Book-Entry-Only Underlying Rating: S&P Global Ratings “A+”

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Management Services for City of Bloomington Venues ABOUT VENUWORKS

Presentation for: Management Services for City of Bloomington Venues ABOUT VENUWORKS Since 1996 it has been our mission…. To maximize the presentation and revenue of events at our client’s venues for the cultural, recreational, educational and economic benefit of the communities we serve. …..it’s all about the events! COMPANY BACKGROUND: Arenas We Serve s Ice Arenas TOYOTA UNITED WIRELESS HOFHEINZ HARTMAN TOYOTA CENTER ARENA DODGE PAVILION ARENA ARENA KENNEWICK CITY, KS HOUSTON, TX WICHITA, KS KENNEWICK , WA , WA SWIFTEL SANFORD HARA ALERUS CEDAR RAPIDS CENTER CENTER ARENA CENTER ICE ARENA BROOKINGS, SD BEMIDJI, MN DAYTON, OH GRAND CEDAR RAPIDS, IA FORKS, ND COMPANY BACKGROUND: Theatres We Serves STEPHENS TOPEKA PERFORMING HOYT SHERMAN CULLEN PERFORMANCE AUDITORIUM ARTS CENTER PLACE HALL AMES, IA TOPEKA, KS DES MOINES, IA HOUSTON, TX AMES BRIDGE VIEW RACINE CIVIC CENTRE - BURLINGTON MEMORIAL CENTER CENTER MEMORIAL HALL AUDITORIUM BURNSVILLE OTTUMWA, IA RACINE, WI BURLINGTON, IA , MN COMPANY BACKGROUND: Comparable Arenass These two VenuWorks managed arenas are close to Bloomington, offering significant block booking and networking opportunities for programming the US Cellular Coliseum. US CELLULAR CENTER FORD CENTER 9,000 seats 11,000 seats CEDAR RAPIDS, IA EVANSVILLE, IN COMPANY BACKGROUND: VenuWorks manages over 50 venues in 12 states throughout the country. ADVANTAGES: VenuWorks Headquarters in Midwest We are Midwest Based! •We are easily accessible to community leaders •Independent ownership gives us total flexibility in working with -

Disability Awareness Month Participate in Orange out Days

The Arc of Evansville NONPROFIT ORG 615 W. Virginia Street US POSTAGE Evansville, IN 47710 PAID EVANSVILLE, IN PERMIT NO 2140 March 2020 Disability Awareness Month In the state of Indiana, Disability Awareness Month is held one-fifth of Indiana’s population? As a community, we have each March to promote the independence, integration, a responsibility to learn about and understand the needs of and inclusion of all people with disabilities. Did you know our fellow Hoosiers. Here are some ways you can support that adults and children with disabilities represent nearly individuals with disabilities in our community. Attend the Give-Back Events Tuesday, March 3, 11:00 a.m. until 9:00 p.m. Sunday, March 15, 3:00 p.m. Azzip Pizza at North Park Evansville Thunderbolts Game, Chuck-A-Puck Thursday, March 5, 5:00 p.m. until 9:00 p.m. Benefiting The Arc of Evansville at The Ford Center Freddy’s on North Green River Road Tuesday, March 17, 10:30 a.m. - 9:00 p.m. Thursday, March 5, 6:00 p.m. McAlister’s on Pearl Drive Visit The Arc of Evansville’s table at UE Women’s Basketball Thursday, March 19, 11:00 a.m. until 10:00 p.m. Game at UE Hacienda on 1st Avenue Tuesday, March 10, 11:00 a.m. until 9:00 p.m. Tuesday, March 24, 5:00 p.m. until 9:00 p.m. Fazoli’s on North Green River Road Jason’s Deli on North Green River Road Thursday, March 12, 11:00 a.m. -

