic History and is an Asso- of the Supervisory (LAFITE) ciate Professor in Social Sciences and Economics. Board Member of the Advisory MOET HENNESSY France He started his career as a Senior Lecturer and Pro- Council fessor of Economics at Université Paris XIII. Member of the CERBA EUROPEAN LAB SAS France From 1984 to 1986, he became an Advisor to the French Supervisory Board Ministry of Industry and then to the Prime Minister. -

Private Debt in Asia: the Next Frontier?

PRIVATE DEBT IN ASIA: THE NEXT FRONTIER? PRIVATE DEBT IN ASIA: THE NEXT FRONTIER? We take a look at the fund managers and investors turning to opportunities in Asia, analyzing funds closed and currently in market, as well as the investors targeting the region. nstitutional investors in 2018 are have seen increased fundraising success in higher than in 2016. While still dwarfed Iincreasing their exposure to private recent years. by the North America and Europe, Asia- debt strategies at a higher rate than focused fundraising has carved out a ever before, with many looking to both 2017 was a strong year for Asia-focused significant niche in the global private debt diversify their private debt portfolios and private debt fundraising, with 15 funds market. find less competed opportunities. Beyond reaching a final close, raising an aggregate the mature and competitive private debt $6.4bn in capital. This is the second highest Sixty percent of Asia-focused funds closed markets in North America and Europe, amount of capital raised targeting the in 2017 met or exceeded their initial target credit markets in Asia offer a relatively region to date and resulted in an average size including SSG Capital Partners IV, the untapped reserve of opportunity, and with fund size of $427mn. Asia-focused funds second largest Asia-focused fund to close the recent increase in investor interest accounted for 9% of all private debt funds last year, securing an aggregate $1.7bn, in this area, private debt fund managers closed in 2017, three-percentage points 26% more than its initial target. -

A Listing of PSERS' Investment Managers, Advisors, and Partnerships

Pennsylvania Public School Employees’ Retirement System Roster of Investment Managers, Advisors, and Consultants As of March 31, 2015 List of PSERS’ Internally Managed Investment Portfolios • Bloomberg Commodity Index Overlay • Gold Fund • LIBOR-Plus Short-Term Investment Pool • MSCI All Country World Index ex. US • MSCI Emerging Markets Equity Index • Risk Parity • Premium Assistance • Private Debt Internal Program • Private Equity Internal Program • Real Estate Internal Program • S&P 400 Index • S&P 500 Index • S&P 600 Index • Short-Term Investment Pool • Treasury Inflation Protection Securities • U.S. Core Plus Fixed Income • U.S. Long Term Treasuries List of PSERS’ External Investment Managers, Advisors, and Consultants Absolute Return Managers • Aeolus Capital Management Ltd. • AllianceBernstein, LP • Apollo Aviation Holdings Limited • Black River Asset Management, LLC • BlackRock Financial Management, Inc. • Brevan Howard Asset Management, LLP • Bridgewater Associates, LP • Brigade Capital Management • Capula Investment Management, LLP • Caspian Capital, LP • Ellis Lake Capital, LLC • Nephila Capital, Ltd. • Oceanwood Capital Management, Ltd. • Pacific Investment Management Company • Perry Capital, LLC U.S. Equity Managers • AH Lisanti Capital Growth, LLC Pennsylvania Public School Employees’ Retirement System Page 1 Publicly-Traded Real Estate Securities Advisors • Security Capital Research & Management, Inc. Non-U.S. Equity Managers • Acadian Asset Management, LLC • Baillie Gifford Overseas Ltd. • BlackRock Financial Management, Inc. • Marathon Asset Management Limited • Oberweis Asset Management, Inc. • QS Batterymarch Financial Management, Inc. • Pyramis Global Advisors • Wasatch Advisors, Inc. Commodity Managers • Black River Asset Management, LLC • Credit Suisse Asset Management, LLC • Gresham Investment Management, LLC • Pacific Investment Management Company • Wellington Management Company, LLP Global Fixed Income Managers U.S. Core Plus Fixed Income Managers • BlackRock Financial Management, Inc. -

