Stock Market Prediction Using Candlestick Chart

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Copyrighted Material

Index 12b-1 fee, 68–69 combining with Western analysis, 3M, 157 122–123 continuation day, 116 ABC of Stock Speculation, 157 doji, 115 accrual accounting, 18 dragonfl y doji, 116–117 accumulated depreciation, 46–47 engulfi ng pattern, 120, 121 accumulation phase, 158 gravestone doji, 116, 117, 118 accumulation/distribution line, hammer, 119 146–147 hanging man, 119 Adaptive Market Hypothesis, 155 harami, 119, 120 Altria, 29, 127, 185–186 indicators 120 Amazon.com, 151 long, 116, 117, 118 amortization, 47, 49 long-legged doji, 118 annual report, 44–46 lower shadow, 115 ascending triangle, 137–138, 140 marubozu, 116 at the money, 192 real body, 114–115 AT&T, 185–186 segments illustrated, 114 shadows, 114 back-end sales load, 67–68 short,116, 117 balance sheet, 46–50 spinning top, 118–119 balanced mutual funds, 70–71 squeeze alert, 121, 122, 123 basket of stocks, 63 tails, 114 blue chip companies, 34 three black crows, 122, 123 Boeing, 134–135 three white soldiers, 122, 123 book value, 169 trend-based, 117–118 breadth, 82–83, 97 upper shadow, 115 breakaway gap, 144 wicks, 114 break-even rate, 16–17 capital assets, 48, 49 breakout, 83–84, 105–106 capitalization-based funds, 71 Buffett, Warren, 152 capitalization-weighted average, 157 bull and bear markets,COPYRIGHTED 81, 174–175 Caterpillar, MATERIAL 52–54, 55, 57, 58, 59, 131 Bureau of Labor Statistics (BLS), 15 CBOE Volatility Index (VIX), 170, 171 Buy-and-hold strategy, 32, 204–205 Chaikin Money Flow (CMF), 146 buy to open/sell to open, 96 channel, 131–132 charting calendar spreads, 200–201 -

Japanese Candlestick Patterns

Presents Japanese Candlestick Patterns www.ForexMasterMethod.com www.ForexMasterMethod.com RISK DISCLOSURE STATEMENT / DISCLAIMER AGREEMENT Trading any financial market involves risk. This course and all and any of its contents are neither a solicitation nor an offer to Buy/Sell any financial market. The contents of this course are for general information and educational purposes only (contents shall also mean the website http://www.forexmastermethod.com or any website the content is hosted on, and any email correspondence or newsletters or postings related to such website). Every effort has been made to accurately represent this product and its potential. There is no guarantee that you will earn any money using the techniques, ideas and software in these materials. Examples in these materials are not to be interpreted as a promise or guarantee of earnings. Earning potential is entirely dependent on the person using our product, ideas and techniques. We do not purport this to be a “get rich scheme.” Although every attempt has been made to assure accuracy, we do not give any express or implied warranty as to its accuracy. We do not accept any liability for error or omission. Examples are provided for illustrative purposes only and should not be construed as investment advice or strategy. No representation is being made that any account or trader will or is likely to achieve profits or losses similar to those discussed in this report. Past performance is not indicative of future results. By purchasing the content, subscribing to our mailing list or using the website or contents of the website or materials provided herewith, you will be deemed to have accepted these terms and conditions in full as appear also on our site, as do our full earnings disclaimer and privacy policy and CFTC disclaimer and rule 4.41 to be read herewith. -

