Draper Oakwood Technology Acquisition Inc. Form 8-K Current

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Report of the Committee on the Future Economy (CFE)

Report of the Committee on the Future Economy Pioneers of the next generation A B CONTENTS Exchange of Letters with the Prime Minister ................................................................................... ii Executive Summary ............................................................................................................................. 1 Strategy 1: Deepen and diversify our international connections .................................................. 16 Strategy 2: Acquire and utilise deep skills ........................................................................................ 22 Strategy 3: Strengthen enterprise capabilities to innovate and scale up ................................... 28 Appendix 3.1: The role of manufacturing in Singapore’s economy ............................... 33 Strategy 4: Build strong digital capabilities ...................................................................................... 36 Strategy 5: Develop a vibrant and connected city of opportunity ................................................ 41 Strategy 6: Develop and implement Industry Transformation Maps (ITMs) ................................ 48 Appendix 6.1: List of ITM Clusters and Industries ............................................................ 53 Appendix 6.2: Logistics ITM ................................................................................................. 54 Appendix 6.3: Retail ITM ...................................................................................................... 56 -

E-Commerce and Its Impact on Competition Policy and Law in Singapore

E-commerce and its impact on competition policy and law in Singapore A DotEcon study for the Competition Commission of Singapore Final Report – October 2015 DotEcon Ltd 17 Welbeck Street London W1G 9XJ www.dotecon.com Content Content 1 Introduction ................................................................................................................. 1 2 E-commerce activity in Singapore ............................................................................... 4 2.1 An introduction to e-commerce ........................................................................... 4 2.2 E-commerce adoption in Singapore ................................................................... 17 3 E-commerce and competition .................................................................................... 38 3.1 What changes with e-commerce? ...................................................................... 38 3.2 The impact of e-commerce on market boundaries ............................................. 59 3.3 The impact of e-commerce on market structure and competition ...................... 65 3.4 Vertical restraints ............................................................................................... 77 4 Implications of e-commerce for competition policy in Singapore .............................. 83 4.1 Defining a relevant market ................................................................................. 84 4.2 Assessing market power ................................................................................... -

Reebonz Holding Ltd Form F-1 Filed 2019-02-25

SECURITIES AND EXCHANGE COMMISSION FORM F-1 Registration statement for securities of certain foreign private issuers Filing Date: 2019-02-25 SEC Accession No. 0001213900-19-003091 (HTML Version on secdatabase.com) FILER Reebonz Holding Ltd Mailing Address Business Address C/O REEBONZ LIMITED C/O REEBONZ LIMITED CIK:1752108| IRS No.: 000000000 | State of Incorp.:E9 | Fiscal Year End: 1231 5 TAMPINES NORTH DRIVE 5 TAMPINES NORTH DRIVE Type: F-1 | Act: 33 | File No.: 333-229839 | Film No.: 19629509 5 5 SIC: 5961 Catalog & mail-order houses #07-00 U0 528548 #07-00 U0 528548 65 6499 9469 Copyright © 2019 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document As filed with the Securities and Exchange Commission on February 25, 2019 Registration No. 333- UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM F-1 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 REEBONZ HOLDING LIMITED (Exact Name of Registrant as Specified in Its Charter) Cayman Islands 5961 Not Applicable (Jurisdiction of (Primary Standard Industrial (I.R.S. Employer Incorporation or Organization) Classification Code Number) Identification Number) c/o Reebonz Limited 5 Tampines North Drive 5 #07-00 Singapore 528548 +65 6499 9469 (Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices) Puglisi & Associates 850 Library Avenue, Suite 204 Newark, DE 19715 (302) 738-6680 (Name, address, including zip code, and telephone number, including area code, of agent for service) With copies to: David Dinner, Esq. Ira L. Kotel, Esq. Dentons Cayman Brian Lee, Esq. -

