Audited Annual Financial Statements for the Year Ended December 31, 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2020 Public Accountability Statement

2020 PUBLIC ACCOUNTABILITY STATEMENT ABOUT CORPORATE SMALL ACCESS TO NUMBER OF DEBT TAXES BRANCH THIS REPORT DONATIONS & BUSINESS FINANCIAL EMPLOYEES FINANCING OPENINGS, PHILANTHROPIC BANKING SERVICES IN CANADA CLOSINGS & ACTIVITY RELOCATIONS What’s Inside 2 About this Report 17 Number of Employees in Canada 3 Corporate Donations & Philanthropic Activity 18 Debt Financing 9 Small Business Banking 20 Taxes 11 Access to Financial Services 21 Branch Openings, Closings & Relocations About this Report Scope of Reporting About Scotiabank This Public Accountability Statement includes Scotiabank is a leading bank in the Americas. information from November 1, 2019 to Guided by our purpose: “for every future”, we help October 31, 2020, for the following affiliates our customers, their families and their communities of Scotiabank in Canada: Scotia Capital Inc., achieve success through a broad range of advice, National Trust Company, Scotia Mortgage products and services, including personal and Corporation, Scotia General Insurance Company, commercial banking, wealth management and ADS Canadian Bank, Montreal Trust Company private banking, corporate and investment banking, of Canada, Scotia Life Insurance Company, and capital markets. With a team of over 90,000 The Bank of Nova Scotia Trust Company, employees and assets of approximately $1.1 trillion Scotia Dealer Advantage Inc., Roynat Inc., (as at October 31, 2020), Scotiabank trades on the MD Private Trust Company, and MD Life Insurance Toronto Stock Exchange (TSX: BNS) and New York Company. These affiliates are finance entities or Stock Exchange (NYSE: BNS). For more information, financial institution subsidiaries of Scotiabank please visit scotiabank.com and follow us on Twitter operating in Canada that have less than $1 billion @ScotiabankViews. -

2021 Salary Projection Survey Summary

2021 Salary Projection Survey Insights on compensation trends expected in 2021 - Summary report 38th edition | September 2020 Table of contents 1 Introduction 2 Compensation consulting 3 Participant profile 6 Survey highlights 8 Historical base salary increase trend 9 Base salary 11 Salary structure 13 Survey participants 22 Notice 22 For more information Introduction The results presented in this report are an analysis of responses collected between July and August 2020 to the 38th edition of Morneau Shepell’s 2021 Salary Projection Survey. The data represents a broad cross-section of industries representing 889 organizations across Canada and provides data on actual salary budget increase percentages for the past and current years, along with projected increases for next year. • The report contains segmented data and a detailed analysis by Morneau Shepell’s compensation consultants. • Survey participation jumped over 75% on a year over year basis from 506 organizations participating in 2019, to 889 in 2020. Many of these organizations also participated in our 2020 Canadian Salary Surveys. • Survey data includes actual 2020 and projected 2021 base salary increases and salary structure adjustments. • Survey data is reported excluding zeros and including zeros (freezes) but does not include temporary rollbacks due to COVID-19. • Findings are summarized for non-unionized employees. • Statistical requirements applied to the data analysis include a minimum of three organizations for average/mean reported results, and a minimum of five organizations -

BANK MERGERS: IS BIGGER BETTER? Introduction

BANK MERGERS: IS BIGGER BETTER? Introduction In January 1998, the Bank of Montreal and the Royal Bank of Canada announced plans to merge and create one superbank. A few months later, in April, the Toronto Dominion Bank and the Canadian Imperial Bank of Commerce announced similar plans. The proposed bank mergers caught many people off guard, including Minister of Finance Paul Martin. In a Macleans interview, Martin said, "Just because they decided to get into bed together doesnt mean that I have to bless their union." Martins message seemed to be that Ottawa, not the banks, would decide the future of banking in Canada. "There will be no mergers in the banking sector until we are convinced that [it] is what is best for Canadians, and we will not be stampeded into making that decision." According to the banks, the proposed mergers were a natural response to a changing and highly competitive global marketplace. Mergers, they said, provide a way of maintaining a strong Canadian presence in the banking industry. Certainly, recent technological advances have dramatically changed the manner in which the financial services industry conduct their business, and the above- mentioned banks feel, therefore, that they need to be bigger to compete and to have a substantial presence in the global banking community. Martin himself acknowledged the changed nature of banking when he said, "If you look back at banking five years ago, you might as well look back two centuries." While the proposed bank mergers brought attention to the challenges facing Canadas banks, these challenges are not peculiar to the banks alone. -

