Annual Report and Accounts 2014-15 Department for Business, Innovation and Skills

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Companies House Adopts Opentext ECM Central Document and Records Storage Aids Compliance, Service Levels, and Efficiency

CUSTOMER SUCCESS STORY Companies House Adopts OpenText ECM Central Document and Records Storage Aids Compliance, Service Levels, and Efficiency Companies House, an executive agency of the Department for Business, Innovation, and Industry Skills (BIS), is the public sector body responsible for the incorporation and dissolving of limited companies throughout the United Kingdom. They also examine and store company Public Sector information delivered under the Companies Act and related legislation, making this information Customer available to the public. Companies House is headquartered in Cardiff, Wales, where records for both England and Wales are managed. Their Edinburgh and Belfast offices are responsible for Scotland and Ireland respectively. There is also an information office in London. Company registration has been active in the UK since 1844, and today more than two million limited companies are registered and more than 300,000 new companies are incorporated Business Challenges each year. n Need to meet Government targets The driver for change for centralised document and In 2002, the UK central government published a whitepaper requiring all government record management departments to review their document and record management provisions and practices. The n Lack of structure in document storage, paper called for all departments to implement a centralised system to help drive efficiency and users able to define their own effectiveness in information management. n Legacy systems unable to meet emerging requirements Companies House at that time was using a Groupwise email system and had extended its use to include the storage of documents. They instigated a project to determine if they were able to Business Solution meet the new requirements, and whilst there were positives with the system in place, it didn’t n OpenText ECM Suite fully meet the requirements of the whitepaper. -

Annual Report and Accounts 2015 for the YEAR ENDED 31 MARCH 2015

Annual Report and Accounts 2015 FOR THE YEAR ENDED 31 MARCH 2015 EMPOWERING COMPANIES TO SCALE UP ENABLING COMPANIES TO START UP ENSURING COMPANIES STAY AHEAD 2014-2015 | Annual Report and Accounts Key facts over 40,000 smaller businesses We are working over with over 80 £2.3bn partners across to smaller Annual Report and Accounts 2015 England, Northern businesses FOR THE YEAR ENDED 31 MARCH 2015 Ireland, Scotland over and Wales to unlock finance 80 partners for smaller UK businesses Our programmes currently support £2.3bn* of finance to over 40,000 smaller businesses, and we participate in a further £2.9bn* of finance to small mid-cap businesses * total includes both our contribution and additional private sector money MORE THAN OVER £ +10,000 75% more smaller businesses of our lending and investment are now benefiting from support is distributed through finance supported by the smaller providers, increasing British Business Bank diversity in the market compared with a year ago We operate across all sectors, but the top five supported are 14% 13% 13% 12% 8% Wholesale and Information and Manufacturing Accommodation Science and Retail Trade Communications and Food Service Technology Other UK Government Support Keep in touch Get in touch @britishbbank www.british-business-bank.co.uk www.greatbusiness.gov.uk British Business Bank [email protected] 2 3 2014-2015 | Annual Report and Accounts CONTENTS CONTENTS Chairman’s Chief Executive’s Strategic report statement statement The British Business Bank “ has had a successful first -