Updated As of 2020.08.20 Appointment Address Telephone

Updated as of 2020.08.20 Name of Details of Designated Representative Name of Network Service Provider Designated Representative DR number Appointment Address Telephone Number Fax Number Email Address WEBVISIONS PTE LTD Roger Lim DR 05-000001 Chief Executive Officer 75, Science Park Drive, #02-06/07, 65 6773 9388 65 6773 [email protected] Cintech 2, Singapore Science Park 1, 9389 Singapore 118255 STARHUB GROUP StarHub Abuse Response DR 05-000002 − c/o StarHub, AOS Building, 2D Ayer Rajah 65 6725 5008 - [email protected] Team Crescent, Singapore 139928 PACIFIC INTERNET (S) LIMITED Abuse Response Team DR 05-000004 − 89 Science Park Drive #01-07, The 65 6872 1560 65 6773 [email protected] Rutherford, Singapore 118261 6812 SINGAPORE TELECOMMUNICATIONS LIMITED GROUP OF Jacquelin Tay DR 05-000005 Legal Counsel 31 Exeter Road, #18-00 Comcentre, 65 6887 2953 65 6738 [email protected] COMPANIES Singapore 239732 3769 GOVERNMENT CONSULTATION PORTAL Toh Yong Chuan DR 05-000006 Head, Feedback Unit Ministry of Community Development, Youth 65 6353 5555 65 6354 [email protected] and Sports, 512 Thomson Road, 14th 8128 Floor, Singapore 298136 NEWMEDIA EXPRESS PTE LTD Woo Shian Loong DR 05-000007 Director 25 Kallang Avenue, #05-04, Singapore 65 6396 7188 - [email protected] 339416 om W3HUB PTE LTD Kenny HWL DR 05-000008 Webmaster 81A-3B Geylang Road, Singapore 389199 65 67490862 65 [email protected] 68467378 READYSPACE NETWORK PTE LTD Loke Di Huei DR 05-000009 Legal Officer 20 Ayer Rajah Crescent #09-16 65 68260170 65 [email protected] Technopreneur Centre Singapore 139964 68725655 FIVECUBE PTE LTD James Tan DR 05-000010 Managing Director No. -

European Technology Media & Telecommunications Monitor

European Technology Media & Telecommunications Monitor Market and Industry Update H1 2013 Piper Jaffray European TMT Team: Eric Sanschagrin Managing Director Head of European TMT [email protected] +44 (0) 207 796 8420 Jessica Harneyford Associate [email protected] +44 (0) 207 796 8416 Peter Shin Analyst [email protected] +44 (0) 207 796 8444 Julie Wright Executive Assistant [email protected] +44 (0) 207 796 8427 TECHNOLOGY, MEDIA & TELECOMMUNICATIONS MONITOR Market and Industry Update Selected Piper Jaffray H1 2013 TMT Transactions TMT Investment Banking Transactions Date: June 2013 $47,500,000 Client: IPtronics A/S Transaction: Mellanox Technologies, Ltd. signed a definitive agreement to acquire IPtronics A/S from Creandum AB, Sunstone Capital A/S and others for $47.5 million in cash. Pursuant to the Has Been Acquired By transaction, IPtronics’ current location in Roskilde, Denmark will serve as Mellanox’s first research and development centre in Europe and IPtronics A/S will operate as a wholly-owned indirect subsidiary of Mellanox Technologies, Ltd. Client Description: Mellanox Technologies Ltd. is a leading supplier of end-to-end InfiniBand and June 2013 Ethernet interconnect solutions and services for servers and storage. PJC Role: Piper Jaffray acted as exclusive financial advisor to IPtronics A/S. Date: May 2013 $46,000,000 Client: inContact, Inc. (NasdaqCM: SAAS) Transaction: inContact closed a $46.0 million follow-on offering of 6,396,389 shares of common stock, priced at $7.15 per share. Client Description: inContact, Inc. provides cloud contact center software solutions. PJC Role: Piper Jaffray acted as bookrunner for the offering. -

APM 2018 Winners Announced with a Special Tribute to Rossa

For immediate release Media Release APM 2018 winners announced with a special tribute to Rossa Singapore, 29 September 2018 – A total of 18 awards were given out to the cream of the Malay music industry at this year’s Anugerah Planet Muzik (APM), held at the MES Theatre at Mediacorp. Making headlines was Indonesian pop sensation Judika, who clinched four awards: namely, Best APM Song, Best Song (Indonesia), Best Artiste (Male) and Best Collaboration (Artiste) for his duet with the legendary Dato’ Sri Siti Nurhaliza. Isyana Sarasvati won this year’s Best Artiste (Female) award, beating hot favourites Siti Nurhaliza, Dayang Nurfaizah and Raisa. Sheila on 7 clinched the Best Band award for their latest hit, Film Favorit. Singapore’s powerhouse vocalist Sufi Rashid and Malaysia’s pop idol Khai Bahar won two awards each. Khai Bahar also reigned as APM’s Most Popular Artiste two years in a row and took home the Social Media Icon award that was previously won by Ayda Jebat. This year, Ayda clinched Best Song (Malaysia) for her latest single, Mata. Brunei’s rising star, Jaz, Indonesia’s trio GAC, Sara Fajira, Adrian Khalif as well as Malaysia’s Haqiem Rusli and Singapore’s Farhan Shah are among those who won their first APM awards last night. Now into its 17th edition, this year’s APM event also paid tribute to Indonesia’s Queen of Pop, Rossa, who received the Planet Muzik Award that celebrates performers who have made outstanding contributions of artistic significance to the field of recording. Widely recognised as the one of the most influential Indonesian songstresses of all time, Sri Rossa Roslaina Handiyani, also known as Te’ Ocha or Dato’ Rossa, released her best-selling albums not only in Indonesia, but also in Southeast Asia and Japan. -