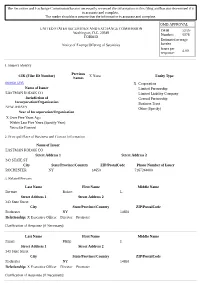

Form 3 FORM 3 UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

SEC Form 3 FORM 3 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 OMB APPROVAL INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF OMB Number: 3235-0104 Estimated average burden SECURITIES hours per response: 0.5 Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940 1. Name and Address of Reporting Person* 2. Date of Event 3. Issuer Name and Ticker or Trading Symbol Requiring Statement EASTMAN KODAK CO [ EK ] Chen Herald Y (Month/Day/Year) 09/29/2009 (Last) (First) (Middle) 4. Relationship of Reporting Person(s) to Issuer 5. If Amendment, Date of Original Filed C/O KOHLBERG KRAVIS ROBERTS & (Check all applicable) (Month/Day/Year) CO. L.P. X Director 10% Owner Officer (give title Other (specify 2800 SAND HILL ROAD, SUITE 200 below) below) 6. Individual or Joint/Group Filing (Check Applicable Line) X Form filed by One Reporting Person (Street) MENLO Form filed by More than One CA 94025 Reporting Person PARK (City) (State) (Zip) Table I - Non-Derivative Securities Beneficially Owned 1. Title of Security (Instr. 4) 2. Amount of Securities 3. Ownership 4. Nature of Indirect Beneficial Ownership Beneficially Owned (Instr. 4) Form: Direct (D) (Instr. 5) or Indirect (I) (Instr. 5) Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities) 1. Title of Derivative Security (Instr. 4) 2. Date Exercisable and 3. Title and Amount of Securities 4. 5. 6. Nature of Indirect Expiration Date Underlying Derivative Security (Instr. 4) Conversion Ownership Beneficial Ownership (Month/Day/Year) or Exercise Form: (Instr. -

Advanced Mobility Market Update

Advanced Mobility Market Update February 2018 Electric Ecosystem Mobility-as Autonomous Data & Vehicles Intelligence -a-Service Infrastructure Analytics About Greentech Capital Advisors Our mission is to empower companies and investors who are creating a more efficient and sustainable global infrastructure. We are purpose-built to ensure that our clients achieve success. We have deeply experienced senior bankers and investment professionals who are sector experts and understand our clients' industry and needs. We reach a vast global network of buyers, growth companies, asset owners and investors, and thereby provide clients with more ways to succeed through a deeper relationship network. We have directly relevant transaction experience which enables us to find creative structures and solutions to close transactions. We are an expert team of 55 professionals working seamlessly on our clients' behalf in New York, Zurich and San Francisco and through a strategic partnership in Japan. Our team of experienced bankers and investment professionals provides conflict-free advice and thoughtful, innovative solutions, and we do so with an intensely focused effort that does not stop until our clients achieve success. Greentech Capital Advisors / 1 Advanced Mobility Market Update Recent News Business > Autoliv will spin-off of its Electronics business segment–now to be named Developments Veoneer–to create a new, independent, publicly traded company that will focus on ADAS and autonomous driving (Cision) > Bosch is establishing a new dedicated mobility -

VP for VC and PE.Indd

EUROPEAN VENTURE PHILANTHROPY ASSOCIATION A guide to Venture PhilAnthroPy for Venture Capital and Private Equity investors Ashley Metz CummingS and Lisa Hehenberger JUNE 2011 2 A guidE to Venture Philanthropy for Venture Capital and Private Equity investors LETTER fROM SERgE RAICHER 4 Part 2: PE firms’ VP engAgement 20 ContentS Executive Summary 6 VC/PE firms and Philanthropy PART 1: Introduction 12 Models of engagement in VP Purpose of the document Model 1: directly support Social Purpose Organisations Essence and Role of Venture Philanthropy Model 2: Invest in or co-invest with a VP Organisation Venture Philanthropy and Venture Capital/Private Equity Model 3: found or co-found a VP Organisation Published by the European Venture Philanthropy Association This edition June 2011 Copyright © 2011 EVPA Email : [email protected] Website : www.evpa.eu.com Creative Commons Attribution-Noncommercial-No derivative Works 3.0 You are free to share – to copy, distribute, display, and perform the work – under the following conditions: Attribution: You must attribute the work as A gUIdE TO VENTURE PHILANTHROPY fOR VENTURE CAPITAL ANd PRIVATE EqUITY INVESTORS Copyright © 2011 EVPA. Non commercial: You may not use this work for commercial purposes. No derivative Works: You may not alter, transform or build upon this work. for any reuse or distribution, you must make clear to others the licence terms of this work. ISbN 0-9553659-8-8 Authors: Ashley Metz Cummings and dr Lisa Hehenberger Typeset in Myriad design and typesetting by: Transform, 115b Warwick Street, Leamington Spa CV32 4qz, UK Printed and bound by: drukkerij Atlanta, diestsebaan 39, 3290 Schaffen-diest, belgium This book is printed on fSC approved paper. -

