7960 Clark Road Jessup, MD

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Howard County

A. Raul Delerme, Director Howard County [email protected] RECREATION & PARKS Phone: 410-313-4640 Fax: 410-313-1699 7120 Oakland Mills Road, Columbia, Maryland 21046 www.howardcountymd.gov/rapVoicefRelay: 410-31 3 -7275 August 25, 2020 Ms. Margaret Lashar ProgramOpen SpaceAdministrator Departmentof Natural Resources 580 Taylor Avenue, E-4 Annapolis, MD 21401 RE: Howard County FY2021 Annual Program for Program Open Space Assistance Dear Ms. Lashar: Enclosed is the FY2021 Howard County Annual Program for Program Open Space funding. This Annual Program is in accordance with our 2017 Land Preservation, Parks and Recreation Plan and the Plan Howard 2030 General Plan. A narrativeis attachedto addressour projectselection process, as well asthe compatibility of our projects to the Eight Visions, the Plan Howard 2030 General Plan, the 2017 Land Preservation, Parks and Recreation Plan, and the Smart Growth initiatives. We have listed projects to fully encumber all available funds. Should you require additional information, please do not hesitate to call. Sincerely, au Chief lg and Construction A. Raul Delerme Director Enclosure CC: Calvin Ball, County Executive Delegate Warren E. Miller DelegateTrent M. Kittleman DelegateCourtney Watson DelegateEric D. Ebersole DelegateTerri L. Hill DelegateJessica Feldmark Delegate Vanessa E. Atterbeary DelegateShane E. Pendergrass DelegateJen Tenasa SenatorKatie Fry Hester SenatorClarence K. Lam Senator Guy J. Guzzone Margaret Lashar,Maryland Department of Natural Resources Debbie Herr Cornwell, Maryland Department of Planning Howard County Executive Calvin Ball w\vw.howardcountymd.gov A. Raul Delerme, Director Howard County rdelerme@how ardcountymd.gov RECREATION & PARKS Phone: 410-313-4640 Fax: 410-313-1699 7120 Oakland Mills Road, Columbia, Maryland 21046 www.howardcountymd.gov/rapVoice/Relay: 410-31 3 -7275 August 25, 2020 Debbie Herr Cornwell, PLA, ASLA Maryland Department of Planning 301 West Preston Street, Suite 1101 Baltimore, MD 21201 RE: Howard County FY2021 Annual Program for Program Open Space Assistance Dear Mrs. -

HOWARD COUNTY OFFICIALS FIELD DIRECTIONS Alpha Ridge Park from the Baltimore Beltway (I-695) Or from Route 29, Take I-70 West to the Marriottsville Road Exit

HOWARD COUNTY OFFICIALS FIELD DIRECTIONS Alpha Ridge Park From the Baltimore Beltway (I-695) or from Route 29, take I-70 West to the Marriottsville Road exit. Turn Right (North) on Marriottsville Road, then left at the next traffic light, Route 99. Follow Route 99 about 0.8 miles to the wooden sign (second sign) for Alpha Ridge Park on the left. From Columbia, take Route 32 West to Route 99. Make a right turn and follow Route 99 to the entrance of Alpha Ridge Park. APL From Route 32 take Cedar Lane/Pindell School Road exit (1st exit West of Route 29). Go South on Pindell School Road to 1st intersection. Turn left onto Sanner Road. After Sanner Road makes a sharp right it will go up a hill. Field will be at the top of the hill on the left. Alternate: From Route 32 take Route 29 South. Go to Johns Hopkins Road. Take Johns Hopkins Road West to Sanner Road. Turn Right on Sanner Road and follow to field which will be on your Right. Cedar Lane Park From Route 29 take Route 108 west toward Clarksville about 2 3/4 miles. Turn left onto Cedar Lane (across from Board of Education). Entrance to park is about 1/4 mile on the left. Centennial Park Centennial Park West (Ball Fields 3,4,5) From Route 29 take Route 108 west toward Clarksville. Turn right onto Centennial Lane. Entrance to park will be on the right. Centennial Park North (Ball Fields 1,2) Continue past entrance to Centennial Park West. -

