Copyrighted Material

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Estimating 90-Day Market Volatility with VIX and VXV

Estimating 90-Day Market Volatility with VIX and VXV Larissa J. Adamiec, Corresponding Author, Benedictine University, USA Russell Rhoads, Tabb Group, USA ABSTRACT The CBOE Volatility Index (VIX) has historically been a consistent indicator of 30-day or 1-month (21-day actual) realized market volatility. In addition, the Chicago Board Options Exchange also quotes the CBOE 3-Month Volatility Index (VXV) which indicates the 3-month realized market volatility. This study demonstrates both VIX and VXV are still reliable indicators of their respective realized market volatility periods. Both of the indexes consistently overstate realized volatility, indicating market participants often perceive volatility to be much higher than volatility actually is. The overstatement of expected volatility leads to an indicator which is consistently higher. Perceived volatility in the long-run is often lower than volatility in the short-run which is why VXV is often lower than VIX (VIX is usually lower than VXV). However, the accuracy of the VXV is roughly 35% as compared with the accuracy of the VIX at 60.1%. By combining the two indicators to create a third indicator we were able to provide a much better estimate of 64-Day Realized volatility, with an accuracy rate 41%. Due to options often being over-priced, historical volatility is often higher than both realized volatility or the volatility index, either the VIX or the VXV. Even though the historical volatility is higher we find the estimated historical volatility to be more easily estimated than realized volatility. Using the same time period from January 2, 2008 through December 31, 2016 we find the VIX estimates the 21-Day Historical Volatility with 83.70% accuracy. -

Stock Market Prediction Using Candlestick Chart

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056 Volume: 07 Issue: 01 | Jan 2020 www.irjet.net p-ISSN: 2395-0072 Stock Market Prediction using Candlestick Chart Razik Batliwala1, Muddassir Khan2, Durvesh Bhushan3 1,2Information Technology, PadmabhushanVasantdada Patil Pratishthan’s College of Engineering, Sion Mumbai 3Vaity Information Technology PadmabhushanVasantdada Patil Pratishthan’s College of Engineering, Sion Mumbai ------------------------------------------------------------------------***------------------------------------------------------------------------- Abstract—The stock market is a place where shares of publicly listed companies are traded. There shares based on brought and sold on this basis of there stock. The price of stocks and assets are an important part of the economy. There are many factors that affect share prices. However there is no specific cause for the prices to rise or fall. This makes investment subject to various risks. We proposed a novel method for prediction of stocks price on the basis of statistical data and making of candlestick chart for up to 3-4 days to find if investment are beneficial or loss of money, It is also beneficial to analyzing in future stock. In this paper we developing (LCS) Longest Common Subsequence Algorithm to retrieve numerical sequences that partially match. It also use for real time service provider to provide stock market sentiments. Keywords—Stock price prediction; Technical analysis; Candlestick charts; Longest common subsequence algorithm for numbers; Multi numerical attributes; Nse,Bse stock average. 1. INTRODUCTION Stock market prediction techniques play a crucial role to bring more people into market and encourage markets as a whole. Fundamental analysis and technical analysis are two popular approaches to successful stock trading. -

Asset Allocation POINT WHAT DOES a LOW VIX TELL US June 2017 ABOUT the MARKET? Timely Intelligence and Analysis for Our Clients

PRICE Asset Allocation POINT WHAT DOES A LOW VIX TELL US June 2017 ABOUT THE MARKET? Timely intelligence and analysis for our clients. KEY POINTS . The financial press has been paying considerable attention lately to the Chicago Board Options Exchange Volatility Index (VIX), with many financial pundits citing recent low readings on the VIX as evidence of investor complacency and rising equity risk. Robert Harlow, CFA, CAIA . Quantitative Analyst Media coverage often implies that a low current VIX is a strong signal of expected Asset Allocation future volatility and will be followed by a sell-off in U.S. equities and other risk-seeking assets. Historical evidence shows that, over the near term, investors typically overestimate the next 30-day volatility of the S&P 500 Index. Further, when the VIX has been low, U.S. equities have outperformed U.S. bonds on average over the next 12 months, regardless of the change in the VIX over that horizon. Without a meaningful and prolonged catalyst, we do not believe a low level of the VIX David Clewell, CFA alone implies investor complacency or an immediate danger of a risk-off event. Research Analyst Asset Allocation BACKGROUND There has been much discussion in the financial press recently about the danger of investor complacency—with a low VIX frequently cited as compelling evidence that equity investors have grown too relaxed about potential risks. The problem is that it is difficult to determine whether markets are truly complacent or not; we can’t survey all investors and, even if we could, how many investors would admit that they were complacent? Instead, we take a mental shortcut and presume that something we can measure is a good proxy for the thing we actually care about. -

