News Release Polaris Industries Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

INTERNATIONAL TRUCK & ENGINE COW, Ooiootoaoa

Page: 6 Friday August 22, 2003 Docket: 01-022Nll-B Comment Date Date of Number Received SubmitterlFinnlSubject Document ___-__________ 09003 0312612003 1 01123l2001 DANIEL'S CERTIFIED WAHLING INC. 09004 03/26/2003 2 01/24/2001 LIPPERT COMPONENT MFG. INC. 09005 0312612003 1 0411 012001 DAN GURNEY ALLIGATOR MOTORCYCLES INC. 09006 0312612003 1 0211 612000 CYCLE CONCEPTS OF NEW YORK INC. 09007 0312612003 2 04103l2002 IRISBUS 09008 0312612003 STEPHAN J. SPETH 10 04/26/2002 DAIMLER CYRYSLER 09009 0312612003 9 04/26/2002 INTERNATIONAL TRUCK & ENGINE CON. 090 10 0312612003 ARTHUR DELAROSA 2 0510612002 VOLVO 0901 1 0312612003 SUZANNE K. PETERSON 3 0411 112002 VICTORY MOTORCYCLES USA 090 12 0312612003 42 0511712002 GENERAL MOTORS (GM) USG 3680 090 13 0312612003 LOUIS J. CARLIN 43 0511712002 GENERAL MOTORS (GM) USG 3682 090 14 03l2612003 PETER M. YI 5 05102l2002 DREAM TOUR 090 15 0312612003 2 05/02/2002 ADVANCED TRANSP. TECH. R & D 09016 03/26/2003 3 0410412002 B AND M TRAILER SALES 090 17 03l2612003 KEVIN E. KIRSCHKE 20 0513 112002 FORD MOTOR CO. 09018 03l2612003 2 ooiootoaoa PATRIOT MOTORCYCLES 09019 0312612003 RICHARD KEMPF 9 0lI2812002 INTERNATIONAL TRUCK & ENGINE COW, GENERAL MOTORS NORTH AMERICA Safety Center May 17, 2002 01- USG 3682 Office of the Administrator National Highway Traffic Safety Administration 400 Seventh Street, SW Washington, DC 20590 Attention: Mr. George Entwistle, VIN Coordinator Subject: Update of General Motors Vehicle Identification Number decoding for 2003 Model Year Dear Mr. Entwistle: The latest revision of the General Motors Vehicle Identification Numbering (VIN) Standard for 2003 model year dated May, 2002 is submitted per the VIN reporting requirements of 49 CFR Part 565.7. -

Modern American Muscle Victory Motorcycles 2017

MODERN AMERICAN MUSCLE VICTORY MOTORCYCLES 2017 Closed course. Professional rider. Do not attempt. 04 2017 MODEL LINEUP 08 VICTORY OCTANE 12 VICTORY HAMMER S 14 VICTORY GUNNER 16 VICTORY HIGH-BALL 18 VICTORY VEGAS 20 VICTORY MAGNUM 24 VICTORY CROSS COUNTRY TOUR 26 VICTORY TECHNICAL FAQ 30 VICTORY APPAREL 32 VICTORY ACCESSORIES 34 SPECIFICATIONS 02 VICTORY MOTORCYCLES ‘17 *Overseas model shown with optional extras TABLE OF CONTENTS 03 OCTANE® HAMMER® S VICTORY GUNNER® Suede Super Steel Gray White Graphic over Gloss Black Suede Green OCTANE® VEGAS® HIGH-BALL® Gloss Black with Racing Stripes Gloss Black Sunset Red Suede Black Nuclear Sunset Orange MAGNUM® MAGNUM® ® Gloss Black Habanero Inferno CROSS COUNTRY TOUR Turbo Silver/Gloss Black 04 VICTORY MOTORCYCLES ‘17 05 JUST WHAT YOU NEED TO GO FAST THE MODERN AMERICAN MUSCLEBIKE PUTS PERFORMANCE FIRST 06 VICTORY MOTORCYCLES ‘17 Closed course. Professional rider. Do not attempt. 1200CC 07 Named for the number of turns along the 20 km ® public road that forms the Pikes Peak Hill Climb racecourse, Project 156 is powered by a race-prepared OCTANE version of the liquid-cooled V-Twin that motivates the new Victory POWER TO BURN Octane production motorcycle. Go ahead and light up that rear tire. Octane makes it easy by following the classic American musclecar formula: a powerful motor in a lightweight chassis. What’s left is just what you need Take away the bored-out cylinders to go very fast and nothing else. and prototype billet heads, and the Project 156 powerplant is remarkably similar to the stock Octane engine. The crankcases and bottom end are identical, for example, and the transmission is shared, too. -