2747 Annapolis Road Flyer Lease

+/- 1 ACRE FOR LEASE 2747 ANNAPOLIS ROAD, HANOVER, MD 21076 | ANNE ARUNDEL COUNTY NEARBY AMENITIES MICHAEL MORAN [email protected] | 443-574-1402 klnb.com R R S S I I L L O O P P A A N N N N A A PROPERTY FEATURES • +/- 1 ACRE OF C-4 LAND IDEAL FOR CAR SALES, O EQUIPMENT AND RENTALS O D D A A BALLENTINES WAY 2747 Annapolis Road 175 • • Existing auto sales office • Highly visible paved lot • Secure rear lot Available in 60 days Custom Map +/- 1 ACRE FOR LEASE LOCATION 2747 ANNAPOLIS ROAD, HANOVER, MD 21076 | ANNE ARUNDEL COUNTY PROPERTY HIGHLIGHTS: +/- 1 acre of of C-4 land for lease with easy access to Maryland Route 175 & Maryland Route 295. DEMOGRAPHICS | 2021: 1-MILE 3-MILE 5-MILE Population SITE 6,834 60,737 166,678 Households 2,464 18,454 57,797 1 MILE Average HH Income $125,314 $118,473 $124,736 3 MILE TRAFFIC COUNTS | 2021: 5 MILE Annapolis Road 38,090 ADT Maryland Route 295 105,090 ADT Source: ©2020 Esri. MICHAEL MORAN April 27, 2021 [email protected] | 443-574-1402 ©2021 Esri Page 1 of 1 7996 7956 1972 1985 7990 7962 7986 1961 C2 +/- 1 ACRE FOR LEASEµ 79967982 79707956 2747 ANNAPOLIS ROAD, 1972HANOVER, MD 21076 | ANNE ARUNDEL COUNTY 1977 ZONING MAP 1985 1962 7996 7956 1972 7990 79767962 1985 Features 7986 Structure Addresses 1961 Zoning 7990 7962 C1 Commercial - Local C2 7986 1951 C2 Commercialµ - Office C3 Commercial - General 1961 C4 Commercial - Highway 7982 7970 C2 City of Annapolis µ 1977 MA1-Community Marina 7982 7970 MA2-Light Commercial Marina 1977 MA3-Yacht Club MB-General Commercial Marina 1962 MC-Heavy Commercial Marina -

Walgreens Located in the Middle of a Master Planned Community with 10% Rental Increases Every 10-Years

EXCLUSIVELY LISTED INVESTMENT OFFERING 5585 Twin Knolls Road Columbia [Baltimore-Washington DC], MD A Rare Opportunity To Own a Strong Performing Walgreens located in the middle of a Master Planned Community with 10% Rental Increases every 10-Years EXCLUSIVELY MARKETED BY: TED DOWDING DIRECT 858.999.7431 | Broker License Number CQ1054183 Walgreens 5585 Twin Knolls Rd, Columbia, MD 21045 Executive Summary OMDM exclusively presents this rare opportunitity to acquire this strong performing freestanding Walgreens in Columbia, Maryland. In August, 2009, Walgreens signed a 60-year Ground Lease with 25-years on the primary term, followed by Seven 5-year renewal options. There are currently 16+ years remainig on the primary term. This lease features structured rent increases of 10% every 10 years throughout base term and all of the option periods. This site boasts outstanding residual value as it sits upon a signalized 2.62 acre parcel paired with strong local market demographics and traffic counts (58,000+ vehicles per day). Columbia has a population over 100,000 and is the most populous census designated place in Maryland. Howard County has the highest income and educational levels of any county in the State of Maryland, and is the 6th highest in the nation. This Investment is priced at $9,850,000 which represents a 4.75% capitalization rate on current income, with a blended cap rate at the asking price of 5.80% over the entirety of the lease. Financial Overview Annualized Operating Data Price $9,850,000 Rent Increases Annual Rent Price/SF -