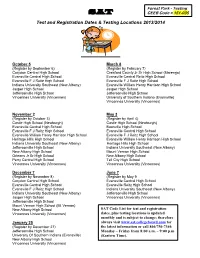

Test and Registration Dates & Testing Locations 2013/2014

Forest Park - Testing SAT CEEB Code = 151-035 Test and Registration Dates & Testing Locations 2013/2014 October 5 March 8 (Register by September 6) (Register by February 7) Corydon Central High School Crawford County Jr Sr High School (Marengo) Evansville Central High School Evansville Central Reitz High School Evansville F J Reitz High School Evansville F J Reitz High School Indiana University Southeast (New Albany) Evansville William Henry Harrison High School Jasper High School Jasper High School Jeffersonville High School Jeffersonville High School Vincennes University (Vincennes) University of Southern Indiana (Evansville) Vincennes University (Vincennes) November 2 May 3 (Register by October 3) (Register by April 4) Castle High School (Newburgh) Castle High School (Newburgh) Evansville Central High School Boonville High School Evansville F J Reitz High School Evansville Central High School Evansville William Henry Harrison High School Evansville F J Reitz High School Heritage Hills High School Evansville William Henry Harrison High School Indiana University Southeast (New Albany) Heritage Hills High School Jeffersonville High School Indiana University Southeast (New Albany) New Albany High School Mount Vernon High School Orleans Jr Sr High School New Albany High School Perry Central High School Tell City High School Vincennes University (Vincennes) Vincennes University (Vincennes) December 7 June 7 (Register by November 8) (Register by May 9 Corydon Central High School Evansville Central High School Evansville Central High School -

Newsletter Dated October 1, 2013

Neighborhood Associations working together to preserve, enhance, and promote U N O E the Evansville neighborhoods NEIGHBOR TO NEIGHBOR A Publication of United Neighborhoods of Evansville Volume 13 Issue 10 20 N.W. Fourth Street, Suite 501, 47708 October 2013 Website: www.unoevansville.org Email: [email protected] Phone 812-428-4243 From the President …… UPCOMING UNOE DATES IT IS NOT TOO EARLY TO THINK Oct. 15th - Sparkplug Comm. ABOUT CHRISTMAS GIFTS Meeting Oct. 16th- Board Meeting This year, why not think about giving family holiday gifts that Oct. 24th - SPARKPLUG are lasting and introduce them to attractions in Evansville. BANQUET They can probably be ordered via the internet or telephone. Here are some suggestions that offer gift certificates: Please remember there Mesker Park Zoo and Botanic Garden - The zoo has over 700 animal species will be no and the botanic garden has a variety of large trees and ever changing seasonal plants. UNOE General Meetings 1545 Mesker Park Dr. in November & December 812-435-6143 MeskerParkZoo.com due to the holidays. Evansville Museum of Arts, History and Science (Submersive Planetarium Our October meeting will opens in Spring of 2014) 411 S.E. Riverside Dr. be the Sparkplug Banquet 812-425-2406 emuseum.org on Thursday, October 24th. Evansville African American Museum - Shows the roots of the African American residents in the 20th century. Our next 579 S Garvin St. General Meeting 812-423-5188 EvansvilleAAMuseum.wordpress.com will be Thursday, cMoe Koch Family Children's Museum of Evansville - Speak Loud! Live January 23rd, 2014 Big! Work Smart ! Quack Galleries! 22 SE Fifth St. -

Evansville (9-19, 0-15 MVC) Vs. Indiana State (15-11, 8-7 MVC)