Three Advancing White Soldiers

Continuation Patterns 143 DAILY BAR 1990 CQG INC. -- . 2021 -H= 2021 . ... 1991 -L= 2002 . .A= -20 . 2150 ... 7/23/90 . Hammer . 2021 .L= -C= 2002 . 3 EXHIBIT 7.35. Dow Jones Utilities-1990, Daily (Falling Three Methods). wrong. Wait until the pattern is formed, or confirmed, before acting on its implications! Exhibit 7.35 is a classic falling three method whose bearish implica- tion was negated by the hammer. If the hammer was not enough to tell one the was ending more proof was added with the white ses- sion following the hammer. This completed a bullish engulfing pattern. THREE ADVANCING WHITE SOLDIERS Like much of the candlestick terminology, this pattern has a military association. It is known as the three advancing white soldiers (see Exhibit 7.36) or, more commonly, three white soldiers. It is a group of three white candlesticks with consecutively higher closes. If this pattern appears at a low price area after a period of stable prices, then it is a sign of strength ahead. The three white soldiers are a gradual and steady rise with each white line opening within or near the prior session's white real body. Each of the white candlesticks should close at, or near, its highs. It is a 144 The Basics EXHIBIT 7.36. Three Advancing EXHIBIT 7.37. Advance Block EXHIBIT 7.38. Stalled Pattern White Soldiers healthy method for the market to rise (although if the white candlesticks are very extended, one should be cautious about an overbought market). If the second and third, or just the third candlestick, show signs of weakening it is an advance block pattern (see Exhibit 7.37). -

Trading Guide

Tim Trush & Julie Lavrin Introducing MAGIC FOREX CANDLESTICKS Trading Guide Your guide to financial freedom. © Tim Trush, Julie Lavrin, T&J Profit Club, 2017, All rights reserved https://tinyurl.com/forexmp Table Of Contents Chapter I: Introduction to candlesticks I.1. Understanding the candlestick chart 3 Most traders focus purely on technical indicators and they don't realize how valuable the original candlesticks are. I.2. Candlestick patterns really work! 4 When a candlestick reversal pattern appears, you should exit position before it's too late! Chapter II: High profit candlestick patterns II.1. Bullish reversal patterns 6 This category of candlestick patterns signals a potential trend reversal from bearish to bullish. II.2. Bullish continuation patterns 8 Bullish continuation patterns signal that the established trend will continue. II.3. Bearish reversal patterns 9 This category of candlestick patterns signals a potential trend reversal from bullish to bearish. II.4. Bearish continuation patterns 11 This category of candlestick patterns signals a potential trend reversal from bullish to bearish. Chapter III: How to find out the market trend? 12 The Heiken Ashi indicator is a popular tool that helps to identify the trend. The disadvantage of this approach is that it does not include consolidation. Chapter IV: Simple scalping strategy IV.1. Wow, Lucky Spike! 14 Everyone can learn it, use it, make money with it. There are traders who make a living trading just this pattern. IV.2. Take a profit now! 15 When to enter, where to place Stop Loss and when to exit. IV.3. Examples 15 The next examples show you not only trend reversal signals, but the Lucky Spike concept helps you to identify when the correction is over and the main trend is going to recover. -

Candlestick Patterns

INTRODUCTION TO CANDLESTICK PATTERNS Learning to Read Basic Candlestick Patterns www.thinkmarkets.com CANDLESTICKS TECHNICAL ANALYSIS Contents Risk Warning ..................................................................................................................................... 2 What are Candlesticks? ...................................................................................................................... 3 Why do Candlesticks Work? ............................................................................................................. 5 What are Candlesticks? ...................................................................................................................... 6 Doji .................................................................................................................................................... 6 Hammer.............................................................................................................................................. 7 Hanging Man ..................................................................................................................................... 8 Shooting Star ...................................................................................................................................... 8 Checkmate.......................................................................................................................................... 9 Evening Star .................................................................................................................................... -