TELTE Akt,Iual LIDDLE ATLAI

---~ TELTE AKt,iUAL LI DDLE ATLAI,;TIC ARCI-,EOLOGIC AL CONFERE1'1CE Dover, Dela wa r e ~,a r ch 21 , 22, 23 , 1 980 Friday, Marc h 21 11 :00 -1 : 30 Reg istratio n 1 : 30-4 :00 Regional Resea rc h Des ign Chaire d by Jay F. Custer, t r.is s ess ion will in vo lve presentations on res ea rc h des i gn, p ro b l ems, a nd future d ir ect i ons. Aud i en ce feedback is essen tial. Jay F . Custer , Un iversity of Dela wa r e. "REGI ONAL RESEARCE DESIGN I K THE r,,-~I DDLE ATLANTIC ." Jose ph Cen t , The Accok eek Foundat ion. "Ot-~TOLOGICAL AND EPIST Ef'.'OLOGICAL IL LUSI 0 ~1 S AND REALITI ES CONCER!'1 H 1G TEE FALEO-I NDI A!:--1 Atm EARLY ARCEAIC PERI ODS CF MI DDLE ATLANTIC PREHIST ORY." Tn is p aper add r e ss es the problem(s) o f unde r standing the a rc he olo g ical phenome na in t h e Middle Atlantic region known as the Pa l eo I nd ian an d Early Archaic p e ri ods . Past and p r e sent attempts t owa r d t h i s goa l a r e exam in ed in t e r ms of bo th their streng ths and wea k nes ses. Comments are then offered on t h e f uture possibilities of undertaking r egion wide ant h ro p ological r e se arch on those t wo soc iocultural perio ds within the Mi dd le At lantic re g ion Allan Meunier, New York University . -

“Introduction to Mental Health Recovery Including WRAP®”

Registration Directions “Introduction to Mental Health ® The Meeting House Recovery including WRAP ” 5885 Robert Oliver Place March 12 & 13, 2012 Village of Oakland Mills 8:30 am - 5:30 pm Columbia, Maryland Registration 8:00 am - 8:30 am 410-730-4090 Cost: $229 per person. Space is limited to 30, please register early. q Enclosed is my check for $229. Please register me for the March 12 & 13, 2012 training. q Enclosed is a purchase order for this training. Please register me for the March 12 & 13, 2012 From Baltimore or Washington: training and send me an invoice for payment. 1. Take I-95 to Maryland Route 175 2. Exit onto westbound Route 175, toward Columbia Please complete a separate form for each individual. 3. Turn left at Thunder Hill Road Name ____________________________________ 4. Thunder Hill Road dead-ends at The Meeting House; the parking lot is on the Organization _______________________________ opposite side of the building “Introduction to Address ___________________________________ From points north or south of Columbia: City __________________ Zip Code ___________ 1. Take US 29 to Maryland Route 175 2. Exit onto eastbound Route 175, toward Jessup Mental Health Recovery Phone ____________________________________ 3. Turn right at the first traffic light onto ® Thunder Hill Road including WRAP ” E-mail _________________________________ 4. Thunder Hill Road dead-ends at The q Vegetarian Meal Meeting House; the parking lot is on the with Denise Camp, opposite side of the building ® ® q Special accommodations, i.e. hearing interpreter. WRAP Coordinator, WRAP Outreach Project (10 day notice is required) From Maryland’s Eastern Shore: ____________________________________________ 1. -