FIVE NATIONAL CHAMPIONSHIPS | FIVE NCAA D-1 TOURNAMENTS | 2015 CIT CHAMPIONS 2019-20 MEN’S BASKETBALL GAME NOTES 2019-20 Schedule/Results OCTOBER 2019 Game Evansville (9-19, 0-15 MVC) vs. Oct. 28 vs. USI (exh.) W, 71-68 OT Indiana State (15-11, 8-7 MVC) NOVEMBER 2019 Nov. 9 vs. Ball State - ESPN3 W, 79-75 29 February 23, 2020 | Ford Center | Evansville, Ind. Nov. 12 at #1 Kentucky - SEC Network W, 67-64 Nov. 14 vs. IU Kokomo % - ESPN3 W, 89-71 Nov. 18 vs. SMU - ESPN+ L, 57-59 Evansville Purple Aces Indiana State Sycamores Nov. 22 vs. East Carolina % Flosports L, 68-85 STAT SHEET Nov. 23 vs. George Washington % - Flosports L, 70-78 Nov. 24 vs. Morgan State % - Flosports W, 115-112 3 OT 68.1 Points Per Game 68.8 Nov. 30 at IUPUI - ESPN+ W, 70-64 31.8 Rebounds Per Game 32.4 42.7% Shooting Percentage 45.0% DECEMBER 2019 Dec. 4 vs. Western Illinois - ESPN3 W, 90-86 72.6% Free Throw Percentage 70.3% Dec. 7 vs. Miami Ohio - ESPN+ W, 101-87 12.3 Assists Per Game 12.8 Dec. 14 at Green Bay - ESPN+ W, 72-62 4.8 Steals Per Game 5.4 Dec. 16 at Jacksonville State - ESPN+ L, 59-85 Dec. 21 vs. Murray State - ESPN+ W, 78-76 OT Evansville Coaching Info ISU Coaching Info Dec. 31 at Missouri State* - ESPN+ L, 52-65 Head Coach: Todd Lickliter Head Coach: Greg Lansing Record at UE: 0-9 (1st Season) Record at ISU: 163-153 (10th Season) JANUARY 2020 Career Record: 218-164 (13th Season) Career Record: Same Jan. -

Mccutchan Family

Descendants of William McCutchan Generation No. 1 1. WILLIAM1 MCCUTCHAN was born 01 August 1775 in County Westmeathe, Ireland, and died 22 October 1836. He married MARY ANN VICKERSTAFF. She was born 16 September 1777 in County Meath, Ireland, and died 22 September 1858. More About WILLIAM MCCUTCHAN: Burial: Hillard's Cemitary (Blue Grass) Indiana More About MARY ANN VICKERSTAFF: Burial: Hillard's Cemitary (Blue Grass) Indiana Children of WILLIAM MCCUTCHAN and MARY VICKERSTAFF are: 2. i. SAMUAL2 MCCUTCHAN, b. 16 October 1797, County Longford, Ireland; d. 26 November 1880. 3. ii. ALEXANDER DENNISON MCCUTCHAN, b. 1800; d. 1843. 4. iii. WILLIAM JR. MCCUTCHAN, b. 1801; d. 1843. 5. iv. JOHN MCCUTCHAN, b. 16 July 1800, Co. Longford, Ireland; d. 1840. 6. v. THOMAS MCCUTCHAN, b. 05 April 1803, Co. Longford Ireland; d. 04 January 1886. 7. vi. SARAH BOND, b. 20 March 1807; d. 10 June 1889. 8. vii. GEORGE BOND MCCUTCHAN, b. 03 February 1812; d. 02 January 1884. 9. viii. ROBERT MCCUTCHAN, b. February 1817, Sullivan Co. NY; d. March 1863. 10. ix. JAMES A. MCCUTCHAN, b. 05 April 1818; d. 29 July 1885. Generation No. 2 2. SAMUAL2 MCCUTCHAN (WILLIAM1) was born 16 October 1797 in County Longford, Ireland, and died 26 November 1880. He married AGNES (NANCY) MCCRABBIE 23 April 1820 in Bethyl, N.Y., Sullivan Co., daughter of ROBERT MCCRABBIE. She was born 29 May 1805 in Leith, Scotland, and died 19 September 1880. Notes for SAMUAL MCCUTCHAN: First Postmaster of McCutchanville, IN More About SAMUAL MCCUTCHAN: Burial: McCutchanville Church Cemetery More About AGNES (NANCY) MCCRABBIE: Burial: McCutchanville Church Cemetery More About SAMUAL MCCUTCHAN and AGNES MCCRABBIE: Marriage: 23 April 1820, Bethyl, N.Y., Sullivan Co. -

Evansville (6-6, 4-2 MVC) at Bradley (7-4, 1-1 MVC)

