Healthy Financial Structure

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Santiago, Chile RESULTADOS NEGOCIO COSTANERA CENTER PRINCIPALES HITOS CRECIMIENTO

Santiago, Chile RESULTADOS NEGOCIO COSTANERA CENTER PRINCIPALES HITOS CRECIMIENTO 01Resultados Negocio Chile & Argentina RESULTADOS NEGOCIO COSTANERA CENTER PRINCIPALES HITOS CRECIMIENTO Chile repite su positiva performance 2016 Resultados Cencosud Shopping Chile al cierre de Junio 2017 INGRESOS* VENTA VISITAS OCUPACIÓN (CLP$ BN) LOCATARIOS (MILLONES) (%) (CLP$ BN) 98,0% 97,9% 72,4 62,4 62,5 1.337 64,4 1.246 H1 2016 H1 2017 H1 2016 H1 2017 H1 2016 H1 2017 H1 2016 H1 2017 +12,4% +7,3% +0,1% -0,1 % *Excluye Ingresos por Alquiler de Empresas Relacionadas al grupo Cencosud. RESULTADOS NEGOCIO COSTANERA CENTER PRINCIPALES HITOS CRECIMIENTO DESACELERACIÓN ECONÓMICA EN ARGENTINA Impactó el poder de compra y visitas a los centros comerciales 2016 Resultados Cencosud Shopping Argentina al cierre de Junio 2017 INGRESOS* VENTA VISITAS OCUPACIÓN (ARS$ MM) LOCATARIOS (MILLONES) (%) (ARS$ BN) 97,4% 28,2 28,0 96,0% 817,1 18,6 689,9 15,6 H1 2016 H1 2017 H1 2016 H1 2017 H1 2016 H1 2017 H1 2016 H1 2017 +18,4% +19,0% -0,7% -1,4 % *Excluye Ingresos por Alquiler de Empresas Relacionadas al grupo Cencosud. RESULTADOS NEGOCIO COSTANERA CENTER PRINCIPALES HITOS CRECIMIENTO 02Costanera Center El mall de América Latina RESULTADOS NEGOCIO COSTANERA CENTER PRINCIPALES HITOS CRECIMIENTO COSTANERA CENTER ES EL Centro Comercial más relevante de América Latina Destino clave del turismo de compras en Chile: El “Miami” de América Latina según prensa extranjera. Más de 3,2 millones de visitas mensuales (5% de crecimiento contra 2016). Venta Locatarios +15% en 2017; Ingresos de alquiler +21%. Habilitación nuevas áreas comerciales. -

Jumbo Supermarket, a Chilean Case Linking Consumption to Materials

Understanding the material recovery by material flows in food retailers: Jumbo supermarket, a Chilean case linking consumption to materials C.G. Ide1 & A. Godoy-Faundez2,3 1Head of Sustainability Department, CENCOSUD, Santiago, Chile 2CiSGER, Facultad de Ingeniería, Universidad del Desarrollo, Santiago, Chile 3.WTERT Chile Keywords: Food Security, Waste Management, Material Flow Analysis Presenting author email: [email protected] Introduction The Rome Declaration (World Food Security, 1996) define: “Food security exists when all people, at all times, have physical and economic access to sufficient, safe and nutritious food that meets their dietary needs and food preferences for an active and healthy life”. According to Atkin et al. (2015), the impact of foreign multinational food retailers increased the household welfare mainly driven by a reduction in the cost of living and providing access and availability to high diversity of food with a right spatial distribution is achieved throughout city (Guy et al, 2015), a contribution to food security. However, a big challenge for the food sector today is related to reducing the food wasted. Each year a third of all that is produced, is wasted, including about 45% of all fruit and vegetables, 35% of fish and seafood, 30% of cereals, 20% of dairy products and 20% of meat. In developed countries, consumers and retailers throw away between 30% and 40% of all food purchased, whereas in poorer countries between 5% to 20%. The carbon footprint of food produced and not eaten is estimated at 3.3 gigatonnes of CO2 (Scholz et al. 2015). These numbers don’t include the product's packaging discharged as containers and wrapping. -

