Cryptoasset Firms with Temporary Registration

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bitcoin Tumbles As Miners Face Crackdown - the Buttonwood Tree Bitcoin Tumbles As Miners Face Crackdown

6/8/2021 Bitcoin Tumbles as Miners Face Crackdown - The Buttonwood Tree Bitcoin Tumbles as Miners Face Crackdown By Haley Cafarella - June 1, 2021 Bitcoin tumbles as Crypto miners face crackdown from China. Cryptocurrency miners, including HashCow and BTC.TOP, have halted all or part of their China operations. This comes after Beijing intensified a crackdown on bitcoin mining and trading. Beijing intends to hammer digital currencies amid heightened global regulatory scrutiny. This marks the first time China’s cabinet has targeted virtual currency mining, which is a sizable business in the world’s second-biggest economy. Some estimates say China accounts for as much as 70 percent of the world’s crypto supply. Cryptocurrency exchange Huobi suspended both crypto-mining and some trading services to new clients from China. The plan is that China will instead focus on overseas businesses. BTC.TOP, a crypto mining pool, also announced the suspension of its China business citing regulatory risks. On top of that, crypto miner HashCow said it would halt buying new bitcoin mining rigs. Crypto miners use specially-designed computer equipment, or rigs, to verify virtual coin transactions. READ MORE: Sustainable Mineral Exploration Powers Electric Vehicle Revolution This process produces newly minted crypto currencies like bitcoin. “Crypto mining consumes a lot of energy, which runs counter to China’s carbon neutrality goals,” said Chen Jiahe, chief investment officer of Beijing-based family office Novem Arcae Technologies. Additionally, he said this is part of China’s goal of curbing speculative crypto trading. As result, bitcoin has taken a beating in the stock market. -

Alex Treadway / Design & Photography

ALEX TREADWAY / DESIGN & PHOTOGRAPHY 1 ALEX TREADWAY / DESIGN & PHOTOGRAPHY ICIMOD ICIMOD is a regional knowledge development and learning centre serving the eight regional member countries of the Hindu Kush-Himalayas. Primarily they’re working to develop an economically and environmentally sound mountain ecosystem to improve the livelihoods of mountain populations. They needed a new brand, website, photography and a solid set of guidelines in order to generate publications, books and web pages themselves. I developed an extensive set of templates and guidelines which can be used in an endless variety of ways to keep the them appearing fresh and different, but at the same time consistently looking and behaving as one organisation. The identity subtly highlights two of their key areas: Mountains and Water. 2 ALEX TREADWAY / DESIGN & PHOTOGRAPHY ICIMOD PASSING THE BATON ICIMOD publish a large amount of materials which are almost exclusively produced themselves by their in-house design team. They needed a set of guidelines which would cater for a vast array of different formats and content. I gave them an intuitive system which could adapt as necessary but at the same time be ever-so- simple to use. Now they’re doing it all themselves. 3 ALEX TREADWAY / DESIGN & PHOTOGRAPHY ICIMOD 4 ALEX TREADWAY / DESIGN & PHOTOGRAPHY ICIMOD ICIMOD PHOTOGRAPHY As well as re-establishing ICIMOD’s branding I also travalled to all of their member countries to generate an entire port folio of photography. The result was such a success ICIMOD decided to publish a coffee table book called ‘Life in the Himalayas’ to showcase the photographs and tell their story. -

Short Selling Attack: a Self-Destructive but Profitable 51% Attack on Pos Blockchains