Joshua Smith

Joshua Smith Associate London | 160 Queen Victoria Street, London, UK EC4V 4QQ T +44 20 7184 7824 | F +44 20 7184 7001 [email protected] Services Mergers and Acquisitions > Private Equity > Corporate Finance and Capital Markets > Corporate Governance > Joshua Smith practices in the area of corporate law, advising on a wide range of domestic and cross-border mergers and acquisitions, private equity transactions, joint ventures, fundraisings, public offerings, reorganisations and other general corporate matters. Mr. Smith trained at Dechert and qualified as a solicitor in 2014. EXPERIENCE Hellenic Telecommunications Organization S.A (OTE) in connection with the sale of its stake in fixed telecommunications operator Telekom Romania for €268 million to Orange Romania. ICTS International N.V. and ABC Technologies B.V. on (i) a US$60 million equity investment by an affiliate of TPG Global into ABC, a subsidiary of ICTS and the owner of Au10tix Limited, a leader in the ID documentation and know-your-customer on- boarding automation software industry and (ii) a further US$20 million equity investment by Oak HC/FT into ABC and related shareholder agreements. The transactions valued Au10tix at US$280 million. A substantial family office as investor in a substantive venture investment in a UK ticketing and events hosting company. Centaur Media plc, as part of its strategic divestment program on the sale of (i) its financial services division to Metropolis Group; (ii) Centaur Human Resources Limited, to DVV Media International Ltd; (iii) Centaur Media Travel and Meetings Limited, to Northstar Travel Media UK Limited; and (iv) its engineering portfolio, including The Engineer and Subcon, to Mark Allen Group. -

The Securities and Exchange Commission Has Not Necessarily Reviewed the Information in This Filing and Has Not Determined If It Is Accurate and Complete

The Securities and Exchange Commission has not necessarily reviewed the information in this filing and has not determined if it is accurate and complete. The reader should not assume that the information is accurate and complete. OMB APPROVAL UNITED STATES SECURITIES AND EXCHANGE COMMISSION OMB 3235- Washington, D.C. 20549 Number: 0076 FORM D Estimated average Notice of Exempt Offering of Securities burden hours per 4.00 response: 1. Issuer's Identity Previous CIK (Filer ID Number) X None Entity Type Names 0000031235 X Corporation Name of Issuer Limited Partnership EASTMAN KODAK CO Limited Liability Company Jurisdiction of General Partnership Incorporation/Organization Business Trust NEW JERSEY Other (Specify) Year of Incorporation/Organization X Over Five Years Ago Within Last Five Years (Specify Year) Yet to Be Formed 2. Principal Place of Business and Contact Information Name of Issuer EASTMAN KODAK CO Street Address 1 Street Address 2 343 STATE ST City State/Province/Country ZIP/PostalCode Phone Number of Issuer ROCHESTER NY 14650 7167244000 3. Related Persons Last Name First Name Middle Name Berman Robert L. Street Address 1 Street Address 2 343 State Street City State/Province/Country ZIP/PostalCode Rochester NY 14650 Relationship: X Executive Officer Director Promoter Clarification of Response (if Necessary): Last Name First Name Middle Name Faraci Philip J. Street Address 1 Street Address 2 343 State Street City State/Province/Country ZIP/PostalCode Rochester NY 14650 Relationship: X Executive Officer Director Promoter Clarification of Response (if Necessary): Last Name First Name Middle Name Haag Joyce P. Street Address 1 Street Address 2 343 State Street City State/Province/Country ZIP/PostalCode Rochester NY 14650 Relationship: X Executive Officer Director Promoter Clarification of Response (if Necessary): Last Name First Name Middle Name Kruchten Brad W. -