Costanera Center

SKIDATA Installations Shopping Centers Chile Costanera Center The Costanera Center is located in the up-and-coming business district of Santiago - unofficially known as “Sanhattan”. The complex, covering an area of 700,000 2m , includes the tallest skyscraper in Latin America, the “Gran Torre Santiago”, which is 300 meters high and has 64 floors, as well as the largest shopping center in the region with 300 stores, restaurants, a large cinema and a huge, high-quality supermarket. Every month, hundreds of thousands of visitors are welcomed to the center. After six years of construction, the Costanera Center finally opened its doors in 2012. The 5,700 available parking spaces, of which 3,500 are in the parking garages, are frequented by 12,000 vehicles daily. Additional parking facilities are currently in planning to meet the needs of hotel guests and the numerous companies which are moving into new offices in the “Gran Torre Santiago”. www.skidata.com Costanera Center Shopping Centers Chile Project description The owner and operator, Cencosud, was looking on which of the thousands of parking spaces his for an ultra-modern and reliable solution with a car is parked, he only needs to use one of the special focus on both design and functionality. SKIDATA automated pay stations. After reading Especially important was the ability to adapt the customer’s parking ticket, the system then to the current and future demands of the searches for the vehicle using its cameras. dynamic retail sector, particularly in light of the huge increase in the number of visitors For its regular customers, Cencosud offers a at peak shopping periods throughout the post-payment customer card (RFID-based), year, such as Christmas and Valentine’s Day. -

2018 Cod International Conference Chile Table of Contents

2018 COD INTERNATIONAL CONFERENCE CHILE TABLE OF CONTENTS Remarks 4 Introduction 4 Welcome to Chile 5 Thank You 6 AIA Board 8 Organizing Team 10 Seminar 12 Architecture Tour / Architects 14 Downtown 18 Campus 50 Modern Architecture 62 Contemporary Architecture 70 Additional Reading 98 2 AIA COD Conference, Santiago 2018 3 THE AIA COMMITTEE ON DESIGN 2018 COD THEME The AIA Committee on Design (COD) was The theme for the AIA Conference on founded to promote design excellence Architecture 2018 is Blueprint for Better among members of the AIA, the broader Cities. During 2018, the AIA Committee on design community, and the public at Design will visit Vancouver BC; New York; large, both nationally and internationally. and Santiago, Chile. What better places to The committee goals are to examine and visit to learn about the Blueprint for Better promote knowledge of contemporary Cities? Studying these three great cities design issues, to compare current design gives us the opportunity to delve into the and historic precedents, to learn from the important issues of planning, urban design, contrast or progression of ideas, and to architecture, and the significance of design! advocate leadership roles for architects These cities display excellence in design at within the fields of design and planning. As all levels, from the smallest scale to mega one of the largest interest areas within the developments. Our journey will expose us family of the AIA Knowledge Communities, to design excellence and the importance of the COD is the standard bearer for design design in our lives. in the Institute. The committee makes recommendations for Gold Medalists, Firm Awards, Honorary Fellows, and Institute Honor Awards. -