DFA Canada Global 50EQ-50FI Portfolio - Class a (USD) As of March 31, 2021 (Updated Monthly) Source: RBC Holdings Are Subject to Change

DFA Canada Global 50EQ-50FI Portfolio - Class A (USD) As of March 31, 2021 (Updated Monthly) Source: RBC Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. This fund operates as a fund-of-funds and generally allocates its assets among other mutual funds, but has the ability to invest in securities and derivatives directly. The holdings listed below contain both the investment holdings of the corresponding underlying funds as well as any direct investments of the fund. -

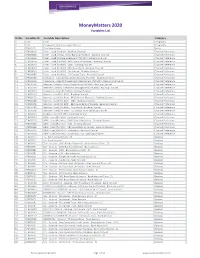

Moneymatters 2020 Variables List

MoneyMatters 2020 Variables List Order Variable ID Variable Description Category 0 CODE Code Geography 0 GEO Geographic Summarization Indicator Geography 1 CBASHHD Total Households Basics 2 CFM0001B Teller - Used [Pst Mth] - Banking Channel Channel Preference 3 CFM0002B Teller - Used for Day to Day Banking [Pst Mth] - Banking Channel Channel Preference 4 CFM0003B Teller - Used to Make Investment [Pst Mth] - Banking Channel Channel Preference 5 CFM0004B Teller - Used [Pst Mth] - BMO Bank of Montreal - Banking Channel Channel Preference 6 CFM0005B Teller - Used [Pst Mth] - CIBC - Banking Channel Channel Preference 7 CFM0006B Teller - Used [Pst Mth] - RBC Royal Bank - Banking Channel Channel Preference 8 CFM0007B Teller - Used [Pst Mth] - Scotiabank - Banking Channel Channel Preference 9 CFM0008B Teller - Used [Pst Mth] - TD Canada Trust - Banking Channel Channel Preference 10 CFM0010B Telephone - Used for Day to Day Banking [Pst Mth] - Banking Channel Channel Preference 11 CFM0011B Telephone - Used for Investment Management [Pst Mth] - Banking Channel (!) Channel Preference 12 CFM0013B Internet - Used for Day to Day Banking [Pst Mth] - Banking Channel Channel Preference 13 CFM0014B Internet - Used for Investment Management [Pst Mth] - Banking Channel Channel Preference 14 CFM0009B Telephone - Used [Pst Mth] - Banking Channel Channel Preference 15 CFM0012B Internet - Used [Pst Mth] - Banking Channel Channel Preference 16 CFM0015B Internet - Used [Pst Mth] - BMO Bank of Montreal - Banking Channel Channel Preference 17 CFM0016B Internet - -

Audited Annual Financial Statements for the Year Ended December 31, 2018

Audited Annual Financial Statements For the year ended December 31, 2018 Tangerine Balanced Portfolio Tangerine Balanced Portfolio Audited Annual Financial Statements for the year ended December 31, 2018 (In Canadian dollars, unless otherwise indicated) Independent Auditors’ Report To the Unitholders of Tangerine Balanced Portfolio (the “Fund”) Opinion We have audited the financial statements of the Fund, which comprise the statements of financial position as at December 31, 2018 and 2017, and the statements of comprehensive income, statements of changes in net assets attributable to holders of redeemable units and statements of cash flows for the years then ended, and notes to the financial statements, including a summary of significant accounting policies. In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Fund as at December 31, 2018 and 2017, and its financial performance and its cash flows for the years then ended in accordance with International Financial Reporting Standards (IFRSs). Basis for Opinion We conducted our audit in accordance with Canadian generally accepted auditing standards. Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are independent of the Fund in accordance with the ethical requirements that are relevant to our audit of the financial statements in Canada, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. Other Information Management is responsible for the other information. -

Audited Annual Financial Statements for the Year Ended December 31, 2018

Audited Annual Financial Statements For the year ended December 31, 2018 Tangerine Balanced Income Portfolio Tangerine Balanced Income Portfolio Audited Annual Financial Statements for the year ended December 31, 2018 (In Canadian dollars, unless otherwise indicated) Independent Auditors’ Report To the Unitholders of Tangerine Balanced Income Portfolio (the “Fund”) Opinion We have audited the financial statements of the Fund, which comprise the statements of financial position as at December 31, 2018 and 2017, and the statements of comprehensive income, statements of changes in net assets attributable to holders of redeemable units and statements of cash flows for the years then ended, and notes to the financial statements, including a summary of significant accounting policies. In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Fund as at December 31, 2018 and 2017, and its financial performance and its cash flows for the years then ended in accordance with International Financial Reporting Standards (IFRSs). Basis for Opinion We conducted our audit in accordance with Canadian generally accepted auditing standards. Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are independent of the Fund in accordance with the ethical requirements that are relevant to our audit of the financial statements in Canada, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. Other Information Management is responsible for the other information. -