FIVE NATIONAL CHAMPIONSHIPS | FIVE NCAA D-1 TOURNAMENTS | 2015 CIT CHAMPIONS 2020-21 PURPLE ACES MEN’S BASKETBALL GAME NOTES 2020-21 Schedule/Results NOVEMBER 2020 Game Evansville (6-6, 4-2 MVC) at Nov. 25 at Louisville % ACC Network L, 44-79 Bradley (7-4, 1-1 MVC) Nov. 25 vs. Prairie View A&M % ESPN3 L, 61-64 13 January 16-17, 2021 | Carver Arena | Peoria, Ill. DECEMBER 2020 Dec. 2 at UT Martin L, 87-93 2OT Dec. 6 vs. IUPUI Canceled Evansville Purple Aces Bradley Braves Dec. 9 vs. Eastern Illinois W, 68-65 STAT SHEET Dec. 12 at Saint Louis Canceled Dec. 15 vs. Southeast Missouri State W, 66-63 OT 65.8 Points Per Game 74.6 Dec. 21 vs. Belmont L, 63-72 29.4 Rebounds Per Game 42.2 Dec. 27 at Southern Illinois* L, 57-63 41.6% Shooting Percentage 45.1% Dec. 28 at Southern Illinois* W, 84-72 71.6% Free Throw Percentage 70.0% JANUARY 2021 12.8 Assists Per Game 15.5 Jan. 2 UNI* W, 65-61 4.8 Steals Per Game 6.7 Jan. 3 UNI* W, 70-64 Evansville Coaching Info Bradley Coaching Info Jan. 9 Illinois State* W, 57-48 Head Coach: Todd Lickliter Head Coach: Brian Wardle Jan. 10 Illinois State* L, 68-73 Record at UE: 6-19 (2nd Season) Record at BU: 88-90 (6th Season) Jan. 16 at Bradley* 3 p.m. Career Record: 224-174 (14th Season) Career Record: 183-155 (11th Season) Jan. 17 at Bradley* 3 p.m. -

Louisville Cardinals Vs. Evansville Purple Aces

Louisville Basketball Quick Facts Location Louisville, Ky. 40292 Founded / Enrollment 1798 / 22,000 Nickname / Colors Cardinals / Red & Black 1980, 1986, 2013 NCAA Champions 10 NCAA Final Fours 41 NCAA Tournament Appearances Conference Atlantic Coast Sports Information University of Louisville Louisville, KY 40292 www.GoCards.com Home Court KFC Yum! Center (22,000) Phone: (502) 852-6581 Fax: (502) 852-7401 email: [email protected] Twitter: @KKcards Acting President Dr. Neville Pinto Vice President for Athletics Tom Jurich Louisville Cardinals Head Coach Rick Pitino (UMass ‘74) U of L Record 391-134 (16th yr.) vs. Evansville Purple Aces Overall Record 745-262 (32nd yr.) Associate Head Coach Kenny Johnson Friday, Nov. 11 7:02 p.m. ET KFC Yum! Center Louisville, Ky. Assistant Coaches Mike Balado, David Padgett Dir. of Basketball Operations Michael Bowden PROBABLE STARTING LINEUPS All-Time Record 1,778-892 (103rd yr.) Louisville Ht. Wt. Yr. PPG RPG Hometown All-Time NCAA Tournament Record 75-42 F 10 Jaylen JOHNSON 6-9 230 Jr. 5.0 3.5 Ypsilanti, Mich. (41 Appearances, 10 Final Fours, F 22 Deng ADEL 6-7 200 So. 4.0 2.1 Melbourne, Australia Three NCAA Championships - 1980, 1986, 2013) C 14 Anas MAHMOUD 7-0 215 Jr. 3.2 3.0 Cairo, Egypt Important Phone Numbers G 4 Quentin SNIDER 6-2 175 Jr. 9.4 2.3 Louisville, Ky. Athletics Office (502) 852-5732 G 45 Donovan MITCHELL 6-3 195 So. 7.4 3.4 Greenwich, Conn. Basketball Office (502) 852-6651 *UE’s Ryan Taylor stats from Ohio University in 2014-15; remaining stats for both schools from last season. -