Trader Export V-RCH 02 JUNE 2016 for PRINT

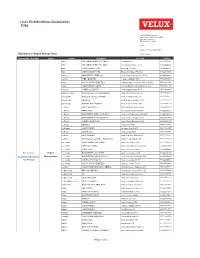

Lista Distribuidores Autorizados 2016 VELUX Chile Limitada San Patricio 4099 Ofic. 201 Vitacura, Santiago Zip code 763 0328 Chile Teléfono +56 2 953 6789 Distribuidores Región Metropolitana www.velux.cl Representante de ventas Región Comuna Distribuidor Dirección Teléfono Buin DAB CENTRO FERRETERO (MTS) San Martin 220 +56228212161 Buin DAB CENTRO FERRETERO (MTS) José Manuel Balmaceda 15 +56228212161 Buin CONSTRUMART BUIN Errázuriz 330. Buin +56229151000 Buin CONSTRUMART BUIN Manuel Rodriguez 758. Buin +56225698689 Cerrillos HOMECENTER CERRILLOS Avda. Américo Vespucio Sur 1501 +56223918002 Cerrillos PUNTO MAESTRO Camino a Melipilla 7739 +56227260800 Colina YOLITO CENTRO FERRETERO Carretera Gral. San Martín 6800, Km 16.5 +56224990600 Colina CONSTRUMART COLINA Av. San Martín con Los Álamos, Colina. +56228600913 Conchalí COMERCIAL EL DATO Avda. independencia 4907 +56224448369 Estación Central HOMECENTER ESTACIÓN CENTRAL San Francisco de Borja 402 +56227381000 Huechuraba HOMECENTER HUECHURABA Avda. Vespucio Norte 1737 +56227381000 Huechuraba IMPERIAL Avda. Américo Vespucio 1399 +56223997000 Huechuraba SODIMAC HUECHURABA Avda. Pedro Fontova 5903 +56226249959 La Florida EASY LA FLORIDA Avda.Vicuña Mackenna 6100 +56227206300 La Florida FERROLUSAC Avda.Vicuña Mackenna 8652 +56222814653 La Florida HOMECENTER NUEVA LA FLORIDA Avda. José Pedro Alessandri 6402 +56227381007 La Florida HOMECENTER PLAZA VESPUCIO Avda. Américo Vespucio 7310 +56223908001 La Florida SODIMAC LA FLORIDA Avda. Vicuña Mackenna 9101 +56222620154 La Granja IMPERIAL Santa Rosa 7876 +56223997000 La Pintana CONSTRUMART Av Santa Rosa 11905 +56227903545 La Reina AQUAMODEL Avda. Larrain 7138 +56222773477 La Reina EASY LA REINA Avda. Francisco Bilbao 8750 +56223362300 La Reina HOMECENTER LA REINA - PEÑALOLÉN Avda. Pte. Alessandri 1347 +56223898009 Las Condes CONSTRUMART LAS CONDES Avda. Las Condes 12391 +56224302901 Las Condes EASY LAS CONDES Avda. -

Bono Puntos Productos Catálogo Junio Jumbo”

BASES PROMOCIÓN “BONO PUNTOS PRODUCTOS CATÁLOGO JUNIO JUMBO” En Santiago de Chile, a 18 de Junio de 2014, CIRCULO MÁS S.A., RUT N° 76.476.830-2, con domicilio en Av. Kennedy N° 9001, comuna de Las Condes, Santiago, en adelante Jumbo, ha organizado la siguiente promoción: Artículo 1°: Objeto: Con motivo de reconocer la preferencia de sus clientes, CIRCULO MAS realizará una promoción denominada “BONO PUNTOS PRODUCTOS CATÁLOGO JUNIO JUMBO”, en adelante, la “Promoción”, cuyos términos y condiciones se regulan en las presentes bases. Articulo 2° Condiciones de participación: Los consumidores inscritos al Club de Puntos Cencosud organizado por CIRCULO MAS, que durante la vigencia de la Promoción realicen compras en Supermercados Jumbo en productos que se detallan en la siguiente tabla y dicten su número de cédula de identidad en la caja respectiva, podrán acumular los siguientes Puntos Cencosud que correspondan a dichos productos: PRODUCTOS EN PROMOCIÓN PUNTOS A ACUMULAR Pack Cars 110X12 SKU 974934 100 Pack Princesas 110X12 SKU 1354073 100 Promoción 2x de Pañales Pampers Premium Care P 56 unidades SKU 1363043, XXG 32 unidades SKU 1363047, XG 32 1000 unidades SKU 1363046, M 48 unidades SKU 1363044, G 40 unidades SKU 1363045 Promoción 2x de CIF crema blanco con micro partículas 750GR, SKU 1492544 y CIF crema limón con micro partículas 750GR 200 SKU 1492545 Ketchup Heinz envase 567 G SKU 402725 200 Agua mineral Cachantun sin gas bidón 6 L SKU 1407538 250 Pack ron Flor de Caña 4 años botella 750cc + Petaca Ron Flor 500 de Caña 5 años botella 375 CC SKU 1413796 Raviolini Nutra7 Bicolor Carne 350 G SKU 1515095 300 Raviolini Nutra7 Bicolor Pollo 350 G SKU 1515096 300 Nescafé mixes vainilla 148g SKU 1329803 450 Nescafé mixes Vienes 144 g SKU 1329804 450 Nescafé mixes caramelo 136g SKU 1336323 450 Artículo 3º: Duración y Modificaciones.- 3.1 La vigencia de la Promoción será desde el 26 de Junio hasta el 06 de Julio, ambos de 2014, ambas fechas inclusive y solo válidas para la República de Chile. -