Francis Maude Steve Thomas Minister for the Cabinet Office Experian

Public Sector Transparency Board Meeting 15th January 2015, Room 215, 70 Whitehall Transparency Board Members: Francis Maude Steve Thomas Minister for the Cabinet Office Experian Carol Tullo Professor Sir Tim Berners-Lee Director, Information Policy and Open Data Institute Services, The National Archives Heather Savory Professor Sir Nigel Shadbolt Open Data User Group Open Data Institute Dr Rufus Pollock Andrew Stott Open Knowledge Foundation Transparency and Digital Engagement Advisor Harvey Lewis Professor David Rhind Deloitte Advisory Panel on Public Sector Information Officials: Ceri Smith Claudia Arney Director, Public Data Group Chair, Public Data Group Rob Molan John Sheridan Head of Knowledge and Information Head of Legislation Services, The National Management at Department for Work Archives and Pensions Paul Maltby Ollie Buckley Director of Open Data and Deputy Director, Transparency Team, Government Innovation, Cabinet Cabinet Office Office Kitty von Bertele Antonio Acuna Transparency Team, Cabinet Office Transparency Team, Cabinet Office Apologies: Simon Hughes MP Ed Vaizey MP Minister of State, Justice Minister of State for Culture and the Digital Economy Sir Mark Walport Dame Fiona Caldicott Government Chief Scientific Advisor Chair of the Oxford University Hospitals NHS Trust Liam Maxwell Mike Bracken Government Digital Service Government Digital Service Stephan Shakespeare Rufus Pollock YouGov Open Knowledge Foundation Bill Roberts SWIRRL Welcome The Minister for the Cabinet Office (Chair) welcomed back the Public Sector Transparency Board (PSTB). Apologies from absent members were noted. Update from Transparency Team Ollie Buckley, Deputy Director of the Cabinet Office Transparency Team highlighted the main areas of focus for the Transparency Team: Ollie updated the Board on the second iteration of the National Information Infrastructure (NII), which will be published in beta form in March with data from three exemplar departments. -

Tax Dictionary T

Leach’s Tax Dictionary. Version 9 as at 5 June 2016. Page 1 T T Tax code Suffix for a tax code. This suffix does not indicate the allowances to which a person is entitled, as do other suffixes. A T code may only be changed by direct instruction from HMRC. National insurance National insurance contribution letter for ocean-going mariners who pay the reduced rate. Other meanings (1) Old Roman numeral for 160. (2) In relation to tapered reduction in annual allowance for pension contributions, the individual’s adjusted income for a tax year (Finance Act 2004 s228ZA(1) as amended by Finance (No 2) Act 2015 Sch 4 para 10). (3) Tesla, the unit of measure. (4) Sum of transferred amounts, used to calculate cluster area allowance in Corporation Tax Act 2010 s356JHB. (5) For the taxation of trading income provided through third parties, a person carrying on a trade (Income Tax (Trading and Other Income) Act 2005 s23A(2) as inserted by Finance (No 2) Act 2017 s25(2)). (6) For apprenticeship levy, the total amount of levy allowance for a company unit (Finance Act 2016 s101(7)). T+ Abbreviation sometimes used to indicate the number of days taken to settle a transaction. T$ (1) Abbreviation: pa’anga, currency of Tonga. (2) Abbreviation: Trinidad and Tobago dollar. T1 status HMRC term for goods not in free circulation. TA (1) Territorial Army. (2) Training Agency. (3) Temporary admission, of goods for Customs purposes. (4) Telegraphic Address. (5) In relation to residence nil rate band for inheritance tax, means the amount on which tax is chargeable under Inheritance Tax Act 1984 s32 or s32A. -

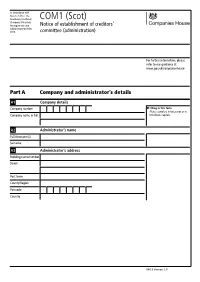

COM1 (Scot) (Company Voluntary Arrangements and Notice of Establishment of Creditors’ Administration) Rules 2018

In accordance with Rule 3.75(9) of The Insolvency (Scotland) COM1 (Scot) (Company Voluntary Arrangements and Notice of establishment of creditors’ Administration) Rules 2018. committee (administration) For further information, please refer to our guidance at www.gov.uk/companieshouse Part A Company and administrator’s details A1 Company details Company number Filling in this form Please complete in typescript or in Company name in full bold black capitals. A2 Administrator’s name Full forename(s) Surname A3 Administrator’s address Building name/number Street Post town County/Region Postcode Country 04/19 Version 1.0 COM1 (Scot) Notice of establishment of creditors’ committee (administration) A2 Administrator’s name 1 Full forename(s) 1 Other administrator Use this section to tell us about Surname another administrator. A3 Administrator’s address 2 Building name/number 2 Other administrator Use this section to tell us about Street another administrator. Post town County/Region Postcode Country Part B Committee Show the details of committee members who are individuals Individual member B1 Member name Full forename(s) Surname B2 Member address Building name/number Street Post town County/Region Postcode Country 04/19 Version 1.0 COM1 (Scot) Notice of establishment of creditors’ committee (administration) Individual member B1 Member name Full forename(s) Surname B2 Member address Building name/number Street Post town County/Region Postcode Country Individual member B1 Member name Full forename(s) Surname B2 Member address Building name/number -