Ts£^ Diane Schwartz Jones, Admtbistraior

County Council Of Howard County, Maryland 2020 Legislative Session LegEsiative Day No. 1 Resolution No. 13-2020 Introduced by: The Chairperson at the request of the County Executive A RESOLUTION designating the area of Howard County surrounding and including the Dorsey MARC Station as a Transit-oriented Development in accordance with the Governor's Executive Order 01.01.2009.12 and State law. ^, 2020. By order fX^^S^ ^ 'tS£^_ Diane Schwartz Jones, AdmtBiStraior Read for a second time at a public hearing on *J 6V\<<k<<OA^L _, 2020. By order P^^/TdL ^ Diane Schwartz Jones, Adiy^risfrator This Resolution was read the third time and was Adopted_, Adopted with amendments',^ Failed_, Withdrawn_, by the County Council onRw^CATU^ '3 • 202°- C.rtif1ed Byyt^l^tj ^:^>^^- Diane Schwartz Jones,' Adi'nM&ftrator Approved by She County Executive ^ ^ •€ {.)^ ^rt-\ ^^J. \ . 2020 Calvifh'ffatf, County Executive NOTE: [[text in brackets]] indicates deletions from existing law, TEXT IN SMALL CAPITALS indicates additions to existing law, Strike-out indicates materiat deleted by amendment; Underlining indicates material added by Emiendment 1 WHEREAS, Title 7, Subtitle 1 of the Transportation Article of the Annotated Code of 2 Maryland requires that the Maryland Secretary of Transportation and the local government with 3 land use and planning responsibility for the relevant land area designate a Transit-Oriented 4 Development ("TOD"); and 5 6 WHEREAS, the area of Howard County surrounding and including the Maryland Area 7 Regional Commuter Dorsey Station (the -

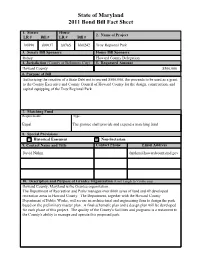

2011 Regular Session

State of Maryland 2011 Bond Bill Fact Sheet 1. Senate House 2. Name of Project LR # Bill # LR # Bill # lr0890 sb0037 lr0765 hb0242 Troy Regional Park 3. Senate Bill Sponsors House Bill Sponsors Robey Howard County Delegation 4. Jurisdiction (County or Baltimore City) 5. Requested Amount Howard County $500,000 6. Purpose of Bill Authorizing the creation of a State Debt not to exceed $500,000, the proceeds to be used as a grant to the County Executive and County Council of Howard County for the design, construction, and capital equipping of the Troy Regional Park. 7. Matching Fund Requirements: Type: Equal The grantee shall provide and expend a matching fund 8. Special Provisions Historical Easement X Non-Sectarian 9. Contact Name and Title Contact Phone Email Address David Nitkin [email protected] 10. Description and Purpose of Grantee Organization (Limit Length to Visible area) Howard County, Maryland is the Grantee organization. The Department of Recreation and Parks manages over 8000 acres of land and 49 developed recreation areas in Howard County. The Department, together with the Howard County Department of Public Works, will secure an architectural and engineering firm to design the park based on the preliminary master plan. A final schematic plan and a design plan will be developed for each phase of this project. The quality of the County's facilities and programs is a testament to the County's ability to manage and operate this proposed park. 11. Description and Purpose of Project (Limit Length to Visible area) Troy Regional Park is a major public amenity planned for the Elkridge area of Howard County. -