Análisis Sectorial De Las Grandes Superficies En Colombia

ANÁLISIS SECTORIAL DE LAS GRANDES SUPERFICIES EN COLOMBIA CLAUDIA MAITEE BAHAMÓN OSORIO CÓDIGO 0622074 PROYECTO DE GRADO II PROFESOR: EVA ORIETTA RODRÍGUEZ UNIVERSIDAD ICESI FACULTAD DE CIENCIAS ADMINISTRATIVAS Y ECONÓMICAS PROGRAMA DE ADMINISTRACIÓN DE EMPRESAS NOCTURNO SANTIAGO DE CALI NOVIEMBRE 28 DEL 2013 1 Contenido RESUMEN ...................................................................................................... 9 INTRODUCCIÓN .......................................................................................... 10 1. METODOLOGÍA ................................................................................. 12 1.1. TRATAMIENTO DEL PROBLEMA ...................................................... 12 1.2. OBJETIVOS ..................................................................................... 14 1.2.1. Objetivo general ........................................................................ 14 1.2.2. Objetivos específicos ................................................................ 14 1.3. JUSTIFICACIÓN .............................................................................. 14 1.4. MARCO TEORICO .......................................................................... 15 1.4.1. Definición de sector ................................................................... 15 1.4.2. Los determinantes de la competencia en el sector: .................. 18 1.4.3. Diamante de competitividad ...................................................... 22 1.4.4. La ley de la ventaja comparativa .............................................. -

Quiénes Somos

Acerca de Easy Quiénes somos Somos Cencosud Easy es una de las empresas del grupo Cencosud, un holding internacional con más de 50 años de historia y con presencia en América Latina que opera una estrategia multiformato, a través de supermercados, tiendas de mejoramiento para el hogar, centros comerciales, tiendas por departamento y retail financiero. Estas operaciones las complementa con actividades de corretaje de seguros y centros de entretención familiar. Actualmente, el holding cuenta con una presencia significativa en Argentina, Brasil, Chile, Perú y Colombia, operaciones coordinadas desde su casa matriz en Chile, y posee una dotación cercana a los 150.000 colaboradores. Cencosud es una Sociedad Anónima abierta y, como tal, se encuentra sujeta a las disposiciones de la Ley Nº 18.046 sobre Sociedades Anónimas, de la Ley Nº 18.045 sobre Mercado de Valores y la normativa de la Superintendencia de Valores y Seguros, entre otras. Además, como entidad que transa valores en los Estados Unidos de Norteamérica, Cencosud S.A. está inscrita en la SEC (Securities and Exchange Commission) y cumple con las disposiciones de la Ley Sarbanes Oxley de 2002, entre otras. Easy comenzó su historia en Argentina en 1993 y al año siguiente abrió sus puertas en Chile. Somos especialistas en la comercialización de productos y servicios orientados a la construcción, remodelación y equipamiento del hogar, y entregamos soluciones integrales para que cada persona pueda llevar a cabo sus propios proyectos. Nos dedicamos a la venta al detalle y mayorista de productos para el mejoramiento del hogar tanto de casa y jardín, como de construcción. -