Minnesota Dition S Remiere E FREE Minnesota’ P TAKE ONE

VOLUME 1 ISSUE 1 DECEMBER 2009 MAGAZINE R MINNESOTA DITION S REMIERE E FREE MINNESOTA’ P TAKE ONE Runs Rallys nat’l & local events AMERICA’S FASTEST GROWING BIKER PUBLICATION CONTENTS December 2009 Events Thundercam.................................................................4 Dec 5- Christmas Open House @ Rochester Harley-Davidson in Rochester, MN from 9am A Day With Erik Buell...................................................5 - 3pm. Lonestar Exclusive Interview.........................................6 Dec 5- Abate of MN’s Glacier Ridge Chapter Joker.............................................................................8 St. Nick Celebration @ Rooney’s in Sedan, MN from 1pm - 4pm. Thunder Roads Magazine of Minnesota Greetings Riders, Lady Bikers.................................................................10 P.O. Box 769 I would like to tell you about myself. I’ve been Bikers Defined............................................................12 Dec 25- MERRY CHRISTMAS!!! Albert Lea, MN 56007 riding for 41 years and I suffer from crippling bouts (877) 230-4520 KISS.........................................................................13 of depression. The depression struggles usually [email protected] Get Licensed..............................................................16 begin early in the mornings. About the time when Staff stepping out the door going to work and seeing the TNT.............................................................................17 Flashback...................................................................18 -

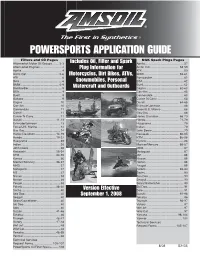

POWERSPORTS APPLICATION GUIDE Filters and Oil Pages Includes Oil, Filter and Spark NGK Spark Plugs Pages Aftermarket Motor Oil Groups

POWERSPORTS APPLICATION GUIDE Filters and Oil Pages Includes Oil, Filter and Spark NGK Spark Plugs Pages Aftermarket Motor Oil Groups ........ 2-3 Aprilia................................................57 Aftermarket Engines ...........................4 Plug Information for Arctic Cat .................................... 58-59 Aprilia..................................................4 ATK ...................................................59 Arctic Cat ........................................ 5-6 Motorcycles, Dirt Bikes, ATVs, BMW........................................... 59-61 ATK .....................................................6 Bombardier .......................................62 Beta ....................................................6 Snowmobiles, Personal BSA ..................................................62 BMW............................................... 6-9 Buell..................................................62 Bombardier .........................................9 Watercraft and Outboards Cagiva ........................................ 62-63 BSA ....................................................9 Can-Am ............................................63 Buell....................................................9 Cannondale ......................................63 , Bultaco ...............................................9 Curise N Carry .................................63 Cagiva ..............................................10 Ducati ......................................... 64-65 Can-Am ............................................10 -