Short Selling Attack: A Self-Destructive But Profitable 51% Attack On PoS Blockchains Suhyeon Lee and Seungjoo Kim CIST (Center for Information Security Technologies), Korea University, Korea Abstract—There have been several 51% attacks on Proof-of- With a PoS, the attacker needs to obtain 51% of the Work (PoW) blockchains recently, including Verge and Game- cryptocurrency to carry out a 51% attack. But unlike PoW, Credits, but the most noteworthy has been the attack that saw attacker in a PoS system is highly discouraged from launching hackers make off with up to $18 million after a successful double spend was executed on the Bitcoin Gold network. For this reason, 51% attack because he would have to risk of depreciation the Proof-of-Stake (PoS) algorithm, which already has advantages of his entire stake amount to do so. In comparison, bad of energy efficiency and throughput, is attracting attention as an actor in a PoW system will not lose their expensive alternative to the PoW algorithm. With a PoS, the attacker needs mining equipment if he launch a 51% attack. Moreover, to obtain 51% of the cryptocurrency to carry out a 51% attack. even if a 51% attack succeeds, the value of PoS-based But unlike PoW, attacker in a PoS system is highly discouraged from launching 51% attack because he would have to risk losing cryptocurrency will fall, and the attacker with the most stake his entire stake amount to do so. Moreover, even if a 51% attack will eventually lose the most. For these reasons, those who succeeds, the value of PoS-based cryptocurrency will fall, and attempt to attack 51% of the PoS blockchain will not be the attacker with the most stake will eventually lose the most. -

Galaxy Digital Announces Launch of Decentralized Finance (Defi) Index Fund

NEWS RELEASE Galaxy Digital Announces Launch of Decentralized Finance (DeFi) Index Fund 8/19/2021 The Fund seeks to track the newly launched Bloomberg Galaxy DeFi Index NEW YORK, Aug. 19, 2021 /CNW/ - Galaxy Digital Holdings Ltd. (TSX: GLXY) ("Galaxy Digital" or the "Company"), the pre-eminent global provider of blockchain and cryptocurrency nancial services for institutions, today announced the launch of the Galaxy DeFi Index Fund, a passively managed fund that seeks to track the performance of the newly-launched Bloomberg Galaxy DeFi Index (ticker: DEFI). As one of the fastest growing sectors in crypto, DeFi brings nancial services on-chain, enabling participants to borrow, lend, and exchange assets on blockchains governed by smart contracts instead of through centralized intermediaries. DeFi is distinct because it expands the use of blockchain from simple value transfer to more complex nancial use cases. At the time of writing, users have deposited over $80.7 billion worth of crypto into DeFi smart contracts up from $4.7 billion one year ago today. The Galaxy DeFi Index Fund seeks to provide institutional investors access to returns based on the performance of DeFi through a simple, secure vehicle with exposure to the largest, most liquid portion of the decentralized nance crypto market, one of the fastest-growing segments of the crypto ecosystem. The fund is seeded by NZ Funds, a wealth management rm that manages over $2bn of New Zealanders' savings. "Galaxy continues to pioneer inroads for institutions seeking exposure to the innovation happening within the crypto ecosystem," said Steve Kurz, Partner and Head of Asset Management at Galaxy Digital. -

The Bitcoin Trading Ecosystem

ArcaneReport(PrintReady).qxp 21/07/2021 14:43 Page 1 THE INSTITUTIONAL CRYPTO CURRENCY EXCHANGE INSIDE FRONT COVER: BLANK ArcaneReport(PrintReady).qxp 21/07/2021 14:43 Page 3 The Bitcoin Trading Ecosystem Arcane Research LMAX Digital Arcane Research is a part of Arcane Crypto, bringing LMAX Digital is the leading institutional spot data-driven analysis and research to the cryptocurrency exchange, run by the LMAX Group, cryptocurrency space. After launch in August 2019, which also operates several leading FCA regulated Arcane Research has become a trusted brand, trading venues for FX, metals and indices. Based on helping clients strengthen their credibility and proven, proprietary technology from LMAX Group, visibility through research reports and analysis. In LMAX Digital allows global institutions to acquire, addition, we regularly publish reports, weekly market trade and hold the most liquid digital assets, Bitcoin, updates and articles to educate and share insights. Ethereum, Litecoin, Bitcoin Cash and XRP, safely and securely. Arcane Crypto develops and invests in projects, focusing on bitcoin and digital assets. Arcane Trading with all the largest institutions globally, operates a portfolio of businesses, spanning the LMAX Digital is a primary price discovery venue, value chain for digital nance. As a group, Arcane streaming real-time market data to the industry’s deliver services targeting payments, investment, and leading indices and analytics platforms, enhancing trading, in addition to a media and research leg. the quality of market information available to investors and enabling a credible overview of the Arcane has the ambition to become a leading player spot crypto currency market. in the digital assets space by growing the existing businesses, invest in cutting edge projects, and LMAX Digital is regulated by the Gibraltar Financial through acquisitions and consolidation. -

Building Up: What Are London's Limits?