Audited Annual Financial Statements for the Year Ended December 31, 2019

Audited Annual Financial Statements For the year ended December 31, 2019 Tangerine® Balanced Income Portfolio Tangerine Balanced Income Portfolio Audited Annual Financial Statements for the year ended December 31, 2019 (In Canadian dollars, unless otherwise indicated) Independent Auditor’s Report To the Unitholders of Tangerine Balanced Income Portfolio (the “Fund”) Opinion We have audited the financial statements of the Fund, which comprise the statements of financial position as at December 31, 2019 and 2018, and the statements of comprehensive income, statements of changes in net assets attributable to holders of redeemable units and statements of cash flows for the years then ended, and notes to the financial statements, including a summary of significant accounting policies. In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Fund as at December 31, 2019 and 2018, and its financial performance and its cash flows for the years then ended in accordance with International Financial Reporting Standards (IFRSs). Basis for Opinion We conducted our audit in accordance with Canadian generally accepted auditing standards. Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are independent of the Fund in accordance with the ethical requirements that are relevant to our audit of the financial statements in Canada, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. Other Information Management is responsible for the other information. -

2016 APEGS Annual Report

2016 Annual Report ON THE COVER: March 7, 1997 - Honourable John E.N. Wiebe Lieutenant Governor of Saskatchewan signs the proclamation of The Engineering and Geoscience Professions Act, attended by Heinrich Feldkamp, P.Eng., FEC (APES President 1996 – 1997) and Frances Haidl, P.Geo., FEC (Hon.), FGC (Act Amendment Committee) 2 Table of Contents President's Report . 4 Geoscientists Canada Director’s Report . 30 Executive Director and Registrar's Report . 6 College of Engineering, University of Saskatchewan . 34 Investigation Committee. 8 Department of Geological Sciences, University of Saskatchewan. 35 Discipline Committee . 9 Faculty of Engineering & Applied Science, University of Regina . 36 30 by 30 Task Group . 10 Department of Geology, University of Regina. 38 Governance Board . 11 Saskatoon Engineering Students' Society . 39 Academic Review Committee . 12 Regina Engineering Students' Society. 39 Licensee Admissions Committee . 13 D.M. Kent Geology Club (U of R Geology Students) . 40 Experience Review Committee . 14 Regina Engineering Society. 41 Professional Practice Examination Committee. 14 Saskatoon Engineering Society . 43 Registrar's Advisory Committee . 15 Moose Jaw Engineering Society. 44 Legislative Liaison Committee . 15 Saskatchewan Geological Society (Regina). 44 Saskatchewan Construction Panel . 16 Association of Consulting Engineering Companies - SK . 46 Image and Identity Board . 16 Awards Committee. 17 Financial Report . 47 Connection and Involvement Committee . 18 Balance Sheet . 48 Professional Edge Committee . 19 Consolidated Statement of Revenue and Expenditures. 49 Communications and Public Relations Committee. 20 Investments & Cash Funds . 52 Equity and Diversity Committee . 21 Education Board . 22 2015-2016 APEGS Council . 55 2016 APEGS Volunteers. 56 Professional Development Committee . 23 Student Development Committee . 24 K-12 Committee . -