Company Name Chorus Games PT Rajawali Prima Indonesia Zenglove Gogorilla Pte Ltd INEX Carousell SIDLR Raprindo Company Bitspark

Company Name Chorus Games PT Rajawali Prima Indonesia ZenGlove Gogorilla Pte Ltd INEX Carousell SIDLR Raprindo Company Bitspark PT Rajawali Prima Indonesia Day7 Pte Ltd Tocco Studios Pirate3D Telistar Solutions Pte Ltd Hull Traders Grafyt PT Rajawali Prima Indonesia Pinder Inc Digital Influence Lab Pte Ltd EARNGO PTE LTD MandarinCampus Mondano NEWCLEUS Pte. Ltd. Green Koncepts Pte Ltd Innervative We Are One Singapore YOYO HOLDINGS PTE LTD The Co-Foundry Novatap THE SUNSHINE KIDS LLP Slide Comet LLP Blitzr Pte. Ltd. Intuity Lab FireForge Pte Ltd Evenesis Ohanae Pte Ltd Freelancer.com Appcara Ltd The Co-Foundry EventNook Pte. Ltd. Sharefolio ELITERATE Asia Viscovery Pte. Ltd. Training Point Pte Ltd Tripid Philippines, Inc. Asia Venture Group Sdn Bhd Solution@IT Pte Ltd Social Bacon Planyourwedding.my PriAv Flight Singapore Transport Systems Disrptiv Exchange Pte Ltd Applay Pte Ltd TripZilla Cambrian Concepts Atiral Media Lab Edukasyon.ph TripZilla Alphapod MatchMove Global Pte Ltd Yushan Ventures, Ltd. Investing Note Pte Ltd AdzCentral Receivables Purchase LP Wego Pte Ltd The Hotbox Buzzclout EtonHouse International Education Group Certis CISCO Security Pte Ltd Standard Chartered Bank Standard Chartered Bank Toys\'R\'Us (Singapore) Pte Ltd Sirius Marketing Pte Ltd Catalyst Pte Ltd MavenTree Technology Pte Ltd Redwoods Advance Pte Ltd Miam Miam Singapore Pte Ltd Toys\'R\'Us (Singapore) Pte Ltd Asian International College Pte. Ltd. E M Services Pte Ltd Amore Fitness Pte Ltd Advisors\' Clique - The Associate Recruit Express Pte Ltd JobsCentral Singapore Jobs - Customer Service Admin | Clementi/Jurong East | $1.6K HRX OUTSOURCING & CONSULTING PTE LTD Permanent Personnel Services Pte Ltd Misumi South East Asia Pte Ltd Keppel Sea Scan Pte Ltd Unilite Recruitment Services Pte Ltd Grand Mercure Roxy Hotel Autism Association (Singapore) JobsCentral Singapore Jobs - Mechanics/Assistants by The Hearing Solution Co. -