Timeframeset

QuantShare Programming Language Table of contents 1. QuantShare Language 1.1 Application Info 1.1.1 NbGroups 1.1.2 NbIndexes 1.1.3 NbIndustries 1.1.4 NbInGroup 1.1.5 NbInIndex 1.1.6 NbInIndustry 1.1.7 NbInMarket 1.1.8 NbInSector 1.1.9 NbMarkets 1.1.10 NbSectors 1.2 Candlestick Pattern 1.2.1 Cdl2crows (0) 1.2.2 Cdl2crows (1) 1.2.3 Cdl3blackcrows (0) 1.2.4 Cdl3blackcrows (1) 1.2.5 Cdl3inside (0) 1.2.6 Cdl3inside (1) 1.2.7 Cdl3linestrike (0) 1.2.8 Cdl3linestrike (1) 1.2.9 Cdl3outside (0) 1.2.10 Cdl3outside (1) 1.2.11 Cdl3staRsinsouth (0) 1.2.12 Cdl3staRsinsouth (1) 1.2.13 Cdl3whitesoldiers (0) 1.2.14 Cdl3whitesoldiers (1) 1.2.15 CdlAbandonedbaby (0) 1.2.16 CdlAbandonedbaby (1) 1.2.17 CdlAdvanceblock (0) 1.2.18 CdlAdvanceblock (1) 1.2.19 CdlBelthold (0) 1.2.20 CdlBelthold (1) 1.2.21 CdlBreakaway (0) 1.2.22 CdlBreakaway (1) 1.2.23 CdlClosingmarubozu (0) 1.2.24 CdlClosingmarubozu (1) 1.2.25 CdlConcealbabyswall (0) 1.2.26 CdlConcealbabyswall (1) 1.2.27 CdlCounterattack (0) 1.2.28 CdlCounterattack (1) 1.2.29 CdlDarkcloudcover (0) 1.2.30 CdlDarkcloudcover (1) 1.2.31 CdlDoji (0) 1.2.32 CdlDoji (1) 1.2.33 CdlDojistar (0) 1.2.34 CdlDojistar (1) 1.2.35 CdlDragonflydoji (0) 1.2.36 CdlDragonflydoji (1) 1.2.37 CdlEngulfing (0) 1.2.38 CdlEngulfing (1) 1.2.39 CdlEveningdojistar (0) 1.2.40 CdlEveningdojistar (1) 1.2.41 CdlEveningstar (0) 1.2.42 CdlEveningstar (1) 1.2.43 CdlGapsidesidewhite (0) 1.2.44 CdlGapsidesidewhite (1) 1.2.45 CdlGravestonedoji (0) 1.2.46 CdlGravestonedoji (1) 1.2.47 CdlHammer (0) 1.2.48 CdlHammer (1) 1.2.49 CdlHangingman (0) 1.2.50 -

Everything You Wanted to Know About Candlestick Charts Is an Unregulated Product Published by Thames Publishing Ltd

EEvveerryytthhiinngg yyoouu wwaanntteedd ttoo kknnooww aabboouutt ccaannddlleessttiicckk cchhaarrttss by Mark Rose • Read candlestick charts accurately • Spot patterns quickly and easily • Use that information to make profitable trading decisions Contents Chapter 1. What is a candlestick chart? 3 Chapter 2. Candlestick shapes: 6 Anatomy of a candle 6 Doji 7 Marubozo 8 Chapter 3. Candlestick Patterns 9 Harami (bullish / bearish) 9 Hammer / Hanging Man 11 Inverted Hammer / Shooting Star 13 Engulfing (bullish/ bearish) 14 Morning Star / Evening Star 15 Three White Soldiers / Three Black Crows 16 Piercing Line / Dark Cloud Cover 17 Chapter 4. The history of candlestick charts 18 Conclusion 20 Candlestick Cheat Sheet 22 2 Chapter 1. What is a candlestick chart? Before I start to talk about candlestick patterns, I’d like to get right back to basics on candles: what they are, what they look like, and why we use them … Drawing lines When you look at a chart of market prices, you can usually choose from line charts or candlestick charts. A line chart will take its price levels from the opening or closing prices according to the timeframe you have selected. So, if you’re looking at a one-minute line chart of closing prices, it will plot the closing price for each one-minute period – something like this … Line charts can be useful for looking at the “bigger picture” and finding long-term trends, but they simply cannot offer up the kind of information contained in a candlestick chart. Here is a one-minute candlestick chart for the same period … 3 At first glance, it might look a little confusing, but I can assure you that once you’re used to candlestick charts – you won’t look back. -