Accounting, Auditing & Bookkeeping Adjustment

2016 Southwest Indiana Chamber Membership Directory ad.pdf 1 6/22/2016 5:37:45 PM Umbach & Associates, LLP Kitch & Schreiber, Inc. _________________ IGT Indiana 400 Bentee Wes Ct., Evansville, IN 47715-4060 402 Court St., Evansville, IN 47708 1302 N. Meridian St., Indianapolis, IN 46202 (812) 428-224 • www.umbach.com (812) 424-7710 • www.kitchandschreiber.com (317) 264-4637 • web.1si.org/Retail/IGT-Indiana-2694 ______________________ ______________________ AGRICULTURE ______________________ C Vowells & Schaaf, LLP Lumaworx Media PRODUCTION/CROPS Indoor Golf League P.O. Box 119, Evansville, IN 47701 _________________ P.O. Box 608, Mt. Vernon, IN 47620 M 101 N.W. First St., Evansville, IN 47708 (812) 421-4165 • www.vscpas.com (812) 480-9057 812-459-1355 • www.lumaworxmedia.com Azteca Milling, LP ______________________ ______________________ ______________________ Y 15700 Hwy. 41 North, Evansville, IN 47725 Weinzapfel & Co., LLC Media Mix Communications, Inc. Painting With a Twist Evansville (972) 232-5300 • www.aztecamilling.com 5625 E. Virginia St., Ste. A, Evansville, IN 47715 CM 21 S.E. Third Steet, Suite 500 1301 Mortensen Lane, Evansville, IN 47715 4630 Bayard Park Dr., Evansville, IN 47716 ______________________ Evansville, IN 47708 (812) 474-1015 • www.weinzapfel.com (812) 473-0600 • www.mediamix1.com CGB Diversified Services (812) 304-0243 MY _________________ ______________________ www.paintingwithatwist.com/evansville (812) 464-9161 (800) 880-7800 1811 N. Main St., Mt. Vernon, IN 47620 ______________________ MOB Media (812) 833-3074 • www.cgb.com CY www.hsccpa.com ______________________ Sky Zone Indoor Trampoline Park ADJUSTMENT & 800 E. Oregon St., Evansville, IN 47711 49 N. Green River Rd., Evansville, IN 47715 CMY (812) 773-3526 Consolidated Grain & Barge ______________________ (812) 730-4759 • www.skyzone.com/evansville Real Solutions. -

Save the Date Evansville Area Council PTA Founder's Day Gala

Save the Date Evansville Area Council PTA Founder’s Day Gala Get in the Game! Wednesday, February 22nd, 2017 St. Mary’s Manor 5:00pm Social Hour & Silent Auction & Cupcake Wars 5pm Meet and Greet, Silent Auction 6:00pm Dinner 7pm – Heads or Tails Awards Program Sponsorship Donations Disney World Evansville Philharmonic Louisville Mega Caverns Mesker Park Zoo Holiday World & Splashin Safari Swonder Ice Rink The Magic House Tropicana Evansville Evansville Thunderbolts Evansville Otters Franklin Lanes YMCA University of Evansville Aces Evansville Philharmonic Indianapolis Zoo Founder’s Day Gala Get in the Game with Evansville Area Council PTA! Silent Auction Donation Form nd February 22 , 2017 St. Mary’s Manor Name of Business/PTA Unit/Individual_________________________________________ Contact Name: _____________________________________ Title_____________________ Telephone: ___________________________________ Cell: __________________________ Email: ______________________________________________________________________ Basket Theme/Item Description________________________________________________ ____________________________________________________________________________ ____________________________________________________________________________ Value of Donation: $_____________________ Get in the Game with PTA! Please return this form to Carol Blair, either by email or school mail, to Washington Middle School. Please feel free to call/text to make arrangements for dropping off of the Theme Baskets and Donations. Thank you, This year’s -