Building Up Contents Building Up: What are London's limits? 01 Is London falling short on tall buildings? In the first of our ‘Building Up’ series, we look at some of the key challenges to 03 Dame Judith Hackitt’s review following delivering taller developments in the capital. With pressure for growth and land the Grenfell fire: the final values at record levels in certain areas, property experts are seeking innovative report ways to deliver high quality developments at increased densities. In this 04 Whose light is it anyway? Releasing publication, we go beyond the typical issues of planning, construction and lettings rights of light reaches the High to look at the specific issues that come with building up. Court 06 Love thy neighbour: starting your Charles Russell Speechlys cohosted a panel discussion with GIA on ‘London's development on the right foot skyline and the challenges of building up’ on 5 June 2018. At the seminar, we 08 Branding your Building (before drew together industry insight from our panel of experts from across development, someone else does) planning, politics and law and through live polling of our audience of leading 10 The only way is up? How new national professionals working within the real estate sector. This gave us an indepth planning policy will increase understanding of this topic from different perspectives in the market. pressure on building height and density If you have any questions on this publication, please get in touch with 12 About Charles Russell Speechlys Claire Fallows on [email protected] or James Souter on [email protected] with any questions. -

Coinbase Explores Crypto ETF (9/6) Coinbase Spoke to Asset Manager Blackrock About Creating a Crypto ETF, Business Insider Reports

Crypto Week in Review (9/1-9/7) Goldman Sachs CFO Denies Crypto Strategy Shift (9/6) GS CFO Marty Chavez addressed claims from an unsubstantiated report earlier this week that the firm may be delaying previous plans to open a crypto trading desk, calling the report “fake news”. Coinbase Explores Crypto ETF (9/6) Coinbase spoke to asset manager BlackRock about creating a crypto ETF, Business Insider reports. While the current status of the discussions is unclear, BlackRock is said to have “no interest in being a crypto fund issuer,” and SEC approval in the near term remains uncertain. Looking ahead, the Wednesday confirmation of Trump nominee Elad Roisman has the potential to tip the scales towards a more favorable cryptoasset approach. Twitter CEO Comments on Blockchain (9/5) Twitter CEO Jack Dorsey, speaking in a congressional hearing, indicated that blockchain technology could prove useful for “distributed trust and distributed enforcement.” The platform, given its struggles with how best to address fraud, harassment, and other misuse, could be a prime testing ground for decentralized identity solutions. Ripio Facilitates Peer-to-Peer Loans (9/5) Ripio began to facilitate blockchain powered peer-to-peer loans, available to wallet users in Argentina, Mexico, and Brazil. The loans, which utilize the Ripple Credit Network (RCN) token, are funded in RCN and dispensed to users in fiat through a network of local partners. Since all details of the loan and payments are recorded on the Ethereum blockchain, the solution could contribute to wider access to credit for the unbanked. IBM’s Payment Protocol Out of Beta (9/4) Blockchain World Wire, a global blockchain based payments network by IBM, is out of beta, CoinDesk reports. -

Galaxy Digital Holdings Ltd. Management's Discussion And

Galaxy Digital Holdings Ltd. Management’s Discussion and Analysis November 12, 2020 Introduction This Management’s Discussion and Analysis (“MD&A”), dated November 12, 2020, relates to the financial condition and results of operations of Galaxy Digital Holdings Ltd. (“GDH Ltd.” or together with its consolidated subsidiary, the “Company”) as of November 12, 2020, and is intended to supplement and complement the Company’s condensed consolidated interim financial statements for the three and nine months ended September 30, 2020. The Company's only significant asset is a minority interest in Galaxy Digital Holdings LP ("GDH LP" or the "Partnership"), an operating partnership that is building a diversified financial services and investment management business in the cryptocurrency and blockchain space (See Transaction section). GDH LP has separately filed its condensed consolidated interim financial statements and MD&A for the three and nine months ended September 30, 2020, which are available on the Company's SEDAR profile at www.sedar.com. The Company's MD&A should be read in conjunction with GDH LP's condensed consolidated interim financial statements and MD&A. The Company has included GDH LP's MD&A as an appendix to this MD&A. This MD&A, when read in conjunction with GDH LP's MD&A, was written to comply with the requirements of National Instrument 51-102 – Continuous Disclosure Obligations (“NI 51-102”). The condensed consolidated interim financial statements and MD&A are presented in US dollars, unless otherwise noted and have been prepared in accordance with International Financial Reporting Standards (“IFRS”). In the opinion of management, all adjustments (which consist only of normal recurring adjustments) considered necessary for a fair presentation have been included. -