Buenos Aires Instituto De Ciencias De La Computación Facultad De Ciencias Exactas Y Naturales Universidad De Buenos Aires FSCD 2021 Proposal for Location

Buenos Aires Instituto de Ciencias de la Computación Facultad de Ciencias Exactas y Naturales Universidad de Buenos Aires FSCD 2021 Proposal for location ORGANISING COMMITTEE LOCAL ORGANISERS Alejandro Díaz-Caro (Chair) , ICC (CONICET/UBA) & UNQ Santiago Figueira , ICC (CONICET/UBA) Carlos Lombardi , UNQ Carlos López Pombo, ICC (CONICET/UBA) Ricardo O. Rodriguez, ICC (CONICET/UBA) * I CC (CONICET/UBA) = Instituto de Ciencias de la Computación (CONICET/Universidad de Buenos Aires) * UNQ = Universidad Nacional de Quilmes LIAISONS Mauricio Ayala-Rincón, Universidade de Brasília/CNPq. Mauro Jaskelioff, CONICET/Universidad Nacional de Rosario. Nora Szasz, Universidad ORT Uruguay/ANII/Pedeciba Beta Ziliani , CONICET/Universidad Nacional de Córdoba. The organizing committee is composed by five researchers from Buenos Aires, and four researchers in the region who are involved in the FSCD community. In addition, there will be several PhD students collaborating with the local arrangements. BUENOS AIRES, ARGENTINA The City of Buenos Aires is one of the cultural capitals of South America and one of the most important and dynamic business points of the region. Every month an impressive amount of cultural activities take place (a surprising number of them are free of charge): art exhibitions, classic films, stage performances, among many others. The fair and conference industry is experiencing a significant growth, both quantitatively and qualitatively. Buenos Aires is the venue of international exhibitions and world congresses comprising different industries and topics. It is currently one of the most popular business meeting cities in Latin American, hosting around 50 major conferences every year with up to 5,000 participants in the largest meetings (for more information on this, please see https://turismo.buenosaires.gob.ar/en/agrupador-noticias/meetings-events-mice-tourism) . -

Dominican Republic

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 12/27/2017 GAIN Report Number: DR1718 Dominican Republic Retail Foods Diverse Retail Sector Facilitates Fifth-Largest Market for U.S. Consumer-Oriented Products in Latin America Approved By: Lisa Ahramjian, Agricultural Attaché Prepared By: Mayra Carvajal, Agricultural Marketing Specialist Report Highlights: The Dominican Republic is one of the most dynamic economies in the Caribbean region. With U.S. consumer-oriented product exports reaching $484 million in 2016, the country represents the fifth- largest market for such products in Latin America. The Dominican modern retail sector offers a wide variety of U.S. products, is dominated by locally-owned companies, and is growing rapidly. However, despite the prominence and growth of local supermarket chains, they only account for 20-25 percent of retail sales. The majority of sales are still in the traditional channel, which includes neighborhood stores (colmados) and warehouses and offers largely local products. Post: Santo Domingo SECTION I. MARKET SUMMARY The Dominican Republic (DR) is one of the largest and most stable economies in Central America and the Caribbean. With U.S. consumer-oriented product exports reaching $484 million in 2016, the country represents the fifth-largest market for such products in Latin America. For general information on the Dominican market, please refer to Post’s 2017 Exporter Guide, DR1717. The Dominican retail sector can be divided into two distinct segments or channels; the modern and the traditional. The modern retail distribution channel is comprised of three main components: supermarket chains, independent supermarkets, and convenience stores known as “food shops.” Supermarket chains dominate this segment and offer a wide variety of U.S. -