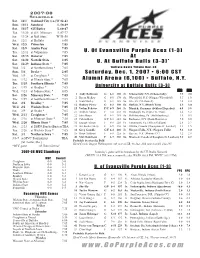

Game Notes 2-11-07

2007-08 Schedule Sat. 11/3 Oakland City (ex.) W 82-43 Sun. 11/11 Samford L 50-49 Sat. 11/17 #25 Butler L 60-47 Tue. 11/20 at S.E. Missouri L 87-77 Sat. 11/24 at Ball State W 51-50 Sat. 12/1 at Buffalo 6:00 Wed. 12/5 Princeton 7:05 Sat. 12/8 Austin Peay 7:05 Tue. 12/11 at Valparaiso 7:05 U. Of Evansville Purple Aces (1-3) Sat. 12/15 Hanover 7:05 At Sat. 12/22 Norfolk State 2:05 U. At Buffalo Bulls (3-3)* Sat. 12/29 Indiana State * 7:05 Wed. 1/2 at Northern Iowa * 7:05 *Buffalo hosts Tulane Nov. 30 Sun. 1/6 Drake * 2:05 Saturday, Dec. 1, 2007 • 6:00 CST Wed. 1/9 at Creighton * 7:05 Sat. 1/12 at Illinois State * 7:05 Alumni Arena (6,100) • Buffalo, N.Y. Tue. 1/15 Southern Illinois * 7:05 Sat. 1/19 at Bradley * 7:05 University at Buffalo Bulls (3-3) PPG RPG Wed. 1/23 at Indiana State * 6:05 Sat. 1/26 Missouri State * 7:05 1 Andy Robinson G 6-1 190 Jr. Schenectady, N.Y. (Schenectady) 7.2 2.0 2 Byron Mulkey G 6-0 170 So. Wheatfield, N.Y. (Niagara Wheatfield) 5.3 1.0 Tue. 1/29 at Southern Illinois * 7:05 3 Sean Smiley G 6-1 165 So. Erie, Pa. (McDowell) 7.8 2.0 Sat. 2/2 Bradley * 7:05 12 Rodney Pierce G 6-2 190 So. -

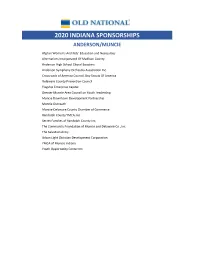

2020 Sponsorship Website Template.Xlsx

2020 INDIANA SPONSORSHIPS ANDERSON/MUNCIE Afghan Women's And Kids' Education and Necessities Alternatives Incorporated Of Madison County Anderson High School Choral Boosters Anderson Symphony Orchestra Association Inc. Crossroads of America Council, Boy Scouts Of America Delaware County Prevention Council Flagship Enterprise Capital Greater Muncie Area Council on Youth Leadership Muncie Downtown Development Partnership Muncie Outreach Muncie‐Delaware County Chamber of Commerce Randolph County YMCA, Inc. Secret Families of Randolph County Inc. The Community Foundation of Muncie and Delaware Co., Inc. The Salvation Army Urban Light Christian Development Corporation YMCA of Muncie Indiana Youth Opportunity Center Inc. BLOOMINGTON Amethyst House Inc. Bedford Clothe A Child Inc. Big Brothers Big Sisters of South Central Indiana Bloomington Health Foundation Bloomington PRIDE Boys and Girls Clubs of Bloomington Boys and Girls Club of Lawrence County Cardinal Stage Company Catholic Charities City of Bloomington Dr. Martin Luther King Jr. Birthday Celebration Commission Community Foundation of Bloomington and Monroe County Dimension Mill Inc. Dr Martin Luther King Commission City of Bloomington Ellettsville Chamber of Commerce Fairview Elementary School Foundation of Monroe County Community Schools Inc. Greater Bloomington Chamber of Commerce, Inc. Habitat for Humanity of Monroe County Indiana Hannah Center Inc. Hoosier Hills Food Bank Inc. Ivy Tech Foundation Kiwanis Club of South Central Indiana Lotus Education And Arts Foundation Inc. Monroe County Community School Corporation Monroe County YMCA Pantry 279 Inc. People and Animal Learning Services Inc. Radius Indiana Inc. Shalom Community Center Inc. Southern Indiana Exchange Clubs Foundation Inc. The Salvation Army of Monroe County United Way of Monroe County Indiana United Way of South Central IN/Lawrence County Wonderlab‐Museum Of Science Health and Technology Inc.