2017-001, Elio Motors, Inc. #2017-023, Taotao USA, Inc

AGENDA LOUISIANA MOTOR VEHICLE COMMISSION 3519 12th Street Metairie, Louisiana 70002 Monday, July 10, 2017 At 10:00 a.m. Call to order. Attendance roll call. Hearings: #2017-001, Elio Motors, Inc. #2017-023, TaoTao USA, Inc. Discussion: 2017 Legislation (SB 107 - Act 45) Executive Session: Personnel Matters/Legal Advice Report by Counselors. Report by Executive Director: Reading of the Minutes of May 8, 2017. Reading of the May and June Financial Statements. Ratification of Distributor Branches License issued: DISTRIBUTOR BRANCH CITY LIC. # Kia Motors America, Inc. Plano, Texas #DB-2017-00108 Ratification of Convertor Licenses issued: CONVERTOR CITY LIC. # MAKE Louisiana Emergency Equipment LLC Eunice, Louisiana #CV-2015-00183 Louisiana Emergency Equipment Halcore Group, Inc. Jefferson, North Carolina #CV-2016-00190 AEV Trauma Hawk DBA American Emergency Vehicles Diamond Acquisition, LLC Oswego, Kansas #CV-2016-00191 Diamond Bus DBA Diamond Coach Kovatch Mobile Equipment Corp. Nesquehoning, #CV-2016-00192 KME Fire Apparatus DBA KME Fire Apparatus Pennsylvania Nite-Hawk Sweepers, LLC Kent, W ashington #CV-2017-00162 Nitehawk Sweepers McSweeney Designs, LLC Trussville, Alabama #CV-2017-00169 Ford Transit, Mercedes-Benz Sprinter Ratification of Specialty Vehicle Dealer License issued: SPECIALTY VEHICLE DEALER CITY LIC. # MAKE Louisiana Evergency Equipment LLC Eunice, Louisiana #SV-2015-00142 Louisiana Emergency Equipment Kovatch Mobile Equipment Corp. Nesquehoning, #SV-2016-00139 Conversion: KME Fire DBA KME Fire Apparatus Pennsylvania Apparatus Ratification of New Motor Vehicle Dealer Licenses issued: DEALER CITY LIC. # CAR Farmerville Motors, Inc. Farmerville, Louisiana #N-2015-00345 Buick (Passenger C ars), DBA Premier Autoplex Buick (Light Duty Trucks), C h e v r o le t ( L ig h t D u ty T r u c k s ) , C h e v r o l e t (Passenger Cars), GMC (Light Duty Trucks) This was a change in name from Farmerville Motors, Inc., 1001 Sterlington Highway, Farmerville, Louisiana to Farmerville Motors, Inc. -

2010//Pure Victory Gear Accessories//Apparel

2010//PURE VICTORY GEAR ACCESSORIES//APPAREL VIC_MY10_Cat_Touring Section_Keyline_Fnl.indd 1 7/1/09 8:08:57 AM VICTORY MOTORCYCLES BUILT FOR THE OPEN ROAD For the past 10 years, Victory Motorcycles have rolled on to the scene ready to ride. Backroads, highways, roadhouses. Anywhere, anytime. Grab your buddies, grab your gear and see where you’ll end up. That’s the reason Pure™ Victory Gear is built. It’s about the ride. We build the accessories and apparel that riders need out on the open road — and let’s be honest — the stuff that makes your bike stand out when you’re parked in the lot and hangin’ with your boys. 4-25 TOURING SECTION 26-63 CRUISER SECTION 64-83 APPAREL SECTION VIC_MY10_Cat_Touring Section_Keyline_Fnl.indd 2-3 7/1/09 8:09:03 AM TOURING VICTORY VISION®//VICTORY CROSS COUNTRY ™//VICTORY CROSS ROADS ™ Three bikes that are changing the face of the American Cruiser World. Smooth, flowing high mileage warriors. We’ve built all the accessories you need to make any of them your perfect ride. Whether you’re looking for all the chrome under the sun, a GPS to get you there, or performance parts that help your bike breathe better. TOURING—FIT EXPLANATIONS MODEL YEARS VISION VISION 08-10 VV=[Vision Street, Vision Tour] KINGPIN MODEL YEARS CROSS COUNTRY 10 CC=[Cross Country Model] HAMMER MODEL YEARS CROSS ROADS 10 CR=[Cross Roads Model] JACKPOT VEGAS TOURING—FIT Shown here are some of the most popular parts from Pure Victory. These fit across all of these bikes: Vision, Cross Roads and Cross Country. -