9789814841535

25.6mm Pantone 877C Back Cover (from left to right) Project Team Members Television arrived in Singapore on 15 February 1963. For Review only Philip Tay Joo Thong (Leader) About 500 VIPs and thousands of others watched the Joan Chee inauguration at Victoria Memorial Hall and at 52 community centres around the island. Raymond Anthony Fernando Mun Chor Seng The Radio and Television Towers on Bukit Batok. Horace Wee Antenna mounted on the high towers have beamed Belinda Yeo signals to Singapore homes since the early 60s. Satellite dishes receive international programmes, List of Contributors such as the Oscars, and world sporting events. Mushahid Ali • Asaad Sameer Bagharib The 1974 World Cup match between Holland and ON AIR P N Balji • Chan Heng Wing Untold Stories from Caldecott Hill Germany was the first signal beamed to homes Cheng Tong Fatt • Anthony Chia and reached more than a million viewers. Michael Chiang • Choo Lian Liang from Caldecott Hill Untold Stories Untold Susan Lim and the Crescendos (John Chee, Francis Chowdhurie • David Christie Leslie Chia and Raymond Ho) performing in the Amy Chua • Chua Swan television studio. The Crescendos were a popular band Ee Boon Lee • George Favacho in Singapore in the 60s and were the first local pop Sakuntala Gupta • Raymon T H Huang group to be signed by an international record label. Suhaimi Jais • Larry Lai This collection of 51 essays contains rich memories of Singapore’s Lau Hing Tung • Lee Kim Tian A cultural performance with Gus Steyn conducting the broadcasting pioneers based in their station atop Caldecott Hill. -

THE HOLS E Y ND F W I Ith Myriadthingsfor Lle D

Need Past Issues? LOVE US, “LIKE US” MICA (P) 144/08/2012 WEEKENDER www.facebook.com/ www.facebook.com/ weekendersgp weekendersgp NOVEMBER 16 - 22, 2012 YOUR INSPIRATION TO A WEEKEND FILLED WITH FUN AND HAPPINESS DELIVERED FREE TO YOUR HOME INSIDE... >> TURKEY 06 BRIYANI, ANYONE? Join Goodwood Park Hotel’s merrymaking with their localised take on the traditional Christmas turkey dinner. ALL HAIL 07 THE KING OF TIRAMISU Try this decadently rich tiramisu recipe with a local twist. Learn how to mix the freshest D24 durians into this traditional Italian recipe. By LESTER J WAN A BALL OF A 08 TIME! Singapore’s netball THE HOLS co-captain Micky Lin shares tips and encourages all to try netball. Also, win tickets to the Nations Cup 2012! SAVVY ABOUT 11 SEVILLE OF FUN Tapas, flamenco, siesta WELCOME TO THE HOLS OF FUN! TEMPTATIONS and fiestas. Seville is everything you’d want on a ARE ON THEIR WAY WITH MYRIAD THINGS FOR trip to Spain. Travel blogger Albino Chua savours the YOUNG PEOPLE TO SEE, DO AND PLAY THIS splendours of Seville. HOLIDAY SEASON Like our page on: • Page 2... facebook.com/weekendersgp For a pdf copy visit: www.facebook.com/weekendersgp 02 • WEEKENDER • NOVEMBER 16 - 22, 2012 YOUR INSPIRATION TO A WEEKEND FILLED WITH FUN AND HAPPINESS For a pdf copy of Weekender OVER STORY visit: www.facebook.com/weekendersgp C • Continued from page 1. GET LEGO-RISED Why travel across the Causeway, when we READ, EAT, SEE, JUMP, RUN, SING, have The Art of the Brick at ArtScience Museum? New York-based artist Nathan DANCE, FLY, PARTY, PLAY AND Sawaya’s works use Lego bricks as the sole medium. -

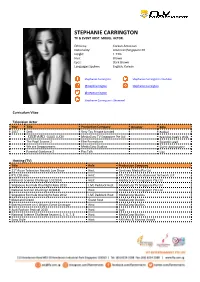

Stephanie Carrington Tv & Event Host

STEPHANIE CARRINGTON TV & EVENT HOST. MODEL. ACTOR. Ethnicity: Korean-American Nationality: American/Singapore PR Height: 1.74m Hair: Brown Eyes: Dark Brown Languages Spoken: English, Korean Stephanie Carrington Stephanie Carrington’s Youtube @stephcarrington Stephanie Carrington @stephcarrington Stephanie Carrington's Showreel Curriculum Vitae Television Actor Year Title Production Company Director Role 2017 Sent Very Tay Private Limited Rachel 《百岁大吉》GOOD LUCK! MediaCorp TV Singapore Pte Ltd Brendon Kuah’s Wife. The Pupil Season 2 Film Formations Episodic Lead We are Singaporeans MediaCorp Studios Guest Appearance Parental Guidance 2 Pics Talk Lisa Hosting (TV) Title Role Production Company 21st Asian Television Awards Live Show Host Contineo Media Pte Ltd RTL CBS Asia Host RTL CBS Asia Entertainment Network LLP National Science Challenge 10 (2014) Host Mediacorp TV Singapore Pte Ltd Singapore Formula One Night Race 2013 LIVE Paddock Host MediaCorp TV Singapore Pte Ltd National Science Challenge 9 (2013) Host Mediacorp TV Singapore Pte Ltd Singapore Formula One Night Race 2012 LIVE Paddock Host MediaCorp Studios Meat and Greed Guest host MediaCorp Studios Entertainment on 5 Origins Event Coverage Host MediaCorp Studios Audi Fashion Festival 2010 Host Audi National Science Challenge Season 4, 5, 6, 7, 8 Host MediaCorp Studios Sony Style Host AXN Asia & Moving Visuals Hosting (Events) Title Role Company Changi Airline Awards 2020 Host BCD Meetings & Events Asia Pacific Pte Ltd Motorshow 2020 - Mazda & MG Host Kingsmen Exhibits Pte Ltd -