Q1-2012 Presentation (PDF, 645

Costanera Center, Santiago, Chile, height: 300m 109 elevators, of which 77 Schindler 7000 Welcome to Schindler 86 Schindler escalators and moving walks Selected key figures as of March 31, 2012 April 19, 2012 Highlights in Q1/2012 Pleasing start into 2012 – 9.5% growth in order intake in LC (+5.4% in CHF); especially in Asia/Pacific, India and Americas – Strong order backlog of CHF 6 795 million (+7.8% in LC, +5.5% in CHF) – 7.3% growth in revenue in LC (+3.1% in CHF); negative FX impact of CHF 77 million – E&E EBIT of CHF 224 million; negative FX impact of CHF 12 million – E&E EBIT margin: 11.8% (Q1/2011: 11.5%) – Net profit of CHF 156 million slightly above Q1/2011 level (before one-time book-gain of CHF 31 million in Q1/2011) – Strong operating cashflow of CHF 331 million – LEAP on track – Introduction of new products on track © Schindler | Corporate Communications | Page 2 E&E: Good development in all KPIs January - March ∆% In CHF million Q1/2012 Q1/2011 ∆% in LC Orders received 2 193 2 081 +5.4 +9.5 Revenue 1 904 1 846 +3.1 +7.3 Operating profit (EBIT) 224 212 +5.7 +11.3 in % 11.8 11.5 31.03.12 31.12.11 Order backlog 6 795 6 438 + 5.5 +7.8 Headcount at end of period 44 314 44 387 –0.2 © Schindler | Corporate Communications | Page 3 Group: Key figures as of March 31, 2012 January - March In CHF million Q1/2012 Q1/20111 ∆ in % ∆% in LC Revenue 1 904 1 846 +3.1 +7.3 Operating profit (EBIT) 214 201 +6.5 +12.4 Net income from financing/investing activities 3 12 Profit before taxes 217 213 +1.9 Profit from continuing operations 156 152 -

Informe De Clasificacin De Riesgo

Clasificadora de Riesgo HUMPHREYS LTDA. An affiliate of MOODY´S INVESTORS SERVICE CENCOSUD S.A. Mayo 2004 Categoría de Riesgo y Contacto Tipo de Instrumento Categoría Contactos Bonos AA Socio Responsable Alejandro Sierra M. Tendencia En Observación Gerente a Cargo Aldo Reyes D. Analista Margarita Andrade P. Otros Instrumentos: Teléfono 56-2-204 7293 Acciones Primera Clase Nivel 3 Fax 56-2-223 4937 Tendencia En Observación Correo Electrónico [email protected] Página Web www.moodyschile.cl EEFF base 31 marzo 2004 Tipo de Reseña Informe Anual Número y Fecha de Inscripción de Instrumentos Bono Series A1, A2, B1 y B2 N° 268 de 05.09.01 Clasificación Histórica Bonos AAA AA+ AA AA- 07/2001 05/2002 05/2003 05/2004 Estado de Resultados Consolidado Cifras en Miles de $ Año Año Año Año Marzo de cada Año 2000 2001 2002 2003 2004 Ingreso Operacional 771.437.977 934.259.830 684.009.074 921.291.442 279.678.527 Costo Explotación (551.001.321) (676.580.698) (494.009.563) (677.867.424) (201.523.777) Gasto Admin. y Venta (168.589.797) (208.458.924) (155.330.373) (200.667.400) (66.185.802) Resultado Operacional 51.846.859 49.220.208 34.669.138 42.756.618 11.968.948 Resultado No Operacional 539.735 (21.982.922) 16.869.556 192.315 (1.720.647) Utilidad Neta 37.883.382 35.236.9201 42.625.303 44.170.193 8.695.438 Balance General Consolidado Cifras en Miles de $ Año Año Año Año Marzo de cada Año 2000 2001 2002 2003 2004 Activo Circulante 188.265.520 28.779.747 218.058.373 208.682.409 237.028.192 Activo Fijo 467.246.999 625.469.164 796.655.525 834.638.435 851.495.690