Dorsey MARC Station Transit-Oriented Development

Dorsey MARC Station Transit-Oriented Development Opportunity Howard County, Maryland Request for Expressions of Interest Issuance Date: April 2, 2019 Response Date: May 16, 2019 REQUEST FOR EXPRESSIONS OF INTEREST The Maryland Department of Transportation (MDOT) is seeking responses to this Request for Expressions of Interest (RFEI) from experienced respondents interested in transforming surface parking lots and unimproved land into a dynamic mixed-use Transit- Oriented Development (TOD). The approximately 20.93 acre site (surface parking lot and unimproved land), owned by the MDOT Maryland Transit Administration (MDOT MTA) and MDOT State Highway Administration (MDOT SHA), is located at 7000 Deerpath Road at Maryland Route 100 (MD100), Elkridge, Maryland 21075 in the Dorsey Community. The development site is served by the Maryland Area Regional Commuter (MARC) Train Service-Camden Line extending from Camden Station in Baltimore City, Maryland to Union Station in Washington, D.C. (refer to Figure 1). The Camden Line serves approximately 4,000 daily passengers on average with approximately 530 daily boardings at the Dorsey MARC Station. The Station is approximately 15 minutes to downtown Baltimore and 30 minutes to metropolitan Washington, D.C. This project represents a significant TOD opportunity for the State of Maryland and Howard County. The Dorsey MARC Station is located adjacent to Maryland US 100 at Exit 7, also known as the Paul T. Pitcher Memorial Dorsey MARC Highway. The proposed development site will be Station accessed via Deerpath Road with access to the station for commuters via Rt. 100. The transportation network includes three (3) local bus routes with access to Dorsey MARC Station and easy access to major highways and the Baltimore Washington Thurgood Marshall International (BWI) Airport. -

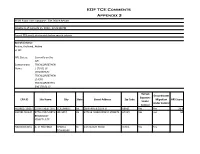

EDF TCE Comments Appendix 3

SEMS Public User Database - Site Search Results Results as of: January 15, 2020 - 12:22:08 PM Found 731 site(s) that match below search criteria: Search Criteria: Active, Archived, Active or All : NPL Status: Currently on the NPL Contaminant TRICHLOROETHEN Name: E (79-01-6) [SYNONYMS : TRICHLOROETHEN E] (OR) TRICHLOROETHYL ENE (79-01-6) Human Groundwater Exposure EPA ID Site Name City State Street Address Zip Code Migration HRS Score Under Under Control Control NED981713837 10TH STREET SITE COLUMBUS NE 28TH AVE & 10TH ST 68601 Yes Yes 28.9 KSD981710247 57TH AND NORTH WICHITA KS 57TH & N BROADWAY STREETS 67219 Yes Yes 50 BROADWAY STREETS SITE NJD030253355 A. O. POLYMER SPARTA NJ 44 STATION ROAD 07871 Yes Yes TOWNSHIP PAD004351003 A.I.W. FRANK/MID- EXTON PA INT RTE 202 & RTE 30 19341 Yes Yes 42.4 COUNTY MUSTANG NCD024644494 ABC ONE HOUR JACKSONVILLE NC 2127 LE JEUNE BLVD. 28540 Yes Yes 29.11 CLEANERS NCN000407447 ABERDEEN ABERDEEN NC HWY 211, OLD PEE DEE RD, 28315 Yes No 50 CONTAMINATED BLUES BRG RD GROUND WATER MD2210020036 ABERDEEN EDGEWOOD MD OFF RTE 40 21010 Insufficient Insufficient 53.57 PROVING Data Data GROUND (EDGEWOOD AREA) MD3210021355 ABERDEEN ABERDEEN MD OFF RTE 40 21005 Insufficient Insufficient 31.09 PROVING Data Data GROUND (MICHAELSVILLE LANDFILL) ILD053219259 ACME SOLVENT MORRISTOWN IL EAST OF LINDENWOOD RD 61109 Yes Yes 31.98 RECLAIMING, INC. (MORRISTOWN PLANT) MID006522791 ADAM'S PLATING LANSING MI 521 NORTH ROSEMARY 48917 Insufficient Yes 29.64 Data ILD980607055 ADAMS COUNTY QUINCY IL 2 MILES NORTH OF BURTON 62301 Yes Yes 34.21 QUINCY TWP 1/2 MI WEST LANDFILLS 2&3 CAD048634059 ADVANCED SUNNYVALE CA 901 THOMPSON PL 94086 No Yes 37.93 MICRO DEVICES, INC. -