Bullish Pattern

International School of Financial Markets WWW.ISFM.CO.IN Best Stock Market School Gurgaon 0124-2200689, 9540008689 Reg. office: Plot no. 152 - P (LGF), Sec – 38, Medicity Road, NR Bakhtawar Chowk Phone : 0124-2200689, +91 9540008689, +91 9953147497, +91 9911878442 Web: www.isfm.co.in , Email : [email protected] Reg. office: Plot no. 152 - P (LGF), Sec – 38, Medicity Road, Near Medanta Hospital Contact No. - 0124-2200689, +919540008689, WWW.ISFM.CO.IN Accumulation The act of buying more shares of a security without causing the price to increase significantly. After a decline, a stock may start to base and trade sideways for an extended period. While this base builds, well-informed traders and investors may seek to establish or increase existing long positions. In that case, the stock is said to have come under accumulation. Accumulation Distribution Line A momentum indicator that relates price changes with volume. It relates the closing price to the range of prices (H - L). The closer the close is to the high, the more volume is added to the cumulative total. Advance Decline Line One of the most widely used indicators to measure the breadth of a stock market advance or decline. The AD line tracks the net difference between advancing and declining issues. It is usually compared to a market average WWW.ISFM.CO.INwhere divergence from that average would be an early indication of a possible trend reversal. AdvanceBest Decline Stock Ratio Market School The ratio of advancing issues over declining issues. Taking the moving average of the AD ratioGurgaon will smooth it so it can be used as an overbought and oversold indicator. -

![Three White Soldiers: 3 Things You Must Consider Before Trading [Video]](https://docslib.b-cdn.net/cover/9506/three-white-soldiers-3-things-you-must-consider-before-trading-video-2559506.webp)

Three White Soldiers: 3 Things You Must Consider Before Trading [Video]

Three White Soldiers: 3 Things You Must Consider Before Trading [Video] The Three White Soldiers pattern is a popular bullish candlestick pattern. It is fairly easy for most traders to spot in real time given the 3 large range successive candles. Moreover, in the right context it can signal a reversal of a trend. In this post we’ll discuss the context, requirements, and a free video on how to trade this pattern. If you aren’t familiar with candlesticks in general, be sure to check out our Candlestick Pattern Guide. In that post we’ve put together a free infographic cheat sheet for you to use with your trading, along with manybullish and bearish examples! Three White Soldiers Video Tutorial Our in house trading expert, Al Hill has put together a quick video explaining the pattern. Have a look before you get started with the tutorial. Overview The three white soldiers is a Japanesecandlestick pattern that is comprised of three or more bullish candles. [1] The candles are white because positive price movement in eastern technical analysis is represented white and not green (as most charting platforms default to these days). The reference to soldiers is in the context of the battle between the bulls and bears. Visually, they are marching forward with no impediment. Three White Soldiers 3 Requirements for Confirmation Now that you have the image of the three white soldiers candlestick pattern in your mind, hopefully you’ll begin to see the pattern on your charts more often. Sometimes studying candlestick patterns can be a lot like listening to a new song, it gets stuck in your mind. -

Candlestick Patterns Cheat Sheet

Candlestick Patterns Cheat Sheet Alphaex Capital https://www.alphaexcapital.com/ Copyright © 2021 Alphaex Capital Limited All rights reserved. 2 RISK DISCLAIMER THE INFORMATION CONTAINED WITHIN THIS EBOOK IS FOR EDUCATIONAL INFORMATIONAL PURPOSES ONLY. NO FINANCIAL ADVICE OR GUARANTEES ARE GIVEN THROUGHOUT THE EBOOK. The contents of this eBook are supplied for its instructional value. Neither the author nor publisher offers any warranties or representations in respect of the accuracy of the material or their fitness for a particular purpose, nor does the author or publisher accept any legal responsibility or liability for any errors or omissions nor any loss or damage arising from their use. The reader should make his/her own evaluation as to the appropriateness or otherwise of any of the techniques or strategies described. Trading financial assets (such as foreign exchange, commodities, indices, or stocks) carries a high level of risk and you may lose some or all of your money. Losses can and will occur as a natural part of trading. Don’t trade with money you can’t afford to lose. No system or methodology has ever been developed that can guarantee profits or ensure freedom from losses. No representation or implication is being made that using the information in this publication will generate profits or ensure freedom from losses. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Frequently there are considerable differences between hypothetical performance results and the actual results subsequently achieved by any particular trader or trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. -