Japanese Candlestick Patterns

Presents Japanese Candlestick Patterns www.ForexMasterMethod.com www.ForexMasterMethod.com RISK DISCLOSURE STATEMENT / DISCLAIMER AGREEMENT Trading any financial market involves risk. This course and all and any of its contents are neither a solicitation nor an offer to Buy/Sell any financial market. The contents of this course are for general information and educational purposes only (contents shall also mean the website http://www.forexmastermethod.com or any website the content is hosted on, and any email correspondence or newsletters or postings related to such website). Every effort has been made to accurately represent this product and its potential. There is no guarantee that you will earn any money using the techniques, ideas and software in these materials. Examples in these materials are not to be interpreted as a promise or guarantee of earnings. Earning potential is entirely dependent on the person using our product, ideas and techniques. We do not purport this to be a “get rich scheme.” Although every attempt has been made to assure accuracy, we do not give any express or implied warranty as to its accuracy. We do not accept any liability for error or omission. Examples are provided for illustrative purposes only and should not be construed as investment advice or strategy. No representation is being made that any account or trader will or is likely to achieve profits or losses similar to those discussed in this report. Past performance is not indicative of future results. By purchasing the content, subscribing to our mailing list or using the website or contents of the website or materials provided herewith, you will be deemed to have accepted these terms and conditions in full as appear also on our site, as do our full earnings disclaimer and privacy policy and CFTC disclaimer and rule 4.41 to be read herewith. -

Futures & Options on the VIX® Index

Futures & Options on the VIX® Index Turn Volatility to Your Advantage U.S. Futures and Options The Cboe Volatility Index® (VIX® Index) is a leading measure of market expectations of near-term volatility conveyed by S&P 500 Index® (SPX) option prices. Since its introduction in 1993, the VIX® Index has been considered by many to be the world’s premier barometer of investor sentiment and market volatility. To learn more, visit cboe.com/VIX. VIX Futures and Options Strategies VIX futures and options have unique characteristics and behave differently than other financial-based commodity or equity products. Understanding these traits and their implications is important. VIX options and futures enable investors to trade volatility independent of the direction or the level of stock prices. Whether an investor’s outlook on the market is bullish, bearish or somewhere in-between, VIX futures and options can provide the ability to diversify a portfolio as well as hedge, mitigate or capitalize on broad market volatility. Portfolio Hedging One of the biggest risks to an equity portfolio is a broad market decline. The VIX Index has had a historically strong inverse relationship with the S&P 500® Index. Consequently, a long exposure to volatility may offset an adverse impact of falling stock prices. Market participants should consider the time frame and characteristics associated with VIX futures and options to determine the utility of such a hedge. Risk Premium Yield Over long periods, index options have tended to price in slightly more uncertainty than the market ultimately realizes. Specifically, the expected volatility implied by SPX option prices tends to trade at a premium relative to subsequent realized volatility in the S&P 500 Index. -

Three Advancing White Soldiers

Continuation Patterns 143 DAILY BAR 1990 CQG INC. -- . 2021 -H= 2021 . ... 1991 -L= 2002 . .A= -20 . 2150 ... 7/23/90 . Hammer . 2021 .L= -C= 2002 . 3 EXHIBIT 7.35. Dow Jones Utilities-1990, Daily (Falling Three Methods). wrong. Wait until the pattern is formed, or confirmed, before acting on its implications! Exhibit 7.35 is a classic falling three method whose bearish implica- tion was negated by the hammer. If the hammer was not enough to tell one the was ending more proof was added with the white ses- sion following the hammer. This completed a bullish engulfing pattern. THREE ADVANCING WHITE SOLDIERS Like much of the candlestick terminology, this pattern has a military association. It is known as the three advancing white soldiers (see Exhibit 7.36) or, more commonly, three white soldiers. It is a group of three white candlesticks with consecutively higher closes. If this pattern appears at a low price area after a period of stable prices, then it is a sign of strength ahead. The three white soldiers are a gradual and steady rise with each white line opening within or near the prior session's white real body. Each of the white candlesticks should close at, or near, its highs. It is a 144 The Basics EXHIBIT 7.36. Three Advancing EXHIBIT 7.37. Advance Block EXHIBIT 7.38. Stalled Pattern White Soldiers healthy method for the market to rise (although if the white candlesticks are very extended, one should be cautious about an overbought market). If the second and third, or just the third candlestick, show signs of weakening it is an advance block pattern (see Exhibit 7.37). -