Cheryl Pabich, Director of Marketing Phone: (414) 973-4426

For Immediate Release For more information, contact: Cheryl Pabich, Director of Marketing Phone: (414) 973‐4426 Email: [email protected] Polaris Industries Inc.® Selects ARI’s PartSmart®; Global Electric Motorcars (GEM) Parts Catalogs to be featured on Leading Parts Lookup MILWAUKEE, Nov. 9, 2011 – ARI (OTCBB:ARIS), a leading provider of technology‐enabled business solutions that help dealers, distributors and manufacturers in selected vertical markets increase revenue and reduce costs, announced today that Polaris Industries, located in Minneapolis, Minn., will provide GEM car dealers with access to parts and service information via PartSmart®, ARI’s renowned CD‐based electronic parts catalogs. GEM, a growing brand within Polaris®, is the recognized leader in the low‐speed vehicle market, with a worldwide presence. Under the agreement with ARI, authorized GEM dealers will be able to use PartSmart to look up parts and service information for GEM’s complete line of electric‐powered vehicles, including the e2, e4, e6, eS, eL, and eL XD models. “We’ve partnered with ARI for more than 10 years to provide our Polaris® and Victory® dealers with up‐to‐date parts and pricing information through PartSmart,” said Marlys Knutson, spokesperson at Polaris. “To support our strategy to further penetrate the On‐Road market and grow GEM sales, we recognize the importance of providing GEM dealers with the tools they need to be successful. Polaris® and Victory® dealers who use PartSmart today have been able to streamline their parts lookup process, gain efficiencies and increase customer satisfaction. We are confident that GEM dealers will experience the same results, which will help them increase sales and grow profits.” PartSmart is ARI's premier parts lookup software known to more than 50,000 users worldwide. -

Police Vehicle Evaluation Model Year 2014

STATE OF MICHIGAN Department of State Police and Department of Technology, Management and Budget 2014 Model Year Police Vehicle Evaluation Program Published by: Michigan State Police Precision Driving Unit December 2013 Prepared by: Mrs. Tricia Steel Michigan State Police Precision Driving Unit Photographs by: Mr. Ray Holt Michigan State Police TABLE OF CONTENTS Preface .............................................................................................................................................................. 1 General Information ........................................................................................................................................... 2 Acknowledgements ........................................................................................................................................... 3 Test Equipment.................................................................................................................................................. 4 Police Package Vehicle Descriptions Police Package Vehicle Photographs & Descriptions .................................................................................... 5-35 Vehicle Dynamics Testing Vehicle Dynamics Testing Objective & Methodology ....................................................................................... 36 Test Facility Diagram ........................................................................................................................................ 37 Vehicle Dynamics Test Data ........................................................................................................................ -

Indian& Victory

INDIAN& VICTORY ACCESSORIES CATALOG WWW.BIGBIKEPARTS.COM VOLUME #37.1 GREAT LOOKING ACCESSORIES FOR GREAT LOOKING BIKES • BigBikeParts.com has all our exciting NEW Products. • See related or alternative accessories on selected products. • Subscribe under News to receive Big Bike Parts® Newsletters. • Conveniently order replacement parts directly online. A Reason to Ride! • Use the Dealer Locator to find an Authorized Dealer. • Easily download the latest catalog, flyers and fitments. Visit www.bigbikeparts.com to find a dealer near you • Find great deals on closeouts in our Specials section. • Download Big Bike Parts® product instructions. • Search for products by motorcycle type or by fitment. • Dealers: Set-up an account online to view purchase history, • Products for Can-Am, Honda, Harley, Indian, Kawasaki, check your account balance and place orders. Victory, Yamaha and others. VISIT OUR SIGN UP ONLINE GREAT PRODUCT LIKE US ON FACEBOOK WEBSITE AT: to find out about New INSTALLATION to get New Product Updates, www.BigBikeParts.com Products, Open House Events VIDEOS AT: Open House Event Information 1000’s of products and and a chance to win great prizes. www.youtube.com/user and Other Information product ideas Remember to check our Monthly /BigBikeParts from Dealerships. Specials for replacement parts www.facebook.com/pages/ and great deals. BigBikePartsInc Leading designer and distributor of touring and cruiser aftermarket accessories for Can-Am, Harley-Davidson, Honda, Indian, Kawasaki, Suzuki, Victory and Yamaha motorcycles. UltraGard™ Dresser Cover pg18 Driving Lights pg31 Detachable Smart Mount™ Backrest pg35 Chrome Trunk Luggage Rack pg36 Hopnel™ 1900 Saddlebag Liner pg23 Gas Tank Mini Bra pg21 Four great product lines, one lasting commitment to quality. -