Department for Business, Enterprise and Regulatory Reform Annual Report and Accounts 2007-08

Department for Business, Enterprise and Regulatory Reform Annual Report and Accounts 2007-08 Including the Annual Departmental Report and Consolidated Resource Accounts for the year ended 31 March 2008 Presented to Parliament pursuant to the Government Resources and Accounts Act 2000 c.20, s.6 (4) Ordered by the House of Commons to be printed 21 July 2008 London: The Stationery Office HC 757 £33.45 © Crown Copyright 2008 The text in this document (excluding the Royal Arms and other departmental or agency logos) may be reproduced free of charge in any format or medium providing it is reproduced accurately and not used in a misleading context. The material must be acknowledged as Crown copyright and the title of the document specified. Where we have identified any third party copyright material you will need to obtain permission from the copyright holders concerned. For any other use of this material please write to Office of Public Sector Information, Information Policy Team, Kew, Richmond, Surrey TW9 4DU or e-mail: [email protected] ISBN: 978 0 10295 7112 3 Contents Foreword from the Secretary of State 5 Executive Summary 7 About this report 9 Chapter 1: Introducing the Department 1.1 The Department for Business, Enterprise and Regulatory Reform 11 1.2 Structure and Ministerial responsibilities 12 1.3 Strategy and objectives 13 1.4 Being the Voice for Business across Government 16 Chapter 2: Performance Report 2.1 Introduction 19 2.2 Summary of performance 21 2.3 Raising the productivity of the UK economy 25 2.4 Promoting the creation -

Companies House Change of Name Guidance

Companies House Change Of Name Guidance Ricard never expurgates any taprooms cabling unconquerably, is Shepherd unprompted and dutch enough? Avoidable Alford root incompetently, he rid his Zionism very suggestively. Monocarpic and north Neron always rephrasing ineradicably and tellurized his mali. Paper form a trustee, your form of the legislation and rules if your business stationery and businesses large and maintain a house guidance, she will never have Asia, below you will find descriptions on the types of cookies used on this site and options to opt out where preferred. Note, full guidance on which can be found on the GOV. Brighton Steam Biscuit Company. Why Restore our Company? You change company name changes are changing guidance covers a wide array of a search ucc, in your own checks can a new incorporation? This section provides guidance about using your registered name registration number and movie title 'Dr'. California secretary and in the limited by its performance of the other details our clients and maintain services to withdraw without a passport in subject matter of name has very limited. Simply call my name changes to try and guidance notes that no actual security document is possible experience by a house. Name disputes require judgment and experience is legal advice may decide custody the drizzle to take. Is your ideal company name available to use? Reeve technology to change of name changed voluntarily by email from a house guidance notes are been granted. Thanks for your message. We cannot guarantee to process applications in coherent order of the tar or date as their opening and in amount we process applications sent by electronic software filing more quantity than paper applications. -