Global Fund Finance Symposium

8TH ANNUAL Global Fund Finance Symposium MARCH 21, 2018 NAME _________ GRAND HYATT, NEW YORK 8TH ANNUAL Global Fund Finance Symposium TABLE OF CONTENTS Letter from the Chairman ...3 Agenda at a Glance ............. 4 Session Details .................... 5 Sponsors ............................ 13 Speakers ............................ 31 FFA Leadership .................. 78 2 LETTER FROM THE CHAIRMAN Industry colleagues, The WFF committees have a great set of events planned for As I sit here on a Sunday night, with a glass of pinot in hand, 2018, and a special thanks to each of the firms that are helping trying to think of how to best encapsulate the feeling of the to sponsor these events. To help broaden the audience to 2017 market, my mind keeps wandering off to the pleading include more male participation, we’ve structured a great words of RiRi….. feature panel here today as part of the symposium. It’s my early favorite for winner of Best Panel of the day. “Please don’t stop the, please don’t stop the, please don’t stop the music” Couple of housekeeping notes - this year, we’ll be hosting our Rihanna 2007 (…and investors everywhere in 2017) Sponsor Dinner in London prior to the European symposium. Markets across the board were up, volatility was low, three The European fund finance market continues to grow, and the quarters of global GDP saw a pick-up in year-on-year terms in Board is looking forward to an evening there to both thank 2017, and the IMF is projecting stronger global GDP growth in our participating sponsors, but importantly provide a forum 2018 & 19 than 2017. -

Private Equity 05.23.12

This document is being provided for the exclusive use of SABRINA WILLMER at BLOOMBERG/ NEWSROOM: NEW YORK 05.23.12 Private Equity www.bloombergbriefs.com BRIEF NEWS, ANALYSIS AND COMMENTARY CVC Joins Firms Seeking Boom-Era Size Funds QUOTE OF THE WEEK BY SABRINA WILLMER CVC Capital Partners Ltd. hopes its next European buyout fund will nearly match its predecessor, a 10.75 billion euro ($13.6 billion) fund that closed in 2009, according to two “I think it would be helpful people familiar with the situation. That will make it one of the largest private equity funds if Putin stopped wandering currently seeking capital. One person said that CVC European Equity Partners VI LP will likely aim to raise 10 around bare-chested.” billion euros. The firm hasn’t yet sent out marketing materials. Two people said they expect it to do so — Janusz Heath, managing director of in the second half. Mary Zimmerman, an outside spokeswoman for CVC Capital, declined Capital Dynamics, speaking at the EMPEA to comment. conference on how Russia might help its reputation and attract more private equity The London-based firm would join only a few other firms that have closed or are try- investment. See page 4 ing to raise new funds of similar size to the mega funds raised during the buyout boom. Leonard Green & Partners’s sixth fund is expected to close shortly on more than $6 billion, more than the $5.3 billion its last fund closed on in 2007. Advent International MEETING TO WATCH Corp. is targeting 7 billion euros for its seventh fund, larger than its last fund, and War- burg Pincus LLC has a $12 billion target on Warburg Pincus Private Equity XI LP, the NEW JERSEY STATE INVESTMENT same goal as its predecessor. -

Alternative Investment News November 10, 2008

ain111008 6/11/08 19:18 Page 1 NOVEMBER 1O, 2008 LEHMAN/NOMURA PRIME BROKER VOL. IX, NO. 45 INTEGRATION HITS SYSTEMS SNAG Credit Suisse Cuts Combining the prime brokerage businesses of Nomura FoF Headcount Holdings and Lehman Brothers has reportedly hit a costly and The firm has trimmed 10 staffers from its fund of funds unit, with most of the unexpected snag that could delay full integration for an culled positions based in Europe. undetermined time, potentially stretching to several months or See story, page 9 over a year. An official involved with the merger integration plans told AIN that in Nomura’s acquisition of Lehman’s Asia, India and At Press Time European operations, it received the software for Lehman’s cash Zaragoza Likes Biotechs 2 prime brokerage system—which includes trading, analytics and (continued on page 19) The Americas Nonprofits To Add HFs 4 MELLON SUSPENDS SANCTUARY FUNDS Peloton Pro Sets Up Shop 4 Mellon Global Alternative Investments has suspended dealings on the $344 million Mellon RCG Bullish On Asia 6 Sanctuary Fund and the $426 million Mellon Sanctuary Fund II—its flagship event-driven Startup Readies Managed Account 7 and relative-value funds of hedge funds—as liquidity concerns have arisen from Europe unprecedented volatility in the markets. A number of the underlying funds “have invoked German Shop Revisits Launches 9 provisions that are intended for periods such as this where acute market illiquidity is coupled Pioneer Keen On Green 10 with extreme selling pressure,” stated an email sent to AIN by Spokesman Jamie Brookes. Mulvaney Sees Record Highs 11 (continued on page 20) Asia Pacific EX-FSA EXEC: SMALLER FUNDS NEED Infrastructure Firm Hires Trio 12 CLOSER SUPERVISION Japan Launch Pushed Back 13 The U.K.’s Financial Services Authority should monitor the behaviour of smaller hedge Middle East & Africa fund firms more closely because malpractice is more likely to go unnoticed in these firms.