The Best Candlestick Patterns

Candlestick Patterns to Profit in FX-Markets Seite 1 RISK DISCLAIMER This document has been prepared by Bernstein Bank GmbH, exclusively for the purposes of an informational presentation by Bernstein Bank GmbH. The presentation must not be modified or disclosed to third parties without the explicit permission of Bernstein Bank GmbH. Any persons who may come into possession of this information and these documents must inform themselves of the relevant legal provisions applicable to the receipt and disclosure of such information, and must comply with such provisions. This presentation may not be distributed in or into any jurisdiction where such distribution would be restricted by law. This presentation is provided for general information purposes only. It does not constitute an offer to enter into a contract on the provision of advisory services or an offer to buy or sell financial instruments. As far as this presentation contains information not provided by Bernstein Bank GmbH nor established on its behalf, this information has merely been compiled from reliable sources without specific verification. Therefore, Bernstein Bank GmbH does not give any warranty, and makes no representation as to the completeness or correctness of any information or opinion contained herein. Bernstein Bank GmbH accepts no responsibility or liability whatsoever for any expense, loss or damages arising out of, or in any way connected with, the use of all or any part of this presentation. This presentation may contain forward- looking statements of future expectations and other forward-looking statements or trend information that are based on current plans, views and/or assumptions and subject to known and unknown risks and uncertainties, most of them being difficult to predict and generally beyond Bernstein Bank GmbH´s control. -

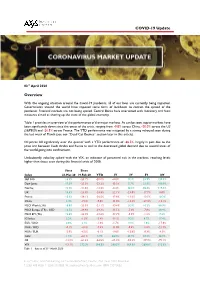

COVID-19 Update Overview

COVID-19 Update 03rd April 2020 Overview With the ongoing situation around the Covid-19 pandemic, all of our lives are currently being impacted. Governments around the world have imposed some form of lockdown to contain the spread of the pandemic. Financial markets are not being spared. Central Banks have intervened with monetary and fiscal measures aimed at shoring up the state of the global economy. Table 1 provides an overview of the performance of the major markets. As can be seen, equity markets have been significantly down since the onset of the crisis, ranging from -9.8% across China, -20.0% across the US (S&P500) and -26.5% across France. The YTD performance was mitigated by a strong rebound seen during the last week of March (see our “Dead Cat Bounce” section later in this article). Oil prices fell significantly over the quarter with a YTD performance of -66.5%, largely in part due to the price war between Saudi Arabia and Russia as well as the decreased global demand due to several areas of the world going into confinement. Undoubtedly volatility spiked with the VIX, an indicator of perceived risk in the markets, reaching levels higher than those seen during the financial crisis of 2008. Since Since Index 23-Mar-20 19-Feb-20 YTD 1Y 3Y 5Y 10Y S&P 500 15.5% -23.7% -20.0% -8.8% 9.1% 23.9% 120.3% Dow Jones 17.9% -25.3% -23.2% -15.5% 5.7% 21.9% 100.9% Nasdaq 12.2% -21.6% -14.2% -0.4% 30.2% 55.6% 219.4% UK 13.6% -23.9% -24.8% -22.1% -23.0% -17.7% 0.0% France 12.3% -28.1% -26.5% -17.8% -13.6% -13.5% 10.3% China 3.4% -7.6% -9.8% -11.0% -

The DB Currency Volatility Index (CVIX): a Benchmark for Volatility

Global Foreign Excahnge Deutsche Bank@ October 2007 Deutsche Bank Guide To Currency Indices Global Markets Saravelos Global Hzead Global Head FX StrategyBilal Jason Rashid James Torquil George Hafeez Batt Hoosenally Malcolm Wheatley Editor Contributors George Saravelos Mirza Baig Jason Batt Bilal Hafeez FX Strategy EM FX Strategy Global Head Global Head FX Index Products FX Strategy Rashid Hoosenally Caio Natividade James Malcolm Global Head FX Derivatives Strategy EM FX Strategy Global Risk Strategy Deutsche Bank@ Guide to Currency Indices October 2007 Table of Contents Introduction............................................................................................................................. 3 Overview ................................................................................................................................ 4 The Deutsche Bank Menu of Currency Indices...................................................................... 7 Currency Markets: Money Left on the Table?........................................................................ 9 Tactical Currency Indices DB G10 Trade-Weighted Indices: From Theory to Practice.................................................. 18 DB EM Asia Policy Baskets .................................................................................................. 22 The Emerging Asia Reserves, Liquidity and Yield (EARLY) Index......................................... 26 The DB Currency Volatility Index (CVIX): A Benchmark for Volatility ................................... -