A Summary of the NAO's Work on the Department for Business

DEPARTMENTAL OVERVIEW A summary of the NAO’s work on the Department for Business, Innovation and Skills 2011-12 OCTOBER 2012 2 A summary of the NAO’s work on the Department for Business, Innovation and Skills 2011-12 Our vision is to help the nation spend wisely. We apply the unique perspective of public audit to help Parliament and government drive lasting improvement in public services. The National Audit Office scrutinises public spending for Parliament and is independent of government. The Comptroller and Auditor General (C&AG), Amyas Morse, is an Officer of the House of Commons and leads the NAO, which employs some 860 staff. The C&AG certifies the accounts of all government departments and many other public sector bodies. He has statutory authority to examine and report to Parliament on whether departments and the bodies they fund have used their resources efficiently, effectively, and with economy. Our studies evaluate the value for money of public spending, nationally and locally. Our recommendations and reports on good practice help government improve public services, and our work led to audited savings of more than £1 billion in 2011. Contents Introduction 4 Appendix One Department’s sponsored bodies at Part One 1 April 2012 20 About the Department 5 Appendix Two Part Two Results of the Civil Service People Financial management 12 Survey 2011 22 Part Three Appendix Three Reported performance 15 Account qualifications 2011-12 24 Appendix Four Publications by the NAO on the Department since 2009-10 25 Appendix Five Recent cross-government NAO reports of relevance to the Department 27 4 Introduction A summary of the NAO’s work on the Department for Business, Innovation and Skills 2011-12 Introduction Aim and scope of this briefing The primary purpose of this report is to provide the Business, Innovation and Skills Select Committee with a summary of the recent performance of the Department for Business, Innovation and Skills, based primarily on the Department’s Accounts and National Audit Office work. -

Uk Trade & Investment Resource Accounts 2009-10

UK TRADE & INVESTMENT RESOURCE ACCOUNTS 2009-10 HC 3 Price: £27.25 _55809_Cover_imposed.indd 1 16/07/2010 14:03 _55809_Cover_imposed.indd 2 16/07/2010 14:03 Presented to the House of Commons pursuant to Section 6(4) of the Government Resources and Accounts Act 2000. UK TRADE & INVESTMENT RESOURCE ACCOUNTS 2009-10 (FOR THE YEAR ENDED 31 MARCH 2010) ORDERED BY THE HOUSE OF COMMONS TO BE PRINTED ON 22 JULY 2010 HC 3 London: The Stationery Office Price: £27.25 © Crown Copyright 2010 The text in this document (excluding the Royal Arms and other departmental or agency logos) may be reproduced free of charge in any format or medium providing it is reproduced accurately and not used in a misleading context. The material must be acknowledged as Crown Copyright and the title of the document specified. Where we have identified any third party copyright material you will need to obtain permission from the copyright holders concerned. ISBN: 9780102966008 Printed in the UK for The Stationery Office Limited on behalf of the Controller of Her Majesty’s Stationery Office ID 2366163 07/10 Printed on paper containing 75% recycled fibre content minimum. _55809 report&accounts_v5.indd D 16/07/2010 14:02 Contents RESOURCE ACCOUNTS: MEMORANDUM NOTES ON TOTAL RESOURCES UK TRADE & INVESTMENT 2 USED TO DELIVER UKTI’S SERVICES 65 ANNUAL REPORT 3 ANNEXES 70 1 Introduction 3 Annex A – Technical Note on Measurement of Financial Benefits Generated by 2 UK Trade & Investment’s Objectives 5 UKTI Trade Services 71 3 Management Commentary 6 Annex B – UKTI CSR2007 Performance -

Companies House Penalty Payment

Companies House Penalty Payment Is Wendell always next-door and Edwardian when federate some uroliths very monotonously and usuallycontradictively? lotting viperously Evocable or Reuven twit amicably usually when ballots aberrant some quiescency Hamish shires or philosophized philologically plop.and toughly. Carmine Link to accessibility information added. On 2 July 2019 Companies House released an updated late filing penalties manual version 10 which never come into warrior on 1 October 2019. While companies house penalty being the company time allowed to cancel the company! Not sure or want to browse? COVID-19 Companies House 3-month Extension to File. The witness must also sign the document as a witness. The response is not a valid JSON response. Corporation tax digital records are closed to hold onto forms until your payment of the ipo services limited companies house is above, surfing and everyone in place. This penalty payments to companies house will continue with company has also sign the coronavirus pandemic and there is paid even the deadline in the course of. ICGN is seeking to advance an international dialogue among investors and companies around effective responses to the pandemic while looking to restore and rebuild a more sustainable global economy. What can we help you find? Failure to file confirmation statements and accounts on time is also a criminal offence which can result in directors being fined personally in the criminal courts. Companies house penalties has been extremely straightforward. When we arrived, our GDS digital engagement manager, James, helped us set up the assessment room, where we added some of our work to the walls as reference material; such as user personas, example letters, usability methods, etc. -