Archeological Survey of Maryland Route 32 Between Pindell School Road and Maryland Route 108, Howard County, Maryland

1 Patterson Par!, & M-.-^v DEPARTMENT OF NATURAL RESOURCES MARYLAND GEOLOGICAL SURVEY DIVISION OF ARCHEOLOGY FILE REPORT NUMBER 238 ARCHEOLOGICAL SURVEY OF MARYLAND ROUTE 32 BETWEEN PINDELL SCHOOL ROAD AND MARYLAND ROUTE 108, HOWARD COUNTY, MARYLAND by RICHARD G. ERVIN Report submitted to the Maryland State Highway Administration Contract Number HO 292-202-770 HO 1989 36 I •• » I. .' - -!>t£: V) f "')•'•:>","'I :i".- ':Ti t.r L-rn Frontispiece: Painting of the mill at Simpsonville as it appeared in the early 20th century. The artist painted the mill while recuperating from an automobile accident near Simpsonville. The original of this painting and the one in Figure 12 are in the possession of Walter Iglehart, whose father operated the mill in the early 20th century. Photograph courtesy of Lee Preston. -u - Ho DEPARTMENT OF NATURAL RESOURCES £ . 1 MARYLAND GEOLOGICAL SURVEY DIVISION OF ARCHEOLOGY FILE REPORT NUMBER 238 ARCHEOLOGICAL SURVEY OF MARYLAND ROUTE 32 BETWEEN PINDELL SCHOOL ROAD AND MARYLAND ROUTE 108, HOWARD COUNTY, MARYLAND by RICHARD G. ERVIN Report submitted to the Maryland State Highway Administration Contract Number HO 292-202-770 1989 Archeological Survey of Maryland Route 32 Between Pindell School Road and Maryland Route 108, Howard County, Maryland by Richard G. Ervin Division of Archeology Maryland Geological Survey ABSTRACT Archeologists surveyed five proposed alignments of Maryland Route 32 between Pindell School Road and Maryland Route 108, finding three archeological sites in the project area. The Spring Hill site (18HO148) is a possible late 19th century rural residential structure location. The site is outside the proposed Alternate B right-of-way, and it is recommended that it be avoided during construction. -

BYLAWS and ARTICLES of INCORPORATION

GLEN BURNIE IMPROVEMENT ASSOCIATION BYLAWS and ARTICLES OF INCORPORATION As Amended April 10, 2012 Bylaws Committee Nancy Brown, Chairman Beth Behegan Candy Fontz Brenda Kelly Barbara Sabur ARTICLE I - Name This Association shall be known as the "Glen Burnie Improvement Association, Incorporated". ARTICLE II - Objectives The objectives of this Association shall be: A. To secure concert of action in all matters pertaining to the development and improvement of Glen Burnie. B. To promote the general welfare as defined in the Articles of Incorporation and Bylaws of this Association. C. To assist in preserving law and order. ARTICLE III – Members Section 1: Qualification for Membership Any citizen of the United States who is at least 18 years of age and who lives within the boundary lines of this Association, as set forth in Article IV, may apply for membership in this Association by submitting a signed application and one (1) dollar for lifetime dues. Membership applications shall lie on the table for one (1) month before being voted upon at a regular meeting. Applicants may be elected to membership by a majority of the members present and voting at the meeting. Section 2: Termination on Membership and Reinstatement Any member who moves his or her residence beyond the boundaries as set forth in Article IV hereof shall automatically forfeit membership in this Association. Former members may be reinstated under the provisions of Article III, Section 1. Section 3: Honorary Membership A. Any citizen of the United States who has distinguished himself or herself by exceptional effort or achievement in the field of child, community or general public welfare may be recommended by the Board of Directors for honorary (non-voting) lifetime membership in this Association.