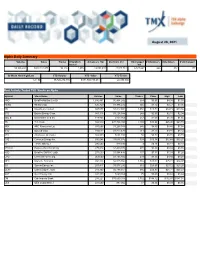

August 26, 2021 Alpha Daily Summary

August 26, 2021 Alpha Daily Summary Volume Value Trades # Symbols Advancers Vol Decliners Vol Unchanged # Advancers # Decliners # Unchanged traded Vol 53,396,832 $823,112,875 96,116 1,655 19,051,433 27,817,712 6,527,687 646 832 177 52-Week New High/Low YTD Volume YTD Value YTD Trades 68 / 36 15,720,274,735 $171,700,733,631 22,890,300 Most Actively Traded TSX Stocks on Alpha Symbol Stock Name Volume Value Trades Close High Low HND BetaProNatGas Lev Br 1,686,497 $6,404,242 664 $3.65 $4.09 $3.59 HEXO HEXO Corp. 636,320 $1,986,272 545 $3.12 $3.27 $3.05 BB BlackBerry Limited 567,077 $7,812,991 1,052 $13.72 $14.15 $13.36 BTE Baytex Energy Corp. 543,118 $1,128,584 248 $2.07 $2.10 $2.04 BBD.B Bombardier Cl B SV 449,865 $755,069 257 $1.69 $1.70 $1.65 TD T.D. Bank 388,529 $32,788,298 2,200 $83.86 $85.98 $83.70 ARX ARC Resources Ltd. 387,696 $3,208,743 646 $8.46 $8.46 $7.98 BTO B2Gold Corp. 382,047 $1,817,670 714 $4.77 $4.81 $4.72 ATH Athabasca Oil Corp J 368,900 $261,193 50 $0.72 $0.72 $0.70 CVE Cenovus Energy Inc. 350,548 $3,637,676 533 $10.34 $10.48 $10.27 TV Trevali Mining J 280,500 $49,090 9 $0.18 $0.18 $0.18 BTCC.B Purpose BitcnCA NCHg 275,816 $2,439,270 472 $8.86 $8.89 $8.76 HSD BetaPro S&P500 -2xBr 273,000 $1,994,438 107 $7.33 $7.33 $7.26 CPG Crescent Point Corp. -

An Investigative Study of Cryptocurrency Abuses in the Dark Web

Cybercriminal Minds: An investigative study of cryptocurrency abuses in the Dark Web Seunghyeon Leeyz Changhoon Yoonz Heedo Kangy Yeonkeun Kimy Yongdae Kimy Dongsu Hany Sooel Sony Seungwon Shinyz yKAIST zS2W LAB Inc. {seunghyeon, kangheedo, yeonk, yongdaek, dhan.ee, sl.son, claude}@kaist.ac.kr {cy}@s2wlab.com Abstract—The Dark Web is notorious for being a major known as one of the major drug trading sites [13], [22], and distribution channel of harmful content as well as unlawful goods. WannaCry malware, one of the most notorious ransomware, Perpetrators have also used cryptocurrencies to conduct illicit has actively used the Dark Web to operate C&C servers [50]. financial transactions while hiding their identities. The limited Cryptocurrency also presents a similar situation. Apart from coverage and outdated data of the Dark Web in previous studies a centralized server, cryptocurrencies (e.g., Bitcoin [58] and motivated us to conduct an in-depth investigative study to under- Ethereum [72]) enable people to conduct peer-to-peer trades stand how perpetrators abuse cryptocurrencies in the Dark Web. We designed and implemented MFScope, a new framework which without central authorities, and thus it is hard to identify collects Dark Web data, extracts cryptocurrency information, and trading peers. analyzes their usage characteristics on the Dark Web. Specifically, Similar to the case of the Dark Web, cryptocurrencies MFScope collected more than 27 million dark webpages and also provide benefits to our society in that they can redesign extracted around 10 million unique cryptocurrency addresses for Bitcoin, Ethereum, and Monero. It then classified their usages to financial trading mechanisms and thus motivate new business identify trades of illicit goods and traced cryptocurrency money models, but are also adopted in financial crimes (e.g., money flows, to reveal black money operations on the Dark Web. -