SPH-Mediacorp Joint Release

For Immediate Release MPL-SPH JOINT MEDIA RELEASE Mediacorp buys SPH’s minority shareholdings of its entertainment television and newspaper businesses Singapore, 25 August 2017 – Mediacorp has entered into an agreement with Singapore Press Holdings to buy its minority shareholdings in Mediacorp’s entertainment television and newspaper businesses. The purchase, valued at S$18 million, will involve Mediacorp buying SPH’s · 20 per cent stake in Mediacorp TV Holdings Pte Ltd which owns Channels 5, 8 and U and Mediacorp Studios; and · 40 per cent stake in Mediacorp Press Pte Ltd, which operates the TODAY newspaper. Completion of the deal, signed today, is subject to regulatory approval and scheduled for the end of September 2017. Once completed, both entities will become wholly owned subsidiaries of Mediacorp. The agreement comes 12 years after SPH purchased the stakes as part of a media industry asset consolidation in 2005. During the consolidation, SPH transferred a TV channel to Mediacorp and took a 20 per cent stake in Mediacorp TV Holdings. SPH merged its free newspaper STREATS with TODAY, and invested in a 40 per cent stake of Mediacorp Press. Issued by Singapore Press Holdings Ltd Co. Registration. No. 198402868E For more information, please contact: Chin Soo Fang (Ms) Head Corporate Communications & CSR Singapore Press Holdings Limited DID: 6319 1216 Email: [email protected] Karen Yew (Ms) Head Brand and Communications Mediacorp Tel: +65 63503261 Email: [email protected] About Singapore Press Holdings Ltd Incorporated in 1984, main board-listed Singapore Press Holdings Ltd (SPH) is Asia’s leading media organisation, engaging minds and enriching lives across multiple languages and platforms, ranging from print, digital, radio and out-of-home media. -

Mediacorp and KLN Form Strategic Alliance

For immediate release Media Release MediaCorp and KLN form strategic alliance Jakarta, 24 April 2015 – Singapore-based media company MediaCorp and KapanLagi Network (KLN), an Indonesian digital media company, announced that MediaCorp has invested in a 52 per cent equity stake in the KLN Group which owns several of Indonesia’s most successful web portals including kapanlagi.com. The two parties signed the agreement in Jakarta today, cementing a strategic, long- term partnership that brings together complementary strengths of the two companies – MediaCorp’s transmedia expertise and pan-Asian reach, and KLN’s digital-native mindset and market leadership in Indonesia. The partnership is also aimed at delivering fresh experiences for consumers across the region, and creating innovative solutions for advertisers to embark on new approaches to reach customers and prospects. MediaCorp pioneered the broadcasting industry in Singapore but has since diversified into print, live entertainment, out-of-home and digital businesses. Its digital properties include over-the-top service Toggle, channelnewsasia.com and Kuala-Lumpur headquartered gaming publisher Cubinet. In 2013 it launched Mediapreneur, an incubator programme for digital startups aimed at providing a conducive, operational platform for media startups to be systematically nurtured and developed into full-fledged tech companies, supported by funding, networking opportunities and intellectual property and content. MediaCorp also recently reorganised its products and platforms along customer lines such as family, youth, men, women and foodies. While KLN is best known for its popular twin engines of kapanlagi.com and merdeka.com, it also has sites targetting men, women, car enthusiasts and soccer aficionados. The KLN Group's video content has been viewed more than 450 million times and KLN has seen impressive revenue growth in Indonesia's rapidly increasing digital advertising spend.