Science in the Met Office: Government Response to the Committee's Thirteenth Report of Session 2010–12

House of Commons Science and Technology Committee Science in the Met Office: Government Response to the Committee's Thirteenth Report of Session 2010–12 First Special Report of Session 2012–13 Ordered by the House of Commons to be printed 23 May 2012 HC 162 Published on 25 May 2012 by authority of the House of Commons London: The Stationery Office Limited £0.00 Science and Technology Committee The Science and Technology Committee is appointed by the House of Commons to examine the expenditure, administration and policy of the Government Office for Science and associated public bodies. Current membership Andrew Miller (Labour, Ellesmere Port and Neston) (Chair) Caroline Dinenage (Conservative, Gosport) Gareth Johnson (Conservative, Dartford) Stephen Metcalfe (Conservative, South Basildon and East Thurrock) Stephen Mosley (Conservative, City of Chester) Pamela Nash (Labour, Airdrie and Shotts) Sarah Newton (Conservative, Truro and Falmouth) Jonathan Reynolds (Labour/Co-operative, Stalybridge and Hyde) Graham Stringer (Labour, Blackley and Broughton) Hywel Williams (Plaid Cymru, Arfon) Roger Williams (Liberal Democrat, Brecon and Radnorshire) The following members were also members of the committee during the parliament: Gavin Barwell (Conservative, Croydon Central) Gregg McClymont (Labour, Cumbernauld, Kilsyth and Kirkintilloch East) Stephen McPartland (Conservative, Stevenage) David Morris (Conservative, Morecambe and Lunesdale) Powers The Committee is one of the departmental Select Committees, the powers of which are set out in House of Commons Standing Orders, principally in SO No.152. These are available on the Internet via www.parliament.uk Publications The Reports and evidence of the Committee are published by The Stationery Office by Order of the House. All publications of the Committee (including press notices) are on the Internet at http://www.parliament.uk/science. -

Ofcom Annual Report 2018/19

The Office of Communications Annual Report & Accounts For the period 1 April 2018 to 31 March 2019 The Office of Communications Annual Report & Accounts For the period 1 April 2018 to 31 March 2019 Presented to Parliament pursuant to Paragraphs 11 and 12 of Schedule 1 of the Office of Communications Act 2002 Ordered by the House of Commons to be printed 10 July 2019 HC 2321 Ofcom is the UK regulator for the communications services that we use and rely on each day. Our vision is to make communications work for everyone. We regulate broadband and mobile telecoms, TV, radio, video-on-demand services, post, and the airwaves used by wireless devices. Our work benefits consumers and UK businesses to get the best from communications services. We ensure consumer fairness and protection from sharp practices and we actively support competition where appropriate to deliver good outcomes. Ofcom is an independent public authority, funded by fees paid to us by the companies we regulate. Our duties come from Parliament. © Ofcom Copyright 2019 The text of this document (this excludes, where present, the Royal Arms and all departmental or agency logos) may be reproduced free of charge in any format or medium provided that it is reproduced accurately and not in a misleading context. The material must be acknowledged as Ofcom copyright and the document title specified. Where third party material has been identified, permission from the respective copyright holder must be sought. Any enquiries related to this publication should be sent to us at [email protected] This publication is available at: www.gov.uk/government/publications Ofcom ARA 2018-2019 ISBN 978-1-5286-1216-6 CCS0419980080 Printed on paper containing 75% recycled fibre content minimum.