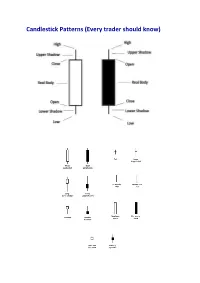

Candlestick Patterns (Every Trader Should Know)

Candlestick Patterns (Every trader should know) A doji represents an equilibrium between supply and demand, a tug of war that neither the bulls nor bears are winning. In the case of an uptrend, the bulls have by definition won previous battles because prices have moved higher. Now, the outcome of the latest skirmish is in doubt. After a long downtrend, the opposite is true. The bears have been victorious in previous battles, forcing prices down. Now the bulls have found courage to buy, and the tide may be ready to turn. For example = INET Doji Star A “long-legged” doji is a far more dramatic candle. It says that prices moved far higher on the day, but then profit taking kicked in. Typically, a very large upper shadow is left. A close below the midpoint of the candle shows a lot of weakness. Here’s an example of a long-legged doji. For example = K Long-legged Doji A “gravestone doji” as the name implies, is probably the most ominous candle of all, on that day, price rallied, but could not stand the altitude they achieved. By the end of the day. They came back and closed at the same level. Here ’s an example of a gravestone doji: A “Dragonfly” doji depicts a day on which prices opened high, sold off, and then returned to the opening price. Dragonflies are fairly infrequent. When they do occur, however, they often resolve bullishly (provided the stock is not already overbought as show by Bollinger bands and indicators such as stochastic). For example = DSGT The hangman candle , so named because it looks like a person who has been executed with legs swinging beneath, always occurs after an extended uptrend The hangman occurs because traders, seeing a sell-off in the shares, rush in to grab the stock a bargain price. -

Index.Pdf (69.91KB)

26_178089 bindex.qxp 2/27/08 9:38 PM Page 329 Index • Symbols & • B • Numerics • bar charts candlestick chart, compared to, 19, 20, %K (fast) stochastic oscillators, 263 317–319 %D (slow) stochastic oscillators, 263 defined, 10, 27–28 5-day moving average, 253–254, 256, 257, single line, 28 258–260 on Web sites, 53 10-day moving average, 259–260 BEA Systems, 220 20-day moving average, 255, 256, 258–260 bear market, defined, 22 24-hour electronic trading Bear Stearns Companies, Inc., 147 high and low prices, futures, 36–37 bearish state volume, relationship to, 25 candlestick charting and patterns, 20–22, 30-minute chart, 74–75 279–290 200-day moving average, 253 closing price as body of candlestick, 38 defined, 96 double-stick patterns • A • dark cloud cover, 172–174 abandoned baby doji star, 167–168 bearish, 229–231 engulfing pattern, 156–158 bullish, 199–201 harami, 159–161 affordability and trading choices, 15 harami cross, 161–164 after-hours trading inverted hammer, 164–167 high and low prices, futures, 36–37 meeting line, 168–172 volume, relationship to, 25 neck lines, 180–183 Alcoa, 170, 171 piercing line, 172–174 Altera Corp., 304 separating lines, 178–180 Amazon.com, 269 thrusting lines, 175–177 American Express, 310–311 sell indicators, 279–290 American Stock Exchange (AMEX), 33, 68 single-stick pattern Amgen, Inc., 151–152 belt hold, 113 Analog Devices Inc., 206–207 doji, 90–94 Apple Computer, 93–94, 168, 169, 276, gravestone doji, 90–94 292–293 long black candle, 84–90 Applebee’s International, 221–222 long marubozus, 86–88