Winners Supplement

INVESTMENT AWARDS Winners Supplement 037_PP_Feb21.indd 37 01/02/2021 15:26 Helping you BUILD YOUR PORTFOLIO through the complexities of pension investment Trustees need a partner to provide bespoke investment solutions for today and tomorrow. And with us, it’s always personal. As a market leader, we use our size to benefit clients by delivering advice with a personal touch – rooted by a thorough knowledge of our clients’ individual needs and preferences, we help schemes to build their own portfolios by deconstructing the complexities of pension scheme investment. So talk to us about your scheme’s investment requirements. For more information, visit aon.com/investmentuk, email [email protected], or call us on 0800 279 5588. Aon Solutions UK Limited Registered in England and Wales No. 4396810 Registered office: The Aon Centre, 122 Leadenhall Street, London, EC3V 4AN. a10144-01 Fiduciary and Investment ad PI_220 x 280_V3.indd 1 6/23/2020 1:01:38 AM PP INVESTMENT AWARDS WINNERS INVESTMENT AWARDS Contents CONTACT 40 Roll of honour 48 Sustainable Equity Manager of the Year Professional Pensions, New London House, 172 Drury Lane, London WC2B 5QR 42 Multi Asset/Sector Credit An interview with Marianne Harper Gow phone Prefix phone numbers with 020 7484 of Baillie Gifford unless specified otherwise Manager of the Year email [email protected] An interview with Campe Goodman of web professionalpensions.com 50 UK & European Commercial @profpensions Wellington Management twitter Real Estate Debt Manager of Editorial 43 Multi-Asset -

Galaxy Digital Expands Galaxy Fund Management with Acquisition of Vision Hill Group

NEWS RELEASE Galaxy Digital Expands Galaxy Fund Management with Acquisition of Vision Hill Group 5/24/2021 NEW YORK, May 24, 2021 /CNW/ - Galaxy Digital Holdings Ltd. (TSX: GLXY) ("Galaxy Digital" or the "Company") today announced that it has acquired Vision Hill Group, a premier investment consultant and asset manager in the digital asset sector that provides sophisticated investors with access to institutional-caliber investment products, data, benchmarks, and analytics for more informed investment decisions. The acquisition adds to Galaxy Fund Management's leading platform for institutions looking to unlock investment opportunities across the digital asset class. "As the institutionalization of digital assets accelerates, so does the need for comprehensive, institutional-grade platforms to support it and that's precisely what we're building at Galaxy," said Damien Vanderwilt, Co-President, and Head of Global Markets. "The powerful data capabilities that Scott Army, Dan Zuller, and the Vision Hill team have developed are the perfect addition to our full suite of technology-driven nancial services and investment management solutions, fostering the broader mainstream adoption of digital assets." The transaction will further expand Galaxy Fund Management's growing product suite and enable institutional clients to access an even broader array of data and intelligence to streamline research and inform investment decisions. Vision Hill Group's family of crypto hedge fund indices, leading crypto-market intelligence database VisionTrack, and sophisticated asset management capabilities with a crypto-focused fund of funds product sit at the intersection of information (data), expertise (strategies), and access (opportunities). "Galaxy Fund Management is rapidly expanding its capabilities to ultimately provide institutional-grade exposure to every investable corner of digital assets so that institutions can easily get involved in this booming industry," said Steve Kurz, Partner and Head of Asset Management at Galaxy Digital.