VIX Futures As a Market Timing Indicator

Journal of Risk and Financial Management Article VIX Futures as a Market Timing Indicator Athanasios P. Fassas 1 and Nikolas Hourvouliades 2,* 1 Department of Accounting and Finance, University of Thessaly, Larissa 41110, Greece 2 Department of Business Studies, American College of Thessaloniki, Thessaloniki 55535, Greece * Correspondence: [email protected]; Tel.: +30-2310-398385 Received: 10 June 2019; Accepted: 28 June 2019; Published: 1 July 2019 Abstract: Our work relates to the literature supporting that the VIX also mirrors investor sentiment and, thus, contains useful information regarding future S&P500 returns. The objective of this empirical analysis is to verify if the shape of the volatility futures term structure has signaling effects regarding future equity price movements, as several investors believe. Our findings generally support the hypothesis that the VIX term structure can be employed as a contrarian market timing indicator. The empirical analysis of this study has important practical implications for financial market practitioners, as it shows that they can use the VIX futures term structure not only as a proxy of market expectations on forward volatility, but also as a stock market timing tool. Keywords: VIX futures; volatility term structure; future equity returns; S&P500 1. Introduction A fundamental principle of finance is the positive expected return-risk trade-off. In this paper, we examine the dynamic dependencies between future equity returns and the term structure of VIX futures, i.e., the curve that connects daily settlement prices of individual VIX futures contracts to maturities across time. This study extends the VIX futures-related literature by testing the market timing ability of the VIX futures term structure regarding future stock movements. -

Trading Guide

Tim Trush & Julie Lavrin Introducing MAGIC FOREX CANDLESTICKS Trading Guide Your guide to financial freedom. © Tim Trush, Julie Lavrin, T&J Profit Club, 2017, All rights reserved https://tinyurl.com/forexmp Table Of Contents Chapter I: Introduction to candlesticks I.1. Understanding the candlestick chart 3 Most traders focus purely on technical indicators and they don't realize how valuable the original candlesticks are. I.2. Candlestick patterns really work! 4 When a candlestick reversal pattern appears, you should exit position before it's too late! Chapter II: High profit candlestick patterns II.1. Bullish reversal patterns 6 This category of candlestick patterns signals a potential trend reversal from bearish to bullish. II.2. Bullish continuation patterns 8 Bullish continuation patterns signal that the established trend will continue. II.3. Bearish reversal patterns 9 This category of candlestick patterns signals a potential trend reversal from bullish to bearish. II.4. Bearish continuation patterns 11 This category of candlestick patterns signals a potential trend reversal from bullish to bearish. Chapter III: How to find out the market trend? 12 The Heiken Ashi indicator is a popular tool that helps to identify the trend. The disadvantage of this approach is that it does not include consolidation. Chapter IV: Simple scalping strategy IV.1. Wow, Lucky Spike! 14 Everyone can learn it, use it, make money with it. There are traders who make a living trading just this pattern. IV.2. Take a profit now! 15 When to enter, where to place Stop Loss and when to exit. IV.3. Examples 15 The next examples show you not only trend reversal signals, but the Lucky Spike concept helps you to identify when the correction is over and the main trend is going to recover. -

An Introduction to the VIX Index and Volatility Instruments Alexander Ryvkin Pace University

Pace University DigitalCommons@Pace Honors College Theses Pforzheimer Honors College 2019 Volatility Products and their Uses: An Introduction to the VIX Index and Volatility Instruments Alexander Ryvkin Pace University Follow this and additional works at: https://digitalcommons.pace.edu/honorscollege_theses Part of the Business Commons Recommended Citation Ryvkin, Alexander, "Volatility Products and their Uses: An Introduction to the VIX Index and Volatility Instruments" (2019). Honors College Theses. 230. https://digitalcommons.pace.edu/honorscollege_theses/230 This Thesis is brought to you for free and open access by the Pforzheimer Honors College at DigitalCommons@Pace. It has been accepted for inclusion in Honors College Theses by an authorized administrator of DigitalCommons@Pace. For more information, please contact [email protected]. Volatility Products and Their Uses 1 Volatility Products and their Uses An Introduction to the VIX Index and Volatility Instruments Pace University, Lubin School of Business Pforzheimer Honors College Majoring in Finance Presenting May 9th, 2019 Graduating May 18th, 2019 Examiner: Andrew Coggins By Alexander Ryvkin Volatility Products and Their Uses 2 Volatility Products and Their Uses 3 Abstract Volatility instruments are complex investment products that can be used to hedge or speculate based on changes in market sentiment and fluctuations in the S&P 500. These products offer a unique approach to protecting one’s portfolio and making strategic bets on future market volatility. However, lack of understanding of these products can be potentially dangerous as they can change dramatically in value within extremely short time-frames. Investors must be wary of using these products improperly; failure to adequately assess the risk of using volatility products can deliver devastating losses to one’s portfolio.