CUSTODIAL AGREEMENTS As of April 30, 2019

Contact: Samantha Duffield Manager, Financial Compliance Phone: (416) 943-4662 Email: [email protected] CUSTODIAL AGREEMENTS The following is an alphabetical listing of prescribed Custodial Agreements executed as of April 30, 2019 between the Mutual Fund Dealers Association of Canada (MFDA), as bare trustee on behalf of Members, and mutual fund companies and other financial institutions, in accordance to the Member Regulation Notice MSN-0058, Acceptable Securities Locations. Please ensure that your assets held are included in the types of products listed by the entity. Fund Manager/ Financial Institution Type of Products 1 1832 Asset Management L.P. Mutual Fund / Hedge Fund / Labour Dynamic Mutual Fund Sponsored Fund / Deposit Accounts 2 Acker Finley Asset Management Inc. Mutual Fund 3 ACM Advisors Ltd. Mortgage Investment Fund 4 Acorn Global Investments Inc. Hedge Fund 5 ADS Canadian Bank GIC’s / High Interest Savings Account 6 AGF Investments Inc. Mutual Fund / Pooled Fund - Acuity Pooled Funds - AGF Pooled Funds - AGF family of mutual funds - AGF Elements family of mutual funds - Harmony family of mutual funds 7 AIP Asset Management Inc. Mutual Fund / Hedge Fund / Limited Partnership 8 AlphaNorth Asset Management Mutual Fund 9 Arrow Capital Management Inc. Investment Products 10 ATB Investment Management Inc. Mutual Fund 11 Aurion Capital Management Inc. Pooled Fund 12 Aventine Management Group Inc. Mutual Fund 13 B2B Bank GIC’s / High Interest Investment Accounts 14 Bank of Montreal GIC’s / High Interest Savings Accounts 15 Bank of Montreal Mortgage Corporation GIC’s 16 Bank of Nova Scotia (The) GIC’s 17 Barometer Capital Management Inc. Mutual Fund / Pooled Fund Doc 110950 Page 1 of 30 Fund Manager/ Financial Institution Type of Products 18 BC Advantage Fund Management Limited Venture Capital Corporation (VCC) Funds 19 B.E.S.T. -

2020 Canada Banking and Credit Card Mobile App

Investments in Easy-to-Use Digital Tools Paying Off for Banks, Credit Card Companies in Canada, J.D. Power Finds Ease of Navigation, Accessibility of Important Information and Seamless Cross-Channel Experience Seen As Key Drivers of Customer Satisfaction TORONTO: 10 June 2020 — During the height of the COVID-19 pandemic, 41% of retail bank customers said they were using their bank’s mobile app more frequently than ever before, and 40% said they were using credit cards in a contactless manner. Years of digital investments are paying off as banks support homebound customers to continue their banking activities, based on a series of recent J.D. Power studies, released today, of bank and credit card online and mobile app users. Data shows that ease of use, speed and accessibility of common features are the most-often-cited variables shared by the best-performing digital platforms. The studies—J.D. Power 2020 Canada Banking Mobile App Satisfaction Study,SM 2020 Canada Online Banking Satisfaction Study,SM 2020 Canada Credit Card Mobile App Satisfaction StudySM and 2020 Canada Online Credit Card Satisfaction Study SM—track overall customer satisfaction with banking and credit card providers’ digital offerings. “Banks have been investing heavily in digital for several years and those investments paid off during the past three months as the COVID-19 pandemic dramatically accelerated the shift to digital, forcing many remaining holdouts to finally take the plunge,” said Jennifer White, senior consultant for banking and payment intelligence at J.D. Power. “It’s never been more important for banks and credit card companies to make their digital offerings easy to access and use. -

OSC Bulletin

The Ontario Securities Commission OSC Bulletin February 22, 2018 Volume 41, Issue 8 (2018), 41 OSCB The Ontario Securities Commission administers the Securities Act of Ontario (R.S.O. 1990, c. S.5) and the Commodity Futures Act of Ontario (R.S.O. 1990, c. C.20) The Ontario Securities Commission Published under the authority of the Commission by: Cadillac Fairview Tower Thomson Reuters 22nd Floor, Box 55 One Corporate Plaza 20 Queen Street West 2075 Kennedy Road Toronto, Ontario Toronto, Ontario M5H 3S8 M1T 3V4 416-593-8314 or Toll Free 1-877-785-1555 416-609-3800 or 1-800-387-5164 Contact Centre – Inquiries, Complaints: Fax: 416-593-8122 TTY: 1-866-827-1295 Office of the Secretary: Fax: 416-593-2318 The OSC Bulletin is published weekly by Thomson Reuters Canada, under the authority of the Ontario Securities Commission. Thomson Reuters Canada offers every issue of the Bulletin, from 1994 onwards, fully searchable on SecuritiesSource™, Canada’s pre-eminent web-based securities resource. SecuritiesSource™ also features comprehensive securities legislation, expert analysis, precedents and a weekly Newsletter. For more information on SecuritiesSource™, as well as ordering information, please go to: http://www.westlawecarswell.com/SecuritiesSource/News/default.htm or call Thomson Reuters Canada Customer Support at 1-416-609-3800 (Toronto & International) or 1-800-387-5164 (Toll Free Canada & U.S.). Claims from bona fide subscribers for missing issues will be honoured by Thomson Reuters Canada up to one month from publication date. Space is available in the Ontario Securities Commission Bulletin for advertisements. The publisher will accept advertising aimed at the securities industry or financial community in Canada.