Case 8 HARLEY-DAVIDSON, INC., JANUARY 20011

Case 8 HARLEY-DAVIDSON, INC., JANUARY 20011 You’ve shown us how to be the best. You’ve been leaders in new technology. You’ve stuck by the basic American values of hard work and fair play...Most of all, you’ve worked smarter, you’ve worked better, and you’ve worked together...as you’ve shown again, America is someplace special. We’re on the road to unprecedented prosperity...and we’ll get there on a Harley. President Ronald Reagan, speech at Harley-Davidson plant, York, Pennsylvania, May 6, 1987 The recovery of this company since the 1980s has been truly remarkable. When you were down in the dumps, people were saying American industry was finished, that we couldn't compete in the global economy, that the next century would belong to other countries and other places. Today, you're not just surviving -- you're flourishing, with record sales and earnings; and one of the best-managed companies in America. According to management and labor, one of the reasons you're the best-managed company in America is that you have a genuine partnership between labor and management, where all employees are valuable and expected to make good decisions on their own for the benefit of the common enterprise. And I thank you for setting that example. I wish every manufacturer in America would model it. President Bill Clinton, speech at Harley-Davidson plant, York Pennsylvania, November 10, 1999 It’s one thing to have people buy your products. It’s another for them to tattoo your name on their bodies. -

February 2017

QUICK THROTTLE MAGAZINE PO Box 3062 • Dana Point, CA 92629 949-328-3157 FEBRUARY 2017 [email protected] • www.quickthrottle.com CONTACT: [email protected] [email protected] • [email protected] 04 - NEW PRODUCTS INSTAGRAM.COM/QUICKTHROTTLEMAGAZINE • FACEBOOK.COM/QUICKTHROTTLEMAGAZINE 05 - RIDE & EVENT CALENDAR 06 - POLARIS TO WIND DOWN VICTORY 07 - VICTORY: 1998 - 2017 10 - AZ THUNDER RUN 14 - SEEING RED 19 - RADY’S HOSPITAL TOY RUN 20 - BIG COVER UP WRITERS: CD, Randy Twells, Lisa Dalgaard, Mike Dalgaard, Gary Mraz, Tom “PIR8” Tinney, Ray Seidel, Robert Sweeney, Art Hall, “Wild Bill” Saxton PHOTOGRAPHERS: Randy Twells, Art Hall, Ron Sinoy, CD, George Childress WEBMASTER: 25 - WREATHS ACROSS AMERICA Chrome Horse Promotions www.chrome-horse.net 26 - WALK SLOWLY 28 - BIKER NEWS 30 - IMS PICTORIAL 31 - HARLEY HAR HAR QUICK THROTTLE LLC® 2017 is published monthly and NO reproduction of content is permitted without Publisher or Editor’s prior written approval. Publisher and Editor assume no financial responsibility for errors in ads beyond the cost of space occupied by error; a correction will be printed. Publisher is not liable for: any slandering of an individual, or group as we mean no malice or individual criticism at any time; nor are we responsible for ON THE COVER: “TIMBER TITAN” by DAVID UHL. the opinions or comments of our columnists; and promises, coupons, or lack of fulfillment from advertisers who are solely responsible for the content of their ads. Publisher and Editor are also to be held harmless from: failure To see more of David’s work or to buy prints be sure to to produce any issue as scheduled due to reasons beyond our control; all suits. -

2014 Model Year Police Vehicle Evaluation Program

STATE OF MICHIGAN Department of State Police and Department of Technology, Management and Budget 2014 Model Year Police Vehicle Evaluation Program Published by: Michigan State Police Precision Driving Unit December 2013 Prepared by: Mrs. Tricia Steel Michigan State Police Precision Driving Unit Photographs by: Mr. Ray Holt Michigan State Police TABLE OF CONTENTS Preface .............................................................................................................................................................. 1 General Information ........................................................................................................................................... 2 Acknowledgements ........................................................................................................................................... 3 Test Equipment.................................................................................................................................................. 4 Police Package Vehicle Descriptions Police Package Vehicle Photographs & Descriptions .................................................................................... 5-35 Vehicle Dynamics Testing Vehicle Dynamics Testing Objective & Methodology ....................................................................................... 36 Test Facility Diagram ........................................................................................................................................ 37 Vehicle Dynamics Test Data ........................................................................................................................